UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of February 2014

Commission File Number: 0-9266

AVINO SILVER & GOLD MINES LTD.

Suite 900, 570 Granville Street, Vancouver, BC V6C 3P1

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

x

Form 20-F

o

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

o

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934. Yes

o

No

x

If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

On February 21, 2014, Avino Silver & Gold Mines Ltd. (the “Company”) entered into a Placement Agency Agreement (“Placement Agreement”) with Noble International Investments, Inc., doing business as Noble Financial Capital Markets, as exclusive placement agent (the “Placement Agent”), in connection with the proposed sale to certain investors (the “Direct Offering”) of 2,066,115 units consisting of (i) one (1) Common Share, no par value per share, of the Company (“Shares”) and (ii) one half (1/2) of a share purchase warrant to purchase one Common Share of the Company (the “Warrant”, and collectively with the Common Share the “Units”) to the signatory to a Subscription Agreement, dated as of February 21, 2014 (the “Subscription Agreement”), entered into by and between the Company and the signatory thereto. The Shares and Warrants will be sold together in the Offering as a Unit with a per Unit purchase price of $2.42. The Warrants will be exercisable at $2.87 per whole Share and will expire three years from the date of issuance, subject to early expiration if the VWAP for a Common Share exceeds $6.85 during a consecutive twenty day trading period. The net proceeds to the Company, after deducting expenses payable by the Company and assuming no exercise of the Warrants, will be approximately $4.590 million. The net proceeds from the Direct Offering will be used for advancing the development of the Avino mine and its operations and production including mill improvements, mining and transportation equipment, buildings and construction and working capital. The Company expects to close the Direct Offering on or about February 25, 2014.

The Direct Offering is being made pursuant to a prospectus filed with the Company’s existing shelf registration statement on Form F-3 (File No. 333-193471), which was filed with the Securities and Exchange Commission (the “Commission”) on January 21, 2014 and declared effective by the Commission on January 28, 2014, and the prospectus supplement dated February 21, 2014.

The Placement Agent Agreement contains customary representations, warranties and agreements by the Company, and customary conditions to closing, indemnification obligations of the Company and the Placement Agent, including liabilities under the Securities Act of 1933, as amended, other obligations of the parties and termination provisions. Under the terms of the Placement Agreement, the Placement Agent, as agent of the Company, used commercially reasonable efforts to solicit offers from potential investors in connection with the Direct Offering and will receive a placement fee equal to 7% of the gross proceeds of the Direct Offering. The Placement Agreement has been attached hereto as an exhibit to provide investors and security holders with the information regarding its terms. The representations, warranties and covenants contained in the Placement Agreement were made only for purposes of such agreement as of specific dates, were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties.

The Subscription Agreement contains customary representations, warranties and agreements by the Company and the investor signatories thereto, including closing conditions and termination provisions.

A copy of the opinion of Salley Bowes Harwardt Law Corporation relating to the legality of the issuance and sale of the Shares and Warrants in the Offering is attached as Exhibit 5.1 hereto. A copy of the Placement Agency Agreement, the form of Subscription Agreement and the form of Warrant to be issued in connection with the Offering are filed herewith as Exhibits 10.1, 10.2 and 10.3 respectively, and are incorporated herein by reference. The foregoing descriptions of the Offering by the Company and the documentation related thereto, including the Placement Agency Agreement, the form of the Subscription Agreement and the form of Warrant, do not purport to be complete and are qualified in their entirety by reference to such Exhibits.

The Shares, Warrants, and common shares underlying the Warrants (“Warrant Shares”) will be issued pursuant to the Company's previously filed and effective Registration Statement on Form F-3 (File No. 333-193471), the base prospectus dated January 28, 2014 filed as part of such Registration Statement, and the prospectus supplement dated February 21, 2014, filed by the Company with the SEC. This Report on Form 6-K shall not constitute an offer to sell or the solicitation of an offer to buy Shares, Warrants or Warrant Shares, nor shall there be any sale of the Shares, Warrants or Warrant Shares in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

The information contained in this Report is hereby incorporated by reference into the Company’s Registration Statement on Form F-3, File No. 333-193471.

Cautionary Statement Regarding Forward-Looking Statements

This Report on Form 6-K contains forward-looking statements. Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements that are other than statements of historical facts, such as statements regarding the sale of Shares, Warrants and Warrant Shares under the Agreement, if any, the intended use of proceeds, as well as termination of the Agreement. These statements are subject to uncertainties and risks including, but not limited to the risks identified in reports filed from time to time with the SEC. All such forward-looking statements are expressly qualified by these cautionary statements and any other cautionary statements which may accompany the forward-looking statements. In addition, we disclaim any obligation to update any forward-looking statements to reflect events or circumstances after the date hereof.

Exhibits

|

Exhibit

|

|

|

|

Number

|

|

Description of Exhibit

|

|

|

|

|

|

5.1

|

|

Opinion of Salley Bowes Harwardt Law Corporation

|

|

10.1

|

|

Placement Agency Agreement dated February 21, 2014,

by and between Avino Silver & Gold Mines Ltd. and Noble Financial Investments, Inc. doing business as Noble Financial Capital Markets.

|

|

10.2

|

|

Form of Subscription Agreement

|

|

10.3

|

|

Form of Warrant Agreement.

|

|

23.1

|

|

Consent of Salley Bowes Harwardt Law Corporation (included in Exhibit 5.1).

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Avino Silver & Gold Mines Ltd.

|

|

|

|

|

|

|

|

Date: February 21, 2014

|

By:

|

/s/ Dorothy Chin

|

|

|

|

|

Dorothy Chin

|

|

|

|

|

Corporate Secretary

|

|

5

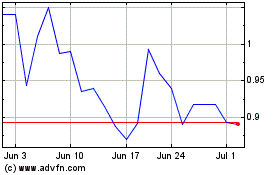

Avino Silver and Gold Mi... (AMEX:ASM)

Historical Stock Chart

From Sep 2024 to Oct 2024

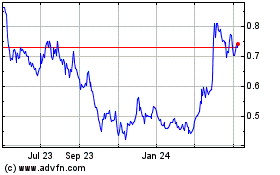

Avino Silver and Gold Mi... (AMEX:ASM)

Historical Stock Chart

From Oct 2023 to Oct 2024