Pre-Market Optimism as Investors Eye Weekly Gains; Dip in Crude Oil Prices

March 15 2024 - 7:32AM

IH Market News

U.S. index futures are trading higher in pre-market on Friday,

following a previous session that ended lower, as the market

reassesses expectations for Federal Reserve interest rate cuts in

light of recent inflation data. Investors await further economic

indicators, maintaining optimism for a slightly positive weekly

close in the major indexes.

At 07:05 AM, the Dow Jones futures (DOWI:DJI)

were up 48 points, or 0.12%. S&P 500 futures

advanced 0.19%, and Nasdaq-100 futures gained

0.18%. The yield on 10-year Treasury notes was at 4.277%.

In the commodities market, West Texas Intermediate crude oil for

April fell 0.44% to $80.89 per barrel. Brent crude oil for May

dropped 0.46% to around $85.03 per barrel. Iron ore traded on the

Dalian exchange fell 3.46% to $108.59 per metric ton.

Friday’s economic agenda kicks off with the release of

February’s import and export prices at 8:30 AM by the Department of

Labor. Concurrently, the Empire State manufacturing activity index

for March will be released, also at 8:30 AM, by the New York

Federal Reserve. At 09:15 AM, the focus shifts to February’s

industrial production and capacity utilization data, which will be

published by the Federal Reserve. Concluding the series of economic

reports, at 10:00 AM will be the time for the preliminary reading

of the March consumer sentiment index.

The Asia-Pacific stock markets closed mixed, influenced by the

latest U.S. inflation data and monetary policy decisions in China.

While most indexes fell due to reduced expectations for aggressive

U.S. interest rate cuts, the Chinese markets stood out positively

(+0.54%), driven by technology and automotive stocks. Additionally,

the Chinese regulator promised increased market supervision, and

the central bank maintained its medium-term lending rate,

indicating interest rate policy stability.

European markets are slightly higher on Friday morning, despite

concerns brought by recent U.S. inflation data. In the pan-European

Stoxx 600, the automotive and telecommunications sectors lead the

gains while domestic goods stocks declined. Shares of

Vonovia (TG:VNA) are a negative highlight after

the company announced a record annual loss, reflecting challenges

faced by the real estate sector in Germany.

On Thursday, U.S. stock markets opened without a clear direction

but soon succumbed to selling pressure, closing in the red despite

an attempt at a recovery towards the end of the day. Concerns

intensified after the release of a producer price report that

exceeded expectations, fueling fears about the Federal Reserve’s

future policy. Anxiety rose with the approach of the central bank’s

next meeting, keeping investors on alert. The Dow

Jones, S&P 500, and

Nasdaq closed down 0.35%, 0.29%, and 0.30%,

respectively.

For quarterly earnings, scheduled to present financial reports

today are Jabil (NYSE:JBL),

Embraer (NYSE:ERJ), Soho House

(NYSE:SHCO), Townsquare Media (NYSE:TSQ),

Telos Corp (NASDAQ:TLS), among others.

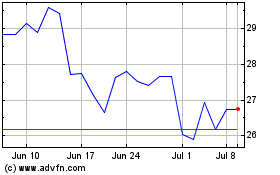

Embraer (NYSE:ERJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

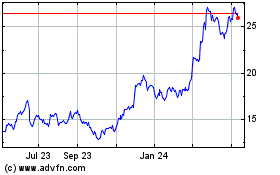

Embraer (NYSE:ERJ)

Historical Stock Chart

From Apr 2023 to Apr 2024