false

0001281845

0001281845

2024-03-05

2024-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 5, 2024

UNIQUE

LOGISTICS INTERNATIONAL, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-50612 |

|

01-0721929 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

154-09

146th Ave,

Jamaica,

NY 11434

(Address

of Principal Executive Offices)

(718)

978-2000

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

None |

|

None |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2

of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Amendment to a Material Definitive Agreement.

Amendment

to Promissory Notes

As

previously announced, on February 21, 2023, Unique Logistics International, Inc., a Nevada corporation (“Unique” or

the “Company”), issued to Unique Logistics Holdings Limited, a Hong Kong corporation (“ULHL”),

three promissory notes, as amended, with the following original principal amounts: (i) $2,500,000 (the “Net Assets Note”),

(ii) $2,000,000 (the “Second Net Assets Note”), (iii) $2,000,000 (the “Taiwan Note”), and (iv)

$1,000,000 (the “Original Seller Note”), respectively.

On

October 3, 2023, the Company and ULHL agreed to cancel, replace and supersede the Net Assets Note and the Taiwan Note, each in their

entirety, in favor of a newly issued promissory note as of the same date (“Note 9”). Note 9 includes the remaining

balances of the Net Assets Note and the Taiwan Note, along with an additional loan in the principal amount of $1,100,000 (the “Additional

Loan”) for an aggregate principal amount of $4,500,000. Note 9 matures on March 31, 2025, and has an interest rate of 15% per

annum.

On

October 9, 2023, the Company amended the Second Net Assets Note (the “Amended Second Net Assets Note”), which extended

the maturity date thereof from February 21, 2024, to March 31, 2025. The Amended Second Net Assets Note includes simple interest accruing

at a rate of fifteen percent (15%) per annum starting February 21, 2024, until such time as the principal amount is paid in full.

On

March 5, 2024, the Company and ULHL agreed to cancel, replace and supersede Note 9, in its entirety, in favor of (i) a promissory note

in the aggregate principal amount of $2,500,000 (“Note 11”) and (ii) a promissory note in the aggregate principal

amount of $3,400,000 (“Note 12”).

Note

11 matures on June 30, 2025, with an interest rate of 15% per annum, payable to ULHL in quarterly installments.

Note 12 matures on June 30, 2025, with an interest

rate of 15% per annum.

On

March 5, 2024, the Company and ULHL further amended the Amended Second Net Assets Note (the “Second Amended Second Net Assets

Note”), which extended the maturity date thereof from March 31, 2025 to June 30, 2025.

Additionally,

on March 6, 2024, the Company and ULHL amended the Original Seller Note (the “Amended Original Seller Note”), which

extended the maturity date thereof from the second anniversary of the date of the Note to June 30, 2025 and increased the principal amount

of the Note to $1,053,000.

The

foregoing descriptions of Note 11, Note 12, the Second Amended Second Net Assets Note and the Amended Original Seller Note do not purport

to be complete and are qualified in their entirety by reference to Note 11, Note 12, the Second Amended Second Net Assets Note and the

Amended Original Seller Note, copies of which are filed as Exhibit 10.1, Exhibit 10.2, Exhibit 10.3 and Exhibit 10.4, respectively, to this Current Report

on Form 8-K and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation

or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The foregoing information in Item 1.01 is hereby incorporated by reference.

Item

9.01. Exhibits.

(d)

Exhibits

| Exhibit

No. |

|

Exhibit |

| 10.1* |

|

Note

11, dated as of March 5, 2024, by and between Unique Logistics International, Inc. and Unique Logistics Holdings

Limited. |

| 10.2* |

|

Note

12, dated as of March 5, 2024, by and between Unique Logistics International, Inc. and Unique Logistics Holdings

Limited |

| 10.3* |

|

Second

Amended Second Net Assets Note, dated as of March 5, 2024, by and between Unique Logistics International, Inc. and Unique Logistics

Holdings Limited |

| 10.4* |

|

Amended

Original Seller Note, dated as of March 6, 2024, by and between Unique Logistics International, Inc. and Unique Logistics Holdings

Limited |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

UNIQUE

LOGISTICS INTERNATIONAL, INC. |

| |

|

|

| Dated:

March 11, 2024 |

By: |

/s/

Sunandan Ray |

| |

|

Sunandan

Ray |

| |

|

Chief

Executive Officer |

Exhibit 10.1

PROMISSORY

NOTE

| March

5, 2024 |

US$2,500,000 |

FOR

VALUE RECEIVED, Unique Logistics International, Inc., a Nevada corporation (the “Maker”), hereby promises

to pay to the order of Unique Logistics Holdings Limited, a Hong Kong corporation (“ULHL”), or its successors, assigns

or other subsequent noteholder, as the case may be (the “Noteholder”), the principal amount of Two Million Five Hundred

Thousand Dollars (US$2,500,000) (the “Principal Amount”), as provided herein (as the same may be amended, restated,

supplemented, or otherwise modified from time to time in accordance with the terms hereof, the “Note”).

WHEREAS,

each of the Maker and the Noteholder may be referred to herein as a “Party” and, collectively, as the “Parties.”

WHEREAS,

reference is hereby made to that certain Promissory Note dated September 29, 2023, issued by the Maker in favor of ULHL in the original

principal amount of $4,500,000 (the “September 2023 Note”), as amended, all of which principal amount remains outstanding

as of the date hereof.

WHEREAS,

concurrent with the execution hereof ULHL shall advance an additional loan in the principal amount of $1,400,000 to the Maker (the “Additional

Loan”).

WHEREAS,

by it receipt hereof ULHL agreed to cancel, replace and supersede the September 2023 Note with respect to that portion thereof representing

a $1,100,000 loan extended by ULHL to Maker (the “Initial Loan”), and agrees that this Note shall include and evidence

the extension of the Additional Loan, which amounts together constitute the initial Principal Amount of this Note.

Capitalized

terms used herein but not otherwise defined, if any, shall have the respective meanings attributed to them in the Purchase Agreement.

1. Payment

Due Date; Optional Prepayment.

1.1 Payment

of Principal Amount; Maturity Date.

The Principal Amount outstanding under this Note shall become due and payable on June 30, 2025 (the “Maturity Date”).

1.2 Optional

Prepayment. The Maker, in its sole discretion, may prepay the Principal Amount in whole or in part at any time or from time

to time prior to the Maturity Date without penalty or premium.

1.3

No Dividends by Subsidiaries; Exception.

From the date hereof, for so long as any of the Principal Amount hereunder remains outstanding, the Maker agrees, as a shareholder of

the ULHL Subsidiaries, that it will not vote in favor of or cause there to be declared any dividend in or by any of the ULHL Subsidiaries,

other than dividends payable to the Buyer to be used for repayment of amounts due to ULHL under this Note or any other note issued or

issuable by the Maker in favor of ULHL under the Purchase Agreement.

2. Interest.

The Principal Amount outstanding hereunder shall bear simple interest at the rate of fifteen percent (15%) per annum (the

“Interest Rate”) from the date hereof until such time as the Principal Amount is paid in full (the “Interest”)

and shall be payable by Maker to ULHL in quarterly installments. Interest shall not accrue on the date on which payment of the Principal

Amount and accrued Interest is paid. Any accrued interest on the Initial Loan from the period beginning October 5, 2023, through the

date hereof, shall be payable to ULHL at the Interest Rate upon the execution of this Note.

3. Payment

Mechanics.

3.1 Manner

of Payment. All payments hereunder

shall be made in lawful currency of the United States of America on the date on which such payment is due, by cashier’s check,

certified check, or by wire transfer of immediately available funds to the Noteholder’s account at such bank as may be specified

by the Noteholder in writing to the Maker from time to time.

3.2 Application

of Payments. All payments made hereunder

shall be applied first to the payment of any fees or charges outstanding hereunder and second to the payment of accrued

Interest, and third to payment the Principal Amount outstanding under the Note.

3.3 Business

Day Convention. Payment hereunder

shall be due on a business day, meaning a day other than Saturday, Sunday, or other day on which commercial banks in New York, New York

are authorized or required by law to close (each such day, a “Business Day”). Whenever any payment to be made hereunder

shall be due on a day that is not a Business Day, such payment shall be made on the next succeeding Business Day.

4. Representations

and Warranties. The Maker hereby represents

and warrants to the Noteholder on the date hereof as follows:

4.1 Existence.

The Maker is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Nevada.

4.2 Power

and Authority. The Maker has the requisite

power and authority, and the legal right, to execute and deliver this Note and to perform its obligations hereunder.

4.3 Authorization;

Execution and Delivery. The execution

and delivery of this Note by the Maker and the performance of its obligations hereunder have been duly authorized by all necessary corporate

action in accordance with all applicable laws. The Maker has duly executed and delivered this Note.

4.4 No

Violations. The execution and delivery

of this Note and the consummation by the Maker of the transactions contemplated hereby do not and will not, to the knowledge of the Maker:

(a) violate any law applicable to the Maker or by which any of its properties or assets are bound; or (b) constitute a material default

under any material agreement or contract by which the Maker is bound.

4.5 Enforceability.

The Note is the valid, legal, and binding obligation of the Maker, enforceable against the Maker in accordance with its terms, except

as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws affecting the enforcement

of creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at

law).

5. Events

of Default. The occurrence and continuance

of any of the following events shall constitute an Event of Default hereunder:

5.1 Failure

to Pay. The Maker fails to pay:

(a) the

Principal Amount or Interest when due; or

(b) such

failure continues without cure for seven (7) days after written notice thereof to the Maker.

5.2 Bankruptcy.

(a) The

Maker commences any case, proceeding, or other action (i) under any existing or future law relating to bankruptcy, insolvency, reorganization,

or other relief of debtors, seeking to have an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or

insolvent, or seeking reorganization, arrangement, adjustment, winding-up, liquidation, dissolution, composition, or other relief with

respect to it or its debts, or (ii) seeking appointment of a receiver, trustee, custodian, conservator, or other similar official for

it or for all or any substantial part of its assets, or the Maker makes a general assignment for the benefit of its creditors;

(b) There

is commenced against the Maker any case, proceeding, or other action of a nature referred to in Section 5.2(a) which (i) results in the

entry of an order for relief or any such adjudication or appointment or (ii) remains undismissed, undischarged, or unbonded for a period

of sixty (60) days;

(c) There

is commenced against the Maker any case, proceeding, or other action seeking issuance of a warrant of attachment, execution, or similar

process against all or any substantial part of its assets which results in the entry of an order for any such relief which has not been

vacated, discharged, or stayed or bonded pending appeal within sixty (60) days from the entry thereof;

(d) the

Maker takes any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the acts set forth in

Section 5.2(a), Section 5.2(b), or Section 5.2(c); or

(e) The

Maker is generally not, or is unable to, or admits in writing its inability to, pay its debts as they become due.

5.3 Purchase

Agreement Obligations. Notwithstanding any other provisions of this Note and without prejudice to any right of the Noteholder under

that certain Stock Purchase Agreement, dated as of the 28th of April, 2022, by and between the Maker and ULHL, as amended,

pursuant to which the Maker has agreed to purchase from ULHL certain shares of capital stock owned by ULHL in certain of its subsidiaries

(the “Purchase Agreement”), the Maker acknowledges and agrees that: (a) upon an Event of Default hereunder, so long

as no other event has occurred which would result in an event of default by Maker under either: (i) that certain Revolving Purchase,

Loan and Security Agreement, dated as of June 1, 2021, as amended, supplemented or restated from time to time, between the Maker, certain

of its affiliates and TBK Bank SSB; or (ii) that certain Financing Agreement, dated as of March 10, 2023, as amended by that certain

Waiver and Amendment No. 1 thereto, dated as of September 13, 2023, and that certain Waiver and Amendment No. 2 thereto, dated as of

February 5, 2024, among the Maker, certain subsidiaries of the Maker, the lenders party thereto from time to time, CB Agent Services

LLC, as origination agent, and Alter Domus (US) LLC, as administrative agent and collateral agent (collectively, the “Facilities”),

the Maker shall use a portion of the cash available to it as a result of consummation of the merger contemplated by that certain merger

agreement with Edify Acquisition Corp, not to exceed US$10,000,000, to pay the amounts owing hereunder, and (b) while this Note is outstanding

the Maker shall not directly or indirectly grant a security interest in any of its business or assets other than those granted in connection

with the foregoing Facilities.

5.4 Remedies.

Upon the occurrence of an Event of Default and at any time thereafter during the continuance of such Event of Default, the Noteholder

may at its option, by written notice to the Maker provided within ten (10) Business Days of the Noteholder’s discovery of the subject

Event of Default: (a) declare any Principal Amount or Interest outstanding under this Note to become immediately due and payable, and

(b) exercise any or all of its rights, powers, or remedies under applicable law or this Note; provided, however that, if an Event

of Default described in Section 5.2 shall occur, the Principal Amount shall become immediately due and payable without any notice, declaration,

or other act on the part of the Noteholder. If an Event of Default hereunder occurs, Maker agrees to pay all of Noteholder’s reasonable

costs and expenses incurred in connection with collection with amounts then due, including, without limitation, reasonable and documented

attorney’s fees and expenses incurred by the Noteholder as a result of the occurrence of such Event of Default. This Note is unsecured

and without recourse other than as specifically set forth herein.

6. Subordination.

Notwithstanding any other provisions of this Note, but subject to Section 5.3, by its acceptance of this Note the Holder acknowledges

and agrees that the obligations of the Maker under this Note shall be subordinate in all respects to the obligations of the Maker under

each of the Facilities.

7. Miscellaneous.

7.1 Notices.

Any notice, request or other communication to be given or made under this Note to the Maker or the Noteholder shall be in writing. Such

notice, request or other communication shall be deemed to have been duly given or made when it shall be delivered by hand, national or

international courier (confirmed by email), or email or other electronic or digital means (with a hard copy delivered within two (2)

Business Days) to the Party to which it is required or permitted to be given or made at such Party’s address as such Party shall

have designated by notice to the Party giving or making such notice, request or other communication, it being understood that the failure

to deliver a copy of any notice, request or other communication to a Party to whom copies are to be sent shall not affect the validity

of any such notice, request or other communication or constitute a breach of this Note.

7.2 Expenses.

The Maker shall reimburse the Noteholder on demand for all reasonable and documented out-of-pocket costs, expenses, and fees (including

reasonable attorneys’ fees) actually incurred by the Noteholder in connection with the Noteholder’s collection of amounts

due hereunder or enforcement of any of the Noteholder’s rights hereunder.

7.3 Governing

Law. This Note and any claim, controversy,

dispute, or cause of action (whether in contract or tort or otherwise) based upon, arising out of, or relating to this Note and the transactions

contemplated hereby, shall be governed by the laws of the State of New York, without regard to any conflict of law provisions thereof.

7.4 Submission

to Jurisdiction.

(a) The

Maker hereby irrevocably and unconditionally (i) agrees that any legal action, suit, or proceeding arising out of or relating to this

Note may be brought in the courts of any county or borough of New York City in the State of New York or in any federal court sitting

therein, and (ii) submits to the exclusive jurisdiction of any such court in any such action, suit, or proceeding. Final judgment against

the Maker in any action, suit, or proceeding shall be conclusive and may be enforced in any other jurisdiction by suit on the judgment.

(b) Nothing

in this Section 7.4 shall affect the right of the Noteholder to (i) commence legal proceedings or otherwise sue the Maker in any other

court having jurisdiction over the Maker, or (ii) serve process upon the Maker in any manner authorized by the laws of any such jurisdiction.

7.5 Venue.

THE MAKER IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY OBJECTION THAT IT MAY NOW OR

HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS NOTE IN ANY COURT REFERRED TO IN

Section 7.4 AND THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE OF SUCH ACTION OR PROCEEDING IN ANY SUCH COURT.

7.6 Waiver

of Jury Trial. THE MAKER HEREBY IRREVOCABLY

WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY

OR INDIRECTLY RELATING TO THIS NOTE OR THE TRANSACTIONS CONTEMPLATED HEREBY WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY.

7.7 Successors

and Assigns. This Note may not be

assigned, transferred, or negotiated by the Noteholder to any person or entity, at any time, without the prior written notice to and

consent of the Maker. This Note shall inure to the benefit of and be binding upon the Parties and their permitted successors and assigns.

7.8 Headings.

The headings of the various sections and subsections herein are for reference only and shall not define, modify, expand, or limit any

of the terms or provisions hereof.

7.9 No

Waiver; Cumulative Remedies. No failure

to exercise and no delay in exercising, on the part of the Noteholder, of any right, remedy, power, or privilege hereunder shall operate

as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power, or privilege hereunder preclude any other

or further exercise thereof or the exercise of any other right, remedy, power, or privilege. The rights, remedies, powers, and privileges

herein provided are cumulative and not exclusive of any rights, remedies, powers, and privileges provided by law.

7.10 Automatic

Cancellation. After the Principal Amount outstanding under this Note has been paid in full with accrued and outstanding Interest,

this Note shall automatically be deemed canceled, shall be surrendered to the Maker for cancellation, and shall not be re-issued.

IN

WITNESS WHEREOF, the Maker has executed this Note as of March 5, 2024.

| |

UNIQUE LOGISTICS INTERNATIONAL, INC. |

| |

|

|

| |

By: |

|

| |

|

Sunandan

Ray, Chief Executive Officer |

Agreed

to and accepted by:

| UNIQUE LOGISTICS HOLDINGS LIMITED |

|

| |

|

|

| By: |

|

|

| |

Richard

Lee Chi Tak, Chief Executive Officer |

|

Exhibit 10.2

PROMISSORY

NOTE

| March 5, 2024 |

US$3,400,000 |

FOR

VALUE RECEIVED, Unique Logistics International, Inc., a Nevada corporation (the “Maker”), hereby promises

to pay to the order of Unique Logistics Holdings Limited, a Hong Kong corporation (“ULHL”), or its successors, assigns

or other subsequent noteholder, as the case may be (the “Noteholder”), the principal amount of Three Million Four

Hundred Thousand Dollars (US$3,400,000) (the “Principal Amount”), as provided herein (as the same may be amended,

restated, supplemented, or otherwise modified from time to time in accordance with the terms hereof, the “Note”).

WHEREAS,

each of the Maker and the Noteholder may be referred to herein as a “Party” and, collectively, as the “Parties.”

WHEREAS,

reference is made to that certain Promissory Note, dated September 29, 2023, issued by the Maker in favor of ULHL in the original principal

amount of $4,500,000 (the “September 2023 Note”), as amended, all of which principal amount remains outstanding as

of the date hereof.

WHEREAS,

(i) $1,400,000 of the principal amount of the September 2023 Note was originally owing pursuant to that certain promissory note dated

February 21, 2023 issued by the Maker in favor of ULHL in the original principal amount of $2,500,000, of which $1,400,000 remained outstanding

as of the date of the September 2023 Note (the “Net Assets Note”), (ii) $2,000,000 of the principal amount of the

September 2023 Note was originally owing pursuant to that certain promissory note dated February 21, 2023 issued by the Maker in favor

of ULHL in the original principal amount of $2,000,000 (the “Taiwan Note”), and (iii) $1,100,000 of the principal

amount of the September 2023 Note is owing pursuant to an additional loan to the Maker by ULHL (the “Initial Loan”).

WHEREAS,

by it receipt hereof ULHL has agreed to cancel, replace and supersede the September 2023 Note, with respect to $3,400,000 of the principal

thereof and which amount constitutes the initial Principal Amount of this Note.

Capitalized

terms used herein but not otherwise defined, if any, shall have the respective meanings attributed to them in the Purchase Agreement.

1. Payment

Due Date; Optional Prepayment.

1.1 Payment

of Principal Amount; Maturity Date. The Principal

Amount outstanding under this Note shall become due and payable on June 30, 2025 (the “Maturity Date”).

1.2 Optional

Prepayment. The Maker, in its sole discretion, may prepay the Principal Amount in whole or in part at any time or from time

to time prior to the Maturity Date without penalty or premium.

1.3

No Dividends by Subsidiaries; Exception. From

the date hereof, for so long as any of the Principal Amount hereunder remains outstanding, the Maker agrees, as a shareholder of the

ULHL Subsidiaries, that it will not vote in favor of or cause there to be declared any dividend in or by any of the ULHL Subsidiaries,

other than dividends payable to the Buyer to be used for repayment of amounts due to ULHL under this Note or any other note issued or

issuable by the Maker in favor of ULHL under the Purchase Agreement.

2. Interest.

The Principal Amount outstanding hereunder shall bear simple interest at the rate of fifteen percent (15%) per annum (the

“Interest Rate”) from the date hereof until such time as the Principal Amount is paid in full (the “Interest”).

Interest shall not accrue on the date on which payment of the Principal Amount and accrued Interest is paid.

3. Payment

Mechanics.

3.1 Manner

of Payment. All payments hereunder shall be made

in lawful currency of the United States of America on the date on which such payment is due, by cashier’s check, certified check,

or by wire transfer of immediately available funds to the Noteholder’s account at such bank as may be specified by the Noteholder

in writing to the Maker from time to time.

3.2 Application

of Payments. All payments made hereunder shall be

applied first to the payment of any fees or charges outstanding hereunder and second to the payment of accrued Interest,

and third to payment the Principal Amount outstanding under the Note.

3.3 Business

Day Convention. Payment hereunder shall be due on

a business day, meaning a day other than Saturday, Sunday, or other day on which commercial banks in New York, New York are authorized

or required by law to close (each such day, a “Business Day”). Whenever any payment to be made hereunder shall be

due on a day that is not a Business Day, such payment shall be made on the next succeeding Business Day.

4. Representations

and Warranties. The Maker hereby represents and

warrants to the Noteholder on the date hereof as follows:

4.1 Existence.

The Maker is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Nevada.

4.2 Power

and Authority. The Maker has the requisite power

and authority, and the legal right, to execute and deliver this Note and to perform its obligations hereunder.

4.3 Authorization;

Execution and Delivery. The execution and delivery

of this Note by the Maker and the performance of its obligations hereunder have been duly authorized by all necessary corporate action

in accordance with all applicable laws. The Maker has duly executed and delivered this Note.

4.4 No

Violations. The execution and delivery of this Note

and the consummation by the Maker of the transactions contemplated hereby do not and will not, to the knowledge of the Maker: (a) violate

any law applicable to the Maker or by which any of its properties or assets are bound; or (b) constitute a material default under any

material agreement or contract by which the Maker is bound.

4.5 Enforceability.

The Note is the valid, legal, and binding obligation of the Maker, enforceable against the Maker in accordance with its terms, except

as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, or similar laws affecting the enforcement

of creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at

law).

5. Events

of Default. The occurrence and continuance of any

of the following events shall constitute an Event of Default hereunder:

5.1 Failure

to Pay. The Maker fails to pay:

(a) the

Principal Amount or Interest when due; or

(b) such

failure continues without cure for seven (7) days after written notice thereof to the Maker.

5.2 Bankruptcy.

(a) The

Maker commences any case, proceeding, or other action (i) under any existing or future law relating to bankruptcy, insolvency, reorganization,

or other relief of debtors, seeking to have an order for relief entered with respect to it, or seeking to adjudicate it as bankrupt or

insolvent, or seeking reorganization, arrangement, adjustment, winding-up, liquidation, dissolution, composition, or other relief with

respect to it or its debts, or (ii) seeking appointment of a receiver, trustee, custodian, conservator, or other similar official for

it or for all or any substantial part of its assets, or the Maker makes a general assignment for the benefit of its creditors;

(b) There

is commenced against the Maker any case, proceeding, or other action of a nature referred to in Section 5.2(a) which (i) results in the

entry of an order for relief or any such adjudication or appointment or (ii) remains undismissed, undischarged, or unbonded for a period

of sixty (60) days;

(c) There

is commenced against the Maker any case, proceeding, or other action seeking issuance of a warrant of attachment, execution, or similar

process against all or any substantial part of its assets which results in the entry of an order for any such relief which has not been

vacated, discharged, or stayed or bonded pending appeal within sixty (60) days from the entry thereof;

(d) the

Maker takes any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the acts set forth in

Section 5.2(a), Section 5.2(b), or Section 5.2(c); or

(e) The

Maker is generally not, or is unable to, or admits in writing its inability to, pay its debts as they become due.

5.3 Purchase

Agreement Obligations. Notwithstanding any other provisions of this Note and without prejudice to any right of the Noteholder under

that certain Stock Purchase Agreement, dated as of the 28th of April, 2022, by and between the Maker and ULHL, as amended,

pursuant to which the Maker has agreed to purchase from ULHL certain shares of capital stock owned by ULHL in certain of its subsidiaries

(the “Purchase Agreement”), the Maker acknowledges and agrees that: (a) upon an Event of Default hereunder, so long

as no other event has occurred which would result in an event of default by Maker under either: (i) that certain Revolving Purchase,

Loan and Security Agreement, dated as of June 1, 2021, as amended, supplemented or restated from time to time, between the Maker, certain

of its affiliates and TBK Bank SSB; or (ii) that certain Financing Agreement, dated as of March 10, 2023, as amended by that certain

Waiver and Amendment No. 1 thereto, dated as of September 13, 2023, and that certain Waiver and Amendment No. 2 thereto, dated as of

February 5, 2024, among the Maker, certain subsidiaries of the Maker, the lenders party thereto from time to time, CB Agent Services

LLC, as origination agent, and Alter Domus (US) LLC, as administrative agent and collateral agent (collectively, the “Facilities”),

the Maker shall use a portion of the cash available to it as a result of consummation of the merger contemplated by that certain merger

agreement with Edify Acquisition Corp, not to exceed US$10,000,000, to pay the amounts owing hereunder, and (b) while this Note is outstanding

the Maker shall not directly or indirectly grant a security interest in any of its business or assets other than those granted in connection

with the foregoing Facilities.

5.4 Remedies.

Upon the occurrence of an Event of Default and at any time thereafter during the continuance of such Event of Default, the Noteholder

may at its option, by written notice to the Maker provided within ten (10) Business Days of the Noteholder’s discovery of the subject

Event of Default: (a) declare any Principal Amount or Interest outstanding under this Note to become immediately due and payable, and

(b) exercise any or all of its rights, powers, or remedies under applicable law or this Note; provided, however that, if an Event

of Default described in Section 5.2 shall occur, the Principal Amount shall become immediately due and payable without any notice, declaration,

or other act on the part of the Noteholder. If an Event of Default hereunder occurs, Maker agrees to pay all of Noteholder’s reasonable

costs and expenses incurred in connection with collection with amounts then due, including, without limitation, reasonable and documented

attorney’s fees and expenses incurred by the Noteholder as a result of the occurrence of such Event of Default. This Note is unsecured

and without recourse other than as specifically set forth herein.

6. Subordination.

Notwithstanding any other provisions of this Note, but subject to Section 5.3, by its acceptance of this Note the Holder acknowledges

and agrees that the obligations of the Maker under this Note shall be subordinate in all respects to the obligations of the Maker under

each of the Facilities.

7. Miscellaneous.

7.1 Notices.

Any notice, request or other communication to be given or made under this Note to the Maker or the Noteholder shall be in writing. Such

notice, request or other communication shall be deemed to have been duly given or made when it shall be delivered by hand, national or

international courier (confirmed by email), or email or other electronic or digital means (with a hard copy delivered within two (2)

Business Days) to the Party to which it is required or permitted to be given or made at such Party’s address as such Party shall

have designated by notice to the Party giving or making such notice, request or other communication, it being understood that the failure

to deliver a copy of any notice, request or other communication to a Party to whom copies are to be sent shall not affect the validity

of any such notice, request or other communication or constitute a breach of this Note.

7.2 Expenses.

The Maker shall reimburse the Noteholder on demand for all reasonable and documented out-of-pocket costs, expenses, and fees (including

reasonable attorneys’ fees) actually incurred by the Noteholder in connection with the Noteholder’s collection of amounts

due hereunder or enforcement of any of the Noteholder’s rights hereunder.

7.3 Governing

Law. This Note and any claim, controversy, dispute,

or cause of action (whether in contract or tort or otherwise) based upon, arising out of, or relating to this Note and the transactions

contemplated hereby, shall be governed by the laws of the State of New York, without regard to any conflict of law provisions thereof.

7.4 Submission

to Jurisdiction.

(a) The

Maker hereby irrevocably and unconditionally (i) agrees that any legal action, suit, or proceeding arising out of or relating to this

Note may be brought in the courts of any county or borough of New York City in the State of New York or in any federal court sitting

therein, and (ii) submits to the exclusive jurisdiction of any such court in any such action, suit, or proceeding. Final judgment against

the Maker in any action, suit, or proceeding shall be conclusive and may be enforced in any other jurisdiction by suit on the judgment.

(b) Nothing

in this Section 7.4 shall affect the right of the Noteholder to (i) commence legal proceedings or otherwise sue the Maker in any other

court having jurisdiction over the Maker, or (ii) serve process upon the Maker in any manner authorized by the laws of any such jurisdiction.

7.5 Venue.

THE MAKER IRREVOCABLY AND UNCONDITIONALLY WAIVES, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY OBJECTION THAT IT MAY NOW OR

HEREAFTER HAVE TO THE LAYING OF VENUE OF ANY ACTION OR PROCEEDING ARISING OUT OF OR RELATING TO THIS NOTE IN ANY COURT REFERRED TO IN

Section 7.4 AND THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE OF SUCH ACTION OR PROCEEDING IN ANY SUCH COURT.

7.6 Waiver

of Jury Trial. THE MAKER HEREBY IRREVOCABLY WAIVES,

TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN ANY LEGAL PROCEEDING DIRECTLY OR INDIRECTLY

RELATING TO THIS NOTE OR THE TRANSACTIONS CONTEMPLATED HEREBY WHETHER BASED ON CONTRACT, TORT, OR ANY OTHER THEORY.

7.7 Successors

and Assigns. This Note may not be assigned, transferred,

or negotiated by the Noteholder to any person or entity, at any time, without the prior written notice to and consent of the Maker. This

Note shall inure to the benefit of and be binding upon the Parties and their permitted successors and assigns.

7.8 Headings.

The headings of the various sections and subsections herein are for reference only and shall not define, modify, expand, or limit any

of the terms or provisions hereof.

7.9 No

Waiver; Cumulative Remedies. No failure to exercise

and no delay in exercising, on the part of the Noteholder, of any right, remedy, power, or privilege hereunder shall operate as a waiver

thereof; nor shall any single or partial exercise of any right, remedy, power, or privilege hereunder preclude any other or further exercise

thereof or the exercise of any other right, remedy, power, or privilege. The rights, remedies, powers, and privileges herein provided

are cumulative and not exclusive of any rights, remedies, powers, and privileges provided by law.

7.10 Automatic

Cancellation. After the Principal Amount outstanding under this Note has been paid in full with accrued and outstanding Interest,

this Note shall automatically be deemed canceled, shall be surrendered to the Maker for cancellation, and shall not be re-issued.

IN

WITNESS WHEREOF, the Maker has executed this Note as of March 5, 2024.

| |

UNIQUE LOGISTICS INTERNATIONAL, INC. |

| |

|

|

| |

By: |

|

| |

|

|

| |

|

Sunandan Ray, Chief Executive Officer |

| Agreed to and accepted by: |

| |

|

| UNIQUE

LOGISTICS HOLDINGS LIMITED |

|

| |

|

|

| By: |

|

|

| |

|

|

| |

Richard Lee Chi Tak, Chief Executive Officer |

|

Exhibit

10.3

SECOND

AMENDMENT

TO

PROMISSORY

NOTE

THIS

SECOND AMENDMENT TO PROMISSORY NOTE (this “Amendment”), dated as of March 5, 2024, by and between Unique

Logistics International, Inc., a Nevada corporation (the “Maker”), and Unique Logistics Holdings Limited, a Hong Kong

corporation (“ULHL”), or its successors, assigns or other subsequent noteholder, as the case may be (the “Noteholder”).

Reference

is hereby made to that certain Promissory Note dated February 21, 2023, issued by the Maker in favor of ULHL in the original principal

amount of $2,000,000, and as amended by that certain amendment on October 9, 2023 (the “Note”); all capitalized terms

used herein but not otherwise defined herein shall have the respective meanings set forth in the Note.

WHEREAS,

the Maker and ULHL desire hereby to amend the Note to provide for, among other things, the foregoing upon the terms and conditions set

forth herein.

NOW,

THEREFORE, for other good and valuable consideration, the parties hereto hereby agree as follows:

ARTICLE

I: AMENDMENT OF AGREEMENT

Section

1.1 Amendments. Subject to the terms and conditions contained herein, Maker and ULHL hereby amend the Note as

follows:

1.1.1

The definition of “Maturity Date” appearing in Section 1.1 of the Note shall be hereby amended by elimination

of “March 31, 2025” and insertion in lieu thereof of “June 30, 2025.” All references to the Maturity Date hereafter

shall refer to June 30, 2025.

ARTICLE

II: MISCELLANEOUS

Section

2.1 Miscellaneous Provisions Governing this Amendment.

2.1.1

Except as specifically modified and amended herein, all other terms, conditions and covenants contained in the Note shall remain

in full force and effect.

2.1.2 All references to the “Note” shall mean the Note as hereby amended.

2.1.3 This Amendment may be executed in any number of counterparts with the same effect as if all parties hereto had signed the same document.

All such counterparts shall be construed together and shall constitute one instrument, but in making proof hereof it shall only be necessary

to produce one such counterpart.

2.1.4 This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors and assigns.

2.1.5 This Note and any claim, controversy, dispute, or cause of action (whether in contract or tort or otherwise) based upon, arising

out of, or relating to this Note and the transactions contemplated hereby, shall be governed by the laws of the State of New York, without

regard to any conflict of law provisions thereof.

[SIGNATURE

PAGES IMMEDIATELY FOLLOW]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their duly authorized representatives, all

as of the day and year first above written.

| |

MAKER |

| |

|

| |

Unique

Logistics International, Inc., a Nevada corporation |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

ULHL/NOTEHOLDER: |

| |

|

| |

Unique

Logistics Holdings Limited, a Hong Kong corporation |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

Exhibit

10.4

AMENDMENT

TO

PROMISSORY

NOTE

THIS

AMENDMENT TO PROMISSORY NOTE (this “Amendment”), dated as of March 6, 2024, by and between Unique Logistics International,

Inc., a Nevada corporation (the “Maker”), and Unique Logistics Holdings Limited, a Hong Kong corporation (“ULHL”),

or its successors, assigns or other subsequent noteholder, as the case may be (the “Noteholder”).

Reference

is hereby made to that certain Promissory Note dated February 21, 2023, issued by the Maker in favor of ULHL in the original principal

amount of $1,000,000 (the “Note”); all capitalized terms used herein but not otherwise defined herein shall have the

respective meanings set forth in the Note.

WHEREAS,

the Maker and ULHL desire hereby to amend the Note to provide for, among other things, the foregoing upon the terms and conditions set

forth herein.

NOW,

THEREFORE, for other good and valuable consideration, the parties hereto hereby agree as follows:

ARTICLE

I: AMENDMENT OF AGREEMENT

Section

1.1 Amendments. Subject to the terms and conditions contained herein, Maker and ULHL hereby amend the Note as follows:

1.1.1

The “Principal Amount” of the Note shall be hereby amended to provide for a Principal Amount of $1,053,000.

1.1.2

The definition of “Maturity Date” appearing in Section 1.1 of the Note shall be hereby amended by elimination

of “the second anniversary of the date hereof” and insertion in lieu thereof of “June 30, 2025.” All references

to the Maturity Date hereafter shall refer to June 30, 2025.

ARTICLE

II: MISCELLANEOUS

Section

2.1 Miscellaneous Provisions Governing this Amendment.

2.1.1

Except as specifically modified and amended herein, all other terms, conditions and covenants contained in the Note shall remain

in full force and effect.

2.1.2

All references to the “Note” shall mean the Note as hereby amended.

2.1.3

This Amendment may be executed in any number of counterparts with the same effect as if all parties hereto had signed the same document.

All such counterparts shall be construed together and shall constitute one instrument, but in making proof hereof it shall only be necessary

to produce one such counterpart.

2.1.4

This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors and assigns.

2.1.5

This Note and any claim, controversy, dispute, or cause of action (whether in contract or tort or otherwise) based upon, arising

out of, or relating to this Note and the transactions contemplated hereby, shall be governed by the laws of the State of New York, without

regard to any conflict of law provisions thereof.

[SIGNATURE

PAGES IMMEDIATELY FOLLOW]

IN

WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed by their duly authorized representatives, all

as of the day and year first above written.

| |

MAKER |

| |

|

|

| |

Unique

Logistics International, Inc., a Nevada corporation |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

| |

|

|

| |

ULHL/NOTEHOLDER: |

| |

|

|

| |

Unique

Logistics Holdings Limited, a Hong Kong corporation |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

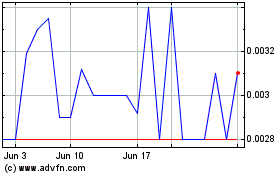

Unique Logistics (PK) (USOTC:UNQL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unique Logistics (PK) (USOTC:UNQL)

Historical Stock Chart

From Apr 2023 to Apr 2024