U.S. Index Futures Dip Ahead of Inflation Data and Oracle’s Earnings; Oil Prices Edge Higher

March 11 2024 - 6:39AM

IH Market News

In Monday’s pre-market trading, U.S. index futures are

indicating a downward move, following the worst week for the Dow

Jones since October. Investors are keeping an eye on the important

inflation data expected this week and the financial results from

Oracle, which will be announced after today’s market close.

At 06:15 AM, Dow Jones futures (DOWI:DJI) dropped 132 points, or

0.34%. S&P 500 futures fell by 0.17%, and Nasdaq-100 futures

declined by 0.12%. The yield on 10-year Treasury notes was at

4.075%.

In the commodities market, West Texas Intermediate crude oil for

April rose by 0.32%, to $78.23 per barrel. Brent crude for May went

up by 0.32%, near $82.34 per barrel. Iron ore traded on the Dalian

exchange fell by 5.41%, to $115.65 per metric ton.

Bitcoin (COIN:BTCUSD) reached a new peak, surpassing $71,000 on

Monday, driven by the influx of investments into new bitcoin funds

and expectations of interest rate cuts by the Federal Reserve.

Asian and Pacific exchanges closed mixed, with gains in China

after easing deflation concerns due to recent inflation data. In

contrast, Tokyo recorded significant losses, influenced by the

revision of Japanese GDP, which increased expectations of a

possible change in BoJ’s monetary policy, reflecting in the mixed

performance of the markets in the region. Shanghai SE in China

closed with a gain of +0.74%, the Nikkei in Japan showed a decrease

of -2.19%, the Hang Seng Index in Hong Kong went up by +1.43%, the

Kospi in South Korea had a reduction of -0.77%, and the ASX 200 in

Australia ended with a decrease of -1.82%.

European markets are down, following the losses in Asia-Pacific

overnight, in anticipation of upcoming U.S. inflation data during

the week. At the start of operations, the Stoxx 600 registered a

drop of 0.4%, with the technology sector suffering a reduction of

over 2%.

On Friday, U.S. stocks started high but fell throughout the day,

affected by negative revisions in job growth and an increase in the

unemployment rate. The initial optimism, fueled by a strong jobs

report, dissipated, leading to profit-taking, especially in the

Nasdaq and S&P 500. The expectation of interest rate cuts by

the Federal Reserve, based on mixed economic data, also influenced

the market. With the drop on the day, the Nasdaq, Dow, and S&P

500 closed with weekly declines of 1.2%, 0.9%, and 0.3%,

respectively.

In terms of quarterly earnings, financial reports are scheduled

to be presented before market open from Ballard

(NASDAQ:BLDP), Fortrea, Eltek

(NASDAQ:ELTK), SilverCrest Metals (NYSE:SILV),

Legend Biotech (NASDAQ:LEGN), Endeavour

Silver Corporation (NYSE:EXK), among others.

After the close, the numbers from Oracle

(NYSE:ORCL), Asana (NYSE:ASAN),

Casey’s (NASDAQ:CASY), Vail

Resorts (NYSE:MTN), Ocular Therapeutix

(NASDAQ:OCUL), LifeMD (NASDAQ:LFMD),

Mission Produce (NASDAQ:AVO), Assertio

Holdings (NASDAQ:ASRT), CytomX

Therapeutics (NASDAQ:CTMX), Playstudios

(NASDAQ:MYPS), and more are awaited.

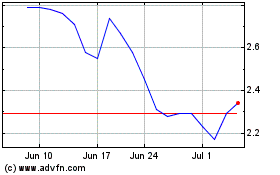

Ballard Power Systems (NASDAQ:BLDP)

Historical Stock Chart

From Mar 2024 to Apr 2024

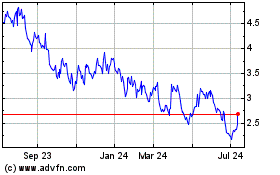

Ballard Power Systems (NASDAQ:BLDP)

Historical Stock Chart

From Apr 2023 to Apr 2024