false000176725800017672582024-02-222024-02-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 22, 2024

Date of Report (date of earliest event reported)

XPEL, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| Nevada | 001-38858 | 20-1117381 |

| (State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | |

711 Broadway, Suite 320 | 78215 |

| San Antonio | Texas | | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant's telephone number, including area code: (210) 678-3700

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | XPEL | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 22, 2024, XPEL, Inc. (“XPEL”) announced its consolidated financial results for the quarter and year ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 to this current report on Form 8-K, and the information set forth therein is incorporated herein by reference and constitutes a part of this report.

The information contained in Item 2.02 of this report and Exhibit 99.1 to this report shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and shall not be incorporated by reference into any filings made by XPEL under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibit is to be filed as part of this Form 8-K:

| | | | | | | | |

| EXHIBIT NO. | | IDENTIFICATION OF EXHIBIT |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| XPEL, Inc. |

| |

| Dated: February 22, 2024 | By: /s/ Barry R. Wood |

| Barry R. Wood |

| Senior Vice President and Chief Financial Officer |

XPEL Reports Fourth Quarter and 2023 Year End Results

San Antonio, TX – February 22, 2024 – XPEL, Inc. (Nasdaq: XPEL) (the "Company"), a global provider of protective films and coatings, announced consolidated results1 for the fourth quarter and year ended December 31, 2023.

Fourth Quarter 2023 Highlights:

•Revenue increased 34.5% to $105.5 million compared to fourth quarter 2022.

•Net income increased 43.2% to $12.0 million, or $0.43 per basic and diluted share, versus net income of $8.4 million, or $0.30 per basic and diluted share in the fourth quarter of 2022.

•EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) grew 33.6% to $17.7 million, or 16.7% of revenue compared to $13.2 million, or 16.8% of revenue in fourth quarter 2022.2

Year End 2023 Highlights:

•Revenue increased 22.3% to $396.3 million as compared to the prior year.

•Net income increased by 27.6% to $52.8 million, or $1.91 per basic and diluted share, compared to $41.4 million, or $1.50 per basic and diluted share, in 2022.

•EBITDA grew 25.6% to $76.9 million, or 19.4% of revenue, as compared to $61.2 million, or 18.9% in the prior year.2

Ryan Pape, President and Chief Executive Officer of XPEL, commented, “We are pleased with our full year 2023 performance and closed out the year with solid growth in the fourth quarter. We delivered strong performance across our end markets and product offerings driving improved profitability for the year. We've made important progress in 2023 in key areas including enhancing our focus on new car dealerships, improving our go-to-market strategy in China, India and the Middle East and launching our next generation software platform DAPNext. We look forward to building on the momentum of last year across all of our initiatives, staying close to our customers and furthering the XPEL brand in 2024.”

Financial Highlights for the Fourth Quarter 2023 (continued):

Summary consolidated financial information for the fourth quarter 2023 and 2022 (unaudited, dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | % Change |

| 2023 | | %

of Total Revenue | | 2022 | | %

of Total Revenue | | 2023 vs. 2022 |

| Total Revenue | $ | 105,538 | | | 100.0 | % | | $ | 78,481 | | | 100.0 | % | | 34.5 | % |

| | | | | | | | | |

| Gross Margin | 40,932 | | | 38.8 | % | | 31,046 | | | 39.6 | % | | 31.8 | % |

| Operating Expenses | 26,708 | | | 25.3 | % | | 20,201 | | | 25.7 | % | | 32.2 | % |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Net Income | 11,970 | | | 11.3 | % | | 8,358 | | | 10.6 | % | | 43.2 | % |

EBITDA2 | 17,654 | | | 16.7 | % | | 13,217 | | | 16.8 | % | | 33.6 | % |

| Cash flow (used in) provided by operations | $ | (1,117) | | | n/a | | $ | 2,361 | | | n/a | | n/a |

Geographical Revenue Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | % | | % of Total Revenue |

| 2023 | | 2022 | | Increase | | 2023 | | 2022 |

| United States | $ | 55,611 | | | $ | 47,615 | | | 16.8 | % | | 52.7 | % | | 60.7 | % |

| Canada | 11,592 | | | 9,224 | | | 25.7 | % | | 11.0 | % | | 11.8 | % |

| China | 16,584 | | | 6,221 | | | 166.6 | % | | 15.7 | % | | 7.9 | % |

| Continental Europe | 8,529 | | | 6,041 | | | 41.2 | % | | 8.1 | % | | 7.7 | % |

| Middle East/Africa | 4,958 | | | 2,474 | | | 100.4 | % | | 4.7 | % | | 3.2 | % |

| United Kingdom | 3,218 | | | 2,793 | | | 15.2 | % | | 3.0 | % | | 3.6 | % |

| Asia Pacific | 2,751 | | | 2,476 | | | 11.1 | % | | 2.6 | % | | 3.2 | % |

| Latin America | 2,120 | | | 1,378 | | | 53.8 | % | | 2.0 | % | | 1.8 | % |

| Other | 175 | | | 259 | | | (32.4) | % | | 0.2 | % | | 0.1 | % |

| Total | $ | 105,538 | | | $ | 78,481 | | | 34.5 | % | | 100.0 | % | | 100.0 | % |

Overall Revenue

•Total revenue grew 34.5% year-over-year ("YoY") and 2.8% over the third quarter 2023 ("QoQ").

•China region grew 166.6% and represented 15.7% of revenue. This increase was helped by a favorable comparable as the region was still dealing with the impacts of COVID-19 during the fourth quarter 2022.

•Middle East/Africa region grew 100.4% YoY and 26.8% QoQ.

Product and Service Revenue

•Total product revenue increased 35.8% YoY and 1.2% QoQ. This increase was due primarily to increased demand for our film products across multiple regions.

•Total window film increased 19.2% YoY, declined 25.9% QoQ, and represented 13.2% of total revenue. The sequential quarterly decline was due primarily to seasonality.

•Total service revenue increased 30.0% YoY and 8.9% QoQ. This increase is due primarily to an increase in installation labor revenue.

•Total installation revenue (labor and product combined) grew 45.7% YoY and represented 18.8% of total revenue. This increase was due primarily to increased demand in our Company-owned installation facilities and across our dealership services and OEM businesses.

•Adjusted product revenue (combining cutbank credits revenue and product revenue) grew 32.4% YoY.

Other Financial Information

•Gross margin percentage was 38.8% and 39.6% in the fourth quarter 2023 and 2022 respectively. This decline in gross margin percentage was due mainly to the significant increase in YoY lower margin China and Middle East/Africa revenue.

•Total operating expenses grew 32.2% YoY and 11.7% QoQ.

◦Sales and marketing expenses grew 34.8% YoY and 19.5% QoQ and represented 8.8% of revenue.

◦General and administrative expenses grew 30.9% YoY and 8.1% QoQ. This increase was due mainly to increases in personnel, occupancy costs, information technology

costs, research and development costs and professional fees to support the ongoing growth of the business.

•Net income grew 43.2% YoY and declined 12.3% QoQ.

•EBITDA grew 33.6% YoY and declined 10.5% QoQ2.

Cash Flows from Operations

•Cash flows used in operations was $1.1 million in the fourth quarter 2023.

2024 Outlook

•Annual revenue growth of approximately 15%

Please see the information under "Forward-looking Statements" below regarding certain cautionary statements relating to our 2024 Outlook.

Conference Call Information

The Company will host a conference call and webcast today, February 22, 2024 at 11:00 a.m. Eastern Time to discuss the Company’s fourth quarter and year end 2023 results.

To access the live webcast, please visit the XPEL, Inc. website at www.xpel.com/investor.

To participate in the call by phone, dial 888-506-0062 approximately five minutes prior to the scheduled start time. International callers please dial (973) 528-0011. Callers should use access code: 997135.

A replay of the teleconference will be available until March 23, 2024 and may be accessed by dialing (877) 481-4010. International callers may dial (919) 882-2331. Callers should use conference ID: 49778.

About XPEL, Inc.

XPEL is a leading provider of protective films and coatings, including automotive paint protection film, surface protection film, automotive and architectural window films, and ceramic coatings. With a global footprint, a network of trained installers and proprietary DAP software, XPEL is dedicated to exceeding customer expectations by providing high-quality products, leading customer service, expert technical support and world-class training. XPEL, Inc. is publicly traded on Nasdaq under the symbol “XPEL”.

1 The results summarized above for 2023 are preliminary and unaudited. As the Company completes its quarter-end and fiscal year-end financial close processes and finalizes its financial statements for the fourth quarter and full fiscal year 2023, it is possible that the Company may identify items that require it to make adjustments to the preliminary unaudited financial information set forth above, and those adjustments could be material. Full fiscal year 2023 financial information will be included in the filing of the Company’s Annual Report on Form 10-K with the Securities and Exchange Commission which is anticipated on or prior to February 29, 2024.

2 See "Non-GAAP Financial Measure" and "Reconciliation of Non-GAAP Financial Measure" below.

Forward-looking Statements

This release includes forward-looking statements (within the meaning of Section 27A of the Securities act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended) regarding XPEL, Inc. and its business, which may include, but is not limited to, anticipated use of proceeds from capital transactions, expansion into new markets, execution of the company's growth strategy and outlook. Often, but not always, forward-looking statements can be identified by the use of words such as "plans," "is expected," "expects," "scheduled," "intends," "contemplates," "anticipates," "believes," "proposes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may," "could,"

"would," "might" or "will" be taken, occur or be achieved. Such statements are based on the current expectations and assumptions of the management of XPEL. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements expressed or implied by the forward-looking statements. These risks, uncertainties and other factors relate to, among others: competition, disruption in our supply chain, technology that could render our products obsolete, changes in the way vehicles are sold, our brand and reputation, cyber events and other legal and regulatory developments. There are several risks, uncertainties, and other important factors, many of which are beyond the Company’s control, that could cause its actual results to differ materially from the forward-looking statements contained in this press release, including those described in the “Risk Factors” section of Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other documents filed from time to time with the SEC by XPEL and available on XPEL's website at www.xpel.com/corporate filings. Although XPEL has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and XPEL undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

Non-GAAP Financial Measure

To aid in the understanding of XPEL's ongoing business performance, XPEL uses EBITDA, a non-GAAP financial measure. EBITDA is defined as net income (loss) plus interest expense, net, plus income tax expense plus depreciation and amortization expense. EBITDA should be considered in addition to, not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. It is not a measurement of XPEL's financial performance under GAAP and should not be considered as an alternative to revenue or net income, as applicable, or any other performance measures derived in accordance with GAAP and may not be comparable to other similarly title measures. For a full reconciliation of EBITDA to comparable GAAP measure, refer to the reconciliation titled "Reconciliation of Non-GAAP Financial Measure."

| | |

For more information, contact: |

Investor Relations: John Nesbett/Jennifer Belodeau IMS Investor Relations Phone: (203) 972-9200 Email: xpel@imsinvestorrelations.com |

XPEL, Inc.

Consolidated Statements of Income

(In thousands except per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (Unaudited) | | (Unaudited) | | | | (Unaudited) | | | | |

| 2023 | | 2022 | | | | 2023 | | 2022 | | |

| Revenue | | | | | | | | | | | |

| Product revenue | $ | 82,067 | | | $ | 60,421 | | | | | $ | 311,406 | | | $ | 258,174 | | | |

| Service revenue | 23,471 | | | 18,060 | | | | | 84,887 | | | 65,819 | | | |

| Total revenue | 105,538 | | | 78,481 | | | | | 396,293 | | | 323,993 | | | |

| | | | | | | | | | | |

| Cost of Sales | | | | | | | | | | | |

| Cost of product sales | 54,395 | | | 40,259 | | | | | 198,008 | | | 169,905 | | | |

| Cost of service | 10,211 | | | 7,176 | | | | | 35,871 | | | 26,576 | | | |

| Total cost of sales | 64,606 | | | 47,435 | | | | | 233,879 | | | 196,481 | | | |

| Gross Margin | 40,932 | | | 31,046 | | | | | 162,414 | | | 127,512 | | | |

| | | | | | | | | | | |

| Operating Expenses | | | | | | | | | | | |

| Sales and marketing | 9,234 | | | 6,852 | | | | | 31,788 | | | 25,367 | | | |

| General and administrative | 17,474 | | | 13,349 | | | | | 63,654 | | | 48,208 | | | |

| Total operating expenses | 26,708 | | | 20,201 | | | | | 95,442 | | | 73,575 | | | |

| | | | | | | | | | | |

| Operating Income | 14,224 | | | 10,845 | | | | | 66,972 | | | 53,937 | | | |

| | | | | | | | | | | |

| Interest expense | 301 | | | 477 | | | | | 1,248 | | | 1,410 | | | |

| Foreign currency exchange (gain) loss | (726) | | | (272) | | | | | (307) | | | 562 | | | |

| | | | | | | | | | | |

| Income before income taxes | 14,649 | | | 10,640 | | | | | 66,031 | | | 51,965 | | | |

| Income tax expense | 2,679 | | | 2,282 | | | | | 13,231 | | | 10,584 | | | |

| Net income | $ | 11,970 | | | $ | 8,358 | | | | | $ | 52,800 | | | $ | 41,381 | | | |

| | | | | | | | | | | |

| Earnings per share | | | | | | | | | | | |

| Basic | $ | 0.43 | | | $ | 0.30 | | | | | $ | 1.91 | | | $ | 1.50 | | | |

| Diluted | $ | 0.43 | | | $ | 0.30 | | | | | $ | 1.91 | | | $ | 1.50 | | | |

| Weighted Average Number of Common Shares | | | | | | | | | | | |

| Basic | 27,629 | | | 27,616 | | | | | 27,622 | | | 27,614 | | | |

| Diluted | 27,633 | | | 27,618 | | | | | 27,634 | | | 27,616 | | | |

XPEL, Inc.

Consolidated Balance Sheets

(In thousands except share and per share data)

| | | | | | | | | | | |

| (Unaudited)

12/31/2023 | | December 31, 2022 |

| Assets | | | |

| Current | | | |

| Cash and cash equivalents | $ | 11,609 | | | $ | 8,056 | |

| Accounts receivable, net | 24,111 | | | 14,726 | |

| Inventory, net | 106,509 | | | 80,575 | |

| Prepaid expenses and other current assets | 3,529 | | | 3,464 | |

| Income tax receivable | 696 | | | — | |

| Total current assets | 146,454 | | | 106,821 | |

| Property and equipment, net | 16,980 | | | 14,203 | |

| Right-of-use lease assets | 15,459 | | | 15,309 | |

| Intangible assets, net | 34,905 | | | 29,294 | |

| Other non-current assets | 782 | | | 972 | |

| Goodwill | 37,461 | | | 26,763 | |

| Total assets | $ | 252,041 | | | $ | 193,362 | |

| Liabilities | | | |

| Current | | | |

| | | |

| Current portion of notes payable | $ | 62 | | | $ | 77 | |

| Current portion of lease liabilities | 3,966 | | | 3,885 | |

| Accounts payable and accrued liabilities | 32,444 | | | 22,970 | |

| Income tax payable | — | | | 470 | |

| Total current liabilities | 36,472 | | | 27,402 | |

| Deferred tax liability, net | 2,658 | | | 2,049 | |

| Other long-term liabilities | 890 | | | 1,070 | |

| Borrowings on line of credit | 19,000 | | | 26,000 | |

| Non-current portion of lease liabilities | 12,715 | | | 12,119 | |

| Non-current portion of notes payable | 317 | | | — | |

| Total liabilities | 72,052 | | | 68,640 | |

| Commitments and Contingencies (Note 15) | | | |

| Stockholders’ equity | | | |

| Preferred stock, $0.001 par value; authorized 10,000,000; none issued and outstanding | — | | | — | |

| Common stock, $0.001 par value; 100,000,000 shares authorized; 27,630,025 and 27,616,064 issued and outstanding, respectively | 28 | | | 28 | |

| Additional paid-in-capital | 12,546 | | | 11,073 | |

| Accumulated other comprehensive loss | (1,209) | | | (2,203) | |

| Retained earnings | 168,624 | | | 115,824 | |

| Total stockholders’ equity | 179,989 | | | 124,722 | |

| Total liabilities and stockholders’ equity | $ | 252,041 | | | $ | 193,362 | |

XPEL, Inc.

Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months ended December 31, | | Year Ended December 31, |

| (Unaudited) | | (Unaudited) | | (Unaudited) | | |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows from operating activities | | | | | | | |

| Net income | $ | 11,970 | | | $ | 8,358 | | | $ | 52,800 | | | $ | 41,381 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | | | | |

| Depreciation of property, plant and equipment | 1,305 | | | 947 | | | 4,534 | | | 3,433 | |

| Amortization of intangible assets | 1,399 | | | 1,153 | | | 5,059 | | | 4,401 | |

| (Gain) loss on sale of property and equipment | (2) | | | 2 | | | (13) | | | (8) | |

| Stock compensation | 496 | | | 205 | | | 1,640 | | | 522 | |

| Bad debt expense | 27 | | | 117 | | | 243 | | | 467 | |

| Deferred income tax | (77) | | | (478) | | | (921) | | | (471) | |

| Accretion on notes payable | — | | | 1 | | | — | | | 7 | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable, net | 2,483 | | | 3,268 | | | (7,000) | | | (2,631) | |

| Inventory, net | (13,260) | | | (10,142) | | | (24,843) | | | (28,565) | |

| Prepaid expenses and other assets | 7,892 | | | 4,241 | | | 604 | | | 259 | |

| Income tax payable or receivable | (1,517) | | | 83 | | | (1,197) | | | 1,160 | |

| Accounts payable and accrued liabilities | (11,833) | | | (5,393) | | | 6,478 | | | (7,898) | |

| Net cash (used in) provided by operating activities | (1,117) | | | 2,362 | | | 37,384 | | | 12,057 | |

| Cash flows used in investing activities | | | | | | | |

| Purchase of property, plant and equipment | (1,615) | | | (2,402) | | | (6,356) | | | (7,936) | |

| Proceeds from sale of property and equipment | 9 | | | 7 | | | 29 | | | 73 | |

| Acquisitions, net of cash acquired, payment holdbacks, and notes payable | (14,038) | | | (1,680) | | | (18,735) | | | (4,673) | |

| Development or purchase of intangible assets | (493) | | | (252) | | | (1,291) | | | (1,620) | |

| Net cash used in investing activities | (16,137) | | | (4,327) | | | (26,353) | | | (14,156) | |

| Cash flows from financing activities | | | | | | | |

| Net borrowings (payments) on revolving credit agreements | 19,000 | | | — | | | (7,000) | | | 1,000 | |

| | | | | | | |

| Restricted stock withholding taxes paid in lieu of issued shares | — | | | — | | | (167) | | | (30) | |

| Repayments of notes payable | (15) | | | (64) | | | (92) | | | (368) | |

| Net cash provided by (used in) financing activities | 18,985 | | | (64) | | | (7,259) | | | 602 | |

| Net change in cash and cash equivalents | 1,731 | | | (2,029) | | | 3,772 | | | (1,497) | |

| Foreign exchange impact on cash and cash equivalents | (496) | | | (160) | | | (219) | | | (91) | |

| Increase (Decrease) in cash and cash equivalents during the period | 1,235 | | | (2,189) | | | 3,553 | | | (1,588) | |

| Cash and cash equivalents at beginning of period | 10,374 | | | 10,245 | | | 8,056 | | | 9,644 | |

| Cash and cash equivalents at end of period | $ | 11,609 | | | $ | 8,056 | | | $ | 11,609 | | | $ | 8,056 | |

| Supplemental schedule of non-cash activities | | | | | | | |

| Non-cash lease financing | $ | 2,384 | | | $ | 885 | | | $ | 4,231 | | | $ | 6,094 | |

| Issuance of common stock for vested restricted stock units | $ | 327 | | | $ | — | | | $ | 1,201 | | | $ | 222 | |

| Supplemental cash flow information | | | | | | | |

| Cash paid for income taxes | $ | 4,149 | | | $ | 2,592 | | | $ | 15,293 | | | $ | 9,897 | |

| Cash paid for interest | $ | 240 | | | $ | 407 | | | $ | 1,240 | | | $ | 1,306 | |

Reconciliation of Non-GAAP Financial Measure

EBITDA is a non-GAAP financial measure. EBITDA is defined as net income (loss) plus interest expense, net, plus income tax expense plus depreciation expense and amortization expense. EBITDA should be considered in addition to, not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. It is not a measurement of our financial performance under GAAP and should not be considered as alternatives to revenue or net income, as applicable, or any other performance measures derived in accordance with GAAP and may not be comparable to other similarly titled measures of other businesses. EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our operating results as reported under GAAP.

EBITDA does not reflect the impact of certain cash charges resulting from matters we consider not to be indicative of ongoing operations and other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

EBITDA Reconciliation (in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| (Unaudited) | | (Unaudited) | | | | (Unaudited) | | | | |

| 2023 | | 2022 | | | | 2023 | | 2022 | | |

| Net Income | $ | 11,970 | | | $ | 8,358 | | | | | $ | 52,800 | | | $ | 41,381 | | | |

| Interest | 301 | | | 477 | | | | | 1,248 | | | 1,410 | | | |

| Taxes | 2,679 | | | 2,282 | | | | | 13,231 | | | 10,584 | | | |

| Depreciation | 1,305 | | | 947 | | | | | 4,534 | | | 3,433 | | | |

| Amortization | 1,399 | | | 1,153 | | | | | 5,059 | | | 4,401 | | | |

| EBITDA | $ | 17,654 | | | $ | 13,217 | | | | | $ | 76,872 | | | $ | 61,209 | | | |

Cover

|

Feb. 22, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 22, 2024

|

| Entity Registrant Name |

XPEL, INC.

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001767258

|

| Soliciting Material |

false

|

| City Area Code |

(210)

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

XPEL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Local Phone Number |

678-3700

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-38858

|

| Entity Tax Identification Number |

20-1117381

|

| Entity Address, Postal Zip Code |

78215

|

| Entity Address, Address Line One |

711 Broadway, Suite 320

|

| Entity Address, State or Province |

TX

|

| Entity Address, City or Town |

San Antonio

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

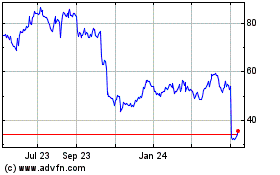

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

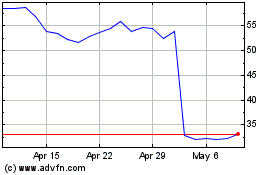

XPEL (NASDAQ:XPEL)

Historical Stock Chart

From Apr 2023 to Apr 2024