Cheniere Partners Declares Quarterly Distributions

October 24 2022 - 4:15PM

Business Wire

Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE

American: CQP) today declared (i) a cash distribution of $1.07 per

common unit to unitholders of record as of November 3, 2022,

comprised of a base amount equal to $0.775 and a variable amount

equal to $0.295, and (ii) the related distribution to its general

partner. These distributions are payable on November 14, 2022.

This press release serves as qualified notice to nominees as

provided for under Treasury Regulation Section 1.1446-4(b)(4) and

(d). Please note that 100 percent of Cheniere Partners’

distributions to foreign investors are attributable to income that

is effectively connected with a United States trade or business.

Accordingly, all of Cheniere Partners’ distributions to foreign

investors are subject to federal income tax withholding at the

highest applicable effective tax rate. Nominees are treated as

withholding agents responsible for withholding distributions

received by them on behalf of foreign investors.

About Cheniere Partners

Cheniere Partners owns the Sabine Pass LNG terminal located in

Cameron Parish, Louisiana, which has natural gas liquefaction

facilities consisting of six operational liquefaction Trains with a

total production capacity of approximately 30 million tonnes per

annum of liquefied natural gas (“LNG”). The Sabine Pass LNG

terminal also has operational regasification facilities that

include five LNG storage tanks, vaporizers, and two marine berths

with a third marine berth in commissioning. Cheniere Partners also

owns the Creole Trail Pipeline, which interconnects the Sabine Pass

LNG terminal with a number of large interstate pipelines.

For additional information, please refer to the Cheniere

Partners website at www.cheniere.com and Quarterly Report on Form

10-Q for the quarter ended June 30, 2022, filed with the Securities

and Exchange Commission.

Forward-Looking Statements

This press release contains certain statements that may include

“forward-looking statements.” All statements, other than statements

of historical or present facts or conditions, included herein are

“forward-looking statements.” Included among “forward-looking

statements” are, among other things, (i) statements regarding

Cheniere Partners’ financial and operational guidance, business

strategy, plans and objectives, including the development,

construction and operation of liquefaction facilities, (ii)

statements regarding regulatory authorization and approval

expectations, (iii) statements expressing beliefs and expectations

regarding the development of Cheniere Partners’ LNG terminal and

liquefaction business, (iv) statements regarding the business

operations and prospects of third parties, (v) statements regarding

potential financing arrangements, and (vi) statements regarding

future discussions and entry into contracts. Although Cheniere

Partners believes that the expectations reflected in these

forward-looking statements are reasonable, they do involve

assumptions, risks and uncertainties, and these expectations may

prove to be incorrect. Cheniere Partners’ actual results could

differ materially from those anticipated in these forward-looking

statements as a result of a variety of factors, including those

discussed in Cheniere Partners’ periodic reports that are filed

with and available from the Securities and Exchange Commission. You

should not place undue reliance on these forward-looking

statements, which speak only as of the date of this press release.

Other than as required under the securities laws, Cheniere Partners

does not assume a duty to update these forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221024005725/en/

Cheniere Partners Investors Randy

Bhatia, 713-375-5479 Frances Smith, 713-375-5753

Media Relations Eben

Burnham-Snyder, 713-375-5764 Phil West, 713-375-5586

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Mar 2024 to Apr 2024

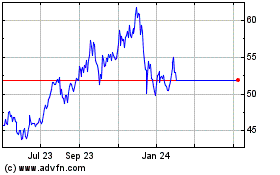

Cheniere Energy Partners (AMEX:CQP)

Historical Stock Chart

From Apr 2023 to Apr 2024