0001720116false00017201162024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported): March 7, 2024

_________________

RED VIOLET, INC.

(Exact name of Registrant as specified in its charter)

_________________

|

|

|

|

|

Delaware (State or other jurisdiction of incorporation or organization) |

|

001-38407 (Commission File Number) |

|

82-2408531 (I.R.S. Employer

Identification Number) |

2650 North Military Trail, Suite 300, Boca Raton, FL 33431

(Address of principal executive offices)

561-757-4000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

_________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol (s) |

Name of each exchange on which registered |

Common Stock, $0.001 par value per share |

RDVT |

The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On March 7, 2024, Red Violet, Inc., a Delaware corporation (the “Company”), issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2023 (the “Earnings Release”). A copy of the Earnings Release is furnished herewith as Exhibit 99.1.

Also on March 7, 2024, following the issuance of the Earnings Release, the Company conducted a conference call to discuss the reported financial results for the fourth quarter and year ended December 31, 2023. The Company had issued a press release on February 26, 2024 to announce the scheduling of the conference call. A copy of the transcript of the conference call is furnished herewith as Exhibit 99.2.

The information included herein and in Exhibit 99.1 and Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (“Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

99.1 Press Release, dated March 7, 2024

99.2 March 7, 2024 conference call transcript

104 Cover page Interactive Data File (embedded within the inline XBRL file).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Red Violet, Inc. |

|

|

|

Date: March 11, 2024 |

|

By: |

|

/s/ Derek Dubner |

|

|

|

|

Derek Dubner |

|

|

|

|

Chief Executive Officer (Principal Executive Officer) |

|

|

|

|

|

Exhibit 99.1

red violet Announces Fourth Quarter and Full Year 2023 Financial Results

Fourth Quarter Revenue Increased 15% to $15.1 Million Producing $4.2 Million of Cash Flow from Operations

Full Year 2023 Revenue Increased 13% to $60.2 Million Generating Net Income of $13.5 Million

BOCA RATON, Fla. – March 7, 2024 – Red Violet, Inc. (NASDAQ: RDVT), a leading analytics and information solutions provider, today announced financial results for the quarter and full year ended December 31, 2023.

“We delivered a solid quarter, capping off another record year for red violet that produced records in revenue, gross profit, net income, adjusted EBITDA, cash flow from operations, and free cash flow,” stated Derek Dubner, red violet’s CEO. “Our industry-leading AI/ML-powered platform, proprietary linking algorithms, and core identity graph continue to drive our excellence in entity resolution that is pivotal to identity verification, fraud prevention, and risk mitigation. With 2024 revenue to date off to a record start, we are highly focused on accelerating our business and continuing to deliver exceptional customer and shareholder value in 2024 and beyond.”

Fourth Quarter Financial Results

For the three months ended December 31, 2023, as compared to the three months ended December 31, 2022:

•Total revenue increased 15% to $15.1 million.

•Gross profit increased 16% to $9.6 million. Gross margin increased to 64% from 63%.

•Adjusted gross profit increased 17% to $11.7 million. Adjusted gross margin increased to 78% from 77%.

•Net loss narrowed 31% to $1.1 million, which resulted in a loss of $0.08 per basic and diluted share. Net loss margin improved to 7% from 12%.

•Adjusted EBITDA increased 76% to $2.7 million. Adjusted EBITDA margin increased to 18% from 12%.

•Adjusted net income increased 157% to $0.3 million, which resulted in adjusted earnings of $0.02 per basic and diluted share.

•Cash from operating activities decreased 4% to $4.2 million.

•Cash and cash equivalents were $32.0 million as of December 31, 2023.

Full Year Financial Results

For the year ended December 31, 2023, as compared to the year ended December 31, 2022:

•Total revenue increased 13% to $60.2 million.

•Gross profit increased 13% to $39.0 million. Gross margin remained consistent at 65%.

•Adjusted gross profit increased 15% to $47.1 million. Adjusted gross margin increased to 78% from 77%.

•Net income increased to $13.5 million from $0.6 million, which resulted in earnings of $0.97 and $0.96 per basic and diluted share, respectively. Net income margin increased to 22% from 1%.

•Adjusted EBITDA increased 27% to $16.4 million. Adjusted EBITDA margin increased to 27% from 24%.

•Adjusted net income increased 17% to $8.1 million, which resulted in adjusted earnings of $0.58 and $0.57 per basic and diluted share, respectively.

•Cash from operating activities increased 21% to $15.1 million.

Fourth Quarter and Recent Business Highlights

•Added over 100 customers to IDI™ during the fourth quarter, ending the year with 7,875 customers.

•Added over 17,000 users to FOREWARN® during the fourth quarter, ending the year with 185,380 users. Over 400 REALTOR® Associations are now contracted to use FOREWARN.

•Continued growth in the onboarding of higher-tier customers, with 72 customers contributing over $100,000 of revenue in 2023 compared to 67 customers in 2022.

•Appointed Bill Livek as an independent director of the Board of Directors, bringing his knowledge and expertise in platform-driven consumer insights to the red violet Board of Directors.

•Appointed Jonathan McDonald as Executive Vice President of Public Sector division, leveraging his extensive experience and proven leadership in the public sector to strengthen our ability to deliver our impactful solutions and drive sustainable growth in this key market segment.

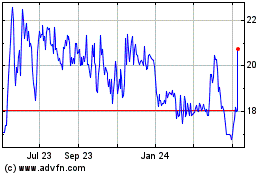

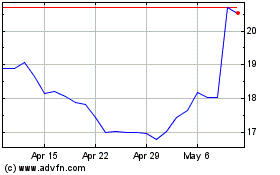

•The Board of Directors authorized the repurchase of an additional $5.0 million of the Company’s common stock on December 19, 2023. During the fourth quarter, the Company purchased 125,703 shares at an average price of $19.89 per share pursuant to the Stock Repurchase Program. Since inception in May of 2022, through February 29, 2024, the Company purchased a total of 289,340 shares at an average price of $18.73 per share. As of March 1, 2024, the Company had approximately $4.6 million remaining under the Stock Repurchase Program.

Conference Call

In conjunction with this release, red violet will host a conference call and webcast today at 4:30pm ET to discuss its quarterly and full year results and provide a business update. Please click here to pre-register for the conference call and obtain your dial in number and passcode. To access the live audio webcast, visit the Investors section of the red violet website at www.redviolet.com. Please login at least 15 minutes prior to the start of the call to ensure adequate time for any downloads that may be required. Following the completion of the conference call, an archived webcast of the conference call will be available on the Investors section of the red violet website at www.redviolet.com.

About red violet®

At red violet, we build proprietary technologies and apply analytical capabilities to deliver identity intelligence. Our technology powers critical solutions, which empower organizations to operate with confidence. Our solutions enable the real-time identification and location of people, businesses, assets and their interrelationships. These solutions are used for purposes including identity verification, risk mitigation, due diligence, fraud detection and prevention, regulatory compliance, and customer acquisition. Our intelligent platform, CORE™, is purpose-built for the enterprise, yet flexible enough for organizations of all sizes, bringing clarity to massive datasets by transforming data into intelligence. Our solutions are used today to enable frictionless commerce, to ensure safety, and to reduce fraud and the concomitant expense borne by society. For more information, please visit www.redviolet.com.

Company Contact:

Camilo Ramirez

Red Violet, Inc.

561-757-4500

ir@redviolet.com

Investor Relations Contact:

Steven Hooser

Three Part Advisors

214-872-2710

ir@redviolet.com

Use of Non-GAAP Financial Measures

Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per share, adjusted gross profit, adjusted gross margin, and free cash flow ("FCF"). Adjusted EBITDA is a non-GAAP financial measure equal to net income (loss), the most directly comparable financial measure based on US GAAP, excluding interest income, net, income tax expense (benefit), depreciation and amortization, share-based compensation expense, litigation costs, and write-off of long-lived assets and others. We define adjusted EBITDA margin as adjusted EBITDA as a percentage of revenue. Adjusted net income is a non-GAAP financial measure equal to net income (loss), the most directly comparable financial measure based on US GAAP, excluding share-based compensation expense, amortization of share-based compensation capitalized in intangible assets, and discrete tax items, and including the tax effect of adjustments. We define adjusted earnings per share as adjusted net income divided by the weighted average shares outstanding. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. We define FCF as net cash provided by operating activities reduced by purchase of property and equipment and capitalized costs included in intangible assets.

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements," as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as "expects," "plans," "projects," "will," "may," "anticipate," "believes," "should," "intends," "estimates," and other words of similar meaning. Such forward looking statements are subject to risks and uncertainties that are often difficult to predict, are beyond our control and which may cause results to differ materially from expectations, including whether the 2024 revenue to date resulting in a record start will help in accelerating our business and continuing to deliver exceptional customer and shareholder value in 2024 and beyond. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this press release and speak only as of the date of this press release and are advised to consider the factors listed above together with the additional factors under the heading "Forward-Looking Statements" and "Risk Factors" in red violet's Form 10-K for the year ended December 31, 2022 filed on March 8, 2023, as may be supplemented or amended by the Company's other SEC filings, including the Form 10-K for year ended December 31, 2023 expected to be filed today. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

RED VIOLET, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

|

December 31, 2022 |

|

ASSETS: |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

32,032 |

|

|

$ |

31,810 |

|

Accounts receivable, net of allowance for doubtful accounts of $159 and $60 as of December 31, 2023 and 2022, respectively |

|

|

7,135 |

|

|

|

5,535 |

|

Prepaid expenses and other current assets |

|

|

1,113 |

|

|

|

771 |

|

Total current assets |

|

|

40,280 |

|

|

|

38,116 |

|

Property and equipment, net |

|

|

592 |

|

|

|

709 |

|

Intangible assets, net |

|

|

34,403 |

|

|

|

31,647 |

|

Goodwill |

|

|

5,227 |

|

|

|

5,227 |

|

Right-of-use assets |

|

|

2,457 |

|

|

|

1,114 |

|

Deferred tax assets |

|

|

9,514 |

|

|

|

- |

|

Other noncurrent assets |

|

|

517 |

|

|

|

601 |

|

Total assets |

|

$ |

92,990 |

|

|

$ |

77,414 |

|

LIABILITIES AND SHAREHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,631 |

|

|

$ |

2,229 |

|

Accrued expenses and other current liabilities |

|

|

1,989 |

|

|

|

1,845 |

|

Current portion of operating lease liabilities |

|

|

569 |

|

|

|

692 |

|

Deferred revenue |

|

|

690 |

|

|

|

670 |

|

Total current liabilities |

|

|

4,879 |

|

|

|

5,436 |

|

Noncurrent operating lease liabilities |

|

|

1,999 |

|

|

|

598 |

|

Deferred tax liabilities |

|

|

- |

|

|

|

287 |

|

Total liabilities |

|

|

6,878 |

|

|

|

6,321 |

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

Preferred stock—$0.001 par value, 10,000,000 shares authorized, and 0 shares issued and outstanding, as of December 31, 2023 and 2022 |

|

|

- |

|

|

|

- |

|

Common stock—$0.001 par value, 200,000,000 shares authorized, 13,980,274 and 13,956,404 shares issued, and 13,970,846 and 13,956,404 shares outstanding, as of December 31, 2023 and 2022 |

|

|

14 |

|

|

|

14 |

|

Treasury stock, at cost, 9,428 and 0 shares as of December 31, 2023 and 2022 |

|

|

(188 |

) |

|

|

- |

|

Additional paid-in capital |

|

|

94,159 |

|

|

|

92,481 |

|

Accumulated deficit |

|

|

(7,873 |

) |

|

|

(21,402 |

) |

Total shareholders' equity |

|

|

86,112 |

|

|

|

71,093 |

|

Total liabilities and shareholders' equity |

|

$ |

92,990 |

|

|

$ |

77,414 |

|

RED VIOLET, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Revenue |

|

$ |

60,204 |

|

|

$ |

53,318 |

|

Costs and expenses(1): |

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of depreciation and amortization) |

|

|

13,069 |

|

|

|

12,211 |

|

Sales and marketing expenses |

|

|

13,833 |

|

|

|

10,834 |

|

General and administrative expenses |

|

|

22,446 |

|

|

|

23,237 |

|

Depreciation and amortization |

|

|

8,352 |

|

|

|

6,675 |

|

Total costs and expenses |

|

|

57,700 |

|

|

|

52,957 |

|

Income from operations |

|

|

2,504 |

|

|

|

361 |

|

Interest income, net |

|

|

1,334 |

|

|

|

351 |

|

Income before income taxes |

|

|

3,838 |

|

|

|

712 |

|

Income tax (benefit) expense |

|

|

(9,691 |

) |

|

|

96 |

|

Net income |

|

$ |

13,529 |

|

|

$ |

616 |

|

Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.97 |

|

|

$ |

0.04 |

|

Diluted |

|

$ |

0.96 |

|

|

$ |

0.04 |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

|

13,974,125 |

|

|

|

13,759,296 |

|

Diluted |

|

|

14,134,021 |

|

|

|

14,107,144 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Share-based compensation expense in each category: |

|

|

|

|

|

|

|

|

Sales and marketing expenses |

|

$ |

462 |

|

|

$ |

290 |

|

General and administrative expenses |

|

|

4,924 |

|

|

|

5,215 |

|

Total |

|

$ |

5,386 |

|

|

$ |

5,505 |

|

RED VIOLET, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Amounts in thousands)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

Net income |

|

$ |

13,529 |

|

|

$ |

616 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

8,352 |

|

|

|

6,675 |

|

Share-based compensation expense |

|

|

5,386 |

|

|

|

5,505 |

|

Write-off of long-lived assets |

|

|

6 |

|

|

|

177 |

|

Provision for bad debts |

|

|

1,088 |

|

|

|

174 |

|

Noncash lease expenses |

|

|

576 |

|

|

|

547 |

|

Deferred income tax (benefit) expense |

|

|

(9,801 |

) |

|

|

89 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(2,688 |

) |

|

|

(1,973 |

) |

Prepaid expenses and other current assets |

|

|

(342 |

) |

|

|

(172 |

) |

Other noncurrent assets |

|

|

84 |

|

|

|

(464 |

) |

Accounts payable |

|

|

(598 |

) |

|

|

624 |

|

Accrued expenses and other current liabilities |

|

|

100 |

|

|

|

1,450 |

|

Deferred revenue |

|

|

20 |

|

|

|

(171 |

) |

Operating lease liabilities |

|

|

(641 |

) |

|

|

(618 |

) |

Net cash provided by operating activities |

|

|

15,071 |

|

|

|

12,459 |

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(122 |

) |

|

|

(373 |

) |

Capitalized costs included in intangible assets |

|

|

(9,024 |

) |

|

|

(8,456 |

) |

Net cash used in investing activities |

|

|

(9,146 |

) |

|

|

(8,829 |

) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Taxes paid related to net share settlement of vesting of restricted stock units |

|

|

(1,992 |

) |

|

|

(5,200 |

) |

Repurchases of common stock |

|

|

(3,711 |

) |

|

|

(878 |

) |

Net cash used in financing activities |

|

|

(5,703 |

) |

|

|

(6,078 |

) |

Net increase (decrease) in cash and cash equivalents |

|

$ |

222 |

|

|

$ |

(2,448 |

) |

Cash and cash equivalents at beginning of period |

|

|

31,810 |

|

|

|

34,258 |

|

Cash and cash equivalents at end of period |

|

$ |

32,032 |

|

|

$ |

31,810 |

|

SUPPLEMENTAL DISCLOSURE INFORMATION: |

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

- |

|

|

$ |

- |

|

Cash paid for income taxes |

|

$ |

82 |

|

|

$ |

39 |

|

Share-based compensation capitalized in intangible assets |

|

$ |

1,851 |

|

|

$ |

1,621 |

|

Retirement of treasury stock |

|

$ |

5,559 |

|

|

$ |

6,078 |

|

Right-of -use assets obtained in exchange of operating lease liabilities |

|

$ |

1,919 |

|

|

$ |

- |

|

Operating lease liabilities arising from obtaining right-of-use assets |

|

$ |

1,919 |

|

|

$ |

- |

|

Use and Reconciliation of Non-GAAP Financial Measures

Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per share, adjusted gross profit, adjusted gross margin, and FCF. Adjusted EBITDA is a non-GAAP financial measure equal to net income (loss), the most directly comparable financial measure based on US GAAP, excluding interest income, net, income tax expense (benefit), depreciation and amortization, share-based compensation expense, litigation costs, and write-off of long-lived assets and others. We define adjusted EBITDA margin as adjusted EBITDA as a percentage of revenue. Adjusted net income is a non-GAAP financial measure equal to net income (loss), the most directly comparable financial measure based on US GAAP, excluding share-based compensation expense, amortization of share-based compensation capitalized in intangible assets, and discrete tax items, and including the tax effect of adjustments. We define adjusted earnings per share as adjusted net income divided by the weighted average shares outstanding. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. We define FCF as net cash provided by operating activities reduced by purchase of property and equipment and capitalized costs included in intangible assets.

The following is a reconciliation of net income (loss), the most directly comparable US GAAP financial measure, to adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

(Dollars in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net income (loss) |

|

$ |

(1,070 |

) |

|

$ |

(1,544 |

) |

|

$ |

13,529 |

|

|

$ |

616 |

|

Interest income, net |

|

|

(387 |

) |

|

|

(225 |

) |

|

|

(1,334 |

) |

|

|

(351 |

) |

Income tax expense (benefit) |

|

|

562 |

|

|

|

(148 |

) |

|

|

(9,691 |

) |

|

|

96 |

|

Depreciation and amortization |

|

|

2,211 |

|

|

|

1,815 |

|

|

|

8,352 |

|

|

|

6,675 |

|

Share-based compensation expense |

|

|

1,328 |

|

|

|

1,439 |

|

|

|

5,386 |

|

|

|

5,505 |

|

Litigation costs |

|

|

- |

|

|

|

4 |

|

|

|

49 |

|

|

|

132 |

|

Write-off of long-lived assets and others |

|

|

19 |

|

|

|

171 |

|

|

|

77 |

|

|

|

178 |

|

Adjusted EBITDA |

|

$ |

2,663 |

|

|

$ |

1,512 |

|

|

$ |

16,368 |

|

|

$ |

12,851 |

|

Revenue |

|

$ |

15,061 |

|

|

$ |

13,069 |

|

|

$ |

60,204 |

|

|

$ |

53,318 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) margin |

|

|

(7 |

%) |

|

|

(12 |

%) |

|

|

22 |

% |

|

|

1 |

% |

Adjusted EBITDA margin |

|

|

18 |

% |

|

|

12 |

% |

|

|

27 |

% |

|

|

24 |

% |

The following is a reconciliation of net income (loss), the most directly comparable US GAAP financial measure, to adjusted net income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

(Dollars in thousands, except share data) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net income (loss) |

|

$ |

(1,070 |

) |

|

$ |

(1,544 |

) |

|

$ |

13,529 |

|

|

$ |

616 |

|

Share-based compensation expense |

|

|

1,328 |

|

|

|

1,439 |

|

|

|

5,386 |

|

|

|

5,505 |

|

Amortization of share-based compensation capitalized in intangible assets |

|

|

263 |

|

|

|

210 |

|

|

|

969 |

|

|

|

766 |

|

Discrete tax items(1) |

|

|

- |

|

|

|

- |

|

|

|

(10,272 |

) |

|

|

- |

|

Tax effect of adjustments(2) |

|

|

(251 |

) |

|

|

- |

|

|

|

(1,526 |

) |

|

|

- |

|

Adjusted net income |

|

$ |

270 |

|

|

$ |

105 |

|

|

$ |

8,086 |

|

|

$ |

6,887 |

|

Earnings (loss) per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.08 |

) |

|

$ |

(0.11 |

) |

|

$ |

0.97 |

|

|

$ |

0.04 |

|

Diluted |

|

$ |

(0.08 |

) |

|

$ |

(0.11 |

) |

|

$ |

0.96 |

|

|

$ |

0.04 |

|

Adjusted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.58 |

|

|

$ |

0.50 |

|

Diluted |

|

$ |

0.02 |

|

|

$ |

0.01 |

|

|

$ |

0.57 |

|

|

$ |

0.49 |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

13,985,426 |

|

|

|

13,964,010 |

|

|

|

13,974,125 |

|

|

|

13,759,296 |

|

Diluted(3) |

|

|

14,307,797 |

|

|

|

14,205,633 |

|

|

|

14,134,021 |

|

|

|

14,107,144 |

|

(1) During the three months ended September 30, 2023, $10.3 million of income tax benefit was recognized as a result of the release of the valuation allowance previously recorded on our deferred tax asset and cumulative research and development tax credit, which were excluded to calculate the adjusted net income.

(2) The tax effect of adjustments is calculated using the expected federal and state statutory tax rate. The expected federal and state income tax rate was approximately 25.75% for the three and twelve months ended December 31, 2023. There was no tax effect of such adjustments for the three and twelve months ended December 31, 2022, as a full valuation allowance was provided for the net deferred tax assets.

(3) For the three months ended December 31, 2023 and 2022, diluted weighted average shares outstanding for adjusted diluted earnings per share are calculated by the inclusion of unvested RSUs, which were not included in US GAAP diluted weighted average shares outstanding due to the Company's net loss position for such periods.

The following is a reconciliation of gross profit, the most directly comparable US GAAP financial measure, to adjusted gross profit:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

(Dollars in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

|

$ |

15,061 |

|

|

$ |

13,069 |

|

|

$ |

60,204 |

|

|

$ |

53,318 |

|

Cost of revenue (exclusive of depreciation and amortization) |

|

|

(3,337 |

) |

|

|

(3,054 |

) |

|

|

(13,069 |

) |

|

|

(12,211 |

) |

Depreciation and amortization of intangible assets |

|

|

(2,154 |

) |

|

|

(1,758 |

) |

|

|

(8,119 |

) |

|

|

(6,440 |

) |

Gross profit |

|

|

9,570 |

|

|

|

8,257 |

|

|

|

39,016 |

|

|

|

34,667 |

|

Depreciation and amortization of intangible assets |

|

|

2,154 |

|

|

|

1,758 |

|

|

|

8,119 |

|

|

|

6,440 |

|

Adjusted gross profit |

|

$ |

11,724 |

|

|

$ |

10,015 |

|

|

$ |

47,135 |

|

|

$ |

41,107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross margin |

|

|

64 |

% |

|

|

63 |

% |

|

|

65 |

% |

|

|

65 |

% |

Adjusted gross margin |

|

|

78 |

% |

|

|

77 |

% |

|

|

78 |

% |

|

|

77 |

% |

The following is a reconciliation of net cash provided by operating activities, the most directly comparable US GAAP measure, to FCF:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

(Dollars in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net cash provided by operating activities |

|

$ |

4,204 |

|

|

$ |

4,359 |

|

|

$ |

15,071 |

|

|

$ |

12,459 |

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(24 |

) |

|

|

(102 |

) |

|

|

(122 |

) |

|

|

(373 |

) |

Capitalized costs included in intangible assets |

|

|

(2,103 |

) |

|

|

(2,317 |

) |

|

|

(9,024 |

) |

|

|

(8,456 |

) |

Free cash flow |

|

$ |

2,077 |

|

|

$ |

1,940 |

|

|

$ |

5,925 |

|

|

$ |

3,630 |

|

In order to assist readers of our consolidated financial statements in understanding the operating results that management uses to evaluate the business and for financial planning purposes, we present non-GAAP measures of adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per share, adjusted gross profit, adjusted gross margin, and FCF as supplemental measures of our operating performance. We believe they provide useful information to our investors as they eliminate the impact of certain items that we do not consider indicative of our cash operations and ongoing operating performance. In addition, we use them as an integral part of our internal reporting to measure the performance and operating strength of our business.

We believe adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per share, adjusted gross profit, adjusted gross margin, and FCF are relevant and provide useful information frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies similar to ours and are indicators of the operational strength of our business. We believe adjusted EBITDA eliminates the uneven effect of considerable amounts of non-cash depreciation and amortization, share-based compensation expense and the impact of other non-recurring items, providing useful comparisons versus prior periods or forecasts. Adjusted EBITDA margin is calculated as adjusted EBITDA as a percentage of revenue. We believe adjusted net income provides additional means of evaluating period-over-period operating performance by eliminating certain non-cash expenses and other items that might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing operations. Adjusted net income is a non-GAAP financial measure equal to net income (loss), excluding share-based compensation expense, amortization of share-based compensation capitalized in intangible assets, and discrete tax items, and including the tax effect of adjustments. We define adjusted earnings per share as adjusted net income divided by the weighted average shares outstanding. Our adjusted gross profit is a measure used by management in evaluating the business’s current operating performance by excluding the impact of prior historical costs of assets that are expensed systematically and allocated over the estimated useful lives of the assets, which may not be indicative of the current operating activity. Our adjusted gross profit is calculated by using revenue, less cost of revenue (exclusive of depreciation and amortization). We believe adjusted gross profit provides useful information to our investors by eliminating the impact of non-cash depreciation and amortization, and specifically the amortization of software developed for internal use, providing a baseline of our core operating results that allow for analyzing trends in our underlying business consistently over multiple periods. Adjusted gross margin is calculated as adjusted gross profit as a percentage of revenue. We believe FCF is an important liquidity measure of the cash that is available, after capital expenditures, for operational expenses and investment in our business. FCF is a measure used by management to understand and evaluate the business’s operating performance and trends over time. FCF is calculated by using net cash provided by operating activities, less purchase of property and equipment and capitalized costs included in intangible assets.

Adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per share, adjusted gross profit, adjusted gross margin, and FCF are not intended to be performance measures that should be regarded as an alternative to, or more meaningful than, financial measures presented in accordance with US GAAP. In addition, FCF is not intended to represent our residual cash flow available for discretionary expenses and is not necessarily a measure of our ability to fund our cash needs. The way we measure adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per share, adjusted gross profit, adjusted gross margin, and FCF may not be comparable to similarly titled measures presented by other companies, and may not be identical to corresponding measures used in our various agreements.

SUPPLEMENTAL METRICS

The following metrics are intended as a supplement to the financial statements found in this release and other information furnished or filed with the SEC. These supplemental metrics are not necessarily derived from any underlying financial statement amounts. We believe these supplemental metrics help investors understand trends within our business and evaluate the performance of such trends quickly and effectively. In the event of discrepancies between amounts in these tables and the Company's historical disclosures or financial statements, readers should rely on the Company's filings with the SEC and financial statements in the Company's most recent earnings release.

We intend to periodically review and refine the definition, methodology and appropriateness of each of these supplemental metrics. As a result, metrics are subject to removal and/or changes, and such changes could be material.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited) |

|

(Dollars in thousands) |

|

Q1'22 |

|

|

Q2'22 |

|

|

Q3'22 |

|

|

Q4'22 |

|

|

Q1'23 |

|

|

Q2'23 |

|

|

Q3'23 |

|

|

Q4'23 |

|

Customer metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IDI - billable customers(1) |

|

|

6,592 |

|

|

|

6,817 |

|

|

|

6,873 |

|

|

|

7,021 |

|

|

|

7,256 |

|

|

|

7,497 |

|

|

|

7,769 |

|

|

|

7,875 |

|

FOREWARN - users(2) |

|

|

91,490 |

|

|

|

101,261 |

|

|

|

110,051 |

|

|

|

116,960 |

|

|

|

131,348 |

|

|

|

146,537 |

|

|

|

168,356 |

|

|

|

185,380 |

|

Revenue metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contractual revenue %(3) |

|

|

77 |

% |

|

|

80 |

% |

|

|

68 |

% |

|

|

77 |

% |

|

|

75 |

% |

|

|

79 |

% |

|

|

79 |

% |

|

|

82 |

% |

Gross revenue retention %(4) |

|

|

97 |

% |

|

|

95 |

% |

|

|

94 |

% |

|

|

95 |

% |

|

|

94 |

% |

|

|

94 |

% |

|

|

94 |

% |

|

|

92 |

% |

Revenue from new customers(5) |

|

$ |

1,014 |

|

|

$ |

805 |

|

|

$ |

2,016 |

|

|

$ |

1,216 |

|

|

$ |

1,869 |

|

|

$ |

1,147 |

|

|

$ |

1,326 |

|

|

$ |

1,258 |

|

Base revenue from existing customers(6) |

|

$ |

9,721 |

|

|

$ |

10,164 |

|

|

$ |

10,839 |

|

|

$ |

10,574 |

|

|

$ |

11,121 |

|

|

$ |

11,707 |

|

|

$ |

12,432 |

|

|

$ |

12,111 |

|

Growth revenue from existing customers(7) |

|

$ |

1,994 |

|

|

$ |

1,525 |

|

|

$ |

2,171 |

|

|

$ |

1,279 |

|

|

$ |

1,636 |

|

|

$ |

1,826 |

|

|

$ |

2,079 |

|

|

$ |

1,692 |

|

Other metrics |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employees - sales and marketing |

|

59 |

|

|

57 |

|

|

64 |

|

|

68 |

|

|

61 |

|

|

63 |

|

|

65 |

|

|

71 |

|

Employees - support |

|

10 |

|

|

9 |

|

|

10 |

|

|

10 |

|

|

10 |

|

|

9 |

|

|

9 |

|

|

9 |

|

Employees - infrastructure |

|

23 |

|

|

25 |

|

|

25 |

|

|

28 |

|

|

27 |

|

|

26 |

|

|

27 |

|

|

27 |

|

Employees - engineering |

|

50 |

|

|

52 |

|

|

52 |

|

|

54 |

|

|

47 |

|

|

47 |

|

|

47 |

|

|

51 |

|

Employees - administration |

|

26 |

|

|

27 |

|

|

26 |

|

|

27 |

|

|

25 |

|

|

25 |

|

|

25 |

|

|

25 |

|

(1) We define a billable customer of IDI as a single entity that generated revenue in the last three months of the period. Billable customers are typically corporate organizations. In most cases, corporate organizations will have multiple users and/or departments purchasing our solutions, however, we count the entire organization as a discrete customer.

(2) We define a user of FOREWARN as a unique person that has a subscription to use the FOREWARN service as of the last day of the period. A unique person can only have one user account.

(3) Contractual revenue % represents revenue generated from customers pursuant to pricing contracts containing a monthly fee and any additional overage divided by total revenue. Pricing contracts are generally annual contracts or longer, with auto renewal.

(4) Gross revenue retention is defined as the revenue retained from existing customers, net of reinstated revenue, and excluding expansion revenue. Revenue is measured once a customer has generated revenue for six consecutive months. Revenue is considered lost when all revenue from a customer ceases for three consecutive months; revenue generated by a customer after the three-month loss period is defined as reinstated revenue. Gross revenue retention percentage is calculated on a trailing twelve-month basis. The numerator of which is revenue lost during the period due to attrition, net of reinstated revenue, and the denominator of which is total revenue based on an average of total revenue at the beginning of each month during the period, with the quotient subtracted from one. Prior to Q1’22, FOREWARN revenue was excluded from our gross revenue retention calculation. Beginning Q4’22, our gross revenue retention calculation excludes revenue from idiVERIFIED, which is purely transactional and currently represents less than 3% of total revenue.

(5) Revenue from new customers represents the total monthly revenue generated from new customers in a given period. A customer is defined as a new customer during the first six months of revenue generation.

(6) Base revenue from existing customers represents the total monthly revenue generated from existing customers in a given period that does not exceed the customers' trailing six-month average revenue. A customer is defined as an existing customer six months after their initial month of revenue.

(7) Growth revenue from existing customers represents the total monthly revenue generated from existing customers in a given period in excess of the customers' trailing six-month average revenue.

Exhibit 99.2

Red Violet, Inc. (NASDAQ: RDVT)

Fourth Quarter 2023 Earnings Results Conference Call

Company Participants:

Camilo Ramirez, Senior Vice President, Finance and Investor Relations

Derek Dubner, Chairman and Chief Executive Officer

Dan MacLachlan, Chief Financial Officer

Operator:

Good day ladies and gentlemen, and welcome to red violet’s fourth quarter and full year 2023 earnings conference call. At this time, all participants are in a listen only mode. Later we will conduct a question and answer session and instructions will follow at that time.

As a reminder this call is being recorded.

I would now like to introduce your host for today’s call Camilo Ramirez, Senior Vice President, Finance and Investor Relations. Please go ahead.

Camilo Ramirez:

Good afternoon and welcome. Thank you for joining us today to discuss our fourth quarter and full year 2023 financial results.

With me today is Derek Dubner, our Chairman and Chief Executive Officer, and Dan MacLachlan, our Chief Financial Officer. Our call today will begin with comments from Derek and Dan, followed by a question and answer session.

I would like to remind you that this call is being webcast live and recorded. A replay of the event will be available following the call on our website. To access the webcast, please visit our Investors page on our website www.redviolet.com.

Before we begin, I would like to advise listeners that certain information discussed by management during this conference call are forward-looking statements covered under the Safe Harbor Provisions of the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from those stated or implied by our forward-looking statements due to risks and uncertainties associated with the company’s business. The company undertakes no obligation to update the information provided on this call. For a discussion of risks and uncertainties associated with red violet’s business, I encourage you to review the company’s filings with the Securities and Exchange Commission, including the most recent Annual Report on Form 10-K and the subsequent 10-Qs.

During the call, we may present certain non-GAAP financial information relating to adjusted gross profit, adjusted gross margin, adjusted EBITDA, adjusted EBITDA margin, adjusted net income, adjusted earnings per share, and free cash flow. Reconciliations of these non-GAAP financial measures to their most directly comparable US GAAP financial measure are provided in the earnings press release issued earlier today. In addition, certain supplemental

metrics that are not necessarily derived from any underlying financial statement amounts may be discussed and these metrics and their definitions can also be found in the earnings press release issued earlier today.

With that, I am pleased to introduce red violet’s Chairman and Chief Executive Officer, Derek Dubner.

Derek Dubner

Thanks Camilo. Good afternoon to those joining us today to discuss our fourth quarter and full year 2023 results. We are pleased to announce a strong fourth quarter, capping off another record year for red violet. It was a year of producing higher financial metrics across the board. Reflecting on the prior year in an economic climate that certainly experienced its ebbs and flows but found its footing as the year progressed, we grew revenue in the mid-teens, generated very strong margins and cash flow, and invested in our business while returning capital to shareholders via our stock repurchase program. Our industry-leading AI/ML-powered platform, proprietary linking algorithms, and core identity graph continue to be recognized by industry, and, as time passes, more and more customers and prospects are realizing that we do entity resolution better than anybody else. And entity resolution is essential for identity verification, fraud detection and prevention, and risk mitigation across industries and across transactions. Case in point: our solutions are now an integral component of the solutions of a number of the leading identity verification platform companies in the market today. These companies rely on our entity resolution capabilities to serve their many end markets. Our differentiated assets and capabilities have us very well positioned for 2024 and beyond. Given the continuing expansion of our product suite and with 2024 revenue to date off to a record start, we are very optimistic and highly focused on accelerating our business and continuing to deliver exceptional customer and shareholder value.

Now, turning to the numbers. Total revenue for the fourth quarter was $15.1 million, a 15% increase over prior year. We produced $11.7 million in adjusted gross profit, resulting in a margin of 78% in the fourth quarter, up 1-percentage point. Adjusted EBITDA for the quarter was $2.7 million, up 76% over prior year. Adjusted EBITDA margin was 18%, up 6-percentage points. Adjusted net income increased 157% to $0.3 million for the quarter, resulting in adjusted earnings of $0.02 per share. Cash and cash equivalents were $32.0 million at December 31, 2023.

Our contractual revenue was 82% for the quarter, up 5-percentage points from prior year. For those that are new to our story, it always bears mention that the fourth quarter presents some seasonality just due to the fact that there are less business days to transact around the holiday periods, which impacts our transactional revenue.

Our IDI billable customer base grew by 106 customers sequentially from the third quarter, ending the fourth quarter at 7,875 customers. FOREWARN added over 17,000 users during the fourth quarter, ending the quarter at 185,380 users. Over 400 Realtor® Associations are now contracted to use FOREWARN. We continue to hear personal stories from appreciative FOREWARN subscribers about how impactful FOREWARN is in ensuring their safety as they meet unknown prospects in often isolated locations. We are working urgently to get this essential safety tool into the hands of all real estate professionals.

For the year, total revenue increased 13% to $60.2 million, generating an adjusted gross profit of $47.1 million and adjusted EBITDA of $16.4 million. Adjusted EBITDA margin was 27%, up 3-percentage points. We saw strong customer onboarding throughout the year, with continued growth in the onboarding of higher-tier customers, with 72 customers contributing over $100,000 of revenue in 2023 compared to 67 customers in 2022. We generated $5.9 million in free cash flow in 2023, compared to generating $3.6 million in 2022.

Throughout the year, we continued our expansion within existing verticals and our move into larger enterprise, experiencing solid demand across Financial and Corporate Risk as we continued to evolve our KYC verification platform with intelligent fraud signals and scoring capabilities. We completed the integration of our leading background screening support solutions, idiCRIM, idiTRACE, and idiALIAS, which provide an essential, informed view of the consumer prior to the commencement of the background screening process. Our focus on law enforcement, within our Investigative vertical, has driven increased agency onboarding due to the accuracy and currentness of our data, our differentiated interface, leading mobile app, and unique search functionality, including our map-based criminal search, real-time arrest search, and arrest monitoring. In the last two quarters of the year, we saw signs of recovery in our Collections vertical, and that progress continues throughout the first quarter to date.

Closing out the year, we completed our idiMARKETING data integration with our holistic core consumer identity graph. We added hundreds of data attributes to the graph, with idiMARKETING products now in market to inform a vast set of industries in identity verification across the entire customer journey – from prospecting, onboarding, app login, purchase, transfer, and more. We are highly focused on these areas for 2024 with the goal of accelerating revenue by way of identity verification, background screening support, government, law enforcement, and marketing services -- as we will roll out new products and expanded capabilities throughout 2024 and beyond. Given the economic climate last year, we likely sacrificed a bit of top line growth as we tilted conservatively in managing the business and ensuring a very healthy bottom line. We, of course, will remain focused on the health of our business but we see real opportunities in our current endeavors to lean in and accelerate revenue growth in 2024 and to position ourselves for continued acceleration in subsequent years.

Given our announcement today on the appointment of Jonathan McDonald, I do want to take a little time to discuss the public sector. It is a large market opportunity for us, and we have proven, when given the chance to test against larger competition, that our platform, core consumer identity graph, and superior API functionality are differentiating in generating insights needed by government agencies to solve for their complex problems. As government is a unique industry with its own complexities, and as an example of where we are leaning in to accelerate our path, we are excited to welcome Jonathan McDonald to the red violet team. Jonathan will be joining us as EVP of Public Sector. Jonathan has over two decades of experience leading public sector divisions of global information solution providers, responsible for product development, go-to-market strategy, sales, and contract procurement. Jonathan’s prior experience includes his role as EVP, U.S. Public Sector, at TransUnion, where he was instrumental in TransUnion’s entrance into, and expansion within, the U.S. public sector. Previously, Jonathan held leadership roles at Clarivate, Pivotal Software, Dell, IBM, and LexisNexis Risk Solutions.

Another area that we had previously said we would lean in is AI, specifically deep learning. As you may recall, we discussed a few quarters ago that we are in a unique position to expand our AI capabilities given our valuable assets; namely, our AI/ML-driven platform and our high-confidence, core consumer identity graph. We are investing in this area and, at present, we have added two individuals with expertise in deep learning who are leading the charge in training transformer models to identify fraud signals across massive amounts of data, in utilizing generative AI to develop new ways of interacting with our high-confidence data assets, in using large language models to analyze data and to identify patterns and relationships to assimilate into our core identity graph, and in providing deep learning models to diverse industries to extract valuable insights and intelligence from the large volumes of data within our identity graph. We believe our key assets combined with the natural language processing capabilities of large language models, as well as the analytical advantages of deep learning, will prove invaluable to any business or organization in making more informed decisions, driving innovation, and gaining a competitive edge in today's data-driven world.

On the corporate governance front, it is important to the company that as the company and business landscape evolve, so must our Board of Directors to ensure that we can adapt to emerging opportunities and challenges, drive innovation, and solidify the long-term sustainability and growth of the company. We recently announced the appointment of Bill Livek to our Board of Directors. Bill’s multi-decade career building platform-driven solutions to derive consumer insights has established him as a leading innovator in the information services space, and we are pleased to have Bill on the red violet Board of Directors.

Turning now to our stock repurchase program. As you may recall, on December 19, 2023, our Board of Directors authorized the repurchase of an additional $5.0 million of the Company’s common stock. During the fourth quarter, the Company purchased 125,703 shares at an average price of $19.89 per share. Since inception in May of 2022, through February 29, 2024, the Company purchased a total of 289,340 shares at an average price of $18.73 per share. As of March 1, 2024, the Company had approximately $4.6 million remaining under the Stock Repurchase Program.

With that, I’ll turn it over to Dan to discuss the financials.

Dan MacLachlan

Thank you, Derek, and good afternoon. 2023 was a strong year for red violet, again producing yearly records in revenue, gross profit, net income, adjusted EBITDA, and free cash flow. Reflecting back to the first quarter of

2023, in the shadow of some broader economic uncertainty, our goals were to advance our long-term strategic plan by converting our healthy cash flow and solid balance sheet into innovative solutions, enhanced capabilities, entry into new markets, and increasing market penetration. I’m happy to report that we executed well against those goals with several product releases in 2023, including, enhanced KYC functionality with fraud signals and scoring for the broader identity market, a robust background screening support suite that now includes idiTRACE, idiCRIM and idiALIAS, and enhanced criminal information capabilities for Law Enforcement and our Investigative vertical that includes map-based criminal search functionality, real-time arrest search, and arrest monitoring. We are now hitting the market with our idiMARKETING solution, providing more than 400 attributes across more than 260 million U.S. consumers. idiMARKETING, along with our coreIDENTITY solution, allows us the opportunity to capture the entire identity journey, and corresponding wallet share, from our customers. Through prospecting and acquisition, verification and onboarding, and protecting and personalizing, these combined solutions encompass the full customer identity lifecycle. Closing out the year, we launched several AI initiatives, including enhanced AI-driven entity resolution, predictive analytics driven by deep learning, and improved data extraction using large language models. Moving into 2024, we are extremely excited about our solution suite and the expanding applicability to the markets we serve. And, as Derek discussed our opportunity to lean in a bit to accelerate our revenue in 2024, because of our incremental margin on every growth dollar, we believe we can accomplish this acceleration while still generating increasing profitability with adjusted EBITDA margin nearing 30% and producing strong free cash flow.

At this time, I would like to discuss two updates we have made to our reporting. The first update is that we have started reporting two additional non-GAAP measures -- adjusted net income and adjusted earnings per share. We believe adjusted net income and adjusted earnings per share provides additional means of evaluating period-over-period operating performance by eliminating certain non-cash expenses and other items that might obscure trends in our operations and otherwise make comparisons of our ongoing business more difficult.

The second update relates to our supplemental metrics. Beginning with the first quarter of 2024, we will no longer provide revenue from new customers, base revenue from existing customers, and growth revenue from existing customers as supplemental metrics. As we periodically review and refine the definition, methodology, and appropriateness of our supplemental metrics, the way these supplemental revenue metrics are currently defined and tracked have become less relevant to management internally and we believe they no longer provide meaningful information to understand or evaluate the trends in our business.

Turning now to our fourth quarter results, for clarity, all the comparisons I will discuss today will be against the fourth quarter of 2022, unless noted otherwise.

Total revenue was $15.1 million, a 15% increase over prior year. We produced $11.7 million in adjusted gross profit, resulting in a margin of 78% in the fourth quarter, up 1-percentage point. Adjusted EBITDA for the quarter was $2.7 million, up 76% over prior year. Adjusted EBITDA margin was 18%, up 6-percentage points. Adjusted net income increased 157% to $0.3 million for the quarter, resulting in adjusted earnings of $0.02 per share.

Moving through the details of our P&L, as mentioned, revenue was $15.1 million for the fourth quarter. Digging in a bit to IDI’s revenue segments, we saw strong double-digit percentage revenue growth in Financial and Corporate Risk, as well as within our Investigative segment, which was led by Law Enforcement, where we continue to focus sales resources and are making nice traction. Continuing the trend we saw last quarter; Collections revenue as a percentage over prior year grew in the high single digits. After a year of negative year-over-year quarterly growth, we have now had two consecutive quarters of year-over-year quarterly growth within our Collections vertical. We remain cautiously optimistic regarding these recent trends as we are starting to see stronger consistent volumes across our Collections customer base. Rounding out IDI, both Emerging Markets, which is comprised of multiple industries, and Real Estate, which does not include FOREWARN, were down a few percentage points over prior year. Our IDI billable customer base grew by 106 customers sequentially from the third quarter, ending the fourth quarter at 7,875 customers.

As it relates to FOREWARN revenue, we continue to see strong adoption from associations which drove solid growth in the quarter. As we discussed on our last earnings call, we proudly announced an agreement with Florida Realtors®, the largest state REALTOR Association in the Unted States, to begin using FOREWARN in January 2024. While Florida’s revenue is not included in our fourth quarter results presented today, this win is indicative of

the continued progress in market penetration for FOREWARN. FOREWARN added over 17,000 users during the fourth quarter, ending the quarter at 185,380 users. Over 400 Realtor® Associations are now contracted to use FOREWARN.

Our contractual revenue was 82% for the quarter, up 5-percentage points from prior year. Our gross revenue retention percentage was 92%, compared to 95% in prior year. We expect our gross revenue retention percentage to trend between 90% and 95% for the foreseeable future.

Moving back to the P&L, our cost of revenue (exclusive of depreciation and amortization) increased $0.2 million or 9% to $3.3 million. This $0.2 million increase was primarily a result of an increase in data acquisition costs. Adjusted gross profit increased 17% to $11.7 million, producing an adjusted gross margin of 78%, a 1-percentage point increase over fourth quarter 2022.

Sales and marketing expenses increased $0.5 million or 17% to $3.5 million for the quarter. This increase was due primarily to an increase in salaries and benefits and advertising and marketing. The $3.5 million of sales and marketing expense for the quarter consisted primarily of $1.9 million in employee salaries and benefits and $0.7 million in sales commissions.

General and administrative expenses decreased $0.2 million or 3% to $6.9 million for the quarter. This decrease was primarily the result of a $0.2 million decrease in share-based compensation expense. The $6.9 million in general and administrative expenses for the quarter consisted primarily of $4.1 million of employee salaries and benefits, which included year-end bonuses as part of our company’s discretionary bonus plan, $1.2 million of non-cash share-based compensation expense, and $0.9 million in accounting, IT and other professional fees.

Depreciation and amortization increased $0.4 million or 22% to $2.2 million for the quarter. This increase was primarily the result of the amortization of internally developed software.

Our net loss for the quarter narrowed $0.4 million or 31% to $1.1 million.

We reported a loss of $0.08 per basic and diluted share for the quarter based on a weighted average share count of 14.0 million shares.

Adjusted net income for the quarter increased $0.2 million or 157% to $0.3 million, which resulted in adjusted earnings of $0.02 per basic and diluted share.

Moving on to the balance sheet. Cash and cash equivalents were $32.0 million at December 31, 2023, compared to $31.8 million at December 31, 2022. Current assets were $40.3 million compared to $38.1 million and current liabilities were $4.9 million compared to $5.4 million.

We generated $15.1 million in cash from operating activities for the year ended December 31, 2023, compared to generating $12.5 million in cash from operating activities for the same period in 2022.

We generated $5.9 million in free cash flow in 2023, compared to generating $3.6 million in 2022.

Cash used in investing activities was $9.1 million for the year ended December 31, 2023, mainly the result of $9.0 million used for software developed for internal use. Cash used in investing activities in prior year was $8.8 million.

Cash used in financing activities was $5.7 million for the year ended December 31, 2023, mainly the result of two items. One, purchasing 195,740 shares of company common stock for $3.7 million under our stock repurchase program at an average price of $19.14 per share. And, two, acquiring approximately 99,234 shares of company common stock for $2.0 million from the net share tax settlement of employee restricted stock units. These shares were withheld in treasury and retired prior to the end of the year.

During the same period 2022, cash used in financing activities was $6.1 million. This was the result of mainly two items. One, acquiring approximately 252,000 shares of company common stock for $5.2 million from the net share tax settlement of employee restricted stock units and, two, purchasing 50,000 shares of company stock for $0.9

million under our stock repurchase program at an average price of $17.52 per share. These shares were withheld in treasury and retired prior to the end of the year.

As it relates to our stock repurchase program, we will continue to monitor prevailing market conditions and other opportunities that we have for the use or investment of our cash balances and, as applicable, strategically acquire additional shares in accordance with our repurchase program.

In closing, we are pleased with our fourth quarter and full year results. With revenue off to a record start, increasing opportunity within current markets, and additional solutions to penetrate new markets, we are excited to accelerate revenue and produce another record year in 2024.

With that, our operator will now open the line for Q&A.

Operator

Thank you. As a reminder, to ask a question, you will need to press *11 on your telephone. Again, that’s *11 on your telephone to ask a question. To remove yourself from the question que, you may press *11 again. Please stand by while we compile the Q&A roster. Again, to ask a question, that’s *11 on your telephone. As there are no questions in que, I would like to turn the call back over to Derek Dubner for closing remarks. Sir.

Derek Dubner

Thank you. We are pleased to have reported another strong quarter and record year for red violet. We are executing upon our strategic plan, which includes our robust product roadmap. We are well positioned to accelerate the business and to deliver exceptional customer and shareholder value. Good afternoon.

Operator

This concludes today's conference call. Thank you for participating. You may now disconnect.

v3.24.0.1

Document And Entity Information

|

Mar. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 07, 2024

|

| Entity Registrant Name |

RED VIOLET, INC.

|

| Entity Central Index Key |

0001720116

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-38407

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-2408531

|

| Entity Address, Address Line One |

2650 North Military Trail

|

| Entity Address, Address Line Two |

Suite 300

|

| Entity Address, City or Town |

Boca Raton

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33431

|

| City Area Code |

561

|

| Local Phone Number |

757-4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value per share

|

| Trading Symbol |

RDVT

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |