As

filed with the United States Securities and Exchange Commission on January 18, 2024

Registration

No. 333-[●]

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

| AGEAGLE

AERIAL SYSTEMS INC. |

| (Exact

name of registrant as specified in our charter) |

| Nevada |

|

3721 |

|

88-0422242 |

(State

or other jurisdiction of

Incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

I.D.

N.) |

8201

E. 34th Cir N

Wichita,

Kansas 67226

Tel.

No. (620) 325-6363

(Address,

including zip code and telephone number, including area code, of registrant’s principle executive offices)

Mark

DiSiena

Chief

Financial Officer

AgEagle

Aerial Systems Inc.

8201

E. 34th Cir N

Wichita,

Kansas 67226

Tel.

No. (620) 325-6363

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Mitchell

S. Nussbaum, Esq.

Tahra

Wright, Esq.

Jane

K. P. Tam, Esq.

Loeb

& Loeb LLP

345

Park Avenue

New

York, New York 10154

Tel.

No. (212) 407-4000

Approximate

date of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.:

| Large

Accelerated Filer |

☐ |

Accelerated

Filer |

☐ |

| Non-accelerated

Filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

Registrant will file a further amendment which specifically states that this Registration Statement will thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement will become effective

on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this Prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission becomes effective. This Prospectus is not an offer to sell these securities and we

are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JANUARY 18, 2024

PRELIMINARY

PROSPECTUS

AGEAGLE

AERIAL SYSTEMS INC.

16,319,165 WARRANT

SHARES

This

prospectus relates to the resale by the Selling Shareholders (the “Selling Shareholders”), identified on page 24 of this

prospectus, of up to 16,319,165 shares of common stock (the “Warrant Shares”), par value $0.001 per share (the “Common

Stock”) of AgEagle Aerial Systems Inc. (the “Company”), issuable upon the exercise of warrants (the “Warrants”)

consisting of (i) 14,835,605 Warrant Shares underlying the Warrants at an initial exercise price of $0.1247 per warrant (which was adjusted to $0.10 per warrant as a result of the Common Stock Offering defined below)

issued to the Selling Shareholders in a private placement pursuant to Investor Notices (as defined below) received by the Company from

the Selling Shareholders on November 15, 2023, the Assignment, Waiver and Amendment Agreement (the “Assignment Agreement”)

among the Company and the Selling Shareholders, dated November 15, 2023, and the Securities Purchase Agreement (the “Series F Agreement”)

between the Company and one of its investors, dated June 26, 2022; and (ii) 1,483,560 Warrant Shares underlying the Warrants at the exercise

price of $0.1247 per warrant initially issued to Dawson James Securities, Inc. (“Dawson”) in a private placement pursuant

to an engagement letter between Dawson and the Company, dated November 15, 2023 (the “Engagement Letter”), of which Warrant

for 1,281,796 Warrant Shares were subsequently assigned by Dawson to certain Selling Shareholders.

We

are registering the above described offer and sale of the Warrant Shares by the Selling Shareholders to satisfy certain registration

rights we have granted. We will not receive any proceeds from the sale of the Warrant Shares by the Selling Shareholders. We may

receive up to approximately $1.6 million in proceeds upon the exercise of the Warrants for cash. The Selling Shareholders may

offer all or part of the Warrant Shares for resale from time to time through public or private transactions, at either prevailing

market prices or at privately negotiated prices. The Warrant Shares are being registered to permit the Selling Shareholders to sell

shares from time to time, in amounts, at prices and on terms determined at the time of offering. The Selling Shareholders may sell

these Warrant Shares through ordinary brokerage transactions, directly to market makers of our shares or through any other means

described in the section titled “Plan of Distribution.” In connection with any sales of Warrant Shares offered

hereunder, the Selling Shareholders, any underwriters, agents, brokers or dealers participating in such sales may be deemed to be

“underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities

Act”).

We

will bear all costs, expenses and fees in connection with the registration of the Warrant Shares. The Selling Shareholders will bear

all commissions and discounts, if any, attributable to the sale or disposition of the Warrant Shares, or interests therein.

Investing

in our shares involves substantial risks. See “RISK FACTORS” on page 23 of this prospectus. You should carefully read

this prospectus and the documents incorporated herein before making any investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these Warrant Shares or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is January 18, 2024.

TABLE

OF CONTENTS

This

prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”)

pursuant to which the Selling Shareholders named herein may, from time to time, offer and sell or otherwise dispose of the Warrant Shares

covered by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent

to the date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any

date subsequent to the date of the document incorporated by reference, even though this prospectus is delivered, or Warrant Shares are

sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in this prospectus,

including the documents incorporated by reference therein, in making your investment decision. You should also read and consider the

information in the documents to which we have referred you under the caption “Where You Can Find Additional Information”

in this prospectus.

We

have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or

in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for and can

provide no assurance as to the reliability of, any other information that others may give to you. The information contained in this prospectus

is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our Warrant

Shares.

You

should rely only on the information contained in this prospectus. No dealer, salesperson or other person is authorized to give information

that is not contained in this prospectus. This prospectus is not an offer to sell nor is it seeking an offer to buy these shares in any

jurisdiction.

ABOUT

THIS PROSPECTUS

In

this prospectus, unless otherwise noted, references to “AgEagle,” the “Company,” “we,” “us,”

and “our” refer to AgEagle™ Aerial Systems Inc. and our subsidiaries.

Neither

we, nor any of our officers, directors, agents or representatives, make any representation to you about the legality of an investment

in our Common Stock. You should not interpret the contents of this prospectus or any free writing prospectus to be legal, business, investment

or tax advice. You should consult with your own advisors for that type of advice and consult with them about the legal, tax, business,

financial and other issues that you should consider before investing in our Common Stock. You should rely only on the information contained

in this prospectus or in any prospectus supplement that we may authorize to be delivered or made available to you. We have not authorized

anyone to provide you with different information. The information in this prospectus is accurate only as of the date hereof, regardless

of the time of its delivery or any sale of our Warrant Shares.

INDUSTRY

AND MARKET DATA

This

prospectus contains and incorporates by reference market data, industry statistics and other data that have been obtained from, or compiled

from, information made available by third parties. Although we believe these third-party sources are reliable, we have not independently

verified the information. Except as may otherwise be noted, none of the sources cited in this prospectus has consented to the inclusion

of any data from its reports, nor have we sought their consent. In addition, some data are based on our good faith estimates. Such estimates

are derived from publicly available information released by independent industry analysts and third-party sources, as well as our own

management’s experience in the industry, and are based on assumptions made by us based on such data and our knowledge of such industry

and markets, which we believe to be reasonable. However, none of our estimates have been verified by any independent source. See “Special

Note Regarding Forward-Looking Statements” below.

MARKET

INFORMATION

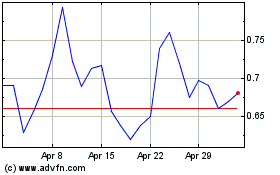

Our

shares of Common Stock are traded on The NYSE American under the symbol “UAVS.” On January 17, 2024, the last reported

sale price of our Common Stock was $0.10 per share. As of January 12, 2024, there were approximately 332 holders of our Common

Stock. The actual number of stockholders of our Common Stock is greater than the number of record holders and includes holders of shares

of our Common Stock which are held in street name by brokers and other nominees.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements within the meaning of the Securities Act, or the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or the Private Securities Litigation Reform Act of 1995. Investors are cautioned that such forward-looking

statements are based on our management’s beliefs and assumptions and on information currently available to our management and involve

risks and uncertainties. Forward-looking statements include statements regarding our plans, strategies, objectives, expectations and

intentions, which are subject to change at any time at our discretion. Forward-looking statements include our assessment, from time to

time of our competitive position, the industry environment, potential growth opportunities, the effects of regulation and events outside

of our control, such as natural disasters, wars or health epidemics. Forward-looking statements include all statements that are not historical

facts and can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,”

“expects,” “hopes,” “intends,” “may,” “plans,” “potential,” “predicts,”

“projects,” “should,” “will,” “would” or similar expressions.

Forward-looking

statements are merely predictions and therefore inherently subject to uncertainties and other factors which could cause the actual results

to differ materially from the forward-looking statement. These uncertainties and other factors include, among other things:

| ● |

unexpected

technical and marketing difficulties inherent in major research and product development efforts; |

| |

|

| ● |

our

ability to remain a market innovator, to create new market opportunities, and/or to expand into new markets; |

| |

|

| ● |

the

potential need for changes in our long-term strategy in response to future developments; |

| |

|

| ● |

our

ability to attract and retain skilled employees; |

| |

|

| ● |

our

ability to raise sufficient capital to support our operations and fund our growth initiatives; |

| |

|

| ● |

unexpected

changes in significant operating expenses, including components and raw materials; |

| |

|

| ● |

any

disruptions or threatened disruptions to or relations with our resellers, suppliers, customers and employees, including shortages

in components for our products; |

| |

|

| ● |

changes

in the supply, demand and/or prices for our products; |

| |

|

| ● |

increased

competition, including from companies which may have substantially greater resources than we have, and, in the unmanned aircraft

systems segments from lower-cost commercial drone manufacturers who may seek to enhance their systems’ capabilities over time; |

| |

|

| ● |

the

complexities and uncertainty of obtaining and conducting international business, including export compliance and other reporting

and compliance requirements; |

| |

|

| ● |

the

impact of potential security and cyber threats or the risk of unauthorized access to our, our customers’ and/or our suppliers’

information and systems; |

| |

|

| ● |

uncertainty

in the customer adoption rate of commercial use unmanned aerial systems; |

| |

|

| ● |

changes

in the regulatory environment and the consequences to our financial position, business and reputation that could result from failing

to comply with such regulatory requirements; |

| |

|

| ● |

our

ability to continue to successfully integrate acquired companies into our operations, including the ability to timely and sufficiently

integrate international operations into our ongoing business and compliance programs; |

| ● |

our

ability to respond and adapt to unexpected legal, regulatory and government budgetary changes, including those resulting from the

ongoing COVID-19 pandemic, such as supply chain disruptions, vaccine mandates, the threat of future variants and resulting government-mandated

shutdowns, quarantine policies, travel restrictions and social distancing, curtailment of trade and other business restrictions affecting

our ability to manufacture and sell our products; |

| |

|

| ● |

failure

to develop new products or integrate new technology into current products; |

| |

|

| ● |

unfavorable

results in legal proceedings to which we may be subject; |

| |

|

| ● |

failure

to establish and maintain effective internal control over financial reporting; and |

| |

|

| ● |

general

economic and business conditions in the United States and elsewhere in the world, including the impact of inflation. |

Any

forward-looking statement in this prospectus, in any related prospectus supplement and in any related free writing prospectus reflects

our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our

business, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus and any

related prospectus supplement and the documents that we reference herein and therein and have filed as exhibits hereto and thereto completely

and with the understanding that our actual future results may be materially different from any future results expressed or implied by

these forward-looking statements. Except as required by law, we assume no obligation to update or revise these forward-looking statements

for any reason, even if new information becomes available in the future.

This

prospectus and any related prospectus supplement also contain or may contain estimates, projections and other information concerning

our industry, our business and the markets for our products, including data regarding the estimated size of those markets and their projected

growth rates. We obtained the industry and market data in this prospectus from our own research as well as from industry and general

publications, surveys and studies conducted by third parties. This data involves a number of assumptions and limitations and contains

projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty,

including those discussed in “Risk Factors.” We caution you not to give undue weight to such projections, assumptions and

estimates. Further, industry and general publications, studies and surveys generally state that they have been obtained from sources

believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that these

publications, studies and surveys are reliable, we have not independently verified the data contained in them. In addition, while we

believe that the results and estimates from our internal research are reliable, such results and estimates have not been verified by

any independent source.

PROSPECTUS

SUMMARY

The

following summary highlights selected information contained elsewhere in this prospectus and is qualified in its entirety by the more

detailed information and financial statements included elsewhere in this prospectus. It does not contain all the information that may

be important to you and your investment decision. You should carefully read this entire prospectus, including the matters set forth under

“Risk Factors” and the financial statements and related notes and other information that we incorporate by reference herein,

including our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q.

Our

Company

AgEagle™

Aerial Systems Inc. (“AgEagle” or the “Company”), through its wholly owned subsidiaries, is actively engaged

in designing and delivering best-in-class drones, sensors and software that solve important problems for our customers. Founded in 2010,

AgEagle was originally formed to pioneer proprietary, professional-grade, fixed-winged drones and aerial imagery-based data collection

and analytics solutions for the agriculture industry. Today, the Company is earning distinction as a globally respected market leader

offering customer-centric, advanced, autonomous unmanned aerial systems (“UAS”) which drive revenue at the intersection of

flight hardware, sensors and software for industries that include agriculture, military/defense, public safety, surveying/mapping and

utilities/engineering, among others. AgEagle has also achieved numerous regulatory firsts, including earning governmental approvals for

its commercial and tactical drones to fly Beyond Visual Line of Sight and/or Operations Over People in the United States, Canada, Brazil

and the European Union and being awarded Blue UAS certification from the Defense Innovation Unit of the U.S. Department of Defense.

AgEagle’s

shift and expansion from solely manufacturing fixed-wing farm drones in 2018, to offering what the Company believes is one of the industry’s

best fixed-wing, full-stack drone solutions, culminated in 2021 when the Company acquired three market-leading companies engaged in producing

UAS airframes, sensors and software for commercial and government use. In addition to a robust portfolio of proprietary, connected hardware

and software products; an established global network of over 200 UAS resellers; and enterprise customers worldwide; these acquisitions

also brought AgEagle a highly valuable workforce comprised largely of experienced engineers and technologists with deep expertise in

the fields of robotics, automation, manufacturing and data science. In 2022, the Company successfully integrated all three acquired companies

with AgEagle to form one global company focused on taking autonomous flight performance to a higher level.

Our

core technological capabilities include robotics and robotics systems autonomy; advanced thermal and multispectral sensor design and

development; embedded software and firmware; secure wireless digital communications and networks; lightweight airframes; small UAS design,

integration and operations; power electronics and propulsion systems; controls and systems integration; fixed wing flight; flight management

software; data capture and analytics; human-machine interface development and integrated mission solutions.

The

Company is currently headquartered in Wichita, Kansas, where we house our sensor manufacturing operations, and we operate our business

and drone manufacturing in Lausanne, Switzerland which supports our international business activities.

Strategic

Acquisitions

MicaSense,

Inc.

In

January 2021, AgEagle acquired MicaSense™, Inc. (“MicaSense”), a company that has been at the forefront of advanced

drone sensor development since its founding in 2014. In early 2022, AgEagle completed development and brought to market the Altum-PT™

and RedEdge-P™ — next generation thermal and multispectral sensors which offer critical advancements on MicaSense’s

legacy sensor products to customers primarily in agriculture, plant research, land management and forestry management. Today, AgEagle’s

multispectral sensors are distributed in over 75 countries worldwide and help customers use drone-based imagery to make better and more

informed business decisions.

Measure

Global, Inc.

In

April 2021, AgEagle acquired Measure Global, Inc. (“Measure”), a company founded in 2020. Serving a world class customer

base, Measure enables its customers to realize the transformative benefits of drone technology through its Ground Control solution. Offered

as Software-as-a-Service, Ground Control is a cloud-based, plug-and-play operating system that empowers pilots and large enterprises

with everything they need to operate drone fleets, fly autonomously, collaborate globally, visualize data, and integrate with existing

business systems and processes. Ground Control serves a world class customer base, including many Fortune 500 companies. By adding Measure’s

advanced software to the AgEagle platform, combined with its sensors and other data capture and analytics innovations, our customers

can capitalize on the significant economic, safety and efficiency benefits made possible by drones used at scale.

senseFly,

S.A.

In

October 2021, the Company acquired senseFly, S.A. and senseFly Inc. (collectively “senseFly”), a global leader in fixed-wing

drones that simplify the collection and analysis of geospatial data, allowing professionals to make better and faster decisions. Founded

in 2009, senseFly develops and produces a proprietary line of eBee™-branded, high performance, fixed-wing drones which have flown

more than one million flights around the world. Safe, ultra-light and easy to use, these autonomous drones are utilized by thousands

of customers around the world in agriculture, government/defense, engineering, and construction, among other industry verticals, to collect

actionable aerial data intelligence.

2022

Integration Activities

In

2022, the Company built an enterprise architecture designed to seamlessly integrate the acquisitions completed in 2021, thereby unifying

four disparate brands under one global brand: AgEagle. As part of this process, AgEagle executed an action plan to create long-term sustainable

value through the efficiencies derived from economies of scale, sharing and optimizing resources – in particular, human capital

and knowledge – and combining assets. Critical to the success of the integration and integral to the Company’s ability to

stay disciplined, structurally organized and rooted in its core values was:

| ● |

implementation

of a new enterprise resource planning system; |

| |

|

| ● |

collapse

of all acquired websites and the creation and launch of one website, found at www.ageagle.com, showcasing the Company’s full

suite of products and capabilities; |

| |

|

| ● |

creation

of an Intranet employee portal to support and promote enterprise-wide communication and connectivity; |

| |

|

| ● |

consolidation

of the Company’s business and manufacturing operations in the United States from multiple offices spread across the country

in Kansas, North Carolina, Texas, Washington and Washington, D.C. to two centralized locations in Wichita, Kansas, and Lausanne,

Switzerland – an initiative which commenced in late 2022 and was completed in 2023; |

| |

|

| ● |

commitment

to customer-centric product development roadmaps designed to best leverage the right combination of process, tools, training and

project management to effectively meet product enhancement and new product launch deadlines and achieve post-launch sales and marketing

key performance indicators; and |

| |

|

| ● |

shifts

in the responsibilities of senior and mid-level management to optimize strengths and squarely align functional and cross-functional

goals and objectives. |

Our

Branded Line of Unmanned Aerial Vehicles

eBee

Line of Professional Drones

Sold

worldwide through AgEagle’s direct sales team and global network of trusted resellers, the Company’s eBee line of

commercial and government/military UAS have logged more than 500,000 flight hours on more than one million successful missions over the

past decade. Moreover, according to AgEagle’s analysis of official FAA Part 107 commercial drone registration data supplied to

the Company pursuant to a Freedom of Information Act Request submission, from 2016 through 2021, the eBee was the commercial sUAS

of choice for U.S. commercial drone operators, outnumbering all other fixed wing drones registered, including Vertical Take-Off and Landing

(“VTOL”) aircraft, accounting for 41% of all commercial fixed-wing drone registrations in the United States.

| ● |

eBee

Ag – a reliable, affordable drone solution to help farmers, agronomists and service providers map and monitor crops

quickly and easily. The eBee Ag and its drone sensor deliver timely plant health insights with accuracy and efficiency that

complements precision agriculture workflows. With its dual-purpose Duet M camera, eBee Ag captures accurate RGB and

multispectral data from the sky to help users make better decisions on the ground. eBee Ag also features available Real-Time

Kinematic (“RTK”) functionality for greater mapping precision. With its available RTK, the agriculture drone can achieve

absolute accuracy down to 2.5 cm (1.0 inch) with its RGB camera. Highly-accurate vegetative index maps allow users to understand

every acre while managing problematic areas field-wide – before they impact profits. Equipped with its standard battery, eBee

Ag is capable of up to 45-minutes of flight. An available endurance battery increases flight times up to 55 minutes — allowing

the drone to cover more than 160 hectares (395 acres) in a single flight and save precious time and money when compared with conventional

crop scouting. |

| |

|

| ● |

eBee

Geo – an affordable fixed-wing mapping drone designed to meet the highest demands of surveyors, civil engineers and

GIS professionals worldwide. Built upon more than 10 years of drone mapping experience, eBee Geo is rugged, intuitive to operate

and makes surveying and mapping small to large areas faster and more efficient than using terrestrial surveying equipment alone.

The data collected can quickly be processed into highly accurate georeferenced orthomosaics, digital elevation models, digital surface

models and high-density point clouds to bring additional value beyond common vectors. Designed to complement the user’s surveying

toolkit, eBee Geo comes with everything needed to get started, including professional drone camera technology and eMotion,

AgEagle’s flight planning software originally designed and developed by senseFly. With eBee Geo, a user can map up to

160 ha (395 ac) at 120 m (400 ft) with a maximum flight time of 45 minutes. eBee Geo is also available with RTK positioning.

Combined with the Company’s purpose-built Sensor Optimized for Drone Applications (“S.O.D.A”), users are

assured of sharp, accurate mapping outputs – even in the harshest conditions. |

| |

|

| ● |

eBee

TAC™– Designed specifically for government and military mapping and mission planning applications,

the eBee TAC operates in disconnected environments, providing a higher accuracy mobile solution to map and locally share aerial

imagery data on rapidly changing field conditions to analyze and provide near real-time situational awareness to ground forces. Weighing

only 3.5 pounds and featuring a digital camouflage skin for increased stealth and up to 90 minutes flight time and silent mission

mode, the eBee TAC can be rapidly deployed, from assembly to hand-launch, in three minutes by a single user to generate 3D

modeling, terrain and thermal maps. Each system features National Defense Authorization Act (“NDAA”) compliant drone,

sensors and active components, secure extension, Endurance activation, two Endurance batteries, one Pitot Pro-kit, two micro-SD cards

with adapters, AES256-bit encryption, pixel camouflage and an IP67 hard transport case with STANAG military standard certification

that is lightweight, rugged and dust and water resistant. Camera options include RGB, multispectral and thermal payloads; and the

system can also be upgraded to include additional features and payloads. |

| |

|

| ● |

In

March 2022, AgEagle’s eBee TAC Unmanned Aerial System was the first approved drone to be added to the U.S. Department

of Defense’s (“DoD”) Defense Innovation Unit’s (“DIU”) Blue UAS Cleared List as part of Blue

sUAS 2.0. The eBee TAC successfully completed a series of demonstrations in association with Blue sUAS 2.0 to provide the

DIU with information and verification of the drone systems’ mission planning and launch capabilities, range and endurance,

NDAA compliance, operational safety of flight procedures and cyber security, in addition to scripted and ad hoc flight profiles.

Based on its evaluation, the DIU designated the eBee TAC as an approved light-weight, medium-range UAS available for immediate

procurement by the DoD without a waiver to operate; and is also available for procurement by other Federal Government agencies. AgEagle’s

success with Blue sUAS 2.0 follows eBee’s use as an integral asset for both conventional and unconventional Department

of Defense units for over five years. |

| ● |

eBee

X – the eBee X has been recognized as the fixed-wing drone that revolutionized the unmanned aerial vehicle sector

with its ease-of-use and multiple, state-of-the-art sensors designed to suit a wide range of mapping jobs. At just 1.6 kg (3.5 lbs.),

eBee X is a lightweight, ultra-portable solution that is easy for a single person to operate. With a unique Endurance Extension

option enabling a flight time of up to 90 minutes and single-flight coverage of up to 500 ha at 122m (1,236 acres at 400 ft.), the

eBee X is a premium drone that offers users the high-precision of on-demand RTK/PPK for achieving absolute accuracy of down

to 1.5 cm (0.6 in) – without ground control points. This capability makes the eBee X ideal for BVLOS operations, such

as long corridor mapping missions for utility companies, expansive crop scouting in agriculture and by enterprise customers who desire

a robust and professional drone fleet. |

| |

|

| ● |

The

eBee X has proven that it meets the highest possible quality and ground risk safety standards, and due to its lightweight

design, the effects of ground impact are reduced. Consequently, the eBee X has been granted BVLOS operations permission in

Brazil and has been approved to run OOP and BVLOS operations in Canada. |

| |

|

| ● |

On

June 21, 2022, the Company announced that the eBee X was the first drone in its class to receive design verification essential

for BVLOS and OOP from the European Union Aviation Safety Agency, enabling drone operations to seek Specific Operations Risk Assessment

(“SORA”) authorization to fly BVLOS and OOP with eBee X in 27 European Union member states, as well as Iceland, Lichtenstein,

Norway and Switzerland. |

| |

|

| ● |

In

October 2022, the eBee X series of fixed wing unmanned aircraft systems, including the eBee X, eBee Geo and

eBee TAC, were the first and only drones on the market to comply with Category 3 of the Operations of Small Unmanned Aircraft

Systems Over People rules published in the Federal Registry by the FAA in March 2021. Securing a Part 107 certificate of waiver from

the FAA is a long, arduous and costly process for sUAS users. Now that the eBee has proven compliant with Category 3 of the

rules, eBee drone operators no longer need an FAA waiver for OOP or Operations Over Moving Vehicles. This major milestone

was achieved by AgEagle following months of work, historic reliability review and extensive testing conducted by Virginia Tech Mid-Atlantic

Aviation Partnership (“MAAP”). Becoming the first and only UAS approved for OOP and over moving vehicles in the U.S.

is expected to have material impact on AgEagle’s growth and standing as a recognized leader in the industry in the years to

come. |

| |

|

| ● |

eBee

VISION – in December 2022, AgEagle announced its latest innovation in commercial and tactical drone technology with

the unveiling of its new eBee VISION Intelligence, Surveillance and Reconnaissance (“ISR”) UAS. Scheduled

for global commercial release during the first half of 2024, the eBee VISION delivers high resolution, medium-range

video imagery made possible by its 32x zoom and powerful thermal observation capabilities. Its sensor payloads are capable of detecting,

tracking and geo-locating objects in both day and night conditions. Offering up to 90 minutes of flight time and the same ease-of-use

that has earned AgEagle’s eBee line of drones industry distinction, the eBee VISION can be deployed and operated

by a single person. Designed, developed and manufactured by AgEagle’s research and development team in Switzerland, the eBee

VISION is NDAA compliant, weighs less than 3.5 pounds/1.6 kilograms and can be carried in a backpack. |

| |

|

| ● |

In

December 2022, eBee VISION prototypes were successfully tested by European Armed Forces. According to an official from a UAV

experimentation unit of a European military force present at the testing, “eBee VISION’s specifications fill the

gap between low endurance quadcopters and large military fixed-wing drones. The small size, lightweight, ease-of-use, autonomy, range

and sensor capabilities make it a promising drone for tactical ISR missions.” |

| |

|

| ● |

As

a result of the tests, European military units have ordered multiple eBee VISION prototypes, with delivery in late 2023. Commercial

production of eBee VISION is planned for worldwide availability in early-2024 worldwide. Additional demonstrations with other

military forces in the United States and NATO countries are being scheduled for the first quarter of 2024. |

Market

Opportunity for UAVs

Drones

have transformed from being freelance videographer toys to mission critical inspection tools for enterprise businesses like construction,

energy and agriculture, and for military/defense applications worldwide. Moreover, the number of use cases for drones has also grown

as drone hardware has become more advanced, safe and reliable. Advanced aerial mapping, crop monitoring, publicly safety uses, disaster

response and consumer drone deliveries have all become available as the commercial drone industry has matured.

According

to DRONEII’s Drone Market Report, published in November 2023, the global drone market is anticipated to grow from 26.3

billion U.S. dollars in 2021 to 54.6 billion U.S. dollars by 2030. The drone market is made up of various segments which include defense,

enterprise, consumer, public safety, logistics, and passenger. Even more bullish on its industry outlook, Precedence Research reported

in July 2022 that it believes the commercial drone market segment alone is poised to grow from $24.4 billion in 2022 to $504 billion

by 2030, representing a 46.04% CAGR over the forecast period 2022 to 2030.

In

September 2022, the Drone Infrastructure Inspection Grant Act was passed by the U.S. House of Representatives. This bi-partisan bill

establishes programs within the Department of Transportation (“DOT”) to support the use of drones and other sUAS when inspecting,

repairing or constructing road infrastructure, electric grid infrastructure, water infrastructure or other critical infrastructure. Specifically,

DOT must award grants in the aggregate of $100 million to state, tribal and local governments, metropolitan planning organizations, or

groups of those entities to purchase or otherwise use drones to increase efficiency, reduce costs, improve worker and community safety,

reduce carbon emissions, or meet other priorities related to critical infrastructure projects. Grant recipients must use domestically

manufactured drones that are made by companies not subject to influence or control from certain foreign entities, including China and

Russia. This legislation is supported by the U.S. Chamber of Commerce, National League of Cities, National Council of State Legislatures,

American Association of State Highway and Transportation Officials, Commercial Drone Alliance and Association of Unmanned Vehicle Systems

International among others. This bill is currently pending approval by the U.S. Senate.

On

the military/defense front, drone technologies are providing numerous tactical advantages to warfighters worldwide, including conducting

surveillance and mapping missions; relaying crucial real-time information on enemy movements, locations and positions of strategic targets;

and transporting valuable supplies and equipment to remote or far-forward areas, among other tactical capabilities. In its 2023 report

titled “Global Military Drones Market,” The Business Research Company (“TBRC”) noted that the global military

drones market size will grow from $14.54 billion 2022 to $15.88 billion in 2023 at a CAGR of 9.2%. Moreover, by 2027, the market size

is forecast to climb to $20.64 by 2027, a 6.8% CAGR. TBRC’s report notes that increasing government funding for military drones

to enhance efficiency in military operations is boosting the demand for production of military drones. The report further cites a May

2021 article published by the National Defense Industrial Association, a U.S.-based trade association for the United States’ government

and defense industry, which revealed that in fiscal year 2021, the DoD allotted $7.5 billion for a range of robotic platforms and associated

technologies. For the purchase of unmanned systems, the Navy and Air Force each received about $1.1 billion; the Army received $885 million;

the Marine Corps received $70 million; and the U.S. Special Operations Command (“SOCOM”) received $90 million.

Sensor

Solutions

Setting

entirely new standards of excellence for high resolution aerial imaging solutions, our proprietary thermal and multispectral sensors

are broadly recognized as the cameras of choice worldwide for advanced applications in agriculture, plant research, land management and

forestry management.

| ● |

Altum-PT™

– an optimized three-in-one solution for advanced remote sensing and agricultural research. It seamlessly integrates

an ultra-high resolution panchromatic imager, a built-in 320X256 radiometric thermal imager and five discrete spectral bands to produce

synchronized outputs such as RGB color, crop vigor, heat maps and high resolution panchromatic in just one flight. Offering twice

the spatial resolution of the prior Altum sensor, Altum-PT, introduced in early 2022 the sensor that empowers users

with deeper analytical capabilities and broader, more diverse applications; enable them to discern issues at the plant level, even

in the early growth stages; and conduct early stage stand counting, as well as season-long soil monitoring, among other critical

uses. Altum-PT also features a global shutter for distortion-free results, open APIs and a new storage device allowing for

two captures per second. |

| |

|

| ● |

RedEdge-P™

– Offering three times the capture speed and twice the spatial resolution of the RedEdge-MX, the all new RedEdge-P,

launched in early 2022, the sensor that builds on the legacy of the rugged, high-quality, multispectral sensor that the industry

has come to trust and adds the power of a higher resolution, panchromatic band to double the output data resolution. A single camera

solution which is compatible with a wide array of drone aircraft ranging from large fixed wing to small multirotor, RedEdge-P

captures calibrated high-resolution multispectral and RGB imagery with an optimized field of view and capture rate for efficient

flights. This solution seamlessly integrates a high resolution, all-color imager with synchronized multispectral imagers to enable

pixel-aligned outputs at previously unattainable resolutions, while maintaining the efficiency and reliability of its RedEdge™

legacy. Processing of data outputs is enabled through industry standard software platforms, including AgEagle’s Ground

Control flight management software. With RedEdge-P, agricultural professionals benefit from a sensor that can enable effective

plant counting and spectral analysis of small plants. Likewise, federal, state and local government and commercial forestry enterprises

will also benefit from precise, efficient data collection and tree-level analysis as opposed to being limited to analyzing large

swaths of land to make critical forestry management decisions. |

| ● |

AgEagle

also offers a wide range of drone cameras to suit every mapping job, from land surveying and topographic mapping to urban planning,

crop mapping, thermal mapping and more. |

| |

|

| ● |

Aeria

X – a compact drone photogrammetry sensor that offers the ideal blend of size, weight and DSLR-like image quality.

It produces stunning image detail and clarity in virtually all light conditions, allowing users to map for more hours per day. |

| |

|

| ● |

Duet

M – a high resolution RGB and multispectral mapping camera rig used to create geo-accurate multispectral maps and high

resolution digital surface models quickly and easily. This sensor is ideal for water management, such as mapping field drains and

areas of compaction; spotting malfunctioning irrigation lines; and evaluating the consistency of plant vigor across a field. |

| |

|

| ● |

Duet

T – a rugged dual RGB/thermal mapping camera rig used to create geo-accurate thermal maps and digital surface models

quickly and easily. The Duet T includes a high resolution thermal infrared (640 x 512 px) camera and a S.O.D.A. RGB

camera. |

| |

|

| ● |

S.O.D.A.

– the first photogrammetry camera built for professional use which quickly became an industry standard for drone operators

worldwide upon being introduced in 2016. It captures sharp aerial images, across light conditions, with which to produce detailed,

vivid orthomosaics and ultra-accurate 3D digital surface models. |

| |

|

| ● |

S.O.D.A.

3D – a professional drone photogrammetry camera that changes orientation during flight to capture three images (two

oblique and one nadir) instead of just one, providing for a much wider field of view. It is optimized for quick, robust image processing

with Pix4DMapper. Designed specifically for use with the eBee X aircraft, the S.O.D.A. 3D can achieve coverage of vast

areas of flat, homogenous terrain (up to 500 ac / 1,235 ac per 122m / 400ft flight). The unique ability of the S.O.D.A. 3D

to capture images in two orientations and the resulting wider field of view translates to stunning digital 3D reconstructions in

vertically-focused environments. such as urban areas or open-pit mines - anywhere with walls or steep sides. This system of data

recording means that less image overlap is needed, resulting in more efficient flights and greater flight coverage, not to mention

quicker image processing for results. |

Market

Opportunity for Sensor Solutions

Sensors

for drones are increasingly being used for surveying, mapping and inspections – particularly in the mining, construction, energy,

environmental management, agriculture, infrastructure and waste management industries. Moreover, with every new innovation in sensor

technologies, the functionality and the underpinning value proposition of commercial UAS continues to improve and allows for an even

wider range of possible applications.

Due

in large measure to increasing demand of drone sensors for mapping services, LiDAR and GPS, the outlook for the drone sensor market is

forecasted to grow to $66.6 billion by 2030, according to a January 2022 research report released by Market Research Future. Verified

Market Research (“VMR”) also published its industry research report in January 2022, stating that the global drone sensor

market will climb to $60.67 billion by 2028 from $10.88 billion in 2020, representing a CAGR of 23.97% from 2021 to 2028. Key market

drivers in VMR’s report cite adoption of drones across different industry verticals, including agriculture, landscaping and military

and defense, as well as a rise in the need for collecting high quality and real-time data insight.

Our

Branded Software Solutions

Ground

Control

A

cloud-based, plug-and-play operating system, Ground Control provides individual pilots and large enterprises with everything they

need to completely automate and scale their drone operations workflows. Offered as Software-as-a-Service, Ground Control continues

to earn the trust and fidelity of its blue chip, industry-diverse customers by providing a single platform to automate flight management

systems safely and securely; easily manage drone programs of any scope and scale; and process, analyze and share drone-captured image

data and visualization necessary for assessing risks, improving workflow processes and achieving time and cost efficiencies across enterprises

of virtually any size. With the aim of empowering AgEagle’s customers to readily extend their reach and human capability through

adoption of scalable autonomous drone programs, Ground Control users can:

| ● |

plan

missions via Keyhole Markup Language (“KML”) files or build a grid or waypoint flight; check airspace for Low Altitude

Authorization and Notification Capability (“LAANC”) authorization and confirm local weather conditions are favorable. |

| |

|

| ● |

fly

with GPS-aided manual control or automated grid and waypoint patterns, and push web-based flight plans to mobile devices for ground-based

in-field control – all with a simple, easy-to-use flight interface. |

| |

|

| ● |

capture

raw data and live streaming field images with multispectral cameras, like AgEagle’s RedEdge-P and Altum-PT, and

automatically convert into organized map indices and composites; or fly an RTK-enabled drone for improved post-flight processing. |

| |

|

| ● |

process

captured imagery into high-quality data products and photogrammetry, and create orthomosaics, digital surface models and contour

maps; or upload ground control points (“GCPs”) with user’s maps for increased accuracy. |

| |

|

| ● |

analyze

drone data or view orthomosaics and other 2D data files on an interactive, account-wide map. |

| |

|

| ● |

collaborate

and support operations with detailed information about missions, including flight logs with screen shots, playbacks and incident

flagging; and efficiently manage equipment and workflows with automatic usage tracking capabilities. |

| |

|

| ● |

benefit

from Ground Control’s obsession to deliver industry-leading, customer-centric support and service. |

Ground

Control has been integrated with several other industry leading UAS technologies, including AgEagle’s own line of proprietary

sensors and airframes. In addition, Ground Control’s industry partnerships include integrations with:

| ● |

DJI

drone platforms, which work seamlessly with Ground Control’s flight app and permits users to sync flights flown with

the DJI Go app and use DJI Geo Unlock; |

| |

|

| ● |

Parrot’s

ANAFI, ANAFI USA and ANAFI Thermal drone platforms, which pair ANAFI’s rapid deployment and ease of operation

with Ground Control’s standard flight tools, as well as enable users to tailor and expand their use through selection of additional

program management and data processing capabilities; |

| |

|

| ● |

Pix4D

software, which makes it easy to create high quality orthomosaics, digital surface models and control maps in the Ground Control

platform; and |

| |

|

| ● |

Wing’s

OpenSky airspace access app, which empowers drone flyers to abide by airspace rules and regulations and request authorization

to fly in controlled airspace in near real-time wherever OpenSky is available. |

eMotion

AgEagle

also offers eMotion, a drone flight and data management solution created specifically for aerial mapping use. With eMotion,

flights are built using intuitive mission blocks and flight modes. Users simply need to choose a block (aerial mapping, corridor, etc.),

highlight the region they want to map, define key settings, and eMotion auto-generates the drone’s flight plan. Multi-flight

missions are supported, and the software’s full 3D environment adds a new dimension to drone flight management, helping users to

plan, simulate and control the drone’s trajectory for safer flights, more consistent performance and improved data quality. Moreover,

eMotion’s built-in Flight Data Manager automatically handles the georeferencing and preparation of images requires for post-processing

in software such as Pix4Dmapper. Connecting wirelessly to a user’s drone, to industry cloud solutions, to survey-grade base

stations and to airspace and live weather data, eMotion is advanced, scalable drone software that anyone can use.

HempOverview

As

one of the agriculture industry’s leading pioneers of advanced aerial-image-based data collection and analytics solutions, AgEagle

leveraged our expertise to champion the use of proven, advanced web- and map-based technologies as the means to streamline and ultimately

standardize hemp cultivation in the United States. Growers need to be registered/permitted; crops need to be monitored and inspected;

and enforcement operations must be established to ensure compliance with state and federal mandates. Through HempOverview, we

believe that AgEagle represents the first agriculture technology company to bring to market an advanced agtech solution that is designed

to meet the unique complexities and vigorous oversight, compliance and enforcement demands of the emerging American hemp industry and

the unique needs and demands of its key stakeholders.

HempOverview

comprises four modules:

| 1) |

Registration:

secure, scalable software to handle all farmer and processer application and licensing matters. |

| |

|

| 2) |

Best

Management Practices: iterative, intelligent data collection and analysis utilizing satellite imagery and advanced, proprietary

algorithms to help farmers reduce input costs, avoid missteps, detect pest impacts and monitor water usage. |

| |

|

| 3) |

Oversight

and Enforcement: integration of data management and satellite imagery to provide continuous monitoring of all hemp fields in

the state, predict and respond to issues and assist in proper crop testing. |

| |

|

| 4) |

Reporting:

generation of actionable reports for USDA requirements, legislative oversight and support of research institutions. |

In

November 2019, the Florida Department of Agriculture and Consumer Services (FDACS) licensed the HempOverview solution to manage

its online application submission and registration process for hemp growers and their farms and hemp fields in the State of Florida for

the years 2020, 2021 and 2022. In June 2021, the State of Florida expanded its licensing of the HempOverview platform to provide

for access to all four of the modules. FDACS also tasked AgEagle with developing a custom registration software platform to enhance communications,

licensing and general compliance relating to the oversight and protection of more than 500 endangered and commercially exploited wild

plants native to Florida. For instance, in an effort to curb exploitation of saw palmetto, a plant whose extract is used in herbal supplements

often marketed for its urinary tract and prostate health benefits, FDACS requires harvesters and sellers of saw palmetto berries to obtain

a Native Plant Harvesting Permit. According to a related FDACS notice, “Widespread gathering of these berries is depleting a wildlife

food source and threatening the stability of some ecosystems.”

In

January 2021, the Iowa Department of Agriculture and Land Stewardship also licensed the HempOverview platform to manage the state’s

online registration, payment processing, comprehensive data collection and compliance oversight for the 2021, 2022 and 2023 planting

seasons.

Market

Opportunity for Drone Software Solutions

Rapid

adoption of UAS for commercial and government/military purposes continues to fuel the growth of the global drone software market, with

particularly robust demand expected for applications in areas that include mapping and surveillance, agriculture 4.0 and precision farming,

academic research, infrastructure inspection and maintenance, search and rescue and shipping and delivery. In a July 2022 report published

by Allied Market Research, the firm’s market analysts reported that the global drone software market was valued at $5.96 billion

in 2021, and is now projected to reach $21.93 billion by 2031, growing at a CAGR of 14.5% from 2022 to 2031.

Market

Opportunity for U.S. Industrial Hemp and Hemp-Derived CBD

According

to the November 2022 report of the industry research firm Markets and Markets, the global industrial hemp market is estimated to be valued

at $6.8 billion in 2033 and is projected to reach $18.1 billion by 2027, recording a 21.6% CAGR. Following the legalization of industrial

hemp production in the United States, the country’s industrial hemp industry has grown rapidly, as it is one of the largest consumers

of hemp-derived products, including oilseeds and cannabidiol (“CBD”). CBD is a non-intoxicant cannabinoid that has become

more popular as a food supplement and as an ingredient in pharmaceutical and cosmetic products. Hemp bioplastics made from hemp seeds

and CBD oil is also driving growth of the industry. Growing consumer demand for sustainable goods, as well as corporate and government

initiatives and support, are expected to fuel the growth of hemp-based biofuel and bioplastics.

AgEagle’s

Manufacturing Operations

For

years, federal agencies have been using drones for a wide range of use cases, from mapping to surveillance, search and rescue, and scientific

research. However, in recent years federal agencies’ use of and ability to procure UAS has evolved, largely stemming from security

concerns about drones from Chinese manufacturers. In 2020, for example, the U.S. Department of Interior grounded its entire fleet of

drones over concerns “that Chinese parts in them might be used for spying, making exceptions only for emergency missions like fighting

wildfires and search-and-rescue operations,” as The New York Times reported on January 29, 2020.

Former

President Donald Trump issued an executive order just before leaving office that said the U.S. government would seek to prevent “the

use of taxpayer dollars to procure UAS that present unacceptable risks and are manufactured by, or contain software or critical electronic

components from, foreign adversaries, and to encourage the use of domestically produced UAS.” As a result, the General Services

Administration works to ensure that only drones approved by the DoD’s Defense Innovation Unit are permitted under Multiple Award

Schedule contracts.

AgEagle

believes that these measures to ban China-manufactured drones and components has fueled and will continue to fuel, demand for “Made

in America” drones and components, creating a significant opportunity for U.S.-based drone manufacturers, like AgEagle. Consequently,

it is AgEagle’s intention to establish best industry practices and define quality standards for manufacturing, assembly, design/engineering

and testing of drones, drone subcomponents and related drone equipment in the Company’s U.S. facilities. The Company also has established

manufacturing operations in its Lausanne, Switzerland facility, where it assembles its line of eBee-branded fixed wing drones

for AgEagle’s international customer base.

AgEagle’s

commitment to its discerning customers has driven its efforts to establish recognized centers of excellence in drone airframes, sensors

and software, which, in turn, has resulted in the Company’s drone production operations receiving official ISO:9001 certification

for its Quality Management System (“QMS”) in 2022. Meeting a wide variety of strict standards, AgEagle has demonstrated that

it delivers consistently high-quality products and services in every aspect of its fixed-wing drone operations, including design, manufacturing,

marketing, sales and after-sales. An international certification, ISO:9001 recognizes organizational excellence and good quality practices

based on a strong customer focus, robust process approach and proof of continual improvement. The certification was achieved following

an extensive audit across AgEagle’s drone operations, led by the Company’s dedicated in-house quality management team. The

QMS was developed over a two-year period, outlining a framework of policies, processes and procedures to help achieve the Company’s

high-performance objectives.

Key

Growth Strategies

We

intend to materially grow our business by leveraging our proprietary, best-in-class, full-stack drone solutions, industry influence and

deep pool of talent with specialized expertise in robotics, automation, custom manufacturing and data science to achieve greater penetration

of the global UAS industry – with near-term emphasis on capturing larger market share of the agriculture, energy/utilities, infrastructure

and government/military verticals. We expect to accomplish this goal by first bringing three core values to life in our day-to-day operations

and aligning them with our efforts to earn the trust and continued business of our customers and industry partners:

| ● |

Curiosity

– this pushes us to find value where others aren’t looking. It inspires us to see around corners for our customers,

understanding the problems they currently face or will be facing in the future, and delivering them solutions best suited for their

unique needs |

| |

|

| ● |

Passion

– this fuels our obsession with excellence, our desire to try the difficult things and tackle big problems, and our commitment

to meet our customers’ needs – and then surpass them. |

| |

|

| ● |

Integrity

– this is not optional or situational at AgEagle – it is the foundation for everything we do, even when no one is

watching. |

Key

components of our growth strategy include the following:

| ● |

Establish

three centers of excellence with respective expertise in UAS software, sensors and airframes. These centers of excellence cross

pollinate ideas, industry insights and skillsets to yield intelligent autonomous solutions that fully leverage AgEagle’s experienced

team’s specialized knowledge and know-how in robotics, automation, custom manufacturing and data science. |

| |

|

| ● |

Deliver

new and innovative solutions. AgEagle’s research and development efforts are critical building blocks of the Company, and

we intend to continue investing in our own innovations, pioneering new and enhanced products and solutions that enable us to satisfy

our customers – both in response to and in anticipation of their needs. AgEagle believes that by investing in research and

development, the Company can be a leader in delivering innovative autonomous robotics systems and solutions that address market needs

beyond our current target markets, enabling us to create new opportunities for growth. |

| |

|

| ● |

Foster

our entrepreneurial culture and continue to attract, develop and retain highly skilled personnel. AgEagle’s company culture

encourages innovation and entrepreneurialism, which helps to attract and retain highly skilled professionals. We intend to preserve

this culture to nurture the design and development of the innovative, highly technical system solutions that give us our competitive

advantage. |

| |

|

| ● |

Effectively

manage our growth portfolio for long-term value creation. Our production and development programs present numerous investment

opportunities that we believe will deliver long-term growth by providing our customers with valuable new capabilities. We evaluate

each opportunity independently, as well as within the context of other investment opportunities, to determine its relative cost,

timing and potential for generation of returns, and thereby its priority. This process helps us to make informed decisions regarding

potential growth capital requirements and supports our allocation of resources based on relative risks and returns to maximize long-term

value creation, which is the key objective of our growth strategy. We also review our portfolio on a regular basis to determine if

and when to narrow our focus on the highest potential growth opportunities. |

| |

|

| ● |

Growth

through acquisition. Through successful execution of our growth-through-acquisition strategies, we intend to acquire technologically

advanced UAS companies and intellectual property that complement and strengthen our value proposition to the market. We believe that

by investing in complementary acquisitions, we can accelerate our revenue growth and deliver a broader array of innovative autonomous

flight systems and solutions that address specialized market needs within our current target markets and in emerging markets that

can benefit from innovations in artificial intelligence-enabled robotics and data capture and analytics. |

Competitive

Strengths

AgEagle

believes the following attributes and capabilities provide us with long-term competitive advantages:

| ● |

Proprietary

technologies, in-house capabilities and industry experience – We believe our decade of experience in commercial UAS design

and engineering; in-house manufacturing, assembly and testing capabilities; and advanced technology development skillset serve to

differentiate AgEagle in the marketplace. In fact, approximately 70% of our Company’s global workforce is comprised of engineers

and data scientists with deep experience and expertise in robotics, automation, custom manufacturing, and data analytics. In addition,

AgEagle is committed to meeting and exceeding quality and safety standards for manufacturing, assembly, design and engineering and

testing of drones, drone subcomponents and related drone equipment in our U.S. and Swiss-based manufacturing operations. As a result,

we have earned ISO:9001 international certification for our Quality Management System. |

| |

|

| ● |

AgEagle

is more than just customer- and product-centric, we are obsessed with innovation and knowing

the needs of our customers before they do – We are focused on capitalizing on our

specialized expertise in innovating and commercializing advanced drone, sensor and software

technologies to provide our existing and future customers with autonomous robotic solutions

that meet the highest possible safety and operational standards and fit their specific business

needs. We have established three Centers of Excellence that our leadership has challenged

to cross-pollinate ideas, industry insights and interdisciplinary skillsets to generate intelligent

autonomous solutions that efficiently leverage our expertise in robotics, automation and

manufacturing to solve problems for our customers, irrespective of the industry sector in

which they may operate.

In

December 2022, we unveiled our new eBee™ VISION, a small, fixed-wing UAS designed to provide real-time, enhanced situational

awareness for critical intelligence, surveillance and reconnaissance missions; and in April 2023, were awarded a federal contract

from the U.S. Department of Defense’s Defense Innovation Unit (“DIU”) to produce and deliver eBee™ VISION

fixed-wing drones and customized command and control software that proves compatible and is in full compliance with the DoD Robotic

and Autonomous System-Air Interoperability Profile (“RAS-A IOP”). In addition, three branches of European military forces

have taken delivery of eBee VISION drones in 2023. In anticipation of achieving commercial production of eBee VISIONs

later this year, we have teams hosting live demonstrations of eBee VISION prototypes for officials of government and military

agencies in Austria, the Baltics, Italy, Poland, Spain and across the United States.

In

May 2023, we released the new RedEdge-P™ dual high resolution and RGB composite drone sensor, representing yet another

AgEagle technological advancement in aerial imaging cameras, seamlessly integrating the power and performance of the RedEdge-P

and the new RedEdge-P blue cameras in a single solution. The RedEdge-P dual doubles analytical capabilities with

the benefit of a single camera workflow. Its coastal blue band – the first of its kind in the market – was specifically

designed for vegetation analysis of water bodies; environmental monitoring; water management; habitat monitoring, protection and

restoration; and vegetation species and weeds identification, including differentiating and counting plants, trees, invasive species

and weeds.

In

April 2023, AgEagle released Field Check for the Measure Ground Control mobile app. Measure Ground Control

is a complete Software-as-a-Service solution for drone program management that is available as a web app and mobile app for both

iOS and Android devices. The software’s capabilities include mission and equipment management, flight control, data processing

and analysis, secure data storage and sharing, online collaboration and reporting. Field Check’s unique feature set

enables users to review and validate the quality of their drone-captured imagery on-site. Capturing target imagery right the first

time in one trip to a project site allows users to eliminate time loss and costs associated with project reworks by ensuring data

capture is complete and ready for processing into high-resolution outputs before leaving a site. Reflecting our software development

team’s superb problem-solving capabilities, Field Check provides our clients with a competitive edge in their drone

operations and across the industries they serve by avoiding project repeats and downtime due to data processing errors or poor image

quality. |

| |

|

| ● |

AgEagle

was awarded a Multiple Award Schedule (“MAS”) Contract by the U.S. federal government’s General Services Administration

(“GSA”) – In April 2023, the centralized procurement arm of the federal government, the GSA, awarded us with a

five-year MAS contract. The GSA Schedule Contract is a highly coveted award in the government contracting space and is the result

of a rigorous proposal process involving the demonstration of products and services in-demand by government agencies, and the negotiation

of their prices, qualifications, terms and conditions. Contractors selling through the GSA Contract are carefully vetted and must

have a proven track record in the industry. We believe that this will serve to advance our efforts to achieve deeper penetration

of the government sector over the next five years. |

| ● |

Our

eBee TAC UAS has been approved by the Defense Innovation Unit (DIU) for procurement by the Department of Defense. We believe

that the eBee TAC is ideally positioned to become an in-demand, mission critical tool for the U.S. military, government and

civil agencies and our allies worldwide; and expect that this will prove to be a major growth catalyst for our Company in 2022, positively

impacting our financial performance in the years ahead. eBee TAC is available for purchase by U.S. government agencies and

all branches of the military on GSA Schedule Contract #47QTCA18D003G, supplied by Hexagon US Federal and partner Tough Stump Technologies

as a standalone solution or as part of the Aerial Reconnaissance Tactical Edge Mapping Imagery System (“ARTEMIS”). Tough

Stump is actively engaged in training military ground forces based in the U.S. and in Central Europe on the use of eBee TAC

for mid-range tactical mapping and reconnaissance missions. |

| ● |

Our

eBee X series of fixed wing UAS, including the eBee X, eBee Geo and eBee TAC, are the first and only drones

on the market to comply with Category 3 of the sUAS Over People rules published by the FAA. It is another important testament

to our commitment to provide best-in-class solutions to our commercial customers, and we believe it will serve as a key driver in

the growth of eBee utilization in the United States. We further believe it will improve the business applications made possible

by our drone platform for a wide range of commercial enterprises which stand to benefit from adoption of drones in their businesses

– particularly those in industries such as insurance for assessment of storm damage, telecommunications for network coverage

mapping and energy for powerline and pipeline inspections, just to name a few. |

| |

|

| ● |

Our

eBee X series of drones are the world’s first UAS in its class to receive design verification for BVLOS and OOP from

European Union Aviation Safety Agency (“EASA”). The EASA design verification report (“DVR”) demonstrates

that the eBee X meets the highest possible quality and ground risk safety standards and, thanks to its lightweight design,

effects of ground impact are reduced. As such, drone operators conducting advanced drone operations in 27 European Member States,

Iceland, Liechtenstein, Norway, and Switzerland can obtain the HIGH or MEDIUM robustness levels of the M2 mitigation without additional

verification from EASA. Regulatory constraints relating to limitations of BVLOS and OOP have continued to be a gating factor to widespread

adoption of commercial drone technologies across a wide range of industry sectors worldwide. Being the first company to receive this

DVR from EASA for M2 mitigation is a milestone for AgEagle and our industry in the European Union and will be key to fueling growth

of our international customer base. |

| |

|

| ● |

Our

global reseller network currently has more than 200 drone solutions providers in 75+ countries – By leveraging our relationships

with the specialty retailers that comprise our global reseller network, AgEagle benefits from enhanced brand-building, lower customer

acquisition costs and increased reach, revenues and geographic and vertical market penetration. With the integration of our 2021

acquisitions completed in 2021 (the “2021 Acquisitions”), we can now leverage our collective reseller network to accelerate

our revenue growth by educating and encouraging our partners to market AgEagle’s full suite of airframes, sensors and software

as bundled solutions in lieu of marketing only previously siloed products or product lines to end users. |

| |

|

| ● |

In

November 2022, we partnered with government contractor W.S. Darley & Co. (“Darley”) to expand the market reach of

AgEagle’s high performance fixed wing drones and sensors to the U.S. first responder and tactical defense markets. Distinguished

as one of the nation’s longest standing government contracting organizations, Darley is expected to become a key contributor

to AgEagle’s success in delivering best-in-class UAS solutions to a wide range of state and federal agencies. Providing our