0001820302FALSE00018203022024-02-292024-02-290001820302us-gaap:CommonClassAMember2024-02-292024-02-290001820302us-gaap:WarrantMember2024-02-292024-02-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

February 29, 2024

Bakkt Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-39544 | | 98-1550750 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

10000 Avalon Boulevard, Suite 1000, Alpharetta, Georgia | | 30009 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (678) 534-5849

| | | | | | | | | | | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A Common Stock, par value $0.0001 per share | | BKKT | | The New York Stock Exchange |

Warrants to purchase Class A Common Stock | | BKKT WS | | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Conditions.

The information disclosed in Item 8.01 of this Current Report on Form 8-K is incorporated by reference herein.

Item 8.01 Other Events.

On February 29, 2024, Bakkt Holdings, Inc. (the “Company”) issued a press release announcing certain preliminary financial results for the quarter and year ended December 31, 2023. The full text of the Press Release announcing such results is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: February 29, 2024

| | | | | | | | | | | |

| | BAKKT HOLDINGS, INC. |

| | |

| | By: | /s/ Marc D'Annunzio |

| | | Name: | Marc D’Annunzio |

| | | Title: | General Counsel and Secretary |

Bakkt Announces Preliminary 2023 Financial Results; Preliminary Estimates Within Previously Provided Guidance

ALPHARETTA, GA – February 29, 2024 – Bakkt Holdings, Inc. (“Bakkt”) (NYSE: BKKT) announced certain preliminary financial results for the fourth quarter and full year ended December 31, 2023.

Preliminary financial results for fourth quarter 2023

•Total revenues for the fourth quarter of 2023 are estimated to be in a range of $213 million to $215 million.

•Gross crypto revenues for the fourth quarter of 2023 are estimated to be in a range of $197 million to $199 million.

•Net loyalty revenues for the fourth quarter of 2023 are estimated to be in a range of $13 million to $15 million.

•Total crypto costs and execution, clearing and brokerage fees for the fourth quarter of 2023 are estimated to be in a range of $196 million to $198 million.

•Available cash, cash equivalents and available-for-sale securities at year-end 2023 are estimated to be in a range of $68 million to $70 million.

•Net cash used in operating activities (excluding customer funds payable) for the fourth quarter of 2023 is estimated to be in a range of $16 million to $18 million

•Free cash flow usage (non-GAAP) for the fourth quarter of 2023 is estimated to be in a range of $18 million to $20 million.

Preliminary financial results for full year 2023

•Total revenues for fiscal year 2023 are estimated to be in a range of $778 million to $780 million, which is expected to be in line with prior guidance of between $750 million and $1,268 million.

•Gross crypto revenues for fiscal year 2023 are estimated to be in a range of $725 million to $727 million, which is expected to be in line with prior guidance of between $697 million and $1,215 million.

•Net loyalty revenues for fiscal year 2023 are estimated to be in a range of $51 million to $53 million, which is expected to be in line with prior guidance of $53 million.

•Total crypto costs and execution, clearing and brokerage fees for fiscal year 2023 are estimated to be in a range of $720 million to $722 million, which is expected to be in line with prior guidance of between $693 million and $1,208 million.

•Net cash used in operating activities (excluding customer funds payable) for fiscal year 2023 is estimated to be in a range of $87 million to $89 million, which is expected to be in line with prior guidance of between $86 million and $89 million.

•Free cash flow usage (non-GAAP) for fiscal year 2023 is estimated to be in a range of $100 million to $102 million, which is expected to be in line with prior guidance of between $99 million and $102 million.

The preliminary financial information set forth above has not been audited by Bakkt’s independent registered accounting firm and is subject to revision and is anticipated to be finalized in connection with the completion of the Bakkt’s Annual Report on Form 10-K for the year ended December 31, 2023. Bakkt’s preliminary estimates above are not a comprehensive statement of Bakkt’s financial results and are not necessarily indicative of the results to be expected as of or for the fiscal period ended December 31, 2023, or any future period. Accordingly,

you should not place undue reliance on these preliminary estimates. Bakkt expects to report its fourth quarter 2023 results during a conference call in March, at which point it will discuss its 2023 financial results in more detail.

During the course of Bakkt’s quarter-end closing procedures and review process, including the finalization of its financial statements for and as of the period and year ended December 31, 2023, Bakkt may identify items that would require it to make adjustments, which may be material, including but not limited to potential non-cash asset impairments, to the information presented above. As a result, the estimates above constitute forward-looking information and are subject to risks and uncertainties, including possible adjustments to preliminary results.

###

About Bakkt

Founded in 2018, Bakkt builds solutions that enable our clients to grow with the crypto economy. Through institutional-grade custody, trading, and onramp capabilities, our clients leverage technology that’s built for sustainable, long-term involvement in crypto.

Bakkt is headquartered in Alpharetta, GA.

Bakkt-C

Source: Bakkt Holdings, Inc.

Contacts

Investor Relations

Ann DeVries, Head of Investor Relations

Ann.DeVries@bakkt.com

Media

press@bakkt.com

Note on Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, but are not limited to, Bakkt’s preliminary financial results and the timing for Bakkt announcing its audited financial results, among others. Forward-looking statements can be identified by words such as “will,” “likely,” “expect,” “continue,” “anticipate,” “estimate,” “believe,” “intend,” “plan,” “projection,” “outlook,” “grow,” “progress,” “potential” or words of similar meaning. Such forward-looking statements are based upon the current beliefs and expectations of Bakkt’s management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are difficult to predict and beyond Bakkt’s control. Actual results and the timing of events may differ materially from the results anticipated in such forward-looking statements as a result of the following factors, among others: changes resulting from the Company’s finalization of its financial statements for and as of the period and year ended December 31, 2023; information or new changes in facts or circumstances that may occur prior to the filing of the Company’s Annual

Report on Form 10-K for the year ended December 31, 2023 that are required to be included in such annual report; the Company's failure to implement the Company's business plans or strategies; and other risks and uncertainties indicated in Bakkt’s filings with the Securities and Exchange Commission. You are cautioned not to place undue reliance on such forward-looking statements. Such forward-looking statements relate only to events as of the date on which such statements are made and are based on information available to us as of the date of this press release. Unless otherwise required by law, we undertake no obligation to update any forward-looking statements made in this press release to reflect events or circumstances after the date of this press release or to reflect new information or the occurrence of unanticipated events.

Non-GAAP Financial Measures

Free Cash Flow is a non-GAAP financial measure. Free Cash Flow is cash flow from operations adjusted for “capitalized internal use software development costs and other capital expenditures” and “interest income.” We adjust for capitalized expenses associated with internally developed software for our technology platforms given they are a large component of our ongoing expense base given our position as a technology platform company.

Information reconciling forward-looking Free Cash Flow to the comparable GAAP financial measure is unavailable to us without unreasonable effort. We are not able to provide a reconciliation of forward-looking Free Cash Flow to the comparable GAAP financial measure because certain items required for such reconciliations are outside of our control and/or cannot be reasonably predicted, such as timing of customer payments for account receivables and payment terms for operating expenses. Preparation of such reconciliations would require a forward-looking statement of income and statement of cash flow, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to us without unreasonable effort (as specified in the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K). We provide a range for our Free Cash Flow forecast that we believe will be achieved, however we cannot accurately predict all the components of the Free Cash Flow calculation. We provide a Free Cash Flow because we believe that Free Cash Flow, when viewed with our results under GAAP, provides useful information for the reasons noted above. However, Free Cash Flow is not a measure of liquidity under GAAP and, accordingly, should not be considered as an alternative to net cash used in operating activities (excluding customer funds payable) as an indicator of liquidity.

Reconciliation of Net Cash Used in Operating Activities (Excluding Customer Funds Payable) to Non-GAAP Free Cash Flow ($ in millions) (unaudited)

| | | | | | | | | | | | | | | | | |

| 4Q23E | | FY 2023E |

| $ in millions | Low | High | | Low | High |

| Net cash used in operating activities (excluding customer funds payable) | ($16) | ($18) | | ($87) | ($89) |

| Capex* | (1) | (1) | | (9) | (9) |

| Interest income, net | (1) | (1) | | (4) | (4) |

| Free Cash Flow | ($18) | ($20) | | ($100) | ($102) |

* Capex includes capitalized internal-use software development costs and other capital expenditures

v3.24.0.1

Cover

|

Feb. 29, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity Registrant Name |

Bakkt Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39544

|

| Entity Tax Identification Number |

98-1550750

|

| Entity Address, Address Line One |

10000 Avalon Boulevard

|

| Entity Address, Address Line Two |

Suite 1000

|

| Entity Address, City or Town |

Alpharetta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30009

|

| City Area Code |

678

|

| Local Phone Number |

534-5849

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001820302

|

| Amendment Flag |

false

|

| Common Class A |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

BKKT

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Class A Common Stock

|

| Trading Symbol |

BKKT WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

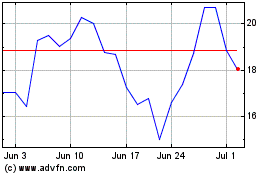

Bakkt (NYSE:BKKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bakkt (NYSE:BKKT)

Historical Stock Chart

From Apr 2023 to Apr 2024