false000156490200015649022024-04-022024-04-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): April 02, 2024 |

United Parks & Resorts Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35883 |

27-1220297 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

6240 Sea Harbor Drive |

|

Orlando, Florida |

|

32821 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 407 226-5011 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

PRKS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Marketing of Term B Facility Repricing

On April 2, 2024, United Parks & Resorts Inc. (the “Company”) announced that it is launching a fungible incremental term loan facility under that certain Amended and Restated Credit Agreement, dated as of August 25, 2021 (and as amended on June 9, 2022, June 12, 2023 and January 22, 2024), among the Company, SeaWorld Parks & Entertainment, Inc., the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent, to, among other things, incur a term loan facility in an aggregate principal amount of $230 million to finance the redemption of the 2025 Secured Notes (as defined below). The amendment is subject to market and other conditions, and may not occur as described or at all.

This disclosure shall not constitute an offer to sell or the solicitation of an offer to purchase any security and shall not constitute an offer, solicitation or sale in any state or jurisdiction in which such offering, solicitation or sale would be unlawful.

Redemption of 8.750% First-Priority Senior Secured Notes due 2025

On April 2, 2024, SeaWorld Parks & Entertainment, Inc. (the “Issuer”), a direct wholly-owned subsidiary of the Company, issued a conditional notice of redemption (the “Redemption Notice”) for all of the $227.5 million aggregate principal amount of the Issuer’s 8.750% First-Priority Senior Secured Notes due 2025 (the “2025 Secured Notes”) that remain outstanding as of the date thereof.

The Redemption Notice states that, upon satisfaction of certain conditions as set forth therein, $227.5 million aggregate principal amount of the 2025 Secured Notes will be redeemed on May 2, 2024 (the “Redemption Date”) at a price equal to the sum of (i) 100.000% of the principal amount of the 2025 Secured Notes to be redeemed, plus (ii) accrued and unpaid interest, if any, to, but excluding, the Redemption Date.

The redemption pursuant to the Redemption Notice is conditioned on the completion of a financing, which may be in the form of notes, loans or other securities, or a combination thereof, on or prior to the Redemption Date, by the Company and/or the Issuer on terms satisfactory to the Company and/or the Issuer, as applicable, and in an aggregate principal amount satisfactory to the Company and/or Issuer as the case may be. This disclosure shall not constitute an offer to sell or the solicitation of an offer to purchase any of the 2025 Secured Notes.

The information in this Current Report on Form 8-K is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Forward Looking Statements

This report contains statements relating to future results (including certain projections and business trends) that are “forward-looking statements” within the meaning of the federal securities laws. The Company generally uses the words such as “might,” “will,” “may,” “should,” “estimates,” “expects,” “continues,” “contemplates,” “anticipates,” “projects,” “plans,” “potential,” “predicts,” “intends,” “believes,” “forecasts,” “future,” “guidance,” “targeted,” “goal” and variations of such words or similar expressions in this report and any attachment to identify forward-looking statements. All statements, other than statements of historical facts included in this report, including statements concerning plans, objectives, goals, expectations, beliefs, business strategies, future events, business conditions, results of operations, financial position, business outlook, earnings guidance, business trends and other information are forward-looking statements. The forward-looking statements are not historical facts, and are based upon current expectations, beliefs, estimates and projections, and various assumptions, many of which, by their nature, are inherently uncertain and beyond management’s control. All expectations, beliefs, estimates and projections are expressed in good faith and the Company believes there is a reasonable basis for them. However, there can be no assurance that management’s expectations, beliefs, estimates and projections will result or be achieved and actual results may vary materially from what is expressed in or indicated by the forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and other important factors, many of which are beyond management’s control, that could cause actual results to differ materially from the forward-looking statements contained in this report, including among others: various factors beyond the Company’s control adversely affecting attendance and guest spending at the Company’s theme parks, including, but not limited to, weather, natural disasters, labor shortages, inflationary pressures, supply chain delays or shortages, foreign exchange rates, consumer confidence, the potential spread of travel-related health concerns including pandemics and epidemics, travel related concerns, adverse general economic related factors including increasing interest rates, economic uncertainty, and recent geopolitical events outside of the United States, and governmental actions; failure to retain and/or hire employees; a decline in discretionary consumer spending or consumer confidence, including any unfavorable impacts from Federal Reserve interest rate actions and inflation which may influence discretionary spending, unemployment or the overall economy; the ability of Hill Path Capital LP and its affiliates to significantly influence the Company’s decisions and their interests may conflict with ours or yours in the future; increased labor costs, including minimum wage increases, and employee health and welfare benefit costs; complex federal and state regulations governing the treatment of animals, which can change, and claims and lawsuits by activist groups before government regulators and in the courts; activist and other third-party groups and/or media can pressure governmental agencies, vendors, partners, guests and/or regulators, bring action in the courts or create negative publicity about the Company; incidents or adverse publicity concerning the Company’s theme parks, the theme park industry and/or zoological facilities; a significant portion of the Company’s revenues have historically been generated in the States of Florida, California and

Virginia, and any risks affecting such markets, such as natural disasters, closures due to pandemics, severe weather and travel-related disruptions or incidents; technology interruptions or failures that impair access to the Company’s websites and/or information technology systems; cyber security risks to the Company or the Company’s third-party service providers, failure to maintain or protect the integrity of internal, employee or guest data, and/or failure to abide by the evolving cyber security regulatory environment; inability to compete effectively in the highly competitive theme park industry; interactions between animals and the Company’s employees and the Company’s guests at attractions at the Company’s theme parks; animal exposure to infectious disease; high fixed cost structure of theme park operations; seasonal fluctuations in operating results; changing consumer tastes and preferences; inability to grow the Company’s business or fund theme park capital expenditures; inability to realize the benefits of developments, restructurings, acquisitions or other strategic initiatives, and the impact of the costs associated with such activities; the effects of public health events on the Company’s business and the economy in general; adverse litigation judgments or settlements; inability to protect the Company’s intellectual property or the infringement on intellectual property rights of others; the loss of licenses and permits required to exhibit animals or the violation of laws and regulations; unionization activities and/or labor disputes; inability to maintain certain commercial licenses; restrictions in the Company’s debt agreements limiting flexibility in operating the Company’s business; inability to retain the Company’s current credit ratings; the Company’s leverage and interest rate risk; inadequate insurance coverage; inability to purchase or contract with third party manufacturers for rides and attractions, construction delays or impacts of supply chain disruptions on existing or new rides and attractions; environmental regulations, expenditures and liabilities; suspension or termination of any of the Company’s business licenses, including by legislation at federal, state or local levels; delays, restrictions or inability to obtain or maintain permits; inability to remediate an identified material weakness; financial distress of strategic partners or other counterparties; tariffs or other trade restrictions; actions of activist stockholders; the policies of the U.S. President and his administration or any changes to tax laws; changes or declines in the Company’s stock price, as well as the risk that securities analysts could downgrade the Company’s stock or the Company’s sector; risks associated with the Company’s capital allocation plans and share repurchases, including the risk that the Company’s share repurchase program could increase volatility and fail to enhance stockholder value, uncertainties and factors set forth in the section entitled “Risk Factors” in the Company’s most recently available Annual Report on Form 10-K, as such risks, uncertainties and factors may be updated in the Company’s periodic filings with the Securities and Exchange Commission. Although the Company believes that these statements are based upon reasonable assumptions, it cannot guarantee future results and readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date of this report. There can be no assurance that (i) the Company has correctly measured or identified all of the factors affecting its business or the extent of these factors’ likely impact, (ii) the available information with respect to these factors on which such analysis is based is complete or accurate, (iii) such analysis is correct or (iv) the Company’s strategy, which is based in part on this analysis, will be successful. Except as required by law, the Company undertakes no obligation to update or revise forward-looking statements to reflect new information or events or circumstances that occur after the date of this report or to reflect the occurrence of unanticipated events or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

UNITED PARKS & RESORTS INC. |

|

|

|

|

Date: |

April 2, 2024 |

By: |

/s/ G. Anthony (Tony) Taylor |

|

|

Name: Title: |

G. Anthony (Tony) Taylor

Chief Legal Officer, General Counsel and Corporate Secretary |

v3.24.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

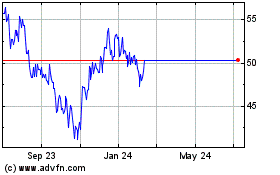

SeaWorld Entertainment (NYSE:SEAS)

Historical Stock Chart

From Apr 2024 to May 2024

SeaWorld Entertainment (NYSE:SEAS)

Historical Stock Chart

From May 2023 to May 2024