Organogenesis Holdings Inc. (Nasdaq: ORGO), a leading regenerative

medicine company focused on the development, manufacture, and

commercialization of product solutions for the Advanced Wound Care

and Surgical & Sports Medicine markets, today reported

financial results for the fourth quarter and the year ended

December 31, 2023.

Fourth Quarter 2023 Financial Results

Summary:

- Net revenue of $99.7 million for the

fourth quarter of 2023, a decrease of 14% compared to net revenue

of $115.5 million for the fourth quarter of 2022. Net revenue for

the fourth quarter of 2023 consists of:

- Net revenue from Advanced Wound Care

products of $93.2 million, a decrease of 14% from the fourth

quarter of 2022.

- Net revenue from Surgical &

Sports Medicine products of $6.5 million, a decrease of 3% from the

fourth quarter of 2022.

- Net loss of $0.6

million for the fourth quarter of 2023, compared to net income of

$7.5 million for the fourth quarter of 2022, a decrease of $8.1

million.

- Adjusted net

income1 of $1.9 million for the fourth quarter of 2023, compared to

adjusted net income of $8.9 million for the fourth quarter of 2022,

a decrease of $7.0 million.

- Adjusted EBITDA

of $7.5 million for the fourth quarter of 2023, compared to

Adjusted EBITDA of $14.1 million for the fourth quarter of 2022, a

decrease of $6.6 million.

Fiscal Year 2023 Financial Results

Summary:

- Net revenue of $433.1 million for

the year ended December 31, 2023, a decrease of 4% compared to

net revenue of $450.9 million for the year ended December 31,

2022. Net revenue for the year ended December 31, 2023

consists of:

- Net revenue from Advanced Wound Care

products of $405.5 million, a decrease of 4% year-over-year.

- Net revenue from Surgical &

Sports Medicine products of $27.6 million, a decrease of 4%

year-over-year.

- Net income of

$4.9 million for the year ended December 31, 2023, compared to

net income of $15.5 million for the year ended December 31,

2022, a decrease of $10.5 million.

- Adjusted net

income1 of $12.7 million for the year ended December 31, 2023,

compared to an adjusted net income of $26.2 million for the year

ended December 31, 2022, a decrease of $13.5 million.

- Adjusted EBITDA

of $42.6 million for the year ended December 31, 2023,

compared to an adjusted EBITDA of $49.3 million for the year ended

December 31, 2022, a decrease of $6.7 million.

“We are building positive momentum with the many commercial

support programs implemented to enhance existing customer

relationships and regain lost accounts in a uniquely challenging

operating environment”, said Gary S. Gillheeney, Sr., President and

Chief Executive Officer of Organogenesis. "Despite the expected

operating environment challenges, we delivered revenues within the

lower end of our guidance. Looking ahead to 2024, we expect to

return to revenue growth through continued demonstration of value

to our customers and new product launches in both our Advanced

Wound Care and Surgical & Sports Medicine markets broadening

our portfolio of differentiated treatment options.”

Mr. Gillheeney, Sr. continued: “We continue to make progress

with the ReNu program, which we believe, represents a significant

value driver by addressing a critical unmet need in treating the

symptoms of knee osteoarthritis. We remain confident in the

long-term opportunity for Organogenesis and expect to continue to

lead in our space with highly innovative products that deliver on

our mission to provide integrated healing solutions that

substantially improve outcomes while lowering the overall cost of

care.”

1Defined as GAAP net income adjusted to exclude the effect of

amortization, restructuring charges, LCD legal fees and sales

retention, write-off of certain assets, facility construction

project pause, GPO settlement fee and the resulting income taxes on

these items.

Fourth Quarter 2023 Financial

Results:

| |

|

Three Month Ended December 31, |

|

|

Change |

|

| |

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

| |

|

(in thousands, except for percentages) |

|

|

|

|

|

|

|

|

Advanced Wound Care |

|

$ |

93,165 |

|

|

$ |

108,836 |

|

|

$ |

(15,671 |

) |

|

|

(14 |

%) |

| Surgical & Sports

Medicine |

|

|

6,486 |

|

|

|

6,680 |

|

|

|

(194 |

) |

|

|

(3 |

%) |

|

Net revenue |

|

$ |

99,651 |

|

|

$ |

115,516 |

|

|

$ |

(15,865 |

) |

|

|

(14 |

%) |

Net revenue for the fourth quarter of 2023 was $99.7 million,

compared to $115.5 million for the fourth quarter of 2022, a

decrease of $15.9 million, or 14%. The decrease in net revenue was

driven by a decrease of $15.7 million, or 14% in net revenue of

Advanced Wound Care products and a decrease of $0.2 million, or 3%

in net revenue of Surgical & Sports Medicine products.

Gross profit for the fourth quarter of 2023 was $71.9 million,

or 72% of net revenue, compared to $88.4 million or 77% of net

revenue, for the fourth quarter of 2022, a decrease of $16.5

million, or 19%.

Operating expenses for the fourth quarter of 2023 were $73.2

million, compared to $79.7 million for the fourth quarter of 2022,

a decrease of $6.5 million, or 8%. R&D expenses were $11.8

million for the fourth quarter of 2023, compared to $11.4 million

in the fourth quarter of 2022, an increase of $0.4 million, or 3%.

Selling, general and administrative expenses were $61.4 million,

compared to $68.3 million in the fourth quarter of 2022, a decrease

of $6.9 million, or 10%.

Operating loss for the fourth quarter of 2023 was $1.3 million,

compared to operating income of $8.7 million for the fourth quarter

of 2022, a decrease of $10.0 million.

Total other expense, net, for the fourth quarter of 2023 was

$0.5 million, compared to other income, net of less than $0.1

million for the fourth quarter of 2022, a decrease of approximately

$0.6 million.

Net loss for the fourth quarter of 2023 was $0.6 million, or

$(0.00) per share, compared to net income of $7.5 million, or $0.06

per share, for the fourth quarter of 2022, a decrease of $8.1

million, or $0.06 per share.

Adjusted net income was $1.9 million for the fourth quarter of

2023, compared to adjusted net income of $8.9 million for the

fourth quarter of 2022, a decrease of $7.0 million, or 78%.

Adjusted EBITDA was $7.5 million for the fourth quarter of 2023,

compared to $14.1 million for the fourth quarter of 2022, a

decrease of $6.6 million, or 47%.

As of December 31, 2023, the Company had $104.3 million in

cash, cash equivalents and restricted cash and $66.2 million in

term loan debt obligations, compared to $103.3 million in cash,

cash equivalents and restricted cash and $70.8 million in term loan

debt obligations, as of December 31, 2022.

Fiscal Year 2023 ResultsThe following table

represents net revenue by product grouping for the year ended

December 31, 2023 and December 31, 2022,

respectively:

| |

|

Year Ended December 31, |

|

|

Change |

|

| |

|

2023 |

|

|

2022 |

|

|

$ |

|

|

% |

|

| |

|

(in thousands, except for percentages) |

|

|

|

|

|

|

|

|

Advanced Wound Care |

|

$ |

405,514 |

|

|

$ |

422,231 |

|

|

$ |

(16,717 |

) |

|

|

(4 |

%) |

| Surgical & Sports

Medicine |

|

|

27,626 |

|

|

|

28,662 |

|

|

|

(1,036 |

) |

|

|

(4 |

%) |

|

Net revenue |

|

$ |

433,140 |

|

|

$ |

450,893 |

|

|

$ |

(17,753 |

) |

|

|

(4 |

%) |

Net revenue for the year ended December 31, 2023 was $433.1

million, compared to $450.9 million for the year ended

December 31, 2022, a decrease of $17.8 million, or 4%. The

decrease in net revenue was driven by a decrease of $16.7 million,

or 4% in net revenue of Advanced Wound Care products and a decrease

of $1.0 million, or 4% in net revenue of Surgical & Sports

Medicine products.

Gross profit for the year ended December 31, 2023 is $326.7

million, or 75% of net revenue, compared to $345.9 million, or 77%

of net revenue, for the year ended December 31, 2022, a

decrease of $19.2 million, or 6%.

Operating expenses for the year ended December 31, 2023

were $314.1 million, compared to $323.6 million for the year ended

December 31, 2022, a decrease of $9.4 million, or 3%. R&D

expenses were $44.4 million for the year ended December 31,

2023, compared to $39.8 million for year ended December 31,

2022, an increase of $4.6 million, or 12%. Selling, general and

administrative expenses were $269.8 million for year ended

December 31, 2023, compared to $283.8 million year ended

December 31, 2022, a decrease of $14.1 million, or 5%.

Operating income for the year ended December 31, 2023 was

$12.5 million, compared to an operating income of $22.3 million for

the year ended December 31, 2022, a decrease of $9.8

million.

Total other expense, net, for the year ended December 31,

2023 was $2.1 million, compared to $2.0 million for the year ended

December 31, 2022, a decrease of $0.1 million.

Net income of $4.9 million for the year ended December 31,

2023 or $0.04 per share, compared to net income of $15.5 million,

or $0.12 per share for the year ended December 31, 2022, a

decrease of $10.5 million, or $0.08 per share.

Adjusted net income for the year ended December 31, 2023

was $12.7 million., compared to $26.2 million for the year ended

December 31, 2022, a decrease of $13.5 million, or 52%.

Adjusted EBITDA of $42.6 million for the year ended

December 31, 2023, compared to Adjusted EBITDA of $49.3

million for the year ended December 31, 2022, a decrease of

$6.7 million, or 14%.

Fiscal Year 2024 Guidance:

For the year ending December 31, 2024, the Company expects:

- Net revenue between $445.0 million

and $470.0 million, an increase of approximately 3% to 9%

year-over-year, as compared to net revenue of $433.1 million for

the year ended December 31, 2023.

- The 2024 net revenue guidance range

assumes:

- Net revenue from Advanced Wound Care

products between $415.0 million and $435.0 million, an increase of

approximately 2% to 7% year-over-year as compared to net revenue of

$405.5 million for the year ended December 31, 2023.

- Net revenue from Surgical &

Sports Medicine products between $30.0 million and $35.0 million,

an increase of approximately 9% to 27% year-over-year as compared

to net revenue of $27.6 million for the year ended

December 31, 2023.

- Net income (loss) between ($10.6)

million and $4.6 million and adjusted net income (loss) between

($8.1) million and $7.1 million.

- EBITDA between $5.8 million and

$25.0 million and Adjusted EBITDA between $15.8 million and $35.0

million.

Earnings Conference Call:

Financial results for the fourth fiscal quarter and year ended

December 31, 2023 will be reported after the market closes on

Thursday, February 29th. Management will host a conference call at

5:00 p.m. Eastern Time on February 29th to discuss the results of

the quarter, and provide a corporate update with a question and

answer session. Those who would like to participate may access the

live webcast here, or access the teleconference here. A live

webcast of the call will also be provided on the investor relations

section of the Company's website at

investors.organogenesis.com.

For those unable to participate, the webcast will be archived at

investors.organogenesis.com for approximately one year.

|

ORGANOGENESIS HOLDINGS INC. UNAUDITED CONSOLIDATED

BALANCE SHEETS (amounts in thousands, except share

and per share data) |

|

|

|

|

|

|

|

December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

103,840 |

|

|

$ |

102,478 |

|

|

Restricted cash |

|

|

498 |

|

|

|

812 |

|

|

Accounts receivable, net |

|

|

81,999 |

|

|

|

89,450 |

|

|

Inventories |

|

|

28,253 |

|

|

|

24,783 |

|

|

Prepaid expenses and other current assets |

|

|

10,454 |

|

|

|

5,086 |

|

|

Total current assets |

|

|

225,044 |

|

|

|

222,609 |

|

| Property and equipment, net |

|

|

116,228 |

|

|

|

102,463 |

|

| Intangible assets, net |

|

|

15,871 |

|

|

|

20,789 |

|

| Goodwill |

|

|

28,772 |

|

|

|

28,772 |

|

| Operating lease right-of-use

assets, net |

|

|

40,118 |

|

|

|

43,192 |

|

| Deferred tax asset, net |

|

|

28,002 |

|

|

|

30,014 |

|

| Other assets |

|

|

5,990 |

|

|

|

1,520 |

|

|

Total assets |

|

$ |

460,025 |

|

|

$ |

449,359 |

|

| |

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Current portion of term loan |

|

$ |

5,486 |

|

|

$ |

4,538 |

|

|

Current portion of finance lease obligations |

|

|

1,081 |

|

|

|

— |

|

|

Current portion of operating lease obligations - related party |

|

|

3,140 |

|

|

|

3,001 |

|

|

Current portion of operating lease obligations |

|

|

10,004 |

|

|

|

8,707 |

|

|

Accounts payable |

|

|

30,724 |

|

|

|

32,330 |

|

|

Accrued expenses and other current liabilities |

|

|

30,074 |

|

|

|

26,447 |

|

|

Total current liabilities |

|

|

80,509 |

|

|

|

75,023 |

|

| Term loan, net of current

portion |

|

|

60,745 |

|

|

|

66,231 |

|

| Finance lease obligations, net of

current portion |

|

|

1,888 |

|

|

|

— |

|

| Operating lease obligations, net

of current portion - related party |

|

|

17,227 |

|

|

|

20,367 |

|

| Operating lease obligations, net

of current portion |

|

|

19,780 |

|

|

|

20,947 |

|

| Other liabilities |

|

|

1,213 |

|

|

|

1,122 |

|

|

Total liabilities |

|

|

181,362 |

|

|

|

183,690 |

|

| Commitments and contingencies

(Note 18) |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value; 1,000,000 shares authorized;

none issued |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.0001 par value; 400,000,000 shares authorized;

132,044,944 and 131,647,677 shares issued; 131,316,396 and

130,919,129 shares outstanding at December 31, 2023 and 2022,

respectively. |

|

|

13 |

|

|

|

13 |

|

|

Additional paid-in capital |

|

|

319,621 |

|

|

|

310,957 |

|

|

Accumulated deficit |

|

|

(40,971 |

) |

|

|

(45,301 |

) |

|

Total stockholders' equity |

|

|

278,663 |

|

|

|

265,669 |

|

|

Total liabilities and stockholders' equity |

|

$ |

460,025 |

|

|

$ |

449,359 |

|

|

ORGANOGENESIS HOLDINGS INC. UNAUDITED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME(amounts in thousands, except share and per

share data) |

|

|

|

|

| |

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net revenue |

|

$ |

99,651 |

|

|

$ |

115,516 |

|

|

$ |

433,140 |

|

|

$ |

450,893 |

|

| Cost of goods sold |

|

|

27,769 |

|

|

|

27,110 |

|

|

|

106,481 |

|

|

|

105,019 |

|

| Gross profit |

|

|

71,882 |

|

|

|

88,406 |

|

|

|

326,659 |

|

|

|

345,874 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

|

61,381 |

|

|

|

68,293 |

|

|

|

269,754 |

|

|

|

283,808 |

|

|

Research and development |

|

|

11,770 |

|

|

|

11,395 |

|

|

|

44,380 |

|

|

|

39,762 |

|

|

Total operating expenses |

|

|

73,151 |

|

|

|

79,688 |

|

|

|

314,134 |

|

|

|

323,570 |

|

| Loss (income) from

operations |

|

|

(1,269 |

) |

|

|

8,718 |

|

|

|

12,525 |

|

|

|

22,304 |

|

| Other expense, net: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

|

(502 |

) |

|

|

30 |

|

|

|

(2,190 |

) |

|

|

(2,009 |

) |

|

Other income (expense), net |

|

|

(25 |

) |

|

|

6 |

|

|

|

57 |

|

|

|

(13 |

) |

|

Total other expense, net |

|

|

(527 |

) |

|

|

36 |

|

|

|

(2,133 |

) |

|

|

(2,022 |

) |

| Net income before income

taxes |

|

|

(1,796 |

) |

|

|

8,754 |

|

|

|

10,392 |

|

|

|

20,282 |

|

| Income tax (expense) benefit |

|

|

1,228 |

|

|

|

(1,268 |

) |

|

|

(5,447 |

) |

|

|

(4,750 |

) |

| Net (loss) income and

comprehensive (loss) income |

|

$ |

(568 |

) |

|

$ |

7,486 |

|

|

$ |

4,945 |

|

|

$ |

15,532 |

|

| Net income, per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.00 |

) |

|

$ |

0.06 |

|

|

$ |

0.04 |

|

|

$ |

0.12 |

|

|

Diluted |

|

$ |

(0.00 |

) |

|

$ |

0.06 |

|

|

$ |

0.04 |

|

|

$ |

0.12 |

|

| Weighted-average common shares

outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

130,916,950 |

|

|

|

128,661,435 |

|

|

|

131,231,317 |

|

|

|

130,070,231 |

|

|

Diluted |

|

|

131,857,509 |

|

|

|

133,348,995 |

|

|

|

132,746,727 |

|

|

|

132,383,152 |

|

|

ORGANOGENESIS HOLDINGS INC. UNAUDITED CONSOLIDATED

STATEMENT OF CASH FLOWS(amounts in thousands, except share

and per share data) |

|

| |

|

| |

|

Year Ended December 31, |

|

| |

|

2023 |

|

|

2022 |

|

|

2021 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

4,945 |

|

|

$ |

15,532 |

|

|

$ |

94,202 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

|

10,448 |

|

|

|

5,845 |

|

|

|

5,781 |

|

|

Amortization of intangible assets |

|

|

4,918 |

|

|

|

4,883 |

|

|

|

4,949 |

|

|

Amortization of operating lease right-of-use assets |

|

|

8,083 |

|

|

|

7,303 |

|

|

|

5,946 |

|

|

Non-cash interest expense |

|

|

427 |

|

|

|

434 |

|

|

|

346 |

|

|

Deferred interest expense |

|

|

490 |

|

|

|

501 |

|

|

|

1,493 |

|

|

Deferred tax expense (benefit) |

|

|

2,012 |

|

|

|

1,980 |

|

|

|

(31,976 |

) |

|

Loss on disposal of property and equipment |

|

|

235 |

|

|

|

4,482 |

|

|

|

1,407 |

|

|

Loss on lease termination |

|

|

559 |

|

|

|

— |

|

|

|

— |

|

|

Provision recorded for credit losses |

|

|

1,297 |

|

|

|

1,781 |

|

|

|

2,999 |

|

|

Adjustment for excess and obsolete inventories |

|

|

6,580 |

|

|

|

9,648 |

|

|

|

12,079 |

|

|

Stock-based compensation |

|

|

8,996 |

|

|

|

6,552 |

|

|

|

3,864 |

|

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

1,883 |

|

|

Change in fair value of earnout liability |

|

|

— |

|

|

|

— |

|

|

|

(3,985 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

5,539 |

|

|

|

(8,770 |

) |

|

|

(28,654 |

) |

|

Inventories |

|

|

(8,179 |

) |

|

|

(9,410 |

) |

|

|

(9,302 |

) |

|

Prepaid expenses and other current and other assets |

|

|

(10,115 |

) |

|

|

(378 |

) |

|

|

(34 |

) |

|

Operating leases |

|

|

(8,439 |

) |

|

|

(7,006 |

) |

|

|

(6,156 |

) |

|

Accounts payable |

|

|

(108 |

) |

|

|

3,260 |

|

|

|

3,847 |

|

|

Accrued expenses and other current liabilities |

|

|

3,138 |

|

|

|

(11,850 |

) |

|

|

9,354 |

|

|

Other liabilities |

|

|

91 |

|

|

|

72 |

|

|

|

(6,065 |

) |

|

Net cash provided by operating activities |

|

|

30,917 |

|

|

|

24,859 |

|

|

|

61,978 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

|

| Purchases of property and

equipment |

|

|

(24,364 |

) |

|

|

(33,898 |

) |

|

|

(31,220 |

) |

|

Net cash used in investing activities |

|

|

(24,364 |

) |

|

|

(33,898 |

) |

|

|

(31,220 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

|

| Line of credit repayments under

the 2019 Credit Agreement |

|

|

— |

|

|

|

— |

|

|

|

(10,000 |

) |

| Term loan repayments under the

2019 Credit Agreement |

|

|

— |

|

|

|

— |

|

|

|

(60,000 |

) |

| Proceeds from term loan under the

2021 Credit Agreement, net of debt discount and issuance cost |

|

|

— |

|

|

|

— |

|

|

|

73,174 |

|

| Term loan repayments under the

2021 Credit Agreement |

|

|

(4,688 |

) |

|

|

(2,813 |

) |

|

|

(938 |

) |

| Principal repayments of finance

lease obligations |

|

|

(485 |

) |

|

|

(200 |

) |

|

|

(2,630 |

) |

| Proceeds from the exercise of

stock options |

|

|

— |

|

|

|

2,070 |

|

|

|

2,198 |

|

| Payments of withholding taxes in

connection with RSUs vesting |

|

|

(332 |

) |

|

|

(648 |

) |

|

|

(737 |

) |

| Payments of deferred acquisition

consideration |

|

|

— |

|

|

|

(608 |

) |

|

|

(483 |

) |

| Payment to extinguish debt |

|

|

— |

|

|

|

— |

|

|

|

(1,620 |

) |

|

Net cash used in financing activities |

|

|

(5,505 |

) |

|

|

(2,199 |

) |

|

|

(1,036 |

) |

| Change in cash, cash

equivalents and restricted cash |

|

|

1,048 |

|

|

|

(11,238 |

) |

|

|

29,722 |

|

| Cash, cash equivalents, and

restricted cash, beginning of year |

|

|

103,290 |

|

|

|

114,528 |

|

|

|

84,806 |

|

| Cash, cash equivalents, and

restricted cash, end of year |

|

$ |

104,338 |

|

|

$ |

103,290 |

|

|

$ |

114,528 |

|

| Supplemental disclosure

of cash flow information: |

|

|

|

|

|

|

|

|

|

| Cash paid for interest |

|

$ |

5,436 |

|

|

$ |

2,649 |

|

|

$ |

5,787 |

|

| Cash paid for income taxes |

|

$ |

3,052 |

|

|

$ |

1,201 |

|

|

$ |

607 |

|

| Supplemental disclosure

of non-cash investing and financing activities: |

|

|

|

|

|

|

|

|

|

| Cumulative effect adjustment

for adoption of ASU No. 2016-13 (Note 2) |

|

$ |

615 |

|

|

$ |

— |

|

|

$ |

— |

|

| Deferred acquisition

consideration and earnout liability recorded for business

acquisition |

|

$ |

— |

|

|

$ |

828 |

|

|

$ |

— |

|

| Purchases of property and

equipment in accounts payable and accrued expenses |

|

$ |

841 |

|

|

$ |

1,928 |

|

|

$ |

3,750 |

|

| Right-of-use assets obtained

through operating lease obligations |

|

$ |

5,869 |

|

|

$ |

1,350 |

|

|

$ |

53,793 |

|

| Right-of-use assets obtained

through finance lease obligations |

|

$ |

3,454 |

|

|

$ |

— |

|

|

$ |

— |

|

Non-GAAP Financial Measures

Our management uses financial measures that are not in

accordance with generally accepted accounting principles in the

United States, or GAAP, in addition to financial measures in

accordance with GAAP to evaluate our operating results. These

non-GAAP financial measures should be considered supplemental to,

and not a substitute for, our reported financial results prepared

in accordance with GAAP. Our management uses Adjusted EBITDA and

adjusted net income to evaluate our operating performance and

trends and make planning decisions. Our management believes

Adjusted EBITDA and adjusted net income help identify underlying

trends in our business that could otherwise be masked by the effect

of the items that we exclude. Accordingly, we believe that Adjusted

EBITDA and adjusted net income provide useful information to

investors and others in understanding and evaluating our operating

results, enhancing the overall understanding of our past

performance and prospects, and allowing for greater transparency

with respect to key financial metrics used by our management in its

financial and operational decision-making.

The following table presents a reconciliation of GAAP net income

to non-GAAP EBITDA and non-GAAP Adjusted EBITDA, for each of the

periods presented:

| |

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| ($, in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net (loss) income |

|

$ |

(568 |

) |

|

$ |

7,486 |

|

|

$ |

4,945 |

|

|

$ |

15,532 |

|

|

Interest expense, net |

|

|

502 |

|

|

|

(30 |

) |

|

|

2,190 |

|

|

|

2,009 |

|

|

Income tax expense (benefit) |

|

|

(1,228 |

) |

|

|

1,268 |

|

|

|

5,447 |

|

|

|

4,750 |

|

|

Depreciation |

|

|

2,982 |

|

|

|

1,514 |

|

|

|

10,448 |

|

|

|

5,845 |

|

|

Amortization |

|

|

1,229 |

|

|

|

1,221 |

|

|

|

4,918 |

|

|

|

4,883 |

|

| EBITDA |

|

|

2,917 |

|

|

|

11,459 |

|

|

|

27,948 |

|

|

|

33,019 |

|

|

Stock-based compensation expense |

|

|

2,366 |

|

|

|

1,855 |

|

|

|

8,996 |

|

|

|

6,552 |

|

|

Restructuring charge (1) |

|

|

1,918 |

|

|

|

750 |

|

|

|

3,796 |

|

|

|

2,268 |

|

|

Write-off of certain assets (2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,200 |

|

|

Settlement fee (3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,600 |

|

|

Facility construction project pause (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

632 |

|

|

Legal fees (5) |

|

|

— |

|

|

|

— |

|

|

|

1,182 |

|

|

|

— |

|

|

Sales retention (6) |

|

|

272 |

|

|

|

— |

|

|

|

694 |

|

|

|

— |

|

| Adjusted EBITDA |

|

$ |

7,473 |

|

|

$ |

14,064 |

|

|

$ |

42,616 |

|

|

$ |

49,271 |

|

(1) Amounts reflect employee retention and benefits as well as

other exit costs associated with the Company’s restructuring

activities.

(2) Amount reflects the disposal of certain equipment related to

the same facility.

(3) Amounts reflect the fee the Company paid to a GPO to settle

previously disputed GPO fees.

(4) Amount reflects the cancellation fees incurred in connection

with the Company’s decision to pause one of its manufacturing

facility construction projects.

(5) Amount represents the legal fees incurred related to the

recently published and withdrawn local coverage determinations, or

LCDs.

(6) Amount represents the compensation expenses related to

retention for those sales employees impacted by the LCDs.

The following table presents a reconciliation of GAAP net income

to non-GAAP adjusted net income, for each of the periods

presented:

| |

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

| ($, in thousands) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net (loss) income |

|

$ |

(568 |

) |

|

$ |

7,486 |

|

|

$ |

4,945 |

|

|

$ |

15,532 |

|

|

Amortization |

|

|

1,229 |

|

|

|

1,221 |

|

|

|

4,918 |

|

|

|

4,883 |

|

|

Restructuring charge (1) |

|

|

1,918 |

|

|

|

750 |

|

|

|

3,796 |

|

|

|

2,268 |

|

|

Write-off of certain assets (2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,200 |

|

|

Settlement fee (3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,600 |

|

|

Facility construction project pause (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

632 |

|

|

Legal fees (5) |

|

|

— |

|

|

|

— |

|

|

|

1,182 |

|

|

|

— |

|

|

Sales retention (6) |

|

|

272 |

|

|

|

— |

|

|

|

694 |

|

|

|

— |

|

|

Tax on above |

|

|

(923 |

) |

|

|

(527 |

) |

|

|

(2,859 |

) |

|

|

(3,898 |

) |

| Adjusted net income |

|

$ |

1,928 |

|

|

$ |

8,930 |

|

|

$ |

12,676 |

|

|

$ |

26,217 |

|

(1) Amounts reflect employee retention and benefits as well as

other exit costs associated with the Company’s restructuring

activities.

(2) Amount reflects the disposal of certain equipment related to

the same facility.

(3) Amounts reflect the fee the Company paid to a GPO to settle

previously disputed GPO fees.

(4) Amount reflects the cancellation fees incurred in connection

with the Company’s decision to pause one of its manufacturing

facility construction projects.

(5) Amount represents the legal fees incurred related to the

recently published and withdrawn local coverage determinations, or

LCDs.

(6) Amount represents the compensation expenses related to

retention for those sales employees impacted by the LCDs.

The following table presents a reconciliation of projected GAAP

net income (loss) to projected non-GAAP EBITDA and projected

non-GAAP Adjusted EBITDA included in our guidance for the year

ending December 31, 2024:

| |

|

Year Ended December 31, |

|

| ($, in thousands) |

|

2024L |

|

|

2024H |

|

|

Net (loss) income |

|

$ |

(10,565 |

) |

|

$ |

4,616 |

|

|

Interest expense, net |

|

|

3,000 |

|

|

|

2,200 |

|

|

Income tax expense (benefit) |

|

|

308 |

|

|

|

5,061 |

|

|

Depreciation |

|

|

9,680 |

|

|

|

9,680 |

|

|

Amortization |

|

|

3,400 |

|

|

|

3,400 |

|

| EBITDA |

|

|

5,823 |

|

|

|

24,957 |

|

|

Stock-based compensation expense |

|

|

10,000 |

|

|

|

10,000 |

|

|

Restructuring charge |

|

|

- |

|

|

|

- |

|

|

Adjusted EBITDA |

|

|

15,823 |

|

|

|

34,957 |

|

The following table presents a reconciliation of projected GAAP

net income (loss) to projected non-GAAP adjusted net income

included in our guidance for the year ending December 31, 2024:

|

|

|

Year Ended December 31, |

|

| ($, in thousands) |

|

2024L |

|

|

2024H |

|

|

Net (loss) income |

|

$ |

(10,565 |

) |

|

$ |

4,616 |

|

|

Amortization |

|

|

3,400 |

|

|

|

3,400 |

|

|

Restructuring charge |

|

|

— |

|

|

|

— |

|

|

Tax on above |

|

|

(918 |

) |

|

|

(918 |

) |

|

Adjusted net (loss) income |

|

$ |

(8,083 |

) |

|

$ |

7,098 |

|

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements relate to expectations or

forecasts of future events. Forward-looking statements may be

identified by the use of words such as “forecast,” “intend,”

“seek,” “target,” “anticipate,” “believe,” “expect,” “estimate,”

“plan,” “outlook,” and “project” and other similar expressions that

predict or indicate future events or trends or that are not

statements of historical matters. Such forward-looking statements

include statements relating to the Company’s expected revenue, net

income, adjusted net income, EBITDA, and Adjusted EBITDA for fiscal

2024 and the breakdown of expected revenue in both its Advanced

Wound Care and Surgical & Sports Medicine categories.

Forward-looking statements with respect to the operations of the

Company, strategies, prospects, and other aspects of the business

of the Company are based on current expectations that are subject

to known and unknown risks and uncertainties, which could cause

actual results or outcomes to differ materially from expectations

expressed or implied by such forward-looking statements. These

factors include, but are not limited to: (1) the impact of any

changes to the reimbursement levels for the Company’s products; (2)

the Company faces significant and continuing competition, which

could adversely affect its business, results of operations and

financial condition; (3) rapid technological change could cause the

Company’s products to become obsolete and if the Company does not

enhance its product offerings through its research and development

efforts, it may be unable to effectively compete; (4) to be

commercially successful, the Company must convince physicians that

its products are safe and effective alternatives to existing

treatments and that its products should be used in their

procedures; (5) the Company’s ability to raise funds to expand its

business; (6) the Company has incurred losses in prior years and

may incur losses in the future; (7) changes in applicable laws or

regulations; (8) the possibility that the Company may be adversely

affected by other economic, business, and/or competitive factors;

(9) the Company’s ability to maintain production or obtain supply

of its products in sufficient quantities to meet demand; (10) any

resurgence of the COVID-19 pandemic and its impact, if any, on the

Company’s fiscal condition and results of operations; (11) the

impact of the suspension of commercialization of: (a) ReNu and

NuCel in connection with the expiration of the FDA’s enforcement

grace period for HCT/Ps on May 31, 2021 and (b) Dermagraft in the

second quarter of 2022 pending transition of manufacturing to a new

manufacturing facility or a third-party manufacturer; and (12)

other risks and uncertainties described in the Company’s filings

with the Securities and Exchange Commission, including Item 1A

(Risk Factors) of the Company’s Form 10-K for the year ended

December 31, 2023 and its subsequently filed periodic reports.

You are cautioned not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Although it may voluntarily do so from time to time, the Company

undertakes no commitment to update or revise the forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by applicable securities laws.

About Organogenesis Holdings Inc. Organogenesis

Holdings Inc. is a leading regenerative medicine company offering a

portfolio of bioactive and acellular biomaterials products in

advanced wound care and surgical biologics, including orthopedics

and spine. Organogenesis’s comprehensive portfolio is designed to

treat a variety of patients with repair and regenerative needs. For

more information, visit www.organogenesis.com.

Investor Inquiries:

ICR Westwicke

Mike Piccinino, CFA

OrganoIR@westwicke.com

Press and Media Inquiries:

Organogenesis

Lori Freedman

LFreedman@organo.com

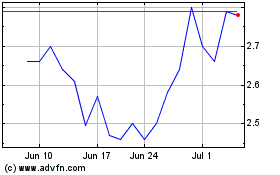

Organogenesis (NASDAQ:ORGO)

Historical Stock Chart

From Mar 2024 to Apr 2024

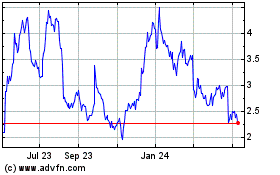

Organogenesis (NASDAQ:ORGO)

Historical Stock Chart

From Apr 2023 to Apr 2024