Palisade Bio, Inc. (Nasdaq: PALI) (“Palisade”, “Palisade Bio”

or the “Company”), a pre-clinical biopharmaceutical company focused

on developing and advancing novel therapeutics for patients living

with autoimmune, inflammatory, and fibrotic diseases, today

reported its financial results for the full year 2023 and provided

a corporate update.

Recent Highlights

- The Company formed its Clinical

Advisory Board and appointed preeminent Key Opinion Leaders, Bruce

Sands, MD, MS and Florian Rieder, MD;

- The exercise in February 2024, of

3,422,286 previously issued warrants to purchase common stock

resulting in gross cash proceeds to the Company of $2.5

million;

- Presentation of positive

preclinical data of its lead asset, PALI-2108 at the 2024 Crohn’s

& Colitis Congress; and

- Giiant Pharma, Inc., the Company’s

joint development partner, received the second milestone payment to

assist in funding PALI-2108 from the US Crohn’s and Colitis

Foundation, through its IBD Ventures program.

“2023 was a transformative year for Palisade Bio

as we strategically shifted into the autoimmune, inflammatory, and

fibrotic disease space, with the focus on our precision medicine

approach in inflammatory bowel disease,” commented J.D. Finley,

Chief Executive Officer. “As a result of the progress made by our

development team, we are on track to launch the Phase 1 study of

PALI-2108 by the end of 2024. We are looking forward to the

advancement of our lead program to bring our product candidates

into clinical trials and to increase our value for all

stakeholders.”

PALI-2108 Development

Program

The Company continues to advance its lead

program, PALI-2108, for the treatment of moderate-to-severe

ulcerative colitis (UC) toward a Phase 1 clinical study. PALI-2108

is an orally administered, locally acting colon-specific

phosphodiesterase-4 (PDE4) inhibitor prodrug in development for

patients affected by UC.

Upcoming Target Milestones

- Complete ongoing IND/CTA-enabling

tox studies by the end of the second quarter of 2024;

- Complete nonclinical

IND/CTA-enabling activities by the end of the third quarter of

2024;

- Submit initial IND/CTA prior to the

end of 2024; and

- Initiate Phase 1a/b prior to the

end of 2024.

Precision Medicine Approach

Additionally, the Company is in the process of

developing a genetic- or biomarker-based precision medicine

approach that, if developed, will aid patients and physicians in

selecting patients most likely to respond to PDE4 inhibitor therapy

with PALI-2108. The Company is working with a strategic

collaborator on development and has completed curation of a

pipeline including over 1600 UC patients clinical and biomarker

data and is in ongoing discussions with potential partners with

access to additional patient data to support development of an

FDA-approved test. The Company plans to leverage this expertise and

infrastructure to fuel a growing pipeline of validated and

high-priority autoimmune, inflammatory, and fibrotic disease

product candidates.

Summary of Financial Results for the

Year Ended December 31, 2023

As of December 31, 2023, the Company had cash,

cash equivalents and restricted cash of $12.5 million. The Company

believes it has sufficient cash to fund its currently planned

operations into the first quarter of 2025.

Net operating loss was $13.1 million for the

year ended December 31, 2023 compared to $15.7 million for the year

ended December 31, 2022. Included in the net operating loss for the

year ended December 31, 2023 was license revenue of $0.3 million,

of which there was none in 2022, and restructuring costs of $0.2

million in 2023, compared to restructuring costs of $0.4 million in

2022.

Research and development expenses were $6.9

million for the year ended December 31, 2023, an increase of $0.3

million, or approximately 5% compared to the year ended December

31, 2022. The year-over-year increase is attributable to increased

costs associated with the Giiant License Agreement, which we

entered into on September 1, 2023, as well an increase in

employee-related costs and employee recruiting costs, which were

partially offset by a decrease in costs directly related to our

development of LB1148, which we ceased in August of 2023.

General and administrative expenses decreased

from $8.8 million for the year ended December 31, 2022 to $6.2

million for the year ended December 31, 2023. The decrease of $2.6

million, or 26%, was primarily as a result of cost-saving

opportunities implemented by us in the third and fourth quarters of

2022, including those associated with the 2022 Cost-Reduction Plan.

General and administrative employee compensation costs for the year

ended December 31, 2023 decreased by approximately $1.4 million

compared to the year ended December 31, 2022, primarily due to an

approximately $0.9 million decrease in salaries and benefits and an

approximately $0.5 million decrease in stock-based compensation

expense. Other decreases in general and administrative expenses for

the year ended December 31, 2023 compared to the year ended

December 31, 2022 include: (i) an approximately $0.3 million

decrease in professional fees, including accounting and legal fees

and financial printing costs, (ii) an approximately $0.3 million

decrease in investor and public relations costs and shareholder

services costs, (iii) an approximately $0.2 million decrease in

consultants and contract labor costs, (iv) an approximately $0.2

million decrease in general and administrative employee recruiting

costs, and (v) an approximately $0.2 million decrease in insurance

costs.

About Palisade

Bio Palisade Bio is a pre-clinical biopharmaceutical

company focused on developing and advancing novel therapeutics for

patients living with autoimmune, inflammatory, and fibrotic

diseases. The Company believes that by using a targeted approach

with its novel therapeutics it will transform the treatment

landscape. For more information, please go

to www.palisadebio.com.

Forward Looking StatementsThis

communication contains “forward-looking” statements for purposes of

the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements include statements

regarding the Company’s intentions, beliefs, projections, outlook,

analyses or current expectations concerning, among other things:

the extent of our cash runway; our ability to successfully develop

our licensed technologies; estimates about the size and growth

potential of the markets for our product candidates, and our

ability to serve those markets, including any potential revenue

generated; future regulatory, judicial, and legislative changes or

developments in the United States (U.S.) and foreign countries and

the impact of these changes; our ability to maintain the Nasdaq

listing of our securities; our ability to build a commercial

infrastructure in the U.S. and other markets; our ability to

compete effectively in a competitive industry; our ability to

identify and qualify manufacturers to provide API and manufacture

drug product; our ability to enter into commercial supply

agreements; the success of competing technologies that are or may

become available; our ability to attract and retain key scientific

or management personnel; the accuracy of our estimates regarding

expenses, future revenues, capital requirements and needs for

additional financing; our ability to obtain funding for our

operations; our ability to attract collaborators and strategic

partnerships; and the impact of the COVID-19 pandemic or any global

event on our business, and operations, and supply. Any statements

contained in this communication that are not statements of

historical fact may be deemed to be forward-looking statements.

These forward-looking statements are based upon the Company’s

current expectations. Forward-looking statements involve risks and

uncertainties. The Company’s actual results and the timing of

events could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, the Company’s

ability to advance its nonclinical and clinical programs, the

uncertain and time-consuming regulatory approval process; and the

Company’s ability to secure additional financing to fund future

operations and development of its product candidates. Additional

risks and uncertainties can be found in the Company’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, filed

with the Securities and Exchange Commission (“SEC”) on March 26,

2024. These forward-looking statements speak only as of the date

hereof and the Company expressly disclaims any obligation or

undertaking to release publicly any updates or revisions to any

forward-looking statements contained herein to reflect any change

in the Company’s expectations with regard thereto or any change in

events, conditions or circumstances on which any such statements

are based.

Investor Relations Contact

JTC Team, LLCJenene Thomas 833-475-8247PALI@jtcir.com

Palisade Bio,

Inc.Consolidated Balance Sheets

(Unaudited)(in thousands, except share and per

share amounts)

| |

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

12,432 |

|

|

$ |

12,383 |

|

|

Prepaid expenses and other current assets |

|

|

896 |

|

|

|

2,350 |

|

|

Total current assets |

|

|

13,328 |

|

|

|

14,733 |

|

| Restricted cash |

|

|

26 |

|

|

|

26 |

|

| Property and equipment,

net |

|

|

10 |

|

|

|

10 |

|

| Operating lease right-of-use

asset |

|

|

198 |

|

|

|

300 |

|

| Other noncurrent assets |

|

|

490 |

|

|

|

694 |

|

|

Total assets |

|

$ |

14,052 |

|

|

$ |

15,763 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

698 |

|

|

$ |

1,759 |

|

|

Accrued liabilities |

|

|

831 |

|

|

|

574 |

|

|

Accrued compensation and benefits |

|

|

778 |

|

|

|

486 |

|

|

Current portion of operating lease liability |

|

|

121 |

|

|

|

105 |

|

|

Insurance financing debt |

|

|

158 |

|

|

|

88 |

|

|

Total current liabilities |

|

|

2,586 |

|

|

|

3,012 |

|

| Warrant liability |

|

|

2 |

|

|

|

61 |

|

| Contingent consideration

obligation |

|

|

61 |

|

|

|

— |

|

| Operating lease liability, net

of current portion |

|

|

90 |

|

|

|

211 |

|

|

Total liabilities |

|

|

2,739 |

|

|

|

3,284 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Series A Convertible Preferred Stock, $0.01 par value, 7,000,000

shares authorized; 200,000 issued and outstanding at

December 31, 2023 and December 31, 2022 |

|

|

2 |

|

|

|

2 |

|

|

Common stock, $0.01 par value; 280,000,000 shares

authorized;9,270,894 and 2,944,306 shares issued and outstanding at

December 31, 2023 and December 31, 2022,

respectively |

|

|

93 |

|

|

|

30 |

|

|

Additional paid-in capital |

|

|

132,724 |

|

|

|

121,637 |

|

|

Accumulated deficit |

|

|

(121,506 |

) |

|

|

(109,190 |

) |

|

Total stockholders' equity |

|

|

11,313 |

|

|

|

12,479 |

|

|

Total liabilities and stockholders' equity |

|

$ |

14,052 |

|

|

$ |

15,763 |

|

Palisade Bio,

Inc.Consolidated Statements of Operations

(Unaudited)(in thousands, except share and per

share amounts)

|

|

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

| License revenue |

|

$ |

250 |

|

|

$ |

— |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

|

6,893 |

|

|

|

6,547 |

|

|

General and administrative |

|

|

6,202 |

|

|

|

8,764 |

|

|

Restructuring costs |

|

|

225 |

|

|

|

410 |

|

|

Total operating expenses |

|

|

13,320 |

|

|

|

15,721 |

|

|

Loss from operations |

|

|

(13,070 |

) |

|

|

(15,721 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(15 |

) |

|

|

(13 |

) |

|

Other income |

|

|

785 |

|

|

|

2,584 |

|

|

Loss on issuance of warrants |

|

|

— |

|

|

|

(1,110 |

) |

| Total other income, net |

|

|

770 |

|

|

|

1,461 |

|

| Net loss |

|

$ |

(12,300 |

) |

|

$ |

(14,260 |

) |

| |

|

|

|

|

|

|

|

|

| Net loss available to common

stockholders |

|

$ |

(12,316 |

) |

|

$ |

(14,548 |

) |

| Basic and diluted weighted

average shares used in computing basic and diluted net loss per

common share |

|

|

6,840,213 |

|

|

|

880,311 |

|

| Basic and diluted net loss per

common share |

|

$ |

(1.80 |

) |

|

$ |

(16.53 |

) |

Palisade Bio,

Inc.Consolidated Statements of Cash Flows

(Unaudited)(in thousands, except share and per

share amounts)

|

|

|

Year Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

| Net loss |

|

$ |

(12,300 |

) |

|

$ |

(14,260 |

) |

| Adjustments to

reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

4 |

|

|

|

3 |

|

|

Noncash operating lease expense |

|

|

102 |

|

|

|

164 |

|

|

Loss on issuance of warrants |

|

|

— |

|

|

|

1,110 |

|

|

Fair value of contingent consideration obligation |

|

|

204 |

|

|

|

— |

|

|

Change in fair value of warrant liabilities |

|

|

(59 |

) |

|

|

(2,426 |

) |

|

Stock-based compensation and related charges |

|

|

624 |

|

|

|

1,032 |

|

|

Other |

|

|

(108 |

) |

|

|

(233 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Prepaid and other current assets and other noncurrent assets |

|

|

705 |

|

|

|

1,027 |

|

|

Accounts payable and accrued liabilities |

|

|

(492 |

) |

|

|

399 |

|

|

Accrued compensation |

|

|

292 |

|

|

|

(25 |

) |

|

Operating lease liabilities |

|

|

(105 |

) |

|

|

(151 |

) |

|

Net cash used in operating activities |

|

|

(11,133 |

) |

|

|

(13,360 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(4 |

) |

|

|

(10 |

) |

|

Net cash used in investing activities |

|

|

(4 |

) |

|

|

(10 |

) |

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

Payments on insurance financing debt |

|

|

(391 |

) |

|

|

(790 |

) |

|

Proceeds from issuance of common stock and warrants |

|

|

9,419 |

|

|

|

14,401 |

|

|

Proceeds from the exercise of warrants |

|

|

2,758 |

|

|

|

2,274 |

|

|

Payment of equity issuance costs |

|

|

(617 |

) |

|

|

(627 |

) |

|

Proceeds from issuance of common stock under Employee Stock

Purchase Plan |

|

|

17 |

|

|

|

— |

|

|

Net cash provided by financing activities |

|

|

11,186 |

|

|

|

15,258 |

|

| Net increase in cash, cash

equivalents and restricted cash |

|

|

49 |

|

|

|

1,888 |

|

| Cash, cash equivalents and

restricted cash, beginning of year |

|

|

12,409 |

|

|

|

10,521 |

|

| Cash, cash equivalents and

restricted cash, end of year |

|

$ |

12,458 |

|

|

$ |

12,409 |

|

| Reconciliation of

cash, cash equivalents and restricted cash to the balance

sheets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

12,432 |

|

|

$ |

12,383 |

|

| Restricted cash |

|

|

26 |

|

|

|

26 |

|

| Total cash, cash equivalents

and restricted cash |

|

$ |

12,458 |

|

|

$ |

12,409 |

|

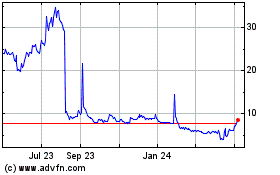

Palisade Bio (NASDAQ:PALI)

Historical Stock Chart

From Mar 2024 to Apr 2024

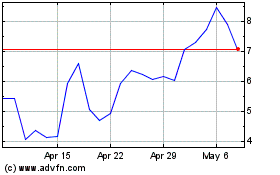

Palisade Bio (NASDAQ:PALI)

Historical Stock Chart

From Apr 2023 to Apr 2024