false000166013400016601342024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported)

February 28, 2024

___________________________________

Okta, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

| Delaware | 001-38044 | 26-4175727 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification Number) |

|

|

|

|

|

|

100 First Street, Suite 600

San Francisco, California 94105

(Address of principal executive offices)

(888) 722-7871

(Registrant's telephone number, including area code)

___________________________________

___________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | OKTA | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition

On February 28, 2024, Okta, Inc. (the "Company") issued a press release announcing its financial results for the fiscal quarter and year ended January 31, 2024.

A copy of the press release is attached as Exhibit 99.1.

Item 7.01 - Regulation FD Disclosures

On February 28, 2024, the Company posted supplemental investor materials on its investor.okta.com website. The Company uses its investor.okta.com website and okta.com/blog websites (including the Security Blog, Okta Developer Blog and Auth0 Developer Blog) as a means of disclosing material non-public information, announcing upcoming investor conferences and for complying with its disclosure obligations under Regulation FD. Accordingly, investors should monitor the Company’s investor relations and okta.com/blog websites in addition to following its press releases, SEC filings and public conference calls and webcasts.

The information furnished in the current report on Form 8-K and in the accompanying Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filings, unless expressly incorporated by specific reference in such filing.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

|

Exhibit Number | | Description |

| | Press release dated February 28, 2024, issued by Okta, Inc. |

| 104 | | Cover Page Interactive Data File—the cover page XBRL tags are embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 28th day of February 2024.

| | | | | | | | |

| |

| | |

| Okta, Inc. |

| | |

| By: | /s/ Brett Tighe |

| Name: | Brett Tighe |

| Title: | Chief Financial Officer |

| | (Principal Financial Officer) |

Okta Announces Fourth Quarter And Fiscal Year 2024 Financial Results

•Q4 revenue grew 19% year-over-year; subscription revenue grew 20% year-over-year

•Current remaining performance obligations (cRPO) grew 16% year-over-year to $1.952 billion

•Record operating cash flow of $174 million and free cash flow of $166 million

SAN FRANCISCO – February 28, 2024 – Okta, Inc. (Nasdaq: OKTA), the leading independent identity partner, today announced financial results for its fourth quarter and fiscal year ended January 31, 2024.

“We achieved record non-GAAP profitability and record cash flow in the fourth quarter, capping a year of significant margin expansion,” said Todd McKinnon, Chief Executive Officer and co-founder of Okta. "We’re also pleased with the strong top-line performance, which was driven by strength with large customers. Organizations continue to turn to Okta to help modernize and simplify their identity infrastructure. As we start the new fiscal year, we’re excited to deliver powerful new features and products, with security as the foundation, to better serve our customers and power even more identity use cases.”

Fourth Quarter Fiscal 2024 Financial Highlights:

•Revenue: Total revenue was $605 million, an increase of 19% year-over-year. Subscription revenue was $591 million, an increase of 20% year-over-year.

•RPO: RPO, or subscription backlog, was $3.385 billion, an increase of 13% year-over-year. cRPO, which is subscription backlog expected to be recognized over the next 12 months, was $1.952 billion, up 16% compared to the fourth quarter of fiscal 2023.

•GAAP Operating Loss: GAAP operating loss was $83 million, or (14)% of total revenue, compared to a GAAP operating loss of $157 million, or (31)% of total revenue, in the fourth quarter of fiscal 2023.

•Non-GAAP Operating Income: Non-GAAP operating income was $129 million, or 21% of total revenue, compared to a non-GAAP operating income of $46 million, or 9% of total revenue, in the fourth quarter of fiscal 2023.

•GAAP Net Loss: GAAP net loss was $44 million, compared to a GAAP net loss of $153 million in the fourth quarter of fiscal 2023. GAAP net loss per share was $0.26, compared to a GAAP net loss per share of $0.95 in the fourth quarter of fiscal 2023.

•Non-GAAP Net Income: Non-GAAP net income was $113 million, compared to non-GAAP net income of $52 million in the fourth quarter of fiscal 2023. Non-GAAP basic and diluted net income per share were $0.68 and $0.63, respectively, compared to non-GAAP basic and diluted net income per share of $0.33 and $0.30 in the fourth quarter of fiscal 2023.

•Cash Flow: Net cash provided by operations was $174 million, or 29% of total revenue, compared to net cash provided by operations of $76 million, or 15% of total revenue, in the fourth quarter of fiscal 2023. Free cash flow was $166 million, or 28% of total revenue, compared to $72 million, or 14% of total revenue, in the fourth quarter of fiscal 2023.

•Cash, cash equivalents, and short-term investments were $2.202 billion at January 31, 2024. During the quarter, the company repurchased $150 million principal amount of the convertible senior notes due in 2026, resulting in a gain on early extinguishment of debt of $15 million.

Full Year Fiscal 2024 Financial Highlights:

•Revenue: Total revenue was $2.263 billion, an increase of 22% year-over-year. Subscription revenue was $2.205 billion, an increase of 23% year-over-year.

•GAAP Operating Loss: GAAP operating loss was $516 million, or (23)% of total revenue, compared to a GAAP operating loss of $812 million, or (44)% of total revenue for fiscal 2023.

•Non-GAAP Operating Income/Loss: Non-GAAP operating income was $310 million, or 14% of total revenue, compared to non-GAAP operating loss of $10 million, or (1)% of total revenue for fiscal 2023.

•GAAP Net Loss: GAAP net loss was $355 million, compared to a GAAP net loss of $815 million for fiscal 2023. GAAP net loss per share was $2.17, compared to a GAAP net loss per share of $5.16 for fiscal 2023.

•Non-GAAP Net Income/Loss: Non-GAAP net income was $286 million, compared to a non-GAAP net loss of $7 million for fiscal 2023. Non-GAAP basic and diluted net income per share were $1.75 and $1.60, compared to non-GAAP basic and diluted net loss per share of $0.04 for fiscal 2023.

•Cash Flow: Net cash provided by operations was $512 million, or 23% of total revenue, compared to $86 million, or 5% of total revenue, for fiscal 2023. Free cash flow was $489 million, or 22% of total revenue, compared to $65 million, or 3% of total revenue, for fiscal 2023.

The section titled "Non-GAAP Financial Measures" below contains a description of the non-GAAP financial measures, and reconciliations between GAAP and non-GAAP information are contained in the tables below.

Financial Outlook:

All periods factor in a stable, but still challenging macro environment, as well as potential impacts on our business related to the October 2023 security incident.

For the first quarter of fiscal 2025, the Company expects:

•Total revenue of $603 million to $605 million, representing a growth rate of 16% to 17% year-over-year;

•Current RPO of $1.915 billion to $1.920 billion, representing a growth rate of 13% year-over-year;

•Non-GAAP operating income of $108 million to $110 million, which yields a non-GAAP operating margin of 18%;

•Non-GAAP diluted net income per share of $0.54 to $0.55, assuming diluted weighted-average shares outstanding of approximately 182 million and a non-GAAP tax rate of 26%; and

•Non-GAAP free cash flow margin of approximately 25%, inclusive of the expected cash impact of approximately $24 million related to the organizational restructuring expected to be paid out in the first quarter.

For the full year fiscal 2025, the Company now expects:

•Total revenue of $2.495 billion to $2.505 billion, representing a growth rate of 10% to 11% year-over-year;

•Non-GAAP operating income of $455 million to $465 million, which yields a non-GAAP operating margin of 18% to 19%;

•Non-GAAP diluted net income per share of $2.24 to $2.29, assuming diluted weighted-average shares outstanding of approximately 182 million and a non-GAAP tax rate of 26%; and

•Non-GAAP free cash flow margin of approximately 21%.

These statements are forward-looking and actual results may differ materially. Refer to the Forward-Looking Statements safe harbor below for information on the factors that could cause our actual results to differ materially from these forward-looking statements.

Okta has not reconciled its forward-looking non-GAAP financial measures to their most directly comparable GAAP measures because certain items are out of Okta’s control or cannot be reasonably predicted. Accordingly, reconciliations for forward-looking non-GAAP financial measures are not available without unreasonable effort.

Webcast Information:

Okta will host a live video webcast at 2:00 p.m. Pacific Time on February 28, 2024 to discuss the results and outlook. The prepared remarks and the news release with the financial results will be accessible from the Company’s website at investor.okta.com prior to the webcast. The live video webcast will be accessible from the Okta investor relations website at investor.okta.com. A replay will be available on the Okta investor relations website following the completion of the event.

Supplemental Financial and Other Information:

Supplemental financial and other information can be accessed through the Company’s investor relations website at investor.okta.com. Okta uses its investor.okta.com website and okta.com/blog websites (including the Security Blog, Okta Developer Blog and Auth0 Developer Blog) as a means of disclosing material non-public information, announcing upcoming investor conferences and for complying with its disclosure obligations under Regulation FD. Accordingly, you should monitor our investor relations and okta.com/blog websites in addition to following our press releases, SEC filings and public conference calls and webcasts.

Non-GAAP Financial Measures:

This press release and the accompanying tables contain the following non-GAAP financial measures: non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating income (loss), non-GAAP operating margin, non-GAAP net income (loss), non-GAAP net margin, non-GAAP net income (loss) per share, basic and diluted, non-GAAP tax rate, free cash flow and free cash flow margin. Certain of these non-GAAP financial measures exclude stock-based compensation, non-cash charitable contributions, amortization of acquired intangibles, acquisition and integration-related expenses, restructuring costs related to severance and termination benefits and lease impairments in connection with the closing of certain leased facilities, amortization of debt issuance costs and (gain) loss on early extinguishment of debt. Acquisition and integration-related expenses include transaction costs and other non-recurring incremental costs incurred through the one-year anniversary of the transaction close.

Stock-based compensation is non-cash in nature and is generally fixed at the time the stock-based instrument is granted and amortized over a period of several years. Although stock-based compensation is an important aspect of the compensation of our employees and executives, the expense for the fair value of the stock-based instruments we utilize may bear little resemblance to the actual value realized upon the vesting or future exercise of the related stock-based awards. We believe excluding stock-based compensation provides meaningful supplemental information regarding the long-term performance of our core business and facilitates comparison of our results to those of peer companies.

We also exclude non-cash charitable contributions, amortization of acquired intangibles, acquisition and integration-related expenses, restructuring costs related to severance and termination benefits and lease impairments in connection with the closing of certain leased facilities, amortization of debt issuance costs and (gain) loss on early extinguishment of debt from the applicable non-GAAP financial measures because these adjustments are considered by management to be outside of our core operating results.

In addition to these exclusions, starting in fiscal 2024, we subtract an assumed provision for income taxes to calculate non-GAAP net income. We utilize a fixed long-term projected tax rate of 26% in our computation of the non-GAAP income tax provision to provide better consistency across the reporting periods. The non-GAAP tax rate could be subject to change for a variety of reasons, including changes in tax laws and regulations, significant changes in our geographic earnings mix, or other changes to our strategy or business operations. We will periodically reevaluate the projected long-term tax rate, as necessary, for significant events, based on our ongoing analysis of relevant tax law changes, material changes in the forecasted geographic earnings mix, and any significant acquisitions.

We define free cash flow, a non-GAAP financial measure, as net cash provided by operating activities, less cash used for purchases of property and equipment, net of sales proceeds, and capitalized software. Free cash flow margin is calculated as free cash flow divided by total revenue. We use free cash flow as a measure of financial progress in our business, as it balances operating results, cash management, and capital efficiency. We believe information regarding free cash flow provides investors and others with an important perspective on the cash available to make strategic acquisitions and investments, to fund ongoing operations, and to fund other capital expenditures. Free cash flow can be volatile and is sensitive to many factors, including changes in working capital and timing of capital expenditures. Working capital at any specific point in time is subject to many variables,

including seasonality, the discretionary timing of expense payments, discounts offered by vendors, vendor payment terms, and fluctuations in foreign exchange rates.

We periodically reassess the components of our non-GAAP adjustments for changes in how we evaluate our performance and changes in how we make financial and operational decisions, and consider the use of these measures by our competitors and peers to ensure the adjustments remain relevant and meaningful.

Okta believes that non-GAAP financial information, when taken collectively with GAAP financial measures, may be helpful to investors because it provides consistency and comparability with past financial performance and assists in comparisons with other companies, some of which use similar non-GAAP financial information to supplement their GAAP results. The non-GAAP financial information is presented for supplemental informational purposes only, and should not be considered a substitute for financial information presented in accordance with GAAP, and may be different from similarly-titled non-GAAP measures used by other companies.

The principal limitation of these non-GAAP financial measures is that they exclude significant expenses that are required by GAAP to be recorded in the Company’s financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgment by the Company's management about which expenses are excluded or included in determining these non-GAAP financial measures. A reconciliation is provided below for each non-GAAP financial measure to the most directly comparable financial measure stated in accordance with GAAP.

Okta encourages investors to review the related GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures, which it includes in press releases announcing quarterly financial results, including this press release, and not to rely on any single financial measure to evaluate the Company’s business.

Forward-Looking Statements: This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, statements regarding our financial outlook, business strategy and plans, market trends and market size, opportunities and positioning. These forward-looking statements are based on current expectations, estimates, forecasts and projections. Words such as "expect," "anticipate," "should," "believe," "hope," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "might," "could," "intend," "shall" and variations of these terms and similar expressions are intended to identify these forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. For example, the market for our products may develop more slowly than expected or than it has in the past; there may be significant fluctuations in our results of operations and cash flows related to our revenue recognition or otherwise; we may be unable to sustain the level of growth that our business has experienced in prior periods; we may not achieve expected synergies and efficiencies of operations between Okta and Auth0, and we may not be able to successfully integrate the companies; we may be unable to attract new customers, or retain or sell additional products to existing customers; global economic conditions could worsen; a prior or future network, data or cybersecurity incident that has allowed or does allow unauthorized access to our network or data or our customers’ data could damage our reputation, cause us to incur significant costs or impact the timing or our ability to land new customers or retain existing customers; we could experience interruptions or performance problems associated with our technology, including a service outage; and we may not be able to pay off our convertible senior notes when due. Further information on potential factors that could affect our financial results is included in our most recent Quarterly Report on Form 10-Q and our other filings with the Securities and Exchange Commission. The forward-looking statements included in this press release represent our views only as of the date of this press release and we assume no obligation and do not intend to update these forward-looking statements.

About Okta

Okta is the World’s Identity Company. As the leading independent Identity partner, we free everyone to safely use any technology—anywhere, on any device or app. The most trusted brands trust Okta to enable secure access, authentication, and automation. With flexibility and neutrality at the core of our Okta Workforce Identity and Customer Identity Clouds, business leaders and developers can focus on innovation and accelerate digital transformation, thanks to customizable solutions and more than 7,000 pre-built integrations. We’re building a world where Identity belongs to you. Learn more at okta.com.

Investor Contact:

Dave Gennarelli

investor@okta.com

Media Contact:

Kyrk Storer

press@okta.com

OKTA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(dollars in millions, shares in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

January 31, | | Twelve Months Ended

January 31, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue: | | | | | | | |

| Subscription | $ | 591 | | | $ | 495 | | | $ | 2,205 | | | $ | 1,794 | |

| Professional services and other | 14 | | | 15 | | | 58 | | | 64 | |

| Total revenue | 605 | | | 510 | | | 2,263 | | | 1,858 | |

| Cost of revenue: | | | | | | | |

Subscription(1) | 126 | | | 119 | | | 502 | | | 464 | |

Professional services and other(1) | 19 | | | 20 | | | 79 | | | 82 | |

| Total cost of revenue | 145 | | | 139 | | | 581 | | | 546 | |

| Gross profit | 460 | | | 371 | | | 1,682 | | | 1,312 | |

| Operating expenses: | | | | | | | |

Research and development(1) | 156 | | | 154 | | | 656 | | | 620 | |

Sales and marketing(1) | 249 | | | 259 | | | 1,036 | | | 1,066 | |

General and administrative(1) | 110 | | | 100 | | | 450 | | | 409 | |

| Restructuring and other charges | 28 | | | 15 | | | 56 | | | 29 | |

| Total operating expenses | 543 | | | 528 | | | 2,198 | | | 2,124 | |

| Operating loss | (83) | | | (157) | | | (516) | | | (812) | |

| Interest expense | (1) | | | (2) | | | (8) | | | (11) | |

| Interest income and other, net | 25 | | | 10 | | | 81 | | | 22 | |

| Gain on early extinguishment of debt | 15 | | | — | | | 106 | | | — | |

| Interest and other, net | 39 | | | 8 | | | 179 | | | 11 | |

| Loss before provision for income taxes | (44) | | | (149) | | | (337) | | | (801) | |

| Provision for income taxes | — | | | 4 | | | 18 | | | 14 | |

| Net loss | $ | (44) | | | $ | (153) | | | $ | (355) | | | $ | (815) | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.26) | | | $ | (0.95) | | | $ | (2.17) | | | $ | (5.16) | |

| | | | | | | |

| Weighted-average shares used to compute net loss per share, basic and diluted | 166,002 | | | 160,038 | | | 163,634 | | | 158,023 | |

(1) Amounts include stock-based compensation expense as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

January 31, | | Twelve Months Ended

January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Cost of subscription revenue | $ | 18 | | | $ | 17 | | | $ | 75 | | | $ | 69 | |

| Cost of professional services and other | 4 | | | 3 | | | 15 | | | 14 | |

| Research and development | 65 | | | 66 | | | 277 | | | 275 | |

| Sales and marketing | 37 | | | 40 | | | 156 | | | 159 | |

| General and administrative | 37 | | | 38 | | | 161 | | | 160 | |

| Total stock-based compensation expense | $ | 161 | | | $ | 164 | | | $ | 684 | | | $ | 677 | |

OKTA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars in millions)

(unaudited)

| | | | | | | | | | | |

| | January 31, | | January 31, |

| 2024 | | 2023 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 334 | | | $ | 264 | |

| Short-term investments | 1,868 | | | 2,316 | |

| Accounts receivable, net of allowances | 559 | | | 481 | |

| Deferred commissions | 113 | | | 92 | |

| Prepaid expenses and other current assets | 106 | | | 76 | |

| Total current assets | 2,980 | | | 3,229 | |

| Property and equipment, net | 48 | | | 59 | |

| Operating lease right-of-use assets | 83 | | | 122 | |

| Deferred commissions, noncurrent | 242 | | | 210 | |

| Intangible assets, net | 182 | | | 241 | |

| Goodwill | 5,406 | | | 5,400 | |

| Other assets | 48 | | | 46 | |

| Total assets | $ | 8,989 | | | $ | 9,307 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 12 | | | $ | 12 | |

| Accrued expenses and other current liabilities | 115 | | | 112 | |

| Accrued compensation | 167 | | | 99 | |

| | | |

| Deferred revenue | 1,488 | | | 1,242 | |

| Total current liabilities | 1,782 | | | 1,465 | |

| Convertible senior notes, net, noncurrent | 1,154 | | | 2,193 | |

| | | |

| Operating lease liabilities, noncurrent | 112 | | | 142 | |

| Deferred revenue, noncurrent | 23 | | | 18 | |

| Other liabilities, noncurrent | 30 | | | 23 | |

| Total liabilities | 3,101 | | | 3,841 | |

| | | |

| | | |

| Stockholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Class A common stock | — | | | — | |

| Class B common stock | — | | | — | |

| Additional paid-in capital | 8,724 | | | 7,974 | |

| Accumulated other comprehensive loss | (6) | | | (33) | |

| Accumulated deficit | (2,830) | | | (2,475) | |

| Total stockholders’ equity | 5,888 | | | 5,466 | |

| Total liabilities and stockholders' equity | $ | 8,989 | | | $ | 9,307 | |

OKTA, INC.

SUMMARY OF CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollars in millions)

(unaudited)

| | | | | | | | | | | |

| | Twelve Months Ended

January 31, |

| | 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net loss | $ | (355) | | | $ | (815) | |

| Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

| Stock-based compensation | 684 | | | 677 | |

| Depreciation, amortization and accretion | 84 | | | 114 | |

| Amortization of debt issuance costs | 3 | | | 6 | |

| Amortization of deferred commissions | 104 | | | 84 | |

| | | |

| Deferred income taxes | 6 | | | 7 | |

| | | |

| | | |

| Lease impairment charges | 28 | | | 14 | |

| Gain on early extinguishment of debt | (106) | | | — | |

Net gain on strategic investments | — | | | (1) | |

| Other, net | 10 | | | 7 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (79) | | | (87) | |

| Deferred commissions | (158) | | | (122) | |

| Prepaid expenses and other assets | (32) | | | (13) | |

| Operating lease right-of-use assets | 23 | | | 27 | |

| Accounts payable | — | | | (6) | |

| Accrued compensation | 68 | | | (44) | |

| Accrued expenses and other liabilities | 21 | | | 8 | |

| Operating lease liabilities | (39) | | | (34) | |

| Deferred revenue | 250 | | | 264 | |

| Net cash provided by operating activities | 512 | | | 86 | |

| Cash flows from investing activities: | | | |

| Capitalized software | (15) | | | (9) | |

| Purchases of property and equipment | (8) | | | (12) | |

| | | |

| Purchases of securities available-for-sale and other | (1,709) | | | (1,411) | |

| Proceeds from maturities and redemption of securities available-for-sale | 2,134 | | | 1,308 | |

| Proceeds from sales of securities available-for-sale and other | 62 | | | — | |

| Payments for business acquisitions, net of cash acquired | (22) | | | (4) | |

| Purchases of intangible assets | (1) | | | (2) | |

| Net cash provided by (used in) investing activities | 441 | | | (130) | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| Payments for repurchases of convertible senior notes | (937) | | | — | |

| | | |

| | | |

| | | |

| Payments for warrants related to convertible senior notes | (7) | | | — | |

| | | |

| | | |

Proceeds from stock option exercises | 15 | | | 17 | |

| | | |

| Proceeds from shares issued in connection with employee stock purchase plan | 46 | | | 31 | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | (883) | | | 48 | |

| Effects of changes in foreign currency exchange rates on cash, cash equivalents and restricted cash | 1 | | | (6) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 71 | | | (2) | |

| Cash, cash equivalents and restricted cash at beginning of period | 271 | | | 273 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 342 | | | $ | 271 | |

OKTA, INC.

Reconciliation of GAAP to Non-GAAP Data

(dollars in millions, shares in thousands, except per share data)

(unaudited)

Non-GAAP Gross Profit and Non-GAAP Gross Margin

We define non-GAAP gross profit and non-GAAP gross margin as GAAP gross profit and GAAP gross margin, adjusted for stock-based compensation expense included in cost of revenue, amortization of acquired intangibles and acquisition and integration-related expenses.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

January 31, | | Twelve Months Ended

January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Gross profit | $ | 460 | | | $ | 371 | | | $ | 1,682 | | | $ | 1,312 | |

| Add: | | | | | | | |

| Stock-based compensation expense included in cost of revenue | 22 | | | 20 | | | 90 | | | 83 | |

| Amortization of acquired intangibles | 12 | | | 13 | | | 47 | | | 46 | |

| Acquisition and integration-related expenses | — | | | — | | | — | | | 1 | |

| Non-GAAP gross profit | $ | 494 | | | $ | 404 | | | $ | 1,819 | | | $ | 1,442 | |

| Gross margin | 76 | % | | 73 | % | | 74 | % | | 71 | % |

| Non-GAAP gross margin | 82 | % | | 79 | % | | 80 | % | | 78 | % |

Non-GAAP Operating Income (Loss) and Non-GAAP Operating Margin

We define non-GAAP operating income (loss) and non-GAAP operating margin as GAAP operating loss and GAAP operating margin, adjusted for stock-based compensation expense, non-cash charitable contributions, amortization of acquired intangibles, acquisition and integration-related expenses and restructuring costs related to severance and termination benefits and lease impairments in connection with the closing of certain leased facilities.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

January 31, | | Twelve Months Ended

January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Operating loss | $ | (83) | | | $ | (157) | | | $ | (516) | | | $ | (812) | |

| Add: | | | | | | | |

| Stock-based compensation expense | 161 | | | 164 | | | 684 | | | 677 | |

| Non-cash charitable contributions | 2 | | | 2 | | | 6 | | | 4 | |

| Amortization of acquired intangibles | 19 | | | 22 | | | 78 | | | 85 | |

| Acquisition and integration-related expenses | 2 | | | — | | | 2 | | | 7 | |

| Restructuring costs | 28 | | | 15 | | | 56 | | | 29 | |

| Non-GAAP operating income (loss) | $ | 129 | | | $ | 46 | | | $ | 310 | | | $ | (10) | |

| Operating margin | (14) | % | | (31) | % | | (23) | % | | (44) | % |

| Non-GAAP operating margin | 21 | % | | 9 | % | | 14 | % | | (1) | % |

Non-GAAP Net Income (Loss), Non-GAAP Net Margin and Non-GAAP Net Income (Loss) Per Share, Basic and Diluted

We define non-GAAP net income (loss) and non-GAAP net margin as GAAP net loss and GAAP net margin, adjusted for stock-based compensation expense, non-cash charitable contributions, amortization of acquired intangibles, acquisition and integration-related expenses, amortization of debt issuance costs, gain on early extinguishment of debt and restructuring costs related to severance and termination benefits and lease impairments in connection with the closing of certain leased facilities. In addition, starting in fiscal 2024, we subtract an assumed provision for income taxes to calculate non-GAAP net income. We utilize a fixed long-term projected tax rate of 26% in our computation of the non-GAAP income tax provision to provide better consistency across the reporting periods.

We define non-GAAP net income (loss) per share, basic, as non-GAAP net income (loss) divided by GAAP weighted-average shares used to compute net loss per share, basic and diluted.

We define non-GAAP net income (loss) per share, diluted, as non-GAAP net income (loss) divided by GAAP weighted-average shares used to compute net loss per share, basic and diluted adjusted for the potentially dilutive effect of (i) employee equity incentive plans, excluding the impact of unrecognized stock-based compensation expense, and (ii) convertible senior notes outstanding and related warrants. In addition, non-GAAP net income (loss) per share, diluted, includes the impact of our note hedge and capped call agreements on convertible senior notes outstanding, as applicable. The note hedge and capped call agreements are intended to offset potential dilution to our Class A common stock upon any conversion or settlement of the convertible senior notes under certain circumstances. Accordingly, we did not record any adjustments for the potential impact of the convertible senior notes outstanding under the if-converted method.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

January 31, | | Twelve Months Ended

January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (44) | | | $ | (153) | | | $ | (355) | | | $ | (815) | |

| Add: | | | | | | | |

| Stock-based compensation expense | 161 | | | 164 | | | 684 | | | 677 | |

| Non-cash charitable contributions | 2 | | | 2 | | | 6 | | | 4 | |

| Amortization of acquired intangibles | 19 | | | 22 | | | 78 | | | 85 | |

| Acquisition and integration-related expenses | 2 | | | — | | | 2 | | | 7 | |

| Amortization of debt issuance costs | — | | | 2 | | | 3 | | | 6 | |

| Gain on early extinguishment of debt | (15) | | | — | | | (106) | | | — | |

| Restructuring costs | 28 | | | 15 | | | 56 | | | 29 | |

| Tax adjustment | (40) | | | — | | | (82) | | | — | |

| Non-GAAP net income (loss) | $ | 113 | | | $ | 52 | | | $ | 286 | | | $ | (7) | |

| | | | | | | |

| Net margin | (7) | % | | (30) | % | | (16) | % | | (44) | % |

| Non-GAAP net margin | 19 | % | | 10 | % | | 13 | % | | — | % |

| | | | | | | |

| Weighted-average shares used to compute net loss per share, basic and diluted | 166,002 | | | 160,038 | | | 163,634 | | | 158,023 | |

| Non-GAAP weighted-average effect of potentially dilutive securities | 13,247 | | | 13,988 | | | 14,763 | | | — | |

| Non-GAAP weighted-average shares used to compute non-GAAP net income (loss) per share, diluted | 179,249 | | | 174,026 | | | 178,397 | | | 158,023 | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.26) | | | $ | (0.95) | | | $ | (2.17) | | | $ | (5.16) | |

| Non-GAAP net income (loss) per share, basic | $ | 0.68 | | | $ | 0.33 | | | $ | 1.75 | | | $ | (0.04) | |

| Non-GAAP net income (loss) per share, diluted | $ | 0.63 | | | $ | 0.30 | | | $ | 1.60 | | | $ | (0.04) | |

OKTA, INC.

Reconciliation of GAAP to Non-GAAP Financial Measures

(dollars in millions)

(unaudited)

Free Cash Flow and Free Cash Flow Margin

We define free cash flow, a non-GAAP financial measure, as net cash provided by operating activities, less cash used for purchases of property and equipment, net of sales proceeds, and capitalized software. Free cash flow margin is calculated as free cash flow divided by total revenue.

In fiscal 2024, we updated our definition of free cash flow to include on-premise software purchases in addition to capitalized internal-use software costs within capitalized software.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended

January 31, | | Twelve Months Ended

January 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

Net cash provided by operating activities | $ | 174 | | | $ | 76 | | | $ | 512 | | | $ | 86 | |

| Less: | | | | | | | |

| Purchases of property and equipment | (3) | | | (3) | | | (8) | | | (12) | |

| Capitalized software | (5) | | | (1) | | | (15) | | | (9) | |

| | | | | | | |

| Free cash flow | $ | 166 | | | $ | 72 | | | $ | 489 | | | $ | 65 | |

| Net cash provided by (used in) investing activities | $ | (133) | | | $ | (83) | | | $ | 441 | | | $ | (130) | |

| Net cash provided by (used in) financing activities | $ | (109) | | | $ | 14 | | | $ | (883) | | | $ | 48 | |

| Operating cash flow margin | 29 | % | | 15 | % | | 23 | % | | 5 | % |

| Free cash flow margin | 28 | % | | 14 | % | | 22 | % | | 3 | % |

v3.24.0.1

Cover Page

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

Okta, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38044

|

| Entity Tax Identification Number |

26-4175727

|

| Entity Address, Address Line One |

100 First Street, Suite 600

|

| Entity Address, City or Town |

San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94105

|

| City Area Code |

888

|

| Local Phone Number |

722-7871

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, par value $0.0001 per share

|

| Trading Symbol |

OKTA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001660134

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

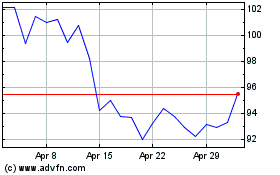

Okta (NASDAQ:OKTA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Okta (NASDAQ:OKTA)

Historical Stock Chart

From Apr 2023 to Apr 2024