UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

|

CKX Lands, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

| |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

|

☒

|

No fee required.

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

CKX LANDS, INC.

2417 Shell Beach Drive

Lake Charles, Louisiana 70601

Tel. 337-493-2399

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 4, 2023

The Annual Meeting of the Shareholders of CKX Lands, Inc. (the “Company”), will be held at 2417 Shell Beach Drive, Lake Charles, Louisiana 70601, on May 4, 2023, at 10:00 a.m., central time, for the following purposes:

| |

2.

|

To vote on a proposal to ratify the appointment of MaloneBailey LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2023;

|

| |

3.

|

To vote on a proposal to approve, in a non-binding, advisory vote, the compensation of our named executive officers; and

|

| |

4.

|

To transact such other business as may properly come before the Annual Meeting.

|

Only shareholders of record at the close of business on March 23, 2023, are entitled to notice of and to vote at the Annual Meeting.

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. THEREFORE, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON, PLEASE SIGN AND DATE YOUR PROXY AND RETURN IT THROUGH ONE OF THE PERMISSIBLE MEANS OF VOTING LISTED ON THE CARD. IF YOU VOTE BY MAIL, RETURN YOUR PROXY IN THE ENCLOSED ENVELOPE, WHICH REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

| |

|

| |

/s/ W. Gray Stream

|

| |

W. Gray Stream

President

|

March 31, 2023

IMPORTANT NOTICE REGARDING THE

AVAILABILITY OF PROXY MATERIALS FOR THE

2023 ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 4, 2023

This Proxy Statement, the form of Proxy and the Company’s Annual Report on Form 10-K for the year

ended December 31, 2022 are available at www.envisionreports.com/ckx.

CKX LANDS, INC.

2417 Shell Beach Drive

Lake Charles, LA 70601

PROXY STATEMENT

This proxy statement and the CKX Lands, Inc. annual report to shareholders on Form 10-K are first being made available to shareholders on or about April 4, 2023.

The Board of Directors of CKX Lands, Inc. (“CKX Lands” or the “Company”) is soliciting your proxy to vote your shares of the Company’s common stock in connection with the Company’s 2023 Annual Meeting of Shareholders or any adjournments or postponements of the meeting. The meeting will be held on May 4, 2023, at 10:00 a.m., central time, at 2417 Shell Beach Drive, Lake Charles, Louisiana 70601. You may revoke your proxy at any time prior to it being voted by:

| |

●

|

giving written notice to the Secretary of the Company,

|

| |

●

|

submitting a later dated proxy through any of the permissible means of voting listed on the enclosed proxy card, or

|

| |

●

|

by voting in person at the meeting.

|

The Company is paying all expenses of preparing, printing, and mailing the proxy statement and all materials used in this solicitation. Proxies may also be solicited in person or by telephone, e-mail or fax by directors, officers and other employees of the Company, none of whom will receive additional compensation for such services. The Company will also request brokerage houses, custodians and nominees who are record owners of the Company’s common stock and who hold the stock on behalf of beneficial owners to forward these materials to the beneficial owners and will pay the reasonable expenses of such persons for forwarding the material.

On March 24, 2023, CKX Lands had outstanding 1,974,427 shares of common stock, its only class of stock, which was held by 284 shareholders of record. Only shareholders of record at the close of business on March 23, 2023, will be entitled to receive notice of and to vote at the meeting. With respect to all matters that will come before the meeting, each shareholder may cast one vote for each share registered in his or her name on the record date. The presence, in person or by proxy, of holders of a majority of the outstanding shares of common stock entitled to vote at the meeting is necessary to constitute a quorum at the meeting. Shareholders voting, or abstaining from voting, by proxy on any issue will be counted as present for purposes of constituting a quorum.

If a quorum is present:

| |

●

|

the election of directors will be decided by a “plurality” vote; and

|

| |

●

|

the approval of the independent auditor and the non-binding advisory vote on our executive compensation will be decided by a majority of the votes actually cast at the Annual Meeting in person or by proxy.

|

When directors are elected by “plurality vote” and all nominees are unopposed, which is the case for our 2023 Annual Meeting, then each nominee who receives at least one vote will be elected. You may choose to “withhold” authority for your votes to be cast in favor of a nominee, which means your shares will not be voted for that nominee.

Abstentions are not votes cast, therefore they will have no effect on the calculation of the vote on the election of directors, the approval of the independent auditor, or the non-binding advisory vote on our executive compensation.

If you are the holder of record your shares (meaning you hold your shares in your own name as reflected on the records of our transfer agent, Computershare), then the shares represented by your properly executed proxy card will be voted at the meeting in accordance with your directions set forth on the proxy, unless you revoke it. If you indicate when voting your shares on the internet or by phone that you wish to vote as recommended by the Board of Directors, or if you sign and return your proxy card but do not give specific voting instructions, your shares will be voted FOR the election of all director nominees, FOR the ratification of the engagement of MaloneBailey LLP as auditors, and FOR the approval of the compensation of the Company’s named executive officers. The proxy also gives authority to the proxy holders to vote your shares in their discretion on any other matter that properly comes before the meeting.

If you hold your shares in an account at a brokerage firm, bank, or other nominee, then you are the beneficial owner of shares held in “street name,” and the proxy materials were forwarded to you by that firm, bank or nominee. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. In this case, if you want to attend the meeting and vote your shares in person, you must first obtain a legal proxy from your broker, bank or other nominee who is the record holder of the shares.

Shares held in “street name” can also be voted by proxy. As a beneficial owner, you have the right to instruct the organization that holds your shares on how to vote the shares held in your account. You will receive instructions from your broker, bank or other nominee that you must follow in order for your broker, bank or other nominee to vote your shares by proxy according to your instructions. Many brokerage firms and banks have a process for their beneficial holders to provide instructions via the internet or by telephone.

If the organization that holds your shares does not receive instructions from you on how to vote your shares, then under the rules of various national and regional securities exchanges, the organization may generally vote your shares in its discretion on routine matters, but it cannot vote on non-routine matters. If the organization that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will not have the authority to vote, and therefore cannot vote, on that matter with respect to your shares. This is generally referred to as a “broker non-vote.” The election of directors (Item 1) and matters relating to executive compensation such as the non-binding advisory vote on the compensation of our named executive officers (Item 3) are non-routine matters, so brokers may not vote your shares on Items 1 or 3 if you do not give specific instructions on how to vote.

We encourage you to provide instructions to your broker or nominee regarding these proposals so your shares will be voted.

The ratification of the engagement of the Company’s independent auditors (Item No. 2) is a matter that we believe will be considered routine. Therefore, no broker non-votes are expected to occur in connection with Item No. 2.

Broker non-votes will be counted as present at the Annual Meeting for the purposes of calculating a quorum but will not be counted as present for any other purpose or as a vote actually cast at the meeting. Thus, we believe broker non-votes will have no effect on the election of directors (Item 1), the ratification of the engagement of our independent auditors (Item No. 2), or the non-binding advisory vote on the compensation of our named executive officers (Item 3).

BENEFICIAL OWNERSHIP OF COMMON STOCK

The following table provides information as of March 27, 2023, concerning the beneficial ownership of the Company’s common stock by each director, each director nominee, each executive officer, all directors and executive officers as a group, and each person known by CKX Lands to own beneficially more than 5% of the outstanding shares of Common Stock. Unless otherwise noted, the listed persons have sole voting and dispositive powers with respect to shares listed below. The address of the directors, nominees and executive officers listed below is c/o CKX Lands, Inc., 2417 Shell Beach Drive, Lake Charles, LA 70601.

|

Name of Beneficial Owner

|

|

Number

Beneficially Owned

|

|

Percent

of Class

|

|

|

5% Shareholders:

|

|

|

|

|

|

|

|

Ottley Properties, LLC(1)

|

|

369,610

|

|

|

18.72

|

% |

|

Executive Officers:

|

|

|

|

|

|

|

|

William Gray Stream(2)

President and Chair of the Board of Directors

|

|

172,443

|

|

|

8.73

|

% |

|

Scott A. Stepp

Chief Financial Officer

|

|

15,966

|

|

|

*

|

|

|

Directors and Nominees for Director:

|

|

|

|

|

|

|

|

Lee W. Boyer

|

|

2,962

|

|

|

*

|

|

|

Keith Duplechin

|

|

1,200

|

|

|

*

|

|

|

Daniel J. Englander

|

|

0

|

|

|

0

|

|

|

Max H. Hart(3)

|

|

9,805

|

|

|

*

|

|

|

Lane T. LaMure

|

|

1,000

|

|

|

*

|

|

|

Eugene T. Minvielle, IV

|

|

1,000

|

|

|

*

|

|

|

Mary Leach Werner(4)

|

|

21,276

|

|

|

1.08

|

% |

|

All directors and executive officers as a group

|

|

225,652

|

|

|

11.43

|

% |

|

(1)

|

Ottley Properties, LLC, 400 Poydras Street, Suite 2100, New Orleans, LA 70130. Michael B. White, who is the immediate past Chair of our Board of Directors, is the sole manager of Ottley Properties, LLC, has sole voting and/or investment power over the shares, and may be deemed to have an indirect interest in the shares.

|

|

(2)

|

Consists of of 25,588 shares directly beneficially owned by Mr. Stream and over which he has sole voting and investment power; 34,000 shares owned by a limited partnership of which the general partner is a corporation that Mr. Stream is president and a shareholder of, and over which he shares voting and investment power; 67,317 shares owned by a limited liability company of which Mr. Stream is sole manager and a member and over which he has sole voting and investment power; 2,050 shares owned by Mr. Stream’s grandmother over which Mr. Stream has power of attorney and over which he shares voting and investment power; 35,644 shares owned by a limited liability company of which Mr. Stream is an officer and over which he shares voting and investment power; and 7,844 shares owned by a limited liability company over which Mr. Stream shares voting and investment power. Mr. Stream disclaims beneficial ownership of all the shares that are not directly beneficially owned by him, except to the extent of his pecuniary interest therein, if any.

|

|

(3)

|

Includes 3,500 shares owned by a trust of which Mr. Hart is a co-trustee; 2,200 shares owned by a trust of which Mr. Hart is a co-trustee; and 1,000 shares owned by a limited liability company of which Mr. Hart is a manager. Mr. Hart does not have sole voting and/or investment power over these 6,700 shares. Mr. Hart does have sole voting and/or investment powers over the remaining 3,105 shares.

|

|

(4)

|

Includes 8,250 shares owned by a partnership of which Mrs. Werner is a partner and 11,250 shares owned by a corporation of which Mrs. Werner is a director. Mrs. Werner does not have sole voting and/or investment power over these 19,500 shares. Mrs. Werner does have sole voting and/or investment power over the remaining 1,776 shares.

|

DELINQUENT SECTION 16(a) REPORTS

Section 16(a) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), requires the Company’s executive officers, directors and more than 10% shareholders to file with the Securities and Exchange Commission (“SEC”) reports on prescribed forms of their ownership and changes in ownership of Company stock and furnish copies of such forms to the Company. Based solely upon a review of the Form 3, 4 and 5 filings received from or filed by CKX Lands, Inc. on behalf of reporting persons during the most recent fiscal year, CKX Lands, Inc. is not aware of any failure to file on a timely basis any Form 3, 4 or 5 specifically during the most recent fiscal year.

ITEM 1: ELECTION OF DIRECTORS

The By-Laws of the Company specify that the Board fixes the number of directors from time to time, but the number may not be less than five nor more than fifteen. The Board has fixed the number of directors from and after the Annual Meeting at eight. Each director will hold office for one year and until either his or her successor is elected and qualified or there is a decrease in the number of directors. On the recommendation of the Nominating Committee, the Board of Directors has nominated the persons listed below for election as director. If a nominee should become unavailable for election, the persons voting the accompanying proxy may in their discretion vote for a substitute. All nominees have been with the same organization and in the same position as listed below for the past five years unless noted. The table below also includes the specific qualifications and experience of each nominee that led to the conclusion that the nominee should serve as a director.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR EACH OF THE NOMINEES NAMED BELOW.

|

Name

|

Age

|

Experience and Qualifications

|

Director

Since

|

|

Lee W. Boyer

|

65

|

Retired Partner of Stockwell, Sievert, Viccellio, Clements & Shaddock, L.L.P. law firm and Secretary of CKX Lands, Inc. since 2020. Former President and Treasurer from 2018 to 2020 of CKX Lands, Inc.; Former President, Second University Homesites, Inc.; Manager, Jones-Boyer, LLC; Manager, Boyer Properties, LLC, which are residential and commercial property management companies. Director, Mallard Bay, LLC, a land management company. Mr. Boyer’s experience in land management and real estate makes him qualified to serve as a director.

|

2016

|

|

Keith Duplechin

|

61

|

Principal, First Capital Group, LLC and AdSource, LLC. Mr. Duplechin’s experience in land management, real estate, banking, and financial matters make him qualified to serve as a director.

|

2018

|

|

Daniel J. Englander

|

54

|

Founder and managing partner of Ursula Capital Partners, an investment management firm. Director, America’s Car-Mart, Inc. (NASDAQ), an automotive retailer, since 2007 and Copart, Inc. (NASDAQ), a provider of online auctions and vehicle remarketing services, since 2006. From 1994 to 2004, investment banker with Allen & Company, a New York-based merchant bank. Mr. Englander’s qualifications to serve on the board include his financial and investment experience and his experience as a director of other public companies. He also brings operational and strategic expertise, as well as business development expertise, to the board.

|

2018

|

|

Max H. Hart

|

64

|

Principal, Haas-Hirsch Interests, a land management company. Mr. Hart’s experience in land management, oil and gas leasing activities, forestry, farming and rights of way makes him qualified to serve as a director.

|

2016

|

|

Lane T. LaMure

|

48

|

Founder and Chief Investment Officer of Enlight Capital Advisors, a private investment advisor to high profile family offices and individuals, and predecessor firm, since 2012. Previously, Mr. LaMure held executive positions at public and private investment funds, where he focused on real estate and real estate-related investment opportunities. Mr. LaMure’s 20 years of public and private investment experience, particularly in real estate, make him ideally suited for the CXK Lands, Inc. board of directors.

|

2021

|

|

Eugene T. Minvielle, IV

|

49

|

Financial Professional, MSE Partners, LLC. Former Chief Financial Officer and Treasurer of Marlin Energy, LLC. Mr. Minvielle’s experience in oil and gas and financial reporting, including past experience as chief financial officer of an upstream oil and gas company, make him qualified to serve as a director.

|

2017

|

|

William Gray Stream

|

43

|

President of CKX Lands, Inc. since July 15, 2020. President since 2013 of Matilda Stream Management, Inc., an investment holding company that, among other things, indirectly owns and operates approximately 100,000 acres of land in Louisiana and provides wetland habitat restoration services. From 2014 until 2022, director of Waitr Holdings Inc. (OTC), a publicly traded on-demand food ordering and delivery company. Mr. Stream’s experience in oil and gas, timber, agriculture, wetlands, ranching and commercial and residential real estate makes him qualified to serve as a director. Also, he previously served as a director of CKX Lands from 2006 to 2017 and was Chair of the Audit Committee from 2011 to 2017.

|

2018

|

|

Mary Leach Werner

|

55

|

Vice President and Director of North American Land Co., LLC and Vice President and Director of The Sweet Lake Land & Oil Co., LLC, both land management companies. Mrs. Werner’s experience in land management and oil and gas activities makes her qualified to serve as a director.

|

2004

|

During fiscal year 2022, Edward M. Ellington, II was a member of the Board of Directors until his retirement at the expiration of his term at the 2022 Annual Meeting.

The Board of Directors determined that directors Englander, Duplechin, Hart, LaMure and Minvielle are “independent directors” as defined under the rules of the NYSE American. The Board of Directors also determined that Messrs. Englander, LaMure and Minvielle are independent within the meaning of the NYSE American standards currently in effect and Rule 10A-3 of the Exchange Act applicable to members of the Audit Committee, and that Messrs. Englander, Hart and Minvielle are independent under the standards applicable to members of the Compensation Committee. The Board of Directors determined that Mr. Ellington was an independent director under the NYSE American and met the independence requirements for Audit Committee members of Rule 10A-3 and the NYSE American during his service.

Each of the Company’s directors is requested to attend the Annual Meeting in person. Seven of the Company’s directors attended the Company’s 2022 Annual Meeting of Shareholders.

BOARD OF DIRECTORS LEADERSHIP STRUCTURE AND RISK OVERSIGHT

William Gray Stream, our President, serves as the Chair of the Board of Directors. The Board believes that due to Mr. Stream’s role as the Company’s President and chief strategist, his role as both President and Chair of the Board benefits the Company’s shareholders and is therefore appropriate.

Independent Directors meet at least annually in executive session without non-independent or management Directors in attendance. During 2022, independent Directors met once in executive session. On March 24, 2022, Mr. Minvielle was appointed to the role of Lead Independent Director. Our Bylaws provide that the Lead Independent Director presides at all meetings of the Board of Directors at which the Chair of the Board is not present, including executive sessions of the independent directors; serves as a liaison between the Chair of the Board and the independent directors; approves information sent to the Board of Directors in preparation for meetings of the Board of Directors; approves agendas for meetings of the Board of Directors; approves schedules for meetings of the Board of Directors to ensure that there is sufficient time for discussion of all agenda items; has the authority to call meetings of the independent directors; is available for communications with the corporation’s shareholders; and has such other responsibilities as the Board of Directors may determine from time to time.

CKX Lands’ Board of Directors administers its risk oversight responsibilities by requiring specific Board authorization of all non-routine activities of the Company and through its Audit Committee’s quarterly review of the Company’s financial statements, discussions of management activities and communication with external auditors.

The Company has a Code of Ethics that applies to all directors, officers and employees. It is available on our website at https://www.ckxlands.com/wp-content/uploads/2022/03/Code-of-Ethics.pdf.

During 2022, the Board of Directors held a total of four meetings. Mr. Englander attended fewer than 75% of the aggregate of Board meetings and meetings of committees of which he was a member during 2022. However, he was engaged with the Board process in between meetings and received and reviewed materials provided in connection with Board and committee meetings. The Louisiana Business Corporation Act and our Restated Articles of Incorporation permit directors to vote by proxy at meetings of the Board of Directors or of a committee of the Board, and Mr. Englander voted by proxy at Board and committee meetings he did not attend.

HEDGING POLICY

The Company’s insider trading policy prohibits hedging transactions. The policy applies to all directors; employees; other persons, including service providers, who have access to the Company’s confidential information; and any other person designated by the Company’s Board of Directors as subject to the policy. The hedging prohibition in the policy is excerpted below:

Hedging transactions permit an individual to hedge against a decline in stock price. Because hedging may have the appearance of a bet against the Company, hedging transactions, whether direct or indirect, involving the Company’s securities are prohibited, regardless of whether the Insider knows Material, Non-Public Information.

Derivative securities transactions, whether or not entered into for hedging purposes, may also appear improper if there is any unusual activity in the underlying equity security. Accordingly, transactions involving CKXbased derivative securities are prohibited, whether or not you know Material, Non-Public Information. Derivative securities include options, warrants, stock appreciation rights, convertible notes or similar rights whose value is derived from the value of CKX common stock. Transactions in derivative securities include trading in CKX-based option contracts, transactions in straddles or collars, and writing puts or calls.

BOARD OF DIRECTORS COMMITTEES

The Board of Directors has an Audit Committee, Compensation Committee and Nominating Committee. The membership of each committee during 2022 consisted solely of non-employee directors who met the independence standards established by the NYSE American. The current members of each committee are set forth below:

|

Committee

|

Chair

|

Other Members

|

|

Audit

|

Minvielle

|

Englander, LaMure

|

|

Compensation

|

Englander

|

Hart, Minvielle

|

|

Nominating

|

Duplechin

|

LaMure

|

During fiscal year 2022 until March 21, 2022, Edward M. Ellington, II served as the Chair of the Audit Committee, and he was a member of the Audit Committee and the Nominating Committee until March 24, 2022. Mr. Ellington retired from the Board of Directors at the expiration of his term at our 2022 Annual Meeting.

The Audit Committee assists the Board of Directors in fulfilling its oversight responsibilities with respect to financial reports and other financial information, and selects and appoints the independent registered public accountants. The Company has determined that Mr. Minvielle qualifies as “audit committee financial expert” under Item 407(d)(5) of Regulation S-K. Each member of the Audit Committee meets the financial literacy requirements of the NYSE American. During 2022, the Audit Committee held four meetings. A copy of the Audit Committee’s charter is available on the company’s website, www.ckxlands.com.

The Compensation Committee approves all executive compensation. The Compensation Committee does not have a charter. During 2022, the Compensation Committee did not hold any meetings, and the sole compensation matter considered in 2022, which was the grant of stock awards to the executive officers under our stock incentive plan, was decided by the full Board. Executive officers do not participate in deliberations about or voting on their compensation or the compensation of directors. In light of the simplicity and relatively modest levels of the Company’s current executive and director cash compensation, the Company does not believe that there is any risk that could arise from its pay practices that would have a material adverse effect on it.

The Nominating Committee selects nominees for the Board of Directors. The Nominating Committee identifies individuals qualified to become directors and recommends them to the Board for directorships. The Nominating Committee will consider persons recommended by shareholders to become nominees for election as directors. Recommendations for consideration by the Nominating Committee should be sent to the Secretary of the Company in writing together with appropriate biographical information. Please see “Shareholder Proposals.”

The Committee identifies and evaluates nominees on the basis of their education, business experience, integrity, and knowledge of Southwest Louisiana, particularly as it relates to land management. Nominees recommended by security holders will be evaluated by the same criteria. When identifying nominees for directorships, the Committee considers diversity of skills, experience and business background, and no specific minimum qualifications are required.

The Nominating Committee has in the past considered potential director candidates suggested by its members, other directors and management. Members on the committee and management have in the past interviewed potential candidates who were not incumbent directors, and the committee has then voted to recommend a slate of nominees to the Board.

The Nominating Committee does not have a charter and operates under a board resolution addressing the nominating process. During 2022, the Nominating Committee held no meetings.

DIRECTOR COMPENSATION

The table below sets forth the compensation paid to our directors during 2022. Fees are paid only for each regular Board of Directors meeting.

| |

|

|

|

|

|

Member

|

|

| Meeting |

|

Chairperson |

|

|

Attending

|

|

|

Non-Attending

|

|

|

Board of Directors

|

|

$ |

1,000 |

|

|

$ |

600 |

|

|

$ |

200 |

|

|

Audit Committee

|

|

|

1,000 |

|

|

|

— |

|

|

|

— |

|

|

Compensation Committee

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Nominating Committee

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Actual compensation paid to Directors during 2022 is presented below:

|

Director

|

|

Fees Paid

|

|

|

Lee W. Boyer(1)

|

|

$ |

3,600 |

|

|

Keith Duplechin

|

|

$ |

2,000 |

|

|

Edward M. Ellington, II

|

|

$ |

600 |

|

|

Daniel J. Englander

|

|

$ |

800 |

|

|

Max H. Hart

|

|

$ |

2,000 |

|

|

Lane T. LaMure

|

|

$ |

2,400 |

|

|

Eugene T. Minvielle, IV

|

|

$ |

6,400 |

|

|

William Gray Stream

|

|

$ |

0 |

|

|

Mary Leach Werner

|

|

$ |

2,000 |

|

|

(1)

|

Mr. Boyer’s compensation includes $300 per regular meeting attended as Company secretary.

Following his appointment as President, Mr. Stream declined to receive director’s fees.

|

COMMUNICATIONS WITH THE BOARD OF DIRECTORS

BY SHAREHOLDERS AND OTHER INTERESTED PARTIES

The Company’s Annual Meeting of Shareholders provides an opportunity for shareholders and others to ask questions directly of Directors on matters relevant to the Company. In addition, shareholders and other interested parties may, at any time, communicate with the full Board of Directors, any individual director or any group of directors, by sending a written communication to the full Board of Directors, individual director or group of directors at the following address: CKX Lands, Inc., P.O. Box 1864, Lake Charles, LA 70602.

EXECUTIVE COMPENSATION

Our named executive officers are William Gray Stream, President, and Scott A. Stepp, Chief Financial Officer. Mr. Stream’s biographical information is given above in “Item 1: Election of Directors.” Mr. Stepp, who is 45, was appointed Chief Financial Officer of the Company effective May 9, 2022. He is the Chief Investment Officer of Matilda Stream Management, Inc. (“MSM”), a private family office and investment holding company that manages a diverse set of operating businesses, investments and assets, including approximately 100,000 acres of land in Louisiana. Mr. Stepp has held his position with MSM since 2014. Mr. Stream is the President of MSM.

Summary Compensation Table

|

Name and Position

|

|

Year

|

|

Salary(1)

|

|

|

Stock Awards(2)

|

|

|

Total

|

|

|

W. Gray Stream, President and

|

|

2022

|

|

$ |

0 |

|

|

$ |

1,154,280 |

|

|

$ |

1,154,280 |

|

| Chairman of the Board of Directors(3) |

|

2021 |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott A. Stepp,

|

|

2022

|

|

$ |

0 |

|

|

$ |

1,154,257 |

|

|

$ |

1,154,257 |

|

| Chief Financial Officer(4) |

|

2021 |

|

$ |

0 |

|

|

$ |

0 |

|

|

$ |

0 |

|

|

(1)

|

Under their Executive Employment Agreements with the Company, Messrs. Stream and Stepp are not entitled to any cash compensation as officers. Instead, they are entitled to receive restricted stock units and performance shares under the Company’s Stock Incentive Plan.

|

|

(2)

|

Reflects the aggregate grant date fair value of awards of restricted stock and performance shares, computed in accordance with FASB ASC Topic 718. See Note 1 to the Company’s financial statements, “Nature of Business and Significant Accounting Policies—Share-Based Compensation,” filed with its Annual Report on Form 10-K for the fiscal year ended December 31, 2022. The values of performance shares are based upon the probable outcome of the performance conditions as of the grant date. The value of the stock awards at the grant date assuming that the highest level of achievement of the performance conditions will be achieved is $2,034,917 for Mr. Stream and $2,034,883 for Mr. Stepp.

|

|

(3)

|

Mr. Stream was appointed President and Treasurer effective July 15, 2020, but ceased holding the office of Treasurer upon Mr. Stepp’s appointment as Chief Financial Officer.

|

|

(4)

|

Mr. Stepp was appointed Chief Financial Officer effective May 9, 2022.

|

Employment Agreements, Stock Awards, and Plans

The Company and Mr. Stream have entered into a First Amended and Restated Executive Employment Agreement that provides for a term of employment of four years from July 15, 2020. The Company and Mr. Stepp have entered to an Executive Employment Agreement that is substantially similar to Mr. Stream’s but provides for a term of employment from May 9, 2022 until July 15, 2024. The Company can terminate the agreements without cause and the executives can terminate their respective agreements without good reason at any time on 30 days’ notice. Neither executive is entitled to any cash compensation under his agreement. However, the agreements do entitle the executives to receive restricted stock units and performance shares under the Company’s stock incentive plan that was approved by our stockholders at our 2021 Annual Meeting. On June 13, 2022, the Board of Directors approved an award to Mr. Stream of 38,378 restricted stock units and 140,124 performance shares and an award to Mr. Stepp of 38,377 restricted stock units and 140,121 performance shares.

Under their stock award agreements, each executive’s restricted stock units vest annually in three increments of 19.05%, 33.33% and 47.62%, respectively, of the number of shares underlying the units, starting on July 15, 2022. On July 15, 2022, a total of 14,622 restricted stock units vested. Pursuant to the terms of the plan and their award agreements, the executives elected to have the Company withhold some vested shares to satisfy withholding tax obligations, so the Company issued a net total of 10,514 shares to settle the vested restricted stock units.

The performance shares vest in increments if the closing price of the Company’s common stock on the NYSE American equals or exceeds certain price targets for at least ten consecutive trading days at any time during the period from July 15, 2020 through July 15, 2024, as follows:

|

Price Target

|

|

|

Percentage of

Performance Share

Award that Vests

|

|

| $ |

12.00 |

|

|

|

11.27% |

|

| $ |

13.00 |

|

|

|

18.47% |

|

| $ |

14.00 |

|

|

|

16.86% |

|

| $ |

14.50 |

|

|

|

22.37% |

|

| $ |

15.00 |

|

|

|

31.03% |

|

The $12.00 price target criteria were satisfied before the grant date, so 31,584 performance shares were vested when granted. The executives elected to have the Company withhold some vested shares to satisfy withholding tax obligations, so the Company issued a net total of 21,418 shares in settlement of vested performance shares. The price target criteria have not been achieved for any other tier of performance shares, so no further performance shares have vested.

Stock awards that are not vested as of the date an executive’s employment ends would be forfeited, except that if:

| |

●

|

the Company terminates the executive’s employment without cause,

|

| |

●

|

the executive resigns with good reason that is not cured after notice,

|

| |

●

|

the executive’s employment ends due to his death or disability, or

|

| |

●

|

there is a change of control of the Company,

|

a pro rata amount of his unvested restricted stock units would vest according to the number of months of the vesting period that have elapsed, plus six months. “Cause” means the executive’s conviction of a crime that injured the Company; knowingly causing material harm to the Company; misappropriation of Company funds or property; fraudulent conduct, misrepresentations of material fact or omissions of material fact related to the Company’s business; or material breach of his employment agreement that is not timely cured. “Good reason” means a reduction in the executive’s compensation other than pursuant to a written compensation recoupment policy; a material diminution of his title, authority, duties, or responsibilities; or a material breach by the Company of his employment agreement.

The employment agreements require the executives to avoid engaging in any activity that competes with the Company or that is contrary to the Company’s best interests during their term of employment.

The Company currently has no long-term compensation programs, stock option program or stock grants program other than the stock incentive plan.

The Company has no employment agreements other than as described above, nor any pension plans or profit-sharing plans.

Outstanding Equity Awards at Fiscal 2022 Year-End

The following table provides information on the named executive officers’ outstanding restricted stock unit and performance share awards as of December 31, 2022. All outstanding stock awards were granted on June 13, 2022.

| |

|

Stock Awards(1)

|

|

|

Name

|

|

Number of shares

or units of stock

that have not

vested(2)

(#)

|

|

|

Market value of

shares of units of

stock that have not

vested

($)

|

|

|

Equity

incentive

plan awards:

Number of

unearned

shares, units or

other rights that

have not vested

(#)(3)

|

|

|

Equity

incentive

plan awards:

Market or payout

value of

unearned

shares, units or

other rights that

have not vested

($)

|

|

|

W. Gray Stream, President and Chairman of the Board of Directors

|

|

|

31,067 |

|

|

$ |

309,117 |

|

|

|

25,881 |

|

|

$ |

257,516 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Scott A. Stepp, Chief Financial Officer

|

|

|

31,066 |

|

|

$ |

309,107 |

|

|

|

25,880 |

|

|

$ |

257,506 |

|

|

(1)

|

Values of equity awards are based on our closing stock price on the NYSE American of $9.95 per share on December 30, 2022, the last trading day of the fiscal year. Pursuant to Instruction 3 to Item 402(p)(2) of Regulation S-K, the number and value of performance shares shown in the table assume that only the $13.00 price target will be achieved, which would result in the minimum possible payout of vested performance shares.

|

|

(2)

|

This column reflects outstanding restricted stock units. Mr. Stream’s restricted stock units will vest as follows: 12,791 on July 15, 2023 and 18,276 on July 15, 2024. Mr. Stepp’s restricted stock units will vest as follows: 12,791 on July 15, 2023 and 18,275 on July 15, 2024.

|

|

(3)

|

This column reflects outstanding performance shares. The performance shares vest in increments if the closing price of the Company’s common stock on the NYSE American equals or exceeds certain price targets for at least ten consecutive trading days at any time until July 15, 2024, as follows:

|

|

Name

|

|

Price Target

|

|

|

Performance

Shares Vesting

|

|

|

Mr. Stream

|

|

$ |

13.00 |

|

|

|

25,881 |

|

| Mr. Stepp |

|

|

|

|

|

|

25,880 |

|

| |

|

|

|

|

|

|

|

|

|

Mr. Stream

|

|

$ |

14.00 |

|

|

|

23,625 |

|

| Mr. Stepp |

|

|

|

|

|

|

23,624 |

|

| |

|

|

|

|

|

|

|

|

|

Mr. Stream

|

|

$ |

14.50 |

|

|

|

31,346 |

|

| Mr. Stepp |

|

|

|

|

|

|

31,345 |

|

| |

|

|

|

|

|

|

|

|

|

Mr. Stream

|

|

$ |

15.00 |

|

|

|

43,480 |

|

| Mr. Stepp |

|

|

|

|

|

|

43,480 |

|

Pursuant to Instruction 3 to Item 402(p)(2) of Regulation S-K, the number and value of performance shares shown in the table assume that only the $13.00 price target will be achieved, which would result in the minimum possible payout of vested performance shares.

Pay Versus Performance

The table below shows for 2021 and 2022 the “total” compensation for our principal executive officer (PEO) and our other named executive officer (NEO) from the Summary Compensation Table above; the “Compensation Actually Paid” to those officers calculated using rules required by the SEC; our total shareholder return (TSR); and our net income. “Compensation Actually Paid” does not represent the value of shares received by the officers during the year, but rather is an amount calculated under Item 402(v) of the SEC’s Regulation S-K.

|

Year

|

|

Summary

Compensation

Table Total for

PEO ($)

|

|

|

Compensation

Actually Paid

to PEO ($)(1)

|

|

|

Average

Summary

Compensation

Table Total for

Non-PEO

NEOs ($)

|

|

|

Average

Compensation

Actually Paid to

Non-PEO NEOs

($)(2)

|

|

|

Value of Initial

Fixed $100

Investment

Based on TSR ($)

|

|

|

Net Income

(Loss) ($)

|

|

|

2022

|

|

$ |

1,154,280 |

|

|

$ |

793,330 |

|

|

$ |

1,154,257 |

|

|

$ |

793,326 |

|

|

|

104.57 |

|

|

$ |

(1,317,718 |

) |

|

2021

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

0 |

|

|

|

117.71 |

|

|

|

819,349 |

|

|

(1)

|

Mr. Stream is the only PEO, and Mr. Stepp is the only non-PEO NEO for whom compensation is reported in the table above. Neither of them received any compensation in 2021 and the only compensation they received in 2022 consisted of stock awards. Accordingly, as required by Item 402(v) of Regulation S-K, the amounts shown as “Compensation Actually Paid” for 2022 represent (i) the fair value, as of the end of 2022, of their stock awards granted in 2022 that were outstanding and unvested as of the end of 2022, plus (ii) the fair value, as of the vesting date, of their awards that were granted and vested in 2022. The Company issued no stock awards before 2022. The performance shares that vested during 2022 vested on the grant date, so they have been valued using the closing price of our stock on that date ($11.40 per share on June 13, 2022). The restricted stock units that vested during 2022 vested on July 15, 2022, and have been valued using the closing price of the Company’s stock on that date ($11.02 per share).

|

Analysis of the Information Presented in the Pay Versus Performance Table

As shown in the graphs below, the “Compensation Actually Paid” to our officers is not aligned with either our two-year TSR or our Net Income (Loss) for 2021 and 2022. Based upon the valuation methodology used for accruing the expense associated with our stock awards, we were required to recognize 68% of the grant date fair value of the awards in 2022, even though only 15% of the grant date fair value of the awards actually vested during the year. The officers received no compensation for their services in 2021, and the stock awards were the only compensation received in 2022. The stock awards are intended to align management’s compensation with shareholder value. Accordingly, 78.5% of the stock awards granted to the officers vest only if certain share price targets are met during the performance period, and of those awards, approximately 89% are unvested and still at risk. The fair value, as of the vesting date, of share awards that actually vested during 2022 was $260,596 for each officer.

|

Compensation Actually Paid (CAP) vs. Two Year TSR

|

|

Compensation Actually Paid (CAP) vs. Net Income

|

|

|

|

|

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The Company and Stream Wetlands Services, LLC (“Stream Wetlands”) were parties to an option to lease agreement dated April 17, 2017 (the “OTL”). The OTL provided Stream Wetlands an option to lease certain lands from the Company, subject to the negotiation and execution of a mutually acceptable lease form.

On February 28, 2022, the Company exercised the OTL and entered into a 25-year lease in exchange for a one-time payment by Stream Wetlands of $38,333. The terms of the lease provide for formulaic contingent payments to the Company based on the amount of revenue generated from activities on the subject property by a third party, with a guaranteed minimum payment of $500,000 in the event that revenue does not meet a minimum threshold. No minimum payment is due unless and until the third party engages in activity on the subject lands, and neither the Company nor Stream Wetlands is able to determine whether that will occur. William Gray Stream, the President and a director of the Company, is the president of Stream Wetlands.

The Company’s President is also the President of Matilda Stream Management, Inc. (“MSM”) and the Company’s Chief Financial Officer is the Chief Investment Officer of MSM. MSM provides administrative and accounting services to the Company for no compensation.

ITEM 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

MaloneBailey LLP, acted as our independent registered public accounting firm and audited our financial statements for the year ended December 31, 2022. The Audit Committee of the Board has selected MaloneBailey LLP as independent registered public accounting firm to audit our financial statements for 2023. Representatives of MaloneBailey LLP will be available at the Annual Meeting, have an opportunity to make a statement if they so desire and respond to appropriate questions.

REPORT OF THE AUDIT COMMITTEE

The following Report of the Audit Committee does not constitute proxy soliciting materials and should not be deemed filed or incorporated by reference into any other filing by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent specifically incorporated into such a filing.

The Audit Committee of the Board of Directors has furnished the following report on the Company’s audit procedures and its relationship with its independent accountants for the twelve-month period ending December 31, 2022.

The Audit Committee has reviewed and discussed with the Company’s management and MaloneBailey LLP the audited financial statements of the Company contained in the Company’s Annual Report on Form 10-K for the Company’s 2022 fiscal year. The Audit Committee has also discussed with MaloneBailey LLP the matters that are required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the SEC.

The Audit Committee also has received from MaloneBailey LLP the written disclosures and the letter required by the PCAOB rules regarding auditors’ communications with audit committees about independence, and has discussed with MaloneBailey LLP their independence from the Company.

Based on the review and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements for the fiscal year ended December 31, 2022 be included in the Company’s Annual Report on Form 10-K for its 2022 fiscal year for filing with the SEC.

The Board of Directors adopted a Charter governing the Audit Committee in January 2003. The Audit Committee is composed of independent directors as required by and in compliance with the listing standards of the NYSE American.

| |

AUDIT COMMITTEE

|

| |

Eugene T. Minvielle, IV (Chair)

Daniel J. Englander

Lane T. LaMure

|

RELATIONSHIP WITH INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

For 2021 and 2022, MaloneBailey LLP was paid $53,000 and $81,500, respectively, solely for audit services. Audit service fees include fees for services performed for the recurring audit of the Company’s financial statements.

MaloneBailey, LLC was paid no audit-related fees, non-audit fees or tax fees during 2021 or 2022. Audit-related fees include fees associated with assurance and related services that are reasonably related to the performance of the audit or review of the Company’s financial statements. Tax fees are for the preparation of the Company’s federal and state income tax returns and the state franchise tax return.

The Audit Committee has adopted policies and procedures which require the pre-approval of all audit and non-audit services to be performed by the independent auditor of the Company.

The Audit Committee may delegate, to one or more designated members of the Committee, the authority to grant pre-approvals of audit and permitted non-audit services. Any decision by such member or members to grant pre-approval shall be presented to the Committee at its next scheduled meeting. During 2022, there was no audit or non-audit work performed by the independent auditor which was not pre-approved by the Audit Committee prior to the engagement.

The Audit Committee has selected the firm of MaloneBailey LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2023. Shareholder approval and ratification of this selection is not required by law or by the By-Laws of the Company. Nevertheless, the Board of Directors has chosen to submit it to the shareholders for their ratification as a matter of good corporate practice. A majority of the votes cast in person or by proxy on the proposal to ratify the appointment of MaloneBailey LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2023 must be voted in favor of the proposal for the proposal to be adopted. If the proposal is not adopted, the Audit Committee will take the vote into consideration in selecting independent auditors for the Company.

The Board of Directors recommends a vote FOR the appointment of MaloneBailey LLP as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2023.

ITEM 3: ADVISORY VOTE ON THE COMPANY’S EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act amended the Exchange Act to require that the Company’s shareholders be provided an opportunity to vote whether to approve the compensation of the Company’s Named Executive Officers as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission. As this “Say-on-Pay” vote is an advisory vote, it is not binding upon the Company, the Board of Directors, or Compensation Committee of the Board of Directors. However, the Board of Directors will take the results of this advisory vote under advisement. Also, this vote is not intended to address any specific element of compensation, but rather relates to the overall compensation of the Company’s Named Executive Officers as disclosed in this Proxy Statement.

In 2014 and 2020, the Company’s shareholders voted to hold an advisory vote on executive compensation every year.

We are asking shareholders to vote on the following proposal, which gives you the opportunity to endorse or not endorse our pay program for our Named Executive Officers by voting for or against the following resolution. This resolution is required pursuant to Section 14A of the Exchange Act.

“RESOLVED, that the shareholders of CKX Lands, Inc. (the Company) approve, on an advisory basis, the compensation of the Company’s Named Executive Officers, as disclosed pursuant to Item 402 of Securities and Exchange Commission Regulation S-K, including the compensation tables and narrative disclosures.”

A majority of the votes cast on the proposal in person or by proxy must be voted in favor of the proposal for the proposal to be adopted.

The Board of Directors recommends that the shareholders vote FOR the proposal to approve the compensation of CKX Lands’ Named Executive Officers as disclosed in its proxy statement relating to its 2023 Annual Meeting of Shareholders pursuant to the SEC’s compensation disclosure rules.

OTHER MATTERS

At the time of the preparation of this Proxy Statement, the Company had not been informed of any matters to be presented by, or on behalf of, the Company or its management, for action at the meeting other than those listed in the notice of meeting and referred to herein. If any other matters come before the meeting or any adjournment thereof, the persons named in the enclosed proxy will vote on such matters according to their best judgment.

A copy of the Company’s Annual Report on Form 10-K as filed with the SEC for 2022 accompanies this Proxy Statement.

Shareholders are urged to sign the enclosed proxy, which is solicited on behalf of the Board of Directors and return it at once in the enclosed envelope. Shareholders can also access the proxy material at www.envisionreports.com/ckx.

SHAREHOLDER PROPOSALS AND PROXY SOLICITATIONS

A shareholder who intends to present a proposal relating to a proper subject for shareholder action at the 2024 annual meeting of shareholders and who wishes the proposal to be included in the Company’s proxy materials for that meeting under SEC Rule 14a-8 must cause the proposal to be received, in proper form and in compliance with SEC Rule 14a-8, at the Company’s corporate office no later than December 2, 2023. If a proposal is not submitted timely, it will not be considered for inclusion in the proxy statement for the 2024 annual meeting.

Our By-Laws govern the submission of nominations for director and other business proposals that a shareholder wishes to have considered at a shareholders’ meeting, other than pursuant to SEC 14a-8. Shareholder nominations or proposals may be made by eligible shareholders only if timely written notice has been given pursuant to the By-Laws. To be timely for the 2024 annual meeting of shareholders, the notice must be received at our corporate office at the address set forth on page 1 of this proxy statement no earlier than the close of business on January 5, 2024 and not later than the close of business on February 4, 2024. All director nominations and shareholder proposals submitted outside of the processes of Rule 14a-8 must comply with the requirements of the By-Laws.

| |

BY ORDER OF THE BOARD OF DIRECTORS

|

| |

|

| |

|

Lake Charles, Louisiana

March 31, 2023

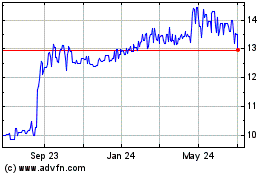

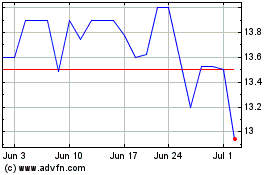

CKX Lands (AMEX:CKX)

Historical Stock Chart

From Apr 2024 to May 2024

CKX Lands (AMEX:CKX)

Historical Stock Chart

From May 2023 to May 2024