false000159842800015984282024-02-272024-02-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported): |

February 27, 2024 |

|

|

|

|

METALLUS INC. (Exact name of registrant as specified in its charter) |

|

|

|

|

|

|

|

|

|

|

|

|

Ohio |

|

1-36313 |

|

46-4024951 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

1835 Dueber Avenue, SW, Canton, OH 44706 |

(Address of Principal Executive Offices) (Zip Code) |

|

(330) 471-7000 |

(Registrant's Telephone Number, Including Area Code) |

|

Not Applicable |

(Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

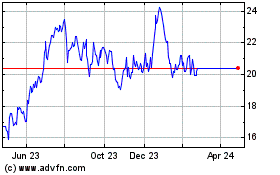

Common Shares, without par value |

MTUS |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02 |

Results of Operations and Financial Condition. |

On February 27, 2024, Metallus Inc. (the “Company”) issued a press release announcing results for the fourth quarter of 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 7.01 |

Regulation FD Disclosure. |

On February 27, 2024, the Company posted to the investor relations page of its website at http://www.metallus.com an updated investor presentation, which now includes Q4 2023 financial information. This presentation is expected to be used by the Company in connection with certain future presentations to investors and others.

The information contained in Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

** Furnished herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

METALLUS INC. |

|

|

|

|

Date: February 27, 2024 |

By: |

/s/ Kristopher R. Westbrooks |

|

|

|

Kristopher R. Westbrooks |

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Metallus Announces Fourth-Quarter and Full-Year 2023 Results

•Net sales of $328.1 million in the fourth quarter and $1.4 billion for the full year

•Fourth-quarter net income of $1.3 million and full-year net income of $69.4 million with adjusted EBITDA(1) of $35.7 million in the fourth quarter and $169.0 million for the full year

•Operating cash flow of $74.1 million in the fourth quarter with $125.3 million for the full year

•For the full year, the company deployed $51.6 million of cash for capital investments and $32.6 million to repurchase common shares

•Cash and cash equivalents totaled $280.6 million with total liquidity(2) of $539.4 million at the end of 2023

CANTON, Ohio: February 27, 2024 – Metallus (NYSE: MTUS), a leader in high-quality specialty metals, manufactured components and supply chain solutions, today reported fourth-quarter 2023 net sales of $328.1 million and net income of $1.3 million, or $0.03 per diluted share. On an adjusted basis(1), the fourth-quarter 2023 net income was $16.5 million, or $0.36 per diluted share, and adjusted EBITDA was $35.7 million.

This compares with the company's sequential third-quarter 2023 net sales of $354.2 million and net income of $24.8 million, or $0.51 per diluted share. On an adjusted basis(1), the third-quarter 2023 net income was $24.9 million, or $0.52 per diluted share, and adjusted EBITDA was $46.8 million.

Fourth-quarter 2022 net sales were $245.4 million with net loss of $33.2 million, or a loss of $0.75 per diluted share. On an adjusted basis(1), the fourth-quarter 2022 net loss was $4.6 million, or a loss of $0.10 per diluted share, and adjusted EBITDA was $11.9 million.

"Throughout the year, our teams actively pursued our strategic imperatives with a focus on targeted growth markets, specifically aerospace and defense. Our continued profitability was driven by strong aerospace and defense demand coupled with increased base pricing. We remain committed to delivering value to our shareholders, as demonstrated by progress in our capital allocation strategy which includes strategic reinvestment in our business and our ongoing share repurchase program," stated Mike Williams, president and chief executive officer.

“As announced in early January, we're excited to introduce our new name, Metallus. This change reflects our expertise in high-performance metals and distinguishes us in the marketplace. It positions us for growth beyond carbon steel and comes at the right time, following a decade of being a standalone company. While we eagerly are looking ahead to our future, our core values and commitment to safety, quality, collaboration, and employee well-being remain unchanged," said Williams.

(1)Please see discussion of non-GAAP financial measures in this news release.

(2)The company defines total liquidity as available borrowing capacity plus cash and cash equivalents.

FOURTH-QUARTER 2023 FINANCIAL SUMMARY

•Net sales of $328.1 million decreased 7 percent compared with $354.2 million in the third quarter 2023. The decrease in net sales was primarily driven by lower shipments and a market decline in average raw material surcharge revenue per ton as a result of lower scrap and alloy prices. Partially offsetting these items were higher base sales(1) prices attributable to incremental retroactive pricing and favorable aerospace & defense product mix. Compared with the fourth quarter of 2022, net sales increased by 34 percent on higher shipments and base sales(1) prices.

•Ship tons of 157,600 decreased 18,200 tons sequentially, or 10 percent, driven by seasonally lower automotive and industrial shipments and the impact of automotive work stoppages. Compared with the fourth quarter of 2022, ship tons increased 23 percent as a result of higher industrial and aerospace & defense shipments. Fourth-quarter 2022 shipments were negatively impacted by the availability of inventory for shipment following unplanned downtime in mid-2022.

•Manufacturing costs increased by $9.9 million on a sequential basis as a result of lower cost absorption combined with higher annual shutdown maintenance expense in the fourth quarter. Melt utilization declined to 58 percent in the fourth quarter from 76 percent in the third quarter. Fourth-quarter melt utilization was impacted by the planned annual shutdown maintenance as well as additional planned downtime to balance inventory with demand. Compared with the prior-year fourth quarter, manufacturing costs decreased by $4.2 million. The decrease was primarily driven by better cost absorption given the 58 percent melt utilization rate compared with 47 percent in the same quarter last year.

•Other income included an insurance recovery of $20.0 million in the fourth quarter of 2023 related to costs associated with 2022 unplanned downtime. Given that the insurance recovery related to 2022 operations, the recovery was excluded from fourth-quarter of 2023 adjusted EBITDA. In the first quarter of 2024, the company collected the $20.0 million and the 2022 insurance claims were closed.

FULL-YEAR FINANCIAL SUMMARY

Net income for the full-year 2023 was $69.4 million, or $1.47 per diluted share, compared with net income of $65.1 million, or $1.30 per diluted share, for the full-year 2022. On an adjusted basis(1), full-year 2023 net income was $89.8 million, or $1.91 per diluted share, and adjusted EBITDA was $169.0 million. In comparison, full-year 2022 net income on an adjusted basis(1) was $94.2 million, or $1.87 per diluted share, and adjusted EBITDA(1) was $172.2 million.

•Net sales of $1,362.4 million increased 2 percent compared with the full-year 2022, driven largely by an increase in base sales(1) prices, partially offset by lower average raw material surcharge revenue per ton and shipments. Within the aerospace & defense end-market, net sales increased by 44 percent to $115.0 million compared with the full-year 2022 and represented 8 percent of consolidated net sales in 2023.

(1)Please see discussion of non-GAAP financial measures in this news release.

(2)The company defines total liquidity as available borrowing capacity plus cash and cash equivalents.

•Ship tons were 683,800, a decrease of 1 percent from 2022 on relatively steady customer demand. Strong demand resulted in a 71 percent increase in aerospace & defense shipments in 2023.

•Manufacturing costs increased by $21.2 million compared with 2022 primarily driven by cost inflation and higher maintenance expenses, partially offset by improved cost absorption. Melt utilization improved to 70 percent in 2023 compared with 63 percent in 2022.

•Other income included insurance recoveries of $31.3 million in 2023 related to costs associated with 2022 unplanned downtime. Given that the insurance recoveries related to 2022 operations, the recoveries were excluded from 2023 adjusted EBITDA.

CASH, LIQUIDITY AND REPURCHASE ACTIVITY

As of December 31, 2023, the company’s cash and cash equivalents balance was $280.6 million. In the fourth quarter, operating cash flow was $74.1 million, primarily driven by profitability and lower working capital. For the full-year 2023, the company generated operating cash flow of $125.3 million driven by profitability, partially offset by higher working capital. Capital expenditures totaled $51.6 million in 2023. Total liquidity(2) was $539.4 million as of December 31, 2023.

In the fourth quarter, the company repurchased 0.2 million common shares in the open market at an aggregate cost of $4.1 million. In total during 2023, the company repurchased 1.7 million common shares at an aggregate cost of $32.6 million. As of December 31, 2023, the company had $40.4 million remaining on its existing share repurchase program.

OUTLOOK

Given the elements outlined in the outlook below, the company expects first-quarter of 2024 adjusted EBITDA to be slightly lower than the fourth quarter of 2023.

Commercial:

•First-quarter shipments are expected to be slightly lower than the fourth quarter of 2023 with continued strength in aerospace & defense demand.

•Lead times for bar products currently extend to April and tube product lead times extend to May.

•Annual price agreement negotiations covering approximately 65 percent of the order book are complete with 2024 average base price per ton for customers covered by annual agreements expected to be similar to average base price per ton for the full-year 2023, mix dependent.

•Price/mix is expected to be unfavorable on a sequential basis in the first quarter given that the fourth quarter of 2023 included approximately $11 million of full-year retroactive price increases.

•Surcharge revenue per ton is expected to be sequentially higher in the first quarter.

(1)Please see discussion of non-GAAP financial measures in this news release.

(2)The company defines total liquidity as available borrowing capacity plus cash and cash equivalents.

Operations:

•The company expects the average melt utilization rate to be approximately 70 percent in the first quarter.

•Manufacturing costs are expected to sequentially decline in the first quarter given the completion of approximately $10 million of annual melt shop shutdown maintenance in the fourth quarter of 2023.

Other matters:

•Planned capital expenditures are approximately $60 million in 2024.

•An effective income tax rate of approximately 25 to 28 percent is expected in 2024.

•Pension expense in 2024 is anticipated to be similar to 2023, excluding the impact of remeasurements. Required cash pension contributions are approximately $40 million in 2024, with approximately $25 million of contributions required in the first quarter.

•As previously mentioned, insurance recoveries of $20.0 million were collected in the first quarter of 2024 (recognized as income in the fourth quarter of 2023), closing out the 2022 insurance claims.

METALLUS EARNINGS WEBCAST INFORMATION

Metallus will provide live Internet listening access to its conference call with the financial community scheduled for Wednesday, February 28, 2024 at 9:00 a.m. ET. The live conference call will be broadcast at investors.metallus.com. A replay of the conference call will also be available at investors.metallus.com.

ABOUT METALLUS INC.

Metallus (NYSE: MTUS) manufactures high-performance specialty metals from recycled scrap metal in Canton, OH, serving demanding applications in industrial, automotive, aerospace & defense and energy end-markets. The company is a premier U.S. producer of alloy steel bars (up to 16 inches in diameter), seamless mechanical tubing and manufactured components. In the business of making high-quality steel for more than 100 years, Metallus' proven expertise contributes to the performance of our customers' products. The company employs approximately 1,840 people and had sales of $1.4 billion in 2023. For more information, please visit us at www.metallus.com.

-###-

Investor contact:

Jennifer Beeman

P 330.471.7760

ir@metallus.com

NON-GAAP FINANCIAL MEASURES

Metallus reports its financial results in accordance with accounting principles generally accepted in the United States (“GAAP”) and corresponding metrics as non-GAAP financial measures. This earnings release includes references to the following non-GAAP financial measures: adjusted earnings (loss) per share, adjusted net income (loss), EBIT, adjusted EBIT, EBITDA, adjusted EBITDA, free cash flow, base sales, and other adjusted items. These are important financial measures used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting these non-GAAP

financial measures is useful to investors as these measures are representative of the company’s performance and provide improved comparability of results. See the attached schedules for definitions of the non-GAAP financial measures referred to above and corresponding reconciliations of these non-GAAP financial measures to the most comparable GAAP financial measures. Non-GAAP financial measures should be viewed as additions to, and not as alternatives for, Metallus' results prepared in accordance with GAAP. In addition, the non-GAAP measures Metallus uses may differ from non-GAAP measures used by other companies, and other companies may not define the non-GAAP measures Metallus uses in the same way.

FORWARD-LOOKING STATEMENTS

This news release includes "forward-looking" statements within the meaning of the federal securities laws. You can generally identify the company's forward-looking statements by words such as "will," "anticipate," "aspire," "believe," "could," "estimate," "expect," "forecast," "outlook," "intend," "may," "plan," "possible," "potential," "predict," "project," "seek," "target," "should," "would," "strategy," or "strategic direction" or other similar words, phrases or expressions that convey the uncertainty of future events or outcomes. The company cautions readers that actual results may differ materially from those expressed or implied in forward-looking statements made by or on behalf of the company due to a variety of factors, such as: (1) the effects of fluctuations in customer demand on sales, product mix and prices in the industries in which the company operates, including the ability of the company to respond to rapid changes in customer demand including but not limited to changes in customer operating schedules due to supply chain constraints or unplanned work stoppages, the ability of customers to obtain financing to purchase the company’s products or equipment that contains its products, the effects of customer bankruptcies or liquidations, the impact of changes in industrial business cycles, and whether conditions of fair trade exist in U.S. markets; (2) changes in operating costs, including the effect of changes in the company's manufacturing processes, changes in costs associated with varying levels of operations and manufacturing capacity, availability of raw materials and energy, the company's ability to mitigate the impact of fluctuations in raw materials and energy costs and the effectiveness of its surcharge mechanism, changes in the expected costs associated with product warranty claims, changes resulting from inventory management, cost reduction initiatives and different levels of customer demands, the effects of unplanned work stoppages, availability of skilled labor and changes in the cost of labor and benefits; (3) the success of the company's operating plans, announced programs, initiatives and capital investments, the consistency to meet demand levels following unplanned downtime, and the company's ability to maintain appropriate relations with the union that represents its associates in certain locations in order to avoid disruptions of business; (4) whether the company is able to successfully implement actions designed to improve profitability on anticipated terms and timetables and whether the company is able to fully realize the expected benefits of such actions; (5) the company's pension obligations and investment performance; (6) with respect to the company's ability to achieve its sustainability goals, including its 2030 environmental goals, the ability to meet such goals within the expected timeframe, changes in laws, regulations, prevailing standards or public policy, the alignment of the scientific community on measurement and reporting approaches, the complexity of commodity supply chains and the evolution of and adoption of new technology, including traceability practices, tools and processes; (7) availability of property insurance coverage at commercially reasonable rates or insufficient insurance coverage to cover claims or damages; (8) the availability of financing and interest rates, which affect the company's cost of funds and/or ability to raise capital; (9) the effects of the conditional conversion feature of the convertible notes due December 1, 2025, which, if triggered, entitles holders to convert the notes at any time during specified periods at their option and therefore could result in potential dilution if the holder elects to convert and the company elects to satisfy a portion or all of the conversion obligation by delivering common shares instead of cash; (10) the impacts from any repurchases of our common shares, including the timing and amount of any repurchases; (11) competitive factors, including changes in market penetration, increasing price competition by existing or new foreign and domestic competitors, the introduction of new products by existing and new competitors, and new technology that may impact the way the company's products are sold or

distributed; (12) deterioration in global economic conditions, or in economic conditions in any of the geographic regions in which the company conducts business, including additional adverse effects from global economic slowdown, terrorism or hostilities, including political risks associated with the potential instability of governments and legal systems in countries in which the company or its customers conduct business, and changes in currency valuations; (13) the impact of global conflicts on the economy, sourcing of raw materials, and commodity prices; (14) climate-related risks, including environmental and severe weather caused by climate changes, and legislative and regulatory initiatives addressing global climate change or other environmental concerns; (15) unanticipated litigation, claims or assessments, including claims or problems related to intellectual property, product liability or warranty, employment matters, regulatory compliance and environmental issues and taxes, among other matters; (16) cyber-related risks, including information technology system failures, interruptions and security breaches; and (17) the potential impact of pandemics, epidemics, widespread illness or other health issues. Further, this news release represents our current policy and intent and is not intended to create legal rights or obligations. Certain standards of measurement and performance contained in this news release are developing and based on assumptions, and no assurance can be given that any plan, objective, initiative, projection, goal, mission, commitment, expectation or prospect set forth in this news release can or will be achieved. Inclusion of information in this news release is not an indication that the subject or information is material to our business or operating results.

Additional risks relating to the company's business, the industries in which the company operates, or the company's common shares may be described from time to time in the company's filings with the SEC. All of these risk factors are difficult to predict, are subject to material uncertainties that may affect actual results and may be beyond the company's control. Readers are cautioned that it is not possible to predict or identify all of the risks, uncertainties and other factors that may affect future results and that the above list should not be considered to be a complete list. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

CONSOLIDATED STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(in millions, except per share data) (Unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

328.1 |

|

|

$ |

245.4 |

|

|

$ |

1,362.4 |

|

|

$ |

1,329.9 |

|

Cost of products sold |

|

|

286.7 |

|

|

|

265.7 |

|

|

|

1,175.9 |

|

|

|

1,203.2 |

|

Gross Profit |

|

|

41.4 |

|

|

|

(20.3 |

) |

|

|

186.5 |

|

|

|

126.7 |

|

Selling, general & administrative expenses (SG&A) |

|

|

22.7 |

|

|

|

17.4 |

|

|

|

84.6 |

|

|

|

73.8 |

|

Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.8 |

|

Loss (gain) on sale or disposal of assets, net |

|

|

0.3 |

|

|

|

(0.6 |

) |

|

|

(2.5 |

) |

|

|

1.9 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

11.4 |

|

|

|

43.1 |

|

Other (income) expense, net |

|

|

16.8 |

|

|

|

(31.8 |

) |

|

|

3.7 |

|

|

|

(90.6 |

) |

Earnings (Loss) Before Interest and Taxes (EBIT) (1) |

|

|

1.6 |

|

|

|

(5.3 |

) |

|

|

89.3 |

|

|

|

97.7 |

|

Interest (income) expense, net |

|

|

(2.1 |

) |

|

|

(1.0 |

) |

|

|

(7.1 |

) |

|

|

0.6 |

|

Income (Loss) Before Income Taxes |

|

|

3.7 |

|

|

|

(4.3 |

) |

|

|

96.4 |

|

|

|

97.1 |

|

Provision (benefit) for income taxes |

|

|

2.4 |

|

|

|

28.9 |

|

|

|

27.0 |

|

|

|

32.0 |

|

Net Income (Loss) |

|

$ |

1.3 |

|

|

$ |

(33.2 |

) |

|

$ |

69.4 |

|

|

$ |

65.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (Loss) per Common Share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings (loss) per share |

|

$ |

0.03 |

|

|

$ |

(0.75 |

) |

|

$ |

1.58 |

|

|

$ |

1.42 |

|

Diluted earnings (loss) per share (2,3) |

|

$ |

0.03 |

|

|

$ |

(0.75 |

) |

|

$ |

1.47 |

|

|

$ |

1.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic |

|

|

43.2 |

|

|

|

44.5 |

|

|

|

43.8 |

|

|

|

45.8 |

|

Weighted average shares outstanding - diluted (2,3) |

|

|

47.1 |

|

|

|

44.5 |

|

|

|

47.8 |

|

|

|

51.5 |

|

(1) EBIT is defined as net income (loss) before interest (income) expense, net and income taxes. EBIT is an important financial measure used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting EBIT is useful to investors as this measure is representative of the company's performance.

(2) For the three and twelve months ended December 31, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (1.7 million shares and 1.9 million shares, respectively) and common share equivalents for shares issuable for equity-based awards (2.2 million shares and 2.1 million shares, respectively) were included in the computation of diluted earnings (loss) per share, as they were considered dilutive. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.2 million and $1.0 million for the three and twelve months ended December 31, 2023, respectively, of convertible notes interest expense (including amortization of convertible notes issuance costs).

(3) Common share equivalents for shares issuable upon the conversion of outstanding convertible notes and common share equivalents for shares issuable for equity-based awards, were excluded from the computation of diluted earnings (loss) per share for the three months ended December 31, 2022, because the effect of their inclusion would have been anti-dilutive. For the year ended December 31, 2022, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (3.6 million shares) and common share equivalents for shares issuable for equity-based awards (2.1 million shares) were included in the computation of diluted earnings (loss) per share, as they were considered dilutive. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, for the year ended December 31, 2022, net income was adjusted to add back $1.9 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

(Dollars in millions) (Unaudited) |

|

December 31,

2023 |

|

|

December 31,

2022 |

|

ASSETS |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

280.6 |

|

|

$ |

257.2 |

|

Accounts receivable, net of allowances |

|

|

113.2 |

|

|

|

79.4 |

|

Inventories, net |

|

|

228.0 |

|

|

|

192.4 |

|

Deferred charges and prepaid expenses |

|

|

10.3 |

|

|

|

6.4 |

|

Other current assets |

|

|

24.7 |

|

|

|

21.2 |

|

Total Current Assets |

|

|

656.8 |

|

|

|

556.6 |

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

492.5 |

|

|

|

486.1 |

|

Operating lease right-of-use assets |

|

|

11.4 |

|

|

|

12.5 |

|

Pension assets |

|

|

9.9 |

|

|

|

19.4 |

|

Intangible assets, net |

|

|

2.7 |

|

|

|

5.0 |

|

Other non-current assets |

|

|

2.0 |

|

|

|

2.4 |

|

Total Assets |

|

$ |

1,175.3 |

|

|

$ |

1,082.0 |

|

|

|

|

|

|

|

|

LIABILITIES |

|

|

|

|

|

|

Accounts payable |

|

$ |

133.3 |

|

|

$ |

113.2 |

|

Salaries, wages and benefits |

|

|

26.8 |

|

|

|

21.2 |

|

Accrued pension and postretirement costs |

|

|

43.5 |

|

|

|

2.0 |

|

Current operating lease liabilities |

|

|

5.0 |

|

|

|

6.0 |

|

Current convertible notes, net |

|

|

13.2 |

|

|

|

20.4 |

|

Other current liabilities |

|

|

26.6 |

|

|

|

23.9 |

|

Total Current Liabilities |

|

|

248.4 |

|

|

|

186.7 |

|

|

|

|

|

|

|

|

Credit Agreement |

|

|

— |

|

|

|

— |

|

Non-current operating lease liabilities |

|

|

6.4 |

|

|

|

6.5 |

|

Accrued pension and postretirement costs |

|

|

160.5 |

|

|

|

162.9 |

|

Deferred income taxes |

|

|

15.0 |

|

|

|

25.9 |

|

Other non-current liabilities |

|

|

13.4 |

|

|

|

13.5 |

|

Total Liabilities |

|

|

443.7 |

|

|

|

395.5 |

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Additional paid-in capital |

|

|

844.2 |

|

|

|

847.0 |

|

Retained deficit |

|

|

(53.7 |

) |

|

|

(123.1 |

) |

Treasury shares |

|

|

(71.3 |

) |

|

|

(52.1 |

) |

Accumulated other comprehensive income (loss) |

|

|

12.4 |

|

|

|

14.7 |

|

Total Shareholders' Equity |

|

|

731.6 |

|

|

|

686.5 |

|

Total Liabilities and Shareholders' Equity |

|

$ |

1,175.3 |

|

|

$ |

1,082.0 |

|

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in millions) (Unaudited) |

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

CASH PROVIDED (USED) |

|

|

|

|

|

|

|

|

|

|

|

|

Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

1.3 |

|

|

$ |

(33.2 |

) |

|

$ |

69.4 |

|

|

$ |

65.1 |

|

Adjustments to reconcile net income (loss) to net cash provided (used) by operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

14.1 |

|

|

|

14.6 |

|

|

|

56.9 |

|

|

|

58.3 |

|

Amortization of deferred financing fees and debt discount |

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.5 |

|

|

|

0.7 |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

11.4 |

|

|

|

43.1 |

|

Loss (gain) on sale or disposal of assets |

|

|

0.3 |

|

|

|

(0.6 |

) |

|

|

(2.5 |

) |

|

|

1.9 |

|

Deferred income taxes |

|

|

(10.4 |

) |

|

|

25.4 |

|

|

|

(9.7 |

) |

|

|

24.9 |

|

Stock-based compensation expense |

|

|

3.0 |

|

|

|

2.3 |

|

|

|

11.5 |

|

|

|

8.8 |

|

Pension and postretirement expense (benefit), net |

|

|

40.7 |

|

|

|

4.2 |

|

|

|

47.1 |

|

|

|

(40.5 |

) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

22.7 |

|

|

|

20.8 |

|

|

|

(33.4 |

) |

|

|

21.3 |

|

Inventories, net |

|

|

27.8 |

|

|

|

13.4 |

|

|

|

(34.9 |

) |

|

|

18.8 |

|

Accounts payable |

|

|

(18.8 |

) |

|

|

(13.3 |

) |

|

|

15.3 |

|

|

|

(33.2 |

) |

Other accrued expenses |

|

|

15.0 |

|

|

|

3.7 |

|

|

|

5.3 |

|

|

|

(8.8 |

) |

Pension and postretirement contributions and payments |

|

|

(1.5 |

) |

|

|

(0.5 |

) |

|

|

(3.9 |

) |

|

|

(5.4 |

) |

Deferred charges and prepaid expenses |

|

|

2.2 |

|

|

|

0.5 |

|

|

|

(2.8 |

) |

|

|

(2.6 |

) |

Other, net |

|

|

(22.4 |

) |

|

|

(13.7 |

) |

|

|

(4.9 |

) |

|

|

(17.9 |

) |

Net Cash Provided (Used) by Operating Activities |

|

|

74.1 |

|

|

|

23.7 |

|

|

|

125.3 |

|

|

|

134.5 |

|

Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

|

(15.4 |

) |

|

|

(11.4 |

) |

|

|

(51.6 |

) |

|

|

(27.1 |

) |

Proceeds from disposals of property, plant and equipment |

|

|

— |

|

|

|

2.4 |

|

|

|

1.7 |

|

|

|

5.4 |

|

Net Cash Provided (Used) by Investing Activities |

|

|

(15.4 |

) |

|

|

(9.0 |

) |

|

|

(49.9 |

) |

|

|

(21.7 |

) |

Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of treasury shares |

|

|

(4.1 |

) |

|

|

(19.6 |

) |

|

|

(32.6 |

) |

|

|

(52.0 |

) |

Proceeds from exercise of stock options |

|

|

0.4 |

|

|

|

0.1 |

|

|

|

2.8 |

|

|

|

8.0 |

|

Shares surrendered for employee taxes on stock compensation |

|

|

— |

|

|

|

(0.3 |

) |

|

|

(3.4 |

) |

|

|

(2.0 |

) |

Repayments on convertible notes |

|

|

— |

|

|

|

— |

|

|

|

(18.7 |

) |

|

|

(67.6 |

) |

Debt issuance costs |

|

|

— |

|

|

|

(0.3 |

) |

|

|

— |

|

|

|

(1.0 |

) |

Net Cash Provided (Used) by Financing Activities |

|

|

(3.7 |

) |

|

|

(20.1 |

) |

|

|

(51.9 |

) |

|

|

(114.6 |

) |

Increase (Decrease) in Cash, Cash Equivalents, and Restricted Cash |

|

|

55.0 |

|

|

|

(5.4 |

) |

|

|

23.5 |

|

|

|

(1.8 |

) |

Cash, cash equivalents, and restricted cash at beginning of period |

|

|

226.3 |

|

|

|

263.2 |

|

|

|

257.8 |

|

|

|

259.6 |

|

Cash, Cash Equivalents, and Restricted Cash at End of Period |

|

$ |

281.3 |

|

|

$ |

257.8 |

|

|

$ |

281.3 |

|

|

$ |

257.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table provides a reconciliation of cash, cash equivalents, and restricted cash reported within the Consolidated Balance Sheets that sum to the total of the same such amounts shown in the Consolidated Statements of Cash Flows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

280.6 |

|

|

$ |

257.2 |

|

|

$ |

280.6 |

|

|

$ |

257.2 |

|

Restricted cash reported in other current assets |

|

|

0.7 |

|

|

|

0.6 |

|

|

|

0.7 |

|

|

|

0.6 |

|

Total cash, cash equivalents, and restricted cash shown in the Consolidated Statements of Cash Flows |

|

$ |

281.3 |

|

|

$ |

257.8 |

|

|

$ |

281.3 |

|

|

$ |

257.8 |

|

Reconciliation of Free Cash Flow(1) to GAAP Net Cash Provided (Used) by Operating Activities:

This reconciliation is provided as additional relevant information about the company's financial position. Free cash flow is an important financial measure used in the management of the business. Management believes that free cash flow is useful to investors because it is a meaningful indicator of cash generated from operating activities available for the execution of its business strategy.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

(Dollars in millions) (Unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net Cash Provided (Used) by Operating Activities |

|

$ |

74.1 |

|

|

$ |

23.7 |

|

|

$ |

125.3 |

|

|

$ |

134.5 |

|

Less: Capital expenditures |

|

|

(15.4 |

) |

|

|

(11.4 |

) |

|

|

(51.6 |

) |

|

|

(27.1 |

) |

Free Cash Flow |

|

$ |

58.7 |

|

|

$ |

12.3 |

|

|

$ |

73.7 |

|

|

$ |

107.4 |

|

(1) Free Cash Flow is defined as net cash provided (used) by operating activities less capital expenditures.

Reconciliation of adjusted net income (loss)(2) to GAAP net income (loss) and adjusted diluted earnings (loss) per share(2) to GAAP diluted earnings (loss) per share for the three months ended December 31, 2023, December 31, 2022, and September 30, 2023:

Adjusted net income (loss) and adjusted diluted earnings (loss) per share are financial measures not required by, or presented in accordance with GAAP. These Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with GAAP, and a reconciliation of these financial measures to the most comparable GAAP financial measures is presented. Management believes this data provides investors with additional useful information on the underlying operations and trends of the business and enables period-to-period comparability of the company’s financial performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, 2023 |

|

|

Three Months Ended

December 31, 2022 |

|

|

Three Months Ended

September 30, 2023 |

|

(Dollars in millions) (Unaudited) |

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(1) |

|

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(9) |

|

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(10) |

|

As reported |

|

$ |

1.3 |

|

|

$ |

0.03 |

|

|

$ |

(33.2 |

) |

|

|

(0.75 |

) |

|

$ |

24.8 |

|

|

$ |

0.51 |

|

Adjustments:(2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss (gain) on sale or disposal of assets, net |

|

|

0.3 |

|

|

|

0.01 |

|

|

|

(0.6 |

) |

|

|

(0.01 |

) |

|

|

(0.3 |

) |

|

|

(0.01 |

) |

Loss (gain) from remeasurement of benefit plans, net |

|

|

38.8 |

|

|

|

0.82 |

|

|

|

1.8 |

|

|

|

0.04 |

|

|

|

(1.0 |

) |

|

|

(0.02 |

) |

Sales and use tax refund |

|

|

(1.4 |

) |

|

|

(0.03 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Business transformation costs(3) |

|

|

0.6 |

|

|

|

0.01 |

|

|

|

0.1 |

|

|

|

0.01 |

|

|

|

0.1 |

|

|

|

— |

|

IT transformation costs(4) |

|

|

1.2 |

|

|

|

0.03 |

|

|

|

1.3 |

|

|

|

0.03 |

|

|

|

1.0 |

|

|

|

0.03 |

|

Insurance recoveries(5) |

|

|

(20.0 |

) |

|

|

(0.42 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Rebranding costs(6) |

|

|

0.5 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

0.01 |

|

Accelerated depreciation and amortization |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.1 |

|

|

|

— |

|

Provision (benefit) for income taxes(7) |

|

|

— |

|

|

|

— |

|

|

|

26.6 |

|

|

|

0.60 |

|

|

|

— |

|

|

|

— |

|

Tax effect on above adjustments(8) |

|

|

(4.8 |

) |

|

|

(0.10 |

) |

|

|

(0.6 |

) |

|

|

(0.02 |

) |

|

|

— |

|

|

|

— |

|

As adjusted |

|

$ |

16.5 |

|

|

$ |

0.36 |

|

|

$ |

(4.6 |

) |

|

|

(0.10 |

) |

|

$ |

24.9 |

|

|

$ |

0.52 |

|

(1) For the three months ended December 31, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (1.7 million shares) and common share equivalents for shares issuable for equity-based awards (2.2 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the three months ended December 31, 2023 was 47.1 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.2 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

(2) Adjusted net income (loss) and adjusted diluted earnings (loss) per share are defined as net income (loss) and diluted earnings (loss) per share, respectively, excluding, as applicable, adjustments listed in the foregoing table.

(3) Business transformation costs consist primarily of professional service fees associated with strategic initiatives and organizational changes.

(4) IT transformation costs were primarily related to professional service fees not eligible for capitalization that are associated specifically with an information technology application simplification and modernization project.

(5) During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. Metallus recognized an insurance recovery of $20.0 million related to the unplanned downtime in the fourth quarter of 2023. These insurance recoveries were received in the first quarter of 2024.

(6) Rebranding costs consist primarily of professional service fees associated with the company's name change to Metallus Inc., announced during the first quarter of 2024.

(7) Provision (benefit) for income taxes includes the net tax benefit (expense) from non-routine income tax items. For the three months ended December 31, 2022, this amount includes a tax benefit associated with the reversal of an inventory reserve related to an accounting policy change from LIFO to FIFO, which occurred in 2019, a tax expense related to the reversal of our full domestic valuation allowance, and a tax benefit to normalize the income tax impact of recognizing full year income tax in the fourth quarter of 2022 due to the timing of release of the company’s full domestic valuation allowance.

(8) Tax effect on above adjustments includes the tax impact related to the adjustments shown above.

(9) Common share equivalents for shares issuable upon the conversion of outstanding convertible notes and common share equivalents for shares issuable for equity-based awards, were excluded from the computation of diluted earnings (loss) per share for the three months ended December 31, 2022, because the effect of their inclusion would have been anti-dilutive.

(10) For the three months ended September 30, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (1.7 million shares) and common share equivalents for shares issuable for equity-based awards (2.1 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the three months ended September 30, 2023 was 47.9 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $0.2 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

Reconciliation of adjusted net income (loss)(2) to GAAP net income (loss) and adjusted diluted earnings (loss) per share(2) to GAAP diluted earnings (loss) per share for the year ended December 31, 2023 and December 31, 2022:

Adjusted net income (loss), adjusted diluted earnings (loss) per share and other adjusted items referred to below are financial measures not required by, or presented in accordance with GAAP. These Non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, the financial measures prepared in accordance with GAAP, and a reconciliation of these financial measures to the most comparable GAAP financial measures is presented. Management believes this data provides investors with additional useful information on the underlying operations and trends of the business and enables period-to-period comparability of the company’s financial performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended

December 31, 2023 |

|

|

Year Ended

December 31, 2022 |

|

(Dollars in millions) (Unaudited) |

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(1) |

|

|

Net

income

(loss) |

|

|

Diluted

earnings

(loss) per

share(9) |

|

As reported |

|

$ |

69.4 |

|

|

$ |

1.47 |

|

|

$ |

65.1 |

|

|

|

1.30 |

|

Adjustments:(2) |

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

0.8 |

|

|

|

0.02 |

|

Loss (gain) on sale or disposal of assets, net |

|

|

(2.5 |

) |

|

|

(0.05 |

) |

|

|

1.9 |

|

|

|

0.04 |

|

Loss on extinguishment of debt |

|

|

11.4 |

|

|

|

0.24 |

|

|

|

43.1 |

|

|

|

0.84 |

|

Loss (gain) from remeasurement of benefit plans, net |

|

|

40.6 |

|

|

|

0.85 |

|

|

|

(35.4 |

) |

|

|

(0.69 |

) |

Sales and use tax refund |

|

|

(1.4 |

) |

|

|

(0.03 |

) |

|

|

— |

|

|

|

— |

|

Business transformation costs(3) |

|

|

0.7 |

|

|

|

0.01 |

|

|

|

1.6 |

|

|

|

0.03 |

|

IT transformation costs(4) |

|

|

4.3 |

|

|

|

0.09 |

|

|

|

4.2 |

|

|

|

0.08 |

|

Insurance recoveries(5) |

|

|

(31.3 |

) |

|

|

(0.65 |

) |

|

|

— |

|

|

|

— |

|

Rebranding costs(6) |

|

|

1.0 |

|

|

|

0.03 |

|

|

|

— |

|

|

|

— |

|

Accelerated depreciation and amortization |

|

|

0.7 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

Provision (benefit) for income taxes(7) |

|

|

— |

|

|

|

— |

|

|

|

6.4 |

|

|

|

0.12 |

|

Tax effect on above adjustments(8) |

|

|

(3.1 |

) |

|

|

(0.06 |

) |

|

|

6.5 |

|

|

|

0.13 |

|

As adjusted |

|

$ |

89.8 |

|

|

$ |

1.91 |

|

|

$ |

94.2 |

|

|

$ |

1.87 |

|

(1) For the year ended December 31, 2023, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (1.9 million shares) and common share equivalents for shares issuable for equity-based awards (2.1 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the year ended December 31, 2023 was 47.8 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $1.0 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

(2) Adjusted net income (loss) and adjusted diluted earnings (loss) per share are defined as net income (loss) and diluted earnings (loss) per share, respectively, excluding, as applicable, adjustments listed in the foregoing table.

(3) Business transformation costs consist primarily of professional service fees associated with strategic initiatives and organizational changes.

(4) IT transformation costs were primarily related to professional service fees not eligible for capitalization that are associated specifically with an information technology application simplification and modernization project.

(5) During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. Metallus recognized an insurance recovery of $31.3 million related to the unplanned downtime in 2023, of which $11.3 million was received during 2023 and $20.0 million was received in the first quarter of 2024.

(6) Rebranding costs consist primarily of professional service fees associated with the company's name change to Metallus Inc., announced during the first quarter of 2024.

(7) Provision (benefit) for income taxes includes the net tax benefit (expense) from non-routine income tax items. For the twelve months ended December 31, 2022, this amount includes a tax benefit associated with the reversal of an inventory reserve related to an accounting policy change from LIFO to FIFO, which occurred in 2019 and a tax expense related to the reversal of our full domestic valuation allowance, and a tax benefit to normalize the income tax impact of recognizing full year income tax in the fourth quarter of 2022 due to the timing of release of the company’s full domestic valuation allowance.

(8) Tax effect on above adjustments includes the tax impact related to the adjustments shown above.

(9) For the year ended December 31, 2022, common share equivalents for shares issuable upon the conversion of outstanding convertible notes (3.6 million shares) and common share equivalents for shares issuable for equity-based awards (2.1 million shares) were included in the computation of as reported and as adjusted diluted earnings (loss) per share, as they were considered dilutive. The total diluted weighted average shares outstanding for the year ended December 31, 2022 was 51.5 million shares. For the convertible notes, the company utilizes the if-converted method to calculate diluted earnings (loss) per share. As such, net income was adjusted to add back $1.9 million of convertible notes interest expense (including amortization of convertible notes issuance costs).

Reconciliation of Earnings (Loss) Before Interest and Taxes (EBIT)(2), Adjusted EBIT(4), Earnings (Loss) Before Interest, Taxes, Depreciation and Amortization (EBITDA)(3) and Adjusted EBITDA(5) to GAAP Net Income (Loss):

This reconciliation is provided as additional relevant information about the company's performance. EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA are important financial measures used in the management of the business, including decisions concerning the allocation of resources and assessment of performance. Management believes that reporting EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA is useful to investors as these measures are representative of the company's performance. Management also believes that it is appropriate to compare GAAP net income (loss) to EBIT, Adjusted EBIT, EBITDA and Adjusted EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Year Ended

December 31, |

|

|

Three Months Ended

September 30, |

|

(Dollars in millions) (Unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

Net income (loss) |

|

$ |

1.3 |

|

|

$ |

(33.2 |

) |

|

$ |

69.4 |

|

|

$ |

65.1 |

|

|

$ |

24.8 |

|

Net Income Margin (1) |

|

|

0.4 |

% |

|

|

(13.5 |

%) |

|

|

5.1 |

% |

|

|

4.9 |

% |

|

|

7.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (benefit) for income taxes |

|

|

2.4 |

|

|

|

28.9 |

|

|

|

27.0 |

|

|

|

32.0 |

|

|

|

9.8 |

|

Interest (income) expense, net |

|

|

(2.1 |

) |

|

|

(1.0 |

) |

|

|

(7.1 |

) |

|

|

0.6 |

|

|

|

(1.8 |

) |

Earnings Before Interest and Taxes (EBIT) (2) |

|

$ |

1.6 |

|

|

$ |

(5.3 |

) |

|

$ |

89.3 |

|

|

$ |

97.7 |

|

|

$ |

32.8 |

|

EBIT Margin (2) |

|

|

0.5 |

% |

|

|

(2.2 |

%) |

|

|

6.6 |

% |

|

|

7.3 |

% |

|

|

9.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

14.1 |

|

|

|

14.6 |

|

|

|

56.9 |

|

|

|

58.3 |

|

|

|

14.0 |

|

Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) (3) |

|

$ |

15.7 |

|

|

$ |

9.3 |

|

|

$ |

146.2 |

|

|

$ |

156.0 |

|

|

$ |

46.8 |

|

EBITDA Margin (3) |

|

|

4.8 |

% |

|

|

3.8 |

% |

|

|

10.7 |

% |

|

|

11.7 |

% |

|

|

13.2 |

% |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.8 |

|

|

|

— |

|

Accelerated depreciation and amortization (EBIT only) |

|

|

— |

|

|

|

— |

|

|

|

0.7 |

|

|

|

— |

|

|

|

0.1 |

|

(Gain) loss from remeasurement of benefit plans |

|

|

38.8 |

|

|

|

1.8 |

|

|

|

40.6 |

|

|

|

(35.4 |

) |

|

|

(1.0 |

) |

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

11.4 |

|

|

|

43.1 |

|

|

|

— |

|

Sales and use tax refund |

|

|

(1.4 |

) |

|

|

— |

|

|

|

(1.4 |

) |

|

|

— |

|

|

|

— |

|

Business transformation costs (6) |

|

|

0.6 |

|

|

|

0.1 |

|

|

|

0.7 |

|

|

|

1.6 |

|

|

|

0.1 |

|

IT transformation costs (7) |

|

|

1.2 |

|

|

|

1.3 |

|

|

|

4.3 |

|

|

|

4.2 |

|

|

|

1.0 |

|

Rebranding costs (8) |

|

|

0.5 |

|

|

|

— |

|

|

|

1.0 |

|

|

|

— |

|

|

|

0.2 |

|

(Gain) loss on sale or disposal of assets, net |

|

|

0.3 |

|

|

|

(0.6 |

) |

|

|

(2.5 |

) |

|

|

1.9 |

|

|

|

(0.3 |

) |

Insurance recoveries (9) |

|

|

(20.0 |

) |

|

|

— |

|

|

|

(31.3 |

) |

|

|

— |

|

|

|

— |

|

Adjusted EBIT (4) |

|

$ |

21.6 |

|

|

$ |

(2.7 |

) |

|

$ |

112.8 |

|

|

$ |

113.9 |

|

|

$ |

32.9 |

|

Adjusted EBIT Margin (4) |

|

|

6.6 |

% |

|

|

(1.1 |

%) |

|

|

8.3 |

% |

|

|

8.6 |

% |

|

|

9.3 |

% |

Adjusted EBITDA (5) |

|

$ |

35.7 |

|

|

$ |

11.9 |

|

|

$ |

169.0 |

|

|

$ |

172.2 |

|

|

$ |

46.8 |

|

Adjusted EBITDA Margin (5) |

|

|

10.9 |

% |

|

|

4.8 |

% |

|

|

12.4 |

% |

|

|

12.9 |

% |

|

|

13.2 |

% |

(1) Net Income Margin is defined as net income (loss) as a percentage of net sales.

(2) EBIT is defined as net income (loss) before interest (income) expense, net and income taxes. EBIT Margin is EBIT as a percentage of net sales.

(3) EBITDA is defined as net income (loss) before interest (income) expense, net, income taxes, depreciation and amortization. EBITDA Margin is EBITDA as a percentage of net sales.

(4) Adjusted EBIT is defined as EBIT excluding, as applicable, adjustments listed in the table above. Adjusted EBIT Margin is Adjusted EBIT as a percentage of net sales.

(5) Adjusted EBITDA is defined as EBITDA excluding, as applicable, adjustments listed in the table above. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of net sales.

(6) Business transformation costs consist primarily of professional service fees associated with strategic initiatives and organizational changes.

(7) IT transformation costs are primarily related to professional service fees not eligible for capitalization that are associated specifically with an information technology application simplification and modernization project.

(8) Rebranding costs consist primarily of professional service fees associated with the company's name change to Metallus Inc., announced during the first quarter of 2024.

(9) During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. Metallus recognized an insurance recovery of $31.3 million related to the unplanned downtime in 2023, of which $11.3 million was received during 2023 and $20.0 million was received in the first quarter of 2024.

Reconciliation of Base Sales by end-market to GAAP Net Sales by end-market:

The tables below present net sales by end-market, adjusted to exclude surcharges, which represents a financial measure that has not been determined in accordance with GAAP. We believe presenting net sales by end-market, both on a gross basis and on a per ton basis, adjusted to exclude raw material and natural gas surcharges, provides additional insight into key drivers of net sales such as base price and product mix. Due to the fact that the surcharge mechanism can introduce volatility to our net sales, net sales adjusted to exclude surcharges provides management and investors clarity of our core pricing and results. Presenting net sales by end-market, adjusted to exclude surcharges including on a per ton basis, allows management and investors to better analyze key market indicators and trends and allows for enhanced comparison between our end-markets.

When surcharges are included in a customer agreement and are applicable (i.e., reach the threshold amount), based on the terms outlined in the respective agreement, surcharges are then included as separate line items on a customer’s invoice. These additional surcharge line items adjust base prices to match cost fluctuations due to market conditions. Each month, the company will post on the surcharges page of its external website, as well as our customer portal, the scrap, alloy, and natural gas surcharges that will be applied (as a separate line item) to invoices dated in the following month (based upon shipment volumes in the following month). All surcharges invoiced are included in GAAP net sales.

In the fourth quarter of 2023, the company split the aerospace & defense end-market out from the industrial end-market for greater visibility into a targeted area of growth for the company. These changes have been retrospectively applied and prior periods have been included for comparability in the following tables.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Dollars in millions, tons in thousands) |

|

|

|

Three Months Ended December 31, 2023 |

|

|

|

Industrial |

|

|

Automotive |

|

|

Aerospace & Defense |

|

|

Energy |

|

|

Other |

|

|

Total |

|

Ship Tons |

|

|

58.7 |

|

|

|

67.4 |

|

|

|

18.5 |

|

|

|

13.0 |

|

|

|

— |

|

|

|

157.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

118.0 |

|

|

$ |

127.1 |

|

|

$ |

44.1 |

|

|

$ |

32.7 |

|

|

$ |

6.2 |

|

|

$ |

328.1 |

|

Less: Surcharges |

|

|

27.7 |

|

|

|

26.0 |

|

|

|

5.9 |

|

|

|

7.2 |

|

|

|

— |

|

|

|

66.8 |

|

Base Sales |

|

$ |

90.3 |

|

|

$ |

101.1 |

|

|

$ |

38.2 |

|

|

$ |

25.5 |

|

|

$ |

6.2 |

|

|

$ |

261.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales / Ton |

|

$ |

2,009 |

|

|

$ |

1,886 |

|

|

$ |

2,384 |

|

|

$ |

2,515 |

|

|

$ |

— |

|

|

$ |

2,082 |

|

Surcharges / Ton |

|

$ |

472 |

|

|

$ |

386 |

|

|

$ |

319 |

|

|

$ |

554 |

|

|

$ |

— |

|

|

$ |

424 |

|

Base Sales / Ton |

|

$ |

1,537 |

|

|

$ |

1,499 |

|

|

$ |

2,065 |

|

|

$ |

1,961 |

|

|

$ |

— |

|

|

$ |

1,658 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2022 |

|

|

|

Industrial |

|

|

Automotive |

|

|

Aerospace & Defense |

|

|

Energy |

|

|

Other |

|

|

Total |

|

Ship Tons |

|

|

40.5 |

|

|

|

67.7 |

|

|

|

7.0 |

|

|

|

13.1 |

|

|

|

— |

|

|

|

128.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales |

|

$ |

74.6 |

|

|

$ |

112.1 |

|

|

$ |

24.9 |

|

|

$ |

29.3 |

|

|

$ |

4.5 |

|

|

$ |

245.4 |

|

Less: Surcharges |

|

|

17.2 |

|

|

|

27.8 |

|

|

|

2.7 |

|

|

|

6.8 |

|

|

|

— |

|

|

|

54.5 |

|

Base Sales |

|

$ |

57.4 |

|

|

$ |

84.3 |

|

|

$ |

22.2 |

|

|

$ |

22.5 |

|

|

$ |

4.5 |

|

|

$ |

190.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Sales / Ton |

|

$ |

1,842 |

|

|

$ |

1,656 |

|

|

$ |

3,557 |

|

|

$ |

2,237 |

|

|

$ |

— |

|

|

$ |

1,913 |

|

Surcharges / Ton |

|

$ |

425 |

|

|

$ |

411 |

|

|

$ |

386 |

|

|

$ |

519 |

|

|

$ |

— |

|

|

$ |

425 |

|

Base Sales / Ton |

|

$ |

1,417 |

|

|

$ |

1,245 |

|

|

$ |

3,171 |

|

|

$ |

1,718 |

|

|

$ |

— |

|

|

$ |

1,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2023 |

|

|

|

Industrial |

|

|

Automotive |

|

|

Aerospace & Defense |