UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-06445

The Herzfeld Caribbean Basin Fund, Inc.

(Exact name of registrant as specified in charter)

119 Washington Ave. Suite 504, Miami Beach, FL 33139

(Address of principal executive offices) (Zip code)

Erik M. Herzfeld

119 Washington Ave. Suite 504, Miami Beach, FL 33139

(Name and address of agent for service)

Copies to:

Joseph V. Del Raso, Esq.

Troutman Pepper Hamilton Sanders LLP

3000 Two Logan Square

18th and Arch Streets

Philadelphia, PA 19103

Registrant's telephone number, including area code: 305-777-1660

Date of fiscal year end: June 30

Date of reporting period: July 1, 2023 to December 31, 2023

ITEM 1. REPORT TO STOCKHOLDERS.

The Semi-Annual Report to Stockholders is filed herewith.

(a)

The

Herzfeld Caribbean Basin Fund, Inc.

119 Washington Avenue, Suite 504

Miami Beach, FL 33139

(305) 777-1660

Investment

Advisor

HERZFELD/CUBA

a division of Thomas J. Herzfeld Advisors, Inc. 119 Washington Avenue, Suite 504

Miami Beach, FL 33139

(305) 777-1660

Administrator,

Transfer Agent

and Fund Accountant

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

Sub-Transfer

Agent

Equiniti Trust Company, LLC

6201 15th Avenue

Brooklyn, NY 11219

Custodian

Fifth Third Bank N.A.

Fifth Third Center

38 Fountain Square Plaza

Cincinnati, OH 45263

Counsel

Troutman Pepper Hamilton Sanders LLP

3000 Two Logan Square

18th and Arch Streets

Philadelphia, PA 19103

Independent

Registered Public Accounting Firm

Tait, Weller & Baker LLP

50 South 16th Street, Suite 2900

Philadelphia, PA 19102

| The

Herzfeld Caribbean Basin Fund, Inc.’s investment objective is long-term capital appreciation. To achieve its objective, the

Fund invests in issuers that are likely, in the Advisor’s view, to benefit from economic, political, structural and technological

developments in the countries in the Caribbean Basin, which include, among others, Cuba, Jamaica, Trinidad and Tobago, the Bahamas,

the Dominican Republic, Barbados, Aruba, Haiti, the former Netherlands Antilles, the Commonwealth of Puerto Rico, Mexico, Honduras,

Guatemala, Belize, Costa Rica, Panama, Colombia, the United States, Guyana and Venezuela (“Caribbean Basin Countries”).

The Fund invests at least 80% of its total assets in equity and equity-linked securities of issuers, including U.S.- based companies

which engage in substantial trade with, and derive substantial revenue from, operations in Caribbean Basin Countries. |

Listed

NASDAQ Capital Market

Symbol: CUBA

| Letter

to Stockholders (unaudited) |

| |

Dear

Fellow Stockholders,

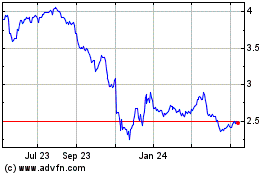

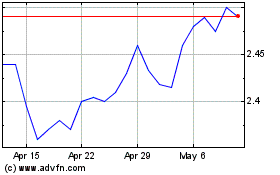

We

are pleased to present our Semi-Annual Report for the six-month period ended December 31, 2023. On that date, the Fund’s net asset

value (“NAV”) per share (reflecting NAV dilution from the Rights Offering (defined below)) was $3.49, down 27.07% over the

six months then ended, adjusted for distributions. The Fund’s share price closed the period at $2.78 per share, a decline of 26.24%

over the same semi-annual time period, adjusted for distributions. For calendar year 2023, the Fund’s net asset value per share

(reflecting NAV dilution from the Rights Offering) and market price declined 14.45% and 13.60%, respectively, in each case adjusted for

distributions. During the six-month period, the discount to NAV was relatively unchanged narrowing from -20.52% to -20.34%. Notwithstanding

the NAV dilution from the Rights Offering, the underlying holdings performed well during the period and for the calendar year as evidenced

by aggregate increases in net assets of 6.48% for the period and 24.98% for the calendar year.

|

| |

| Thomas

J. Herzfeld |

| Chairman

and |

| Portfolio

Manager |

| |

The

Fund completed a non-transferable rights offering (the “Rights Offering”) on December 13, 2023 which resulted in the issuance

of nine million (9,000,000) additional shares of common stock at a price of $2.31 per share, reflecting NAV dilution per share of $1.6053.

The

Fund seeks long-term capital appreciation through investment in companies that we believe are poised to benefit from economic, political,

structural, and technological developments in the Caribbean Basin. Part of the investment strategy focuses on companies in the region

that we believe would benefit from the resumption of U.S. trade with Cuba. Since it is impossible to predict when the U.S. embargo will

be lifted, we have concentrated on investments that we believe can do well even if there is no political or economic change with respect

to Cuba.

Caribbean

Basin Update

Growth

in the Caribbean Basin economies was strong in 2023 providing a positive investment backdrop. The main drivers of growth have been increases

in American tourist arrivals, oil production, and “nearshoring” of supply chains.

“Nearshoring”

of U.S. supply chains refers to a shift from the use of off-shore suppliers (particularly suppliers located in Asia) to suppliers that

are more strategically located in the Western Hemisphere. There are a number of factors that have led to this shift including continuing

political tensions with China and historical difficulties in receiving

| Letter

to Stockholders (unaudited) (continued) |

| |

inventories

from Asian suppliers during the COVID and post-COVID period. As a result, Caribbean economies are benefitting as U.S. companies shift

to supply partners closer to home. For example, Mexico is now the largest U.S. trading partner in dollars, surpassing China. Responding

to nearshoring trends, Jamaica is making strategic investments in its ports to enable increased export of Jamaican agricultural products

to the U.S. and abroad. We believe the nearshoring trend will provide a long-term positive impact in the region and add diversity to

an economic base that was previously heavily weighted to tourism, banking, and commodities.

|

| |

| Erik

M. Herzfeld |

| President

and |

| Portfolio

Manager |

Positive

movements in the region’s oil and gas industry have also been a driver of growth during the period. Guyana’s massive offshore

oil discovery is turning one of the most impoverished countries in Latin America into one of its richest, driving not only oil related

industries but the general service sector as well. The newfound riches for Guyana have inflamed tensions with neighboring Venezuela as

the Maduro government has claimed the Essequibo area of Guyana as part of Venezuela. However, the border dispute has not stopped oil

production offshore which is nearly 400 thousand barrels a day and expected to triple over the next few years.

With

respect to the important tourism sector, the majority of Caribbean nations continue to see double-digit year-over-year growth in visitors

as a result of the resilient economy in the U.S. Only the U.S. Virgin Islands saw a decline of 3.8% in visitors while the Cayman Islands

and British Virgin Islands both saw visitors increase 60.5% combined year-over-year. As recession fears abate in the U.S. and the Federal

Reserve is poised to start cutting rates, we believe continued growth in arrivals to the Caribbean will continue.

Cuba

also saw a sharp uptick in visitor arrivals in 2023 after a disastrous few years since the pandemic. The number of tourism arrivals in

Cuba still remains well below its pre-pandemic high which has contributed to a shrinking economy. With U.S. trade restrictions still

in place, the Cuban economy continues to weaken, resulting in an acceleration of the number of Cubans fleeing the country for the U.S.

Over the last two years, an estimated 400,000 Cubans have emigrated to the U.S., further impacting Cuba’s economy.

The

Cuban government is arguably at its weakest point in the last 60 years. This has led to a loosening of socialist policies that allow

for more capitalism, resulting in a growing entrepreneurial small business sector. In our annual report, we mentioned a shift in U.S.

policy may be coming soon per discussions we have had with private citizens currently doing business in Cuba and signs emanating from

the Biden Administration. Among the specific policy shifts expected is a proposal to allow Cuban citizens to open bank accounts with

U.S. banks. This would provide fuel for entrepreneurial small business owners, helping to drive growth in Cuba. While we believe that

a policy shift may still come to pass, we are concerned that these issues will take a back seat to other issues facing the administration,

including the expanding war in the Middle East, the continuing war in the Ukraine, and of course the upcoming November elections.

| Letter

to Stockholders (unaudited) (continued) |

| |

Portfolio

With

the Federal Reserve pausing interest rate hikes and signaling three cuts by the end of 2024, our bank holdings continued to rebound after

the March 2023 banking crisis that engulfed U.S. banks. Energy also saw strong gains in the period. Our holdings in utilities were mixed

as higher rates continued to compete with defensive stocks for investment dollars. Additionally, a slow start to infrastructure spending

in the U.S. following the landmark passage of the Inflation Reduction Act and Bipartisan Infrastructure Law resulted in weak performance

from companies expected to benefit from that legislation.

|

| |

| Ryan

M. Paylor |

| Portfolio

Manager |

| |

The

largest gainer in the period was Consolidated Water Co.

Ltd.

(CWCO), which gained 47.81% on the back of record revenues of $49.85 million for the most recent quarter. The company has seen significant

growth in its services segment which now makes up 50% of revenues. Additionally, water scarcity is becoming a more visible issue globally

as drought threatens agriculture, global population increases, and manufacturing growth draws on supply. As a result, water desalination,

recycling and reuse technologies are seeing significant investments which are benefitting CWCO. The negative effects of climate change

along with the factors impacting supply cited above are resulting in more demand for CWCO’s products and services which we do not

see changing anytime in the near-term.

Our

bank holdings all saw double-digit gains in the period, increasing between 14.69% and 45.61%. OFG Bancorp (OFG) was the biggest gainer

in the period while Popular Inc. (BPOP) and First Bancorp (FBP) were not far behind rising 37.90% and 37.27% respectively. As we stated

in previous communications, we believed Puerto Rican banks were well insulated from the turmoil on the mainland and our portfolio was

rewarded over the period. Banco Latinoamericano de Comercio Exterior (BLX), known as Bladex, gained 14.69% in the period. We continue

to believe banks servicing the Caribbean and Latin America are poised for a pickup in growth as nearshoring leads to more investment

in the region. Additionally, the region is expected to benefit from stronger growth relative to the rest of the world and war in the

Middle East is increasing demand for alternative routes for trade. Bladex’s expertise is in trade finance for Latin America and

the Caribbean, which is expected to expand due to changes in supply chains but also global increases in commodity demand.

Another

top performer in the period was PGT Innovations Inc. (PGTI) which gained 39.62% over the last half of 2023. PGTI has been the target

of a bidding war between Masonite and Miter Brands which has resulted in a $41 bid from Masonite and a $41.5 bid from Miter Brands. At

the present time, PGTI has not decided which offer to accept but we believe there to be limited price upside from the most recent bids.

The

largest detractor over the six-month period was MasTec Inc. (MTZ) which declined 35.81%. We are among the investors expecting a boom

in infrastructure spending following the passage of the Inflation Reduction Act and Bipartisan Infrastructure Law

| Letter

to Stockholders (unaudited) (continued) |

| |

and

have been disappointed so far as rising interest rates and rising inflation costs resulted in cancellations and postponements of proposed

projects. MasTec’s acquisition spree over the course of the last few years helped diversify the company’s business away from

large clients like AT&T and should bode well for future growth. However, increased debt interest as part of this growth initiative

has resulted in a decline in free cash flow and a pause in share repurchases since 2020. With inflation declining and the Fed poised

to cut rates in 2024, we expect a pickup in infrastructure projects as the economics improve. MasTec should therefore be able to concentrate

on paying down debt and resuming share repurchases.

Marriot

Vacations Worldwide Corporation (VAC) also struggled in the second half, declining 29.71%. The vacation ownership, rental, and property

manager saw record revenues in 2022 only for growth to stagnate in 2023. VAC was able to weather the pandemic without having to add significant

debt like many of its peers in the hospitality and lodging business. This allowed the company to repurchase shares and continue to raise

its dividend. While the flat growth was not part of our forecast, the company is generating enough free cash flow to increase share repurchases

and the dividend. At a 1 year forward PE of 10, manageable debt maturities, and increasing return of capital to shareholders, we believe

the stock price will rise even if revenues remain unchanged for the second year in a row.

Becle

SAB de CV (CUERVO) was another weak performer in the period, declining 18.69%. The Mexican beverage company experienced its first annual

decline in revenues since it went public in 2017. An appreciating Mexican peso along with higher input costs led to declines in sales

and lower gross margins as foreign buyers’ purchasing power decreased. Also, overall weakness in the alcoholic beverage market

due to inflation and changing tastes weighed on valuations as CUERVO’s peers saw similar weakness in 2023. The company is poised

to rebound as inflation declines and currency volatility decreases. CUERVO is the leader in the tequila market with 30% of market share.

They have also diversified their brands into vodka, whiskey, gin, rum, and ready-to-drink offerings. The company is estimated to return

to sales growth in 2024 and with a lower leverage profile than its peers. As a result, we believe CUERVO should trade at a premium to

its peer group.

Outlook

After

two years of interest rate hikes across the globe implemented to combat inflation, global central banks are projecting interest rate

cuts over the next year. Even with tightening monetary policy at its peak, the Caribbean was able to deliver real GDP growth of 9.8%

in 2023. With less restrictive monetary policy going forward in 2024 and the resulting increasing chances of a “soft landing”

in the Americas, Caribbean economies should be major beneficiaries of discretionary spending on travel along with increased investment

in commodities and nearshoring infrastructure. The Fund’s recent Rights Offering that was concluded in December has increased our

ability to deploy capital in the region to take advantage of what we view as an attractive investment backdrop. Guyana is already seeing

a “gold rush” of sorts with investors flocking to the country to invest in the fastest growing economy in the world. We believe

there will be ancillary benefits

| Letter

to Stockholders (unaudited) (continued) |

| |

in

surrounding countries as banking, infrastructure, and trade finance will be needed to support growth.

There

has already been significant investment in nearshoring in Mexico as U.S. trade decouples from China and other overseas supply chains

reliant upon adversarial countries. As discussed above, we believe there are significant opportunities in the Caribbean to take advantage

of nearshoring.

We

continue to be bullish on cruise lines, maintaining an overweight position in the industry. The return of profitability should allow

them to retire and refinance higher cost debt issued during the pandemic. The potential for lower rates also provides them a tailwind

to lower financing costs. We also remain overweight companies we believe will benefit from the Inflation Reduction Act and Bipartisan

Infrastructure Law as lower rates should result in more projects coming back online as cost of capital declines.

Largest

Allocations

The

following tables present our largest investment and geographic allocations1 as of December 31, 2023.

| | |

% of Net |

| |

| |

% of Net |

| Geographic Allocation | |

Assets |

| |

Largest Portfolio Positions | |

Assets |

| USA | |

33.55% |

| |

Royal Caribbean Cruises Ltd. | |

6.88% |

| Mexico | |

20.88% |

| |

Norwegian Cruise Line Holdings Ltd. | |

6.65% |

| Puerto Rico | |

14.78% |

| |

New Fortress Energy, Inc. | |

6.28% |

| Panama | |

8.12% |

| |

MasTec, Inc. | |

5.24% |

| Liberia | |

6.88% |

| |

First BanCorp. | |

4.99% |

| Bermuda | |

6.65% |

| |

Popular, Inc. | |

4.69% |

| Netherlands | |

6.61% |

| |

NextEra Energy, Inc. | |

4.40% |

| Bahamas | |

1.07% |

| |

Martin Marietta Materials, Inc. | |

4.30% |

| Cayman Islands | |

0.83% |

| |

Cemex S.A.B. de C.V. | |

4.15% |

| Cuba | |

0.00% |

| |

Playa Hotels and Resorts | |

3.46% |

| Money Market | |

12.65% |

| |

| |

|

| Liabilities

in excess of other assets | |

-12.02% |

| |

| |

|

| | |

100.00% |

| |

| |

|

Quarterly

Distributions in Stock and Cash

On

December 29, 2023, under the Fund’s managed distribution policy (the “Policy”), we announced a quarterly distribution

in the amount of $0.135375 per share for common stockholders to be paid January 31, 2024. The distribution will be paid in cash or shares

| 1 | Geographic

allocation is determined by the issuer’s legal domicile. |

| Letter

to Stockholders (unaudited) (continued) |

| |

of

our common stock at the election of stockholders. The distribution in stock and cash is consistent with the Fund’s most recent

prior quarterly distributions.

The

total amount of cash distributed to all stockholders will be limited to 20% of the total distribution to be paid excluding any cash paid

for fractional shares. The remainder of the distribution (approximately 80%) will be paid in the form of shares of our common stock.

The exact distribution of cash and stock to any given stockholder will be dependent upon his/her election as well as elections of other

stockholders, subject to the pro-rata limitations.

We

believe this cash and stock distribution will allow the Fund to strengthen its balance sheet and to be in position to capitalize on potential

future investment opportunities.

The

primary purpose of the Policy is to provide stockholders with a constant, but not guaranteed, fixed minimum rate of distribution each

quarter (currently set at the annual rate of 15% of the Fund’s net asset value as determined on December 19, 2023 and payable in

quarterly installments). The Fund cannot predict what effect, if any, the Policy will have on the market price of its shares or whether

such market price will reflect a greater or lesser discount to net asset value as compared to prior to the adoption of the Policy.

Results

of Rights Offering

On

December 18, 2023, the Fund announced the final results of its non-transferable rights offering (the “Offering”) that expired

on December 13, 2023 (the “Expiration Date”). The Fund issued a total of 9,000,000 new shares of common stock as a result

of the Offering. The Offering’s final subscription price per share was determined to be $2.31. The subscription price was established

pursuant to the terms of the Offering and based on a formula equal to 92% of the volume weighted average closing sales price of a share

of common stock on the NASDAQ Capital Market on the Expiration Date of the Offering and the four preceding trading days. The Offering

was oversubscribed and the over-subscription requests exceeded the primary subscription shares available (i.e., 7,150,673 shares). The

Board of Directors of the Fund determined to issue an additional 25.86% of the number of shares issued in the primary subscription, or

1,849,327 additional shares, for a total issuance of 9,000,000 new shares of common stock. The shares issued as part of the oversubscription

privilege of the Offering were allocated pro rata among record

| Letter

to Stockholders (unaudited) (continued) |

| |

date

stockholders who submitted over-subscription requests based on the number of rights originally issued to them by the Fund. Gross proceeds

from the Offering, before any expenses of the Offering, totaled approximately $20.8 million.

|

|

|

| |

|

|

| Thomas

J. Herzfeld |

Erik

M. Herzfeld |

Ryan

M. Paylor |

| Chairman

of the Board |

President

and |

Portfolio

Manager |

| and

Portfolio Manager |

Portfolio

Manager |

|

| |

|

|

The

above commentary is for informational purposes only and does not represent an offer, recommendation or solicitation to buy, hold or sell

any security. The commentary is intended to assist stockholders in understanding our performance during the six months ended December

31, 2023. The views and opinions in this letter were current as of February 29, 2024. Statements other than those of historical facts

included herein may constitute forward-looking statements regarding management’s future expectations, beliefs, intentions, goals,

strategies, plans or prospects, including statements relating to management’s beliefs that the cash and stock distribution will

allow the Fund to strengthen its balance sheet and to be in a position to capitalize on potential future investment opportunities, when

there can be no assurance either will occur, and other factors may contain forward looking statements within the meaning of the Private

Securities Litigation Reform Act, with respect to the Fund’s future financial or business performance, strategies or expectations.

Nothing herein should be relied upon as a representation as to the future performance or portfolio holdings of the Fund. We undertake

no duty to update any forward-looking statement made herein. The specific securities identified and described do not represent all of

the securities purchased or sold and you should not assume that investments in the securities identified and discussed will be profitable.

Portfolio composition is subject to change.

| Investment

Results (unaudited) |

| |

Average

Annual Total Returns*

(For the periods ended December 31, 2023)

| |

Six

Months |

One

Year |

Five

Year |

Ten

Year |

| The

Herzfeld Caribbean Basin Fund |

|

|

|

|

| Net

asset value per share |

-27.07% |

-14.45% |

0.08% |

-1.44% |

| Market

value per share |

-26.24% |

-13.60% |

3.68% |

-1.04% |

| S&P

500® Index** |

8.04% |

26.29% |

15.69% |

12.03% |

| MSCI

Emerging Markets ex Asia Index *** |

8.95% |

18.17% |

2.55% |

0.16% |

| |

|

|

|

|

Total

annual operating expenses, as disclosed in the Herzfeld Caribbean Basin Fund (the “Fund”) Form N-2 dated August 23, 2023,

as amended October 24, 2023, were 3.45% of average daily net assets. During the six months ended December 31, 2023, the Advisor’s

voluntarily waived its management fee by 10 basis points (from 1.45% to 1.35%) in support of the Fund’s initiative to attempt to

reduce the stock price discount to net asset value. Effective November 22, 2023, the Advisor has further agreed to voluntarily waive

its management fee on the Fund’s net assets in excess of $30 million by an additional ten (10) basis points. Accordingly, the Adviser’s

management fee after the voluntary waivers is (i) 1.35% of the Fund’s assets up to and including $30 million and (ii) 1.25% of

the Fund’s assets in excess of $30 million. Additional information pertaining to the Fund’s expense ratios as of December

31, 2023 can be found in the financial highlights.

The

performance quoted represents past performance, which does not guarantee future results. The investment return and principal value of

an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The

returns shown do not reflect deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

The Fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. Current performance

of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained

by calling (305) 777-1660.

| * | Return

figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any

fee reductions during the applicable periods. If such fee reductions had not occurred, the quoted performance would have been lower.

Total returns for periods less than 1 year are not annualized. |

| ** | The

S&P 500® Index is a widely recognized unmanaged index of equity securities

and is representative of a broader domestic equity market and range of securities than is

found in the Fund’s portfolio. Individuals cannot invest directly in the index; however,

an individual can invest in exchange traded funds or other investment vehicles that attempt

to track the performance of a benchmark index. |

| *** | The

MSCI Emerging Markets ex Asia Index (the “Index”) captures large and mid cap representation across 15 Emerging Markets countries

(Brazil, Chile, Colombia, Czech Republic, Egypt, Greece, Hungary, Mexico, Peru, Poland, Qatar, Saudi Arabia, South Africa, Turkey and

United Arab Emirates). With 247 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in

each country excluding Asia. The index is representative of a broader domestic equity market and range of securities than is found in

the Fund’s portfolio. Individuals cannot invest directly in the index; however, an individual can invest in exchange traded funds

or other investment vehicles that attempt to track the performance of a benchmark index. |

The

Fund’s investment objectives, strategies, risks, charges and expenses must be considered carefully before investing. The prospectus

contains this and other important information about the Fund and may be obtained by calling the same number as above. Please read it

carefully before investing.

| Schedule

of Investments as of December 31, 2023 (unaudited) |

| |

| Shares or | | |

| |

| |

| Principal | | |

| |

| |

| Amount | | |

Description | |

Fair Value | |

| Common Stocks — 99.37% of net assets | |

| | |

| | | | |

| |

| | |

| Aerospace and Defense — 2.92% | |

| | |

| | 129,206 | | |

AerSale Corp.* | |

$ | 1,640,270 | |

| | | | |

| |

| | |

| Airlines — 3.45% |

| | |

| | 18,250 | | |

Copa Holdings, S.A. | |

| 1,940,157 | |

| | | | |

| |

| | |

| Banking and finance — 16.82% | |

| | |

| | 62,089 | | |

Banco Latinoamericano de Comercio Exterior, S.A. | |

| 1,536,082 | |

| | 16,956 | | |

Evertec, Inc. | |

| 694,179 | |

| | 170,604 | | |

First BanCorp. (Puerto Rico) | |

| 2,806,436 | |

| | 47,454 | | |

OFG Bancorp | |

| 1,778,576 | |

| | 32,123 | | |

Popular, Inc. | |

| 2,636,335 | |

| | | | |

| |

| | |

| Communications — 0.93% | |

| | |

| | 10,698 | | |

América Móvil, S.A.B. de C.V. Class B ADR | |

| 198,127 | |

| | 209,144 | | |

América Móvil, S.A.B. de C.V. | |

| 193,869 | |

| | 479,175 | | |

Fuego Enterprises, Inc.*1 | |

| 20,652 | |

| | 207,034 | | |

Grupo Radio Centro S.A.B. de C.V.* | |

| 40,845 | |

| | 2 | | |

Sitios LatinoAmerica S.A.B. de C.V. | |

| 1 | |

| | 31,172 | | |

Spanish Broadcasting System, Inc.* | |

| 22,756 | |

| | 33,226 | | |

Telesites S.A.B. Series B-1 | |

| 46,590 | |

| | | | |

| |

| | |

| Construction and related — 18.44% | |

| | |

| | 300,645 | | |

Cemex, S.A.B. de C.V. ADR* | |

| 2,329,999 | |

| | 20 | | |

Ceramica Carabobo Class A ADR*1 | |

| — | |

| | 4,840 | | |

Martin Marietta Materials, Inc. | |

| 2,414,724 | |

| | 38,872 | | |

MasTec, Inc.* | |

| 2,943,388 | |

| | 32,117 | | |

PGT Innovations, Inc.* | |

| 1,307,162 | |

| | 6,019 | | |

Vulcan Materials Company | |

| 1,366,373 | |

| | | | |

| |

| | |

| Food, beverages and tobacco — 5.77% | |

| | |

| | 725,025 | | |

Becle, S.A.B. de C.V. | |

| 1,419,717 | |

| | 18,900 | | |

Fomento Económico Mexicano, S.A.B. de C.V. Series UBD | |

| 246,499 | |

| | 12,110 | | |

Fomento Económico Mexicano, S.A.B. de C.V. ADR | |

| 1,578,538 | |

| | | | |

| |

| | |

See

accompanying notes to the financial statements.

| Schedule

of Investments as of December 31, 2023 (unaudited) |

| |

| Shares or | | |

| |

| |

| Principal | | |

| |

| |

| Amount | | |

Description | |

Fair Value | |

| Housing — 2.78% | |

| | |

| | 10,500 | | |

Lennar Corporation | |

$ | 1,564,920 | |

| | | | |

| |

| | |

| Investment companies — 0.04% | |

| | |

| | 70,000 | | |

Waterloo Investment Holdings Ltd.*1 | |

| 24,500 | |

| | | | |

| |

| | |

| Leisure — 21.87% | |

| | |

| | 58,603 | | |

Carnival Corporation* | |

| 1,086,500 | |

| | 12,424 | | |

Marriott Vacations Worldwide Corporation | |

| 1,054,673 | |

| | 18,657 | | |

Norwegian Cruse Line Holdings Ltd.* | |

| 3,739,023 | |

| | 224,558 | | |

Playa Hotels and Resorts N.V.* | |

| 1,942,427 | |

| | 42,765 | | |

OneSpaWorld Holdings Ltd.* | |

| 602,987 | |

| | 29,863 | | |

Royal Caribbean Cruises Ltd.* | |

| 3,866,960 | |

| | | | |

| |

| | |

| Machinery — 0.72% | |

| | |

| | 228,237 | | |

Grupo Rotoplas S.A.B. de C.V. | |

| 406,332 | |

| | | | |

| |

| | |

| Mining — 1.17% | |

| | |

| | 117,872 | | |

Grupo México, S.A.B. de C.V. Series B | |

| 655,161 | |

| | | | |

| |

| | |

| Oil & Gas Services & Equipment — 3.15% | |

| | |

| | 129,000 | | |

SBM Offshore N.V. | |

| 1,773,074 | |

| | | | |

| |

| | |

| Real Estate Owners & Developers — 2.71% |

| | |

| | 38,412 | | |

Corporacion Inmobilaria Vesta SAB de CV ADR | |

| 1,521,883 | |

| | | | |

| |

| | |

| Retail — 3.33% | |

| | |

| | 14,270 | | |

Grupo Elektra, S.A.B. de C.V. Series CPO | |

| 987,526 | |

| | 210,222 | | |

Wal-Mart de México, S.A.B. de C.V. Series V | |

| 883,838 | |

| | | | |

| |

| | |

| Transportation infrastructure — 2.19% |

| | |

| | 4,175 | | |

Grupo Aeroportuario ADR | |

| 1,228,577 | |

| | | | |

| |

| | |

| Trucking and marine freight — 0.87% |

| | |

| | 137 | | |

Seaboard Corporation | |

| 489,104 | |

| | | | |

| |

| | |

See

accompanying notes to the financial statements.

| Schedule

of Investments as of December 31, 2023 (unaudited) |

| |

| Shares or | | |

| |

| |

| Principal | | |

| |

| |

| Amount | | |

Description | |

Fair Value | |

| Utilities — 11.51% | |

| | |

| | 23,200 | | |

Caribbean Utilies Ltd. Class A | |

$ | 247,544 | |

| | 6,092 | | |

Consolidated Water Company Ltd. | |

| 216,875 | |

| | 700 | | |

Cuban Electric Company*1 | |

| — | |

| | 40,697 | | |

NextEra Energy, Inc. | |

| 2,471,936 | |

| | 93,602 | | |

New Fortress Energy, Inc., Class A | |

| 3,531,603 | |

| | | | |

| |

| | |

| Other — 0.70% |

| | |

| | 55,921 | | |

Margo Caribe, Inc.* | |

| 391,447 | |

| | 79 | | |

Siderurgica Venezolana Sivensa, S.A. Series B*1 | |

| — | |

| | | | |

| |

| | |

| Total common stocks (cost $39,658,345) |

| 55,848,165 | |

| | | | |

| |

| | |

| Bonds — 0.00% of net assets | |

| | |

| $ | 165,000 | | |

Republic of Cuba - 4.5%, 1977 - in default*1 | |

| — | |

| | | | |

| |

| | |

| Total bonds (cost $63,038) | |

| — | |

| | | | |

| |

| | |

| Money Market Funds — 12.65% | |

| | |

| | 7,111,962 | | |

Federated Hermes Government Obligations Fund,Institutional Class, 5.23%2 | |

| 7,111,962 | |

| | | | |

| |

| | |

| Total money market funds (cost $7,111,962) | |

| 7,111,962 | |

| | | | |

| |

| | |

| Total investments (cost $46,833,345) — 112.02% of net assets | |

| 62,960,127 | |

| | | | |

| |

| | |

| Liabilities in excess of other assets — (12.02)% of net assets | |

| (6,757,777 | ) |

| | | | |

| |

| | |

| Net assets — 100% | |

$ | 56,202,350 | |

| | | | |

| |

| | |

See

accompanying notes to the financial statements.

| Schedule

of Investments as of December 31, 2023 (unaudited) |

| |

The

investments are concentrated in the following geographic regions3 (as percentages of net assets)(unaudited):

| USA | |

33.55% |

| Mexico | |

20.88% |

| Puerto Rico | |

14.78% |

| Panama | |

8.12% |

| Liberia | |

6.88% |

| Bermuda | |

6.65% |

| Netherlands | |

6.61% |

| Other, individually under 5%** | |

2.53% |

| | |

100.00% |

| | |

|

| 1 | Securities

have been fair valued in good faith, by the Advisor as “valuation designee”, using fair value methodology approved by the

Board of Directors. Fair valued securities comprised 0.08% of net assets. |

| 2 | Rate

disclosed is the seven day effective yield as of December 31, 2023. |

| 3 | Geographic

allocation is determined by the isser’s legal domicile. |

| ** | Amount

includes liabilities in excess of other assets of (12.02)%. |

See

accompanying notes to the financial statements.

| Statement

of Assets and Liabilities as of |

| December

31, 2023 (unaudited) |

| |

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Investments in securities, at fair value (cost $46,833,345) (Notes 2 and 3) | |

| | | |

$ | 62,960,127 | |

| Dividends receivable | |

| | | |

| 55,144 | |

| Deferred offering costs (shelf) (Note 7) | |

| | | |

| 67,342 | |

| Other assets | |

| | | |

| 38,119 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

| | | |

| 63,120,732 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| Distributions payable | |

$ | 2,186,397 | | |

| | |

| Payable for investments purchased | |

| 4,578,083 | | |

| | |

| Accrued investment advisor fee (Note 4) | |

| 49,676 | | |

| | |

| Accrued administrator fees | |

| 5,981 | | |

| | |

| Accrued professional fees | |

| 14,572 | | |

| | |

| Accrued trustee fees | |

| 34,152 | | |

| | |

| Accrued other expenses | |

| 49,521 | | |

| | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| | | |

| 6,918,382 | |

| | |

| | | |

| | |

| NET ASSETS (Equivalent to

$3.48 per share based on 16,150,673 shares outstanding) | |

| | | |

$ | 56,202,350 | |

| | |

| | | |

| | |

| Net assets consist of the following: | |

| | | |

| | |

| Common stock, $0.001 par value; 100,000,000 shares authorized; 16,150,673 shares issued and outstanding | |

| | | |

| | |

| Paid-in capital | |

| | | |

| 42,663,901 | |

| Accumulated earnings | |

| | | |

| 13,538,449 | |

| | |

| | | |

| | |

| NET ASSETS | |

| | | |

$ | 56,202,350 | |

| | |

| | | |

| | |

See

accompanying notes to the financial statements.

| Statement

of Operations |

| For

the Six Months Ended December 31, 2023 (unaudited) |

| |

| INVESTMENT INCOME | |

| | | |

| | |

| Dividends (net of foreign withholding tax of $9,732) | |

| | | |

$ | 309,750 | |

| Total investment income | |

| | | |

| 309,750 | |

| | |

| | | |

| | |

| EXPENSES | |

| | | |

| | |

| | |

| | | |

| | |

| Investment advisor fees (Note 4) | |

$ | 259,712 | | |

| | |

| Director fees | |

| 64,674 | | |

| | |

| Legal fees | |

| 51,888 | | |

| | |

| Administration fees (Note 4) | |

| 34,898 | | |

| | |

| Compliance and operational support services fees (Note 4) | |

| 30,164 | | |

| | |

| Tender offer fees (Note 7) | |

| 29,519 | | |

| | |

| Audit fees | |

| 20,779 | | |

| | |

| Listing fees | |

| 17,598 | | |

| | |

| Insurance fees | |

| 15,225 | | |

| | |

| Transfer agent fees | |

| 15,084 | | |

| | |

| Printing and postage fees | |

| 12,508 | | |

| | |

| Quarterly distribution fees | |

| 8,755 | | |

| | |

| Proxy mailing and filing fees | |

| 6,745 | | |

| | |

| Custodian fees | |

| 3,013 | | |

| | |

| Other fees | |

| 21,277 | | |

| | |

| Total expenses | |

| | | |

| 591,839 | |

| Fees voluntarily waived by investment advisor | |

| | | |

| (19,149 | ) |

| Net operating expenses | |

| | | |

| 572,690 | |

| | |

| | | |

| | |

| NET INVESTMENT LOSS | |

| | | |

| (262,940 | ) |

| | |

| | | |

| | |

| NET REALIZED AND CHANGE IN UNREALIZED GAIN/ LOSS ON INVESTMENTS | |

| | | |

| | |

| Net realized gain on investments and foreign currency | |

| 113,550 | | |

| | |

| Change in unrealized appreciation/depreciation on investments and foreign currency | |

| 2,355,329 | | |

| | |

| | |

| | | |

| | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS AND FOREIGN CURRENCY | |

| | | |

| 2,468,879 | |

| | |

| | | |

| | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

| | | |

$ | 2,205,939 | |

| | |

| | | |

| | |

See

accompanying notes to the financial statements.

| Statements

of Changes in Net Assets |

| |

| | |

Six Months | | |

| |

| | |

Ended | | |

For the | |

| | |

December 31, | | |

Year Ended | |

| | |

2023 | | |

June 30, | |

| | |

(unaudited) | | |

2023 | |

| INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | |

| | | |

| | |

| Net investment loss | |

$ | (262,940 | ) | |

$ | (419,266 | ) |

| Net realized gain on investments and foreign currency | |

| 113,550 | | |

| 725,551 | |

| Change in unrealized appreciation/depreciation on investments and foreign currency | |

| 2,355,329 | | |

| 7,533,181 | |

| | |

| | | |

| | |

| NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | |

| 2,205,939 | | |

| 7,839,466 | |

| | |

| | | |

| | |

| DISTRIBUTIONS TO STOCKHOLDERS | |

| | | |

| | |

| From earnings | |

| — | | |

| (714,706 | ) |

| Return of capital | |

| (2,186,397 | ) | |

| (3,893,734 | ) |

| | |

| | | |

| | |

| TOTAL DISTRIBUTIONS | |

| (2,186,397 | ) | |

| (4,608,440 | ) |

| | |

| | | |

| | |

| CAPITAL TRANSACTIONS | |

| | | |

| | |

| Proceeds from rights offering of 9,000,000 and 0 shares of newly issued common stock, respectively (Note 7) | |

| 20,607,216 | | |

| — | |

| Reinvestment of distributions, 0 and 935,753 shares issued, respectively | |

| — | | |

| 3,686,258 | |

| Payments for 0 and 338,382 shares repurchased, respectively | |

| — | | |

| (1,685,921 | ) |

| NET INCREASE (DECREASE) IN NET ASSETS FROM COMMON STOCK TRANSACTIONS | |

| 20,607,216 | | |

| 2,000,337 | |

| | |

| | | |

| | |

| TOTAL INCREASE (DECREASE) IN NET ASSETS | |

| 20,626,758 | | |

| 5,231,363 | |

| | |

| | | |

| | |

| NET ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| Beginning of period | |

| 35,575,592 | | |

| 30,344,229 | |

| | |

| | | |

| | |

| End of period | |

$ | 56,202,350 | | |

$ | 35,575,592 | |

| | |

| | | |

| | |

See

accompanying notes to the financial statements.

| | |

Six Months | | |

| | |

| | |

| | |

| | |

| |

| | |

Ended | | |

| | |

| | |

| | |

| | |

| |

| | |

December | | |

| | |

| | |

| | |

| | |

| |

| | |

31, | | |

Year Ended June 30 | |

| | |

2023* | | |

2023 | | |

2022 | | |

2021 | | |

2020 | | |

2019 | |

| | |

(unaudited) | | |

| | |

| | |

| | |

| | |

| |

| Selected Per Share Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net asset value, beginning of period | |

$ | 4.98 | | |

$ | 4.63 | | |

$ | 7.06 | | |

$ | 4.76 | | |

$ | 7.59 | | |

$ | 8.00 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Operations: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net investment loss1 | |

| (0.03 | ) | |

| (0.06 | ) | |

| (0.14 | ) | |

| (0.13 | ) | |

| (0.10 | ) | |

| (0.08 | ) |

| Net realized and unrealized gain (loss) on investment | |

| 0.27 | | |

| 1.19 | | |

| (1.07 | ) | |

| 3.04 | | |

| (1.72 | ) | |

| (0.02 | ) |

| Total from investment operations | |

| 0.24 | | |

| 1.13 | | |

| (1.21 | ) | |

| 2.91 | | |

| (1.82 | ) | |

| (0.10 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Less distributions to shareholders from: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net realized gains | |

| — | | |

| (0.10 | ) | |

| (0.23 | ) | |

| — | | |

| (0.11 | ) | |

| (0.31 | ) |

| Return of capital | |

| (0.14 | ) | |

| (0.59 | ) | |

| (0.83 | ) | |

| (0.62 | ) | |

| (0.90 | ) | |

| — | |

| Total distributions | |

| (0.14 | ) | |

| (0.69 | ) | |

| (1.06 | ) | |

| (0.62 | ) | |

| (1.01 | ) | |

| (0.31 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Anti-dilutive effect due to common stock repurchases | |

| — | | |

| 0.01 | | |

| 0.01 | | |

| 0.01 | | |

| — | | |

| — | |

| Dilutive effect due to dividend reinvestment | |

| — | | |

| (0.10 | ) | |

| (0.17 | ) | |

| — | | |

| — | | |

| — | |

| Dilutive effect due to rights offering | |

| (1.60 | ) | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Net asset value, end of period | |

$ | 3.48 | | |

$ | 4.98 | | |

$ | 4.63 | | |

$ | 7.06 | | |

$ | 4.76 | | |

$ | 7.59 | |

| Per share market value, end of period | |

$ | 2.78 | | |

$ | 3.95 | | |

$ | 4.01 | | |

$ | 6.27 | | |

$ | 3.70 | | |

$ | 6.36 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Investment return based on market value per share2 | |

| (27.28 | )% 3 | |

| 16.24 | % | |

| (22.50 | )% | |

| 91.31 | % | |

| (27.37 | )% | |

| 2.16 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Ratios and Supplemental Data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net assets, end of period (000 omitted) | |

$ | 56,202 | | |

$ | 35,576 | | |

$ | 30,344 | | |

$ | 41,147 | | |

$ | 29,196 | | |

$ | 46,542 | |

| Ratio of expenses to average net assets after waiver | |

| 3.56 | % 4 | |

| 3.35 | % | |

| 3.47 | % | |

| 3.15 | % 5 | |

| 3.10 | % | |

| 2.79 | % |

| Ratio of expenses to average net assets before waiver | |

| 3.66 | % 4 | |

| 3.45 | % | |

| 3.57 | % | |

| 3.25 | % 5 | |

| 3.20 | % | |

| 2.79 | % |

| Ratio of net investment loss to average net assets after waiver | |

| (1.46 | )% 4 | |

| (1.30 | )% | |

| (2.17 | )% | |

| (2.14 | )% 5 | |

| (1.51 | )% | |

| (1.06 | )% |

| Portfolio turnover rate | |

| 2 | % 3 | |

| 7 | % | |

| 9 | % | |

| 12 | % | |

| 8 | % | |

| 6 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| * | Includes

adjustments in accordance with accounting principles generally accepted in the United States and, consequently, the net asset values

for financial reporting purposes and the returns based upon those net asset values may differ from the net asset values and returns for

shareholder transactions. |

| 1 | Computed

by dividing the respective period’s amounts from the Statement of Operations by the average outstanding shares for each period

presented. |

| 2 | Total

investment return is calculated assuming a purchase of common stock at the current market price on the first day and a sale at the current

market price on the last day of each period reported. Dividends and distributions, if any, are assumed for purposes of this calculation

to be reinvested at actual prices pursuant to the Fund’s Dividend Reinvestment Plan. |

| 5 | This

figure includes expenses incurred as a result of the expiration of the Fund’s shelf registration. The overall impact on the Fund’s

ratios is an increase of 0.06% (Note 7). |

See

accompanying notes to the financial statements.

| Notes

to Financial Statements (unaudited) |

NOTE

1. ORGANIZATION AND RELATED MATTERS

The

Herzfeld Caribbean Basin Fund, Inc. (the “Fund”) is a non-diversified, closed-end management investment company incorporated

under the laws of the State of Maryland on March 10, 1992, and registered under the Investment Company Act of 1940, as amended, and follows

accounting and reporting guidance under Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”)

Topic 946, “Financial Services - Investment Companies”. The Fund commenced investing activities in January 1994. The Fund

is listed on the NASDAQ Capital Market and trades under the symbol “CUBA.”

The

Fund’s investment objective is to obtain long-term capital appreciation. The Fund pursues its objective by investing primarily

in equity and equity-linked securities of public and private companies, including U.S.-based companies, (i) whose securities are traded

principally on a stock exchange in a Caribbean Basin Country or (ii) that have at least 50% of the value of their assets in a Caribbean

Basin Country or (iii) that derive at least 50% of their total revenue from operations in a Caribbean Basin Country (collectively, “Caribbean

Basin Companies”). Under normal conditions, the Fund invests at least 80% of its total assets in equity and equity-linked securities

of Caribbean Basin Countries. This 80% policy may be changed without stockholder approval upon sixty days written notice to stockholders.

The Fund’s investment objective is fundamental and may not be changed without the approval of a majority of the Fund’s outstanding

voting securities.

Under

the Fund’s organizational documents, its Officers and Directors are indemnified against certain liabilities arising out of the

performance of their duties to the Fund. In addition, in the normal course of business, the Fund enters into contracts with its vendors

and others that provide for general indemnifications. The Fund’s maximum exposure under these arrangements is unknown as this would

involve any future potential claims that may be made against the Fund. However, based on experience, management expects the risk of loss

to be remote.

NOTE

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Security

Valuation

In

accordance with accounting principles generally accepted in the United States of America (“GAAP”), fair value is defined

as the price that would be received to sell an asset or paid to transfer a liability (i.e., the “exit price”) in an orderly

transaction between market participants at the measurement date.

In

determining fair value, the Fund uses various valuation approaches. In accordance with GAAP, a fair value hierarchy for inputs is used

in measuring fair value that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that observable

inputs be used when available.

Observable

inputs are those that market participants would use in pricing the asset or liability based on market data obtained from sources independent

of the Fund. Unobservable inputs reflect the Fund’s assumptions about the inputs market participants

| Notes

to Financial Statements (unaudited) (continued) |

would

use in pricing the asset or liability developed based on the best information available in the circumstances. The fair value hierarchy

is categorized into three levels based on the inputs as follows:

| Level 1: |

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access. |

| |

|

| Level 2: |

Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability either directly or indirectly. These inputs may include quoted prices for the identical instrument on an active market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates, and similar data. |

| |

|

| Level 3: |

Unobservable inputs for the asset or liability to the extent that relevant observable inputs are not available, representing the Fund’s own assumptions about the assumptions that a market participant would use in valuing the asset or liability, and that would be based on the best information available. |

The

availability of valuation techniques and observable inputs can vary from security to security and is affected by a wide variety of factors

including, the type of security, whether the security is new and not yet established in the marketplace, and other characteristics particular

to the transaction. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market,

the determination of fair value requires more judgment. Those estimated values do not necessarily represent the amounts that may be ultimately

realized due to the occurrence of future circumstances that cannot be reasonably determined. Because of the inherent uncertainty of valuation,

those estimated values may be materially higher or lower than the values that would have been used had a ready market for the securities

existed. Accordingly, the degree of judgment exercised by the Fund in determining fair value is greatest for securities categorized in

Level 3. In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such

cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement in its entirety falls,

is determined based on the lowest level input that is significant to the fair value measurement.

Fair

value is a market-based measure considered from the perspective of a market participant rather than an entity-specific measure. Therefore,

even when market assumptions are not readily available, the Fund’s own assumptions are set to reflect those that market participants

would use in pricing the asset or liability at the measurement date. The Fund uses prices and inputs that are current as of the measurement

date, including periods of market dislocation. In periods of market dislocation, the observability of prices and inputs may be reduced

for many securities. This condition could cause a security to be reclassified to a lower level within the fair value hierarchy.

Investments

in securities traded on a national securities exchange (or reported on the NASDAQ National Market or Capital Market) are stated at the

last reported sales price on the day of valuation (or at the NASDAQ official closing price); other securities traded in the over-the-counter

market and listed securities for which no sale was reported on that date are stated at the last quoted bid price. Restricted securities

and other securities

| Notes

to Financial Statements (unaudited) (continued) |

for

which quotations are not readily available are valued at fair value as determined, in good faith, by the Advisor, as “valuation

designee” under the oversight of the Board of Directors.

The

following table summarizes the classification of the Fund’s investments by the above fair value hierarchy levels as of December

31, 2023:

| | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Assets (at fair value) | |

| | | |

| | | |

| | | |

| | |

| Common Stocks | |

| | | |

| | | |

| | | |

| | |

| USA | |

$ | 18,806,909 | | |

$ | — | | |

$ | 45,152 | | |

$ | 18,852,061 | |

| Mexico | |

| 11,737,502 | | |

| — | | |

| — | | |

| 11,737,502 | |

| Puerto Rico | |

| 7,915,526 | | |

| 391,447 | | |

| — | | |

| 8,306,973 | |

| Panama | |

| 4,562,739 | | |

| — | | |

| — | | |

| 4,562,739 | |

| Liberia | |

| 3,866,960 | | |

| — | | |

| — | | |

| 3,866,960 | |

| Bermuda | |

| 3,739,023 | | |

| — | | |

| — | | |

| 3,739,023 | |

| Netherlands | |

| 3,715,501 | | |

| — | | |

| — | | |

| 3,715,501 | |

| Bahamas | |

| 602,987 | | |

| — | | |

| — | | |

| 602,987 | |

| Cayman | |

| 464,419 | | |

| — | | |

| — | | |

| 464,419 | |

| Bonds | |

| | | |

| | | |

| | | |

| | |

| Cuba | |

| — | | |

| — | | |

| — | | |

| — | |

| Money Market Funds | |

| 7,111,962 | | |

| — | | |

| — | | |

| 7,111,962 | |

| Total Investments in securities | |

$ | 62,523,528 | | |

$ | 391,447 | | |

$ | 45,152 | | |

$ | 62,960,127 | |

The

fair valued securities (Level 3) held in the Fund consisted of Cuban Electric Company, Ceramica Carabobo, Fuego Enterprises, Inc., Siderurgica

Venezolana Sivensa S.A., Waterloo Investment Holdings Ltd. and Republic of Cuba 4.5% bond.

The

following is a reconciliation of assets in which significant unobservable inputs (Level 3) were used to determine fair value as of December

31, 2023:

| | |

Level 3 | |

| Balance as of 6/30/23 | |

$ | 45,152 | |

| Sales | |

| — | |

| Realized gain/(loss) | |

| — | |

| Change in unrealized gain/(loss) | |

| — | |

| Transfer into Level 3 | |

| — | |

| Transfer out of Level 3 | |

| — | |

| Balance as of 12/31/23 | |

$ | 45,152 | |

Under

procedures approved by the Board of Directors, the Advisor provides administration and oversight of the Fund’s valuation policies

and procedures, which are reviewed at least

| Notes

to Financial Statements (unaudited) (continued) |

annually

by the Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities

and financial instrument dealers and other market sources to determine fair value.

The

Fund has procedures to determine the fair value of securities and other financial instruments for which market prices are not readily

available. Under these procedures, the Advisor convenes on a regular and ad hoc basis to review such securities and considers a number

of factors, including valuation methodologies and significant unobservable valuation inputs, when determining a fair value. The Advisor

may employ a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples,

book values and other relevant information for the investment to determine the fair value of the investment. An income-based valuation

approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discount

may be applied due to the nature or duration of any restrictions on the disposition of investments. Due to the inherent uncertainty of

valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market

existed. The Advisor employs various methods for calibrating these valuation approaches including a regular view of valuation methodologies,

key inputs and assumptions, transactional back-testing or disposition analysis and reviews of any related market activity.

The

Fund adopted policies to comply with the SEC’s new Rule 2a-5 under the 1940 Act, which establishes a regulatory framework for registered

investment company fair valuation practices. The Fund’s fair value policies and procedures and valuation practices were updated

prior to the rule’s required compliance date of September 8, 2022. Under Rule 2a-5, the Fund’s Board of Directors designated

the Advisor as the Fund’s “Valuation Designee” to make fair value determinations.

Income

Recognition

Security

transactions are recorded on the trade date. Gains and losses on securities sold are determined on the basis of identified cost. Dividend

income is recognized on the ex-dividend date or in the case of certain foreign securities, as soon as the Fund is notified, and interest

income is recognized on an accrual basis. Discounts and premiums on debt securities purchased are amortized over the life of the respective

securities. It is the Fund’s practice to include the portion of realized and unrealized gains and losses on investments denominated

in foreign currencies as components of realized and unrealized gains and losses on investments and foreign currency. Withholding on foreign

taxes have been provided for in accordance with the Fund’s understanding of the applicable country’s tax rules and rates.

Foreign

Currency

The

accounting records of the Fund are maintained in U.S. dollars. Foreign currency amounts and investments denominated in a foreign currency,

if any, are translated into U.S. dollar amounts at current exchange rates on the valuation date. Purchases and sales

| Notes

to Financial Statements (unaudited) (continued) |

of

investments denominated in foreign currencies are translated into U.S. dollar amounts at the exchange rate on the respective dates of

such transactions.

Deposits

with Financial Institutions

The

Fund may, during the course of its operations, maintain account balances with financial institutions in excess of federally insured limits.

Counterparty

Brokers

In

the normal course of business, substantially all of the Fund’s money balances and security positions are custodied with the Fund’s

custodian, Fifth Third Bank N.A. The Fund also transacts with other brokers. The Fund is subject to credit risk to the extent any broker

with which it conducts business is unable to fulfill contractual obligations on its behalf. The Fund’s management monitors the

financial condition of such brokers and does not anticipate any losses from these counterparties.

Use

of Estimates in the Preparation of Financial Statements

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the

reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Income

Taxes

The

Fund’s policy is to continue to comply with the provisions of the Internal Revenue Code of 1986, as amended, that are applicable

to regulated investment companies and to distribute substantially all of its taxable income to its stockholders. Under these provisions,

the Fund is not subject to federal income tax on its taxable income and no federal income or excise tax provision is required.

The

Fund has adopted a June 30 year-end for federal income tax purposes.

Distributions

to Stockholders

Under

a managed distribution plan, for the six months ended December 31, 2023 the Fund paid distributions to stockholders payable in quarterly

installments at an annual rate set at 15% of the Fund’s December 19, 2023 NAV. The quarterly distributions may be sourced from

income, paid-in capital, and/or capital gains, if any. To the extent that sufficient investment income is not available on a quarterly

basis, the Fund may distribute paid-in capital and/or capital gains, if any, in order to maintain its managed distribution level. The

Board suspended the managed distribution plan in August 2023 and reinstated the managed distribution plan effective November 22, 2023.

Distributions

to stockholders are recorded on the ex-dividend date. Income and capital gain distributions are determined in accordance with income

tax regulations which may

| Notes

to Financial Statements (unaudited) (continued) |

differ

from GAAP. For the six months ended December 31, 2023, a distribution from return of capital of $0.135375 per share was declared on December

29, 2023.

Due

to the timing of dividend distributions and the differences in accounting for income and realized gains and losses for financial statement

and federal income tax purposes, the fiscal year in which the amounts are distributed may differ from the year in which the income and

realized gains and losses are recorded by the Fund.

Derivatives

Risk Management Program

The

Fund adopted policies and procedures to comply with the SEC’s new Rule 18f-4 under the 1940 Act, which limits the amount of derivatives

a fund can enter into, eliminates the asset segregation framework previously used by funds to comply with Section 18 of the 1940 Act,

treats derivatives as senior securities and requires funds whose use of derivatives is more than a limited specified exposure amount

to establish and maintain a comprehensive derivatives risk management program and when applicable, appoint a derivatives risk manager.

The Fund adopted a derivatives risk management program to implement and comply with Rule 18f-4 prior to the SEC’s required compliance

date of August 19, 2022 in the event it is required to rely on Rule 18f-4.

NOTE

3. RESTRICTED SECURITIES OWNED

Investments

in securities include $165,000 principal, 4.5%, 1977 Republic of Cuba bonds, $140,000 purchased for $52,850 on February 15, 1995 and

$25,000 purchased for $10,188 on April 27, 1995, that are currently segregated and restricted from transfer. The bonds were listed on

the New York Stock Exchange (“NYSE”) and had been trading in default since 1960. A “regulatory halt” on trading

was imposed by the NYSE in July 1995 and trading in the bonds was suspended as of December 28, 2006. The NYSE has stated that following

the suspension of trading, application will be made to the Securities and Exchange Commission to delist the issue. As of December 31,

2023 the position was valued at $0 under procedures approved by the Board of Directors.

Investments

in securities also include 700 shares of Cuban Electric Company, 482 shares purchased for $4,005 on September 30, 2005 and 218 shares

purchased for $1,812 on September 30, 2005, which are currently segregated and restricted from transfer. As of December 31, 2023, the

position was valued at $0 under procedures approved by the Board of Directors.

NOTE

4. TRANSACTIONS WITH AFFILIATES AND OTHER SERVICE PROVIDERS

Transactions

with Affiliates

HERZFELD

/ CUBA (the “Advisor”), a division of Thomas J. Herzfeld Advisors, Inc., is the Fund’s investment advisor and charges

a monthly fee at the annual rate of 1.45% of the Fund’s average daily net assets. Total fees for the six months ended December

31, 2023 amounted to $259,712, before the waiver described below. Mr. Thomas J. Herzfeld is the owner of the Advisor.

| Notes

to Financial Statements (unaudited) (continued) |

The

Advisor has agreed to voluntarily waive its management fee by ten basis points, in support of the Fund’s initiative to attempt

to reduce the stock price discount to NAV. Effective November 22, 2023, the Adviser has further agreed to voluntarily waive its management

fee on the Fund’s net assets in excess of $30 million by an additional ten basis points. Accordingly, the Adviser’s management

fee after the voluntary waivers is (i) 1.35% of the Fund’s assets up to and including $30 million and (ii) 1.25% of the Fund’s

assets in excess of $30 million. For the six months ended December 31, 2023, the Advisor waived fees in the amount of $19,149. As of

December 31, 2023 the Fund owed the Advisor $49,676.

TMorgan

Advisers, LLC (“TMA”) has been engaged by the Advisor to provide, among other things, certain compliance and operational

support services with respect to the Fund, including the services of Mr. Thomas K. Morgan as the Fund’s chief compliance officer.

The fees charged by TMA for services to the Fund are billed directly to the Fund by TMA. Fees charged by TMA and/or Mr. Morgan for services

provided to the Advisor are paid directly by the Advisor. For the six months ended December 31, 2023, the total compliance and operational

support services fees paid or payable by the Fund to TMA amounted to $30,164.

Other

Service Providers

Under

a Master Services Agreement between Ultimus Fund Solutions, LLC (“Ultimus”) and the Fund, Ultimus is responsible for fund

administration, including generally managing the administrative affairs of the Fund, and supervising the preparation of reports to stockholders,

reports to and filings with the SEC and materials for meetings of the Board. Ultimus is also responsible for fund accounting, including

calculating the net asset value per share and maintaining the financial books and records of the Fund. Ultimus also serves as the transfer

agent and provides shareholder services to the Fund. The Master Services Agreement permits Ultimus to subcontract for the provision of

services it has contracted for under the Master Services Agreement, and Ultimus has subcontracted transfer agency services to Equiniti

Trust Company, LLC. Ultimus is entitled to receive a fee in accordance with the agreement and was paid $34,898 for the six months ended

December 31, 2023.

The

Fund has entered into an agreement with Fifth Third Bank N.A. to serve as the custodian for the Fund’s assets.

NOTE

5. INVESTMENT TRANSACTIONS

During

the six months ended December 31, 2023, purchases and sales of investment securities were $19,006,350 and $579,889, respectively.

NOTE

6. INCOME TAX INFORMATION

The

cost basis of securities owned for financial statement purposes is lower than the cost basis for income tax purposes by $233,171 due

to wash sale adjustments, passive foreign investment companies and book-to-tax adjustments to partnership investment. As of

| Notes

to Financial Statements (unaudited) (continued) |

December

31, 2023 gross unrealized gains were $16,472,405 and gross unrealized losses were $(578,794) for income tax purposes.

Permanent

differences accounted for during the year ended June 30, 2023, result from differences between book and tax accounting for the characterization

of foreign currency losses, partnership adjustments, and the reclassification of the Fund’s net investment loss for tax purposes.

Such amounts have been reclassified as follows:

| | |

Total | |

|

| | |

Distributable | |

Additional Paid |

| | |

Earnings | |

in Capital |

| Year ended June 30, 2023 | |

$804,272 | |

$(804,272) |

As

of June 30, 2023, the Fund had no post-October losses which are deferred until fiscal year 2023 for tax purposes. Capital losses incurred

after October 31 (“post-October losses”) within that taxable year are deemed to arise on the first day of the Fund’s

next taxable year.

As

of June 30, 2023, the Fund had $19,375 of qualified late-year ordinary losses, which are deferred until fiscal year 2023 for tax purposes.

Net late-year losses incurred after December 31 within the taxable year are deemed to arise on the first day of the Fund’s next

taxable year.

In

accordance with GAAP, the Fund is required to determine whether a tax position is more likely than not to be sustained upon examination

by the applicable taxing authority, including resolution of any related appeals or litigation processes, based on the technical merits

of the position. The Fund files an income tax return in the U.S. federal jurisdiction and may file income tax returns in various U.S.

states and foreign jurisdictions. Generally the Fund is no longer subject to income tax examinations by major taxing authorities for

years before June 30, 2020. The tax benefit recognized is measured as the largest amount of benefit that has a greater than fifty percent

likelihood of being realized upon ultimate settlement.

De-recognition

of a tax benefit previously recognized results in the Fund recording a tax liability that reduces ending net assets.

The

Fund’s policy would be to recognize accrued interest expense to unrecognized tax benefits in interest expense and penalties in

operating expenses. There were none for the fiscal year ended June 30, 2023.

The

tax character of distributions paid to stockholders during the years ended June 30, 2023 and June 30, 2022 were as follows: ordinary

income of $0 and $194,711, respectively, long-term capital gains of $714,706 and $1,148,768, respectively, and a return of capital of

$3,893,734 and $4,951,954, respectively.

| Notes

to Financial Statements (unaudited) (continued) |

NOTE

7. CAPITAL SHARE TRANSACTIONS

Shares

of Common Stock

The

Fund has 100,000,000 shares of common stock authorized and 16,150,673 issued and outstanding at December 31, 2023. Transactions in common

stock for the six months ended December 31, 2023, were as follows:

| Shares at beginning of period | |

| 7,150,673 | |

| Shares issued in connection with rights offering | |

| 9,000,000 | |

| Shares issued in re-investment of dividends and distributions | |

| — | |

| Shares at end of period | |

| 16,150,673 | |

2023

Rights Offering

On

December 19, 2023, the Fund issued 9,000,000 shares of common stock in connection with a rights offering. Stockholders of record November

3, 2023 were issued one non-transferable right for every share owned on that date. The rights entitled the stockholders to purchase one

new share of common stock for every one right held. In addition, the Fund had the discretion to increase the number of shares of common

stock subject to subscription by up to 200% of the shares offered, or up to an additional 14,301,346 shares of common stock.

The

subscription price was equal to 92% of the average volume-weighted closing sales price per share of the Fund’s common stock on

the NASDAQ Capital Market on December 13, 2023, and the four preceding trading days. The final subscription price was $2.31 per share.

The offering was oversubscribed and the oversubscription requests exceeded the primary shares available. The Fund issued an additional

25.86% of the number of shares issued in the primary subscription, or 1,849,327 additional shares, for a total issuance of 9,000,000

new shares of common stock. Net proceeds to the Fund were $20,607,216, after deducting rights offering costs of $182,784. The net asset

value of the Fund’s common shares was decreased by approximately $1.60 per share, as a result of the share issuance.

2022

Tender Offer

The

Fund’s Board of Directors determined to commence an offer to purchase up to 5%, or 338,382 Shares of the Fund’s issued and

outstanding Common Stock. The offer was a cash offer at a price equal to 97.5% of the Fund’s net asset value per share (“NAV”)

as of the close of ordinary trading on the NASDAQ Capital Market on November 8, 2022. As a result of Tender Offer 338,382 shares were

purchased.