UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 3)

Battalion Oil Corporation

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of Securities)

02081G102

(CUSIP Number)

Jeffrey Wade

c/o Gen IV Investment Opportunities, LLC

1700 Broadway, 35th Floor

New York, New York 10019

212-547-2914

With a copy to:

Crosby Scofield

Vinson & Elkins LLP

845 Texas Avenue, Suite 4700

Houston, Texas 77002

713-758-3276

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

December 14, 2023

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this statement on Schedule 13D (this “Schedule 13D”), and is filing this Schedule 13D because of Rule 13d-1(e), 13d-1(f)

or 13d-1(g), check the following box.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures

provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of

the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

GEN IV INVESTMENT OPPORTUNITIES, LLC

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

WC

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

DELAWARE

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.5% (2)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

| (1) |

The number of shares reported above includes (i) 2,369,769 shares of Common Stock owned directly by Gen IV, (ii) 616,330 shares of Common Stock issuable upon conversion or redemption of 5,138 shares of Series A Preferred Stock issued to Gen

IV pursuant to the Series A Purchase Agreement (as discussed in Item 3), (iii) 1,034,360 shares of Common Stock issuable upon conversion or redemption of 7,810 shares of Series A-1 Preferred Stock issued to Gen IV pursuant to the Series A-1

Purchase Agreement (as discussed in Item 3) and (iv) 1,067,633 shares of Common Stock issuable upon conversion or redemption of 6,630 shares of Series A-2 Preferred Stock issued to Gen IV pursuant to the Series A-2 Purchase Agreement (as

discussed in Item 3). Neither the filing of this statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by any Reporting Person hereto that it is the beneficial owner of any Common Stock for purposes of

Section 13(d) of the Securities Exchange Act of 1934, as amended, or for any other purpose, and such beneficial ownership is hereby expressly disclaimed.

|

| (2) |

Based on (i) 16,456,563 shares of Common Stock outstanding as of December 15, 2023, in reliance on the representation made by the Issuer in the Series A-2 Purchase Agreement, plus (ii) (a) 616,330 shares of Common Stock issuable upon

conversion or redemption of the shares of Series A Preferred Stock owned directly by Gen IV, (b) 1,034,360 shares of Common Stock issuable upon conversion or redemption of the shares of Series A-1 Preferred Stock owned directly by Gen IV and

(c) 1,067,633 shares of Common Stock issuable upon conversion or redemption of the shares of Series A-2 Preferred Stock owned directly by Gen IV.

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

LSP GENERATION IV, LLC

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

DELAWARE

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.5% (2)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

| (1) |

The number of shares reported above includes (i) 2,369,769 shares of Common Stock owned directly by Gen IV, (ii) 616,330 shares of Common Stock issuable upon conversion or redemption of 5,138 shares of Series A Preferred Stock issued to Gen

IV pursuant to the Series A Purchase Agreement (as discussed in Item 3), (iii) 1,034,360 shares of Common Stock issuable upon conversion or redemption of 7,810 shares of Series A-1 Preferred Stock issued to Gen IV pursuant to the Series A-1

Purchase Agreement (as discussed in Item 3) and (iv) 1,067,633 shares of Common Stock issuable upon conversion or redemption of 6,630 shares of Series A-2 Preferred Stock issued to Gen IV pursuant to the Series A-2 Purchase Agreement (as

discussed in Item 3). Neither the filing of this statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by any Reporting Person hereto that it is the beneficial owner of any Common Stock for purposes of

Section 13(d) of the Securities Exchange Act of 1934, as amended, or for any other purpose, and such beneficial ownership is hereby expressly disclaimed.

|

| (2) |

Based on (i) 16,456,563 shares of Common Stock outstanding as of December 15, 2023, in reliance on the representation made by the Issuer in the Series A-2 Purchase Agreement, plus (ii) (a) 616,330 shares of Common Stock issuable upon

conversion or redemption of the shares of Series A Preferred Stock owned directly by Gen IV, (b) 1,034,360 shares of Common Stock issuable upon conversion or redemption of the shares of Series A-1 Preferred Stock owned directly by Gen IV and

(c) 1,067,633 shares of Common Stock issuable upon conversion or redemption of the shares of Series A-2 Preferred Stock owned directly by Gen IV.

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

LSP INVESTMENT ADVISORS, LLC

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

|

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

OO

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

|

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

DELAWARE

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

5,088,092 (1)

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

|

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

26.5% (2)

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

| (1) |

The number of shares reported above includes (i) 2,369,769 shares of Common Stock owned directly by Gen IV, (ii) 616,330 shares of Common Stock issuable upon conversion or redemption of 5,138 shares of Series A Preferred Stock issued to Gen

IV pursuant to the Series A Purchase Agreement (as discussed in Item 3), (iii) 1,034,360 shares of Common Stock issuable upon conversion or redemption of 7,810 shares of Series A-1 Preferred Stock issued to Gen IV pursuant to the Series A-1

Purchase Agreement (as discussed in Item 3) and (iv) 1,067,633 shares of Common Stock issuable upon conversion or redemption of 6,630 shares of Series A-2 Preferred Stock issued to Gen IV pursuant to the Series A-2 Purchase Agreement (as

discussed in Item 3). Neither the filing of this statement on Schedule 13D nor any of its contents shall be deemed to constitute an admission by any Reporting Person hereto that it is the beneficial owner of any Common Stock for purposes of

Section 13(d) of the Securities Exchange Act of 1934, as amended, or for any other purpose, and such beneficial ownership is hereby expressly disclaimed.

|

| (2) |

Based on (i) 16,456,563 shares of Common Stock outstanding as of December 15, 2023, in reliance on the representation made by the Issuer in the Series A-2 Purchase Agreement, plus (ii) (a) 616,330 shares of Common Stock issuable upon

conversion or redemption of the shares of Series A Preferred Stock owned directly by Gen IV, (b) 1,034,360 shares of Common Stock issuable upon conversion or redemption of the shares of Series A-1 Preferred Stock owned directly by Gen IV and

(c) 1,067,633 shares of Common Stock issuable upon conversion or redemption of the shares of Series A-2 Preferred Stock owned directly by Gen IV.

|

EXPLANATORY NOTE

The following constitutes Amendment No. 3 (“Amendment No. 3”) to the Schedule 13D filed by the undersigned with the Securities and Exchange Commission (the “SEC”) on October 18, 2019 (the “Original Schedule 13D”), as

amended by Amendment No. 1 thereto, filed with the SEC on March 30, 2023 (“13D Amendment No. 1,”) and Amendment No. 2 thereto, filed with the SEC on September 8, 2023 (collectively, the “Schedule 13D”). Except as specifically provided herein, this

Amendment No. 3 does not modify any of the information previously reported in the Schedule 13D. Capitalized terms used but not defined in this Amendment No. 3 shall the meanings herein as are ascribed to such terms in the Schedule 13D.

| Item 1. |

Security and Issuer.

|

This Amendment No. 3 relates to shares of Common Stock, $0.0001 par value per share (the “Common Stock”) of Battalion Oil Corporation, a Delaware corporation (the “Issuer”). The Issuer’s principal executive offices are located at 3505

West Sam Houston Parkway North, Suite 300, Houston, TX 77043.

| Item 3. |

Source or Amount of Funds or Other Consideration.

|

Item 3 is hereby amended by adding the following:

As described in Item 4 below, on December 15, 2023, Gen IV purchased 6,630 shares of Series A-2 Convertible Redeemable Preferred Stock of the Issuer, par value $0.0001 per share (the “Series A-2 Preferred Stock”), for aggregate consideration of

approximately $6.5 million pursuant to the Series A-2 Purchase Agreement, dated December 15, 2023 (the “Series A-2 Purchase Agreement”), by and among the Issuer, Gen IV and the other purchasers party thereto. The source of funds for such purchase was

working capital of Gen IV.

| Item 4. |

Purpose of Transaction.

|

Item 4 is hereby amended by adding the following:

The information set forth in amended Items 3 and 6 and the Exhibits to Amendment No. 3 are incorporated herein by reference.

On December 15, 2023, the Issuer, Gen IV and the other purchasers party thereto entered into the Series A-2 Purchase Agreement. On December 15, 2023, Gen IV purchased 6,630 shares of Series A-2 Preferred Stock for approximately $6.5 million.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

Item 6 is further amended by adding the following:

Series A-2 Purchase Agreement

On December 15, 2023, the Issuer, Gen IV and the other purchasers party thereto entered into the Series A-2 Purchase Agreement, pursuant to which Gen IV purchased 6,630 shares of Series A-2 Preferred Stock for approximately $6.5 million. The Series

A-2 Purchase Agreement also provides, among other things, that the affirmative vote or prior written consent of the purchasers of Series A-2 Preferred Stock holding at least two-thirds (66 2/3) of the shares held by such purchasers must be obtained

prior to the entry by Issuer into any transaction that is expected to result in a change of control, unless each holder of outstanding shares of Series A-2 Preferred Stock is given the option to receive a cash payment per share equal to the then

applicable Redemption Price (as defined in the Series A-2 Certificate of Designations).

The foregoing description of the Series A-2 Purchase Agreement is qualified in its entirety by reference to the full text of the Series A-2 Purchase Agreement, a copy of which is attached as Exhibit 10.11 to this Amendment No. 2 and incorporated by

reference herein.

Series A-2 Certificate of Designations

Subject to the terms and conditions of the Series A-2 Certificate of Designations the Issuer filed with the Delaware Secretary of State on December 15, 2023 (the “Series A-2 Certificate of Designations”), commencing on April 13, 2023, all or any

portion of the shares of Series A-2 Preferred Stock may be converted into Common Stock at any time based on the then-applicable liquidation preference (as determined in accordance with the Series A-2 Certificate of Designations) divided by the

applicable conversion price (the “Conversion Ratio”). The ordinary conversion price of the Series A-2 Preferred Stock is $6.21 per share and is subject to adjustment for stock splits, combinations, certain distributions or similar events.

Subject to the terms and conditions of the Series A-2 Certificate of Designations, if based on the Issuer’s financial statements for any fiscal quarter and a reserve report as of the same date, as of such date: (x) the PDP PV-20 value (as determined

in accordance with the Series A-2 Certificate of Designations) divided by (y) the number of outstanding shares of Common Stock, calculated on a fully diluted basis is equal to or exceeds 130% of the Conversion Price, then the Issuer may, from time to

time until such time that the foregoing conditions are no longer satisfied or a Material Adverse Effect (as defined in the Series A-2 Purchase Agreement) has occurred since the date of the most financial statements that met the foregoing conditions,

cause the conversion of all or any portion of the Series A-2 Preferred Stock into Common Stock using the then-applicable Conversion Ratio. The shares of Series A-2 Preferred Stock are also subject to redemption by the Issuer at any time following the

closing date of the issuance of shares of Series A-2 Preferred Stock in accordance with the terms of the Series A-2 Certificate of Designations. In the event of a change of control transaction, the shares of Series A-2 Preferred Stock are subject to

redemption or conversion in accordance with the terms of the Series A-2 Certificate of Designations.

This summary is qualified in its entirety by reference to the full text of the Series A-2 Certificate of Designations, a copy of which is attached as Exhibit 10.10 to this Amendment No. 3 and incorporated by reference herein.

Amendment No. 3 to Registration Rights Agreement

Concurrently with the closing of transactions contemplated by the Series A-2 Purchase Agreement, Gen IV entered into Amendment No. 3 to the Registration Rights Agreement, dated October 8, 2019, as amended by Amendment No. 1 thereto on March 28, 2023

and Amendment No. 2 thereto on September 6, 2023 (the “Third RRA Amendment”) with the Issuer and certain other stockholders of the Issuer listed on the signature pages thereto. The Third RRA Amendment, among other things amended the definition of

Registrable Securities to include the shares of Common Stock issuable upon conversion or redemption of the shares of Series A-2 Preferred Stock.

This summary is qualified in its entirety by reference to the full text of the Third RRA Amendment, a copy of which is attached as Exhibit 10.9 to this Amendment No. 3 and incorporated by reference herein.

Merger Agreement

On December 14, 2023, the Issuer entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Fury Resources, Inc., a Delaware corporation (“Parent”), and San Jacinto Merger Sub, Inc. (“Merger Sub”), a Delaware corporation and a

direct, wholly owned subsidiary of Parent. Pursuant to the Merger Agreement, Merger Sub will merge with and into the Issuer (the “Merger”), with the Issuer surviving as a wholly owned subsidiary of Parent.

Subject to the terms and conditions set forth in the Merger Agreement, at the effective time of the Merger (the “Effective Time”): (a) each share of Common Stock shall be converted into the right to receive $9.80 in cash, without interest (the “Merger

Consideration”), and such shares shall automatically be canceled and cease to exist; and (b) each share of (i) Series A Redeemable Convertible Preferred Stock of the Issuer, par value $0.0001 per share (“Series A Preferred Stock”), (ii) Series A-1

Redeemable Convertible Preferred Stock of the Issuer, par value $0.0001 per share (the “Series A-1 Preferred Stock”), and (iii) preferred stock of the Issuer issued following the execution and delivery of the Merger Agreement but prior to the Effective

Time (the “New Preferred Stock” and, together with the Series A Preferred Stock and the Series A-1 Preferred Stock, collectively, the “Preferred Stock”) shall be converted into the right to receive such consideration as is set forth in the applicable

certificate of designations pertaining to such series of Preferred Stock, and such shares shall automatically be canceled and cease to exist.

This summary is qualified in its entirety by reference to the full text of the Merger Agreement, a copy of which is attached as Exhibit 10.12 to this Amendment No. 4 and incorporated by reference herein.

Amendment to Series A-1 Preferred Stock Certificate of Designations

On December 15, 2023, the Issuer filed a certificate of amendment to the Certificate of Designations of Series A- 1 Preferred Stock (the “Series A-1 CoD”) with the Delaware Secretary of State (such

amendment, the “Series A-1 CoD Amendment”). The Series A-1 CoD Amendment, which has been approved by the requisite holder(s) of Series A-1 Preferred Stock, amends, among other things, certain provisions of the Series A-1 CoD, as follows: (a) the period

during which holders of Series A-1 Preferred Stock may convert their shares of Series A-1 Preferred Stock into Common Stock shall not commence until the date that is two hundred forty (240) days following the Issuance Date (as defined in the Series

A-1 CoD); (b) the period during which the Issuer may redeem shares of Series A-1 Preferred Stock at a price per share equal to one hundred and two percent (102%) of the then-current Liquidation Preference (as defined in the Series A-1 CoD) has been

changed such that the period shall begin on the date that is one hundred twenty (120) days after the Issuance Date and end on the date that is two hundred thirty-nine (239) days after such Issuance Date; (c) the period during which the Issuer may

redeem shares of Series A-1 Preferred Stock at a price per share equal to one hundred and five percent (105%) of the then-current Liquidation Preference (as defined in the Series A-1 CoD) has been changed such that the period shall begin on the date

that is two hundred and forty (240) days after the Issuance Date and end on the first (1st) anniversary of the Issuance Date; (d) (i) with respect to the option of the holders of Series A-1 Preferred Stock to convert their Series A-1 Preferred Stock

into a right to receive a cash payment per share of Series A-1 Preferred Stock in connection with a Change of Control (as defined in the Series A-1 CoD), the cash price has been changed from an amount equal to the then-applicable Liquidation Preference

to an amount equal to the then-applicable Redemption Price (as defined in the Series A-1 CoD) per share of such Series A-1 Preferred Stock, and (ii) the period during which holders of Series A-1 Preferred Stock may exercise such conversion option in

connection with a Change of Control has been changed from any time on or prior to the one hundred fiftieth (150th) day to the two hundred fortieth (240th) day following the Issuance Date; (e) the period during which the Issuer

must offer each holder of Series A-1 Preferred Stock a cash payment per share of Series A-1 Preferred Stock equal to the then-applicable Redemption Price in connection with a Change of Control has been changed from the period following the occurrence

of both the one hundred fiftieth (150th) day following the Issuance Date and the end of the Term Loan Restricted Period (as described in the Series A-1 CoD) to the period following the occurrence of both the two hundred fortieth (240th)

day following the Issuance Date and the end of the Term Loan Restricted Period, and (f) the period during which the Issuer shall have the option to offer each holder of Series A-1 Preferred Stock a cash payment per share of Series A-1 Preferred Stock

equal to the then-applicable Redemption Price in connection with a Change of Control has been changed from the period beginning on the one hundred fiftieth (150th) day following the Issuance Date and ending at the end of the Term Loan

Restricted Period to the period beginning on the two hundred fortieth (240th) day following the Issuance Date and ending at the end of the Term Loan Restricted Period.

This summary is qualified in its entirety by reference to the full text of the Series A COD Amendment, a copy of which is attached as Exhibit 10.13 to this Amendment No. 4 and incorporated by reference herein.

| Item 7. |

Material to Be Filed as Exhibits

|

|

|

Amendment No. 3 to the Registration Rights Agreement, dated December 15, 2023, by and among the Issuer and the holders named therein (incorporated by reference to Exhibit 10.2 of the Issuer’s Current Report on Form 8-K, filed on December 18,

2023).

|

| |

|

|

|

Certificate of Designations, dated December 15, 2023, of the Issuer (incorporated by reference to Exhibit 3.2 of the Issuer’s Current Report on Form 8-K, filed on December 18, 2023).

|

| |

|

|

|

Purchase Agreement, dated December 15, 2023, by and among the Issuer, Gen IV and the other parties thereto (incorporated by reference to Exhibit 10.1 of the Issuer’s Current Report on Form 8-K, filed on December 18, 2023).

|

| |

|

|

|

Agreement and Plan of Merger, dated as of December 14, 2023, by and among the Issuer, Parent, and Merger Sub (incorporated by reference to Exhibit 2.1 of the Issuer’s Current Report on Form 8-K, filed on December 18, 2023).

|

| |

|

|

|

Certificate of Amendment to Certificate of Designations of Series A 1 Redeemable Convertible Preferred Stock effective December 15, 2023 (incorporated by reference to Exhibit 3.1 of the Issuer’s Current Report on Form 8-K, filed on December

18, 2023).

|

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this Schedule 13D is true, complete and correct.

|

Dated: December 19, 2023

|

|

|

| |

|

| |

Gen IV Investment Opportunities, LLC

|

| |

|

|

| |

By:

|

/s/ Jeff Wade

|

| |

Name:

|

Jeff Wade

|

| |

Title:

|

Chief Compliance Officer

|

| |

|

| |

LSP Generation IV, LLC

|

| |

|

|

| |

By:

|

/s/ Jeff Wade

|

| |

Name:

|

Jeff Wade

|

| |

Title:

|

Chief Compliance Officer

|

| |

|

| |

LSP Investment Advisors, LLC

|

| |

|

|

| |

By:

|

/s/ Jeff Wade

|

| |

Name:

|

Jeff Wade

|

| |

Title:

|

Chief Compliance Officer and Associate General Counsel

|

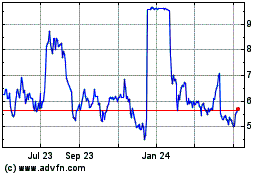

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From Mar 2024 to Apr 2024

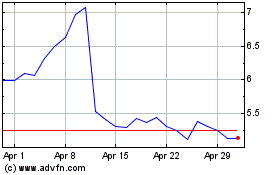

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From Apr 2023 to Apr 2024