UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number: 001-35284

Ellomay Capital Ltd.

(Translation of registrant’s

name into English)

18 Rothschild Blvd., Tel Aviv

6688121, Israel

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Explanatory Note

Ellomay Capital Ltd. (the “Company”)

hereby announces that on May 31, 2024, it published a press release containing the financial results of Dorad Energy Ltd. (“Dorad”)

as of and for the three months ended March 31, 2024 and additional disclosure relating to Dorad (the “Press Release”).

In addition, based on the undertakings

included in the Deet of Trust executed by the Company in connection with its Series E Secured Debentures, the Company published on May

31, 2024, through the filing system of the Israel Securities Authority and the Tel Aviv Stock Exchange, information concerning Ellomay

Luzon Energy Infrastructures Ltd. (formerly U. Dori Energy Infrastructure Ltd.) (“Ellomay Luzon Energy”) based on Israeli

securities regulation (the “Ellomay Luzon Energy Information”) and financial statements of Ellomay Luzon Energy as

of and for the three months ended March 31, 2024 (in Hebrew) that were prepared in accordance with International Financial Reporting Standards

(the “Ellomay Luzon Energy FS”).

The Press Release, the Ellomay

Luzon Energy Information and an English summary of the Ellomay Luzon Energy FS are attached hereto as Exhibit 99.1, Exhibit

99.2 and Exhibit 99.3, respectively.

Information Relating to Forward-Looking

Statements

This report contains forward-looking

statements that involve substantial risks and uncertainties, including statements that are based on the current expectations and assumptions

of the Company’s management or Dorad’s management. All statements, other than statements of historical facts, included in

this report regarding the Company’s or Dorad’s plans and objectives, expectations and assumptions of management are forward-looking

statements. The use of certain words, including the words “estimate,” “project,” “intend,” “expect,”

“believe” and similar expressions are intended to identify forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. The Company or Dorad may not actually achieve the plans, intentions or expectations disclosed in the forward-looking

statements and you should not place undue reliance on the forward-looking statements included in this report. Various important factors

could cause actual results or events to differ materially from those that may be expressed or implied by our forward-looking statements

including the impact of the current war and hostilities in Israel, regulatory changes, the decisions of the Israeli Electricity Authority,

changes in demand, technical and other disruptions in the operations of the power plant operated by Dorad, competition, changes in the

supply and prices of resources required for the operation of the Dorad’s facilities and in the price of oil and electricity, changes

in the Israeli CPI, changes in inflation and interest rates, seasonality, failure to obtain financing for the expansion of Dorad and other

risks applicable to projects under development and construction. These and other risks and uncertainties associated with the Company’s

and Dorad’s business are described in greater detail in the filings the Company makes from time to time with the Securities and

Exchange Commission, including its Annual Report on Form 20-F. The forward-looking statements are made as of this date and the Company

does not undertake any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Exhibit Index

This Report on Form 6-K of Ellomay

Capital Ltd. includes of the following documents, which are attached hereto and incorporated by reference herein:

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Ellomay Capital Ltd. |

| |

|

| |

By: |

/s/ Ran Fridrich |

| |

|

Ran Fridrich |

| |

|

Chief Executive Officer and Director |

Dated: May 31, 2024

3

Exhibit 99.1

Ellomay Capital Reports Publication of Financial

Statements of Dorad Energy Ltd. for the Three Months Ended March 31, 2024

Tel-Aviv, Israel, May 31, 2024 – Ellomay

Capital Ltd. (NYSE American; TASE: ELLO) (“Ellomay” or the “Company”), a renewable energy and power generator

and developer of renewable energy and power projects in Europe, Israel and USA, today reported the publication in Israel of financial

statements for the three months ended March 31, 2024 of Dorad Energy Ltd. (“Dorad”), in which Ellomay currently indirectly

holds approximately 9.4% through its indirect 50% ownership of Ellomay Luzon Energy Infrastructures Ltd. (formerly U. Dori Energy Infrastructures

Ltd.) (“Ellomay Luzon Energy”).

On May 31, 2024, Amos Luzon Entrepreneurship

and Energy Group Ltd. (the “Luzon Group”), an Israeli public company that currently holds the remaining 50% of Ellomay

Luzon Energy, which, in turn, holds 18.75% of Dorad, published its quarterly report in Israel based on the requirements of the Israeli

Securities Law, 1968. Based on applicable regulatory requirements, the quarterly report of the Luzon Group includes the financial statements

of Dorad for the same period.

The financial statements of Dorad for the quarter

ended March 31, 2024 were prepared in accordance with International Financial Reporting Standards. Ellomay will include its indirect share

of these results (through its holdings in Ellomay Luzon Energy) in its financial results for this period. In an effort to provide Ellomay’s

shareholders with access to Dorad’s financial results (which were published in Hebrew), Ellomay hereby provides a convenience translation

of Dorad’s financial results.

Dorad Financial Highlights

| ● | Dorad’s unaudited revenues for the three months ended

March 31, 2024 – approximately NIS 610.9 million. |

| ● | Dorad’s unaudited operating profit for the three months

ended March 31, 2024 – approximately NIS 118.6 million. |

Based on the information provided by Dorad, the

demand for electricity by Dorad’s customers is seasonal and is affected by, inter alia, the climate prevailing in that season. Since

January 1, 2023, the months of the year are split into three seasons as follows: the summer season – the months of June, July, August

and September; the winter season – the months of December, January and February; and intermediate seasons – (spring and autumn),

the months from March to May, October and November. There is a higher demand for electricity during the winter and summer seasons, and

the average electricity consumption is higher in these seasons than in the intermediate seasons and is even characterized by peak demands

due to extreme climate conditions of heat or cold. In addition, Dorad’s revenues are affected by the change in load and time tariffs

– TAOZ (an electricity tariff that varies across seasons and across the day in accordance with demand hour clusters), as, on average,

TAOZ tariffs are higher in the summer season than in the intermediate and winter seasons. Therefore, the results presented for the

quarter ended March 31, 2024, which include winter months of January and February and the intermediate month of March, are not indicative

of full year results. In addition, due to various reasons, including the effects of the increase in the Israeli CPI impacting interest

payments by Dorad on its credit facility, the results included herein may not be indicative of first quarter results in the future or

comparable to first quarter results in the past.

The financial statements of Dorad include a note

concerning the war situation in Israel, which commenced on October 7, 2023, stating that Dorad estimated, based on the information it

had as of May 27, 2024 (the date of approval of Dorad’s financial statements as of March 31, 2024), that the current events and

the security escalation in Israel have an impact on its results but that the impact on its short-term business results will be immaterial.

Dorad further notes that as this event is not under the control of Dorad, and factors such as the continuation of the war and hostilities

or their cessation may affect Dorad’s assessments, as of the date of the financial statements, Dorad is unable to assess the extent

of the impact of the war on its business activities and on its medium and long-term results. Dorad continues to regularly monitor the

developments and is examining the effects on its operations and the value of its assets.

A translation of the financial results for Dorad

as of and for the year ended December 31, 2023 and as of and for each of the three month periods ended March 31, 2024 and 2023 is included

at the end of this press release. Ellomay does not undertake to separately report Dorad’s financial results in a press release

in the future. Neither Ellomay nor its independent public accountants have reviewed or consulted with the Luzon Group, Ellomay Luzon Energy

or Dorad with respect to the financial results included in this press release.

About Ellomay Capital Ltd.

Ellomay is an Israeli based company whose shares

are registered with the NYSE American and with the Tel Aviv Stock Exchange under the trading symbol “ELLO”. Since 2009, Ellomay

Capital focuses its business in the renewable energy and power sectors in Europe and Israel.

To date, Ellomay has evaluated numerous opportunities

and invested significant funds in the renewable, clean energy and natural resources industries in Israel, Italy and Spain, including:

| ● | Approximately 35.9

MW of photovoltaic power plants in Spain, a photovoltaic power plant of approximately 9 MW in Israel and a photovoltaic power plant of

4.95 MW in Italy; |

| ● | 9.375% indirect interest

in Dorad Energy Ltd., which owns and operates one of Israel’s largest private power plants with production capacity of approximately

850MW, representing about 6%-8% of Israel’s total current electricity consumption; |

| ● | 51% of Talasol, which

owns a photovoltaic plant with a peak capacity of 300MW in the municipality of Talaván, Cáceres, Spain; |

| ● | Groen Gas Goor B.V., Groen Gas Oude-Tonge B.V. and Groen Gas Gelderland

B.V., project companies operating anaerobic digestion plants in the Netherlands, with a green gas production capacity of approximately

3 million, 3.8 million and 9.5 million Nm3 per year, respectively; |

| ● | 83.333% of Ellomay Pumped Storage (2014) Ltd., which is involved

in a project to construct a 156 MW pumped storage hydro power plant in the Manara Cliff, Israel; |

| ● | Ellomay Solar Italy One SRL that owns a photovoltaic plant with

installed capacity of 14.8 MW in the Lazio Region, Italy that is ready for connection to the grid; |

| ● | Ellomay Solar Italy Four SRL (15.06 MW PV), Ellomay Solar Italy

Five SRL (87.2 MW PV), Ellomay Solar Italy Seven SRL (54.77 MW PV), Ellomay Solar Italy Nine SRL (8 MW PV) and Ellomay Solar Italy Ten

SRL (18 MW PV) that are developing photovoltaic projects in Italy that have reached “ready to build” status; and |

| ● | Fairfield Solar Project, LLC (13.44 MW PV), Malakoff Solar I, LLC

(6.96 MW PV) and Malakoff Solar II, LLC (6.96 MW PV), that are constructing photovoltaic plants and Mexia Solar I, LLC (5.6 MW PV), Mexia

Solar II, LLC (5.6 MW PV), and Talco Solar, LLC (10.3 MW PV), that are developing photovoltaic projects that have reached “ready

to build” status, all in the Dallas Metropolitan area, Texas.. |

For more information about Ellomay, visit http://www.ellomay.com.

Information Relating to Forward-Looking Statements

This press release contains forward-looking statements

that involve substantial risks and uncertainties, including statements that are based on the current expectations and assumptions of the

Company’s management. All statements, other than statements of historical facts, included in this press release regarding the Company’s

plans and objectives, expectations and assumptions of management are forward-looking statements. The use of certain words, including

the words “estimate,” “project,” “intend,” “expect,” “believe” and similar

expressions are intended to identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of

1995. The Company may not actually achieve the plans, intentions or expectations disclosed in the forward-looking statements and

you should not place undue reliance on the Company’s forward-looking statements. Various important factors could cause actual results

or events to differ materially from those that may be expressed or implied by the Company’s forward-looking statements, including

changes in electricity prices and demand, continued war and hostilities and political and economic conditions generally in Israel, regulatory

changes, the decisions of the Israeli Electricity Authority, changes in demand, technical and other disruptions in the operations of the

power plant operated by Dorad, competition, changes in the supply and prices of resources required for the operation of the Dorad’s

facilities and in the price of oil and electricity, changes in the Israeli CPI, changes in interest rates, seasonality, failure to obtain

financing for the expansion of Dorad and other risks applicable to projects under development and construction, and other risks applicable

to projects under development and construction, in addition to other risks and uncertainties associated with the Company’s and Dorad’s

business that are described in greater detail in the filings the Company makes from time to time with Securities and Exchange Commission,

including its Annual Report on Form 20-F. The forward-looking statements are made as of this date and the Company does not undertake any

obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Contact:

Kalia Rubenbach (Weintraub)

CFO

Tel: +972 (3) 797-1111

Email: hilai@ellomay.com

Dorad Energy Ltd.

Statements

of Financial Position

| |

|

March 31 |

|

|

March 31 |

|

|

December 31 |

|

| |

|

2024 |

|

|

2023 |

|

|

2023 |

|

| |

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Audited) |

|

| |

|

NIS thousands |

|

|

NIS thousands |

|

|

NIS thousands |

|

| Current assets |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

399,596 |

|

|

|

323,883 |

|

|

|

219,246 |

|

| Trade receivables and accrued income |

|

|

181,182 |

|

|

|

184,689 |

|

|

|

211,866 |

|

| Other receivables |

|

|

13,850 |

|

|

|

19,224 |

|

|

|

12,095 |

|

| Financial derivatives |

|

|

- |

|

|

|

3,902 |

|

|

|

- |

|

| Total current assets |

|

|

594,628 |

|

|

|

531,698 |

|

|

|

443,207 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Restricted deposit |

|

|

514,770 |

|

|

|

526,199 |

|

|

|

522,319 |

|

| Prepaid expenses |

|

|

29,548 |

|

|

|

31,573 |

|

|

|

30,053 |

|

| Fixed assets |

|

|

3,065,103 |

|

|

|

3,212,580 |

|

|

|

3,106,550 |

|

| Intangible assets |

|

|

7,573 |

|

|

|

6,722 |

|

|

|

7,653 |

|

| Right of use assets |

|

|

54,544 |

|

|

|

57,109 |

|

|

|

55,390 |

|

| Total non-current assets |

|

|

3,671,538 |

|

|

|

3,834,183 |

|

|

|

3,721,965 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

|

4,266,166 |

|

|

|

4,365,881 |

|

|

|

4,165,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Current maturities of loans from banks |

|

|

329,137 |

|

|

|

313,996 |

|

|

|

299,203 |

|

| Current maturities of lease liabilities |

|

|

4,787 |

|

|

|

4,645 |

|

|

|

4,787 |

|

| Trade payables |

|

|

158,545 |

|

|

|

172,081 |

|

|

|

166,089 |

|

| Other payables |

|

|

19,897 |

|

|

|

19,214 |

|

|

|

31,446 |

|

| Financial derivatives |

|

|

1,125 |

|

|

|

- |

|

|

|

- |

|

| Total current liabilities |

|

|

513,491 |

|

|

|

509,936 |

|

|

|

501,525 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

| Loans from banks |

|

|

2,001,668 |

|

|

|

2,235,981 |

|

|

|

1,995,909 |

|

| Other Long-term liabilities |

|

|

11,562 |

|

|

|

15,926 |

|

|

|

12,943 |

|

| Long-term lease liabilities |

|

|

48,007 |

|

|

|

50,130 |

|

|

|

47,618 |

|

| Provision for dismantling and restoration |

|

|

38,013 |

|

|

|

50,000 |

|

|

|

38,985 |

|

| Deferred tax liabilities |

|

|

297,691 |

|

|

|

231,157 |

|

|

|

278,095 |

|

| Liabilities for employee benefits, net |

|

|

160 |

|

|

|

160 |

|

|

|

160 |

|

| Total non-current liabilities |

|

|

2,397,101 |

|

|

|

2,583,354 |

|

|

|

2,373,710 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Share capital |

|

|

11 |

|

|

|

11 |

|

|

|

11 |

|

| Share premium |

|

|

642,199 |

|

|

|

642,199 |

|

|

|

642,199 |

|

| Capital reserve from activities with shareholders |

|

|

3,748 |

|

|

|

3,748 |

|

|

|

3,748 |

|

| Retained earnings |

|

|

709,616 |

|

|

|

626,633 |

|

|

|

643,979 |

|

| Total equity |

|

|

1,355,574 |

|

|

|

1,272,591 |

|

|

|

1,289,937 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

|

4,266,166 |

|

|

|

4,365,881 |

|

|

|

4,165,172 |

|

Dorad Energy Ltd.

Interim Condensed

Statement of Income

| | |

For the three months ended | | |

Year ended | |

| | |

March 31 | | |

December 31 | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Audited) | |

| | |

NIS thousands | | |

NIS thousands | | |

NIS thousands | |

| Revenues | |

| 610,882 | | |

| 648,316 | | |

| 2,722,396 | |

| | |

| | | |

| | | |

| | |

| Operating costs of the Power Plant | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Energy costs | |

| 131,084 | | |

| 124,074 | | |

| 583,112 | |

| Electricity purchase and | |

| | | |

| | | |

| | |

| infrastructure services | |

| 263,191 | | |

| 317,162 | | |

| 1,244,646 | |

| Depreciation and | |

| | | |

| | | |

| | |

| amortization | |

| 55,514 | | |

| 56,345 | | |

| 242,104 | |

| Other operating costs | |

| 42,469 | | |

| 34,171 | | |

| 186,024 | |

| | |

| | | |

| | | |

| | |

| Total operating costs of Power Plant | |

| 492,258 | | |

| 531,752 | | |

| 2,255,886 | |

| | |

| | | |

| | | |

| | |

| Profit from operating the Power Plant | |

| 118,624 | | |

| 116,564 | | |

| 466,510 | |

| | |

| | | |

| | | |

| | |

| General and administrative expenses | |

| 9,874 | | |

| 6,594 | | |

| 27,668 | |

| | |

| - | | |

| - | | |

| 39 | |

| | |

| | | |

| | | |

| | |

| Operating profit | |

| 108,750 | | |

| 109,970 | | |

| 438,881 | |

| | |

| | | |

| | | |

| | |

| Financing income | |

| 12,879 | | |

| 19,222 | | |

| 45,286 | |

| Financing expenses | |

| 36,396 | | |

| 59,082 | | |

| 209,773 | |

| | |

| | | |

| | | |

| | |

| Financing expenses, net | |

| 23,517 | | |

| 39,860 | | |

| 164,487 | |

| | |

| | | |

| | | |

| | |

| Profit before taxes on income | |

| 85,233 | | |

| 70,110 | | |

| 274,394 | |

| | |

| | | |

| | | |

| | |

| Taxes on income | |

| 19,596 | | |

| 16,141 | | |

| 63,079 | |

| | |

| | | |

| | | |

| | |

| Profit for the period | |

| 65,637 | | |

| 53,969 | | |

| 211,315 | |

Dorad Energy Ltd.

Interim Condensed

Statement of Changes in Shareholders’ Equity

| | |

| | |

| | |

Capital reserve | | |

| | |

| |

| | |

| | |

| | |

for

activities | | |

| | |

| |

| | |

Share | | |

Share | | |

with | | |

Retained | | |

| |

| | |

capital | | |

premium | | |

shareholders | | |

earnings | | |

Total

Equity | |

| | |

NIS thousands | | |

NIS thousands | | |

NIS thousands | | |

NIS thousands | | |

NIS thousands | |

| For

the three months ended March 31, 2024 (Unaudited) | |

| | |

| | |

| | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| |

| Balance

as at January 1, 2024 (Audited) | |

| 11 | | |

| 642,199 | | |

| 3,748 | | |

| 643,979 | | |

| 1,289,937 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Profit

for the period | |

| - | | |

| - | | |

| - | | |

| 65,637 | | |

| 65,637 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as at March 31, 2024 (Unaudited) | |

| 11 | | |

| 642,199 | | |

| 3,748 | | |

| 709,616 | | |

| 1,355,574 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| For

the three months ended March 31, 2023 (Unaudited) | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as at January 1, 2023 (Audited) | |

| 11 | | |

| 642,199 | | |

| 3,748 | | |

| 572,664 | | |

| 1,218,622 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Profit

for the period | |

| - | | |

| - | | |

| - | | |

| 53,969 | | |

| 53,969 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as at March 31, 2023 (Unaudited) | |

| 11 | | |

| 642,199 | | |

| 3,748 | | |

| 626,633 | | |

| 1,272,591 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| For

the year ended December 31, 2023 (Audited) | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as at January 1, 2023 (Audited) | |

| 11 | | |

| 642,199 | | |

| 3,748 | | |

| 572,664 | | |

| 1,218,622 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividend

distributed | |

| - | | |

| - | | |

| - | | |

| (140,000 | ) | |

| (140,000 | ) |

| Profit

for the year | |

| - | | |

| - | | |

| - | | |

| 211,315 | | |

| 211,315 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance

as at December 31, 2023 (Audited) | |

| 11 | | |

| 642,199 | | |

| 3,748 | | |

| 643,979 | | |

| 1,289,937 | |

Dorad Energy Ltd.

Interim Condensed

Statements of Cash Flows

| | |

For the three months ended | | |

Year ended | |

| | |

March 31 | | |

December 31 | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | | |

(Audited) | |

| | |

NIS thousands | | |

NIS thousands | | |

NIS thousands | |

| | |

| | |

| | |

| |

| Cash flows from operating activities: | |

| | |

| | |

| |

| Profit for the period | |

| 65,637 | | |

| 53,969 | | |

| 211,315 | |

| Adjustments: | |

| | | |

| | | |

| | |

| Depreciation and amortization and fuel consumption | |

| 59,379 | | |

| 56,790 | | |

| 245,566 | |

| Taxes on income | |

| 19,596 | | |

| 16,141 | | |

| 63,079 | |

| Financing expenses, net | |

| 23,517 | | |

| 39,860 | | |

| 164,487 | |

| | |

| 102,492 | | |

| 112,791 | | |

| 473,132 | |

| | |

| | | |

| | | |

| | |

| Change in trade receivables | |

| 30,684 | | |

| 53,892 | | |

| 26,715 | |

| Change in other receivables | |

| (4,493 | ) | |

| 13,585 | | |

| 20,714 | |

| Change in trade payables | |

| (8,906 | ) | |

| (67,513 | ) | |

| (115,976 | ) |

| Change in other payables | |

| 5,954 | | |

| 7,775 | | |

| 2,507 | |

| Change in Other long-term liabilities | |

| (1,381 | ) | |

| (1,603 | ) | |

| (4,586 | ) |

| | |

| 21,858 | | |

| 6,136 | | |

| (70,626 | ) |

| | |

| | | |

| | | |

| | |

| Net cash flows provided by operating activities | |

| 189,987 | | |

| 172,896 | | |

| 613,821 | |

| | |

| | | |

| | | |

| | |

| Cash flows used in investing activities | |

| | | |

| | | |

| | |

| Proceeds (used in) for settlement of financial derivatives | |

| (1,395 | ) | |

| 1,172 | | |

| 8,884 | |

| Insurance proceeds in respect of damage to fixed asset | |

| 2,737 | | |

| - | | |

| - | |

| Decrease in long-term restricted deposits | |

| 17,500 | | |

| - | | |

| 40,887 | |

| Investment in fixed assets | |

| (17,069 | ) | |

| (14,213 | ) | |

| (102,082 | ) |

| Investment in intangible assets | |

| (412 | ) | |

| (817 | ) | |

| (3,162 | ) |

| Interest received | |

| 9,577 | | |

| 6,024 | | |

| 33,501 | |

| Net cash flows provided by (used in) investing activities | |

| 10,918 | | |

| (7,834 | ) | |

| (21,972 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | |

| Repayment of lease liability principal | |

| (100 | ) | |

| (100 | ) | |

| (4,817 | ) |

| Repayment of loans from banks | |

| - | | |

| - | | |

| (253,382 | ) |

| Dividends paid | |

| (17,500 | ) | |

| - | | |

| (122,500 | ) |

| Interest paid | |

| (196 | ) | |

| (150 | ) | |

| (151,220 | ) |

| Net cash flows used in financing activities | |

| (17,796 | ) | |

| (250 | ) | |

| (531,919 | ) |

| | |

| | | |

| | | |

| | |

| Net increase in cash and cash equivalents for the period | |

| 183,109 | | |

| 164,812 | | |

| 59,930 | |

| | |

| | | |

| | | |

| | |

| Effect of exchange rate fluctuations on cash and cash equivalents | |

| (2,759 | ) | |

| 7,590 | | |

| 7,835 | |

| Cash and cash equivalents at beginning of period | |

| 219,246 | | |

| 151,481 | | |

| 151,481 | |

| Cash and cash equivalents at end of period | |

| 399,596 | | |

| 323,883 | | |

| 219,246 | |

7

Exhibit 99.2

Other than information

relating to Ellomay Luzon Infrastructures Ltd. (formerly U. Dori Energy Infrastructures Ltd., or Ellomay Luzon Energy), the disclosures

contained herein concerning Dorad Energy Ltd., or Dorad, and the power plant owned by Dorad, or the Dorad Power Plant, are based on information

received from Dorad. Unless the context in which such terms are used would require a different meaning, all references to “Ellomay,”

“us,” “we,” “our” or the “Company” refer to Ellomay Capital Ltd. and its consolidated

subsidiaries.

All reference herein to

the “2023 Annual Disclosure” are to the immediate report provided to the holders of the Company’s Series E Secured Debenture,

submitted to the Israel Securities Authority on March 27, 2024 (filing number 2024-02-033414) and submitted on a Form 6-K to the US Securities

and Exchange Commission on March 27, 2024. Unless otherwise noted, defined terms used herein shall have the same meaning as set forth

in the 2023 Annual Disclosure.

With reference to Section

1.1 of the 2023 Annual Disclosure (“General”) under the heading “‘Iron Swords’ War,” Dorad estimated,

based on the information it had as of May 27, 2024 (the date of approval of Dorad’s financial statements as of March 31, 2024),

that the current events and the security escalation in Israel have an impact on its results but that the impact on its short-term business

results will be immaterial. Dorad further notes that as this event is not under the control of Dorad, and factors such as the continuation

of the war and hostilities or their cessation may affect Dorad’s assessments, as of the date of the financial statements, Dorad

is unable to assess the extent of the impact of the war on its business activities and on its medium and long-term results. Dorad continues

to regularly monitor the developments and is examining the effects on its operations and the value of its assets.

With reference to Section

1.4 of the 2023 Annual Disclosure (“Selected Financial Information”), Dorad’s financial results for the three months

ended March 31, 2024 were included on a press release published by the Company and submitted to the MAGNA system on May 31, 2024.

With reference to Section

1.5.2 of the 2023 Annual Disclosure (“Limitations, Regulation, Standards and Special Requirements applicable to the Field of

Operations”) under the heading “Tariffs and Payments,” on January 29, 2024, the Israeli Electricity Authority published

a decision regarding “Annual Update of 2024 Electricity Rates for Customers of the IEC,” which provided for a decrease in

the average production component of approximately 1% compared with the average production component published by the Israeli Electricity

Authority in March 2023 that was valid up to and including January 2024.

With reference to Section

1.5.2 of the 2023 Annual Disclosure (“Limitations, Regulation, Standards and Special Requirements applicable to the Field of

Operations”) under the heading “Consumption Plants and Deviations,” in connection with the third-party notice against

Dorad filed by the IEC and the appeal submitted by the IEC on its rejection, on March 28, 2024, Dorad submitted its answer to the appeal

(following an extension approved by the court). On February 14, 2024, the applicant in the approval request submitted his response to

the appeal. The appeal hearing is scheduled for January 6, 2025.

With reference to Section

1.5.2 of the 2023 Annual Disclosure (“Limitations, Regulation, Standards and Special Requirements applicable to the Field

of Operations”) under the heading “Virtual Supplier” and Section 1.7 (“Customers”), in

connection with the decision of the Israeli Electricity Authority to open the market to competition in the supply segment, within

which Dorad was given the opportunity to sell electricity to domestic consumers, in April 2024, the Israeli Electricity Authority

published a decision that enables transitioning domestic consumers without a “smart meter” to private manufacturers by

adopting a “Normative Consumption Model of a Domestic Consumer” (a statistical estimation of the consumption by the

average domestic consumer in each half hour during the year). Based on this model, Dorad contracted with a number of entities that

provide services to domestic consumers on a large scale, for the purpose of selling electricity to domestic customers of those

entities. At this stage the income from these agreements does not materially affect Dorad’s results.

With reference to Section

1.5.2 of the 2023 Annual Disclosure (“Limitations, Regulation, Standards and Special Requirements applicable to the Field of

Operations”) under the heading “Market Model for Private Manufacturers on the Transmission Grid,” the arrangement with

the private manufacturers will become effective commencing July 1, 2024. Dorad is continually examining the impact of the resolution

on its operations and may, at any time and from time to time, elect to switch to the proposed central loading mechanism in the event

it resolves that the change will have a positive impact on its financial results.

With reference to Section

1.6 of the 2023 Annual Disclosure (“Products and Services; Production Capacity; Possibility of Expansion of the Power Plant”)

under the heading “Power Plant Malfunctions,” and to Section 1.11.5 (“Operation and Maintenance (O&M) Agreement”)

in connection with the arbitration proceeding with Dorad’s maintenance contractor (Edeltech O&M Ltd.), on March 18, 2024, a

preliminary hearing was held. Based on the recommendation of the arbitrator, the evidentiary hearing was canceled, and the parties will

try to reach a settlement. The parties undertook to update the arbitrator on the progress of their discussions until July 1, 2024, and

thereafter, if necessary, alternative dates for the evidentiary hearings will be scheduled.

With reference to Section

1.6 of the 2023 Annual Disclosure (“Products and Services; Production Capacity; Possibility of Expansion of the Power Plant”)

under the heading “Potential Expansion of the Dorad Power Plant (“Dorad 2”),” following the approval of NIP 11/b,

Dorad approached the NIC for a building permit, however, on January 11, 2024, Dorad was informed in an e-mail message from the NIC that

its position is that as long as NIP 20/B or NIP 91 are not definitively rejected, it is not possible to issue a building permit for the

new power plant, based on a legal opinion of legal advisers in the NIC and in the planning administration, which were sent to Dorad on

January 15, 2024.

On January 16, 2024, Dorad

received a letter from Edelcom stating that Edelcom, as a shareholder of Dorad, objects to the proposal to expand the power plant.

On February 7, 2024, Dorad,

through its legal counsel, sent a letter, among other addressees to the legal advisers of the NIC and the planning administration that

prepared the aforesaid legal opinion, arguing that the NIC’s refusal to grant Dorad a building permit is illegal and contrary to

the proper interpretation of NIP 11/B. On February 26, 2024, Dorad received a response from the NIC, which stands by its position that

the issuance of building permits for the expansion of the power plant should not be promoted.

On February 19, 2024, Dorad

received a planning survey to receive the expansion of the power plant from the System Manager, which allows electricity to be taken out

commencing October 2028.

On March 13, 2024, Dorad filed

a petition with the Israeli High Court of Justice, against the NIC, the Government of Israel, the Ministry of Energy and Infrastructure,

and the legal advisor to the government, requesting a conditional order addressed to the NIC instructing it to provide the reasons refusal

to attend to the request for building permits for the construction of the “Dorad 2” power plant, which was approved by the

Israeli government as aforementioned. Dorad also requested that following the issuance of the conditional order, the order will become

a permanent order instructing the NIC to attend to the issuance of the building permits for the “Dorad 2” power plant in accordance

with the NIP 11/b. On March 13, 2024, the Israeli High Court of Justice ruled that a preliminary response on behalf of the respondents

to the petition will be submitted by May 16, 2024. On May 2, 2024, the legal advisor of the NIC announced that at the April 17, 2024 meeting

of the Israeli government, it was decided to reject NIP 20/B - Hadera Power Station and therefore it is possible to resume and promote

the procedure of issuing the building permits under NIP 11/B at the at the National Licensing Authority. Dorad was therefore asked by

the legal advisor to the NIC to submit a petition to delete the petition, which became redundant in light of the rejection of NIP 20/B.

Considering this development, Dorad submitted a request to the High Court of Justice to delete the petition without an order for costs.

On May 8, 2024, a judgment was issued dismissing the petition without an order for costs.

The expansion of the Dorad

Power Plant by building the Dorad 2 facility in a combined cycle technology, will result in an aggregate capacity of the Dorad Power Plant

of approximately 1,500 MW and the approved plan also enables adding batteries with a capacity of approximately 80 MW. The Company expects

that if the Dorad 2 plan will materialize and the expansion will be completed, the expansion of the power plant will increase the revenues

and income of Dorad. The expansion has not yet been approved by Dorad and its approval and construction are subject to various conditions,

including, among others, receipt of corporate and other approvals and permits, obtaining financing, receipt of licenses from the Israeli

Electricity Authority, regulatory changes and market terms and condition, all of which are not within the control of Dorad or the Company.

As of the date of this report, Dorad has not yet reached a final decision with respect to Dorad 2 and there can be no assurance as to

if, when and under what terms it will be advanced or promoted by Dorad. The abovementioned estimations in connection with Dorad

2, constitute forward-looking information, as defined in the Securities Law, 1968, and is based on the information, experience and estimates

of Dorad and the Company as of this date. Such information and assessments may also not materialize, in whole or in part or may materialize

in a different manner than anticipated, including due to factors that are unknown to Dorad and the Company as of the date of this report

and are not under their control, which include, inter alia, the timing of issuance of building permits,

to the extent issued, receipt of corporate and other approvals, receipt of funding, the outcome and impact of legal proceedings commenced

by third parties, regulatory and market changes, as well as other factors set forth in this section and other risk factors listed in Section

1.17 of the 2023 Annual Disclosure.

With reference to Section

1.12 of the 2023 Annual Disclosure (“Working Capital Deficiency”), as of March 31, 2024, Dorad had a working capital

of approximately NIS 81.1 million, due to an increase in Dorad’s current assets.

With reference to Section

1.13 of the 2023 Annual Disclosure (“Financing”) under the heading “Financing Agreements,” As of March 31,

2024, the outstanding balance of the Dorad Credit Facility was approximately NIS 2.29 billion and Dorad is in compliance with the financial

standards required by the Dorad Credit Facility.

With reference to Section

1.13 of the 2023 Annual Disclosure (“Financing”) under the heading “Dorad Credit Rating,” on April 9, 2024,

Dorad received a ratification of its debt rating of ilAA- from S&P Ma’alot, updating the forecast from “negative”

to “stable.” The updated rating forecast did not have an influence on the interest rate of Dorad’s credit facility.

With reference to Section

1.13 of the 2023 Annual Disclosure (“Financing”) under the heading “Dorad Credit Rating,” in March 2024, Dorad

received a request for materials from the Israeli Tax Authority in connection with tax assessments for the years 2021 and 2022.

With reference to Section

1.16 of the 2023 Annual Disclosure (“Legal Proceedings”) under the headings “Petition to Approve a Derivative Claim

filed by Ellomay Luzon Energy and Ran Fridrich” and “Petition to Approve a Derivative Claim filed by Edelcom”, the parties

filed responses to the appeals on the arbitration ruling in February 2024 and answers to the responses were filed on May 15, 2024. A preliminary

hearing was scheduled for May 30, 2024.

3

Exhibit 99.3

Summary of the Financial Statements of Ellomay

Luzon Energy Infrastructures Ltd. for March 31, 20241

ELLOMAY LUZON ENERGY

INFRASTRUCTURES LTD.

Condensed Statements

of Financial Position

| | |

As at March 31 | | |

As at

December 31 | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

Unaudited | | |

Unaudited | | |

Audited | |

| | |

NIS in thousands | |

| Assets | |

| | |

| | |

| |

| Current assets: | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 113 | | |

| 22 | | |

| 80 | |

| Trade and other receivables | |

| 554 | | |

| 433 | | |

| 1,160 | |

| | |

| 667 | | |

| 455 | | |

| 1,240 | |

| Non-current assets: | |

| | | |

| | | |

| | |

| Investment in equity accounted investee | |

| 263,764 | | |

| 249,057 | | |

| 251,669 | |

| | |

| 264,431 | | |

| 249,512 | | |

| 252,909 | |

| | |

| | | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Trade, related parties and other payables | |

| 1,509 | | |

| 206 | | |

| 1,380 | |

| Loans from shareholders | |

| - | | |

| 21,066 | | |

| - | |

| | |

| 1,509 | | |

| 21,272 | | |

| 1,380 | |

| | |

| | | |

| | | |

| | |

| Equity: | |

| | | |

| | | |

| | |

| Share capital | |

| * | | |

| * | | |

| * | |

| Share premium | |

| 105,116 | | |

| 105,116 | | |

| 46,933 | |

| Capital notes | |

| 46,933 | | |

| 46,933 | | |

| 105,116 | |

| Accumulated profit | |

| 110,873 | | |

| 76,191 | | |

| 99,480 | |

| | |

| 262,922 | | |

| 228,240 | | |

| 251,529 | |

| | |

| 264,431 | | |

| 249,512 | | |

| 252,909 | |

| * | Represents an amount less than NIS 1 thousand |

| 1 | Summary of Hebrew version, the original language was published

by Ellomay Capital Ltd. in Israel and is available upon request. |

ELLOMAY LUZON ENERGY

INFRASTRUCTURES LTD.

Condensed Statements

of Comprehensive Income

| | |

Three Months ended

March 31 | | |

Year ended

December 31 | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| | |

NIS in thousands | |

| | |

| | |

| | |

| |

| General and administrative expenses | |

| (555 | ) | |

| (102 | ) | |

| (983 | ) |

| Operating loss | |

| (555 | ) | |

| (102 | ) | |

| (983 | ) |

| Financing expenses | |

| (147 | ) | |

| (766 | ) | |

| (2,458 | ) |

| Share of profits of equity accounted investee | |

| 12,095 | | |

| 9,910 | | |

| 38,772 | |

| Net profit for the period | |

| 11,393 | | |

| 9,042 | | |

| 35,331 | |

| Total comprehensive income for the period | |

| 11,393 | | |

| 9,042 | | |

| 35,331 | |

ELLOMAY LUZON ENERGY INFRASTRUCTURES LTD.

Condensed Statements of Changes in Equity

| | |

Share

Capital | | |

Capital

Notes | | |

Share

Premium | | |

Accumulated

Profit | | |

Total

Equity | |

| | |

NIS in thousands | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as at January 1, 2024 (audited) | |

| * | | |

| 46,933 | | |

| 105,116 | | |

| 99,480 | | |

| 251,529 | |

| Transaction during the three-month period ended March

31, 2024 (unaudited) – | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive profit for the period | |

| - | | |

| - | | |

| - | | |

| 11,393 | | |

| 11,393 | |

| Balance as at March 31, 2024

(unaudited) | |

| * | | |

| 46,933 | | |

| 105,116 | | |

| 110,873 | | |

| 262,922 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as at January 1, 2023 (audited) | |

| * | | |

| 46,933 | | |

| 105,116 | | |

| 67,149 | | |

| 219,198 | |

| Transaction during the three-month period ended March

31, 2023 (unaudited) – | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total comprehensive profit for the period | |

| - | | |

| - | | |

| - | | |

| 9,042 | | |

| 9,042 | |

| Balance as at March 31, 2023

(unaudited) | |

| * | | |

| 46,933 | | |

| 105,116 | | |

| 76,191 | | |

| 228,240 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance as at January 1, 2023 (audited) | |

| * | | |

| 46,933 | | |

| 105,116 | | |

| 67,149 | | |

| 219,198 | |

| Transaction during the year ended December 31, 2023

(audited) – | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividend | |

| - | | |

| - | | |

| - | | |

| (3,000 | ) | |

| (3,000 | ) |

| Total comprehensive profit for the period | |

| - | | |

| - | | |

| - | | |

| 35,331 | | |

| 35,331 | |

| Balance as at December 31, 2023

(audited) | |

| * | | |

| 46,933 | | |

| 105,116 | | |

| 99,480 | | |

| 251,529 | |

| * | Represents an amount less than NIS 1 thousand |

ELLOMAY LUZON ENERGY

INFRASTRUCTURES LTD.

Condensed Statements

of Cash Flows

| | |

Three months ended

March 31 | | |

Year ended

December 31 | |

| | |

2024 | | |

2023 | | |

2023 | |

| | |

Unaudited | | |

Audited | |

| | |

NIS in thousands | |

| | |

| | |

| | |

| |

| Cash flows from operating activities - | |

| | |

| | |

| |

| Net profit for the period | |

| 11,393 | | |

| 9,042 | | |

| 35,331 | |

| | |

| | | |

| | | |

| | |

| Adjustments needed to present cash flows from the Company’s operating activities: | |

| | | |

| | | |

| | |

| Adjustments to the Company’s profit and loss items: | |

| | | |

| | | |

| | |

| Financing expenses | |

| 147 | | |

| 766 | | |

| 2,458 | |

| Company’s share of profits of equity accounted investee | |

| (12,095 | ) | |

| (9,910 | ) | |

| (38,772 | ) |

| | |

| (11,948 | | |

| (9,144 | ) | |

| (36,314 | ) |

| Changes in the assets and liabilities of the company: | |

| | | |

| | | |

| | |

| Decrease (increase) in trade and other receivables | |

| 459 | | |

| (457 | ) | |

| (1,542 | ) |

| Increase (decrease) in trade, related parties and other payables | |

| 129 | | |

| (13 | ) | |

| 1,161 | |

| | |

| 588 | | |

| (470 | ) | |

| (381 | ) |

| | |

| | | |

| | | |

| | |

| Cash paid during the period for: | |

| | | |

| | | |

| | |

| Interest paid | |

| - | | |

| - | | |

| (12,664 | ) |

| Net cash provided by (used for) operating activities | |

| 33 | | |

| (572 | ) | |

| (14,028 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from investing activities - | |

| | | |

| | | |

| | |

| Dividend from equity accounted investee | |

| - | | |

| - | | |

| 26,250 | |

| Net cash provided by investing activities | |

| - | | |

| - | | |

| 26,250 | |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities - | |

| | | |

| | | |

| | |

| Repayment of loans to shareholders | |

| - | | |

| - | | |

| (10,292 | ) |

| Dividend paid | |

| - | | |

| - | | |

| (3,000 | ) |

| Receipt of loans from shareholders | |

| - | | |

| 440 | | |

| 996 | |

| Net cash provided by financing activities | |

| - | | |

| 440 | | |

| (12,296 | ) |

| | |

| | | |

| | | |

| | |

| Change in cash and cash equivalents | |

| 33 | | |

| (132 | ) | |

| (74 | ) |

| Cash and cash equivalents at the beginning of the period | |

| 80 | | |

| 154 | | |

| 154 | |

| Cash and cash equivalents at the end of the period | |

| 113 | | |

| 22 | | |

| 80 | |

4

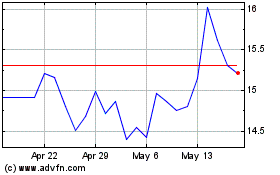

Ellomay Capital (AMEX:ELLO)

Historical Stock Chart

From May 2024 to Jun 2024

Ellomay Capital (AMEX:ELLO)

Historical Stock Chart

From Jun 2023 to Jun 2024