Snowflake Stock Plummets 20.3% After CEO Transition; C3.ai, Okta, and Duolingo Surge Post-Strong Quarterly Reports, and More

February 29 2024 - 6:09AM

IH Market News

Snowflake (NYSE:SNOW) – Snowflake’s shares

plummeted 20.3% following the announcement of CEO Frank Slootman’s

retirement, replaced by Sridhar Ramaswamy, former head of

advertising at Google. Fourth-quarter sales rose 32% to $774.7

million, but operating losses widened to $275.5 million. The

revenue forecast for the first quarter fell short of

expectations.

Okta (NASDAQ:OKTA) – Okta’s shares surged 24%

in pre-market trading after reporting quarterly results that

exceeded expectations, along with an optimistic projection for the

first quarter. Okta posted an adjusted earnings per share of 63

cents, while the FactSet consensus was 51 cents. The company also

projected revenue for the current period between $603 million and

$605 million, surpassing the forecasts of $583.8 million by

analysts surveyed by FactSet.

C3.ai (NYSE:AI) – C3.ai’s shares rose 14.4% in

pre-market trading. The company reported an adjusted loss per share

of 13 cents, which was better than expected, and surpassed revenue

estimates for the most recent quarter. Revenue increased 18% to

$78.4 million. Wall Street analysts surveyed by FactSet had

anticipated a loss of 28 cents per share on revenue of $76.1

million.

Duolingo (NASDAQ:DUOL) – Shares of the language

learning platform rose 22.13% in pre-market trading after exceeding

quarterly expectations, showcasing robust monthly user numbers and

bookings. Duolingo also issued an optimistic revenue forecast for

both the first quarter and the full year.

Salesforce (NYSE:CRM) – Salesforce’s financial

results revealed a mixed trajectory, with its shares declining up

to 1.6% in Thursday’s pre-market trading. The company also

announced the start of dividend payments at 40 cents per share.

Salesforce posted an adjusted earnings per share of $2.29 compared

to the expected $2.26, and revenue of $9.29 billion compared to the

projected $9.22 billion. Net profit reached $1.45 billion, a

significant improvement from the previous quarter. The company’s

future forecasts for the next quarter and fiscal year 2025 indicate

cautious optimism, with adjusted earnings per share and revenue

projections in line with market expectations.

Pure Storage (NYSE:PSTG) – Pure Storage’s

shares rose 8.0% in pre-market trading. The data storage company

exceeded Wall Street’s quarterly estimates by reporting earnings of

50 cents per share with revenues of $790 million. Additionally, its

revenue outlook for the first quarter exceeded analysts’

expectations surveyed by StreetAccount.

Nutanix (NASDAQ:NTNX) – Nutanix’s shares

increased 3.3% in pre-market trading after reporting fiscal

second-quarter earnings that exceeded analysts’ forecasts. The

cloud computing company announced an adjusted profit of 46 cents

per share, with revenue of $565 million, surpassing profit

expectations of 29 cents per share and revenue of $551 million as

predicted by analysts surveyed by LSEG.

Bumble (NASDAQ:BMBL) – Bumble issued a

pessimistic revenue forecast. Additionally, the company plans to

cut 350 jobs, approximately 30% of its workforce. The average

revenue per paying user in the Badoo and Bumble apps fell to $22.64

in the last quarter, compared to $23.01 in the previous year.

Revenue increased 13% in the fourth quarter to $274 million.

HP Inc (NYSE:HPQ) – HP Inc.’s shares declined

approximately 4.1% in pre-market trading after reporting fiscal

first-quarter results, with the company posting revenue of $13.19

billion. This figure fell short of analysts’ expectations surveyed

by LSEG, who had anticipated revenue of $13.56 billion.

Marathon Digital (NASDAQ:MARA) – Marathon

Digital’s shares fell 4.3% in pre-market trading, despite quarterly

profits. Following a 74% increase in shares the previous month, the

positive results were not sufficient to maintain momentum. In the

fourth quarter, Marathon reported a net profit of $151.8 million,

or 66 cents, on revenue of $156.8 million. The company plans to

significantly increase its mining hash rate in the coming years and

has reduced its debt by 56%, to $331 million, with a 21% discount

from the nominal value. The company produced 4,242 bitcoins in the

fourth quarter, compared to 1,562 in the same period last year.

Paramount Global (NASDAQ:PARA) – Paramount

Worldwide fell short of revenue expectations in the fourth quarter

but surprised with a quarterly profit. Its streaming service,

Paramount+, performed strongly. During the period, it recorded a

profit of $514 million, or 77 cents per share, adjusted to 4 cents

per share, against expectations of a 1-cent per share loss.

However, revenue was $7.64 billion against the expected $7.85

billion.

AMC Entertainment (NYSE:AMC) – AMC

Entertainment’s shares fell 9.8% in pre-market trading after

reporting a larger-than-expected loss of 83 cents per share in the

fourth quarter. Analysts surveyed by LSEG had anticipated a loss of

70 cents per share. Revenue grew 11.5% to $1.104 billion, above the

FactSet consensus of $1.058 billion. AMC’s adjusted EBITDA

increased 193% to $42.5 million.

Figs Inc (NYSE:FIGS) – Shares of the medical

apparel company fell 18.7% in pre-market trading due to mixed

fourth-quarter results. The adjusted earnings per share were 5

cents, exceeding the LSEG estimate of 2 cents per share. However,

Figs recorded revenue of $145 million, below the expected $150

million.

Monster Beverage (NASDAQ:MNST) – Monster

Beverage missed Wall Street’s fourth-quarter revenue expectations

due to consumer caution over higher drink prices. However, its

shares rose about 5% after the company reported an estimated

increase in January sales. Net profit increased 14.4% to $1.73

billion but fell short of estimates, while earnings per share

excluding items were 35 cents, below the 38-cent expectations.

Anheuser-Busch InBev (NYSE:BUD) – The world’s

largest brewery reported annual revenue of $59.38 billion, a 7.8%

increase, but below analysts’ expectations of $60.48 billion,

according to LSEG. Anheuser-Busch InBev raised its annual dividend

by 9% on Thursday, but without a new share buyback, worrying

investors. As it seeks to reward shareholders’ patience, it faces

challenges with lower-than-expected sales in the U.S. and

significant debt of over $100 billion. Additionally, the Teamsters

union and Anheuser-Busch Inbev reached a provisional 5-year

agreement, avoiding a strike at U.S. brewery facilities. The

agreement includes wage increases and enhanced benefits for the

5,000 union members.

Wallbox (NYSE:WBX) – The electric vehicle

charging company revealed a smaller-than-expected quarterly loss of

$12 million on sales of $46.8 million, surpassing expectations.

Virgin Galactic (NYSE:SPCE) – Virgin Galactic

reported its fourth-quarter results, where the company recorded a

loss of 26 cents per share, better than the forecasted 30 cents. It

ended the year with nearly $1 billion in cash, expecting to use

about $500 million in 2024. Sales were $2.8 million for the quarter

against sales expectations of $3 million. The company expects

first-quarter revenue of about $2 million, while Wall Street had

anticipated $3.6 million.

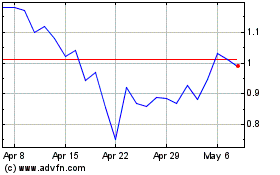

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From Apr 2023 to Apr 2024