0001826889falseBeachbody Company, Inc.00018268892024-04-052024-04-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): April 05, 2024 |

The Beachbody Company, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39735 |

85-3222090 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

400 Continental Blvd Suite 400 |

|

El Segundo, California |

|

90245 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (310) 883-9000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

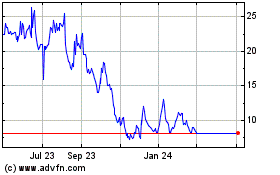

Class A Common Stock, par value $0.0001 per share |

|

BODI |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Financing Agreement Amendment

On April 5, 2024 (the “Closing Date”), Beachbody, LLC (the “Borrower”), a subsidiary of The Beachbody Company, Inc. (the “Company”), the lenders party thereto and Blue Torch Finance, LLC (“Blue Torch”), as collateral agent and as administrative agent, entered into that certain Amendment No. 5 to Financing Agreement (the “Fifth Amendment”), which amended the Company’s existing Financing Agreement, dated as of August 8, 2022 (as previously amended, the “Financing Agreement”), by and among the Company, the Borrower, the lenders party thereto from time to time and Blue Torch, as collateral agent and as administrative agent, which provided for a senior secured term loan facility in an original aggregate principal amount of $50.0 million (the “Credit Facility”).

The Fifth Amendment, among other things, amends certain terms of the Financing Agreement, including without limitation, (i) the minimum revenue financial covenant thereunder, such that the minimum revenue levels shall be (A) $100.0 million for each fiscal quarter ending after the Closing Date and on or prior to December 31, 2024 and (B) $110.0 million for each fiscal quarter ending thereafter and on or prior to December 31, 2025; and (ii) the minimum liquidity financial covenant thereunder, such that the minimum liquidity levels shall be $18.0 million at all times from and after the Closing Date through the maturity of the Credit Facility.

In connection with the Fifth Amendment, on the Closing Date, the Borrower made a partial prepayment of the term loans under the Credit Facility in an aggregate principal amount of $4.0 million, together with accrued interest thereon and a related prepayment premium of $120,000.

The foregoing summary of the Fifth Amendment is qualified in its entirety by reference to the full text of the Fifth Amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Warrant Amendment

In connection with the Fifth Amendment, the Company also amended and restated the warrants to purchase 97,482 shares of the Company’s Class A common stock, par value $0.0001 per share (“Class A Common Stock”), originally issued to affiliates of the lenders and Blue Torch (the “Blue Torch Warrants”) (the “Warrant Second Amendment”). The Warrant Second Amendment amends the exercise price of the warrants from $20.50 per share of Class A Common Stock to $9.16 per share.

The foregoing summary of the Warrant Second Amendment is qualified in its entirety by reference to the full text of the form of the Second Amended and Restated Warrant to Purchase Stock, which is filed as Exhibit 10.2 to this Current Report on Form 8-K and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On April 8, 2024, the Company issued a press release announcing the entry into the Fifth Amendment and the Warrant Second Amendment as described above in Item 1.01 of this Current Report on Form 8-K. The full text of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

In accordance with General Instruction B.2 of Form 8-K, the information contained or incorporated in this Item 7.01, including the press release furnished herewith as Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

The Beachbody Company, Inc. |

|

|

|

|

Date: |

April 8, 2024 |

By: |

/s/ Jonathan Gelfand |

|

|

|

Jonathan Gelfand

Executive Vice President, Business& Legal Affairs, Corporate Secretary |

AMENDMENT NO. 5 TO Financing AGREEMENT

This AMENDMENT NO. 5 TO FINANCING AGREEMENT (this “Agreement”) dated as of April 5, 2024 (the “Amendment No. 5 Effective Date”), is made by and among Beachbody, LLC, a Delaware limited liability company (the “Borrower”), the lenders party hereto (each a “Lender” and collectively, the “Lenders”), Blue Torch Finance, LLC, a Delaware limited liability company (“Blue Torch”), as collateral agent for the Lenders (in such capacity, together with its permitted successors and assigns in such capacity, the “Collateral Agent”) and Blue Torch, as administrative agent for the Lenders (in such capacity, together with its permitted successors and assigns in such capacity, the “Administrative Agent” and together with the Collateral Agent, each an “Agent” and collectively, the “Agents”).

WHEREAS, the Borrower, the Parent, the other Guarantors and the Lenders party thereto from time to time, the Administrative Agent and the Collateral Agent are party to that certain Financing Agreement, dated as of August 8, 2022 (as amended by that certain Amendment No. 1 to Financing Agreement, dated as of October 4, 2022, that certain Amendment No. 2 to Financing Agreement, dated as of July 24, 2023, that certain Consent No. 1 and Amendment No. 3 to Financing Agreement, dated as of January 9, 2024, and that certain Consent No. 2 and Amendment No. 4 to Financing Agreement, dated as of February 29, 2024, and as further amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Financing Agreement”).

NOW THEREFORE, in consideration of the premises and covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto hereby agree as follows:

Section 1. Definitions. Except as otherwise defined in this Agreement, terms defined in the Financing Agreement, after giving effect to this Agreement, are used herein as defined therein. This Agreement shall constitute a Loan Document for all purposes of the Financing Agreement and the other Loan Documents.

Section 2. Amendments. Subject to the satisfaction of the conditions precedent specified in Section 4 below, effective as of the Amendment No. 5 Effective Date:

(a) Section 1.01 of the Financing Agreement is hereby amended by adding the following definitions in proper alphabetical order:

““Amendment No. 5” means that certain Amendment No. 5 to Financing Agreement, dated as of April 5, 2024, by and among the Borrower, the Collateral Agent, the Administrative Agent and the Lenders party thereto.”

““Amendment No. 5 Effective Date” means the Amendment No. 5 Effective Date, as such term is defined in Amendment No. 5.”

““Amendment No. 5 Prepayment Amount” means the Amendment No. 5 Prepayment Amount, as such term is defined in Amendment No. 5.”

““Second Amendment Prepayment Amount” means the Second Amendment Prepayment Amount, as such term is defined in the Second Amendment.”

(b) The definition of “Excess Cash Flow” contained in Section 1.01 of the Financing Agreement is hereby amended and restated in its entirety as follows:

““Excess Cash Flow” means, with respect to any Person for any period, (a) Consolidated EBITDA of such Person and its Subsidiaries for such period, less (b) the sum of, without duplication, (i) the Second Amendment Prepayment Amount, the Amendment No. 5 Prepayment Amount and all scheduled principal payments (excluding any principal payments made pursuant to Section 2.05(b)) on the Loans made during such period, and all scheduled principal payments on Indebtedness (other than Indebtedness incurred under this Agreement) of such Person or any of its Subsidiaries during such period to the extent such other Indebtedness is permitted to be incurred, and such payments are permitted to be made, under this Agreement (but, in the case of revolving loans, only to the extent that the revolving credit commitment in respect thereof is permanently reduced by the amount of such payments), (ii) all Consolidated Net Interest Expense to the extent paid or payable in cash during such period, (iii) the cash portion of Capital Expenditures made by such Person and its Subsidiaries during such period to the extent permitted to be made under this Agreement (excluding Capital Expenditures to the extent financed through the incurrence of Indebtedness), (iv) taxes paid in cash by such Person and its Subsidiaries for such period, (v) all cash expenses, cash charges, cash losses and other cash items that were added back in the determination of Consolidated EBITDA for such period, (vi) the excess, if any, of Working Capital at the end of such period over Working Capital at the beginning of such period (or minus the excess, if any, of Working Capital at the beginning of such period over Working Capital at the end of such period), (vii) to the extent financed from Internally Generated Cash of Parent or any Subsidiary, (A) an amount equal to the cash portion of any aggregate net loss on the Disposition of property (other than accounts and Inventory) outside the ordinary course of business to the extent such amounts are added to Consolidated Net Income in the determination of Consolidated EBITDA for such period, (B) an amount equal to the aggregate net non-cash gain on Dispositions by Parent or any Subsidiary during such period (other than Dispositions in the ordinary course of business) to the extent included in arriving at Consolidated Net Income for such period and the net cash loss on Dispositions to the extent such amounts are otherwise added to arrive at Consolidated Net Income for such period, (C) the amount of Investments made in cash pursuant to clause (dd) of the definition of “Permitted Investments” during such period so long as such Investment is made in an unaffiliated third party, (D) the aggregate amount of any premium, make-whole or penalty payments actually paid in cash by Parent and its Subsidiaries during such period that are made in connection with any payment, prepayment or redemption of Indebtedness to the extent such payments are not expensed during such period or are not deducted in calculating Consolidated Net Income, (E) the amount of Restricted Payments paid in cash during such period pursuant to clauses (a), (b), (f) and (g) of the definition of Permitted Restricted Payments, in each case to the extent financed with Internally Generated Cash of Parent or any Subsidiary, and (F) the aggregate amount of expenditures in respect of obligations under derivative instruments actually paid in cash by Parent and its Subsidiaries during such period to the extent such payments are not deducted in calculating Consolidated Net Income.

Notwithstanding anything in the definition of any term used in the definition of “Excess Cash Flow” to the contrary, all components of Excess Cash Flow shall be computed for Parent and its Subsidiaries on a consolidated basis.”

(c) Section 7.03(a) of the Financing Agreement is hereby amended and restated in its entirety as follows:

“(a) Minimum Revenue. Permit Revenues of the Parent and its Subsidiaries for any fiscal quarter period of the Parent set forth below, calculated as of the last day of such fiscal quarter, to be less than the amount set forth opposite such date, as evidenced by the financial statements delivered or required to be delivered for such fiscal quarter pursuant to Section 7.01(a)(ii):

|

|

Quarter Ending |

Minimum Revenues |

September 30, 2022 (for the fiscal quarter then ended) |

$133,000,000 |

December 31, 2022 (for the two consecutive fiscal quarter period then ended) |

$263,000,000 |

March 31, 2023 (for the three consecutive fiscal quarter period then ended) |

$386,000,000 |

For the standalone fiscal quarter ended June 30, 2023 |

$100,000,000 |

For the standalone fiscal quarter ended September 30, 2023 |

$100,000,000 |

For the standalone fiscal quarter ended December 31, 2023 |

$100,000,000 |

For the standalone fiscal quarter ended March 31, 2024 |

$100,000,000 |

For the standalone fiscal quarter ended June 30, 2024 |

$100,000,000 |

For the standalone fiscal quarter ended September 30, 2024 |

$100,000,000 |

For the standalone fiscal quarter ended December 31, 2024 |

$100,000,000 |

For the standalone fiscal quarter ended March 31, 2025 |

$110,000,000 |

For the standalone fiscal quarter ended June 30, 2025 |

$110,000,000 |

For the standalone fiscal quarter ended September 30, 2025 |

$110,000,000 |

For the standalone fiscal quarter ended December 31, 2025 |

$110,000,000” |

(d) Section 7.03(b) of the Financing Agreement is hereby amended and restated in its entirety as follows:

“(b) Liquidity. Permit Liquidity to be less than (i) at any time from the period commencing on the Effective Date through and including December 31, 2022, $10,000,000, (ii) at any time from the period commencing January 1, 2023 through the Second Amendment Effective Date, $12,500,000, (iii) at any time from the period commencing on the Second Amendment Effective Date through the Consent Effective Date, $20,000,000, (iv) at any time from the period commencing on the Consent Effective Date through the Consent No. 2 Effective Date, $19,000,000, (v) at any time from the period commencing on the Consent No. 2 Effective Date through and including March 31, 2024, $17,000,000, (vi) at any time from the period commencing April 1, 2024 through the Amendment No. 5 Effective Date, $22,000,000 and (vii) at any time from the period commencing on the Amendment No. 5 Effective Date through and including the Final Maturity Date, $18,000,000.”

Section 3. Representations and Warranties. The Borrower represents and warrants to each Agent and the Lenders that, as of the date of this Agreement, after giving effect to the terms of this Agreement:

(a) the representations and warranties contained in Article VI of the Financing Agreement and in each other Loan Document, certificate or other writing delivered to any Secured Party pursuant thereto on or prior to the Amendment No. 5 Effective Date are true and correct in all material respects (except for representations and warranties that are already qualified by materiality, which representations and warranties are true and correct in all respects) on and as of the Amendment No. 5 Effective Date as though made on and as of such date, except to the extent that any such representation or warranty expressly relates solely to an earlier date (in which case such representation or warranty is true and correct in all material respects (except for representations and warranties that are already qualified by materiality, which representations and warranties are true and correct in all respects) on and as of such earlier date); and

(b) no Default or Event of Default has occurred and is continuing on the Amendment No. 5 Effective Date or would result from this Agreement becoming effective in accordance with its terms.

Section 4. Conditions Precedent. The amendments set forth in Section 2 hereof shall become effective upon satisfaction of the following conditions:

(a) Execution. The Agents (or their counsel) shall have received from the Borrower and each Lender party to the Financing Agreement constituting Required Lenders either (i) a counterpart of this Agreement signed on behalf of such party or (ii) written evidence satisfactory to the Agents (which may include telecopy or electronic transmission (e.g., “pdf”) of a signed signature page of this Agreement) that such party has signed a counterpart of this Agreement;

(b) PIK Amendment Fee. The Administrative Agent shall have received from the Borrower for the account of each Initial Term Loan Lender signatory hereto holding outstanding Initial Term Loans immediately prior to the Amendment No. 5 Effective Date a fee (the “PIK Amendment Fee”) in an amount equal to 2.00% of the aggregate outstanding principal amount of the Initial Term Loans held by such Initial Term Lender immediately prior to giving effect to this Agreement and the prepayment set forth in clause (c) below, which fee will be paid in-kind in the form of an increased amount of Initial Term Loan of such Initial Term Loan Lender in accordance with Section 7 hereof;

(c) Prepayment. On or prior to the Amendment No. 5 Effective Date, the Borrower shall have, pursuant to Section 2.05(b)(i) of the Financing Agreement, voluntarily prepaid to the Administrative Agent, for the ratable account of each Lender, the Initial Term Loans in an aggregate principal amount equal to $4,000,000 (the “Amendment No. 5 Prepayment Amount”), together with (A) payment in cash of all accrued interest (other than the Term Loan PIK Amount, which shall be capitalized in accordance with Section 2.04(a) of the Financing Agreement) to the date of such payment on the aggregate principal amount of Initial Term Loans so prepaid (i.e., $11,075.04) and (B) the Prepayment Premium in an amount equal to three percent (3.0%) of such aggregate principal amount of Initial Term Loans so prepaid (i.e., $120,000) (for the avoidance of doubt, the sum of the Amendment No. 5 Prepayment Amount plus the amounts set forth in clauses (A) and (B) above shall be $131,075.04); it being understood and agreed that, (i) notwithstanding anything set forth in the Financing Agreement to the contrary (including Section 2.05(b)(i) thereof), the Amendment No. 5 Prepayment Amount shall be applied to reduce the payment of Initial Term Loans required to be repaid on the Final Maturity Date pursuant to Section 2.03 of the Financing Agreement and shall not be applied to reduce the amount of any scheduled installment of principal and (ii) as of the Amendment No. 5 Effective Date, after giving effect to the Amendment No. 5 Prepayment Amount and the capitalization of the PIK Amendment Fee in accordance with Section 7 hereof, the outstanding principal amount of the Initial Term Loans is $24,844,164.59;

(d) Amendment to Warrants. Blue Torch shall have received from the Borrower duly executed amended and restated Warrants, in form and substance satisfactory to Blue Torch;

(e) Amendment No. 5 Effective Date Certificate. The Borrower shall have delivered to the Administrative Agent a certificate signed by an Authorized Officer of the Borrower certifying as to the matters specified in Sections 3(a) and (b) above; and

(f) Payment of Fees and Expenses. The Agents shall have received reimbursement or payment of all reasonable and documented out-of-pocket expenses required to be reimbursed or paid by the Borrower pursuant to the Financing Agreement (including the fees, disbursements and other charges of Milbank LLP, as counsel to the Administrative Agent, Collateral Agent and the Lenders), in each case to the extent invoiced to the Borrower at least one (1) Business Day prior to the Amendment No. 5 Effective Date.

Section 5. No Novation or Mutual Departure. The Borrower expressly acknowledges and agrees that there has not been, and this Agreement does not constitute or establish, a novation with

respect to the Financing Agreement or any other Loan Document, or a mutual departure from the strict terms, provisions, and conditions thereof, other than as specified herein. Except as otherwise expressed herein, the execution, delivery and effectiveness of this Agreement shall not operate as a waiver of any right, power or remedy of Administrative Agent, the Collateral Agent and the Lenders under the Financing Agreement or any of the other Loan Documents, nor constitute a waiver of any provision of the Financing Agreement or any of the other Loan Documents. Except as set forth herein, the Financing Agreement and all other Loan Documents shall remain unchanged and in full force and effect and the Borrower hereby ratifies and confirms its obligations thereunder as of the date hereof. This Agreement shall not constitute a course of dealing between the Loan Parties, on the one hand, and the Administrative Agent, the Collateral Agent and the Lenders, on the other hand, at variance with the Financing Agreement or any other Loan Document such as to require further notice by the Administrative Agent, the Collateral Agent and the Lenders to any Loan Party to require strict compliance with the terms of the Financing Agreement and the other Loan Documents in the future, except as expressly set forth herein.

Section 6. Confirmation. The Borrower (a) confirms its obligations under the Loan Documents as of the date hereof, (b) confirms that its obligations under the Financing Agreement as modified and expanded hereby are entitled to the benefits of the pledges set forth in the Loan Documents, (c) confirms that its obligations under the Financing Agreement as modified and expanded hereby constitute Obligations and (d) agrees that the Financing Agreement as modified hereby is the Financing Agreement under and for all purposes of the Loan Documents. Each party, by its execution of this Agreement, hereby confirms that the Obligations shall remain in full force and effect as of the date hereof, and such Obligations shall continue to be entitled to the benefits of the grant set forth in the Collateral Documents.

Section 7. PIK Amendment Fee. Notwithstanding anything contained in the Financing Agreement to the contrary, the PIK Amendment Fee payable to each Initial Term Lender shall, on the Amendment No. 5 Effective Date, be fully earned and payable and on such date shall be capitalized and added to the aggregate principal amount of the Initial Term Loans held by such Initial Term Lender and the Administrative Agent shall update the Register to reflect such capitalization of the PIK Amendment Fee of the Initial Term Lenders.

Section 8. Release.

The Borrower, on behalf of itself and its Subsidiaries, and each of their successors, representatives and assignees (each, a “Releasing Party” and collectively, the “Releasing Parties”), does hereby fully, finally, and forever remise, release and discharge, and shall be deemed to have forever remised, released and discharged, the Agents and the Lenders, and each Agent’s and each Lender’s respective successors, assignees and past, present and future Related Parties (collectively hereinafter the “Lender Parties”), from any and all manner of action and actions, cause and causes of action, claims, defenses (other than the defense of payment), rights of setoff, charges, demands, counterclaims, suits, debts, obligations, liabilities, dues, sums of money, accounts, reckonings, bonds, bills, specialties, covenants, contracts, controversies, damages, judgments, expenses, executions, liens, claims of liens, claims of costs, penalties, attorneys’ fees, or any other compensation, recovery or relief on account of any liability, obligation, demand or cause of action of whatever nature, whether in law, equity or otherwise (including interest or other carrying costs, penalties, legal, accounting and other professional fees and expenses, and incidental, consequential and punitive damages payable to third parties), whether known or unknown, fixed or contingent, joint and/or several, secured or unsecured, due or not due, primary or secondary, liquidated or unliquidated, contractual or tortious, direct, indirect, or derivative, asserted or unasserted, foreseen or unforeseen, suspected or unsuspected, which such Releasing Party has ever had or now has against any of the Lender Parties, whether held in a personal or representative capacity, in each case, on or prior to the Amendment No. 5 Effective Date, which are based on any act, circumstance, fact, event or omission or other matter, cause or thing in any way, directly or indirectly, arising out of, connected with, in respect of

or relating to the Financing Agreement or any other Loan Document and the transactions contemplated thereby, and all other agreements, certificates, instruments and other documents and statements (whether written or oral) related to any of the foregoing; provided that, for the avoidance of doubt, nothing in this paragraph shall release any obligations of the Lender Parties under the Loan Documents (or any other related agreements, instruments or documents) arising after the Amendment No. 5 Effective Date.

Section 9. Miscellaneous.

(a) This Agreement shall be limited as written and nothing herein shall be deemed to constitute an amendment or waiver of any other term, provision or condition of any of the Loan Documents in any other instance than as expressly set forth herein or prejudice any right or remedy that any Lender or any Agent may now have or may in the future have under any of the Loan Documents. Except as herein provided, the Financing Agreement shall remain unchanged and in full force and effect. This Agreement, the Financing Agreement, the Security Agreement and the other Loan Documents constitute the entire agreement among the parties with respect to the subject matter hereof and thereof and supersede all other prior agreements and understandings, both written and verbal, among the parties or any of them with respect to the subject matter hereof. This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one and the same amendatory instrument and any of the parties hereto may execute this Agreement by signing any such counterpart. Delivery of a counterpart by electronic transmission shall be effective as delivery of a manually executed counterpart hereof. The provisions of Section 12.08 of the Financing Agreement are hereby incorporated herein, mutatis mutandis.

(b) THIS AGREEMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES HEREUNDER SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK APPLICABLE TO CONTRACTS MADE AND TO BE PERFORMED IN THE STATE OF NEW YORK.

(c) Each of the undersigned Lenders, by its execution hereof, authorizes and directs the Administrative Agent and the Collateral Agent to execute and deliver this Agreement upon the satisfaction of the conditions precedent described above (which shall be conclusively evidenced by such Lender’s execution hereof).

[Signature pages follow]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and delivered as of the day and year first above written.

|

|

|

|

BORROWER: |

|

|

|

BEACHBODY, LLC |

|

By: |

/s/ Marc Suidan |

|

|

Name: Marc Suidan |

|

|

Title: Chief Financial Officer |

|

|

|

|

|

|

|

COLLATERAL AGENT AND ADMINISTRATIVE AGENT: BLUE TORCH FINANCE, LLC |

|

|

|

|

|

By: |

/s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

|

|

|

LENDERS: |

|

|

|

BTC HOLDINGS FUND II LLC |

|

By: |

Blue Torch Credit Opportunities Fund II LP, its sole member |

|

By: |

Blue Torch Credit Opportunities GP II LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

BTC OFFSHORE HOLDINGS FUND II-B LLC |

|

By: |

Blue Torch Offshore Credit Opportunities Master Fund II LP, its sole member |

|

By: |

Blue Torch Offshore Credit Opportunities GP II LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

BTC OFFSHORE HOLDINGS FUND II-C LLC |

|

By: |

Blue Torch Offshore Credit Opportunities Master Fund II LP, its sole member |

|

By: |

Blue Torch Offshore Credit Opportunities GP II LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

BTC HOLDINGS SBAF FUND LLC |

|

By: |

Blue Torch Credit Opportunities SBAF Fund LP, its sole member |

|

By: |

Blue Torch Credit Opportunities SBAF GP LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

|

|

|

BTC HOLDINGS SBAF FUND-B LLC |

|

By: |

Blue Torch Credit Opportunities SBAF Fund LP, its sole member |

|

By: |

Blue Torch Credit Opportunities SBAF GP LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

BTC HOLDINGS KRS FUND LLC |

|

By: |

Blue Torch Credit Opportunities KRS Fund LP, its sole member |

|

By: |

Blue Torch Credit Opportunities KRS GP LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

BLUE TORCH CREDIT OPPORTUNITIES FUND III LP |

|

By: |

Blue Torch Credit Opportunities GP III LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

|

|

|

BTC OFFSHORE HOLDINGS FUND III LLC |

|

By: |

Blue Torch Offshore Credit Opportunities Master Fund III LP, its sole member |

|

By: |

Blue Torch Offshore Credit Opportunities GP III LLC, its general partner |

|

By: |

KPG BTC Management LLC, its managing member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

|

|

|

|

|

|

|

BTC HOLDINGS SC FUND LLC |

|

By: |

Blue Torch Credit Opportunities SC Master Fund LP, its sole member |

|

By: |

Blue Torch Credit Opportunities SC GP LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

|

|

|

BTC HOLDINGS FUND III LLC |

|

By: |

Blue Torch Credit Opportunities Fund III LP, its Sole Member |

|

By: |

Blue Torch Credit Opportunities GP III LLC, its General Partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

|

|

|

|

BLUE TORCH CREDIT OPPORTUNITIES FUND II LP |

|

By: |

Blue Torch Credit Opportunities GP II LLC, its general partner |

|

By: |

KPG BTC Management LLC, its sole member /s/ Kevin Genda |

|

|

Name: Kevin Genda |

|

|

Title: Managing Member |

THIS WARRANT AND THE SHARES ISSUABLE HEREUNDER HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR THE SECURITIES LAWS OF ANY STATE AND, EXCEPT AS SET FORTH IN SECTIONS 5.4 AND 5.5 BELOW, MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED UNLESS AND UNTIL REGISTERED UNDER SAID ACT AND LAWS OR, IN THE OPINION OF LEGAL COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE ISSUER, SUCH OFFER, SALE, PLEDGE OR OTHER TRANSFER IS EXEMPT FROM SUCH REGISTRATION.

SECOND AMENDED AND RESTATED WARRANT TO PURCHASE STOCK

Company: The Beachbody Company, Inc., a Delaware corporation

Number of Shares: [●], subject to adjustment as provided herein

Class: Class A Common Stock, $0.0001 par value per share

Warrant Price: $9.16 per Share, subject to adjustment as provided herein

Original Issue Date: August 8, 2022

Amended and Restated Date: July 24, 2023

Second Amended and Restated Date: April 5, 2024

Expiration Date: August 8, 2029 See also Section 5.1(c).

THIS SECOND AMENDED AND RESTATED WARRANT TO PURCHASE STOCK (“WARRANT”) CERTIFIES THAT, for good and valuable consideration, [●] (together with any successor or permitted assignee or transferee of this Warrant or of any shares issued upon exercise hereof, “Holder”) is entitled to purchase up to the number set forth above, of fully paid and non-assessable shares (subject to adjustment as provided herein, the “Shares”) of Class A Common Stock (“Class A Common Stock”) of The Beachbody Company, Inc., a Delaware corporation (the “Company”) at a purchase price per share of $9.16 (“Warrant Price”), all as set forth above and as adjusted pursuant to Section 2 of this Warrant, subject to the provisions and upon the terms and conditions set forth in this Warrant. This Warrant amends and restates in its entirety that certain Amended and Restated Warrant to Purchase Stock, dated as of the Amended and Restated Date (the “Existing Warrant”) and is effective as of the Original Issue Date. Upon the effectiveness of this Warrant, the Existing Warrant shall be of no further force or effect.

1.1Method of Exercise. Holder may at any time and from time to time exercise this Warrant, for all or any part of the unexercised Vested Shares (as defined below), by delivering to the Company the original of this Warrant together with a duly executed Notice of Exercise in substantially the form attached hereto as Appendix 1 via delivery in accordance with Section 5.9

and, unless Holder is exercising this Warrant pursuant to a cashless exercise set forth in Section 1.2, a check, wire transfer of same-day funds (to an account designated by the Company), or other form of payment acceptable to the Company for the aggregate Warrant Price for the Shares being purchased.

1.2Cashless Exercise. On any exercise of this Warrant, in lieu of payment of the aggregate Warrant Price in the manner as specified in Section 1.1 above, but otherwise in accordance with the requirements of Section 1.1, Holder may elect to receive Vested Shares equal to the value of this Warrant, or portion thereof as to which this Warrant is being exercised. Thereupon, the Company shall issue to the Holder such number of fully paid and non-assessable Shares as are computed using the following formula:

X = Y(A-B)/A

where:

X = the number of Vested Shares to be issued to the Holder;

Y = the number of Vested Shares with respect to which this Warrant is being exercised (inclusive of the Vested Shares surrendered to the Company in payment of the aggregate Warrant Price);

A = the Fair Market Value (as determined pursuant to Section 1.3 below) of one Share; and

B = the Warrant Price.

1.3Fair Market Value. Except in the event of an exercise in connection with an Acquisition, if shares of Class A Common Stock are then traded or quoted on a nationally recognized securities exchange, inter-dealer quotation system or over-the-counter market (a “Trading Market”), the “Fair Market Value” of a Share shall be (i) the closing price or last sale price of a share of Class A Common Stock reported for the Business Day immediately before the date of determination (which, for the avoidance of doubt, in the case of a cashless exercise pursuant to Section 1.2, shall be the date on which the Holder delivers this Warrant together with its Notice of Exercise to the Company) or (ii) solely for purposes of Section 2.1, in the case of an underwritten public offering, the price per share in such offering. If shares of Class A Common Stock are not then traded in a Trading Market, the “Fair Market Value” of a Share shall be determined in good faith by the Board of Directors of the Company (the “Board”); provided, that if Holder disagrees with the Fair Market Value as determined by the Board, Holder may require a determination of the Fair Market Value to be made by a nationally recognized investment banking, accounting or valuation firm that is not affiliated with Holder, in which case, the determination of such firm shall be final and conclusive. The documented out-of-pocket fees and expenses incurred in obtaining such valuation shall be borne by the Company. In the event that this Warrant is exercised in connection with an Acquisition, the Fair Market Value per Share shall be the consideration to be paid or distributed in respect of each share of Class A Common Stock of the Company in connection with such Acquisition.

1.4Delivery of Certificate and New Warrant. Within a reasonable time after Holder exercises this Warrant in the manner set forth in Section 1.1 or 1.2 above, the Company shall deliver to Holder a certificate representing the Shares issued to Holder upon such exercise and, if this Warrant has not been fully exercised and has not expired, the Company shall issue a new warrant representing the Shares not so acquired, and such new warrant (i) shall be of like tenor with this Warrant, (ii) shall represent, as indicated on the face of such new Warrant, the right to purchase the Shares then underlying this Warrant (or in the case of a new Warrant being issued pursuant to Section 1.5, the Shares designated by the Holder which, when added to the number of shares of Common Stock underlying the other new Warrants issued in connection with such issuance, does not exceed the number of Shares then underlying this Warrant), (iii) shall have an issuance date, as indicated on the face of such new Warrant which is the same as the Original Issue Date, and (iv) shall have the same rights and conditions as this Warrant.

1.5Replacement of Warrant. On receipt of evidence reasonably satisfactory to the Company of the loss, theft, destruction or mutilation of this Warrant and, in the case of loss, theft or destruction, on delivery of an indemnity agreement reasonably satisfactory in form, substance and amount to the Company or, in the case of mutilation, on surrender of this Warrant to the Company for cancellation, the Company shall, within a reasonable time, execute and deliver to Holder, in lieu of this Warrant, a new warrant of like tenor and amount.

1.6Treatment of Warrant Upon Acquisition of Company.

(a)Acquisition. For the purpose of this Warrant, “Acquisition” means any transaction or series of related transactions involving: (i) the sale, lease, exclusive license, or other disposition of all or substantially all of the assets of the Company; (ii) any merger, business combination or consolidation of the Company into or with another Person or entity (other than a merger or consolidation effected exclusively to change the Company’s domicile), or any other corporate reorganization, in which the stockholders of the Company in their capacity as such immediately prior to such merger, consolidation or reorganization, own less than a majority of the Company’s (or the surviving or successor entity’s) outstanding voting power immediately after such merger, consolidation or reorganization (or, if such Company stockholders beneficially own a majority of the outstanding voting power of the surviving or successor entity as of immediately after such merger, consolidation or reorganization, such surviving or successor entity is not the Company); or (iii) the acquisition by any person or group of related persons (as defined in Rule 13d-5(b)(1) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) of beneficial ownership (as defined in Rule 13d-3 of the Exchange Act) of shares representing a majority of the Company’s then-total outstanding combined voting power.

(b)Treatment of Warrant at Acquisition. In the event of an Acquisition in which the consideration to be received by the Company’s stockholders consists solely of cash, solely of Marketable Securities or a combination of cash and Marketable Securities (a “Cash/Public Acquisition”), and the fair market value of one Share as determined in accordance with Section 1.3 above (assuming for such purposes that this Warrant and the Notice of Exercise were delivered to the Company on the date of the closing of such Cash/Public Acquisition) would be greater than the an amount equal to lesser of (i) the Warrant Price and (ii) the Black-Scholes Adjusted Warrant Price (as defined below), in each case in effect on such date immediately prior to such Cash/Public Acquisition, and Holder has not exercised this Warrant pursuant to Section 1.1 above as to all

Shares, then this Warrant shall automatically be deemed to be a cashless exercise pursuant to Section 1.2 above as to all Shares effective immediately prior to and contingent upon the consummation of a Cash/Public Acquisition, with such number of shares of Class A Common Stock which would have been so issuable to be determined by (i) subtracting B from A, (ii) dividing the result by A, and (iii) multiplying the quotient by C as set forth in the following equation:

X=A-B×CA

where:

X = the number of shares of Class A Common Stock issuable upon exercise pursuant to this Section 1.6(b).

A = the amount of Sale Consideration payable per share of Class A Common Stock of the Acquisition, (i) with such amount expressed in U.S. dollars and, if applicable, rounded to the nearest whole cent, and (ii) with any non-cash portion of such Sale Consideration valued at the value attributed thereto in the Acquisition.

B = the lesser of (i) the Warrant Price and (ii) the Black-Scholes Adjusted Warrant Price.

C = the number of shares of Class A Common Stock as to which this Warrant is exercisable after giving effect to Section 5.1(a)(2) (prior to payment of the Warrant Price).

In connection with such Cashless Exercise, Holder shall be deemed to have restated each of the representations and warranties in Section 4 of the Warrant as of the date thereof and the Company shall promptly notify the Holder of the number of Shares (or such other securities) issued upon exercise. In the event of a Cash/Public Acquisition where the fair market value of one Share as determined in accordance with the Section 1.3 above would be less than the Warrant Price in effect immediately prior to such Cash/Public Acquisition, then this Warrant will expire immediately prior to the consummation of such Cash/Public Acquisition.

(c)Upon the closing of any Acquisition other than a Cash/Public Acquisition, the acquiring, surviving or successor entity shall assume the obligations of this Warrant, and this Warrant shall thereafter be exercisable for the same securities and/or other property as would have been paid for the Shares issuable upon exercise of the unexercised portion of this Warrant (after giving effect to Section 5.1(a)(2)) as if such Shares were outstanding on and as of the closing of such Acquisition, subject to further adjustment from time to time in accordance with the provisions of this Warrant.

(d)As used in this Warrant:

(1)“Black-Scholes Adjusted Warrant Price” means if the Black-Scholes Value Per Share is greater than the Current Value, the result of (A) the then current Warrant Price less (B) the result of (i) the Black-Scholes Value Per Share less (ii) the Current Value, provided that in no event shall the

Black-Scholes Adjusted Warrant Price be less than the then current par value per share of Class A Common Stock. If the Black-Scholes Value Per Share is equal to or less than the Current Value, there shall be no Black-Scholes Adjusted Warrant Price.

(2)“Black-Scholes Value” means the fair market value of this Warrant on the date of consummation of the applicable Acquisition in accordance with the Black-Scholes model for valuing options, using (A) a risk free rate equal to the annual yield on the U.S. Treasury security with a maturity date closest to the Expiration Date, as the yield on that security exists as of such date, (B) a term equal to the time in years (rounded to the nearest 1/1000th of a year) from such date until the Expiration Date, (C) an assumed volatility based on the 90-day volatility obtained from the HVT function on Bloomberg determined as of the trading day immediately prior to the day of the announcement of the applicable event, (D) an underlying security price for the Class A Common Stock equal to the value of the consideration received in such Acquisition in respect of each outstanding share of Class A Common Stock and (E) the aggregate number of shares of Class A Common Stock for which such Warrant is then exercisable after giving effect to Section 5.1(a)(2).

(3)“Black-Scholes Value Per Share” means with respect to this Warrant, the Black-Scholes Value divided by the number of shares of Class A Common Stock for which this Warrant is then exercisable (without giving effect to any reduction due to cashless exercise).

(4) “Common Stock” means any class of common stock of the Company.

(5)“Current Value” means the difference between (A) sum of the price per share of Common Stock being offered in cash in the applicable Acquisition (if any) plus the fair market value of the non-cash consideration being offered with respect to each share of Class A Common Stock in the applicable Acquisition (if any); and (B) the then current Warrant Price

(6)“Marketable Securities” means securities meeting all of the following requirements: (i) the issuer thereof is then subject to the reporting requirements of Section 13 or Section 15(d) of the Exchange Act and is then current in its filing of all required reports and other information under the Act and the Exchange Act; (ii) the class and series of shares or other security of the issuer that would be received by Holder in connection with the Acquisition were Holder to exercise this Warrant on or prior to the closing thereof is then traded in a Trading Market, and (iii) following the closing of such Acquisition, Holder would not be restricted from publicly re-selling all of the issuer’s shares and/or other securities that would be received by Holder in such Acquisition were Holder to exercise this Warrant in full on or prior to the closing of such Acquisition, except to the extent that any such restriction (x) arises solely under federal or state securities laws, rules or

regulations, and (y) does not extend beyond six (6) months from the closing of such Acquisition.

(e)Disputes. In the case of a dispute as to the determination of the Exercise Price or the arithmetic calculation of the Shares, the Company shall promptly issue to the Holder the number of Shares that are not disputed and resolve such dispute in accordance with Sections 5.14, 5.15, and 5.16.

Section 2ADJUSTMENTS TO THE SHARES AND WARRANT PRICE.

2.1Adjustment to Number of Shares Upon Issuance of Common Stock. Except in the case of (x) Common Stock issued by the Company in connection with any Excluded Securities and (y) an event described in either Sections 2.4 or 2.5, if the Company shall, at any time or from time to time after the Original Issue Date, issue or sell any shares of Common Stock or is deemed to have issued or sold any shares of Common Stock pursuant to Section 2.1(c), in each case without consideration or for consideration or having a combined purchase and conversion, exchange or exercise price of less than the Fair Market Value (as determined in accordance with Section 1.3 above) of such Common Stock in effect immediately prior to such issuance or sale, then immediately upon such issuance or sale (or deemed issuance or sale), the number of Shares issuable upon exercise of this Warrant immediately prior to any such issuance or sale (or deemed issuance or sale) shall be increased to a number of Shares equal to the product obtained by multiplying the number of Shares issuable upon exercise of this Warrant immediately prior to such issuance or sale (or deemed issuance or sale) by a fraction (which shall in no event be less than one): (x) the numerator of which shall be the Common Stock Deemed Outstanding as of immediately after such issuance or sale (or deemed issuance or sale); and (y) the denominator of which shall be the sum of (A) the Common Stock Deemed Outstanding as of immediately prior to such issuance or sale (or deemed issuance or sale) plus (B) the aggregate number of number of shares of Common Stock which the aggregate amount of consideration, if any, received by the Company upon such issuance or sale (or deemed issuance or sale) would purchase at the Warrant Price in effect immediately prior to such issuance or sale. For the purposes of any adjustment of the number of shares of Common Stock issuable upon exercise of a Warrant pursuant to this Section 2, the following provisions shall be applicable:

(a)In the case of the issuance or sale of shares of Common Stock, Options or Convertible Securities for cash, the amount of the consideration received by the Company shall be deemed to be the amount of the gross cash proceeds received by the Company for such securities before deducting from such amount any discounts or commissions allowed, paid or incurred by the Company for any underwriting or otherwise in connection with the issuance and sale of such Common Stock, Options or Convertible Securities.

(b)In the case of the issuance or sale of shares of Common Stock, Options or Convertible Securities (other than upon the conversion of units or other securities of the Company) for consideration in whole or in part other than cash, including securities acquired in exchange for such shares of Common Stock, Options or Convertible Securities (other than securities by their terms so exchangeable), the consideration other than cash shall be deemed to be the fair market value thereof.

(c)In the case of the issuance of Convertible Securities or Options (in each case, whether or not at the time so convertible, exchangeable or exercisable): (A) the aggregate maximum number of shares of Common Stock deliverable upon conversion, exchange or exercise of such Convertible Securities or Options shall be deemed to have been issued at the time such Convertible Securities or Options are issued and for consideration equal to the consideration (determined in the manner provided in this Section 2.1), if any, received by the Company upon the issuance or sale of such Convertible Securities or Options plus the minimum purchase price provided in such Convertible Securities or Options for shares of Common Stock issuable upon conversion, exchange or exercise by such Convertible Securities or Options; and (B) if the number of shares of Common Stock issuable upon exercise of a Warrant shall have been adjusted upon the issuance or sale of any Convertible Securities or Options, no further adjustment of the number of shares of Common Stock issuable upon exercise of a Warrant shall be made for the actual issuance of shares of Common Stock upon the exercise, conversion or exchange of such Convertible Securities or Options.

2.2Record Date. For purposes of any adjustment to the Warrant Price or the number of Shares in accordance with this Section 2, in case the Company shall take a record of the holders of its Common Stock for the purpose of entitling them (A) to receive a dividend or other distribution payable in Common Stock, Options or Convertible Securities or (B) to subscribe for or purchase Common Stock, Options or Convertible Securities, then such record date shall be deemed to be the date of the issue or sale of the shares of Common Stock deemed to have been issued or sold upon the declaration of such dividend or the making of such other distribution or the date of the granting of such right of subscription or purchase, as the case may be.

2.3Adjustments for Dividends or Distributions. Subject to the provisions of this Section 2.3, if the Company shall, at any time or from time to time after the Original Issue Date, make or declare, or fix a record date for the determination of holders of Common Stock entitled to receive, a dividend or any other distribution payable in securities of the Company (other than a dividend or distribution of shares of Common Stock, Options or Convertible Securities in respect of outstanding shares of Common Stock), cash or other property, then, and in each such event, provision shall be made so that the Holder shall receive upon exercise of this Warrant, in addition to the number of Shares receivable thereupon, the kind and amount of securities of the Company, cash or other property which the Holder would have been entitled to receive had this Warrant been exercised in full into Shares on the date of such event and had the Holder thereafter, during the period from the date of such event to and including the date on which the Holder delivers this Warrant together with its Notice of Exercise to the Company, retained such securities, cash or other property receivable by them as aforesaid during such period, giving application to all adjustments called for during such period under this Section 2 with respect to the rights of the Holder; provided, that no such provision shall be made if the Holder receives, simultaneously with the distribution to the holders of Common Stock, a dividend or other distribution of such securities, cash or other property in an amount equal to the amount of such securities, cash or other property as the Holder would have received if this Warrant had been exercised in full into Shares on the date of such event.

2.4Adjustment to Warrant Price and Shares Upon Stock Dividend, Splits. If the Company declares or pays a dividend or distribution on the outstanding shares of Class A Common Stock payable in additional shares of Class A Common Stock or other securities or property (other than

cash), then upon exercise of this Warrant, for each Share acquired, Holder shall receive, without additional cost to Holder, the total number and kind of securities and property which Holder would have received had Holder owned the Shares of record as of the date the dividend or distribution occurred. If the Company subdivides the outstanding shares of Class A Common Stock by reclassification or otherwise into a greater number of shares, the number of Shares purchasable hereunder shall be proportionately increased and the Warrant Price shall be proportionately decreased. If the outstanding shares of Class A Common Stock are combined or consolidated, by reclassification or otherwise, into a lesser number of shares, the Warrant Price shall be proportionately increased and the number of Shares shall be proportionately decreased.

2.5Adjustment to Warrant Price and Shares Upon Reorganization, Reclassification or Similar Transaction. Subject to Section 1.6, in the event of any (i) capital reorganization of the Company, (ii) reclassification of the stock of the Company (other than a change in par value or from par value to no par value or from no par value to par value or as a result of a stock dividend or subdivision, split-up or combination of shares), (iii) Acquisition or (iv) other similar transaction (other than any such transaction covered by Section 2.4, in each case which entitles the holders of Common Stock to receive (either directly or upon subsequent liquidation) stock, securities or assets with respect to or in exchange for Common Stock, each Warrant shall, immediately after such reorganization, reclassification, Acquisition or similar transaction, remain outstanding and shall thereafter, in lieu of or in addition to (as the case may be) the number of Shares then exercisable under this Warrant, be exercisable for the kind and number of shares of stock or other securities or assets of the Company or of the successor Person resulting from such transaction to which the Holder would have been entitled upon such reorganization, reclassification, Acquisition or similar transaction if the Holder had exercised this Warrant in full immediately prior to the time of such reorganization, reclassification, Acquisition or similar transaction and acquired the applicable number of Shares then issuable hereunder as a result of such exercise (without taking into account any limitations or restrictions on the exercisability of this Warrant, including the vesting provisions set forth in Section 5.1(a)); and, in such case, appropriate adjustment (in form and substance satisfactory to the Holder) shall be made with respect to the Holder's rights under this Warrant to insure that the provisions of this Section 2 shall thereafter be applicable, as nearly as possible, to this Warrant in relation to any shares of stock, securities or assets thereafter acquirable upon exercise of this Warrant (including, in the case of any Acquisition or similar transaction in which the successor or purchasing Person is other than the Company, an immediate adjustment in the Warrant Price to the value per share for the Common Stock reflected by the terms of such Acquisition or similar transaction, and a corresponding immediate adjustment to the number of Shares acquirable upon exercise of this Warrant without regard to any limitations or restrictions on exercise, if the value so reflected is less than the Warrant Price in effect immediately prior to such Acquisition or similar transaction). The provisions of this Section 2.5 shall similarly apply to successive reorganizations, reclassifications, Acquisitions or similar transactions. The Company shall not effect any such reorganization, reclassification, Acquisition or similar transaction unless, prior to the consummation thereof, the successor Person (if other than the Company) resulting from such reorganization, reclassification, Acquisition or similar transaction, shall assume, by written instrument substantially similar in form and substance to this Warrant and satisfactory to the Holder, the obligation to deliver to the Holder such shares of stock, securities or assets which, in accordance with the foregoing provisions, such Holder shall be entitled to receive upon exercise of this Warrant.

2.6No Fractional Share. No fractional Share shall be issuable upon exercise of this Warrant and the number of Shares to be issued shall be rounded down to the nearest whole Share. If a fractional Share interest arises upon any exercise of this Warrant, the Company shall eliminate such fractional Share interest by paying Holder in cash the amount computed by multiplying the fractional interest by (a) the Fair Market Value (as determined in accordance with Section 1.3 above) of a full Share, less (b) the then-effective Warrant Price.

2.7Certain Repurchases of Common Stock. In case the Company effects a Pro Rata Repurchase of shares of the Class A Common Stock, then:

(a)the Warrant Price shall be adjusted to the price determined by multiplying the Warrant Price in effect immediately prior to the effective date of such Pro Rata Repurchase by a fraction of which the numerator shall be (x) the product of (1) the number of shares of the Class A Common Stock outstanding immediately before such Pro Rata Repurchase and (2) the Fair Market Value of a share of the Class A Common Stock, as determined in accordance with Section 1.3 above (assuming for such purposes that this Warrant and the Notice of Exercise were delivered on the date of the first public announcement by the Company or any of its affiliates of the intent to effect such Pro Rata Repurchase), minus (y) the aggregate purchase price of the Pro Rata Repurchase, and of which the denominator shall be the product of (1) the number of shares of the Class A Common Stock outstanding immediately prior to such Pro Rata Repurchase minus the number of shares of the Class A Common Stock so repurchased and (2) the Fair Market Value per share of the Class A Common Stock, as determined in accordance with Section 1.3 above (assuming for such purposes that this Warrant and the Notice of Exercise were delivered on the date of the first public announcement by the Company or any of its affiliates of the intent to effect such Pro Rata Repurchase); and

(b)the number of Vested Shares issuable upon the exercise of the Warrant shall be adjusted to the number obtained by dividing (x) the product of (1) the number of Vested Shares issuable upon the exercise of the Warrant before such adjustment, and (2) the Warrant Price in effect immediately prior to the Pro Rata Repurchase giving rise to this adjustment by (y) the new Warrant Price determined in accordance with Section 2.7(a).

2.8Notice/Certificate as to Adjustments. Upon each adjustment of the Warrant Price, class and/or number of Shares, the Company, at the Company’s expense, shall notify Holder in writing within a reasonable time setting forth the adjustments to the Warrant Price, Class and/or number of Shares and facts upon which such adjustment is based. The Company shall, upon written request from Holder, furnish Holder with a certificate of its Chief Financial Officer, including computations of such adjustment and the Warrant Price, Class and number of Shares in effect upon the date of such adjustment.

Section 3REPRESENTATIONS AND COVENANTS OF THE COMPANY.

3.1Representations and Warranties. The Company represents and warrants to, and agrees with, the Holder as follows:

(a)The Company is duly organized and validly existing and in good standing as a corporation under the laws of the State of Delaware.

(b)The Company has all corporate power and authority to execute this Warrant and to perform its obligations hereunder. The execution, delivery and performance by the Company of this Warrant, and the consummation of the transactions contemplated hereby have been duly authorized by all necessary corporate action on the part of the Company, and assuming due authorization, execution and delivery of this Warrant by the Holder, constitutes a legal, valid and binding obligation of the Company, enforceable in accordance with its respective terms, subject, as to enforcement, to bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights and to general equity principles.

(c)None of the execution and delivery of this Warrant, the consummation of the transactions contemplated herein or the performance of and compliance with the terms and provisions hereof will: (i) violate or conflict with any provision of the Company’s certificate of incorporation or bylaws; (ii) violate any law, regulation, order, writ, judgment, injunction, decree or permit applicable to it; (iii) violate or conflict with any material contractual provisions of, or cause an event of default or give rise to any right of acceleration under any agreement, instrument or contract the breach of which or default thereunder is reasonably likely to result in a material adverse effect to the Company; or (iv) result in or require the creation of any lien, security interest or other charge or encumbrance upon or with respect to its properties.

(d)No consent, approval, authorization or order of, or filing, registration or qualification with, any court or governmental authority or other Person (or group of Persons) is required in connection with the execution, delivery or performance of this Warrant, except for any notices of sale required to be filed with the Securities and Exchange Commission under Regulation D of the Securities Act or such filings as may be required under state securities laws.

(e)All Shares which may be issued upon the exercise of this Warrant shall, upon issuance in accordance with the terms hereof (including, without limitation, payment of the aggregate Warrant Price in the manner described in Sections 1.1 or 1.2 above), be duly authorized, validly issued, fully paid and non-assessable, and free of any liens and encumbrances except for restrictions on transfer provided for herein, or under applicable federal and state securities laws. The Company covenants that it shall at all times cause to be reserved and kept available out of its authorized and unissued capital stock such number of shares of Class A Common Stock and other securities as will be sufficient to permit the exercise in full of this Warrant.

3.2Notice of Certain Events. If the Company proposes at any time to:

(a)declare any dividend or distribution upon the outstanding shares of the Class, whether in cash, property, stock, or other securities and whether or not a regular cash dividend;

(b)offer for subscription or sale pro rata to the holders of the outstanding shares of the Class any additional shares of any class or series of the Company’s stock (other than pursuant to contractual pre-emptive rights);

(c)effect any reclassification, exchange, combination, substitution, reorganization or recapitalization of the outstanding shares of the Class; or

(d)effect an Acquisition or agreement to liquidate, dissolve or wind up;

then, in connection with each such event, the Company shall give Holder:

(1)in the case of the matters referred to in clauses (a) and (b) above, at least five (5) Business Days prior written notice of the earlier to occur of the effective date thereof or the date on which a record will be taken for such dividend, distribution, or subscription rights (and specifying the date on which the holders of outstanding shares of the Class will be entitled thereto) or for determining rights to vote, if any; and

(2)in the case of the matters referred to in clauses (c) and (d) above, at least five (5) Business Days prior written notice of the date when the same will take place (and specifying the date on which the holders of outstanding shares of the Class will be entitled to exchange their shares for the securities or other property deliverable upon the occurrence of such event and such reasonable information as Holder may reasonably require regarding the treatment of this Warrant in connection with such event giving rise to the notice).

Section 4REPRESENTATIONS, WARRANTIES OF THE HOLDER.

The Holder represents and warrants to the Company as follows:

4.1Purchase for Own Account. This Warrant and the Shares to be acquired upon exercise of this Warrant by Holder are being acquired for investment for Holder’s account, not as a nominee or agent, and not with a view to the public resale or distribution within the meaning of the Act, except pursuant to sales registered or exempted under the Act.

4.2Disclosure of Information. Holder is aware of the Company’s business affairs and financial condition and has received or has had full access to all the information it considers necessary or appropriate to make an informed investment decision with respect to the acquisition of this Warrant and its underlying securities. Holder further has had an opportunity to ask questions and receive answers from the Company regarding the terms and conditions of the offering of this Warrant and its underlying securities and to obtain additional information (to the extent the Company possessed such information or could acquire it without unreasonable effort or expense) necessary to verify any information furnished to Holder or to which Holder has access.

4.3Investment Experience. Holder understands that the purchase of this Warrant and its underlying securities involves substantial risk. Holder has experience as an investor in securities of companies in the development stage and acknowledges that Holder can bear the economic risk of such Holder’s investment in this Warrant and its underlying securities and has such knowledge and experience in financial or business matters that Holder is capable of evaluating the merits and risks of its investment in this Warrant and its underlying securities and/or has a preexisting personal or business relationship with the Company and certain of its officers, directors or controlling persons of a nature and duration that enables Holder to be aware of the character, business acumen and financial circumstances of such persons.

4.4Accredited Investor Status. Holder is an “accredited investor” within the meaning of Regulation D promulgated under the Act.

4.5The Act. Holder understands that this Warrant and the Shares issuable upon exercise hereof have not been registered under the Act in reliance upon a specific exemption therefrom, which exemption depends upon, among other things, the bona fide nature of the Holder’s investment intent as expressed herein. Holder understands that this Warrant and the Shares issued upon any exercise hereof must be held indefinitely unless subsequently registered under the Act and qualified under applicable state securities laws, or unless exemption from such registration and qualification are otherwise available. Holder is aware of the provisions of Rule 144 promulgated under the Act.

4.6No Voting Rights. Holder, as a Holder of this Warrant, will not have any voting rights until the exercise of this Warrant.

5.1Vesting; Term; Automatic Cashless Exercise Upon Expiration.

(1)Subject to clause (2) of this Section 5.1(a), the Shares shall vest on a monthly basis as follows:

a.On September 8, 2022, this Warrant shall vest as to and may be exercised for [●] Shares; and on the 8th day of each of the following eleven months, this Warrant shall vest as to and may be exercised for an additional [●] Shares;

b.On September 8, 2023 and on the 8th day of each of the following eleven months, this Warrant shall vest as to and may be exercised for an additional [●] Shares;

c.On September 8, 2024 and on the 8th day of each of the following eleven months, this Warrant shall vest as to and may be exercised for an additional [●] Shares; and

d.On September 8, 2025 and on the 8th day of each month thereafter, this Warrant shall vest as to and may be exercised for an additional [●] Shares, until fully vested.

(2)If prior to the date on which this Warrant is fully vested, the Company consummates an Acquisition (the date of such Acquisition, the “Acceleration Date”), then effective immediately prior to the Acceleration Date, this Warrant shall be deemed to have vested fully and be exercisable for the maximum number of Shares described in Section 1.

(b)Term. Subject to the provisions of Section 1.6, this Warrant is exercisable for all or any part of the unexercised Vested Shares at any time and from time to time on or before 6:00 PM, Pacific time, on the Expiration Date and shall be void thereafter.

(c)Automatic Cashless Exercise upon Expiration. In the event that, upon the Expiration Date, the Fair Market Value of one Share as determined in accordance with Section 1.3 is greater than the Warrant Price in effect on such date, then this Warrant shall automatically be deemed on and as of such date to be exercised pursuant to Section 1.2 as to all Shares for which it shall not previously have been exercised, and the Company shall, within a reasonable time, deliver a certificate representing the Shares issued upon such exercise to Holder.

5.2Withholding. Notwithstanding anything in this Warrant or the Financing Agreement, dated as the Original Issue Date, as amended on October 4, 2022, July 24, 2023, January 9, 2024, February 29, 2024 and as further amended on April 5, 2024, by and among Beachbody, LLC, the Company as a Guarantor, the other Guarantors party thereto from time to time, the Lenders party thereto from time to time, and Blue Torch Finance, LLC, as Administrative Agent and Collateral Agent (as amended, the “Financing Agreement”) to the contrary, the Company shall be entitled to deduct and withhold (or cause to be deducted and withheld) from any amounts or property payable or deliverable to the Holder pursuant to this Warrant such amounts as are required to be deducted or withheld under applicable law with respect to the Warrant (and the Company shall be entitled to withhold, for the avoidance of doubt, from any amounts or property that are payable or deliverable with respect to the Warrant that are subsequent to the payment or delivery or other circumstance that gave rise to the requirement to deduct or withhold under applicable law).

5.3Legends. Each certificate evidencing Shares shall be imprinted with a legend in substantially the following form:

THE SHARES EVIDENCED BY THIS CERTIFICATE HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), OR THE SECURITIES LAWS OF ANY STATE AND, EXCEPT AS SET FORTH IN THAT CERTAIN SECOND AMENDED AND RESTATED WARRANT TO PURCHASE STOCK ISSUED BY THE ISSUER TO BLUE TORCH CREDIT OPPORTUNITIES FUND II LP DATED APRIL 5, 2024, MAY NOT BE OFFERED, SOLD, PLEDGED OR OTHERWISE TRANSFERRED UNLESS AND UNTIL REGISTERED UNDER SAID ACT AND LAWS OR, IN THE OPINION OF LEGAL COUNSEL IN FORM AND SUBSTANCE SATISFACTORY TO THE ISSUER, SUCH OFFER, SALE, PLEDGE OR OTHER TRANSFER IS EXEMPT FROM SUCH REGISTRATION.

5.4Compliance with Securities Laws on Transfer. This Warrant and the Shares may be transferred or assigned in whole or in part by the Holder at any time without the consent of the Company, provided that (i) such transfer is in compliance with applicable federal and state securities laws by the transferor; and (ii) any holder with respect to the Warrant shall deliver (and shall at all times be eligible to deliver) a duly executed and valid IRS Form W-9, W-8BEN, W-8BEN E, W-8ECI, W-8IMY (with necessary attachments) or W-8EXP (in each case, as applicable) (and any transfer not in compliance with this Section 5.4 shall be void ab initio). Any transferee of this Warrant or any portion hereof, by their acceptance of this Warrant, is deemed to agree to be bound by the terms and conditions of this Warrant, including, without limitation, the representations and warranties of the Holder in Section 4. The Company shall not require Holder

to provide an opinion of counsel if the transfer is to an affiliate of Holder, provided that any such transferee is an “accredited investor” as defined in Regulation D promulgated under the Act. Additionally, the Company shall also not require an opinion of counsel if there is no material question as to the availability of Rule 144 promulgated under the Act.

5.5Transfer Procedure. Subject to the provisions of Section 5.4 and upon providing the Company with written notice, Holder may transfer all or part of this Warrant or the Shares to any transferee, provided, however, in connection with any such transfer, Holder will give the Company notice of the portion of this Warrant and/or Shares being transferred with the name, address and taxpayer identification number of the transferee and Holder will surrender this Warrant to the Company for reissuance to the transferee(s) (and Holder if applicable); provided, further, that the transferee shall agree in writing with the Company to be bound by all of the terms and conditions of this Warrant.

5.6Certain Definitions. For purposes of this Warrant, the following terms shall have the following meanings:

(a)“Common Stock Deemed Outstanding” means, at any given time, the sum of (a) the number of shares of Common Stock actually outstanding at such time, plus (b) the number of shares of Common Stock issuable upon exercise of Options actually outstanding at such time, plus (c) the number of shares of Common Stock issuable upon conversion or exchange of Convertible Securities actually outstanding at such time (treating as actually outstanding any Convertible Securities issuable upon exercise of Options actually outstanding at such time), in each case, regardless of whether the Options or Convertible Securities are actually exercisable at such time; provided, that Common Stock Deemed Outstanding at any given time shall not include shares owned or held by or for the account of the Company or any of its wholly owned subsidiaries.

(b)“Convertible Securities” means any securities (directly or indirectly) convertible into or exchangeable for Common Stock, but excluding Options.