Filed Pursuant to General Instruction II.L of Form F-10

File No. 333-259994

This prospectus supplement (the "Prospectus Supplement"), together with the short form base shelf prospectus dated July 5, 2021 to which it relates, as amended or supplemented (the "Base Shelf Prospectus"), and each document deemed to be incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus, as amended or supplemented (collectively, the "Prospectus"), constitutes a public offering of these securities only in those jurisdictions where they may be lawfully offered for sale and only by persons permitted to sell such securities. No securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

Information has been incorporated by reference in the Prospectus from documents filed with securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Secretary of Cybin Inc. at 100 King Street West, Suite 5600, Toronto, Ontario M5X 1C9, telephone 1-866-292-4601, and are also available electronically at www.sedar.com and www.sec.gov/edgar.

PROSPECTUS SUPPLEMENT

(To the Short Form Base Shelf Prospectus dated July 5, 2021)

CYBIN INC.

U.S.$35,000,000

Common Shares

Cybin Inc. ("Cybin" or the "Corporation") is hereby qualifying the distribution (the "Offering") of common shares in the capital of the Corporation (the "Common Shares"), having an aggregate sale price of up to U.S.$35,000,000 (or the equivalent in United States dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Common Shares are sold), see "Plan of Distribution" and "Description of the Common Shares".

The issued and outstanding Common Shares are listed in Canada on the Neo Exchange Inc. ("NEO") and in the United States on the NYSE American LLC ("NYSE American"), in each case under the trading symbol "CYBN". On August 5, 2022, the last trading day prior to the filing of this Prospectus Supplement, the closing prices of the Common Shares listed on the NEO and NYSE American were $0.95 and U.S.$0.73, respectively.

The Corporation has entered into an "at-the-market equity" distribution agreement dated August 8, 2022 (the "Distribution Agreement") with Cantor Fitzgerald Canada Corporation (the "Canadian Agent") and Cantor Fitzgerald & Co. (the "US Agent", together with the Canadian Agent, the "Agents") pursuant to which the Corporation may distribute Common Shares from time to time through the Agents, as agents, in accordance with the terms of the Distribution Agreement, see "Plan of Distribution". Sales of Common Shares, if any, under the Prospectus are anticipated to be made in transactions that are deemed to be "at-the-market distributions" as defined in National Instrument 44-102 - Shelf Distributions ("NI 44-102") and an "at-the-market offering" as defined in Rule 415(a)(4) under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), in privately negotiated transactions and/or any other method permitted by applicable law including sales made directly on the NEO by the Canadian Agent, and on NYSE American by the US Agent, or any other recognized marketplace upon which the Common Shares are listed or quoted or where the Common Shares are traded in Canada or the United States. The Common Shares will be distributed at the market prices prevailing at the time of the sale. As a result, prices at which Common Shares are sold may vary as between purchasers and during the period of any distribution. There is no minimum amount of funds that must be raised under the Offering. This means that the Offering may terminate after raising only a portion of the Offering amount set out above, or none at all. The Canadian Agent is not registered as a broker-dealer in the United States and, accordingly, will only sell Common Shares on marketplaces in Canada. The US Agent is not registered as an investment dealer in any Canadian jurisdiction and, accordingly, will only sell Common Shares on marketplaces in the United States. See "Plan of Distribution".

The Offering is being made concurrently in Canada under the terms of the Prospectus and in the United States under the Corporation's Registration Statement on Form F-10 (File No. 333-259994) (the "Registration Statement"), filed with the United States Securities and Exchange Commission (the "SEC"), of which this Prospectus Supplement forms a part.

The Corporation will pay the Agents compensation for their services in acting as agent in connection with the sale of Common Shares pursuant to the Distribution Agreement equal to 3% of the gross sale price per Common Share sold (the "Commission").

The Corporation has applied to list the Common Shares distributed hereunder on the NEO and NYSE American has authorized the listing of the Common Shares to be offered in the Offering. Listing will be subject to the Corporation fulfilling all listing requirements of the NEO and NYSE American.

An investment in the Common Shares is highly speculative and involves significant risks that you should consider before purchasing Common Shares. See the "Risk Factors" section in this Prospectus Supplement, including in the documents incorporated by reference.

The net proceeds that the Corporation will receive from sales of the Common Shares will vary depending on the number of shares actually sold and the offering price for such shares, but will not exceed U.S.$33,950,000 in the aggregate. See "Use of Proceeds" for how the net proceeds, if any, from sales under this Prospectus Supplement will be used.

The Corporation is permitted, under the multi-jurisdictional disclosure system adopted by the United States and Canada ("MJDS"), to prepare this Prospectus Supplement and the accompanying Base Shelf Prospectus in accordance with Canadian disclosure requirements. Purchasers of Common Shares should be aware that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, and may not be comparable to financial statements of United States companies, which are prepared under United States generally accepted accounting principles, or "US GAAP". Such financial statements are subject to the standards of the Public Company Accounting Oversight Board (United States) and the SEC independence standards.

This Prospectus Supplement and the Base Shelf Prospectus do not contain all of the information set forth in the Registration Statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC, or the schedules or exhibits that are part of the Registration Statement. Investors in the United States should refer to the Registration Statement and the exhibits thereto for further information with respect to the Corporation and the Common Shares.

Purchasers of Common Shares should be aware that the acquisition of Common Shares may have tax consequences both in the United States and in Canada. Such consequences for purchasers who are resident in, or citizens of, the United States or who are resident in Canada may not be described fully herein. Purchasers of Common Shares should read the tax discussion contained in this Prospectus Supplement and consult their own tax advisors. See "Certain Canadian Income Tax Considerations" and "Certain United States Federal Income Tax Considerations".

The enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that the Corporation is incorporated under the laws of Canada, certain of the officers and directors are not residents of the United States, that some or all of the Agents or experts named in this Prospectus Supplement and in the accompanying Base Shelf Prospectus are not residents of the United States, and that a substantial portion of the assets of the Corporation and such persons are located outside the United States. See "Enforcement of Civil Liabilities".

NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION OR REGULATOR HAS APPROVED OR DISAPPROVED THE COMMON SHARES NOR PASSED UPON THE ACCURACY OR ADEQUACY OF THE PROSPECTUS AND THIS PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

In connection with the sale of the Common Shares on the Corporation's behalf, the Agents may be deemed to be an "underwriter" within the meaning of Section 2(a)(11) of the U.S. Securities Act, and the compensation of the Agents may be deemed to be underwriting commissions or discounts. The Corporation has agreed to provide indemnification and contribution to the Agents against certain liabilities, including liabilities under the U.S. Securities Act.

As sales agents, the Agents will not engage in any prohibited transactions to stabilize or maintain the price of the Common Shares. Neither the Agents nor any person or company acting jointly or in concert with either of the Agents may, in connection with the distribution, enter into any transaction that is intended to stabilize or maintain the market price of the Common Shares distributed under this Prospectus Supplement, including selling an aggregate number or principal amount of Common Shares that would result in the Agents creating an over-allocation position in the Common Shares.

Each of Douglas Drysdale, Michael Palfreyman, Alex Nivorozhkin and Brett Greene, officers of the Corporation, resides outside of Canada. They have each appointed Maxims CS Inc., Suite 1800, 181 Bay Street, Toronto, Ontario, M5J 2T9, as agent for service of process in Ontario. Prospective purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed an agent for service of process.

Except as otherwise indicated, references to "Canadian dollars" or "$" are to the currency of Canada. Certain totals, subtotals and percentages may not precisely reconcile due to rounding.

The Corporation's head and registered office is located at 100 King Street West, Suite 5600, Toronto, ON M5X 1C9.

Cantor

TABLE OF CONTENTS

Prospectus Supplement

Base Shelf Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this Prospectus Supplement, which describes certain terms of the Common Shares that the Corporation is offering and also adds to and updates certain information contained in the Base Shelf Prospectus and the documents incorporated by reference therein. The second part, the Base Shelf Prospectus, gives more general information, some of which may not apply to the Common Shares offered hereunder. Defined terms or abbreviations used in this Prospectus Supplement that are not defined herein have the meanings ascribed thereto in the Base Shelf Prospectus. Investors should rely only on the information contained or incorporated by reference in this Prospectus Supplement and the Base Shelf Prospectus. The Corporation has not, and the Agents have not, authorized anyone to provide investors with different or additional information. The Corporation is not, and the Agents are not, making an offer to sell Common Shares in any jurisdiction where the offer or sale is not permitted. Investors should not assume that the information appearing in this Prospectus Supplement, the Base Shelf Prospectus or any documents incorporated by reference herein or therein, is accurate as of any date other than the date indicated in those documents, as the Corporation's business, operating results, financial condition and prospects may have changed since such date. Before you invest, you should carefully read this Prospectus Supplement, the accompanying Base Shelf Prospectus and all information incorporated by reference herein and therein. These documents contain information you should consider when making your investment decision.

The Corporation filed the Base Shelf Prospectus with the securities commissions in all Canadian provinces and territories (the "Canadian Qualifying Jurisdictions") in order to qualify the offering of the securities described in the Base Shelf Prospectus in accordance with National Instrument 44-102 Shelf Distributions. The Ontario Securities Commission issued a receipt dated July 5, 2021 in respect of the final Base Shelf Prospectus as the principal regulatory authority under Multilateral Instrument 11-102 Passport System, and each of the other commissions in the Canadian Qualifying Jurisdictions is deemed to have issued a receipt under National Policy 11-202 Process for Prospectus Review in Multiple Jurisdictions.

The Base Shelf Prospectus also forms part of the Registration Statement that the Corporation filed with the SEC on October 1, 2021 under the U.S. Securities Act utilizing the MJDS. The Registration Statement became effective under the U.S. Securities Act on October 8, 2021. The Registration Statement includes the Base Shelf Prospectus with certain modifications and deletions permitted by Form F-10 and the rules and regulations of the SEC. This Prospectus Supplement is being filed by the Corporation with the SEC in accordance with General Instruction II.L of Form F-10.

Unless otherwise indicated or the context otherwise requires, all references in this Prospectus Supplement to "Cybin" or the "Corporation", except as otherwise indicated or as the context otherwise indicates, mean Cybin Inc. and its subsidiaries and associated corporations.

This Prospectus Supplement is deemed to be incorporated by reference in the Base Shelf Prospectus solely for the purposes of the Offering. Other documents are also incorporated or deemed to be incorporated by reference in this Prospectus Supplement and in the Base Shelf Prospectus. See "Documents Incorporated by Reference".

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements contained in this Prospectus Supplement, and in certain documents incorporated by reference herein, constitute "forward-looking information" and "forward-looking statements," within the meaning of applicable securities laws. All statements other than statements of historical fact, including, without limitation, those regarding the Corporation's future financial position and results of operations, strategy, plans, objectives, goals and targets, future developments in the markets where the Corporation participates or is seeking to participate, and any statements preceded by, followed by or that include the words "believe", "expect", "aim", "intend", "plan", "continue", "will", "may", "would", "anticipate", "estimate", "forecast", "predict", "project", "seek", "should", "objective", "assumes" or similar expressions or the negative thereof, are forward-looking statements.

These statements are not historical facts but instead represent only the Corporation's expectations, estimates and projections regarding future events. These statements are not guarantees of future performance and involve assumptions, risks and uncertainties that are difficult to predict. Therefore, actual results may differ materially from what is expressed, implied or forecasted in such forward-looking statements. Additional factors that could cause actual results, performance or achievements to differ materially include, but are not limited to, those discussed under "Risk Factors" in the Annual Information Form (as defined herein) and in this Prospectus Supplement and in other documents incorporated by reference herein. Management provides forward-looking statements because it believes they provide useful information to readers when considering their investment objectives and cautions readers that the information may not be appropriate for other purposes. Consequently, all of the forward-looking statements made in this Prospectus Supplement and in documents incorporated by reference herein are qualified by these cautionary statements and other cautionary statements or factors contained herein, and there can be no assurance that the actual results or developments will be realized or, even if substantially realized, that they will have the expected consequences to, or effects on, the Corporation. These forward-looking statements are made as of the date of this Prospectus Supplement and the Corporation assumes no obligation to update or revise them to reflect subsequent information, events or circumstances or otherwise, except as required by law.

The forward-looking statements in this Prospectus Supplement and in documents incorporated by reference herein are based on numerous assumptions regarding the Corporation's present and future business strategies and the environment in which the Corporation will operate in the future, including assumptions regarding business and operating strategies, and the Corporation's ability to operate on a profitable basis.

Some of the risks which could affect future results and could cause results to differ materially from those expressed in the forward-looking statements contained herein include: the net proceeds, if any, from sales under this Prospectus Supplement; the Corporation's use of proceeds and business objectives and milestones and the anticipated timing of execution, see "Use of Proceeds"; novel coronavirus "COVID-19"; limited operating history; achieving publicly announced milestones; speculative nature of investment risk; early stage of the industry and product development; regulatory risks and uncertainties; plans for growth; limited products; limited marketing and sales capabilities; no assurance of commercial success; no profits or significant revenues; reliance on third parties for clinical development activities; risks related to third party relationships; reliance on contract manufacturers; safety and efficacy of products; clinical testing and commercializing products; completion of clinical trials; commercial grade product manufacturing; nature of regulatory approvals; unfavourable publicity or consumer perception; social media; biotechnology and pharmaceutical market competition; reliance on key executives and scientists; employee misconduct; business expansion and growth; negative results of external clinical trials or studies; product liability; enforcing contracts; product recalls; distribution and supply chain interruption; difficulty to forecast; promoting the brand; product viability; success of quality control systems; reliance on key inputs; liability arising from fraudulent or illegal activity; operating risk and insurance coverage; costs of operating as public company; management of growth; conflicts of interest; foreign operations; cybersecurity and privacy risk; environmental regulation and risks; decriminalisation of psychedelics; forward-looking statements may prove to be inaccurate; effects of inflation; political and economic conditions; application and interpretation of tax laws; enforcement of civil liabilities; Risks Related to Intellectual Property: trademark protection; trade secrets; patent law reform; patent litigation and intellectual property; protection of intellectual property; third-party licences; Financial and Accounting Risks: substantial number of authorized but unissued Common Shares; dilution; negative cash flow from operating activities; additional capital requirements; lack of significant product revenue; estimates or judgments relating to critical accounting policies; inadequate internal controls; Risks related to the Common Shares: market for the Common Shares; significant sales of Common Shares; volatile market price for the Common Shares; tax issues; no dividends; Risks related to the Offering: an investment in the Common Shares is highly speculative; completion of the Offering; negative operating cash flow and going concern; discretion in the use of proceeds; potential dilution; trading market; significant sales of Common Shares; positive return not guaranteed.

Although the forward-looking statements are based upon what management currently believes to be reasonable assumptions, the Corporation cannot assure prospective investors that actual results, performance or achievements will be consistent with these forward-looking statements. In particular, the Corporation has made assumptions regarding, among other things:

• substantial fluctuation of losses from quarter to quarter and year to year due to numerous external risk factors, and anticipation that the Corporation will continue to incur significant losses in the future;

• uncertainty as to the Corporation's ability to raise additional funding to support operations;

• the Corporation's ability to access additional funding;

• the fluctuation of foreign exchange rates;

• the duration of COVID-19 and the extent of its economic and social impact;

• the risks associated with the development of the Corporation's product candidates which are at early stages of development;

• reliance upon industry publications as the Corporation's primary sources for third-party industry data and forecasts;

• reliance on third parties to plan, conduct and monitor the Corporation's preclinical studies and clinical trials;

• reliance on third party contract manufacturers to deliver quality clinical and preclinical materials;

• the Corporation's product candidates may fail to demonstrate safety and efficacy to the satisfaction of regulatory authorities or may not otherwise produce positive results;

• risks related to filing investigational new drug applications to commence clinical trials and to continue clinical trials if approved;

• the risks of delays and inability to complete clinical trials due to difficulties enrolling patients;

• competition from other biotechnology and pharmaceutical companies;

• the Corporation's reliance on the capabilities and experience of the Corporation's key executives and scientists and the resulting loss of any of these individuals;

• the Corporation's ability to fully realize the benefits of acquisitions;

• the Corporation's ability to adequately protect the Corporation's intellectual property and trade secrets;

• the risk of patent-related or other litigation; and

• the risk of unforeseen changes to the laws or regulations in the United States, Canada, the United Kingdom, Ireland and other jurisdictions in which the Corporation operates.

Drug development involves long lead times, is very expensive and involves many variables of uncertainty. Anticipated timelines regarding drug development are based on reasonable assumptions informed by current knowledge and information available to the Corporation. Every patient treated on future studies can change those assumptions either positively (to indicate a faster timeline to new drug applications and other approvals) or negatively (to indicate a slower timeline to new drug applications and other approvals). This Prospectus Supplement and the documents incorporated by reference herein contain certain forward-looking statements regarding anticipated or possible drug development timelines. Such statements are informed by, among other things, regulatory guidelines for developing a drug with safety studies, proof of concept studies, and pivotal studies for new drug application submission and approval, and assumes the success of implementation and results of such studies on timelines indicated as possible by such guidelines, other industry examples, and the Corporation's development efforts to date.

In addition to the factors set out above and those identified under the heading "Risk Factors" in the Annual Information Form and in this Prospectus Supplement, other factors not currently viewed as material could cause actual results to differ materially from those described in the forward-looking statements. Although the Corporation has attempted to identify important risks and factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors and risks that cause actions, events or results not to be anticipated, estimated or intended. Accordingly, readers should not place any undue reliance on forward-looking statements.

Many of these factors are beyond the Corporation's ability to control or predict. These factors are not intended to represent a complete list of the general or specific factors that may affect the Corporation. The Corporation may note additional factors elsewhere in this Prospectus Supplement and in any documents incorporated by reference herein. All forward-looking statements speak only as of the date made. All subsequent written and oral forward-looking statements attributable to the Corporation, or persons acting on the Corporation's behalf, are expressly qualified in their entirety by the cautionary statements. Except as required by law, the Corporation undertakes no obligation to update any forward-looking statement.

The forward-looking statements contained in this Prospectus Supplement and the documents incorporated by reference herein are expressly qualified in their entirety by the foregoing cautionary statement. Investors should read this entire Prospectus, including the Annual Information Form, the documents incorporated by reference herein, and each applicable Prospectus Supplement, and consult their own professional advisers to ascertain and assess the income tax and legal risks and other aspects associated with holding securities of the Corporation.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference in the Base Shelf Prospectus solely for the purpose of the Offering.

As at the date hereof, the following documents of the Corporation filed with the securities commissions or similar authorities in Canada, and filed with, or furnished to, the SEC, are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement:

1. annual information form of the Corporation dated June 20, 2022 (the "Annual Information Form") for the year ended March 31, 2022;

2. the audited consolidated financial statements of the Corporation and the notes thereto as at and for the fiscal year ended March 31, 2022, together with the auditor's report thereon;

3. management's discussion and analysis of the Corporation for the year ended March 31, 2022;

4. the Corporation's unaudited interim condensed consolidated financial statements for the three months ended June 30, 2022, and related notes thereto (the "Interim Financial Statements");

5. the management's discussion and analysis for the three ended June 30, 2022 (the "Interim MD&A"); and

6. management information circular of the Corporation dated July 13, 2022 relating to an annual meeting of shareholders of the Corporation to be held on August 15, 2022.

Any document of the type referred to in Section 11.1 of Form 44-101F1 - Short Form Prospectus Distributions filed by the Corporation with a securities commission or similar regulatory authority in Canada subsequent to the date of this Prospectus Supplement and prior to the termination of this distribution shall be deemed to be incorporated by reference in the Prospectus Supplement for the purposes of the Offering. In addition, if the Corporation disseminates a news release in respect of previously undisclosed information that, in the Corporation's determination, constitutes a "material fact" (as such term is defined under applicable Canadian securities laws), the Corporation will identify such news release as a "designated news release" for the purposes of the Prospectus in writing on the face page of the version of such news release that the Corporation files on SEDAR (any such news release, a "Designated News Release"), and any such Designated News Release shall be deemed to be incorporated by reference into the Prospectus only for the purposes of the Offering. These documents will be available through the internet on the Corporation's SEDAR profile, which can be accessed at www.sedar.com. In addition, any other report on Form 6-K or 40-F or the exhibits thereto filed or furnished, as applicable, by the Corporation with the SEC, under the United States Securities Exchange Act of 1934, as amended (the "Exchange Act"), from the date of this Prospectus Supplement and prior to the termination or completion of the Offering shall be deemed to be incorporated by reference as exhibits to the Registration Statement of which this Prospectus Supplement and accompanying Base Shelf Prospectus forms a part, but in the case of any report on Form 6-K, only if and to the extent expressly so provided in any such report. The Corporation's current reports on Form 6-K and annual reports on Form 40-F are available on EDGAR at www.sec.gov.

Any statement contained in this Prospectus Supplement or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes of the Offering to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference in this Prospectus Supplement or Base Shelf Prospectus modifies or supersedes that statement. Any statement so modified or superseded shall not constitute a part of this Prospectus Supplement except as so modified or superseded. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in light of the circumstances in which it was made.

References to the Corporation's website in any documents that are incorporated by reference into this Prospectus Supplement and the Base Shelf Prospectus do not incorporate by reference the information on such website into this Prospectus Supplement and the Base Shelf Prospectus and the Corporation disclaims any such incorporation by reference. Neither the Corporation nor the Agents have provided or otherwise authorized any other person to provide investors with information other than that contained or incorporated by reference in this Prospectus Supplement or accompanying Base Shelf Prospectus, and neither the Corporation nor the Agents take any responsibility for other information that others may give you. If an investor is provided with different or inconsistent information, he or she should not rely on it.

DOCUMENTS FILED AS PART OF THE REGISTRATION STATEMENT

In addition to the documents specified in this Prospectus Supplement and in the accompanying Base Shelf Prospectus under "Documents Incorporated by Reference", the following documents have been or will be filed with the SEC as part of the Registration Statement: (i) the Distribution Agreement; (ii) powers of attorney from certain of the Corporation's directors and officers (included on the signature page of the Registration Statement); (iii) the consent of Zeifmans LLP; and (iv) the consent of the Corporation's Canadian counsel, Aird & Berlis LLP.

ADDITIONAL INFORMATION

The Corporation has filed with the SEC the Registration Statement under the U.S. Securities Act with respect to the Common Shares offered under this Prospectus Supplement. This Prospectus Supplement, the accompanying Base Shelf Prospectus and the documents incorporated by reference herein and therein, which form a part of the Registration Statement, do not contain all of the information set forth in the Registration Statement, certain parts of which are contained in the exhibits to the Registration Statement as permitted by the rules and regulations of the SEC. Information omitted from this Prospectus Supplement or the Base Shelf Prospectus but contained in the Registration Statement is available on EDGAR under the Corporation's profile at www.sec.gov. Reference is also made to the Registration Statement and the exhibits thereto for further information with respect to the Corporation, the Offering and the Common Shares. Statements contained in this Prospectus Supplement as to the contents of certain documents are not necessarily complete and, in each instance, reference is made to the copy of the document filed as an exhibit to the Registration Statement. Each such statement is qualified in its entirety by such reference.

The Corporation is required to file with the various securities commissions or similar authorities in all of the provinces and territories of Canada, annual and quarterly reports, material change reports and other information. The Corporation is also an SEC registrant subject to the informational requirements of the Exchange Act and, accordingly, files with, or furnishes to, the SEC certain reports and other information. Under MJDS, these reports and other information (including financial information) may be prepared in accordance with the disclosure requirements of Canada, which differ from those of the United States. As a foreign private issuer, the Corporation is exempt from the rules under the Exchange Act prescribing the furnishing and content of proxy statements, and the Corporation's officers, directors and principal shareholders are exempt from the reporting and short-swing profit recovery provisions contained in Section 16 of the Exchange Act.

THE CORPORATION

This summary does not contain all the information that may be important to you in deciding whether to invest in the Common Shares. You should read the entire Prospectus, including the section entitled "Risk Factors", the applicable Prospectus Supplement, and the documents incorporated by reference herein, including the Annual Information Form, before making such decision.

Summary of the Business

The Corporation is a biotechnology company focused on advancing pharmaceutical therapies, delivery mechanisms, novel compounds and protocols as potential therapies for various psychiatric and neurological conditions. The Corporation is developing technologies and delivery systems aiming to improve the pharmacokinetics of its psychedelic molecules while retaining the therapeutics benefit. The new molecules and delivery systems are expected to be studied through clinical trials to confirm safety and efficacy.

The Corporation has historically had two business segments: (a) Serenity Life Sciences Inc. and Cybin US Holdings Inc. ("Cybin U.S.") that focus on the research and development of psychedelic pharmaceutical products; and (b) Natures Journey Inc. ("Natures Journey") that focused on consumer mental wellness, including non-psychedelic nutraceutical products (the "Product Line") and consumer mental wellness. In November 2021, the Corporation decided to not proceed with the Natures Journey business segment in order to prioritize its research and development of psychedelic pharmaceutical products.

Psychedelics

The Corporation is conducting research and development of psychedelic therapeutics that aim to address unmet mental health conditions by leveraging proprietary drug discovery platforms, novel formulation approaches, innovative drug delivery systems, and optimized treatment regimens. This comprehensive strategy is predicated on structural modifications of known and well understood tryptamine derivatives to improve their pharmacokinetic properties without altering their respective pharmacology.

Across the various research and development programs, the Corporation is researching and developing a wide array of novel, synthetic psychedelic API intended to be delivered through innovative drug delivery systems including sublingual films,1 orally disintegrating tablets ("ODT")2 and via inhalation.

The Corporation intends to apply for regulatory approval for products targeting major depressive disorder ("MDD"), alcohol use disorder ("AUD") and various anxiety disorders.3 The Corporation is also developing products that may have the potential to address neuroinflammation.4

Non-Psychedelics

In November 2021, the Corporation decided to not proceed with the Natures Journey business segment, including the Product Line in order to prioritize its progression of its research and development of psychedelic pharmaceutical products. As of the date hereof, the Corporation has not begun operations nor generated any revenue from the sale of the Product Line and it does not expect any revenues from the Product Line going forward.

For additional information in respect of the Corporation and its operation, please see the Corporation's Annual Information Form incorporated by reference into this Prospectus Supplement.

Recent Developments

There have been no material developments in the business of the Corporation since August 7, 2022, the date of the Corporation's most recently issued Interim Financial Statements and Interim MD&A.

___________________________________________

Intercorporate Relationships

As at the date of this Prospectus Supplement, the Corporation's corporate structure includes the following material wholly-owned subsidiaries:

Note:

(1) The shareholders of Adelia Therapeutics Inc. ("Adelia") hold certain non-voting securities of Cybin U.S. issued in connection with the acquisition of Adelia on December 14, 2020 (the "Adelia Transaction"). For additional information in respect of the Adelia Transaction, please see the Corporation's Annual Information Form incorporated by reference in this Prospectus Supplement.

DESCRIPTION OF THE COMMON SHARES

The Corporation is authorized to issue an unlimited number of Common Shares and an unlimited number of preferred shares. As at August 8, 2022, the Corporation had 166,120,171 Common Shares and nil preferred shares issued and outstanding. For a summary of certain material attributes and characteristics of the Common Shares, see "Description of the Securities Being Distributed - Common Shares" in the Base Shelf Prospectus.

CONSOLIDATED CAPITALIZATION

There have been no material changes in the Corporation's share or loan capitalization on a consolidated basis since the date of the Interim Financial Statements. As a result of the Offering, the shareholder's equity of the Corporation will increase by the amount of the net proceeds of the Offering and the number of issued and outstanding Common Shares will increase by the number of Common Shares actually distributed under the Offering.

USE OF PROCEEDS

The net proceeds from the Offering are not determinable in light of the nature of the distribution. The net proceeds of any given distribution of Common Shares through the Agents in an "at-the-market distribution" or "at-the-market offering" will represent the gross proceeds after deducting the applicable compensation payable to the Agents under the Distribution Agreement and the expenses of the distribution. The proceeds actually received by the Corporation will depend on the number of Common Shares actually sold and the offering price of such Common Shares. See "Plan of Distribution".

Assuming net proceeds of the maximum of U.S.$33,950,000 on or before the expiry of the Prospectus on August 5, 2023, the Corporation intends to use the net proceeds of the Offering for: (i) growth opportunities, and (ii) working capital initiatives. The Corporation believes it is prudent, particularly at the Corporation's stage of development and the competitive industry landscape, to secure capital for general corporate and working capital purposes to ensure that the Corporation maintains sufficient liquidity and capital resources in the near to medium term.

At any given time, the Corporation may be engaged in discussions and activities in respect of potential growth initiatives and other strategic opportunities that are complementary or accretive to the Corporation's business, which may include acquisitions or other investments. As of the date of this Prospectus Supplement, the Corporation has not identified any specific investments or projects, nor any probable or significant acquisitions it wishes to undertake; however, it is important for the Corporation to have funds available to quickly and opportunistically pursue such opportunities as they arise. To the extent the Corporation requires additional capital, it may raise funds through debt and equity financing in the future.

The use of the net proceeds of the Offering to fund potential growth initiatives and other strategic opportunities is subject to change due to the influence of many evolving variables, including those as described under "Stage of Development" in the Interim MD&A and in the Annual Information Form, any changes in legislation and regulations, applications for licenses and the receipt of required licenses, renewals and other regulatory approvals. As a result, the Corporation cannot provide definitive details with respect to timing or specific uses of the net proceeds of the Offering. Such decisions will depend on market and competitive factors, as described herein, as they evolve over time. See "Cautionary Statement Regarding Forward-Looking Statements" and "Risk Factors".

There may be circumstances where for sound business reasons, the Corporation reallocates the use of proceeds depending on the amount of proceeds raised, the time periods in which the proceeds are raised, developments in relation to potential growth initiatives and other strategic opportunities or unforeseen events, see "Risk Factors - Risks Related to the Offering - Discretion in the Use of Proceeds".

Since inception, the Corporation has financed its operations primarily from the issuance of equity and interest income on funds available for investment. To date, the Corporation has raised approximately $120,000,000 in gross proceeds through private placement and prospectus offerings. The Corporation has experienced operating losses and cash outflows from operations since incorporation and will require ongoing financing to continue its research and development activities. As the Corporation has not yet achieved profitability, there are uncertainties regarding its ability to continue as a going concern. The Corporation has not earned any revenue or reached successful commercialization of any products. The Corporation's success is dependent upon the ability to finance its cash requirements to continue its activities. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Corporation as those previously obtained, or at all. To the extent that the Corporation has negative operating cash flows in future periods, it may need to deploy a portion of its existing working capital to fund such negative cash flows. The Corporation will be required to raise additional funds through the issuance of additional equity securities, through loan financing, or other means, such as through partnerships with other companies and research and development reimbursements. There is no assurance that additional capital or other types of financing will be available if needed or that these financings will be on terms at least as favourable to the Corporation as those previously obtained. See "Risk Factors - Risks Related to an Offering - Negative Operating Cash Flow and Going Concern".

Until applied, the net proceeds will be held as cash balances in the Corporation's bank account or invested in certificates of deposit and other instruments issued by banks or obligations of or guaranteed by the Government of Canada or any province thereof in accordance with the Corporation's investment policies.

For detailed information in respect of the Corporation's business objectives and milestones, sources and use of capital, and the application of proceeds from prior offerings by the Corporation, prospective purchasers should carefully consider the information described in the Base Shelf Prospectus, Annual Information Form and the Interim MD&A, to which there has been no material changes since the date of the applicable document.

PLAN OF DISTRIBUTION

The Corporation has entered into the Distribution Agreement with the Agents under which the Corporation may issue and sell from time to time Common Shares having an aggregate sale price of up to U.S.$35,000,000 (or the equivalent in United States dollars determined using the daily exchange rate posted by the Bank of Canada on the date the Common Shares are sold) in each of the provinces and territories of Canada and in the United States pursuant to placement notices delivered by the Corporation to the Agents from time to time in accordance with the terms of the Distribution Agreement. Sales of Common Shares, if any, will be made in transactions that are deemed to be "at-the-market distributions" as defined in NI 44-102 and an "at-the-market offering" as defined in Rule 415(a)(4) under the U.S. Securities Act, in privately negotiated transactions and/or any other method permitted by applicable law including sales made by the Agents directly on the NEO, NYSE American or any other trading market for the Common Shares in Canada or the United States. Subject to the pricing parameters in a placement notice, the Common Shares will be distributed at the market prices prevailing at the time of the sale. As a result, prices may vary as between purchasers and during the period of distribution. The Corporation cannot predict the number of Common Shares that the Corporation may sell under the Distribution Agreement on the NEO, NYSE American or any other trading market for the Common Shares in Canada, or if any Common Shares will be sold.

The Agents are not required to sell any specific number or dollar amount of Common Shares, but will use its commercially reasonable efforts to sell the Common Shares pursuant to the terms and conditions of the Distribution Agreement. There is no minimum amount of funds that must be raised under the Offering. This means that the Offering may terminate after only raising a small portion of the offering amount set out above, or none at all.

The Agents will offer the Common Shares subject to the terms and conditions of the Distribution Agreement from time to time or as otherwise agreed upon by the Corporation and the Agents. Subject to the terms and conditions of the Distribution Agreement, the Agents will use their commercially reasonable efforts to sell, on the Corporation's behalf, all of the Common Shares requested to be sold by the Corporation. The Corporation may instruct the Agents not to sell Common Shares if the sales cannot be achieved at or above the price designated by the Corporation in a particular placement notice.

Neither the Corporation nor the Agents may suspend the Offering upon proper notice to the other party. The Corporation and the Agents each have the right, by giving written notice as specified in the Distribution Agreement, to terminate the Distribution Agreement in each party's sole discretion at any time. Pursuant to the Distribution Agreement, the Offering will terminate upon the earliest of (i) the termination of the Distribution Agreement as provided for therein, (ii) the date on which the aggregate gross proceeds from sales of Common Shares pursuant to the Distributions Agreement equal U.S.$35,000,000 and (iii) August 5, 2023.

The Corporation will pay the Agents the Commission for their services in acting as agent in connection with the sale of Common Shares pursuant to the Distribution Agreement in an amount equal to 3% of the gross sale price per Common Share sold (the "Commission"). Provided, however, that the Corporation shall not be obligated to pay the Agents any Commission on any sale of Common Shares that it is not possible to settle due to (i) a suspension or material limitation in trading in securities generally on the NEO or NYSE American, (ii) a material disruption in securities settlement or clearance services in Canada or the United States, (iii) failure by the applicable Agent to comply with its obligations under the terms of the Distribution Agreement; or (iv) if the Corporation and the Agents agree, pursuant to the terms of the Distribution Agreement, that no sale of Common shares will take place. The sales proceeds remaining after payment of the Commission and after deducting any expenses payable by the Corporation and any transaction or filing fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal the net proceeds to the Corporation from the sale of such Common Shares.

The applicable Agent or Agents will provide written confirmation to the Corporation no later than the opening of the trading day immediately following the trading day on which it has made sales of the Common Shares under the Distribution Agreement. Each confirmation will include the number of Common Shares sold on such day (including the number of Common Shares sold on the NEO and or NYSE American, or on any other marketplace in Canada or the United States), the average price of the Common Shares sold on such day (including the average price of Common Shares sold on NEO, NYSE American or on any other marketplace in Canada or the United States), the gross proceeds, the Commission payable by the Corporation to the Agents with respect to such sales and the net proceeds payable to the Corporation. The Agents will also assist the Corporation with such other periodic reporting as may be reasonably requested by the Corporation with respect to the sales of Common Shares.

The Corporation will disclose the number and average price of the Common Shares sold under this Prospectus Supplement, as well as the gross proceeds, Commission and net proceeds from sales hereunder in the Corporation's annual and interim financial statements and related management discussion & analysis, annual information forms and annual reports on Form 40-F, filed on SEDAR and filed or furnished, as applicable, with the SEC on EDGAR, for any quarters or annual periods in which sales of Common Shares occur.

Settlement for sales of Common Shares will occur, unless otherwise specified in an applicable placement notice, on the second trading day on the applicable exchange following the date on which any sales were made in return for payment of the net proceeds to the Corporation. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. Sales of Common Shares in the United States will be settled through the facilities of The Depository Trust Corporation or by such other means as the Corporation and the Agents may agree upon and sales of Common Shares in Canada will be settled through the facilities of The Canadian Depository for Securities or by such other means as the Corporation and the Agents may agree.

The Canadian Agent is not registered as a broker-dealer in the United States and, accordingly, will only sell Common Shares on marketplaces in Canada. The US Agent is not registered as an investment dealer in any Canadian jurisdiction and, accordingly, will only sell Common Shares on marketplaces in the United States.

The Offering is being made in Canada under the terms of this Prospectus Supplement and concurrently in the United States under the terms of the Corporation's Registration Statement filed with the SEC of which this Prospectus Supplement forms a part. In connection with the sale of the Common Shares on the Corporation's behalf, the Agents may be deemed to be an "underwriter" within the meaning of Section 2(a)(11) of the U.S. Securities Act, and the compensation of the Agents may be deemed to be underwriting commissions or discounts. The Corporation has agreed to provide indemnification and contribution to the Agents against certain liabilities, including liabilities under the U.S. Securities Act.

The Corporation has agreed to pay the reasonable fees, disbursements and expenses of counsel to the Agents in connection with the Offering, subject to the terms of the Distribution Agreement and any other agreement in writing between the Corporation and the Agents. No agent, underwriter or dealer involved in the distribution of Common Shares under the Offering, no affiliate of such an agent, underwriter or dealer and no person or company acting jointly or in concert with such an agent, underwriter or dealer has over-allotted, or will over-allot, securities in connection with such distribution or effected, or will affect any other transactions that are intended to stabilize or maintain the market price of the Common Shares.

The total expenses related to the commencement of the Offering to be paid by the Corporation, excluding the Commission payable to the Agents under the Distribution Agreement, are estimated to be approximately up to U.S.$300,000.

Each of the Agents and its affiliates have in the past provided and may in the future provide various investment banking, commercial banking and other financial services for the Corporation and its affiliates, for which services they have received and may in the future receive customary fees. To the extent required by Regulation M, the Agents will not engage in any market making activities involving the Common Shares while the Offering is ongoing under this Prospectus Supplement.

The Corporation has applied to list the Common Shares offered by this Prospectus Supplement on the NEO and NYSE American has authorized the listing of the Common Shares to be offered in the Offering. Listing will be subject to the Corporation fulfilling all of the listing requirements of the NEO and NYSE American.

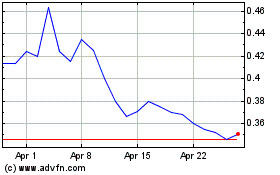

TRADING PRICE AND VOLUME

The Common Shares are listed for trading on the NEO and NYSE American under the symbol "CYBN". The following table sets forth the reported monthly range of high and low prices per Common Share and total monthly volumes traded on the NEO and NYSE American for each of the months indicated during the 12-month period prior to the date of this Prospectus Supplement.

NEO Price Range

|

| |

| Month |

|

High ($)(1) |

|

Low ($)(1) |

|

Volume(1) |

| |

|

|

|

|

|

|

| August 2021 |

|

3.99 |

|

2.15 |

|

11,652,282 |

| |

|

|

|

|

|

|

| September 2021 |

|

3.55 |

|

2.54 |

|

9,933,259 |

| |

|

|

|

|

|

|

| October 2021 |

|

2.79 |

|

2.24 |

|

5,973,696 |

| |

|

|

|

|

|

|

| November 2021 |

|

2.94 |

|

1.65 |

|

14,160,868 |

| |

|

|

|

|

|

|

| December 2021 |

|

1.94 |

|

1.35 |

|

6,191,101 |

| |

|

|

|

|

|

|

| January 2022 |

|

1.54 |

|

1.21 |

|

3,636,976 |

| |

|

|

|

|

|

|

| February 2022 |

|

1.46 |

|

1.11 |

|

2,935,312 |

| |

|

|

|

|

|

|

| March 2022 |

|

1.20 |

|

0.95 |

|

3,883,026 |

| |

|

|

|

|

|

|

| April 2022 |

|

1.12 |

|

0.68 |

|

1,784,193 |

| |

|

|

|

|

|

|

| May 2022 |

|

0.54 |

|

0.50 |

|

3,017,959 |

| |

|

|

|

|

|

|

| June 2022 |

|

1.06 |

|

0.67 |

|

2,662,940 |

| |

|

|

|

|

|

|

| July 2022 |

|

0.79 |

|

0.69 |

|

1,697,807 |

| |

|

|

|

|

|

|

| August (1 - 5), 2022 |

|

0.95 |

|

0.78 |

|

744,487 |

Note:

(1) Source: TMX Money as of the date of this Prospectus Supplement.

On August 5, 2022, being the last day on which the Common Shares traded prior to the date of this Prospectus Supplement, the closing price of the Common Shares as reported on the NEO was $0.95.

| NYSE American Price Range |

| |

| Month |

|

High (U.S.$)(1) |

|

Low (U.S.$)(1) |

|

Volume(1) |

| |

|

|

|

|

|

|

| August 2021(2) |

|

3.38 |

|

1.68 |

|

27,050,719 |

| |

|

|

|

|

|

|

| September 2021 |

|

2.86 |

|

1.98 |

|

23,267,531 |

| |

|

|

|

|

|

|

| October 2021 |

|

2.29 |

|

1.81 |

|

26,186,831 |

| |

|

|

|

|

|

|

| November 2021 |

|

2.355 |

|

1.29 |

|

57,337,568 |

| |

|

|

|

|

|

|

| December 2021 |

|

1.54 |

|

1.05 |

|

32,155,939 |

| |

|

|

|

|

|

|

| January 2022 |

|

1.22 |

|

0.82 |

|

19,882,525 |

| |

|

|

|

|

|

|

| February 2022 |

|

1.16 |

|

0.862 |

|

13,843,580 |

| |

|

|

|

|

|

|

| March 2022 |

|

0.95 |

|

0.70 |

|

14,441,487 |

| |

|

|

|

|

|

|

| April 2022 |

|

0.88 |

|

0.42 |

|

15,659,793 |

| |

|

|

|

|

|

|

| May 2022 |

|

0.71 |

|

0.3903 |

|

14,762,190 |

| |

|

|

|

|

|

|

| June 2022 |

|

0.86 |

|

0.5301 |

|

12,694,019 |

| |

|

|

|

|

|

|

| July 2022 |

|

0.65 |

|

0.50 |

|

11,863,781 |

| |

|

|

|

|

|

|

| August (1 - 5), 2022 |

|

0.73 |

|

0.58 |

|

5,173,572 |

Notes:

(1) Source: NYSE American as of the date of this Prospectus Supplement.

(2) Prior to August 5, 2021, the Common Shares were quoted on the OTCQB® Venture Market under the symbol "CLXPF" (the "OTCQB"). The OTCQB quotation ceased when the Common Shares were listed on NYSE American on August 5, 2021.

On August 5, 2022, being the last day on which the Common Shares traded prior to the date of this Prospectus Supplement, the closing price of the Common Shares as reported on NYSE American was U.S.$0.73.

PRIOR SALES

The following table sets forth the details regarding all issuances of Common Shares, including issuances of all securities convertible or exchangeable into Common Shares, during the 12-month period before the date of this Prospectus Supplement:

| Date of Issuance |

|

Number of

Securities Issued |

|

Type |

|

Issuance / Exercise

Price Per Security |

| August 12, 2021(1) |

|

100,000 |

|

Common Shares |

|

$0.75 |

| August 12, 2021(1) |

|

255,887 |

|

Common Shares |

|

$0.64 |

| August 16, 2021 |

|

215,000 |

|

Options |

|

$2.48 |

| August 17, 2021(2) |

|

18,788.5 |

|

Exchangeable Securities |

|

$33.70(4) |

| August 18, 2021 |

|

300,000 |

|

Options |

|

$2.48 |

| August 31, 2021(2) |

|

9,392.6 |

|

Exchangeable Securities |

|

$33.80(5) |

| September 10, 2021(1) |

|

191,540 |

|

Common Shares |

|

$0.75 |

| September 16, 2021(3) |

|

125,000 |

|

Common Shares |

|

$0.64 |

| September 16, 2021(1) |

|

370,000 |

|

Common Shares |

|

$0.75 |

| September 27, 2021 |

|

585,000 |

|

Options |

|

$3.15 |

| September 27, 2021 |

|

195,000(6) |

|

Options |

|

$2.87 |

| September 30, 2021 |

|

450,000 |

|

Options |

|

$3.15 |

| September 30, 2021 |

|

740,000(7) |

|

Options |

|

$2.78 |

| October 13, 2021(1) |

|

18,000 |

|

Common Shares |

|

$0.25 |

| October 21, 2021(3) |

|

325,000 |

|

Common Shares |

|

$0.25 |

| October 29, 2021(3) |

|

150,000 |

|

Common Shares |

|

$1.36 |

| October 29, 2021(1) |

|

5,500 |

|

Common Shares |

|

$0.25 |

| November 16, 2021(3) |

|

175,000 |

|

Common Shares |

|

$1.39 |

| November 16, 2021(1) |

|

1,000,000 |

|

Common Shares |

|

$0.25 |

| November 18, 2021(2) |

|

28,903 |

|

Exchangeable Securities |

|

$24.40(8) |

| November 23, 2021(3) |

|

88,300 |

|

Common Shares |

|

$1.39 |

| November 29, 2021(2) |

|

31,721.5 |

|

Exchangeable Securities |

|

$19.80(9) |

| November 30, 2021(3) |

|

300,000 |

|

Common Shares |

|

$1.39 |

| December 16, 2021(1) |

|

150,000 |

|

Common Shares |

|

$0.25 |

| December 16, 2021(3) |

|

62,500 |

|

Common Shares |

|

$0.64 |

| December 31, 2021 |

|

40,000 |

|

Options |

|

$3.15 |

| December 31, 2021 |

|

1,250,000 |

|

Options |

|

$1.50 |

| January 6, 2022(2) |

|

15,611.4 |

|

Exchangeable Securities |

|

$15.10(10) |

| January 21, 2022(11) |

|

586,800 |

|

Common Shares |

|

$1.25 |

| February 14, 2022(2) |

|

41,028.2 |

|

Exchangeable Securities |

|

$13.43(12) |

| February 15, 2022(1) |

|

27,585 |

|

Common Shares |

|

$0.64 |

| February 18, 2022(2) |

|

17,239.5 |

|

Exchangeable Securities |

|

$13.50(13) |

| February 28, 2022(3) |

|

37,500 |

|

Common Shares |

|

$0.64 |

| March 4, 2022(11) |

|

1,254,360 |

|

Common Shares |

|

$1.13 |

| March 4, 2022 |

|

1,075,600 |

|

Options |

|

$1.13 |

| March 4, 2022 |

|

60,000 |

|

Options |

|

$3.15 |

| March 8, 2022 |

|

400,000 |

|

Options |

|

$1.02 |

| March 18, 2022(1) |

|

100,000 |

|

Common Shares |

|

$0.25 |

| March 25, 2022(2) |

|

90,546 |

|

Exchangeable Securities |

|

$10.00(14) |

| April 1, 2022(2) |

|

22,428.3 |

|

Exchangeable Securities |

|

$10.20(15) |

| May 5, 2022(15) |

|

380,230 |

|

Common Shares |

|

$0.68 |

| May 24, 2022(1) |

|

500,000 |

|

Common Shares |

|

$0.25 |

| June 14, 2022(1) |

|

500,000 |

|

Common Shares |

|

$0.25 |

| June 22, 2022(1) |

|

99,638 |

|

Common Shares |

|

$0.64 |

| June 22, 2022(2) |

|

456.50 |

|

Exchangeable Securities |

|

$10.20(16) |

| June 24, 2022(2) |

|

266,933.1 |

|

Exchangeable Securities |

|

$7.62(17) |

| June 27, 2022(2) |

|

37,366.2 |

|

Exchangeable Securities |

|

$7.50(18) |

| June 30, 2022 |

|

65,000 |

|

Options |

|

$1.00 |

| June 30, 2022 |

|

500,000 |

|

Options |

|

$0.90 |

Notes:

(1) Common Shares issued on exercise of warrants to purchase Common Shares (each, a "Warrant").

(2) Represents Class B common shares in the capital of Cybin U.S. ("Class B Shares") issued in connection with the Adelia Transaction to Adelia shareholders. The Class B Shares are exchangeable at the holder's option for Common Shares on the basis of 10 Common Shares for 1 Class B Share, subject to customary adjustments.

(3) Common Shares issued on exercise of options to purchase Common Shares granted pursuant to the Corporation's equity incentive plan (each, an "Option").

(4) Price per Class B Share of Cybin U.S., which are exchangeable for 187,886 Common Shares, resulting in an effective issue price of $3.37 per Common Share.

(5) Price per Class B Share of Cybin U.S., which are exchangeable for 93,926 Common Shares, resulting in an effective issue price of $3.38 per Common Share.

(6) As the result of the termination of an employee of the Corporation, 20,000 options expired on October 21, 2021.

(7) On March 4, 2022, 20,000 options were cancelled pursuant to an acknowledgement agreement.

(8) Price per Class B Share of Cybin U.S., which are exchangeable for 289,030 Common Shares, resulting in an effective issue price of $2.44 per Common Share.

(9) Price per Class B Share of Cybin U.S., which are exchangeable for 317,215 Common Shares, resulting in an effective issue price of $1.98 per Common Share.

(10) Price per Class B Share of Cybin U.S., which are exchangeable for 156,114 Common Shares, resulting in an effective issue price of $1.51 per Common Share.

(11) Common Shares issued in exchange for Class B Shares.

(12) Price per Class B Share of Cybin U.S., which are exchangeable for 410,282 Common Shares, resulting in an effective issue price of $1.34 per Common Share.

(13) Price per Class B Share of Cybin U.S., which are exchangeable for 172,395 Common Shares, resulting in an effective issue price of $1.35 per Common Share.

(14) Price per Class B Share of Cybin U.S., which are exchangeable for 905,460 Common Shares, resulting in an effective issue price of $1.00 per Common Share.

(15) Price per Class B Share of Cybin U.S., which are exchangeable for 224,283 Common Shares, resulting in an effective issue price of $1.02 per Common Share.

(16) Price per Class B Share of Cybin U.S., which are exchangeable for 4,560 Common Shares, resulting in an effective issue price of $1.02 per Common Share.

(17) Price per Class B Share of Cybin U.S., which are exchangeable for 2,669,331 Common Shares, resulting in an effective issue price of $0.762 per Common Share.

(18) Price per Class B Share of Cybin U.S., which are exchangeable for 373,662 Common Shares, resulting in an effective issue price of $0.75 per Common Share.

CERTAIN CANADIAN INCOME TAX CONSIDERATIONS

The following is, as at the date of this short form prospectus, a summary of the principal Canadian federal income tax considerations under the Tax Act generally applicable to an investor who acquires Common Shares as beneficial owner pursuant to the Offering and who, for the purposes of the Tax Act and at all relevant times, deals at arm's length with the Corporation and the Agents, is not affiliated with the Corporation or the Agents, and who acquires and holds the Common Shares as capital property (a "Holder"). Generally, the Common Shares will be considered to be capital property to a Holder thereof provided that the Holder does not use the Common Shares in the course of carrying on a business of trading or dealing in securities and such Holder has not acquired them in one or more transactions considered to be an adventure or concern in the nature of trade.

This summary does not apply to a Holder (i) that is a "financial institution" for the purposes of the mark-to-market rules contained in the Tax Act; (ii) that is a "specified financial institution" as defined in the Tax Act; (iii), an interest in which would be a "tax shelter investment" as defined in the Tax Act; (iv) that has made a functional currency reporting election under section 261 of the Tax Act; (v) that has entered into or will enter into a "derivative forward agreement" or "synthetic disposition arrangement", as those terms are defined in the Tax Act, with respect to the Common Shares; or (vi) that receives dividends on the Common Shares under or as part of a "dividend rental arrangement", as defined in the Tax Act. Such Holders should consult their own tax advisors with respect to an investment in Common Shares.

Additional considerations, not discussed herein, may be applicable to a Holder that is a corporation resident in Canada, and is, or becomes, or does not deal at arm's length for purposes of the Tax Act with a corporation resident in Canada that is or becomes, as part of a transaction or event or series of transactions or events that includes the acquisition of Common Shares, controlled by a non-resident person, or group of non-resident persons not dealing with each other at arm's length, for purposes of the foreign affiliate dumping rules in section 212.3 of the Tax Act. Such Holders should consult their own tax advisors.

This summary is based upon the current provisions of the Tax Act and the regulations thereunder in force as of the date hereof and counsel's understanding of the current published administrative policies and assessing practices of the Canada Revenue Agency (the "CRA"). This summary takes into account all specific proposals to amend the Tax Act and the regulations thereunder publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the "Tax Proposals") and assumes that the Tax Proposals will be enacted in the form proposed, although no assurance can be given that the Tax Proposals will be enacted in their current form or at all. This summary does not otherwise take into account any changes in law or in the administrative policies or assessing practices of the CRA, whether by legislative, governmental or judicial decision or action, nor does it take into account or consider other federal or any provincial, territorial or foreign income tax considerations, which considerations may differ significantly from the Canadian federal income tax considerations discussed in this summary.

This summary is not exhaustive of all possible Canadian federal income tax considerations applicable to a Holder in respect of the transactions described herein. The income or other tax consequences will vary depending on the particular circumstances of the Holder, including the province or provinces in which the Holder resides or carries on business. Accordingly, this summary is of a general nature only and is not intended to be, nor should it be construed to be, legal or tax advice or representations to any particular Holder. Moreover, no advance income tax ruling has been applied for or obtained from the CRA to confirm the tax consequences of any of the transactions described herein. Holders should consult their own legal and tax advisors for advice with respect to the tax consequences of an investment in the Common Shares based on their particular circumstances.

Currency Conversion

Subject to certain exceptions that are not discussed herein, for the purposes of the Tax Act, all amounts relating to the acquisition, holding or disposition of Common Shares (including dividends, adjusted cost base and proceeds of disposition) must be expressed in Canadian dollars. Amounts denominated in U.S. dollars must generally be converted into Canadian dollars based on the single daily exchange rate as quoted by the Bank of Canada on the date such amounts arise or such other rate of exchange as is acceptable to the CRA.

Holders Resident in Canada

The following portion of this summary is generally applicable to a Holder who at all relevant times, for purposes of the Tax Act, is or is deemed to be resident in Canada (a "Resident Holder").

Certain Resident Holders whose Common Shares might not constitute capital property may make, in certain circumstances, an irrevocable election permitted by subsection 39(4) of the Tax Act to deem the Common Shares, and every other "Canadian security" as defined in the Tax Act, held by such persons in the taxation year of the election and each subsequent taxation year to be capital property. Resident Holders should consult their own tax advisors regarding this election.

Dividends

Dividends received or deemed to be received on the Common Shares will be included in computing a Resident Holder's income. In the case of an individual (other than certain trusts), such dividends will be subject to the gross-up and dividend tax credit rules normally applicable in respect of "taxable dividends" received from "taxable Canadian corporations" (each as defined in the Tax Act). An enhanced gross-up and dividend tax credit will be available to individuals in respect of "eligible dividends" designated by the Corporation to the Resident Holder in accordance with the provisions of the Tax Act. There may be limitations on the ability of the Corporation to designate dividends as eligible dividends.

Dividends received or deemed to be received on a Common Share by a Resident Holder that is a corporation will be included in computing the corporation's income and will generally be deductible in computing its taxable income. In certain circumstances, subsection 55(2) of the Tax Act will treat a taxable dividend received (or deemed to be received) by a Resident Holder that is a corporation as proceeds of disposition or a capital gain. Resident Holders that are corporations should consult their own tax advisors in this regard.

A Resident Holder that is a "private corporation" (as defined in the Tax Act) or a "subject corporation" (as defined in subsection 186(3) of the Tax Act) may be liable to pay an additional tax (refundable in certain circumstances) under Part IV of the Tax Act on dividends received or deemed to be received on the Common Shares to the extent such dividends are deductible in computing the Resident Holder's taxable income. Resident Holders that are corporations should consult their own tax advisors regarding their particular circumstances.

Dispositions of Common Shares

Upon a disposition (or a deemed disposition) of a Common Share (other than a disposition to the Corporation that is not a sale in the open market in the manner in which shares would normally be purchased by any member of the public in an open market), a Resident Holder generally will realize a capital gain (or a capital loss) equal to the amount by which the proceeds of disposition of such share, net of any reasonable costs of disposition, are greater (or are less) than the adjusted cost base of such share to the Resident Holder immediately before the disposition or deemed disposition. The adjusted cost base to a Resident Holder of a Common Share will be determined by averaging the cost of that Common Share with the adjusted cost base (determined immediately before the acquisition of the Common Share) of all other Common Shares held as capital property at that time by the Resident Holder. For a description of the treatment of capital gains and capital losses, see "Certain Canadian Income Tax Considerations -Holders Resident in Canada - Capital Gain / Loss" below.

Capital Gain / Loss

Generally, a Resident Holder is required to include in computing its income for a taxation year one-half of the amount of any capital gain (a "taxable capital gain") realized in the year. Subject to and in accordance with the provisions of the Tax Act, a Resident Holder is required to deduct one-half of the amount of any capital loss (an "allowable capital loss") realized in a taxation year from taxable capital gains realized in the year by such Resident Holder. Allowable capital losses in excess of taxable capital gains for the taxation year of disposition may be carried back and deducted in any of the three preceding taxation years or carried forward and deducted in any following taxation year against net taxable capital gains realized in such years to the extent and under the circumstances described in the Tax Act.

The amount of any capital loss realized on the disposition or deemed disposition of Common Shares by a Resident Holder that is a corporation may be reduced by the amount of dividends received or deemed to have been received by it on such shares or shares substituted for such shares to the extent and in the circumstances specified by the Tax Act. Similar rules may apply where a Common Share is owned by a partnership or trust of which a corporation, trust or partnership is a member or beneficiary. Resident Holders to whom these rules may be relevant should consult their own tax advisors.

A Resident Holder that is, throughout the relevant taxation year, a "Canadian-controlled private corporation" or "CCPC" (as defined in the Tax Act) will be subject to an additional tax (refundable in certain circumstances) in respect of its "aggregate investment income" (as defined in the Tax Act) for the year, which will include taxable capital gains. Draft legislation released in the 2022 Canadian federal budget extends liability for the additional tax payable by a "Canadian-controlled private corporation" to a "substantive CCPC" (as defined in a draft amendment to the Tax Act). Resident Holders that are "Canadian-controlled private corporations" or "substantive CCPCs" should consult their own tax advisors regarding their particular circumstances.

Minimum Tax

Capital gains realized and dividends received (or deemed to be received) by a Resident Holder that is an individual or a trust, other than certain specified trusts, may give rise to minimum tax under the Tax Act. Resident Holders that are individuals should consult their own tax advisors in this regard.

Holders Not Resident in Canada