0000748268

true

NV

0000748268

2024-02-16

2024-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 16, 2024

Red

Cat Holdings, Inc.

(Exact name of registrant

as specified in its charter)

Nevada

(State or other

jurisdiction of incorporation) |

|

001-40202

(Commission

File Number) |

|

88-0490034

(I.R.S. Employer

Identification No.) |

15

Ave. Munoz Rivera Ste

2200

San

Juan, PR

(Address of principal executive offices) |

00901

(Zip

Code) |

Registrant’s

telephone number, including area code: (833)

373-3228

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| Securities

registered pursuant to Section 12(b) of the Act: |

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, par value $0.001 |

RCAT |

The

Nasdaq Capital

Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory

note – This Amendment No. 1 to the current report on Form 8-K filed February 22, 2024 (the “Original 8-K”) is filed

solely to correct in error regarding the number of shares of Unusual Machines, Inc. owned by Jeffrey M. Thompson. Mr. Thompson owns 328,500

shares of Unusual Machines, Inc., not 1,557,000 shares as incorrectly stated in the Original 8-K. This Amendment No. 1 is otherwise identical

to the Original 8-K in all respects.

Section 2 –

Financial Information

Item 2.01 Completion

of Acquisition or Disposition of Assets

Closing of Sale of Consumer

Division

On February

16, 2024, Red Cat Holdings, Inc., a Nevada corporation (the “Company”) closed the sale of Rotor Riot, LLC (“Rotor

Riot”) and Fat Shark Holdings, Ltd. (“Fat Shark”), its wholly-owned subsidiaries, to Unusual Machines, Inc.,

a Puerto Rico corporation (“UMAC”). The sale was conducted pursuant to a Share Purchase Agreement dated November 21,

2022, as amended on April 13, 2023, July 10, 2023, and December 11, 2023 (the “SPA”). Rotor Riot and Fat Shark previously

focused on sales to the consumer segment, including recreational and hobbyist drones, first-person-view goggles, and acting as a licensed

authorized reseller of consumer drone products. The transaction closed concurrently with UMAC’s initial public offering and listing

on the NYSE American exchange (“IPO”) under the symbol “UMAC.” Following divestiture of its consumer division,

the Company intends to focus its efforts exclusively on drone technology integrating robotic hardware and software for military, government,

and commercial operations.

On September 19, 2022, the Company formed a Special Committee of its Board of Directors consisting of Joe Freedman

and Christopher Moe, independent directors, in order to negotiate and conclude the SPA on behalf of the Company. The SPA was approved

by shareholders of the Company at a special meeting held March 8, 2023. In evaluating the consideration to be paid to the Company for

its ownership of Rotor Riot and Fat Shark, the special committee evaluated the fair market value of both companies and obtained and reviewed

an independent fair market value analysis of the companies prepared by Vantage Point Advisors, Inc.

Consideration for Sale

of Consumer Division Under the SPA

The total

consideration received by the Company for its sale of Rotor Riot and Fat Shark was valued at $20 million, and consisted of the following

elements:

| |

· |

$1 million in cash, which was paid from the proceeds of UMAC’s initial public offering; |

| |

· |

$2 million in the form of a promissory note payable to the Company, filed as Exhibit 10.1 hereto (the “Note”); and |

| |

· |

$17 million worth of UMAC common stock, valued at the initial public offering price for UMAC’s common stock, resulting in 4,250,000 shares of UMAC common stock being issued to the Company (representing approximately 48.66% of UMAC’s issued and outstanding common stock after giving effect to the IPO and to the issuance of common stock to the Company upon closing of the IPO). |

In addition, UMAC

is required to pay the Company for the amount of the working capital balances of Rotor Riot and Fat Shark as of the Closing Date.

8%

Promissory Note

The

Note bears interest at a rate of 8% per year, is due 18 months from the date of issue, and requires monthly payments of interest due in

arrears on the 15th day of each month. In the event of a Qualified Financing (defined as one or more related debt or equity

financings by UMAC resulting in net proceeds of at least $5 million, other than UMAC’s completed IPO), the Company may require payment

of the Note in whole or in part upon written notice given within 10 days of the Qualified Financing. During the occurrence and continuance

of any event of default under the Note, the Company may, at its option, convert the amounts due under the Note to common stock of UMAC

in whole or in part from time to time. The conversion price will be a 10% discount to the average daily volume weighted average price

for UMAC’s common stock over the 10 days preceding the conversion. Conversions under the Note will be limited such that no conversion

may be made to the extent that, after giving effect to the conversion, the Company, together with its affiliates, would beneficially own

in excess of 4.99% of UMAC’s common stock. This limit may be increased by the Company upon 61 days written notice.

Registration

Rights Agreement

In

connection with the closing of the SPA, UMAC and the Company entered into a Registration Rights Agreement (the “RRA”)

filed herewith as Exhibit 10.2. Under the RRA, UMAC has agreed to file a registration statement with the Securities and Exchange Commission

(the “Commission”) covering the Company’s resale of 500,000 of the shares of the UMAC common stock issued to

the Company under the SPA. UMAC is required to file a registration statement with the Commission within 120 days after the effectiveness

of the registration statement for its IPO and must use its best efforts to secure effectiveness of the registration statement within

180 days of the effectiveness of its IPO registration statement.

Non-competition

Agreements

Company

Non-Compete

In

connection with the closing of the SPA, UMAC, Rotor Riot, and Fat Shark entered into a Non-Competition Agreement (the ‘Company

Non-Compete”) in favor of the Company, filed herewith as Exhibit 10.3. Under the Company Non-Compete, UMAC, Rotor Riot, and

Fat Shark have agreed that, for a period of 5 years, they shall not design, manufacture, market, import, build or sell any Group 1 or

Group 2 UAV drone to customers which are a governmental authority (as defined in the agreement) and/or any third-party intermediary to

customers which are a governmental authority, without the prior written consent of the Company. A “Group 1 UAV” drone is defined

as a small, lightweight unmanned system (such as the Teal 2 and RQ-11 Raven drones) weighing up to 20 pounds that are designed for operation

at lower altitudes (capable of reaching up to 1,200 feet above ground level) at speeds of less than 100 knots. A “Group 2 UAV”

drone is defined as drones that weigh between 21 and 55 pounds (such as the RQ-7 Shadow) and are designed for medium range missions, capable

of reaching altitudes up to 3,500 feet above ground level and flying at speed less than 250 knots.

In

addition, UMAC shall be entitled to be paid 10% of net collected revenue as and when collected for sales made by our subsidiary Teal Drones

Inc. which are referred by UMAC for sales of Group 1 or Group 2 UAV drones to a government authority not previously in contact with Teal.

UMAC shall be obligated during the 5-year restricted period to refer all such opportunities to Teal.

Allan

Evans Non-Compete

Also

in connection with the closing of the SPA, the CEO of UMAC, Allan Evans, entered into a Non-Compete agreement (the “Evans Non-Compete”)

in favor of the Company. Under the Evans Non-Compete, Mr. Evans agreed that, for a period of 12 months, he shall not engage in any business

activity similar to, or competitive with, the business conducted by the Company or its affiliates, including, but not limited to, the design,

manufacture, market, import, building or selling of any Group 1 or Group 2 UAV drone to customers which are a governmental authority.

Our

Chief Executive Officer, Chairman and founder, Jeffrey Thompson, is the founder of UMAC and formerly served as its Chief Executive Officer

and Chairman from inception in July 2019 until April 2022. Mr. Thompson owns 328,500 shares of UMAC common stock, which represents approximately

3.76% of UMAC’s shares after giving effect to the IPO and to the issuance of common stock to the Company upon closing of the IPO.

The

foregoing descriptions of the material terms of the SPA, as amended, the Note, the RRA and the Non-Compete agreements does not purport

to be complete and is qualified in its entirety by reference to such exhibits filed herewith, which should be reviewed in their entirety

for additional information.

Section 9 –

Financial Statements and Exhibits

Item. 9.01. Financial Statements and Exhibits

| Exhibit No. |

Description |

| 10.1 |

8% Promissory Note from Unusual Machines, Inc.* |

| 10.2 |

Registration Rights Agreement with Unusual Machines, Inc.* |

| 10.3 |

Non-Competition Agreement with Unusual Machines, Inc., Rotor Riot, LLC, and Fat Shark Holdings, Ltd.* |

| 10.4 |

Non-Compete agreement with Allan Evans* |

| 10.5 |

Share Purchase Agreement with Unusual Machines, Inc. (incorporated by reference to Current Report on Form 8-K filed November 28, 2022) |

| 10.6 |

Amended and Restated Amendment No. 1 to Share Purchase Agreement with Unusual Machines, Inc. (incorporated by reference to Current Report on Form 8-K filed April 14, 2023) |

| 10.7 |

Amendment No. 2 to Share Purchase Agreement with Unusual Machines, Inc. (incorporated by reference to Current Report on Form 8-K filed July 14, 2023) |

| 10.8 |

Amendment No. 3 to Share Purchase Agreement with Unusual Machines, Inc. (incorporated by reference to Quarterly Report on Form 10-Q filed December 15, 2023) |

| 10.9 |

Amendment No. 4 to Share Purchase Agreement with Unusual Machines, Inc. (incorporated by reference to Current Report on Form 8-K filed December 15, 2023) |

| 99.1 |

Unaudited Pro Forma Financial Information* |

*Incorporated by

reference to Current Report on Form 8-K filed February 22, 2024.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

RED CAT HOLDINGS, INC. |

|

| |

|

|

|

| Dated: March 1, 2024 |

By: |

/s/ Jeffrey

Thompson |

|

| |

|

Name: Jeffrey Thompson |

|

| |

|

Title: Chief Executive Officer |

|

v3.24.0.1

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

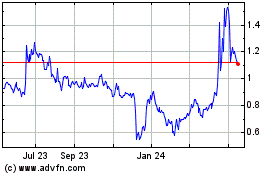

Red Cat (NASDAQ:RCAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

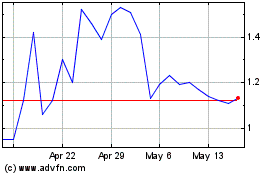

Red Cat (NASDAQ:RCAT)

Historical Stock Chart

From Apr 2023 to Apr 2024