UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934

Check the appropriate box:

| ¨ |

Preliminary

Information Statement |

| |

|

| ¨ |

Confidential, for Use of

the Commission Only (as permitted by Rule 14c-5(d)(2)) |

| |

|

| x |

Definitive Information

Statement |

KULR TECHNOLOGY GROUP, INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required |

| |

|

| ¨ |

Fee paid previously with

preliminary materials. |

| |

|

| ¨ |

Fee computed on table in

exhibit required by Item 25(b) of Schedule 14A (17CFR 240.14a-101) per Item 1 of this Schedule and Exchange Act Rules 14c-5(g) and

0-11 |

KULR Technology Group, Inc.

4863 Shawline Street, Suite B, San Diego,

CA 92111

Telephone: (408) 663-5247

February 23, 2024

NOTICE OF WRITTEN CONSENT OF STOCKHOLDERS

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND A PROXY

To the Stockholders of KULR Technology Group, Inc.:

This Notice and the

accompanying Information Statement are being furnished to the stockholders of KULR Technology Group, Inc., a Delaware

corporation (the “Company,” “we,” “us,” or “our”), in connection with the corporate

actions described below taken by the Company’s Board of Directors (“Board”) and by the holders of a majority of

the Company’s voting capital stock. The holders of a majority of the Company’s voting capital stock, by written consent

in lieu of a meeting delivered on February 9, 2024, pursuant to Section 228 of Title 8 the Delaware General Corporation

Law (“DGCL”) and Article I of our bylaws, provided approval for the following corporate actions, respectively (the

“Authorizations”):

| |

Item 1. |

The approval of the issuance

of shares of Common Stock (and/or securities convertible into or exercisable for common stock), to potential current and/or future

engagements with commercial or strategic parties, which may result in issuances of securities of over 20% of the issued and outstanding

shares of Common Stock, to comply with Section 713 of the NYSE American LLC Company Guide (the “Strategic Issuances”); |

| |

|

|

| |

Item 2. |

The approval of an amendment

to the Company’s Bylaws to decrease the number of shares of Common Stock needed to establish a quorum for meetings of stockholders

to thirty-three-and-one-third percent (33 1/3%) of the outstanding voting securities of the Company (the “Bylaws Amendment”). |

| |

|

|

| |

Item 3. |

The approval of an amendment

to the Amended and Restated Certificate of Incorporation of the Company (the “Certificate of Incorporation”), authorizing

the Board to combine outstanding shares of Common Stock into a lesser number of outstanding shares, a “Reverse Stock Split,”

by a ratio of not less than 1-for-2 and not more than 1-for-80, with the exact ratio to be set at a whole number within this range

by the Board, and the effective date of such Reverse Stock Split to be determined by the Board, in its sole discretion (the “Reverse

Stock Split”); and |

| |

|

|

| |

Item 4. |

The approval of the issuance

of shares of Common Stock (and/or securities convertible into or exercisable for common stock), in connection with the SEPA financing

facility, which may result in potential issuances of securities of over 20% of the issued and outstanding shares of Common Stock,

to comply with Section 713 of the NYSE American LLC Company Guide (the “SEPA Issuances”); |

| |

|

|

Concurrently with the Authorizations,

all of the members of the Board, by written consents in lieu of a meeting, as provided under the DGCL, provided similar authorizations

dated February 2, 2024.

The accompanying

Information Statement is being furnished to our stockholders of record as of February 9, 2024, in accordance with

Rule 14c-2 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the

rules promulgated by the Securities and Exchange Commission thereunder, solely for the purpose of informing our stockholders of

the actions taken by the written consent. As the matters set forth in the accompanying Information Statement have been duly

authorized and approved by the written consent of the holders of more than a majority of the Company’s voting securities, your

vote or consent is not requested or required to approve these matters. The accompanying Information Statement is provided solely for

your information, and also serves the purpose of informing stockholders of the matters described herein pursuant to

Section 14(c) of the Securities Exchange Act of 1934, as amended, and the rules and regulations prescribed

thereunder, including Regulation 14C. The accompanying Information Statement also serves as the notice required by Section 228

of Title 8 of the DGCL of the taking of a corporate action without a meeting by less than unanimous written consent of the

Company’s stockholders. You do not need to do anything in response to this Notice and the Information Statement.

Pursuant to Rule 14c-2(b) promulgated

by the SEC under the Exchange Act, the actions approved by the Authorizations and the written consent of the Board, cannot become effective

until twenty (20) days from the date of mailing of the Definitive Information Statement to our stockholders as of the Record Date.

THIS

IS NOT A NOTICE OF A MEETING AND NO STOCKHOLDERS’ MEETING WILL BE HELD TO CONSIDER THE MATTERS DESCRIBED HEREIN. WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

| By Order of

the Board of Directors |

|

| |

|

| /s/ Michael

Mo |

|

| Michael Mo |

|

| |

|

| Chief Executive Officer |

|

| |

|

| February 23, 2024 |

|

NYSE American Requirements

The Company is subject to the NYSE American Company

Guide because our Common Stock is currently listed on the NYSE American LLC (“NYSE American”). The issuance of shares of

our Common Stock under the Items 1 and 4 of this information statement implicate certain of the NYSE American listing standards requiring

prior stockholder approval in order to maintain our listing on the NYSE American.

Section 713 of the NYSE American Company

Guide requires stockholder approval prior to the issuance of securities in connection with a transaction other than a public offering

involving (1) the sale, issuance, or potential issuance by the issuer of common stock (or securities convertible into common stock)

at a price less than the greater of book or market value which together with sales by officers, directors or principal stockholders of

the issuer equals 20% or more of presently outstanding common stock; (2) the sale, issuance, or potential issuance by the issuer

of common stock (or securities convertible into common stock) equal to 20% or more of presently outstanding common stock for less than

the greater of book or market value of the stock; or (3) the issuance of shares in connection with a transaction other than a public

offering when the issuance or potential issuance will result in a change of control of the issuer.

The

foregoing resolution for the transactions contemplated under Items 1 and 4 is required, among other reasons, because of Section 713

of the NYSE American Company Guide, pursuant to which stockholder approval is required prior to the sale, issuance, or potential issuance

of common stock (or securities convertible into common stock) by the Company, equal to 20% or more of presently outstanding stock for

less than the greater of book or market value of the stock (“Minimum Price”).

As a result of the foregoing Authorizations,

on the date which is 20 calendar days after the date of mailing this Information Statement to its shareholders, the Company will be in

compliance with Section 713 of the NYSE American Company Guide, as the Authorization will then constitute shareholder approval for

the Company to issue shares of Common Stock in an amount greater than 19.99% of the then issued and outstanding Common Stock

of the Company, even if the price per share of Common Stock issued in connection with the transactions is less than the Minimum Price.

Dissenters’ Right of Appraisal

No dissenters’ or appraisal rights under

the DGCL are afforded to the Company’s stockholders as a result of the approval of the Authorizations.

The consent we have received constitutes the

only stockholder approval required under the DGCL, NYSE American Company Guide Section 713, our Certificate of Incorporation and

our Bylaws, to approve the (i) the Strategic Issuances, (ii) the Bylaws Amendment, (iii) the Reverse Stock Split, and

(iv) the SEPA Issuances. Our Board of Directors is not soliciting your consent or your proxy in connection with the actions and

neither any consents nor any proxies are being requested from stockholders.

Vote Required

The vote, which was required to approve the above

Authorizations, was the affirmative vote of the holders of a majority of the Company’s voting stock. Each holder of Common Stock

is entitled to one (1) vote for each share of Common Stock held, and each holder of Series A Voting Preferred Stock, par value

$0.0001 per share (“Preferred Stock”) is entitled to one hundred (100) votes for each share of Preferred Stock held.

The date used for purposes of determining

the number of outstanding shares of the voting stock of the Company entitled to vote to approve the (i) the Strategic

Issuances, (ii) the Bylaws Amendment, (iii) the Reverse Stock Split, and (iv) the SEPA Issuances, is February 9,

2024 (the “Voting Record Date”). The record date for determining those shareholders of the Company entitled to receive

this Information Statement is the close of business on February 9, 2024 (the “Mailing Record Date”). As of the

Voting Record Date, the Company had an aggregate voting power of 206,197,336 attributable to all outstanding shares of voting stock

outstanding, with 133,197,336 shares being votable Common Stock, and 730,000 shares being votable Preferred Stock. All outstanding

shares are fully paid and nonassessable.

Vote Obtained

Section 228(a) of the DGCL and Article I

of our bylaws provide that any action which may be taken at any annual or special meeting of stockholders may be taken without a meeting,

without prior notice and without a vote, via written consent of the holders of outstanding stock having not less than the minimum number

of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled to vote thereon were present

and voted.

The approximate ownership percentage of the voting

stock of the Company as of the Voting Record Date of the consenting stockholders who voted to approve the (i) the Strategic Issuances,

(ii) the Bylaws Amendment, (iii) the Reverse Stock Split, and (iv) the SEPA Issuances, totaled in the aggregate 55.72%.

Notice Pursuant to Section 228 of the

DGCL

Pursuant to Section 228 of the DGCL, no

advance notice is required to be provided to the other shareholders, who have not consented in writing to such action, of the taking

of the stated corporate action without a meeting of stockholders. No additional action will be undertaken pursuant to such written consents,

and no dissenters’ rights under the DGCL are afforded to the Company’s stockholders as a result of the action to be taken.

Pursuant to Section 228 of the DGCL, we

are required to provide prompt notice of the taking of corporate action by written consent to our stockholders who have not consented

in writing to such action. This Information Statement serves as the notice required by Section 228 of the DGCL.

TABLE OF CONTENTS

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND A PROXY

ITEM

1.

STRATEGIC

ISSUANCES

In compliance with section 713 of the NYSE

American company guide

Our common stock is currently listed on NYSE

American market and, as such, we are subject to NYSE American market rules. Section 713 of the NYSE American Company Guide requires

us to obtain stockholder approval prior to the issuance of our common stock in connection with certain non-public offerings involving

the sale, issuance or potential issuance by the Company of common stock (and/or securities convertible into or exercisable for common

stock) equal to 20% or more of the common stock outstanding before the issuance. Shares of our common stock issuable upon the exercise

or conversion of warrants, options, debt instruments, preferred stock or other equity securities issued or granted in such nonpublic

offerings will be considered shares issued in such a transaction in determining whether the 20% limit has been reached.

On December 20, 2023, the Company received

notification from the NYSE American that it was noncompliant with the NYSE American continued listing standards. The notification letter

stated that the Company’s stockholders’ equity as reported in its Quarterly Report on Form 10-Q for the quarter

ended September 30, 2023 was not in compliance with the continued listing standards under Section 1003(a)(iii) of the

NYSE American Company Guide (the “Company Guide”). Section 1003(a)(iii) of the Company Guide requires a listed

company to have stockholders’ equity of $6 million or more if the listed company has reported losses from continuing operations

and/or net losses in its five most recent fiscal years. The Company is now subject to the procedures and requirements of Section 1009

of the Company Guide.

For the purposes of regaining compliance with

the NYSE American Company Guide, the Company has and continues to explore opportunities with commercial counterparties that could result

in the issuance of Common Stock (and/or securities convertible into or exercisable for common stock) to such commercial or strategic

parties (“Strategic Issuances”), which issuance of securities could be equal to or greater than 20% of the issued and outstanding

shares of Common Stock.

Since we may make such Strategic Issuances that

could trigger the requirements of Section 713, this stockholder approval enables us to move quickly to take full advantage of any

opportunities that may develop. We may effectuate the approved Strategic Issuances in one or a series of transactions. Although no assurances

can be made that such a transaction would be consummated, such a transaction could help meet our continuing shareholder’s equity

requirements under the listing standards of the NYSE American.

The issuance of shares of our common stock, or

other securities convertible into shares of our common stock, in accordance with any Strategic Issuance would dilute, and thereby reduce,

each existing stockholder’s proportionate ownership in our common stock. Our stockholders do not have preemptive rights to subscribe

to additional shares that may be issued by the Company in private offerings in order to maintain their proportionate ownership of the

common stock.

The Strategic Issuances could also have an anti-takeover

effect. Such issuance could dilute the voting power of a person seeking control of the Company, thereby deterring, or rendering more

difficult a merger, tender offer, proxy contest or an extraordinary corporate transaction opposed by the Company.

The Board has not yet determined the terms and

conditions of any Strategic Issuances. As a result, the level of potential dilution cannot be determined at this time.

Aligning with our objectives to enhance shareholder

equity and enhance our operations by seeking strategic alliances with commercial counterparties, we have obtained such stockholder approval

to issue shares exceeding 20% of our currently outstanding and issued shares of Common Stock, allowing us to swiftly capitalize on such

strategic opportunities as they arise. This significant step empowers our Company to respond more dynamically to potential growth initiatives,

ensuring we are well-positioned to leverage market conditions favorably and deliver substantial value to our stockholders. The Board

believes that this proactive measure will facilitate our pursuit of Strategic Issuances that will help to enhance our market presence

and drive long-term success.

Item

2.

BYLAWS

AMENDMENT

Amendment to the Bylaws

The Board determined that an amendment to the

Amended and Restated Bylaws of the Company, is in the Company’s and our stockholders’ best interests. More specifically,

the Bylaws Amendment reduced the quorum for stockholder meetings from a majority of the outstanding voting securities of the Company

(the “Current Quorum”) to thirty-three-and-one-third percent (33 1/3%) of the outstanding voting securities of the Company

(the “New Quorum”). The Board has adopted and declared advisable the Bylaws Amendment, which is necessary in order to implement

the New Quorum.

General

A quorum is the minimum number of voting

power that must be present in person or by proxy at a stockholder meeting in order for that meeting to be validly held. It is a

requirement under Delaware law that a company specify its quorum for its stockholder meetings by defining the proportion of the

voting power that constitutes a quorum in its articles of incorporation or bylaws.

Our Bylaws provide that the Current Quorum for

a meeting of the Company’s stockholders is participation of the holders of a majority of the shares entitled to vote, represented in person or by

proxy. Under Delaware law and NYSE Stock Market Rules the minimum quorum requirement is 33 1/3%. Our Current Quorum is above the

minimum quorum requirement under law.

We may have difficulties reaching our Current

Quorum for our stockholder meetings in a timely manner. If we do not achieve our Current Quorum by the originally scheduled meeting dates,

then we would have to adjourn the meeting for some period to allow us to solicit further proxies from our stockholders in order to reach

the Current Quorum and validly hold the meeting of stockholders. At the November 2023 Annual Meeting, less than 55% of our holders

voted by submitting their proxies or voting at the respective meeting.

Reasons for the Bylaws Amendment

As a result of the above, the Board believes

that a reduction in the Current Quorum, for any future stockholder meetings, to the New Quorum, and the Bylaws Amendment to make this

change, is in the best interests of the Company and its stockholders. By adopting the Bylaws Amendment:

| |

· |

we will reduce the risk

of our failing to achieve the required quorum for any stockholder meetings, which failure would require us to adjourn such meetings

and therefore cause us to incur additional costs, such as additional virtual meeting host costs and possibly hiring proxy solicitors,

and suffer disruptions to our business; and |

| |

· |

we believe that the New

Quorum is high enough to ensure that a broad range of stockholders are present at a stockholder meeting in person or by proxy. |

Accordingly, the Board has adopted and declared

advisable the Bylaws Amendment. The text of the Amendment to the Company’s Bylaws is included as Annex A to this Information

Statement.

Effectiveness of the Bylaws Amendment

The Bylaws Amendment will become effective

upon the expiration of the 20-day period commencing on the date of mailing of this Information Statement to our stockholders as required

under Rule 14c-2 under the Exchange Act.

ITEM

3.

REVERSE

STOCK SPLIT

Reasons for Effecting the Reverse Split

To avoid delisting from the NYSE American.

On December 20, 2023, the Company received

a deficiency letter (the “Deficiency Letter”) from the NYSE American LLC (the “NYSE American”) indicating that

the Company is not in compliance with the NYSE American continued listing standard set forth in Sections 1003(a)(i), (ii) and (iii) of

the NYSE American Company Guide (the “Company Guide”), since the Company reported stockholders’ equity of $1.2 million

as of September 30, 2023, and losses from continuing operations and/or net losses in its five most recent fiscal years ended December 31,

2022. Accordingly, the Company does not meet the NYSE American continued listing standards, making the company susceptible to delisting

of our shares of Common Stock.

Management and the Board have considered the

potential harm to us and our stockholders should the NYSE American delist the Common Stock from the NYSE American. Delisting could adversely

affect the liquidity of the Common Stock since alternatives, such as the OTC Bulletin Board and the pink sheets, are generally considered

to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to

buy, Common Stock on an over-the-counter market. Many investors likely would not buy or sell Common Stock due to difficulty in accessing

over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or for other reasons.

The Board believes that the Reverse Split is a potentially effective means for us to, as discussed below, potentially improve the marketability

and liquidity of Common Stock and to help avoid, or at least mitigate, the likely adverse consequences of the Common Stock being delisted

from the NYSE American by potentially attracting investors to financing the Company and increase our shareholder equity.

Our board strongly believes that the Reverse

Stock Split is necessary to maintain our listing on the NYSE American. Accordingly, the board has approved resolutions proposing the

Reverse Stock Split and approving the amendment to the Company’s Certificate of Incorporation and file with the Secretary of the

State of Delaware a Certificate of Amendment to the Certificate of Incorporation (the “Certificate of Amendment”) to effect

the Reverse Stock Split. The text of the Certificate of Amendment is included as Annex B to this Information Statement.

To

potentially improve the marketability and liquidity of the Common Stock.

Our Board believes that the increased market

price of the Common Stock expected as a result of implementing the Reverse Split could improve the marketability and liquidity of the

Common Stock and encourage interest and trading in the Common Stock.

| |

· |

Stock Price Requirements:

We understand that many brokerage houses, institutional investors and funds have internal policies and practices that either prohibit

them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers

or by restricting or limiting the ability to purchase such stocks on margin. Additionally, the Reverse Split could help increase

analyst and broker interest in the Common Stock as their internal policies might discourage them from following or recommending companies

with low stock prices. |

| |

|

|

| |

· |

Stock Price Volatility:

Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors have

internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers

from recommending low-priced stocks to their customers. Some of those policies and practices may make the processing of trades in

low-priced stocks economically unattractive to brokers. |

| |

|

|

| |

· |

Transaction Costs: Investors

may be dissuaded from purchasing stocks below certain prices because brokers’ commissions, as a percentage of the total transaction

value, can be higher for low-priced stocks. |

To

improve the perception of the Common Stock as an investment security.

The Board believes that effecting the Reverse

Split is one potential means of increasing the share price of the Common Stock to improve the perception of the Common Stock as a viable

investment security. Lower-priced stocks have a perception in the investment community as being risky and speculative, which may negatively

impact not only the price of the Common Stock, but also our market liquidity.

To provide us with flexibility with respect

to our authorized Common Stock.

The Reverse Stock Split will effectively increase

the number of authorized and unreserved shares of our Common Stock for future issuances by the amount of the reduction in outstanding

Common Stock effected by the Reverse Stock Split. These additional shares would be available in the event that the Board determines that

it is necessary or appropriate to: (i) provide financial flexibility to raise additional capital through the sale of equity securities,

convertible securities, or other equity-linked securities; (ii) enter into strategic business transactions; (iii) provide equity

incentives to directors, officers, and employees pursuant to equity compensation plans; and (iv) for other corporate purposes. The

availability of additional shares of Common Stock is particularly important in the event that the Board needs to undertake any of the

foregoing actions on an expedited basis, as market conditions permit and favorable financing and business opportunities become available,

and thus without the potential delay associated with convening a special stockholders’ meeting at that time.

Accordingly, the Board believes that the Reverse

Stock Split is in the best interest of the Company and our stockholders to regain NYSE listing compliance, facilitate capital raising,

and enhance the marketability and liquidity of our Common Stock, among other reasons.

Certain Risks Associated with the Reverse

Split

Even if the Reverse Split is effected, some or

all of the expected benefits discussed above may not be realized or maintained. The market price of the Common Stock will continue to

be based, in part, on our performance and other factors unrelated to the number of shares outstanding. The Reverse Split will reduce

the number of outstanding shares of the Common Stock without reducing the number of shares of available but unissued Common Stock, which

will also have the effect of increasing the number of shares of Common Stock available for issuance. The issuance of additional shares

of Common Stock may have a dilutive effect on the ownership of existing stockholders. The current economic environment in which we operate,

the debt we carry, along with otherwise volatile equity market conditions, could limit our ability to raise new equity capital in the

future.

Criteria to be Used for Determining the Reverse

Split Ratio to Implement

In determining which Reverse Split ratio to implement,

if any, our Board may consider, among other things, various factors, such as:

| |

· |

The historical trading

price and trading volume of the Common Stock; |

| |

· |

The then-prevailing trading

price and trading volume of the Common Stock and the expected impact of the Reverse Split on the trading market for the Common Stock

in the short- and long-term; |

| |

· |

Our ability to maintain

our listing on NYSE American; |

| |

· |

Which Reverse Split ratio

would result in the least administrative cost to us; |

| |

· |

Prevailing general market

and economic conditions; and |

| |

· |

Whether and when our Board

desires to have the additional authorized but unissued shares of Common Stock that will result from the implementation of the Reverse

Split available to provide the flexibility to use the Common Stock for business and/or financial purposes, as well as to accommodate

the shares of Common Stock to be authorized and reserved for future equity awards. |

Effects of Reverse Split

After the effective date of the Reverse Split, each stockholder will

own a reduced number of shares of Common Stock. However, the Reverse Split will affect all of our stockholders and holders of derivative

securities and voting securities uniformly and will not affect any stockholder’s percentage ownership or voting interests in the

Company, except to the extent that the Reverse Split results in any of our stockholders owning a fractional share as described below.

Voting rights and other rights and preferences of the holders of Common Stock will not be affected by the Reverse Split (other than as

a result of the rounding up or payment of cash in lieu of issuing fractional shares). For example, a holder of 2% of the voting power

of the outstanding shares of Common Stock immediately prior to the Reverse Split would continue to hold 2% of the voting power of the

outstanding shares of Common Stock immediately after the Reverse Split (assuming there is no impact as a result of the rounding up or

payment of cash in lieu of issuing fractional shares). The number of stockholders of record will not be affected by the Reverse Split.

The Reverse Stock Split will be effected simultaneously

for all of our outstanding Common Stock and the exchange ratio of the Reverse Stock Split and split denominator will be the same for

all of our outstanding Common Stock. The Reverse Stock Split will affect all of our stockholders uniformly and will not affect any stockholder’s

percentage ownership interest in the Company, except to the extent that the Reverse Stock Split results in any of our stockholders owning

a fractional share. As described below, stockholders and holders of options holding fractional shares will have their shares rounded

up to the nearest whole number. Common Stock issued pursuant to the Reverse Stock Split will remain fully paid and non-assessable. We

will continue to be subject to the periodic reporting requirements of the Exchange Act.

The principal effects of the Reverse Split would

be that:

| |

· |

Depending on the Reverse

Split ratio selected by the Board, each 2 to 80 shares of Common Stock owned by a stockholder will be combined into one new share

of Common Stock; |

| |

· |

By effectively condensing

a number of pre-split shares into one share of Common Stock, the per share price of a post-split share is generally greater than

the per share price of a pre-split share. The amount of the initial increase in per share price and the duration of such increase,

however, is uncertain. The Board may utilize the Reverse Split as part of its plan to comply with the Company Guide; |

| |

· |

By reducing the number

of shares outstanding without reducing the number of shares of Common Stock authorized for issuance, the Reverse Split will increase

the number of shares of Common Stock available for issuance. The Board believes the increase is appropriate for use to fund the future

operations of the Company. Although the Company does not have any pending acquisitions for which shares are expected to be used,

the Company may also use authorized shares in connection with the financing of future acquisitions; |

| |

· |

No fractional shares of

Common Stock will be issued in connection with the Reverse Split; instead, stockholders who would be entitled to receive fractional

shares of Common Stock because they hold a number of shares not evenly divisible by the Reverse Split ratio will, as determined by

the Board, either (a) be issued an additional fraction of a share of Common Stock to round up to the next whole post-Reverse

Split share of Common Stock or (b) receive cash in lieu of fractional shares. |

| |

· |

The total number of authorized

shares of Common Stock will remain at 500,000,000; |

| |

· |

The total number of authorized

shares of our preferred stock will remain at 20,000,000; |

| |

· |

Based upon the Reverse

Split ratio selected by the Board, proportionate adjustments will be made to the per share exercise price and the number of shares

issuable upon the exercise or vesting of all then outstanding stock options, restricted stock units and warrants, which will result

in a proportional decrease in the number of shares of Common Stock reserved for issuance upon exercise or vesting of such stock options,

restricted stock units and warrants, and, in the case of stock options and warrants, a proportional increase in the exercise price

of all such stock options and warrants; |

| |

· |

The number of shares then

reserved for issuance under our equity compensation plans will be reduced proportionately based upon the Reverse Split ratio selected

by the Board. |

After the effective date of the Reverse Split,

the Common Stock would have a new committee on uniform securities identification procedures number, or CUSIP number, a number used to

identify the Common Stock.

The Common Stock is currently registered under

Section 12(b) of the Securities Exchange Act, and we are subject to the periodic reporting and other requirements of the Securities

Exchange Act of 1934, as amended, or the Exchange Act. The implementation of the Reverse Split will not affect the registration of the

Common Stock under the Exchange Act. The Common Stock would continue to be listed on NYSE American under the symbol “KULR”

immediately following the Reverse Split.

Effective Date

The Reverse Split would become effective as of

the filing of a Certificate of Amendment with the office of the Secretary of State of the State of Delaware, or such later date and time

as is set forth in the Certificate of Amendment, which date and time we refer to herein as the Reverse Split Effective Time. At the Reverse

Split Effective Time, shares of Common Stock issued and outstanding immediately prior thereto will be combined, automatically and without

any action on the part of us or our stockholders, into a reduced number of shares of Common Stock in accordance with the Reverse Split

ratio determined by our Board within the limits set forth herein and stockholders who otherwise would be entitled to receive fractional

shares because they hold a number of shares not evenly divisible by the Reverse Split ratio will, as determined by the Board, either

(a) be issued an additional fraction of a share of Common Stock to round up to the next whole share or (b) receive cash in

lieu of fractional shares.

Effect on Beneficial Holders (i.e., Stockholders

Who Hold in “Street Name”)

If the proposed Reverse Split is effected, we

intend to treat Common Stock held by stockholders in “street name,” through a bank, broker or other nominee, in the same

manner as stockholders whose shares are registered in their own names. Banks, brokers or other nominees will be instructed to effect

the Reverse Split for their customers holding common stock in “street name.” However, these banks, brokers or other nominees

may have different procedures than registered stockholders for processing the Reverse Split. If you hold shares of Common Stock with

a bank, broker or other nominee and have any questions in this regard, you are encouraged to contact your bank, broker or other nominee.

Effect on Registered “Book-Entry”

Holders (i.e., Stockholders That are Registered on the Transfer Agent’s Books and Records but do not Hold Certificates)

Some of our registered holders of Common Stock

may hold some or all of their shares electronically in book-entry form with our transfer agent, American Stock Transfer & Trust

Company. These stockholders do not have stock certificates evidencing their ownership of Common Stock. They are, however, provided with

a statement reflecting the number of shares registered in their names. If a stockholder holds registered shares in book-entry form with

our transfer agent, no action needs to be taken to receive post-Reverse Split shares. If a stockholder is entitled to post-Reverse Split

shares, a statement will automatically be sent to the stockholder’s address of record indicating the number of shares of Common

Stock held following the Reverse Split.

STOCKHOLDERS SHOULD NOT DESTROY ANY PRE-SPLIT

STOCK CERTIFICATE AND SHOULD NOT SUBMIT ANY CERTIFICATES UNTIL THEY ARE REQUESTED TO DO SO.

Accounting Consequences

The par value of the Common Stock would remain

unchanged at $0.0001 per share, if the Reverse Split is effected.

The Company’s stockholders’ equity

in its consolidated balance sheet would not change in total. However, the Company’s stated capital (i.e., $0.0001 par value times

the number of shares issued and outstanding), would be proportionately reduced based on the reduction in shares of Common Stock outstanding.

Additional paid in capital would be increased by an equal amount, which would result in no overall change to the balance of stockholders’

equity.

Additionally, net income or loss per share for

all periods would increase proportionately as a result of the Reverse Split since there would be a lower number of shares outstanding.

We do not anticipate that any other material accounting consequences would arise as a result of the Reverse Split.

Potential Anti-Takeover Effect

Even though the Reverse Split would result in

an increased proportion of unissued authorized shares to issued shares, which could, under certain circumstances, have an anti-takeover

effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition

of the Board or contemplating a tender offer or other transaction for the combination of us with another company), the Reverse Split

is not being proposed in response to any effort of which we are aware to accumulate shares of Common Stock or obtain control of us, nor

is it part of a plan by management to recommend a series of similar amendments to the Board and our stockholders.

No Appraisal Rights.

Under the DGCL, stockholders are not entitled

to appraisal rights with respect to the proposed Reverse Stock Split and amendment to our articles of incorporation.

Reservation of Right to Abandon Reverse Split

The Board of Directors reserves the right to

abandon the Reverse Split without further action by our stockholders at any time before the effectiveness of the filing with the Secretary

of State of the State of Delaware of the Certificate of Amendment.

ITEM

4.

SEPA

ISSUANCES

In compliance with section 713 of the NYSE

American company guide

On December 19, 2023 the Company entered into a letter amendment

agreement (the “Amendment Agreement”) with YA II PN, Ltd. (“Yorkville”) and Yorkville Advisors Global, L.P

(collectively with Yorkville, the “Investors”) amending and supplementing that certain Letter Agreement dated August 30,

2023 (as amended on November 7, 2023) that was entered into between the Company and the Investors, pursuant to which Amendment Agreement

the Company agreed to seek stockholder approval for issuances, in the event they become needed, above the Exchange Cap (as defined in

the SEPA facility described in detail below). The Amendment Agreement provided the Company an extension to a repayment schedule for amounts

due to the Investors, which repayment schedule was thereafter extended, by amendments, to defer all payments until December 31, 2024.

In the event we are unable to repay any amounts due and owed to Yorkville, Yorkville will have the right to submit investor notices, pursuant

to which the Company would be required to issue shares of its common stock and the aggregate of such issuance could exceed the Exchange

Cap.

Background – the SEPA Facility and Prepaid

Advances

The Company previously entered into the Standby

Equity Purchase Agreement dated May 13, 2022, as amended and supplemented (the “SEPA”) with Yorkville, wherein the Company

has the option to provide advance notices to Yorkville for the purchase of up to $50,000,000 of shares of the Company’s Common Stock.

Pursuant to a supplemental agreement to the SEPA, the Company received certain prepaid Advances (as defined below) from Yorkville. Currently,

the Company owes approximately $4,894,700 in principal amount of the Advances outstanding. In addition to the principal amount the Company

also owes Yorkville interest payments accruing at an annual rate of 10%, and an additional 5% premium payable on cash repayments towards

the Advances.

The terms of the SEPA were intended to comply

with Section 713, in as much as we capped Yorkville’s investment at 19.9% of the total issued and outstanding shares without

giving effect to the investment. Without shareholder approval, the Company may not issue or sell any shares of common stock to Yorkville

under the SEPA which, when aggregated with all other shares of common stock then beneficially owned, would result in the Yorkville beneficially

owning more than 4.99% of the outstanding shares of common stock.

Additionally, we are not currently in compliance

with NYSE American market’s continued listing standards. We have until June 20, 2025, to regain compliance. The Company’s

stockholders’ equity is below the $6.0 million threshold required for listed companies that have reported losses from continuing

operations in its five most recent fiscal years. Issuances under the SEPA could have the effect of increasing stockholders’ equity

and could help meet our continuing shareholder’s equity requirements under the listing standards of the NYSE American.

Pursuant to our obligations under the Amendment

Agreement, we obtained stockholder approval for the issuance of shares of Common Stock to Yorkville beyond the Exchange Cap.

Terms of the SEPA

Pursuant to the SEPA,

the Company has the right, but not the obligation, to sell to Yorkville up to $50,000,000 of its shares of common stock, par value $0.0001

per share, at the Company’s request any time during the commitment period commencing on May 13, 2022 and terminating on the

earliest of (i) the first day of the month following the 24-month anniversary of the SEPA and (ii) the date on which Yorkville

shall have made payment of any advances requested pursuant to the SEPA for shares of the Company’s common stock equal to the commitment

amount of $50,000,000. Each sale the Company requested under the SEPA (an “Advance”) may be for a number of shares of common

stock with an aggregate value of up to $5,000,000. The shares would be purchased at 98.0% of the Market Price (as defined below) and

would be subject to certain limitations, including that Yorkville could not purchase any shares that would result in it owning more than

4.99% of the Company’s outstanding common stock at the time of an Advance (the “Ownership Limitation”) or an aggregate

of 19.9% of the Company’s outstanding common stock as of the date of the SEPA (the “Exchange Cap”). The Exchange Cap

will not apply under certain circumstances, including to any sales of common stock under the SEPA that equal or exceed the Minimum Price

(as defined in Section 312.03 of the NYSE Listed Company Manual). “Market Price” is defined in the SEPA as the average

of the VWAPs (as defined below) during each of the three consecutive trading days commencing on the trading day following the Company’s

submission of an Advance notice to Yorkville. “VWAP” is defined in the SEPA to mean, for any trading day, the daily volume

weighted average price of the Company’s common stock for such date on the NYSE American as reported by Bloomberg L.P. during regular

trading hours.

Notwithstanding, as

to any Advance, the issuance of Shares in respect of such Advance would be excluded from the Exchange Cap (as defined below) if (a) the

Company’s stockholders have approved issuances in excess of the Exchange Cap (as defined in the SEPA) in accordance with the rules of

the Principal Market or (b) the Purchase Price of the Shares, with respect to an Advance, equals or exceeds a per share price equal

to the greater of (i) the book value of the Shares immediately preceding the delivery of the Advance Notice (as defined in the SEPA)

or (ii) or the market value of the Common Shares (as reflected on Bloomberg, LP) immediately preceding the delivery of the Advance

Notice (in either case in compliance with the NYSE American rules).

On September 23,

2022, the Company entered into the Supplemental Agreement to the SEPA (the “Supplemental Agreement”) with Yorkville,

which Supplemental Agreement is intended to amend and supplement the SEPA, as amended by the SEPA Amendment. Pursuant to the Supplemental

Agreement, Yorkville committed to advance up to $50,000,000 against future purchases of shares of Common Stock under the SEPA. Under the

Supplemental Agreement, the Company may request from time-to-time Pre-Paid Advances of up to $15,000,000 each from Yorkville (or such

greater amount that the parties may mutually agree), with a limitation on aggregate Pre-Paid Advances of $50,000,000. Interest accrues

on the outstanding balance of any Pre-Paid Advance at a rate equal to an annual rate of 10%, subject to an increase to 15% upon events

of default described in the Supplemental Agreement. The Company will be required to pay to the Investor an amount in cash representing

any amount of a Pre-Paid Advance that remains outstanding, plus any accrued and unpaid interest thereon, on the date that is 12 months

following the date of each Pre-Paid Advance, unless otherwise agreed by the parties.

Outstanding Pre-Paid

Advances may be offset upon the issuance of our Common Stock to Yorkville at purchase price equal to the lower of (a) 135% of the of

the daily VWAP of our Common Stock as of the trading day immediately prior to the date of such Pre-Paid Advance, or the Fixed Price,

or (b) 95% of the lowest VWAP of our Common Stock during the three consecutive trading days immediately preceding the date on which

YA provides a purchase notice (an “Investor Notice”) to us, or the Variable Price, and the lower of the Fixed Price and the

Variable Price shall be referred to as the Purchase Price; however, in no event shall the Purchase Price be less than the $0.75 per share,

or the Floor Price. Upon the delivery of an Investor Notice, we shall be deemed to have delivered a corresponding Advance Notice to the

Investor requesting the Advance amount set forth in the Investor Notice at the Purchase Price. In no event shall the number of shares

of Common Stock issuable to the Investor pursuant to an Investor Notice and corresponding Advance Notice cause the number of Shares to

exceed the Exchange Cap (as defined in the Supplemental Agreement), to the extent applicable, provided further that, the Exchange Cap

will not apply if (a) the Company’s stockholders have approved issuances in excess of the Exchange Cap or (b) the purchase

price of shares of Common Stock with respect to an Investor Notice and corresponding Advance, equals or exceeds a per share price equal

to the greater of (i) book value of Common Stock immediately preceding the delivery of the Investor Notice and corresponding Advance

Notice or (ii) or the market value of the Common Stock immediately preceding the delivery of the Investor Notice.

Concurrently with the

entry into the Supplemental Agreement, Yorkville advanced, as an initial Pre-Paid Advance, the principal amount of $15,000,000. Pursuant

to the Supplemental Agreement, as amended, Yorkville, under certain circumstances including default under the Amendment Agreement, may

submit to the Company an Investor Notice of up to $3,000,000 per 30-day period, or such greater amount as the parties may mutually agree,

and any outstanding Pre-Paid Advances, and accrued interest, will be offset upon the issuance of Common Stock to Yorkville at the applicable

Purchase Price. The Company at its option shall have the right, but not the obligation, to repay (“Optional Prepayment”) early

a portion or all amounts outstanding under a Pre-Paid Advance, plus a Payment Premium, in cash provided that (i) at the time of the

prepayment notice, the daily VWAP is less than the Fixed Price and (ii) the Company provides the Investor with at least 10 Trading

Days’ prior written notice of its desire to exercise an Optional Prepayment. The number of shares issuable to Yorkville under any

individual Investor Notice or aggregate Investor Notices shall be limited by the same limitations set forth in the SEPA, as amended.

Under

the Supplemental Agreement, the Company received an initial pre-paid advance in the principal amount of $15,000,000 on September 23,

2022 (the “First Advance”) and a second pre-paid advance in the principal amount of $2,000,000 on March 10, 2023 (the

“Second Advance,” and collectively, with the First Advance, the “Advances”). As of the date of this Information

Statement there was approximately $4,894,700 of principal of Advances outstanding, excluding the accrued and unpaid interest thereon.

General; Shares Outstanding

As of the close of business on February 9,

2024, there were 136,774,506 shares of Common Stock issued, 133,197,336 shares of votable Common Stock outstanding due to the existence

of treasury stock and issued but unvested stock, and 73,000,000 votes attributable to 730,000 shares of Series A Voting Preferred

Stock issued and outstanding.

Effect on Current Stockholders; Dilution

The SEPA does not affect the rights of the holders

of outstanding Common Stock, but the issuance of shares to Yorkville pursuant to the terms of the SEPA will have a dilutive effect on

our existing stockholders, including the voting power and the economic rights of the existing stockholders. The Company cannot presently

predict how many shares of Common Stock would be issuable to Yorkville under the SEPA.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth certain information

with respect to the beneficial ownership of the Company’s common stock as of February 9, 2024 for:

| |

· |

each of the Company’s

current directors and executive officers; |

| |

· |

all of the Company’s

current directors and executive officers as a group; and |

| |

· |

each person, or group of

affiliated persons, who beneficially owned more than 5% of our common stock. |

Except as indicated by the footnotes below, the

Company believes, based on information furnished to it, that the persons and entities named in the table below have sole voting and sole

investment power with respect to all shares of common stock that they beneficially owned, subject to applicable community property laws.

The Company’s calculation of the percentage of beneficial ownership

is based on 133,197,336 shares outstanding and entitled to vote, which excludes, as of February 9, 2024, 131,162 treasury shares

and 3,446,008 outstanding shares that are not vested and are not entitled to vote.

| Name of Beneficial Owner | |

Common

Stock

Beneficial

Ownership | | |

Common

Stock

Percentage

Ownership | | |

Series A

Preferred

Stock

Beneficial

Ownership | | |

Series A

Preferred

Stock

Percentage

Ownership | |

| Michael Mo (1) - CEO and Chairman | |

| 21,155,110 | | |

| 15.88 | % | |

| 730,000 | | |

| 100 | % |

| Shawn Canter (2) - CFO | |

| 0 | | |

| * | | |

| 0 | | |

| * | |

| Dr. William Walker (3) - CTO | |

| 37,500 | | |

| * | | |

| 0 | | |

| * | |

| Keith Cochran (4) - President and COO | |

| 0 | | |

| * | | |

| 0 | | |

| * | |

| Michael Carpenter - VP of Engineering | |

| 500,000 | | |

| * | | |

| 0 | | |

| * | |

| Morio Kurosaki (5) - Director | |

| 557,500 | | |

| * | | |

| 0 | | |

| * | |

| Dr. Joanna Massey (6) - Director | |

| 67,500 | | |

| * | | |

| 0 | | |

| * | |

| All directors and executive officers as a group (7 persons) | |

| 22,317,610 | | |

| 16.76 | % | |

| 730,000 | | |

| 100 | % |

| 5% or Greater Beneficial Owners: | |

| | | |

| | | |

| | | |

| | |

| Dr. Timothy Knowles (7) – Former Affiliate | |

| 16,270,360 | | |

| 12.22 | % | |

| 0 | | |

| * | |

* denotes less than 1%

| (1) |

Common Stock Ownership consists of 19,755,110

shares held directly by Mr. Mo and 1,400,000 shares held jointly by Mr. Mo and his spouse, Linda Mo, and excludes shares

held by Mr. Mo’s son Alexander Mo and shares held by Mr. Mo’s son Brandon Mo, over which shares Mr. Mo

disclaims beneficial ownership, as Mr. Mo has no control over the dispositive or voting power over the shares and his sons no

longer live in the same household as Mr. Mo. Does not include a restricted stock award of 1,500,000 shares of the Company’s

common stock that did not vest or settle on or prior to the Record Date.

Mr. Mo is the sole holder of all issued

and outstanding shares of Preferred Stock and after giving effect to the voting rights of such Preferred Stock and the voting rights

of the Common Stock beneficially owned by Mr. Mo, the aggregate voting power held by Mr. Mo would be 45.66% of all voting

rights of the Company’s voting securities (206,197,336 aggregate votes). |

| (2) |

Does not include

a restricted stock award of 1,500,000 shares of the Company’s common stock that did not vest on or prior to the Record Date. |

| (3) |

Does not include

462,500 restricted stock grants that did not vest or settle on or prior to the Record Date. |

| (4) |

Does not include

a restricted stock award of 1,000,000 shares of the Company’s common stock that did not vest on or prior to the Record Date. |

| (5) |

Consists of

20,000 vested shares of common stock granted by the Company, on June 7, 2021, the effective date of Mr. Kurosaki’s

appointment as a director of the Company, 37,500 vested shares of common stock granted by the Company on November 1, 2022, 400,000

shares of common stock acquired prior to being appointed director, and 100,000 shares held by IT-Farm Corporation, a Japanese venture

and capital firm, of which Mr. Kurosaki is the founder and President. |

| (6) |

Consists of

20,000 vested shares of common stock granted by the Company, on June 7, 2021, the effective date of Dr. Massey’s

appointment as a director of the Company, 37,500 vested shares granted by the Company on November 1, 2022, and 10,000 shares

of common stock acquired in open market purchases. |

| |

|

| (7) |

Consists of 15,600,000

shares held directly by Mr. Knowles, 670,360 shares held by Mr. Knowles’ wife, Marianne Knight who maintains all

voting and dispositive control over shares she owns, and excludes 1,500,000 shares held by Mr. Knowles’ daughter, Sonja

Irene Knowles, over which shares Mr. Knowles disclaims beneficial ownership, as Mr. Knowles has no control over the dispositive

or voting power over the shares and his daughter no longer lives in the same household as Mr. Knowles. |

INTERESTS OF CERTAIN PERSONS IN THE AUTHORIZATIONS

No officer, director, nominee for election as

a director, associate of any director, executive officer or nominee, or beneficial owner of more than 5% of our Common Stock has any

substantial interest in the matters acted upon by our Board and shareholders, other than in their role as an officer, director or beneficial

owner.

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING

INFORMATION

This Information Statement may contain “forward-looking

statements” made under the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. The statements

include, but are not limited to, statements concerning the effects of the stockholder approval and statements using terminology such

as “expects,” “sould,” “would,” “could,” “intends,” “plans,”

“anticipates,” “believes,” “projects” and “potential.” Such statements reflect the current

view of the Company with respect to future events and are subject to certain risks, uncertainties, and assumptions. Known and unknown

risks, uncertainties and other factors could cause actual results to differ materially from those contemplated by the statements.

In evaluating these statements, you should specifically

consider various factors that may cause our actual results to differ materially from any forward-looking statements. These risk factors

include the following risk factor relating to the Company’s compliance with the continued listing requirements of Nasdaq:

If we fail to comply with the continued listing

requirements of the NYSE American, we would face possible delisting, which would result in a limited public market for our shares and

make obtaining future debt or equity financing more difficult for us.

On December 20, 2023, the Company received

a deficiency letter from the NYSE Regulation Staff (the “Staff”) of The NYSE American LLC (“NYSE American”) indicating

that the Company is not in compliance with the NYSE American continued listing standard set forth in Sections 1003(a)(i), (ii) and

(iii) of the NYSE American Company Guide (the “Company Guide”), since the Company reported stockholders’ equity

of $1.2 million as of September 30, 2023, and losses from continuing operations and/or net losses in its five most recent fiscal

years ended December 31, 2022. Accordingly, the Company does not meet the NYSE American continued listing standards, making the

company susceptible to delisting of our shares of Common Stock. The Staff’s notice has no immediate impact on the listing of the

Company’s common stock on NYSE American.

On January 19, 2024, the Company submitted

its compliance plan to the NYSE American, to regain compliance on or before June 20, 2025. There can be no assurance that the Staff

will accept the Company’s plan to regain compliance with the Stockholders’ Equity Requirement, or, if accepted, the Company

will be able to evidence compliance with the Stockholders’ Equity Requirement. If the Staff does not accept the Company’s

plan or if the Company is unable to regain compliance within the plan period, the Staff would be required to issue a delisting determination.

The Company would at that time be entitled to appeal to the staff determination in accordance with Section 1010 and Part 12

of the Company Guide.

If we are unable to achieve and maintain compliance

with such listing standards or other NYSE American listing requirements in the future, we could be subject to suspension and delisting

proceedings. A delisting of our common stock and our inability to list on another national securities market could negatively impact

us by: (i) reducing the liquidity and market price of our common stock; (ii) reducing the number of investors willing to hold

or acquire our common stock, which could negatively impact our ability to raise equity financing; (iii) limiting our ability to

use certain registration statements to offer and sell freely tradable securities, thereby limiting our ability to access the public capital

markets; and (iv) impairing our ability to provide equity incentives to our employees.

ADDITIONAL INFORMATION

Householding of Materials

Some banks, brokerage firms, or other nominee

record holders may be participating in the practice of “householding” information statements. This means that only one copy

of this Information Statement may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy

of the Information Statement to you if you contact us at: Technology Group, Inc., 4863 Shawline Street, Suite B, San Diego,

California 92111. You may also contact us at (408) 663-5247.

Any Company stockholder wishing to receive separate

copies of our proxy statement or annual report to Company stockholders in the future, or any Company stockholder who is receiving multiple

copies and would like to receive only one copy per household, should contact the Company stockholder’s bank, broker, or other nominee

record holder, or the Company stockholder may contact us at the above address and phone number.

Costs

We will make arrangements with brokerage firms

and other custodians, nominees, and fiduciaries who are record holders of our Common Stock for the forwarding of this Information Statement

to the beneficial owners of our Common Stock. We will reimburse these brokers, custodians, nominees, and fiduciaries for the reasonable

out-of-pocket expenses they incur in connection with the forwarding of the Information Statement.

Where you can find more information

We

are subject to the information requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and file annual, quarterly, and special reports, proxy statements, and other information with the SEC. You may read and copy any

reports, statements, or other information we file at the public reference facilities maintained by the SEC in Room 1590, 100 F Street,

N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for additional information on the operation of the SEC’s public

reference facilities. The SEC maintains a website that contains reports, proxy statements, and other information, including those filed

by us, at http://www.sec.gov.

You may request a copy of these filings, at no

cost, by sending a written request to KULR Technology Group, Inc., 4863 Shawline Street, Suite B, San Diego, CA 92111, Attention:

Secretary. Any statement contained in a document that is incorporated by reference will be modified or superseded for all purposes to

the extent that a statement contained in this Information Statement (or in any other document that is subsequently filed with the SEC

and incorporated by reference) modifies or is contrary to such previous statement. Any statement so modified or superseded will not be

deemed a part of this Information Statement except as so modified or superseded.

Our common stock is traded on the NYSE American

LLC under the symbol “KULR”

Our transfer agent is Vstock Transfer, LLC. Their

address is 18 Lafayette Place, Woodmere, New York 11598 and their telephone number is (212) 828-8436.

CONCLUSION

As a matter of regulatory compliance, we are

sending you this Information Statement that describes the purpose and effect of the above actions. Your consent to the above action is

not required and is not being solicited in connection with this action. This Information Statement is intended to provide our stockholders

information required by the rules and regulations of the Exchange Act. This Information Statement is being mailed on or about

February 23, 2024 to all stockholders of record as of the record date.

WE ARE NOT ASKING YOU FOR A PROXY AND YOU ARE

REQUESTED NOT TO SEND US A PROXY. THE ATTACHED MATERIAL IS FOR INFORMATIONAL PURPOSES ONLY.

| |

BY ORDER OF

THE BOARD OF DIRECTORS |

| |

|

| |

/s/ Michael

Mo |

| |

Michael Mo |

| |

Chief Executive Officer

and Chairman |

Annex A

Amendment

to the

Bylaws

Of

KULR

Technology Group, INC.

F.K.A.

Grant Hill Acquisition Corporation

This Amendment to the Bylaws

(“Bylaws”) of KULR Technology Group, Inc. (the “Corporation”), a corporation organized and

existing under the laws of the State of Delaware, is hereby duly adopted pursuant to and in accordance with the provisions of the Bylaws.

| 1. | Amend the Bylaws to replace any references

to the Corporation’s former name, Grant Hill Acquisition Corporation, to the Corporations

current name, KULR Technology Group, Inc. |

| 2. | Section 1.6 of the Bylaws of the

Corporation is hereby amended by modifying section 1.6 from requiring a quorum of “a

majority of the shares” to “ thirty-three and a third of the shares entitled

to vote”: |

Section 1.6. Quorum. At any meeting

of the stockholders, the holders of thirty-three and a third percent of the shares entitled to vote, shall constitute a quorum

of the stockholders for all purposes, unless the representation of a larger number shall be required by law, and, in that case, the representation

of the number so required shall constitute a quorum.

If the holders of the amount of stock

necessary to constitute a quorum shall fail to attend in person or by proxy at the time and place fixed in accordance with these By-Laws

for an annual or special meeting, a majority in interest of the stockholders present in person or by proxy may adjourn, from time to

time, without notice other than by announcement at the meeting, until holders of the amount of stock requisite to constitute a quorum

shall attend. At any such adjourned meeting at which a quorum shall be present, any business may be transacted which might have been

transacted at the meeting as originally notified.

IN WITNESS WHEREOF, the undersigned

authorized officer of the Corporation, for the purpose of amending the Bylaws, does hereby make and file this Amendment in the books

and records of the Corporation, hereby declaring and certifying that the facts herein stated are true, and accordingly has hereunto set

his hand this [*] day of [*], 2024.

This Certificate of Amendment shall

become effective at 12:01 a.m. on [EFFECTIVE DATE].

| |

By: |

|

| |

Title: Chief Executive Officer and Chairman |

| |

Name: Michael Mo |

Annex B

Certificate

of Amendment

to the

Certificate

of Incorporation

Of

KULR

Technology Group, INC.

This Certificate of Amendment

to the Certificate of Incorporation of KULR Technology Group, Inc. (the “Corporation”), a corporation organized

and existing under the laws of the State of Delaware, is hereby duly adopted pursuant to and in accordance with the provisions of Section 242

of the Delaware General Corporation Law.

1. Article 4

of the Certificate of Incorporation of the Corporation is hereby amended by adding the following paragraph immediately after the first

paragraph of Article 4:

“Contingent upon filing and effective

as of 12:01 a.m. on [EFFECTIVE DATE] (the “Effective Time”), each [# IN WORDS] ([#]) shares Common Stock issued and

outstanding prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be

combined and converted into one (1) share of Common Stock (the “Reverse Split”). No fractional share shall be issued

in connection with the foregoing combination of the shares pursuant to the Reverse Split. A holder of Common Stock who would otherwise

be entitled to receive a fractional share as a result of the Reverse Split will receive one whole share of Common Stock in lieu of such

fractional share.

The Reverse Split shall occur automatically

without any further action by the holders of Common Stock, and whether or not the certificates representing such shares have been surrendered

to the Corporation; provided, however, that the Corporation shall not be obligated to issue certificates evidencing the shares of Common

Stock issuable as a result of the Reverse Split unless the existing certificates evidencing the applicable shares of stock prior to the

Reverse Split are either delivered to the Corporation, or the holder notifies the Corporation that such certificates have been lost,

stolen or destroyed, and executes an agreement satisfactory to the Corporation to indemnify the Corporation from any loss incurred by

it in connection with such certificates.”

IN WITNESS WHEREOF, the undersigned

authorized officer of the Corporation, for the purpose of amending the Certificate of Incorporation pursuant to the Delaware General

Corporation Law, does hereby make and file this Certificate of Amendment, hereby declaring and certifying that the facts herein stated

are true, and accordingly has hereunto set his hand this [DATE] day of [MONTH], [YEAR].

This Certificate of Amendment shall

become effective at 12:01 a.m. on [EFFECTIVE DATE].

| |

By: |

|

| |

Title: Chief Executive Officer and Chairman |

| |

Name: Michael Mo |

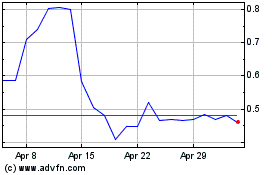

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Mar 2024 to Apr 2024

KULR Technology (AMEX:KULR)

Historical Stock Chart

From Apr 2023 to Apr 2024