Filed Pursuant to Rule 424(b)(3)

Registration No. 333-279888

PROSPECTUS

1847

HOLDINGS LLC

1,394,052

Common Shares

This

prospectus relates to 1,394,052 common shares that may be sold from time to time by the selling shareholders named in this prospectus,

which includes:

| ● | 92,937 common shares issuable to selling shareholders upon

the exercise of warrants; and |

| ● | 1,301,115 common shares that may be issued to the selling

shareholders upon the conversion of 20% OID subordinated promissory notes in the principal amount

of $625,000 that may be converted into common shares only if an event of default occurs under such notes. |

We

will not receive any proceeds from the sales of outstanding common shares by the selling shareholders, but we will receive funds from

the exercise of the warrants held by the selling shareholders.

Our common shares are listed on NYSE American under the symbol “EFSH.”

On June 11, 2024, the last reported sale price of our common shares on NYSE American was $0.4490 per share. There is no public market

for the warrants.

The

selling shareholders may offer and sell the common shares being offered by this prospectus from time to time in public or private transactions,

or both. These sales may occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market

prices, or at negotiated prices. The selling shareholders may sell shares to or through underwriters, broker-dealers or agents, who may

receive compensation in the form of discounts, concessions or commissions from the selling shareholders, the purchasers of the shares,

or both. Any participating broker-dealers and any selling shareholders who are affiliates of broker-dealers may be deemed to be “underwriters”

within the meaning of the Securities Act of 1933, as amended, or the Securities Act, and any commissions or discounts given to any such

broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The

selling shareholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to

distribute their common shares. See “Plan of Distribution” for a more complete description of the ways in which the

shares may be sold.

Investing

in our common shares involves a high degree of risk. See “Risk Factors” beginning on page 4 to read about factors

you should consider before you make an investment decision.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is June 12, 2024

TABLE

OF CONTENTS

You

should rely only on the information that we have provided or incorporated by reference in this prospectus, any applicable prospectus

supplement and any related free writing prospectus that we may authorize to be provided to you. We have not authorized anyone to provide

you with different information. No dealer, salesperson or other person is authorized to give any information or to represent anything

not contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus that we may authorize to

be provided to you. You must not rely on any unauthorized information or representation. This prospectus is an offer to sell only the

securities offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the

information in this prospectus, any applicable prospectus supplement or any related free writing prospectus is accurate only as of the

date on the front of the document and that any information we have incorporated by reference is accurate only as of the date of the document

incorporated by reference, regardless of the time of delivery of this prospectus, any applicable prospectus supplement or any related

free writing prospectus, or any sale of a security.

PROSPECTUS

SUMMARY

This

summary highlights selected information that is presented in greater detail elsewhere, or incorporated by reference, in this prospectus.

It does not contain all of the information that may be important to you and your investment decision. Before investing in our securities,

you should carefully read this entire prospectus, including the matters set forth in the section of this prospectus titled “Risk

Factors” and the financial statements and related notes and other information that we incorporate by reference herein, including

our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q. Unless the context indicates otherwise, references in this prospectus

to “we,” “us,” “our” and “our company” refer, collectively, to 1847 Holdings LLC and

its subsidiaries taken as a whole.

Our

Company

Overview

We

are an acquisition holding company focused on acquiring and managing a group of small businesses, which we characterize as those that

have an enterprise value of less than $50 million, in a variety of different industries headquartered in North America.

Through

our structure, we offer investors an opportunity to participate in the ownership and growth of a portfolio of businesses that traditionally

have been owned and managed by private equity firms, private individuals or families, financial institutions or large conglomerates.

We believe that our management and acquisition strategies will allow us to achieve our goals to make and grow regular distributions

to our common shareholders and increase common shareholder value over time.

We

seek to acquire controlling interests in small businesses that we believe operate in industries with long-term macroeconomic growth opportunities,

and that have positive and stable earnings and cash flows, face minimal threats of technological or competitive obsolescence and have

strong management teams largely in place. We believe that private company operators and corporate parents looking to sell their businesses

will consider us to be an attractive purchaser of their businesses. We make these businesses our majority-owned subsidiaries and actively

manage and grow such businesses. We expect to improve our businesses over the long term through organic growth opportunities, add-on

acquisitions and operational improvements.

Our

Businesses

Construction

Our construction

business is operated through our subsidiaries Kyle’s Custom Wood Shop, Inc., an Idaho corporation, or Kyle’s, High Mountain

Door & Trim Inc., a Nevada corporation, or High Mountain, and Sierra Homes, LLC d/b/a Innovative Cabinets & Design, a Nevada

limited liability company, or Innovative Cabinets. Kyle’s was acquired in the third quarter of 2020 and High Mountain and Innovative

Cabinets were acquired in the fourth quarter of 2021. This business segment accounted for approximately 57.8% and 64.9% of our total

revenues for the years ended December 31, 2023 and 2022, respectively, and for approximately 62.0% and 68.7% of our total revenues for

the three months ended March 31, 2024 and 2023, respectively.

We

specialize in all aspects of finished carpentry and related products and services, including doors, door frames, base boards, crown molding,

cabinetry, bathroom sinks and cabinets, bookcases, built-in closets, and fireplace mantles, among others. We also install windows and

kitchen countertops. We primarily service large homebuilders and homeowners of single-family homes and commercial and multi-family developers

in the greater Reno-Sparks-Fernley metro area in Nevada and in the Boise, Idaho area.

Eyewear

Products

Our

eyewear products business is operated by ICU Eyewear Holdings, Inc., a California corporation, and its subsidiary ICU Eyewear, Inc.,

a California corporation, which we collectively refer to as ICU Eyewear. This segment, which we acquired in the first quarter of 2023,

accounted for approximately 22.5% of our total revenues for the year ended December 31, 2023 and for approximately 26.1% of our total

revenues for the three months ended March 31, 2024.

ICU

Eyewear, which was founded in 1956 and is headquartered in Hollister, California, is a leading designer of over-the-counter, or OTC,

non-prescription reading glasses, sunglasses, blue light blocking eyewear, sun readers and outdoor specialty sunglasses, as well as select

health and personal care items, such as surgical face masks. We sell our products to big-box national retail chains, through various

distributors, as well as online direct to consumer sales. We believe that we are the only OTC eyewear supplier in the U.S. to have meaningful

penetration in all significant retail channels including grocery, specialty, office supply, pharmacy, and outdoor sports stores.

Automotive

Supplies

Our

automotive supplies business is operated by Wolo Mfg. Corp., a New York corporation, and Wolo Industrial Horn & Signal, Inc., a New

York corporation, which we collectively refer to as Wolo. This business segment accounted for approximately 6.6% and 13.3% of our total

revenues for the years ended December 31, 2023 and 2022, respectively, and for approximately 11.9% and 9.7% of our total revenues for

the three months ended March 31, 2024 and 2023, respectively.

Our

automotive supplies business is headquartered in Deer Park, New York and was founded in 1965. We design and sell horn and safety products

(electric, air, truck, marine, motorcycle and industrial equipment), and offer vehicle emergency and safety warning lights for cars,

trucks, industrial equipment and emergency vehicles. Focused on the automotive and industrial after-market, we sell our products to big-box

national retail chains, through specialty and industrial distributors, as well as on- line/mail order retailers and original equipment

manufacturers.

Our Manager

We

have engaged 1847 Partners LLC, which we refer to as our manager, to manage our day-to-day operations and affairs, oversee the management

and operations of our businesses and perform certain other services on our behalf, subject to the oversight of our board of directors.

Ellery W. Roberts, our Chief Executive Officer, is the sole manager of our manager and, as a result, our manager is an affiliate of Mr.

Roberts.

We

have entered into a management services agreement with our manager, pursuant to which we are required to pay our manager a quarterly

management fee equal to 0.5% (2.0% annualized) of our company’s adjusted net assets (as defined in the management services agreement)

for services performed. Pursuant to the management services agreement, we have agreed that our manager may, at any time, enter into offsetting

management services agreements with our businesses pursuant to which our manager may perform services that may or may not be similar

to management services. Any fees to be paid by one of our businesses pursuant to such agreements are referred to as offsetting management

fees and will offset, on a dollar-for-dollar basis, the management fee otherwise due and payable by us under the management services

agreement with respect to a fiscal quarter. Our manager has entered into offsetting management services agreements with our subsidiary

1847 Cabinet Inc., which provides for the payment of quarterly management fees equal to the greater of $75,000 or 2% of adjusted net

assets, and with 1847 Wolo Inc., which provides for the payment of quarterly management fees equal to the greater of $125,000 or 2% of

adjusted net assets. The management services agreement provides that the aggregate amount of offsetting management fees to be paid to

our manager with respect to any fiscal quarter shall not exceed the management fee to be paid to our manager with respect to such fiscal

quarter.

Our

manager also owns all of our allocation shares, which are a separate class of limited liability company interests. The allocation shares

generally will entitle our manager to receive a 20% profit allocation upon the sale of a particular subsidiary, calculated based on whether

the gains generated by such sale (in excess of a high-water mark) plus certain historical profits of the subsidiary exceed an annual

hurdle rate of 8% (which rate is multiplied by the subsidiary’s average share of our consolidated net assets). Once such hurdle

rate has been exceeded, then the profit allocation becomes payable to our manager.

Corporate

Information

Our

principal executive offices are located at 590 Madison Avenue, 21st Floor, New York, NY 10022 and our telephone number is 212-417-9800.

We maintain a website at www.1847holdings.com. Kyle’s maintains a website at www.kylescabinets.com, Innovative Cabinets maintains

a website at www.innovativecabinetsanddesign.com, ICU Eyewear maintains a website at icueyewear.com and Wolo maintains a website at www.wolo-mfg.com.

Information available on our websites is not incorporated by reference in and is not deemed a part of this prospectus.

The

Offering

| Common shares offered by selling shareholders: |

|

This prospectus relates to 1,394,052 common shares that may be sold from time to time by the selling shareholders named in this prospectus, which includes: |

| |

|

|

| |

|

|

● |

92,937 common shares issuable to selling shareholders upon

the exercise of warrants; and |

| |

|

|

|

| |

|

|

● |

1,301,115 common shares that may be issued

to the selling shareholders upon the conversion of 20% OID subordinated promissory notes in the principal amount of $625,000 that may

be converted into common shares only if an event of default occurs under such notes. |

| |

|

|

|

| Common shares outstanding(1): |

|

7,051,477 common shares. |

| |

|

|

|

| Use of proceeds: |

|

We will not receive any proceeds from the sales of outstanding common shares by the selling shareholders, but we will receive funds from the exercise of the warrants held by the selling shareholders. See “Use of Proceeds.” |

| |

|

|

|

| Risk factors: |

|

Investing in our securities involves a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 4. |

| |

|

|

|

| Trading market and symbol: |

|

Our common shares are listing on NYSE American under the symbol “EFSH.” |

| (1) | The

number of common shares outstanding excludes: |

| ● | 110,002

common shares issuable upon the conversion of our outstanding series A senior convertible

preferred shares; |

| ● | 1,063,092 common shares issuable upon the exercise of outstanding warrants

at a weighted average exercise price of $3.00 per share; |

| ● | common

shares issuable upon the conversion of secured convertible promissory notes in the aggregate

principal amount of $24,349,796, which are convertible into our common shares at a conversion

price of $1.00 (subject to adjustment); |

| ● | common

shares issuable upon the conversion of promissory notes in the aggregate principal amount

of $834,689, which are convertible into our

common shares only upon an event of default at a conversion price equal to 80% of the lowest

volume weighted average price of our common shares on any trading day during the 5 trading

days prior to the conversion date, subject to a floor price of $1.00; |

| ● | common

shares issuable upon the conversion of 20% OID subordinated promissory notes in the aggregate

principal amount of $2,531,250, which are convertible into our common shares only upon an

event of default at a conversion price equal to 90% of the lowest volume weighted average

price of our common shares on any trading day during the 5 trading days prior to the conversion

date, subject to a floor price of $3.00; |

| ● | common

shares issuable upon the conversion of a 20% OID subordinated promissory note in the principal

amount of $625,000, which is convertible into our common shares only upon an event of default

at a conversion price equal to 90% of the lowest volume weighted average price of our common

shares on any trading day during the 5 trading days prior to the conversion date, subject

to a floor price of $0.01; |

| ● | common

shares issuable upon the exchange of 6% subordinated convertible promissory notes in the

principal amount of $2,520,345, which are exchangeable for our common shares at an exchange

price equal to the higher of $1,000 or the 30-day volume weighted average price of our common

shares; and |

| ● | 20,000

common shares that are reserved for issuance under our 2023 Equity Incentive Plan. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. You should consider the risks, uncertainties and assumptions discussed under

“Part I-Item 1A-Risk Factors” of our most recent Annual Report on Form 10-K and in “Part II-Item 1A-Risk Factors”

in our most recent Quarterly Report on Form 10-Q filed subsequent to such Form 10-K that are incorporated herein by reference, as may

be amended, supplemented or superseded from time to time by other reports we file with the Securities and Exchange Commission, or the

SEC, in the future. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not

presently known to us or that we currently deem immaterial may also affect our operations.

FORWARD-LOOKING

STATEMENTS

This

prospectus, each prospectus supplement and the information incorporated by reference in this prospectus and each prospectus supplement

contain certain statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities

Act and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. The words “believe,” “may,”

“will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,”

“could,” “would,” “project,” “plan,” “potentially,” “likely,”

and similar expressions and variations thereof are intended to identify forward-looking statements, but are not the exclusive means of

identifying such statements. Those statements appear in this prospectus, any accompanying prospectus supplement and the documents incorporated

herein and therein by reference, particularly in the sections titled “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and include statements regarding the intent, belief or current expectations

of our management that are subject to known and unknown risks, uncertainties and assumptions. You are cautioned that any such forward-looking

statements are not guarantees of future performance and involve risks and uncertainties, and that actual results may differ materially

from those projected in the forward-looking statements as a result of various factors.

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should

not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking

statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements.

Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we

do not plan to publicly update or revise any forward-looking statements contained herein after we distribute this prospectus, whether

as a result of any new information, future events or otherwise. In addition, statements that “we believe” and similar statements

reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date

of this prospectus, and although we believe such information forms a reasonable basis for such statements, such information may be limited

or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially

available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

This

prospectus and the documents incorporated by reference in this prospectus may contain market data that we obtain from industry sources.

These sources do not guarantee the accuracy or completeness of the information. Although we believe that our industry sources are reliable,

we do not independently verify the information. The market data may include projections that are based on a number of other projections.

While we believe these assumptions to be reasonable and sound as of the date of this prospectus, actual results may differ from the projections.

USE

OF PROCEEDS

We

will not receive any proceeds from the sale of common shares by the selling shareholders. We may, however, receive up to approximately

$250,001 from the exercise of warrants held by selling shareholders. We will retain broad discretion over the use of the net proceeds

to us. We currently expect to use the net proceeds that we receive from the exercise of warrants for working capital and other general

corporate purposes. We may also use a portion of the net proceeds to acquire, license or invest in complementary products, technologies

or businesses. The expected use of net proceeds represents our current intentions based on our present plans and business conditions.

We cannot specify with certainty all of the particular uses for the net proceeds to be received upon exercise of the warrants. Pending

these uses, we may invest the net proceeds of this offering in short- and intermediate-term, interest-bearing obligations, investment-grade

instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government.

The

selling shareholders will pay any underwriting discounts and commissions and expenses incurred by them for brokerage, accounting, tax

or legal services or any other expenses incurred by them in disposing of the shares. We will bear all other costs, fees and expenses

incurred in effecting the registration of the shares covered by this prospectus, including, without limitation, all registration and

filing fees and fees and expenses of our counsel and our accountants.

SELLING

SHAREHOLDERS

The

common shares being offered by the selling shareholders are common shares issuable to the selling shareholders upon the exercise of warrants

and common shares that may be issued to the selling shareholders upon the conversion of 20% OID subordinated promissory notes in the

principal amount of $625,000 that may be converted into common shares only if an event of default occurs under such notes. We are registering

the shares in order to permit the selling shareholders to offer the shares for resale from time to time.

We

have determined beneficial ownership in accordance with the rules of the SEC. Except as indicated by the footnotes below, we believe,

based on the information furnished to us, that the persons and entities named in the table below have sole voting and investment power

with respect to all shares that they beneficially own, subject to applicable community property laws. Unless otherwise indicated in the

footnotes below, based on the information provided to us by or on behalf of the selling shareholders, no selling shareholder is a broker-dealer

or an affiliate of a broker-dealer.

The

table below lists the selling shareholders and other information regarding the beneficial ownership of the common shares by each of the

selling shareholders. The second column lists the number of common shares beneficially owned by each selling shareholder. The third column

lists the common shares being offered by this prospectus by the selling shareholders. The fourth column assumes the sale of all of the

ordinary shares offered by the selling shareholders pursuant to this prospectus.

Applicable percentage ownership is based on 7,051,477 common shares

outstanding as of June 11, 2024. For purposes of computing percentage ownership after this offering, we have assumed that all warrants

and 20% OID subordinated promissory notes held by the selling shareholders will be converted to common shares and sold in this offering.

In computing the number of common shares beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding

all common shares subject to options, warrants or other convertible securities held by that person or entity that are currently exercisable

or releasable or that will become exercisable or releasable within 60 days of June 11, 2024. We did not deem these shares outstanding,

however, for the purpose of computing the percentage ownership of any other person.

The

selling shareholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

|

|

|

Common Shares Beneficially

Owned Prior to this Offering |

|

|

Number of

Common

Shares

Being |

|

|

Common Shares Beneficially

Owned After this Offering |

|

| Name of Beneficial Owner |

|

|

Shares |

|

|

% |

|

|

Offered |

|

|

Shares |

|

|

% |

|

| Altium Growth Fund LP(1) |

|

|

|

1,394,052 |

|

|

|

4.99 |

% |

|

|

1,394,052 |

|

|

|

- |

|

|

|

- |

|

| (1) | Includes

92,937 common shares issuable upon the exercise of a warrant and 1,301,115 common shares

that may be issued upon the conversion of a 20% OID subordinated promissory note in the principal

amount of $625,000 that may be converted into common shares only if an event of default occurs

under such note. The warrant and the note contain ownership limitations, such

that we shall not effect any exercise or conversion, and the holder shall not have the right

to exercise or convert, any portion of the warrant or note to the extent that after giving

effect to the issuance of common shares upon exercise or conversion, such holder, together

with its affiliates and any other persons acting as a group together with such holder or

any of its affiliates, would beneficially own in excess of 4.99% of the number of common

shares outstanding immediately after giving effect to the issuance of common shares upon

exercise or conversion, which such percentage may be increased or decreased by the holder,

but not in excess of 9.99%, upon at least 61 days’ prior notice to us.

Therefore, we have reduced the applicable percentage to 4.99%. Altium

Capital Management, LP, the investment manager of Altium Growth Fund, LP, has voting and

investment power over these securities. Jacob Gottlieb is the managing member of Altium Capital

Growth GP, LLC, which is the general partner of Altium Growth Fund, LP. Each of Altium Growth

Fund, LP and Jacob Gottlieb disclaims beneficial ownership over these securities. The principal

address of Altium Capital Management, LP is 152 West 57th Street, 20th Floor, New York, NY

10019. Altium Capital Management LP also holds a warrant for the purchase of 8,197

common shares. |

PLAN

OF DISTRIBUTION

The

selling shareholders and any of their pledgees, donees, transferees, assignees and successors-in-interest may, from time to time, sell

any or all of their common shares on any stock exchange, market or trading facility on which the shares are traded or quoted or in private

transactions. These sales will occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing

market prices, or at negotiated prices.

The

selling shareholders may use any one or more of the following methods when selling shares:

| ● | ordinary

brokerage transactions and transactions in which the broker-dealer solicits investors; |

| ● | block

trades in which the broker-dealer will attempt to sell the shares as agent but may position

and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| ● | an

exchange distribution in accordance with the rules of the applicable exchange; |

| ● | privately

negotiated transactions; |

| ● | through

the writing of options on the shares; |

| ● | to

cover short sales made after the date that the registration statement of which this prospectus

is a part is declared effective by the SEC; |

| ● | broker-dealers

may agree with the selling shareholders to sell a specified number of such shares at a stipulated

price per share; and |

| ● | a

combination of any such methods of sale. |

The

selling shareholders may also sell shares under Rule 144 of the Securities Act, if available, rather than under this prospectus. The

selling shareholders shall have the sole and absolute discretion not to accept any purchase offer or make any sale of shares if it deems

the purchase price to be unsatisfactory at any particular time.

The

selling shareholders or their respective pledgees, donees, transferees or other successors in interest, may also sell the shares directly

to market makers acting as principals and/or broker-dealers acting as agents for themselves or their customers. Such broker-dealers may

receive compensation in the form of discounts, concessions or commissions from the selling shareholders and/or the purchasers of shares

for whom such broker-dealers may act as agents or to whom they sell as principal or both, which compensation as to a particular broker-dealer

might be in excess of customary commissions. Market makers and block purchasers purchasing the shares will do so for their own account

and at their own risk. It is possible that a selling shareholder will attempt to sell shares in block transactions to market makers or

other purchasers at a price per share which may be below the then existing market price. We cannot assure that all or any of the shares

offered in this prospectus will be issued to, or sold by, the selling shareholders. The selling shareholders and any brokers, dealers

or agents, upon effecting the sale of any of the shares offered in this prospectus, may be deemed to be “underwriters” as

that term is defined under the Securities Act, the Exchange Act and the rules and regulations of such acts. In such event, any commissions

received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act.

We

are required to pay all fees and expenses incident to the registration of the shares, including fees and disbursements of counsel to

the selling shareholders, but excluding brokerage commissions or underwriter discounts.

The

selling shareholders, alternatively, may sell all or any part of the shares offered in this prospectus through an underwriter. The selling

shareholders have not entered into any agreement with a prospective underwriter and there is no assurance that any such agreement will

be entered into.

The

selling shareholders may pledge their shares to their brokers under the margin provisions of customer agreements. If a selling shareholder

defaults on a margin loan, the broker may, from time to time, offer and sell the pledged shares. The selling shareholders and any other

persons participating in the sale or distribution of the shares will be subject to applicable provisions of the Exchange Act, and the

rules and regulations under such act, including, without limitation, Regulation M. These provisions may restrict certain activities of,

and limit the timing of purchases and sales of any of the shares by, the selling shareholders or any other such person. In the event

that any of the selling shareholders are deemed an affiliated purchaser or distribution participant within the meaning of Regulation

M, then the selling shareholders will not be permitted to engage in short sales of common shares. Furthermore, under Regulation M, persons

engaged in a distribution of securities are prohibited from simultaneously engaging in market making and certain other activities with

respect to such securities for a specified period of time prior to the commencement of such distributions, subject to specified exceptions

or exemptions. In addition, if a short sale is deemed to be a stabilizing activity, then the selling shareholders will not be permitted

to engage in a short sale of our shares. All of these limitations may affect the marketability of the shares.

If

a selling shareholder notifies us that it has a material arrangement with a broker-dealer for the resale of the shares, then we would

be required to amend the registration statement of which this prospectus is a part, and file a prospectus supplement to describe the

agreements between the selling shareholder and the broker-dealer.

LEGAL

MATTERS

The

validity of the securities offered hereby will be passed upon for us by Bevilacqua PLLC, Washington, DC.

As

of the date of this prospectus, Louis A. Bevilacqua, the managing member of Bevilacqua PLLC, owns 719 common shares. Mr. Bevilacqua also

owns approximately 9% of 1847 Partners Class A Member LLC and 10% of 1847 Partners Class B Member LLC. Mr. Bevilacqua received these

securities as partial consideration for legal services previously provided to us.

EXPERTS

Our

financial statements for the years ended December 31, 2023 and 2022 have been incorporated by reference in this prospectus in reliance

upon the report of Sadler, Gibb & Associates, LLC, an independent registered public accounting firm, upon the authority of said firm

as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public over the Internet at the SEC’s website at www.sec.gov. Copies of certain information filed by us with the SEC are also available

on our website at www.1847holdings.com. Information accessible on or through our website is not a part of this prospectus.

This

prospectus is part of a registration statement that we filed with the SEC and does not contain all of the information in the registration

statement. You should review the information and exhibits in the registration statement for further information on us and our consolidated

subsidiaries and the securities that we are offering. Statements in this prospectus about these documents are summaries and each statement

is qualified in all respects by reference to the document to which it refers. You should read the actual documents for a more complete

description of the relevant matters.

DOCUMENTS

INCORPORATED BY REFERENCE

The

SEC allows us to incorporate by reference much of the information that we file with the SEC, which means that we can disclose important

information to you by referring you to those publicly available documents. The information that we incorporate by reference in this prospectus

is considered to be part of this prospectus. Because we are incorporating by reference future filings with the SEC, this prospectus is

continually updated and those future filings may modify or supersede some of the information included or incorporated by reference in

this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine if any of the

statements in this prospectus or in any document previously incorporated by reference have been modified or superseded. This prospectus

incorporates by reference the documents listed below and any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d)

of the Exchange Act (in each case, other than those documents or the portions of those documents furnished pursuant to Items 2.02 or

7.01 of any Current Report on Form 8-K and, except as may be noted in any such Form 8-K, exhibits filed on such form that are related

to such information), until the offering of the securities under the registration statement of which this prospectus forms a part is

terminated or completed:

| ● | our

Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on April 25, 2024; |

| ● | our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 filed with the SEC on May 15, 2024; |

| ● | our

Definitive Proxy Statement on Schedule 14A filed on April 29, 2024. |

We

undertake to provide without charge to each person (including any beneficial owner) who receives a copy of this prospectus, upon written

or oral request, a copy of all of the preceding documents that are incorporated by reference (other than exhibits, unless the exhibits

are specifically incorporated by reference into these documents). We will provide to each person, including any beneficial owner, to

whom a prospectus is delivered, a copy of any or all of the reports or documents that we incorporate by reference in

this prospectus contained in the registration statement (except exhibits to the documents that are not specifically incorporated by reference)

at no cost to you, by writing or calling us at:

1847

Holdings LLC

590

Madison Avenue, 21st Floor

New

York, NY 10022

Attn:

Secretary

(212)

417-9800

1,394,052

Common Shares

1847

HOLDINGS LLC

PROSPECTUS

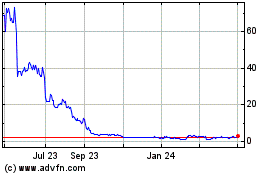

1847 (AMEX:EFSH)

Historical Stock Chart

From Dec 2024 to Jan 2025

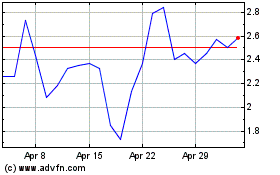

1847 (AMEX:EFSH)

Historical Stock Chart

From Jan 2024 to Jan 2025