false

0000895456

0000895456

2024-02-28

2024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

ROCKY BRANDS, INC.

(Exact name of registrant as specified in its charter)

|

Ohio

|

001-34382

|

31-1364046

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

39 East Canal Street, Nelsonville, Ohio 45764

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (740) 753-1951

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

|

|

|

|

|

Title of class

|

|

Trading symbol

|

|

Name of exchange on which registered

|

|

Common Stock – No Par Value

|

|

RCKY

|

|

Nasdaq

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 28, 2024, Rocky Brands, Inc. (the "Company") issued a press release entitled "Rocky Brands, Inc. Announces Fourth Quarter and Full Year 2023 Results" regarding its consolidated financial results for the quarter and year ended December 31, 2023. A copy of the Company's press release is furnished as Exhibit 99 to this Form 8-K and is incorporated herein by reference.

The information in this Form 8-K and accompanying press release is being furnished under Item 2.02 and shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or otherwise subject to the liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The information contained or incorporated by reference in this Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. Those statements include, but may not be limited to, all statements regarding intent, beliefs, expectations, projections, forecasts, and plans of the Company and its management. These forward-looking statements involve numerous risks and uncertainties, including, without limitation, the various risks inherent in the Company’s business as set forth in periodic reports filed with the Securities and Exchange Commission, including the Company’s annual report on Form 10-K for the year ended December 31, 2022 (filed March 10, 2023), and quarterly reports on Form 10-Q for the quarters ended March 31, 2022 (filed May 10, 2023), June 30, 2023 (filed August 9, 2023) and September 30, 2023 (filed November 8, 2023). One or more of these factors have affected historical results, and could in the future affect the Company’s businesses and financial results in future periods and could cause actual results to differ materially from plans and projections. Therefore, there can be no assurance that the forward-looking statements included in this Form 8-K will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the Company, or any other person should not regard the inclusion of such information as a representation that the objectives and plans of the Company will be achieved. All forward-looking statements made in this Form 8-K are based on information presently available to the management of the Company. The Company assumes no obligation to update any forward-looking statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit 99*

|

|

|

| Exhibit 104 |

|

Cover Page Interactive Data File (imbedded within the Inline XBRL document) |

* Such press release is being "furnished" (not filed) under Item 2.02 of this Current Report on Form 8-K

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 28, 2024

| |

Rocky Brands, Inc.

|

| |

|

| |

/s/ Thomas D. Robertson

|

| |

Thomas D. Robertson

|

| |

Chief Operating Officer, Chief Financial Officer, and Treasurer |

Exhibit 99

Rocky Brands, Inc. Announces Fourth Quarter and Full Year 2023 Results

2023 Year-end Inventories down $66.2 Million or 28.1% and Debt Levels down $83.8 Million or 32.6%

NELSONVILLE, Ohio, February 28, 2024 – Rocky Brands, Inc. (NASDAQ: RCKY) today announced financial results for its fourth quarter and year ended December 31, 2023.

Fourth Quarter 2023 Overview

| |

●

|

Net sales decreased 9.3% to $126.0 million

|

| |

●

|

Wholesale segment sales decreased 13.3%; Retail segment sales increased 1.5%

|

| |

●

|

Operating income increased 8.2% to $14.7 million |

| |

● |

Net income increased 3.0% to $6.7 million, or $0.91 per diluted share |

| |

●

|

Adjusted net income decreased 8.3% to $7.3 million, or $0.98 per diluted share |

Full Year 2023 Overview

| |

●

|

Net sales decreased 25.0% to $461.8 million

|

| |

● |

Wholesale segment sales decreased 30.5%; Retail segment sales increased 1.4%

|

| |

●

|

Operating income decreased 19.7% to $35.4 million

|

| |

● |

Net income decreased 49.1% to $10.4 million, or $1.41 per diluted share |

| |

●

|

Adjusted net income decreased 40.8% to $14.3 million, or $1.93 per diluted share

|

"We are encouraged with our fourth quarter performance as we navigated top-line headwinds and delivered operating income that was ahead of our expectations," said Jason Brooks, Chairman, President and Chief Executive Officer. "Despite market softness towards the end of December, the late arrival of certain materials that pushed back our manufacturing and shipment schedules, and the transition to a distributor model in Canada in early November, net sales improved from the third quarter with year-over-year declines moderating to their lowest levels in 2023."

Mr. Brooks continued, "While it was a challenging year from a sell-in perspective as many of our wholesale accounts worked to rebalance their overall inventory levels, retail sell-through and the performance of our own ecommerce websites underscores that consumer demand for our brands remains solid. Equally important, we made great progress strengthening our balance sheet throughout 2023 highlighted by a $66.2 million reduction in inventories and an $83.8 million decline in our debt levels compared with the end of 2022. This work has put us in a great position to invest in our business to drive profitable growth and increased shareholder value over the near and long-term."

Fourth Quarter Review

Fourth quarter net sales in 2023 decreased 9.3% to $126.0 million compared with $138.9 million in the fourth quarter of 2022. Wholesale segment sales for the fourth quarter of 2023 decreased 13.3% to $85.8 million compared to $98.9 million for the same period in 2022. Retail segment sales for the fourth quarter of 2023 increased 1.5% to $37.8 million compared to $37.3 million for the same period last year. Contract Manufacturing segment sales, which include contract military sales and private label programs, decreased 14.9% to $2.3 million for the fourth quarter of 2023 compared to $2.7 million in the fourth quarter of 2022. The decrease in Contract Manufacturing sales was due to the expiration of certain contracts with the U.S. Military.

Gross margin in the fourth quarter of 2023 was $50.7 million, or 40.3% of net sales, compared to $56.7 million, or 40.8% of net sales, for the same period last year. The 50-basis point decrease in gross margin was attributable to a tariff refund with a net impact of approximately $2.4 million received in the fourth quarter 2022 partially offset by a higher mix of Retail segment sales in the fourth quarter of 2023, which carry higher gross margins than the Wholesale and Contract Manufacturing segments.

Operating expenses were $36.0 million, or 28.6% of net sales, for the fourth quarter of 2023 compared to $43.1 million, or 31.0% of net sales, for the same period a year ago. Excluding $0.7 million of acquisition-related amortization expense and $0.1 million of expenses related to the closure of a manufacturing facility in the fourth quarter of 2023 and $1.7 million in acquisition-related amortization and restructuring costs in the fourth quarter of 2022, adjusted operating expenses were $35.2 million for the fourth quarter of 2023 and $41.4 million for the same period a year ago. The decrease in operating expenses was largely attributable to cost-saving reviews and operational efficiencies achieved through strategic restructuring initiatives implemented over the past year. As a percentage of net sales, adjusted operating expenses were 27.9% in the fourth quarter of 2023 compared with 29.8% in the year ago period.

Income from operations for the fourth quarter of 2023 was $14.7 million, or 11.7% of net sales, compared to $13.6 million or 9.8% of net sales for the same period a year ago. Adjusted operating income for the fourth quarter of 2023 was $15.5 million, or 12.3% of net sales, compared to adjusted operating income of $15.3 million, or 11.0% of net sales, for the same period a year ago.

Interest expense for the fourth quarter of 2023 was $5.3 million compared with $5.9 million a year ago. The decrease was driven by lower debt levels in the fourth quarter of 2023 compared with the fourth quarter of 2022.

The effective tax rate for the fourth quarter of 2023 increased to 29.0% compared to 16.1% a year ago. The year-over-year increase, which was higher than initially projected, was driven primarily by a return to provision adjustment resulting from foreign tax credits recognized in the fourth quarter of 2023.

The Company reported fourth quarter 2023 net income of $6.7 million, or $0.91 per diluted share, compared to net income of $6.5 million, or $0.89 per diluted share, in the fourth quarter of 2022. Adjusted net income for the fourth quarter of 2023, was $7.3 million, or $0.98 per diluted share, compared to adjusted net income of $7.9 million, or $1.08 per diluted share, in the fourth quarter of 2022.

Full Year Review

Full year 2023 net sales decreased 25.0% to $461.8 million compared with $615.5 million in 2022. Adjusted net sales, which exclude returns associated with a supplier-related dispute in the second quarter of 2023 and the sale of inventory related to the divesture of the NEOS brand during the third quarter of 2022, decreased 24.3%. Wholesale segment sales for 2023 decreased 30.5% to $337.0 million compared to $484.8 million in 2022. Retail segment sales for the year increased 1.4% to $117.0 million compared to $115.4 million for the same period last year. Contract Manufacturing segment sales, which includes contract military sales and private label programs, decreased 48.4% to $7.9 million compared to $15.3 million in 2022.

Gross margin in 2023 was $178.6 million, or 38.7% of net sales, compared to $225.2 million, or 36.6% of net sales, for 2022. On an adjusted basis to exclude returns associated with a supplier-related dispute in the second quarter of 2023 and the sale of inventory related to the divesture of the NEOS brand in the third quarter of 2022, gross margins were 38.9% of adjusted net sales in 2023 compared to 36.6% of adjusted net sales in 2022. The 230-basis point improvement in gross margin was driven primarily by a higher mix of Retail segment sales which carry higher gross margins than the Wholesale and Contract Manufacturing segments, combined with a 140-basis point improvement in Wholesale segment gross margins.

Operating expenses were $143.2 million, or 31.0% of net sales, for 2023 compared to $181.2 million, or 29.4% of net sales, for 2022. Excluding $4.8 million of acquisition-related amortization expense, expenses related to the closure of a manufacturing facility and restructuring costs in 2023 and $5.7 million of acquisition-related amortization and integration costs, restructuring costs and disposition of assets in 2022, adjusted operating expenses were $138.4 million, or 29.9% of adjusted net sales in the current year and $175.5 million, or 28.7% of adjusted net sales in the prior year.

Income from operations for 2023 was $35.4 million, or 7.7% of net sales, compared to $44.0 million or 7.2% of net sales for 2022. Adjusted operating income for 2023 was $41.9 million, or 9.0% of adjusted net sales, compared to adjusted operating income of $48.6 million, or 7.9% of adjusted net sales, a year ago.

Interest expense for 2023 was $22.7 million compared with $18.3 million in 2022. The increase is due to an increase in interest rates on the senior term loan and credit facility, partially offset by lower debt levels in 2023 compared with 2022.

The effective tax rate for 2023 increased to 26.3% compared to 20.6% for the full year 2022 driven largely by the aforementioned return to provision adjustment resulting from foreign tax credits recognized in the fourth quarter of 2023.

The Company reported 2023 net income of $10.4 million, or $1.41 per diluted share, compared to net income of $20.5 million, or $2.78 per diluted share, in 2022. Adjusted net income for 2023 was $14.3 million, or $1.93 per diluted share, compared to adjusted net income of $24.1 million, or $3.27 per diluted share, in 2022.

Balance Sheet Review

Cash and cash equivalents were $4.5 million at December 31, 2023 compared to $5.7 million on the same date a year ago.

Total debt at December 31, 2023 was $175.0 million, consisting of $77.9 million senior term loan and $97.1 million of borrowings under the Company's senior secured asset-backed credit facility. Compared with December 31, 2022 and September 30, 2023, total debt at December 31, 2023 was down 32.6% and 19.1%, respectively.

Inventory at December 31, 2023 was $169.2 million compared to $235.4 million on the same date a year ago. Compared with December 31, 2022 and September 30, 2023, inventories at December 31, 2023 were down 28.1% and 13.1%, respectively.

Conference Call Information

The Company's conference call to review fourth quarter 2023 results will be broadcast live over the internet today, Wednesday, February 28, 2024 at 4:30 pm Eastern Time. Investors and analysts interested in participating in the call are invited to dial (877) 704-4453 (domestic) or (201) 389-0920 (international). The conference call will also be available to interested parties through a live webcast at www.rockybrands.com. Please visit the website and select the "Investors" link at least 15 minutes prior to the start of the call to register and download any necessary software.

About Rocky Brands, Inc.

Rocky Brands, Inc. is a leading designer, manufacturer and marketer of premium quality footwear and apparel marketed under a portfolio of well recognized brand names. Brands in the portfolio include Rocky®, Georgia Boot®, Durango®, Lehigh®, The Original Muck Boot Company®, XTRATUF®, and Ranger®. More information can be found at RockyBrands.com.

Safe Harbor Language

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities and Exchange Act of 1934, as amended, which are intended to be covered by the safe harbors created thereby. Those statements include, but may not be limited to, all statements regarding intent, beliefs, expectations, projections, forecasts, and plans of the Company and its management and include statements in this press release regarding the ability of the Company to invest in its business to drive profitable growth and increase shareholder value over the near and long-term (Paragraph 3). These forward-looking statements involve numerous risks and uncertainties, including, without limitation, the various risks inherent in the Company’s business as set forth in periodic reports filed with the Securities and Exchange Commission, including the Company’s annual report on Form 10-K for the year ended December 31, 2022 (filed March 10, 2023), and quarterly reports on Form 10-Q for the quarters ended March 31, 2023 (filed May 10, 2023), June 30, 2023 (filed August 9, 2023) and September 30, 2023 (filed November 8, 2023). One or more of these factors have affected historical results, and could in the future affect the Company’s businesses and financial results in future periods and could cause actual results to differ materially from plans and projections. Therefore there can be no assurance that the forward-looking statements included in this press release will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation or warranty by the Company or any other person that the objectives and plans of the Company will be achieved. All forward-looking statements made in this press release are based on information presently available to the management of the Company. The Company assumes no obligation to update any forward-looking statements.

|

Company Contact:

|

Tom Robertson

|

| |

Chief Operating Officer, Chief Financial Officer, and Treasurer |

| |

(740) 753-9100

|

| |

|

|

Investor Relations:

|

Brendon Frey

|

| |

ICR, Inc.

|

| |

(203) 682-8200

|

Rocky Brands, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(In thousands, except share amounts)

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

ASSETS:

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

4,470 |

|

|

$ |

5,719 |

|

|

Trade receivables – net

|

|

|

77,028 |

|

|

|

94,953 |

|

|

Contract receivables

|

|

|

927 |

|

|

|

- |

|

|

Other receivables

|

|

|

1,933 |

|

|

|

908 |

|

|

Inventories – net

|

|

|

169,201 |

|

|

|

235,400 |

|

|

Income tax receivable

|

|

|

1,253 |

|

|

|

- |

|

|

Prepaid expenses

|

|

|

3,361 |

|

|

|

4,067 |

|

|

Total current assets

|

|

|

258,173 |

|

|

|

341,047 |

|

|

LEASED ASSETS

|

|

|

7,809 |

|

|

|

11,014 |

|

|

PROPERTY, PLANT & EQUIPMENT – net

|

|

|

51,976 |

|

|

|

57,359 |

|

|

GOODWILL

|

|

|

47,844 |

|

|

|

50,246 |

|

|

IDENTIFIED INTANGIBLES – net

|

|

|

112,618 |

|

|

|

121,782 |

|

|

OTHER ASSETS

|

|

|

965 |

|

|

|

942 |

|

|

TOTAL ASSETS

|

|

$ |

479,385 |

|

|

$ |

582,390 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY:

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

49,840 |

|

|

$ |

69,686 |

|

|

Contract liabilities

|

|

|

927 |

|

|

|

- |

|

|

Current Portion of Long-Term Debt

|

|

|

2,650 |

|

|

|

3,250 |

|

|

Accrued expenses:

|

|

|

|

|

|

|

|

|

|

Salaries and wages

|

|

|

1,204 |

|

|

|

1,253 |

|

|

Taxes – other

|

|

|

925 |

|

|

|

1,325 |

|

|

Accrued freight

|

|

|

2,284 |

|

|

|

2,413 |

|

|

Commissions

|

|

|

904 |

|

|

|

1,934 |

|

|

Accrued duty

|

|

|

5,440 |

|

|

|

6,764 |

|

|

Accrued interest

|

|

|

2,104 |

|

|

|

2,822 |

|

|

Income tax payable

|

|

|

- |

|

|

|

1,172 |

|

|

Other

|

|

|

5,251 |

|

|

|

5,675 |

|

|

Total current liabilities

|

|

|

71,529 |

|

|

|

96,294 |

|

|

LONG-TERM DEBT

|

|

|

170,480 |

|

|

|

253,646 |

|

|

LONG-TERM TAXES PAYABLE

|

|

|

169 |

|

|

|

169 |

|

|

LONG-TERM LEASE

|

|

|

5,461 |

|

|

|

8,216 |

|

|

DEFERRED INCOME TAXES

|

|

|

7,475 |

|

|

|

8,006 |

|

|

DEFERRED LIABILITIES

|

|

|

716 |

|

|

|

586 |

|

|

TOTAL LIABILITIES

|

|

|

255,830 |

|

|

|

366,917 |

|

|

SHAREHOLDERS' EQUITY:

|

|

|

|

|

|

|

|

|

|

Common stock, no par value;

|

|

|

|

|

|

|

|

|

|

25,000,000 shares authorized; issued and outstanding December 31, 2023 - 7,412,480; December 31, 2022 - 7,339,011

|

|

|

71,973 |

|

|

|

69,752 |

|

|

Retained earnings

|

|

|

151,582 |

|

|

|

145,721 |

|

|

Total shareholders' equity

|

|

|

223,555 |

|

|

|

215,473 |

|

|

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

|

|

$ |

479,385 |

|

|

$ |

582,390 |

|

Rocky Brands, Inc. and Subsidiaries

Condensed Consolidated Statements of Operations

(In thousands, except share amounts)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

NET SALES

|

|

$ |

125,952 |

|

|

$ |

138,926 |

|

|

$ |

461,833 |

|

|

$ |

615,475 |

|

|

COST OF GOODS SOLD

|

|

|

75,223 |

|

|

|

82,214 |

|

|

|

283,235 |

|

|

|

390,256 |

|

|

GROSS MARGIN

|

|

|

50,729 |

|

|

|

56,712 |

|

|

|

178,598 |

|

|

|

225,219 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

35,993 |

|

|

|

43,092 |

|

|

|

143,226 |

|

|

|

181,181 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS

|

|

|

14,736 |

|

|

|

13,620 |

|

|

|

35,372 |

|

|

|

44,038 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST EXPENSE AND OTHER – net

|

|

|

(5,276 |

) |

|

|

(5,859 |

) |

|

|

(21,218 |

) |

|

|

(18,270 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME BEFORE INCOME TAX EXPENSE

|

|

|

9,460 |

|

|

|

7,761 |

|

|

|

14,154 |

|

|

|

25,768 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX EXPENSE

|

|

|

2,748 |

|

|

|

1,246 |

|

|

|

3,728 |

|

|

|

5,303 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME

|

|

$ |

6,712 |

|

|

$ |

6,515 |

|

|

$ |

10,426 |

|

|

$ |

20,465 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME PER SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$ |

0.91 |

|

|

$ |

0.89 |

|

|

$ |

1.42 |

|

|

$ |

2.80 |

|

|

Diluted

|

|

$ |

0.91 |

|

|

$ |

0.89 |

|

|

$ |

1.41 |

|

|

$ |

2.78 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF COMMON SHARES OUTSTANDING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

7,385 |

|

|

|

7,329 |

|

|

|

7,363 |

|

|

|

7,317 |

|

|

Diluted

|

|

|

7,405 |

|

|

|

7,345 |

|

|

|

7,381 |

|

|

|

7,369 |

|

Rocky Brands, Inc. and Subsidiaries

Reconciliation of GAAP Measures to Non-GAAP Measures

(In thousands, except share amounts)

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES, AS REPORTED

|

|

$ |

125,952 |

|

|

$ |

138,926 |

|

|

$ |

461,833 |

|

|

$ |

615,475 |

|

|

ADD: RETURNS RELATING TO SUPPLIER DISPUTE

|

|

|

- |

|

|

|

- |

|

|

|

1,542 |

|

|

|

- |

|

|

LESS: DISPOSITION OF INVENTORY ASSETS

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(3,569 |

) |

|

ADJUSTED NET SALES

|

|

$ |

125,952 |

|

|

$ |

138,926 |

|

|

$ |

463,375 |

|

|

$ |

611,906 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF GOODS SOLD

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF GOODS SOLD, AS REPORTED

|

|

$ |

75,223 |

|

|

$ |

82,214 |

|

|

$ |

283,235 |

|

|

$ |

390,256 |

|

|

LESS: SUPPLIER DISPUTE INVENTORY ADJUSTMENT

|

|

|

- |

|

|

|

- |

|

|

|

(181 |

) |

|

|

- |

|

|

LESS: DISPOSITION OF INVENTORY ASSETS

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(2,444 |

) |

|

ADJUSTED COST OF GOODS SOLD

|

|

$ |

75,223 |

|

|

$ |

82,214 |

|

|

$ |

283,054 |

|

|

$ |

387,812 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS MARGIN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS MARGIN, AS REPORTED

|

|

$ |

50,729 |

|

|

$ |

56,712 |

|

|

$ |

178,598 |

|

|

$ |

225,219 |

|

|

ADJUSTED GROSS MARGIN

|

|

$ |

50,729 |

|

|

$ |

56,712 |

|

|

$ |

180,321 |

|

|

$ |

224,094 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES, AS REPORTED

|

|

$ |

35,993 |

|

|

$ |

43,092 |

|

|

$ |

143,226 |

|

|

$ |

181,181 |

|

|

LESS: ACQUISITION-RELATED AMORTIZATION

|

|

|

(692 |

) |

|

|

(764 |

) |

|

|

(2,840 |

) |

|

|

(3,110 |

) |

|

LESS: DISPOSITION OF ASSETS

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(33 |

) |

|

LESS: CLOSURE OF MANUFACTURING FACILITY

|

|

|

(100 |

) |

|

|

- |

|

|

|

(498 |

) |

|

|

- |

|

|

LESS: ACQUISITION-RELATED INTEGRATION EXPENSES

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(397 |

) |

|

LESS: RESTRUCTURING COSTS

|

|

|

- |

|

|

|

(927 |

) |

|

|

(1,486 |

) |

|

|

(2,128 |

) |

|

ADJUSTED OPERATING EXPENSES

|

|

$ |

35,201 |

|

|

$ |

41,401 |

|

|

$ |

138,402 |

|

|

$ |

175,513 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME FROM OPERATIONS, ADJUSTED

|

|

$ |

15,528 |

|

|

$ |

15,311 |

|

|

$ |

41,919 |

|

|

$ |

48,581 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST EXPENSE AND OTHER – net , AS REPORTED

|

|

$ |

(5,276 |

) |

|

$ |

(5,859 |

) |

|

$ |

(21,218 |

) |

|

$ |

(18,270 |

) |

|

LESS: GAIN ON SALE OF BUSINESS

|

|

|

- |

|

|

|

- |

|

|

|

(1,341 |

) |

|

|

- |

|

|

ADJUSTED INTEREST EXPENSE AND OTHER – net

|

|

|

(5,276 |

) |

|

|

(5,859 |

) |

|

|

(22,559 |

) |

|

|

(18,270 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME, AS REPORTED

|

|

$ |

6,712 |

|

|

$ |

6,515 |

|

|

$ |

10,426 |

|

|

$ |

20,465 |

|

|

TOTAL NON-GAAP ADJUSTMENTS

|

|

|

792 |

|

|

|

1,691 |

|

|

|

5,206 |

|

|

|

4,543 |

|

|

TAX IMPACT OF ADJUSTMENTS

|

|

|

(230 |

) |

|

|

(271 |

) |

|

|

(1,371 |

) |

|

|

(935 |

) |

|

ADJUSTED NET INCOME

|

|

$ |

7,274 |

|

|

$ |

7,935 |

|

|

$ |

14,261 |

|

|

$ |

24,073 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME PER SHARE, AS REPORTED

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC

|

|

$ |

0.91 |

|

|

$ |

0.89 |

|

|

$ |

1.42 |

|

|

$ |

2.80 |

|

|

DILUTED

|

|

$ |

0.91 |

|

|

$ |

0.89 |

|

|

$ |

1.41 |

|

|

$ |

2.78 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTED NET INCOME PER SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC

|

|

$ |

0.98 |

|

|

$ |

1.08 |

|

|

$ |

1.94 |

|

|

$ |

3.29 |

|

|

DILUTED

|

|

$ |

0.98 |

|

|

$ |

1.08 |

|

|

$ |

1.93 |

|

|

$ |

3.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE SHARES OUTSTANDING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BASIC

|

|

|

7,385 |

|

|

|

7,329 |

|

|

|

7,363 |

|

|

|

7,317 |

|

|

DILUTED

|

|

|

7,405 |

|

|

|

7,345 |

|

|

|

7,381 |

|

|

|

7,369 |

|

Use of Non-GAAP Financial Measures

In addition to GAAP financial measures, we present the following non-GAAP financial measures: "adjusted net sales," "adjusted cost of goods sold," "adjusted gross margin," "adjusted operating expenses," "adjusted operating income" (or "income from operations, adjusted")," "adjusted net income," and "adjusted net income per share." Adjusted results exclude the impact of items that management believes affect the comparability or underlying business trends in our consolidated financial statements in the periods presented. We believe that these non-GAAP measures are useful to investors and other users of our consolidated financial statements as an additional tool for evaluating operating performance. We believe they also provide a useful baseline for analyzing trends in our operations.

Investors should not consider these non-GAAP measures in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. See "Reconciliation of GAAP Measures to Non-GAAP Measures" accompanying this press release.

|

Non-GAAP adjustment or measure

|

|

Definition

|

|

Usefulness to management and investors

|

| Disposition of Inventory Assets |

|

Disposition of inventory assets relating to the sale of inventory and related cost of goods sold in connection with the divesture of the NEOS brand. |

|

We exclude the disposition of inventory assets for purposes of calculating certain non-GAAP measures because the sale and related cost of goods sold does not reflect our normal business operations. These adjustments facilitate a useful evaluation of our current operating performance and comparisons to past operating results and provide investors with additional means to evaluate cost trends. |

| Returns relating to supplier dispute |

|

Returns relating to supplier dispute consist of returns of product produced by a manufacturing supplier. |

|

We excluded these returns for calculating certain non-GAAP measures because these returns are inconsistent in size with our normal course of business and are unique to the on-going dispute with the manufacturing supplier. These adjustments facilitate a useful evaluation of our current operating performance and comparison to past operating performance and provide investors with additional means to evaluate net sales trends. |

|

Supplier dispute inventory adjustment

|

|

Supplier dispute inventory adjustment consists of an inventory adjustment to cost of goods sold for product produced by a manufacturing supplier.

|

|

We excluded this inventory adjustment to cost of goods sold for calculating certain non-GAAP measures because this adjustment is noncustomary and is unique to the on-going dispute with the manufacturing supplier. This adjustment facilitates a useful evaluation of our current operating performance and comparison to past operating performance and provides investors with additional means to evaluate net cost of goods sold trends.

|

|

Acquisition-related amortization

|

|

Amortization of acquisition-related intangible assets consists of amortization of intangible assets such as brands and customer relationships acquired in connection with the acquisition of the performance and lifestyle footwear business of Honeywell International Inc. Charges related to the amortization of these intangibles are recorded in operating expenses in our GAAP financial statements. Amortization charges are recorded over the estimated useful life of the related acquired intangible asset, and thus are generally recorded over multiple years.

|

|

We excluded amortization charges for our acquisition-related intangible assets for purposes of calculating certain non-GAAP measures because these charges are inconsistent in size and are significantly impacted by the valuation of our acquisition. These adjustments facilitate a useful evaluation of our current operating performance and comparison to past operating performance and provide investors with additional means to evaluate cost and expense trends.

|

| Disposition of Assets |

|

Disposition of fixed assets relating disposals of non-financial assets. This includes the disposal of non-financial assets and corresponding expenses related to the divesture of the NEOS brand and other long-lived assets at our manufacturing facilities. |

|

We exclude the disposition of non-financial assets and related expenses for purposes of calculating certain non-GAAP measures because the loss does not accurately reflect our current operating performance and comparisons to past operating results and provide investors with additional means to evaluate cost trends. |

|

Acquisition-related integration expenses

|

|

Acquisition-related integration expenses are expenses including investment banking fees, legal fees, transaction fees, integration costs and consulting fees tied to the acquisition of the performance and lifestyle footwear business of Honeywell International Inc.

|

|

We excluded acquisition-related expenses for purposes of calculating certain non-GAAP measures because the charges do not accurately reflect our current operating performance and comparisons to past operating results and provide investors with additional means to evaluate cost trends.

|

|

Restructuring Costs

|

|

Restructuring costs represent severance expenses associated with headcount reductions following the integration of the acquired performance and lifestyle footwear business of Honeywell International Inc in 2022 and the sale of the Servus Brand in 2023.

|

|

We excluded restructuring costs for purposes of calculating non-GAAP measures because these costs do not reflect our current operating performance. These adjustments facilitate a useful evaluation of our current operations performance and comparisons to past operating results and provide investors with additional means to evaluate expense trends.

|

| Closure of Manufacturing Facility |

|

Closure of manufacturing facility relates to the expenses and overhead incurred associated with closing our Rock Island manufacturing facility. |

|

We exclude costs associated with the closure of our manufacturing facility for purposes of calculating non-GAAP measures because these costs do not reflect our current operating performance. These adjustments facilitate a useful evaluation of our current operations performance and comparison to past operating results and provide investors with additional means to evaluate expense trends. |

| Gain on Sale of Business |

|

Gain on sale of business relates to the sale of the Servus brand. This includes the disposal of non-financial assets and corresponding expenses relating to the sale of the brand along with assets held at our Rock Island manufacturing facility. |

|

We excluded the disposition of non-financial assets and related expenses for purposes of calculating certain non-GAAP measures because the gain does not accurately reflect our current operating performance and comparisons to past operating results and provide investors with additional means to evaluate cost trends. |

v3.24.0.1

Document And Entity Information

|

Feb. 28, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ROCKY BRANDS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 28, 2024

|

| Entity, Incorporation, State or Country Code |

OH

|

| Entity, File Number |

001-34382

|

| Entity, Tax Identification Number |

31-1364046

|

| Entity, Address, Address Line One |

39 East Canal Street

|

| Entity, Address, City or Town |

Nelsonville

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

45764

|

| City Area Code |

740

|

| Local Phone Number |

753-1951

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

RCKY

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000895456

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

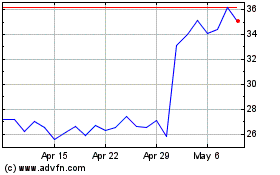

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From Apr 2024 to May 2024

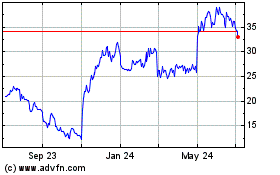

Rocky Brands (NASDAQ:RCKY)

Historical Stock Chart

From May 2023 to May 2024