FALSE000089707700008970772024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 22, 2024

Alamo Group Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

State of Delaware | 0-21220 | 74-1621248 |

| (State or other jurisdiction of incorporation) | (Commission File No.) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

1627 E. Walnut, Seguin, Texas | | 78155 | |

| (Address of Registrant’s principal executive offices) | | (Zip Code) | |

| | | | | | | | |

| (830) 379-1480 | |

Registrant's telephone number, including area code: |

| | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

Common Stock, par value $.10 per share | ALG | New York Stock Exchange |

| |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of

the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 22, 2024, Alamo Group Inc. issued a press release announcing, among other things, financial results for the fourth quarter and year ended December 31, 2023. A copy of the press release is filed as Exhibit 99.1 to this Current Report on Form 8-K. The foregoing description is qualified by reference to such exhibit.

The information furnished in this report, including the exhibit, shall not be deemed to be incorporated by reference into any of Alamo Group filings with the SEC under the Securities Act of 1933, except as shall be expressly set forth by specific reference in any such filing, and shall not be deemed to be "filed" with the SEC under the Securities Exchange Act of 1934.

Item 9.01 Financial Statements and Exhibits

Exhibit 99.1 - Press Release dated February 22, 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| February 22, 2024 | By:/s/ Edward T. Rizzuti |

| | Edward T. Rizzuti, |

| | EVP, General Counsel & Secretary |

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File - Inline XBRL for the cover page of this Current Report on Form 8-K |

| | | | | | | | |

| For: | Alamo Group Inc. |

| | |

| Contact: | Richard Wehrle |

| | Executive Vice President & CFO |

| | 830-372-9615 |

| | |

| | Financial Relations Board |

| | Joe Calabrese |

| | 212-827-3772 |

ALAMO GROUP ANNOUNCES RECORD 2023

FOURTH QUARTER AND YEAR END RESULTS

SEGUIN, Texas, February 22, 2024 -- Alamo Group Inc. (NYSE: ALG) today reported results for the fourth quarter and year ended December 31, 2023.

Highlights

•Ninth consecutive quarterly record for sales and earnings

•Fourth quarter net sales of $417.5 million, up 8%

•Fourth quarter operating income of $44.8 million, up 5%

•Fourth quarter net income of $31.5 million, or $2.63 per diluted share, up 8%

•Full year net sales of $1.69 billion, up 12%

•Full year operating income of $198.0 million, up 33%

•Full year net income of $136.2 million, up 34%

•Full year diluted EPS was $11.36, up 33%

•Record EBITDA of $246.6 million, up 26%

•Year-end 2023 backlog at $860 million

Fourth Quarter Results

Fourth quarter 2023 net sales were $417.5 million compared to $386.6 million in the fourth quarter of 2022, an increase of 8%. Gross margin improved in the quarter versus the fourth quarter of 2022 by $11.1 million or 11%. Fourth quarter net income improved

ALAMO GROUP ANNOUNCES 2023 FOURTH QUARTER AND YEAR END RESULTS PAGE 2

8% to $31.5 million, or $2.63 per diluted share, compared to net income of $29.2 million, or $2.44 per diluted share in the fourth quarter of 2022. The Company’s backlog at the end of 2023 was $860 million.

Full Year Results

Full year 2023 net sales increased to almost $1.7 billion, up 12% compared to $1.5 billion for the full year 2022. Gross margin for 2023 increased $77.1 million or 20% versus the full year 2022. Net income for 2023 was $136.2 million, or $11.36 per diluted share, compared to net income of $101.9 million, or $8.54 per diluted share in 2022, a year-over-year EPS improvement of 33%.

Comments on Results

Jeff Leonard, Alamo Group’s President, and Chief Executive Officer, commented, “We are pleased that our fourth quarter results established new records for sales and earnings for the ninth consecutive quarter. The fourth quarter is normally seasonally softer for us, and this year was no exception as sales growth moderated relative to the pace set in the third quarter.

“It was great to see that our fourth quarter gross margin expanded by 80 basis points reflecting the durable quality of our backlog. Improvements in supply chain performance and labor availability drove operating efficiency higher and contributed to the favorable gross margin. The combined benefits of the higher gross margin and better operating efficiency were partially offset by higher employee-related administrative expenses during the quarter. Fourth quarter operating income of $44.8 million was five percent higher than the comparison period of 2022.

“The Industrial Equipment Division had a very strong fourth quarter with sales that were 32% higher than the fourth quarter of 2022. Governmental and industrial demand for this Division’s products remained robust although order bookings were 9% lower due to a challenging comparable caused by an unusually large snow-removal equipment order that we received in the fourth quarter of 2022. Year-end backlog increased by 18% compared to 2022.

ALAMO GROUP ANNOUNCES 2023 FOURTH QUARTER AND YEAR END RESULTS PAGE 3

“The Vegetation Management Division faced challenging conditions in several of its markets in the fourth quarter. Forestry and Tree Care activity remained constrained by the combined effects of price pressure for domestic wood pellets, slowing demand for land

clearing equipment and sluggish housing starts. The farm and ranch market also remained soft due to lower cattle prices, less favorable commodity prices and declining agricultural exports. Channel inventories remained above optimal levels in the fourth quarter and dealers were reluctant to place new stock orders while interest rates remained elevated. The bright spot in the Vegetation Management Division was its governmental mowing business which enjoyed very strong, historically high sales in the fourth quarter and for all of 2023. Vegetation Management Division fourth quarter order bookings declined 34% and year-end backlog was 39% lower compared to 2022. The Division’s backlog has now returned to a more normal level from a historical perspective.

“The Company’s solid performance in the fourth quarter capped a very strong performance in 2023. Full-year sales were up 12% and net income improved by 34% versus the prior year. As we expected, recent softness in several of the Vegetation Management Division’s markets was largely offset by increasing demand for the Company’s Industrial Equipment from governmental agencies and contractors. We continue to like the way the Company is positioned as we enter 2024. At nearly $860 million, the Company’s backlog remains at a very healthy level and we believe that the quality of the backlog remains excellent. Although the noted softness in Vegetation Management may persist through the first quarter, anticipated relief in the form of modestly lower interest rates later in the year should help clear the inventory overhang and invigorate dealer demand. We expect that the Industrial Equipment Division will continue to display strength in 2024 driven by its sales to governmental agencies. Taken together, we remain confident regarding the Company’s performance in 2024 and believe it will be another excellent year for us.

ALAMO GROUP ANNOUNCES 2023 FOURTH QUARTER AND YEAR END RESULTS PAGE 4

Earnings Conference Call

The Company will host a conference call to discuss fourth quarter and year end 2023 financial results on Friday, February 23, 2024 at 10:00 a.m. ET. Hosting the call will be members of senior management.

Individuals wishing to participate in the conference call should dial 877-317-6789 (domestic) or 412-317-6789 (international). For interested individuals unable to join the call, a replay will be available until Friday, March 01, 2024 by dialing 877-344-7529 (domestic) or 412-317-0088 (internationally), passcode 8022529.

The live broadcast of Alamo Group Inc.’s quarterly conference call will be available online at the Company's website, www.alamo-group.com (under “Investor Relations/Events & and Presentations”) on Friday, February 23, 2024, beginning at 10:00 a.m. ET. The online replay will follow shortly after the call ends and will be archived on the Company’s website for 60 days.

About Alamo Group

Alamo Group is a leader in the design, manufacture, distribution and service of high quality equipment for vegetation management, infrastructure maintenance and other applications. Our products include truck and tractor mounted mowing and other vegetation maintenance equipment, street sweepers, snow removal equipment, excavators, vacuum trucks, other industrial equipment, agricultural implements, forestry equipment and related after-market parts and services. The Company, founded in 1969, has approximately 4,350 employees and operates 29 plants in North America, Europe, Australia and Brazil as of December 31, 2023. The corporate offices of Alamo Group Inc. are located in Seguin, Texas.

ALAMO GROUP ANNOUNCES 2023 FOURTH QUARTER AND YEAR END RESULTS PAGE 5

Forward Looking Statements

This release contains forward-looking statements that are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties, which may cause the Company’s actual results in future periods to differ materially from forecasted results. Among those factors which could cause actual results to differ materially are the following: adverse economic conditions which could lead to a reduction in overall market demand, supply chain disruptions, labor constraints, increasing costs due to inflation, disease outbreaks, geopolitical risks, including effects of the war in the Ukraine and the Middle East, competition, weather, seasonality, currency-related issues, and other risk factors listed from time to time in the Company’s SEC reports. The Company does not undertake any obligation to update the information contained herein, which speaks only as of this date.

(Tables Follow)

# # #

(1) This is a non-GAAP financial measure or other information relating to our GAAP financial measures that we have provided to investors in order to allow greater transparency and a deeper understanding of our financial condition and operating results. For a reconciliation of the non-GAAP financial measure or for a more detailed explanation of financial results, refer to “Non-GAAP Financial Measure Reconciliation” below and the Attachments thereto.

Alamo Group Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(in thousands)

(Unaudited) | | | | | | | | | | | | | | | | | | | | |

| December 31,

2023 | December 31,

2022 |

| ASSETS | | | | | | |

| Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 51,919 | | | | $ | 47,016 | | |

| Accounts receivable, net | | 362,007 | | | | 317,581 | | |

| Inventories | | 377,480 | | | | 352,553 | | |

| Other current assets | | 12,551 | | | | 10,060 | | |

| Total current assets | | 803,957 | | | | 727,210 | | |

| | | | | | |

| Rental equipment, net | | 39,264 | | | | 33,723 | | |

| | | | | | |

| Property, plant and equipment | | 166,660 | | | | 155,007 | | |

| | | | | | | |

| Goodwill | | 206,536 | | | | 195,858 | | |

| Intangible assets | | 168,296 | | | | 171,341 | | |

| Other non-current assets | | 24,673 | | | | 25,369 | | |

| | | | | | |

| Total assets | | $ | 1,409,386 | | | | $ | 1,308,508 | | |

| | | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | | |

| Current liabilities: | | | | | | |

| Trade accounts payable | | $ | 99,678 | | | | $ | 97,537 | | |

| Income taxes payable | | 12,529 | | | | 6,592 | | |

| Accrued liabilities | | 86,711 | | | | 71,368 | | |

| Current maturities of long-term debt and finance lease obligations | | 15,008 | | | | 15,009 | | |

| | | | | | |

| Total current liabilities | | 213,926 | | | | 190,506 | | |

| | | | | | |

| Long-term debt, net of current maturities | | 220,269 | | | | 286,943 | | |

| Long term tax payable | | 2,634 | | | | 3,781 | | |

| | | | | | |

| Other long-term liabilities | | 23,694 | | | | 23,668 | | |

| Deferred income taxes | | 16,100 | | | | 18,250 | | |

| | | | | | |

| Total stockholders’ equity | | 932,763 | | | | 785,360 | | |

| | | | | | |

| Total liabilities and stockholders’ equity | | $ | 1,409,386 | | | | $ | 1,308,508 | | |

Alamo Group Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(in thousands, except per share amounts)

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Fourth Quarter Ended | | Year Ended |

| 12/31/2023 | | 12/31/2022 | | 12/31/2023 | | 12/31/2022 |

| Net sales: | | | | | | | |

| Vegetation Management | $ | 214,357 | | | $ | 232,545 | | | $ | 979,040 | | | $ | 937,065 | |

| Industrial Equipment | 203,185 | | | 154,059 | | | 710,611 | | | 576,551 | |

| | | | | | | |

| Total Net Sales | 417,542 | | | 386,604 | | | 1,689,651 | | | 1,513,616 | |

| | | | | | | |

| Cost of Sales | 308,622 | | | 288,809 | | | 1,236,007 | | | 1,137,098 | |

| Gross Margin | 108,920 | | | 97,795 | | | 453,644 | | | 376,518 | |

| | 26.1 | % | | 25.3 | % | | 26.8 | % | | 24.9 | % |

| | | | | | | |

| Selling, general and administration expense | 60,068 | | | 51,282 | | | 240,158 | | | 212,649 | |

| Amortization Expense | 4,054 | | | 3,796 | | | 15,519 | | | 15,277 | |

| | | | | | | |

| Income from Operations | 44,798 | | | 42,717 | | | 197,967 | | | 148,592 | |

| | 10.7 | % | | 11.0 | % | | 11.7 | % | | 9.8 | % |

| | | | | | | |

| Interest Expense | (6,587) | | | (4,791) | | | (26,093) | | | (14,361) | |

| Interest Income | 360 | | | 530 | | | 1,485 | | | 752 | |

| Other Income | 1,667 | | | (200) | | | 1,761 | | | (673) | |

| | | | | | | |

| Income before income taxes | 40,238 | | | 38,256 | | | 175,120 | | | 134,310 | |

| Provision for income taxes | 8,715 | | | 9,091 | | | 38,959 | | | 32,382 | |

| | | | | | | |

| Net Income | $ | 31,523 | | | $ | 29,165 | | | $ | 136,161 | | | $ | 101,928 | |

| | | | | | | |

| Net Income per common share: | | | | | | | |

| | | | | | | |

| Basic | $ | 2.64 | | | $ | 2.45 | | | $ | 11.42 | | | $ | 8.58 | |

| | | | | | | |

| Diluted | $ | 2.63 | | | $ | 2.44 | | | $ | 11.36 | | | $ | 8.54 | |

| | | | | | | |

| Average common shares: | | | | | | | |

| Basic | 11,930 | | | 11,884 | | | 11,920 | | | 11,877 | |

| | | | | | | |

| Diluted | 12,000 | | | 11,940 | | | 11,987 | | | 11,934 | |

| | | | | | | |

Alamo Group Inc.

Non-GAAP Financial Measures Reconciliation

From time to time, Alamo Group Inc. may disclose certain “non-GAAP financial measures” in the course of its earnings releases, earnings conference calls, financial presentations and otherwise. For these purposes, “GAAP” refers to generally accepted accounting principles in the United States. The Securities and Exchange Commission (SEC) defines a “non-GAAP financial measure” as a numerical measure of historical or future financial performance, financial position, or cash flows that is subject to adjustments that effectively exclude or include amounts from the most directly comparable measure calculated and presented in accordance with GAAP. Non-GAAP financial measures disclosed by Alamo Group are provided as additional information to investors in order to provide them with greater transparency about, or an alternative method for assessing, our financial condition and operating results. These measures are not in accordance with, or a substitute for, GAAP and may be different from, or inconsistent with, non-GAAP financial measures used by other companies. Whenever we refer to a non-GAAP financial measure, we will also generally present the most directly comparable financial measure calculated and presented in accordance with GAAP, along with a reconciliation of the differences between the non-GAAP financial measure we reference and such comparable GAAP financial measure.

Attachment 1 discloses a non-GAAP financial presentation related to the impact of currency translation on net sales by division. Attachment 2 shows the net change in our total debt net of cash and earnings before interest, taxes, depreciation and amortization ("EBITDA") which is a non-GAAP financial measure. The Company considers this information useful to investors to allow better comparability of period-to-period operating performance. Attachment 3 reflects Division performance inclusive of non-GAAP financial measures such as backlog and earnings before interest, tax, depreciation and amortization ("EBITDA").

Attachment 1

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Impact of Currency Translation on Net Sales by Division |

| | | | | | | | | |

| Three Months Ended

December 31, | | | | Change due to currency translation |

| 2023 | | 2022 | | % change from 2022 | | $ | | % |

| | | | | | | | | |

| Vegetation Management | $ | 214,357 | | | $ | 232,545 | | | (7.8) | % | | $ | 2,384 | | | 1.0 | % |

| Industrial Equipment | 203,185 | | | 154,059 | | | 31.9 | % | | 861 | | | 0.6 | % |

| | | | | | | | | |

| Total Net Sales | $ | 417,542 | | | $ | 386,604 | | | 8.0 | % | | $ | 3,245 | | | 0.8 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Twelve Months Ended December 31, | | | | Change due to currency translation |

| 2023 | | 2022 | | % change from 2022 | | $ | | % |

| | | | | | | | | |

| Vegetation Management | $ | 979,040 | | | $ | 937,065 | | | 4.5 | % | | $ | 1,663 | | | 0.2 | % |

| Industrial Equipment | 710,611 | | | 576,551 | | | 23.3 | % | | (1,961) | | | (0.3) | % |

| | | | | | | | | |

| Total Net Sales | $ | 1,689,651 | | | $ | 1,513,616 | | | 11.6 | % | | $ | (298) | | | — | % |

| | | | | | | | | |

Attachment 2

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| Consolidated Net Change of Total Debt, Net of Cash |

| | | | | | |

| | December 31, 2023 | | December 31, 2022 | | Net Change |

| | | | | | |

| Current maturities | | $ | 15,008 | | | $ | 15,009 | | | |

| Long-term debt, net of current | | 220,269 | | | 286,943 | | | |

| Total Debt | | $ | 235,277 | | | $ | 301,952 | | | |

| | | | | | |

| Total Cash | | 51,919 | | | 47,016 | | | |

| Total Debt Net of Cash | | $ | 183,358 | | | $ | 254,936 | | | $ | 71,578 | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| EBITDA |

| | | | | |

| | | Twelve Months Ended |

| | | December 31, 2023 | | December 31, 2022 |

| | | | | |

| Income from operations | | | $ | 197,967 | | | $ | 148,592 | |

| Depreciation | | | 32,454 | | | 31,412 | |

| Amortization | | | 16,222 | | | 15,944 | |

| EBITDA | | | $ | 246,643 | | | $ | 195,948 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Attachment 3

Alamo Group Inc.

Non-GAAP Financial Reconciliation

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Vegetation Management Division Performance |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Backlog | | | | | | $ | 352,080 | | | $ | 577,050 | |

| | | | | | | | |

| Net Sales | | 214,357 | | | 232,545 | | | 979,040 | | | 937,065 | |

| | | | | | | | |

| Income from Operations | | 19,764 | | | 30,247 | | | 122,084 | | | 108,508 | |

| | 9.2 | % | | 13.0 | % | | 12.5 | % | | 11.6 | % |

| | | | | | | | |

| Depreciation | | 4,246 | | | 4,470 | | | 15,581 | | | 15,188 | |

| Amortization | | 3,031 | | | 3,005 | | | 12,155 | | | 12,193 | |

| | | | | | | | |

| EBITDA | | 27,041 | | | 37,722 | | | 149,820 | | | 135,889 | |

| | 12.6 | % | | 16.2 | % | | 15.3 | % | | 14.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Industrial Equipment Division Performance |

| | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Backlog | | | | | | $ | 507,715 | | | $ | 429,439 | |

| | | | | | | | |

| Net Sales | | 203,185 | | | 154,059 | | | 710,611 | | | 576,551 | |

| | | | | | | | |

| Income from Operations | | 25,034 | | | 12,470 | | | 75,883 | | | 40,084 | |

| | 12.3 | % | | 8.1 | % | | 10.7 | % | | 7.0 | % |

| | | | | | | | |

| Depreciation | | 4,534 | | | 4,970 | | | 16,873 | | | 16,224 | |

| Amortization | | 1,199 | | | 958 | | | 4,067 | | | 3,751 | |

| | | | | | | | |

| EBITDA | | 30,767 | | | 18,398 | | | 96,823 | | | 60,059 | |

| | 15.1 | % | | 11.9 | % | | 13.6 | % | | 10.4 | % |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

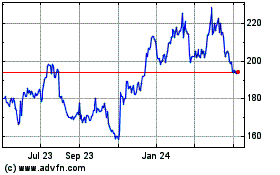

Alamo (NYSE:ALG)

Historical Stock Chart

From Mar 2024 to Apr 2024

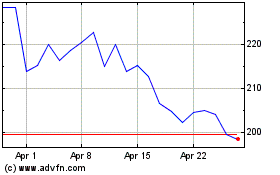

Alamo (NYSE:ALG)

Historical Stock Chart

From Apr 2023 to Apr 2024