ASM INTERNATIONAL N.V. REPORTS THIRD QUARTER 2013 RESULTS

October 31 2013 - 7:07PM

ASM International N.V. (NASDAQ: ASMI and Euronext Amsterdam: ASM) reports today

its third quarter 2013 operating results (unaudited) in accordance with US GAAP.

Following the close of the sale on March 15, 2013 of a 12% share in ASMPT, the

entity in which the Back-end segment is organized, ASMI's shareholding is

reduced to 40.08%. As a consequence, as from March 15, 2013 the results of ASMPT

are deconsolidated. From that date onwards the net result of ASMPT is reported

on the line 'result from investments'. In the second quarter of 2013 a purchase

price allocation took place resulting in the recognition and subsequent

amortization of certain intangible assets.

FINANCIAL HIGHLIGHTS

The pro-forma figures show ASMI numbers whereby ASMPT is deconsolidated.

-------------------------------------------------------------------------------

Pro-

forma

EUR million Q3 2012 Q2 2013 Q3 2013

-------------------------------------------------------------------------------

New orders 64.3 128.4 112.2

Net sales 96.1 128.6 116.4

Gross profit margin % 31.4 % 39.3 % 39.1 %

Operating results (1.6 ) 16.2 11.6

Result from investments (excl. amortization and fair

value purchase price allocation) 13.3 9.2 10.8

Remeasurement gain, realized gain on sale of ASMPT

shares, amortization and fair value adjustments - (40.8 ) (17.2 )

Net earnings 4.9 (23.4 ) (0.9 )

Normalized net earnings (excl. remeasurement gain,

realized gain on sale of ASMPT shares, amortization

and fair value adjustments) 4.9 17.4 16.3

-------------------------------------------------------------------------------

* Net sales for the third quarter 2013 decreased with 9% compared to the

second quarter and increased with 21% year-on-year, mainly driven by (PE)ALD

sales which were subsequently higher than in the comparable period last

year, but below the Q2 level.

* Result from operations for the third quarter 2013 includes restructuring

costs of €1.0 million compared to €0.7 million included in the second

quarter.

COMMENT

Commenting on the results, Chuck del Prado, President and Chief Executive

Officer of ASM International said:

"Q3 was again a strong quarter for ASMI. Sales came in 9% lower than the very

strong second quarter, slightly better than expected. Our book to bill ratio

remained at 1.0. Both sales and order intake were driven by (PE)ALD demand in

the most advanced technology nodes. Margins remained healthy, leading to a 10%

operating result. We also saw strong improvement in our operational cash flow

due to lower working capital requirements for the quarter. Our result from

investments excluding 'PPA-effects' improved due to better results in ASMPT".

OUTLOOK

Our sales in Q4, on a currency comparable level, are expected to show a single

digit increase compared to Q3. Q4 order intake, on a currency comparable level,

is expected to show a low double digit increase as compared to Q3.

About ASM International

ASM International NV, headquartered in Almere, the Netherlands, its subsidiaries

and participations design and manufacture equipment and materials used to

produce semiconductor devices. ASM International, its subsidiaries and

participations provide production solutions for wafer processing (Front-end

segment) as well as for assembly & packaging and surface mount technology (Back-

end segment) through facilities in the United States, Europe, Japan and Asia.

ASM International's common stock trades on NASDAQ (symbol ASMI) and the Euronext

Amsterdam Stock Exchange (symbol ASM). For more information, visit ASMI's

website at www.asm.com.

Safe Harbor Statement under the U.S. Private Securities Litigation Reform Act of

1995: All matters discussed in this statement, except for any historical data,

are forward-looking statements. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially from those in

the forward-looking statements. These include, but are not limited to, economic

conditions and trends in the semiconductor industry generally and the timing of

the industry cycles specifically, currency fluctuations, corporate transactions,

financing and liquidity matters, the success of restructurings, the timing of

significant orders, market acceptance of new products, competitive factors,

litigation involving intellectual property, shareholder and other issues,

commercial and economic disruption due to natural disasters, terrorist activity,

armed conflict or political instability, epidemics and other risks indicated in

the Company's filings from time to time with the U.S. Securities and Exchange

Commission, including, but not limited to, the Company's reports on Form 20-F

and Form 6-K. The Company assumes no obligation nor intends to update or revise

any forward-looking statements to reflect future developments or circumstances.

ASM International will host an investor conference call and web cast on Friday,

November 1, 2013 at 15:00 Continental European Time (10:00 a.m. - US Eastern

Time).

The teleconference dial-in numbers are as follows:

* United States: + 1 212 444 0412

* International: + 44 (0)20 3427 1919

* The Netherlands: + 31 (0)20 716 8295

* Access Code: 9228211

A simultaneous audio web cast will be accessible at www.asm.com.

The teleconference will be available for replay, beginning one hour after

completion of the live broadcast, for a duration of 7 days starting on November

1, 2013.

The replay dial-in numbers are:

* United States: + 1 347 366 9565

* England: + 44 (0)20 3427 0598

* The Netherlands: + 31 (0)20 708 5013

* Access Code: 9228211

CONTACT

Investor contact:

Victor Bareño

T: +31 88 100 8500

E: victor.bareno@asm.com

Mary Jo Dieckhaus

T: +1 212 986 2900

E: maryjo.dieckhaus@asm.com

Media contact:

Ian Bickerton

T: +31 625 018 512

ASMI Reports Third Quarter 2013 Results: http://hugin.info/132090/R/1739794/584040.pdf

[HUG#1739794]

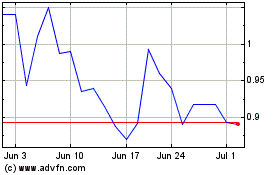

Avino Silver and Gold Mi... (AMEX:ASM)

Historical Stock Chart

From Jul 2024 to Aug 2024

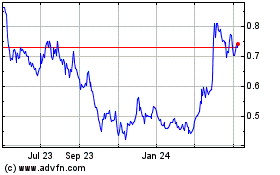

Avino Silver and Gold Mi... (AMEX:ASM)

Historical Stock Chart

From Aug 2023 to Aug 2024