false

0000072741

0000072741

2024-02-29

2024-02-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 29, 2024

EVERSOURCE ENERGY

(Exact name of registrant as specified in its

charter)

| Massachusetts |

|

001-05324 |

|

04-2147929 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| 300

Cadwell Drive, Springfield, Massachusetts, 01104 |

(Address of principal executive offices, including zip code)

(800) 286-5000

Registrant’s telephone number,

including area code

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol

|

Name of each exchange on which registered |

| Common Shares, $5.00 par value per share |

ES |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of the chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of the chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On February 29, 2024, Eversource Energy (“Eversource”)

issued a news release announcing that, following the recent re-bid of the Sunrise Wind offshore wind farm by joint venture

partners Eversource and Ørsted, New York has selected the project in its latest solicitation, New York 4, to deliver substantial

economic benefits and advance climate goals.

The ready-to-build project would be the largest

U.S. offshore wind farm upon its completion in 2026. With this successful award, Eversource will remain contracted to lead Sunrise Wind’s

onshore construction even after finalizing the agreement to sell its 50-percent interest in the project to Ørsted. Upon the completion of a successful sale, Eversource no longer expects

to have any risk exposure related to Sunrise Wind, including abandonment costs that were assumed in its impairment assessment. Eversource

expects the sale of Sunrise Wind to Ørsted will be completed later this year, subject to customary regulatory approvals.

Sunrise Wind will now begin the next steps of finalizing

agreements with New York’s energy agency, NYSERDA, on the OREC (Offshore Wind Renewable Energy Certificates) contract. The completion

of Eversource’s agreement to sell its interest in the project is subject to signing of an OREC contract with NYSERDA, finalization

of acquisition agreements, receipt of the federal construction and operations plan (COP), and relevant regulatory approvals.

The project’s design has been reviewed and

accepted by all relevant state agencies, and it has secured all major supplier and project labor agreements. Sunrise Wind is scheduled

to be operational in 2026 and will begin the full scope of construction once it has received all federal permits, slated for this summer,

and following a final investment decision by Ørsted that is anticipated in the second quarter of 2024.

Forward-Looking Statements

This Current Report on Form 8-K includes

statements concerning Eversource’s expectations, beliefs, plans, objectives, goals, strategies, assumptions of future events,

future financial performance or growth and other statements that are not historical facts. These statements are

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Generally,

readers can identify these forward-looking statements through the use of words or phrases such as “estimate,”

“expect,” “anticipate,” “intend,” “plan,” “project,”

“believe,” “forecast,” “should,” “could” and other similar expressions.

Forward-looking statements involve risks and uncertainties that may cause actual results or outcomes to differ materially from those

included in the forward-looking statements. Forward-looking statements are based on the current expectations, estimates, assumptions

or projections of management and are not guarantees of future performance. These expectations, estimates, assumptions or projections

may vary materially from actual results. Accordingly, any such statements are qualified in their entirety by reference to, and are

accompanied by, the following important factors that may cause our actual results or outcomes to differ materially from those

contained in our forward-looking statements, including, but not limited to: cyberattacks or breaches, including those resulting in

the compromise of the confidentiality of our proprietary information and the personal information of our customers; our ability to

complete the offshore wind investments sales process on the timelines, terms and pricing we expect; if we and the counterparties are

unable to satisfy all closing conditions and consummate the purchase and sale transactions with respect to our offshore wind assets;

if we are unable to qualify for investment tax credits related to these projects; if we experience variability in the projected

construction costs of the offshore wind projects, if there is a deterioration of market conditions in the offshore wind industry;

and if the projects do not commence operation as scheduled or within budget or are not completed, disruptions in the capital markets

or other events that make our access to necessary capital more difficult or costly; changes in economic conditions, including impact

on interest rates, tax policies, and customer demand and payment ability; ability or inability to commence and complete our major

strategic development projects and opportunities; acts of war or terrorism, physical attacks or grid disturbances that may damage

and disrupt our electric transmission and electric, natural gas, and water distribution systems; actions or inaction of local, state

and federal regulatory, public policy and taxing bodies; substandard performance of third-party suppliers and service providers;

fluctuations in weather patterns, including extreme weather due to climate change; changes in business conditions, which could

include disruptive technology or development of alternative energy sources related to our current or future business model;

contamination of, or disruption in, our water supplies; changes in levels or timing of capital expenditures; changes in laws,

regulations or regulatory policy, including compliance with environmental laws and regulations; changes in accounting standards and

financial reporting regulations; actions of rating agencies; and other presently unknown or unforeseen factors.

Other risk factors are detailed in Eversource’s

reports filed with the Securities and Exchange Commission (SEC). They are updated as necessary and available on Eversource’s website

at www.eversource.com and on the SEC’s website at www.sec.gov. All such factors are difficult to predict and contain uncertainties

that may materially affect Eversource’s actual results, many of which are beyond our control. You should not place undue reliance

on the forward-looking statements, as each speaks only as of the date on which such statement is made, and, except as required by federal

securities laws, Eversource undertakes no obligation to update any forward-looking statement or statements to reflect events or circumstances

after the date on which such statement is made or to reflect the occurrence of unanticipated events.

| Section 9 |

Financial Statements and Exhibits |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused the report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

EVERSOURCE ENERGY |

| |

(Registrant) |

| |

|

| February 29, 2024 |

By:

|

/s/ Jay S. Buth |

| |

|

Jay S. Buth |

| |

|

Vice President, Controller and Chief Accounting Officer |

Exhibit 99.1

|

56 Prospect St., Hartford, Connecticut 06103-2818

800

Boylston St., Boston, Massachusetts 02199 |

News Release

Updated Bid for

Sunrise Wind Wins New York’s Latest Offshore Wind Solicitation

Ready-to-build

project from Eversource and Ørsted will spur economic development, create jobs and advance clean energy

With successful

award in the New York 4 solicitation, Eversource to continue moving forward with agreement to sell its 50-percent interest in Sunrise

Wind to Ørsted

HARTFORD, Conn. and BOSTON, Mass. (February 29, 2024) –

Following the recent re-bid of the Sunrise Wind offshore wind farm by joint venture partners Eversource and Ørsted,

New York has selected the project in its latest solicitation, New York 4, to deliver substantial economic benefits and advance climate

goals.

The ready-to-build project would be the largest U.S. offshore wind

farm upon its completion in 2026. With this successful award, Eversource will remain contracted to lead Sunrise Wind’s onshore construction

even after finalizing the agreement to sell its 50-percent interest in the project to Ørsted. Upon the completion of a successful sale, Eversource no longer expects

to have any risk exposure related to Sunrise Wind, including abandonment costs that were assumed in its impairment assessment. Eversource

expects the sale of Sunrise Wind to Ørsted will be completed later this year, subject to customary regulatory approvals.

Sunrise Wind will now begin the next steps of finalizing agreements

with New York’s energy agency, NYSERDA, on the OREC (Offshore Wind Renewable Energy Certificates) contract. The completion of Eversource’s

agreement to sell its interest in the project is subject to signing of an OREC contract with NYSERDA, finalization of acquisition agreements,

receipt of the federal construction and operations plan (COP), and relevant regulatory approvals.

“We’re grateful for the Hochul Administration’s

support of the state’s offshore wind industry and their selection of our updated Sunrise Wind project, and we look forward to

our continued role in making this exciting renewable energy project a reality,” said Eversource Chairman, President and Chief

Executive Officer Joe Nolan. “Sunrise Wind is another major step forward for our shared clean energy future and will deliver

significant new investments to New York State, including the creation of hundreds of local union jobs building the project’s

onshore transmission system. As we continue to move toward finalizing the agreement to sell our 50-percent interest in Sunrise Wind,

we’re excited to get shovels in the ground and begin the full scope of onshore construction with the important role

we’ll play throughout the remainder of this project, as well as helping to enable other offshore wind projects in our region

with our transmission construction expertise in the future.”

The project’s design has been reviewed and accepted by all relevant

state agencies, and it has secured all major supplier and project labor agreements. Sunrise Wind is scheduled to be operational in 2026

and will begin the full scope of construction once it has received all federal permits, slated for this summer, and following a final

investment decision by Ørsted that is anticipated in the second quarter of 2024.

Eversource (NYSE: ES), celebrated as a national leader for its

corporate citizenship, is the #1 energy company in Newsweek’s list of America’s Most Responsible Companies for 2024 and recognized

as a Five-Year Champion, appearing in every edition of the list. Eversource transmits and delivers electricity and natural gas and supplies

water to approximately 4.4 million customers in Connecticut, Massachusetts and New Hampshire. The #1 energy efficiency provider in the

nation, Eversource harnesses the commitment of approximately 9,900 employees across three states to build a single, united company around

the mission of safely delivering reliable energy and water with superior customer service. The company is empowering a clean energy future

in the Northeast, with nationally recognized energy efficiency solutions and successful programs to integrate new clean energy resources

like a first-in-the-nation networked geothermal pilot project, solar, offshore wind, electric vehicles and battery storage, into the

electric system. For more information, please visit eversource.com, and follow us on X, Facebook, Instagram, and LinkedIn. For more information

on our water services, visit aquarionwater.com.

MEDIA CONTACT:

William Hinkle

603-634-2228

william.hinkle@eversource.com

INVESTOR CONTACT:

Robert S. Becker

(860) 665-3249

robert.becker@eversource.com

###

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

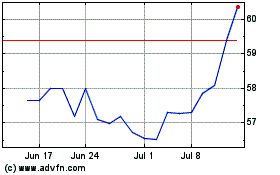

Eversource Energy (NYSE:ES)

Historical Stock Chart

From Apr 2024 to May 2024

Eversource Energy (NYSE:ES)

Historical Stock Chart

From May 2023 to May 2024