false000148158200014815822024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 21, 2024 |

Ryerson Holding Corporation

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-34735 |

26-1251524 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

227 W. Monroe St. 27th Floor |

|

Chicago, Illinois |

|

60606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (312) 292-5000 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.01 par value, 100,000,000 shares authorized |

|

RYI |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

The information contained within Item 2.02 of this Form 8-K and Exhibit 99.1 and Exhibit 99.2 attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

On February 21, 2024, Ryerson Holding Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The Company also provided a presentation as a supplement to its press release. A copy of the presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

d) Exhibits

The following exhibits are being furnished or filed, as applicable, with this Current Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

RYERSON HOLDING CORPORATION |

|

|

|

|

Date: |

February 21, 2024 |

By: |

/s/ James. J. Claussen |

|

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

Ryerson Reports Fourth Quarter and Full Year 2023 Results

Quarterly business highlights include three acquisitions and tenth consecutive increase in quarterly dividend. Results include strong cash flow generation and continued investment in organic growth initiatives, including the University Park, Illinois service center.

CHICAGO – February 21, 2024 – Ryerson Holding Corporation (NYSE: RYI), a leading value-added processor and distributor of industrial metals, today reported results for the fourth quarter and full year ended December 31, 2023.

Highlights:

•Achieved fourth quarter Net Income attributable to Ryerson Holding Corporation of $26 million and Adjusted EBITDA1, excluding LIFO of $26 million

•Delivered fourth quarter Diluted Earnings Per Share of $0.74 on revenue of $1.1 billion

•Generated fourth quarter Operating Cash Flow of $90 million and Free Cash Flow of $65 million

•Acquired three businesses in the fourth quarter, two value-added processors, Norlen Incorporated (“Norlen”) and TSA Processing (“TSA”), as well as a tool steel processor and distributor, Hudson Tool Steel Corporation (“Hudson”)

•Published 2023 Sustainability Report

•Announced first quarter 2024 dividend of $0.1875 per share, our tenth consecutive dividend increase

•Maintained fourth-quarter Net Leverage ratio within target range at 1.7x, with debt of $436 million and net debt2 of $382 million as of December 31, 2023

•Earned full-year Net Income attributable to Ryerson Holding Corporation of $146 million and Adjusted EBITDA1, excluding LIFO of $231 million

•Delivered full-year Diluted Earnings Per Share of $4.10 on revenue of $5.1 billion

•Generated full-year Operating Cash Flow of $365 million and Free Cash Flow of $244 million

•Completed second year of an investment cycle in next-stage operating model growth and shareholder returns through cumulative investments of $422 million in acquisitions and capex and returns to shareholders of $209 million in share buybacks and dividends since 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ in millions, except tons (in thousands), average selling prices, and earnings per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights: |

|

Q4 2023 |

|

Q3 2023 |

|

Q4 2022 |

|

QoQ |

|

YoY |

|

2023 |

|

2022 |

|

YoY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$1,112.4 |

|

$1,246.7 |

|

$1,288.2 |

|

(10.8)% |

|

(13.6)% |

|

$5,108.7 |

|

$6,323.6 |

|

(19.2)% |

Tons shipped |

|

450 |

|

478 |

|

465 |

|

(5.9)% |

|

(3.2)% |

|

1,943 |

|

2,029 |

|

(4.2)% |

Average selling price/ton |

|

$2,472 |

|

$2,608 |

|

$2,770 |

|

(5.2)% |

|

(10.8)% |

|

$2,629 |

|

$3,117 |

|

(15.7)% |

Gross margin |

|

22.2% |

|

20.0% |

|

12.7% |

|

220 bps |

|

950 bps |

|

20.0% |

|

20.7% |

|

-70 bps |

Gross margin, excl. LIFO |

|

16.9% |

|

17.3% |

|

15.3% |

|

-40 bps |

|

160 bps |

|

18.1% |

|

19.8% |

|

-170 bps |

Warehousing, delivery, selling, general, and administrative expenses |

|

$203.7 |

|

$193.0 |

|

$190.5 |

|

5.5% |

|

6.9% |

|

$793.5 |

|

$735.2 |

|

7.9% |

As a percentage of revenue |

|

18.3% |

|

15.5% |

|

14.8% |

|

280 bps |

|

350 bps |

|

15.5% |

|

11.6% |

|

390 bps |

Net income (loss) attributable to Ryerson Holding Corporation |

|

$25.8 |

|

$35.0 |

|

$(24.1) |

|

(26.3)% |

|

(207.1)% |

|

$145.7 |

|

$391.0 |

|

(62.7)% |

Diluted earnings (loss) per share |

|

$0.74 |

|

$1.00 |

|

$(0.65) |

|

$(0.26) |

|

$1.39 |

|

$4.10 |

|

$10.21 |

|

$(6.11) |

Adjusted diluted earnings (loss) per share |

|

$0.73 |

|

$1.00 |

|

$(0.65) |

|

$(0.27) |

|

$1.38 |

|

$4.08 |

|

$10.54 |

|

$(6.46) |

Adj. EBITDA, excl. LIFO |

|

$25.9 |

|

$45.0 |

|

$28.7 |

|

(42.4)% |

|

(9.8)% |

|

$231.1 |

|

$582.0 |

|

(60.3)% |

Adj. EBITDA, excl. LIFO margin |

|

2.3% |

|

3.6% |

|

2.2% |

|

-130 bps |

|

10 bps |

|

4.5% |

|

9.2% |

|

-470 bps |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet and Cash Flow Highlights: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total debt |

|

$436.5 |

|

$365.9 |

|

$367.0 |

|

19.3% |

|

18.9% |

|

$436.5 |

|

$367.0 |

|

18.9% |

Cash and cash equivalents |

|

$54.3 |

|

$37.4 |

|

$39.2 |

|

45.2% |

|

38.5% |

|

$54.3 |

|

$39.2 |

|

38.5% |

Net debt |

|

$382.2 |

|

$328.5 |

|

$327.8 |

|

16.3% |

|

16.6% |

|

$382.2 |

|

$327.8 |

|

16.6% |

Net debt / LTM Adj. EBITDA, excl. LIFO |

|

1.7x |

|

1.4x |

|

0.6x |

|

0.3x |

|

1.1x |

|

1.7x |

|

0.6x |

|

1.1x |

Cash conversion cycle (days) |

|

84.6 |

|

78.3 |

|

91.6 |

|

6.3 |

|

(7.0) |

|

79.3 |

|

80.9 |

|

(1.6) |

Net cash provided by (used in) operating activities |

|

$90.1 |

|

$79.3 |

|

$181.6 |

|

$10.8 |

|

$(91.5) |

|

$365.1 |

|

$501.2 |

|

$(136.1) |

A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included below in this news release.

Management Commentary

Eddie Lehner, Ryerson’s President and Chief Executive Officer, said, “Reflecting on the fourth quarter, and full-year 2023, I want to start by thanking my Ryerson teammates for prioritizing operating safely throughout our entire organization as safety is always our first priority. As far as our over-all business performance, 2023 marked the second year of Ryerson’s longest and most significant investment cycle in more than a generation. We are taking big steps to create our next-generation operating model and the industry’s best customer experience. Over the past year, we invested in the modernization, integration and expansion of our network of interconnected intelligent service centers, highlighted by an Enterprise Resource Planning (“ERP”) conversion across our largest business unit, new and expanding facilities at Centralia, WA, University Park, IL, Las Vegas, NV, and Shelbyville, KY, as well as welcoming four excellent additions to the Family of Companies in BLP Holdings, LLC, Norlen Incorporated, TSA Processing, and Hudson Tool Steel Corporation. We finished the year with approximately two-thirds of our operating cash flow allocated to growth-oriented projects while increasing our dividend over four consecutive quarters and buying back approximately $114 million of Ryerson shares for the full-year.

Over the fourth quarter and the entire year, as we carried out our investments in modernization, integration, and expansion, our business operated against a backdrop of slowing manufacturing activity. You could say the sun wasn’t shining on our addressable markets as full-year industry stainless volumes corrected down 14% and nickel traded down by more than 40%, while other industrial metal-consuming verticals to which we have less exposure performed better, such as automotive, aerospace, defense and non-residential construction. Fourth quarter volumes decreased across most of our end-markets due to holiday seasonality and ongoing destocking across non-ferrous product lines. For the full-year 2023, our end-market volumes mainly increased in our commercial ground transportation and oil & gas end-markets, while decreasing across most other industrial and consumer end-markets. Despite moving through a counter-cyclical bottom across the majority of our commercial book of business, we continue to believe that our aforementioned investments in our next-gen operating model will position us to deliver higher thru-the-cycle earnings to our shareholders with less volatility as we inflect to an anticipated industry upturn as well as expected longer-term secular growth drivers in North American manufacturing.”

Fourth Quarter Results

Ryerson generated revenue of $1.1 billion in the fourth quarter of 2023, a decrease of 10.8% compared to the third quarter of 2023. Revenue during the period was influenced by seasonally lower volumes and easing average selling prices, which decreased 5.9% to 450,000 tons and 5.2% to $2,472 per ton, respectively, compared to the third quarter of 2023.

Gross margin expanded sequentially by 220 basis points to 22.2% in the fourth quarter of 2023, compared to 20.0% in the third quarter. Gross margins reflected LIFO income of $59.3 million, as average inventory costs were impacted by decreases in commodity price for our metals products sales mix. Excluding the impact of LIFO, gross margin contracted 40 basis points to 16.9% in the fourth quarter of 2023, compared to 17.3% in the third quarter. The compression in gross margins, excluding LIFO, was primarily driven by a decrease in prices of our aluminum and stainless-steel product mix due to above normal inventories in the channel that put downward pressure on average selling prices.

Warehousing, delivery, selling, general and administrative expenses increased 5.5% to $203.7 million in the fourth quarter, compared to $193.0 million in the third quarter, primarily driven by higher depreciation expense, increased operating expenses from recent acquisitions, as well as reorganization expenses related to our ERP system conversion and start-up costs associated with the University Park, Illinois service center, partially offset by lower personnel-related expenses, lower delivery expenses, and lower fixed and variable operating expenses.

Net income attributable to Ryerson Holding Corporation for the fourth quarter of 2023 was $25.8 million, or $0.74 per diluted share, compared to net income of $35.0 million, or $1.00 per diluted share in the previous quarter. Ryerson generated Adjusted EBITDA, excluding LIFO of $25.9 million in the fourth quarter of 2023, compared to the third quarter Adjusted EBITDA, excluding LIFO of $45.0 million. For the full-year 2023, Ryerson generated $5.1 billion in revenue and earned $145.7 million in net income and $231.1 million in Adjusted EBITDA, excluding LIFO.

Liquidity & Debt Management

Ryerson generated $90.1 million of cash from operations in the fourth quarter of 2023, supported by net income attributable to Ryerson Holding of $25.8 million and working capital release of $15.1 million. The Company ended the fourth quarter of 2023 with $436.5 million of debt and $382.2 million of net debt, an increase of $69.5 million and $54.4 million, respectively, compared to the fourth quarter of 2022. Ryerson’s leverage ratio as of the fourth quarter was 1.7x, which remains within the Company’s target leverage range.

Ryerson’s global liquidity, composed of cash and cash equivalents and availability on its revolving credit facilities, was $656 million as of December 31, 2023.

Shareholder Return Activity

Dividends. On February 21, 2024, the Board of Directors declared a quarterly cash dividend of $0.1875 per share of common stock, payable on March 21, 2024, to stockholders of record as of March 7, 2024. During the fourth quarter of 2023, Ryerson paid a quarterly dividend in the amount of $0.1850 per share, amounting to a cash return of approximately $6.3 million. For the full-year 2023, Ryerson paid dividends of approximately $0.72 per share, which resulted in a return of $24.8 million to shareholders.

Share Repurchase. Ryerson repurchased 219,614 shares for $6.3 million in the open market during the fourth quarter of 2023. Ryerson made these repurchases in accordance with its share repurchase authorization, which allows the Company to acquire up to an aggregate amount of $100.0 million of the Company’s common stock through April of 2025. For the full-year 2023, the Company repurchased 3.3 million shares, resulting in a return of $113.9 million to shareholders. As of December 31, 2023, $39.4 million of the $100.0 million remained under the existing share repurchase authorization.

Outlook Commentary

For the first quarter of 2024, Ryerson expects normal seasonal demand conditions, with customer shipments expected to increase approximately 8% to 10%, quarter-over-quarter. The Company anticipates first-quarter revenue to be in the range of $1.21 to $1.25 billion, with average selling prices increasing 1% to 3%. LIFO income in the first quarter of 2024 is expected to be zero. We expect Adjusted EBITDA, excluding LIFO in the range of $58 million to $62 million and earnings per diluted share in the range of $0.24 to $0.34.

|

|

|

|

|

|

|

|

|

|

|

|

|

Fourth Quarter 2023 Major Product Metrics |

|

|

|

|

|

|

Net Sales (millions) |

|

|

Q4 2023 |

|

Q3 2023 |

|

|

Q4 2022 |

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

575 |

$ |

647 |

|

$ |

684 |

|

(11.1)% |

|

(15.9)% |

|

Aluminum |

$ |

241 |

$ |

273 |

|

$ |

269 |

|

(11.7)% |

|

(10.4)% |

|

Stainless Steel |

$ |

271 |

$ |

304 |

|

$ |

313 |

|

(10.9)% |

|

(13.4)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Shipped (thousands) |

|

|

Q4 2023 |

|

Q3 2023 |

|

|

Q4 2022 |

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

347 |

|

371 |

|

|

365 |

|

(6.5)% |

|

(4.9)% |

|

Aluminum |

|

48 |

|

49 |

|

|

45 |

|

(2.0)% |

|

6.7% |

|

Stainless Steel |

|

52 |

|

55 |

|

|

52 |

|

(5.5)% |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Selling Prices (per ton) |

|

|

Q4 2023 |

|

Q3 2023 |

|

|

Q4 2022 |

|

Quarter-over-quarter |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

$ |

1,657 |

$ |

1,744 |

|

$ |

1,874 |

|

(5.0)% |

|

(11.6)% |

|

Aluminum |

$ |

5,021 |

$ |

5,571 |

|

$ |

5,978 |

|

(9.9)% |

|

(16.0)% |

|

Stainless Steel |

$ |

5,212 |

$ |

5,527 |

|

$ |

6,019 |

|

(5.7)% |

|

(13.4)% |

|

|

|

|

|

|

|

|

|

|

|

|

Full Year 2023 Major Product Metrics |

|

|

|

|

|

|

|

|

|

|

Net Sales (millions) |

|

|

|

|

2023 |

|

|

2022 |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

$ |

2,597 |

|

$ |

3,371 |

|

(23.0)% |

|

Aluminum |

|

|

$ |

1,121 |

|

$ |

1,235 |

|

(9.2)% |

|

Stainless Steel |

|

$ |

1,291 |

|

$ |

1,625 |

|

(20.6)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Shipped (thousands) |

|

|

|

|

2023 |

|

|

2022 |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

|

1,504 |

|

|

1,583 |

|

(5.0)% |

|

Aluminum |

|

|

|

200 |

|

|

195 |

|

2.6% |

|

Stainless Steel |

|

|

229 |

|

|

242 |

|

(5.4)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average Selling Prices (per ton) |

|

|

|

|

2023 |

|

|

2022 |

Year-over-year |

|

|

|

|

|

|

|

|

|

|

|

Carbon Steel |

|

$ |

1,727 |

|

$ |

2,130 |

|

(18.9)% |

|

Aluminum |

|

|

$ |

5,605 |

|

$ |

6,333 |

|

(11.5)% |

|

Stainless Steel |

|

$ |

5,638 |

|

$ |

6,715 |

|

(16.0)% |

|

Earnings Call Information

Ryerson will host a conference call to discuss fourth quarter and full-year 2023 financial results for the period ended December 31, 2023, on Thursday, February 22, 2024, at 10 a.m. Eastern Time. The live online broadcast will be available on the Company’s investor relations website, ir.ryerson.com. A replay will be available at the same website for 90 days.

About Ryerson

Ryerson is a leading value-added processor and distributor of industrial metals, with operations in the United States, Canada, Mexico, and China. Founded in 1842, Ryerson has around 4,600 employees and 114 locations. Visit Ryerson at www.ryerson.com.

Manager – Investor Relations:

Pratham Dear

312.292.5033

investorinfo@ryerson.com

Notes:

1For EBITDA, Adjusted EBITDA and Adjusted EBITDA excluding LIFO please see Schedule 2

2Net debt is defined as long term debt plus short term debt less cash and cash equivalents and excludes restricted cash

Legal Disclaimer

The contents herein are provided for general information purposes only and do not constitute an offer to sell or buy, or a solicitation of an offer to buy, any security (“Security”) of the Company or its affiliates (“Ryerson”) in any jurisdiction. Ryerson does not intend to solicit, and is not soliciting, any action with respect to any Security or any other contractual relationship with Ryerson. Nothing in this release, individually or taken in the aggregate, constitutes an offer of securities for sale or buy, or a solicitation of an offer to buy, any Security in the United States, or to U.S. persons, or in any other jurisdiction in which such an offer or solicitation is unlawful.

Safe Harbor Provision

Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent our annual report on Form 10-K and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Selected Income and Cash Flow Data - Unaudited |

|

(Dollars and Shares in Millions, except Per Share and Per Ton Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third |

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

|

Quarter |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET SALES |

|

$ |

1,112.4 |

|

|

$ |

1,288.2 |

|

|

$ |

1,246.7 |

|

|

$ |

5,108.7 |

|

|

$ |

6,323.6 |

|

Cost of materials sold |

|

|

865.2 |

|

|

|

1,125.1 |

|

|

|

997.4 |

|

|

|

4,087.1 |

|

|

|

5,013.5 |

|

Gross profit |

|

|

247.2 |

|

|

|

163.1 |

|

|

|

249.3 |

|

|

|

1,021.6 |

|

|

|

1,310.1 |

|

Warehousing, delivery, selling, general, and administrative |

|

|

203.7 |

|

|

|

190.5 |

|

|

|

193.0 |

|

|

|

793.5 |

|

|

|

735.2 |

|

Gain on sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3.8 |

) |

OPERATING PROFIT (LOSS) |

|

|

43.5 |

|

|

|

(27.4 |

) |

|

|

56.3 |

|

|

|

228.1 |

|

|

|

578.7 |

|

Other income and (expense), net (1) |

|

|

(0.5 |

) |

|

|

(0.3 |

) |

|

|

1.2 |

|

|

|

0.3 |

|

|

|

(22.6 |

) |

Interest and other expense on debt |

|

|

(9.5 |

) |

|

|

(7.0 |

) |

|

|

(9.3 |

) |

|

|

(34.7 |

) |

|

|

(33.2 |

) |

INCOME (LOSS) BEFORE INCOME TAXES |

|

|

33.5 |

|

|

|

(34.7 |

) |

|

|

48.2 |

|

|

|

193.7 |

|

|

|

522.9 |

|

Provision (benefit) for income taxes |

|

|

7.5 |

|

|

|

(10.9 |

) |

|

|

12.9 |

|

|

|

47.3 |

|

|

|

131.4 |

|

NET INCOME (LOSS) |

|

|

26.0 |

|

|

|

(23.8 |

) |

|

|

35.3 |

|

|

|

146.4 |

|

|

|

391.5 |

|

Less: Net income attributable to noncontrolling interest |

|

|

0.2 |

|

|

|

0.3 |

|

|

|

0.3 |

|

|

|

0.7 |

|

|

|

0.5 |

|

NET INCOME (LOSS) ATTRIBUTABLE TO RYERSON HOLDING CORPORATION |

|

$ |

25.8 |

|

|

$ |

(24.1 |

) |

|

$ |

35.0 |

|

|

$ |

145.7 |

|

|

$ |

391.0 |

|

EARNINGS (LOSS) PER SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.76 |

|

|

$ |

(0.65 |

) |

|

$ |

1.02 |

|

|

$ |

4.17 |

|

|

$ |

10.41 |

|

Diluted |

|

$ |

0.74 |

|

|

$ |

(0.65 |

) |

|

$ |

1.00 |

|

|

$ |

4.10 |

|

|

$ |

10.21 |

|

Shares outstanding - basic |

|

|

34.1 |

|

|

|

37.0 |

|

|

|

34.3 |

|

|

|

35.0 |

|

|

|

37.6 |

|

Shares outstanding - diluted |

|

|

34.7 |

|

|

|

37.0 |

|

|

|

34.9 |

|

|

|

35.6 |

|

|

|

38.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per share |

|

$ |

0.185 |

|

|

$ |

0.16 |

|

|

$ |

0.1825 |

|

|

$ |

0.7175 |

|

|

$ |

0.535 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Data : |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons shipped (000) |

|

|

450 |

|

|

|

465 |

|

|

|

478 |

|

|

|

1,943 |

|

|

|

2,029 |

|

Shipping days |

|

|

60 |

|

|

|

60 |

|

|

|

63 |

|

|

|

251 |

|

|

|

251 |

|

Average selling price/ton |

|

$ |

2,472 |

|

|

$ |

2,770 |

|

|

$ |

2,608 |

|

|

$ |

2,629 |

|

|

$ |

3,117 |

|

Gross profit/ton |

|

|

549 |

|

|

|

351 |

|

|

|

522 |

|

|

|

526 |

|

|

|

646 |

|

Operating profit (loss)/ton |

|

|

97 |

|

|

|

(59 |

) |

|

|

118 |

|

|

|

117 |

|

|

|

285 |

|

LIFO expense (income) per ton |

|

|

(132 |

) |

|

|

74 |

|

|

|

(70 |

) |

|

|

(50 |

) |

|

|

(29 |

) |

LIFO expense (income) |

|

|

(59.3 |

) |

|

|

34.6 |

|

|

|

(33.4 |

) |

|

|

(97.7 |

) |

|

|

(58.1 |

) |

Depreciation and amortization expense |

|

|

20.1 |

|

|

|

16.5 |

|

|

|

13.6 |

|

|

|

62.5 |

|

|

|

59.0 |

|

Cash flow provided by operating activities |

|

|

90.1 |

|

|

|

181.6 |

|

|

|

79.3 |

|

|

|

365.1 |

|

|

|

501.2 |

|

Capital expenditures |

|

|

(25.4 |

) |

|

|

(33.9 |

) |

|

|

(22.4 |

) |

|

|

(121.9 |

) |

|

|

(105.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The year 2022 includes a $21.3 million loss on retirement of debt. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Schedule 1 for Condensed Consolidated Balance Sheets |

|

See Schedule 2 for EBITDA and Adjusted EBITDA reconciliation |

|

See Schedule 3 for Adjusted EPS reconciliation |

|

See Schedule 4 for Free Cash Flow reconciliation |

|

See Schedule 5 for First Quarter 2024 Guidance reconciliation |

|

|

|

|

|

|

|

|

|

|

Schedule 1 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Condensed Consolidated Balance Sheets |

|

(In millions, except shares) |

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

54.3 |

|

|

$ |

39.2 |

|

Restricted cash |

|

|

1.1 |

|

|

|

1.3 |

|

Receivables, less provisions of $1.7 at December 31, 2023 and $3.2 at December 31, 2022 |

|

|

467.7 |

|

|

|

514.4 |

|

Inventories |

|

|

782.5 |

|

|

|

798.5 |

|

Prepaid expenses and other current assets |

|

|

77.8 |

|

|

|

88.2 |

|

Total current assets |

|

|

1,383.4 |

|

|

|

1,441.6 |

|

Property, plant, and equipment, at cost |

|

|

1,071.5 |

|

|

|

898.6 |

|

Less: accumulated depreciation |

|

|

481.9 |

|

|

|

440.2 |

|

Property, plant, and equipment, net |

|

|

589.6 |

|

|

|

458.4 |

|

Operating lease assets |

|

|

349.4 |

|

|

|

240.5 |

|

Other intangible assets |

|

|

73.7 |

|

|

|

50.9 |

|

Goodwill |

|

|

157.8 |

|

|

|

129.2 |

|

Deferred charges and other assets |

|

|

15.7 |

|

|

|

13.7 |

|

Total assets |

|

$ |

2,569.6 |

|

|

$ |

2,334.3 |

|

Liabilities |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

463.4 |

|

|

$ |

438.4 |

|

Salaries, wages, and commissions |

|

|

51.9 |

|

|

|

67.3 |

|

Other accrued liabilities |

|

|

75.9 |

|

|

|

77.7 |

|

Short-term debt |

|

|

8.2 |

|

|

|

5.8 |

|

Current portion of operating lease liabilities |

|

|

30.5 |

|

|

|

25.2 |

|

Current portion of deferred employee benefits |

|

|

4.0 |

|

|

|

4.8 |

|

Total current liabilities |

|

|

633.9 |

|

|

|

619.2 |

|

Long-term debt |

|

|

428.3 |

|

|

|

361.2 |

|

Deferred employee benefits |

|

|

106.7 |

|

|

|

118.0 |

|

Noncurrent operating lease liabilities |

|

|

336.8 |

|

|

|

215.1 |

|

Deferred income taxes |

|

|

135.5 |

|

|

|

113.5 |

|

Other noncurrent liabilities |

|

|

13.9 |

|

|

|

14.3 |

|

Total liabilities |

|

|

1,655.1 |

|

|

|

1,441.3 |

|

Commitments and contingencies |

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Ryerson Holding Corporation stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.01 par value; 7,000,000 shares authorized; no shares issued and outstanding at December 31, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value; 100,000,000 shares authorized; 39,450,659 and 39,059,198 shares issued at December 31, 2023 and December 31, 2022, respectively |

|

|

0.4 |

|

|

|

0.4 |

|

Capital in excess of par value |

|

|

411.6 |

|

|

|

397.7 |

|

Retained earnings |

|

|

813.2 |

|

|

|

692.5 |

|

Treasury stock, at cost - Common stock of 5,413,434 shares at December 31, 2023 and 2,070,654 shares at December 31, 2022 |

|

|

(179.3 |

) |

|

|

(61.1 |

) |

Accumulated other comprehensive loss |

|

|

(140.0 |

) |

|

|

(144.4 |

) |

Total Ryerson Holding Corporation Stockholders' Equity |

|

|

905.9 |

|

|

|

885.1 |

|

Noncontrolling interest |

|

|

8.6 |

|

|

|

7.9 |

|

Total Equity |

|

|

914.5 |

|

|

|

893.0 |

|

Total Liabilities and Stockholders' Equity |

|

$ |

2,569.6 |

|

|

$ |

2,334.3 |

|

Note: EBITDA represents net income before interest and other expense on debt, provision for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, reorganization expenses, gain on sales of assets, gain or loss on retirement of debt, benefit plan curtailment gain, purchase consideration and other transaction costs, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding

LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit minus LIFO expense (income), divided by net sales. We have excluded LIFO expense (income) from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), gross margin, excluding LIFO expense (income), and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 3 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Reconciliation of Net Income (Loss) and Earnings (Loss) per Share to Adjusted Net Income (Loss) and Adjusted Earnings (Loss) Per Share |

|

(Dollars and Shares in Millions, Except Per Share Data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third |

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

|

Quarter |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

25.8 |

|

|

$ |

(24.1 |

) |

|

$ |

35.0 |

|

|

$ |

145.7 |

|

|

$ |

391.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on bargain purchase |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.6 |

) |

Gain on sale of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3.8 |

) |

Loss on retirement of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21.3 |

|

Benefit plan curtailment gain |

|

|

(0.8 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.8 |

) |

|

|

— |

|

Provision (benefit) for income taxes |

|

|

0.2 |

|

|

|

— |

|

|

|

— |

|

|

|

0.2 |

|

|

|

(4.3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net income (loss) attributable to Ryerson Holding Corporation |

|

$ |

25.2 |

|

|

$ |

(24.1 |

) |

|

$ |

35.0 |

|

|

$ |

145.1 |

|

|

$ |

403.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted diluted earnings (loss) per share |

|

$ |

0.73 |

|

|

$ |

(0.65 |

) |

|

$ |

1.00 |

|

|

$ |

4.08 |

|

|

$ |

10.54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares outstanding - diluted |

|

|

34.7 |

|

|

|

37.0 |

|

|

|

34.9 |

|

|

|

35.6 |

|

|

|

38.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Adjusted net income (loss) and Adjusted diluted earnings (loss) per share is presented to provide a means of comparison with periods that do not include similar adjustments. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 4 |

|

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

|

Cash Flow from Operations to Free Cash Flow Yield |

|

(Dollars in Millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third |

|

|

|

|

|

|

|

|

|

Fourth Quarter |

|

|

Quarter |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

90.1 |

|

|

$ |

181.6 |

|

|

$ |

79.3 |

|

|

$ |

365.1 |

|

|

$ |

501.2 |

|

Capital expenditures |

|

|

(25.4 |

) |

|

|

(33.9 |

) |

|

|

(22.4 |

) |

|

|

(121.9 |

) |

|

|

(105.1 |

) |

Proceeds from sales of property, plant, and equipment |

|

|

0.4 |

|

|

|

— |

|

|

|

— |

|

|

|

0.5 |

|

|

|

8.0 |

|

Free cash flow |

|

$ |

65.1 |

|

|

$ |

147.7 |

|

|

$ |

56.9 |

|

|

$ |

243.7 |

|

|

$ |

404.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Market capitalization |

|

$ |

1,180.4 |

|

|

$ |

1,119.3 |

|

|

$ |

996.5 |

|

|

$ |

1,180.4 |

|

|

$ |

1,119.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free cash flow yield |

|

|

5.5 |

% |

|

|

13.2 |

% |

|

|

5.7 |

% |

|

|

20.6 |

% |

|

|

36.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Market capitalization is calculated using December 31, 2023, September 30, 2023, and December 31, 2022 stock prices and shares outstanding. |

|

|

|

|

|

|

Schedule 5 |

RYERSON HOLDING CORPORATION AND SUBSIDIARY COMPANIES |

Reconciliation of First Quarter 2024 Net Income Attributable to Ryerson Holding Corporation to Adj. EBITDA, excl. LIFO Guidance |

(Dollars in Millions, except Per Share Data) |

|

|

First Quarter 2024 |

|

|

Low |

|

High |

Net income attributable to Ryerson Holding Corporation |

|

$8 |

|

$11 |

|

|

|

|

|

Diluted earnings per share |

|

$0.24 |

|

$0.34 |

|

|

|

|

|

Interest and other expense on debt |

|

10 |

|

10 |

Provision for income taxes |

|

3 |

|

4 |

Depreciation and amortization expense |

|

17 |

|

17 |

EBITDA |

|

$38 |

|

$42 |

Adjustments |

|

20 |

|

20 |

Adjusted EBITDA |

|

$58 |

|

$62 |

LIFO income |

|

— |

|

— |

Adjusted EBITDA, excluding LIFO |

|

$58 |

|

$62 |

|

|

|

|

|

Note: See the note within Schedule 2 for a description of EBITDA and Adjusted EBITDA. |

|

|

|

|

Ryerson Quarterly Release Presentation Q4 and Full-Year 2023 Exhibit 99.2

Important Information About Ryerson Holding Corporation These materials do not constitute an offer or solicitation to purchase or sell securities of Ryerson Holding Corporation (“Ryerson” or “the Company”) or its subsidiaries and no investment decision should be made based upon the information provided herein. Ryerson strongly urges you to review its filings with the Securities and Exchange Commission, which can be found at https://ir.ryerson.com/financials/sec-filings/default.aspx. This site also provides additional information about Ryerson. Safe Harbor Provision Certain statements made in this release and other written or oral statements made by or on behalf of the Company constitute “forward-looking statements” within the meaning of the federal securities laws, including statements regarding our future performance, as well as management's expectations, beliefs, intentions, plans, estimates, objectives, or projections relating to the future. Such statements can be identified by the use of forward-looking terminology such as “objectives,” “goals,” “preliminary,” “range,” “believes,” “expects,” “may,” “estimates,” “will,” “should,” “plans,” or “anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. The Company cautions that any such forward-looking statements are not guarantees of future performance and may involve significant risks and uncertainties, and that actual results may vary materially from those in the forward-looking statements as a result of various factors. Among the factors that significantly impact our business are: the cyclicality of our business; the highly competitive, volatile, and fragmented metals industry in which we operate; the impact of geopolitical events; fluctuating metal prices; our indebtedness and the covenants in instruments governing such indebtedness; the integration of acquired operations; regulatory and other operational risks associated with our operations located inside and outside of the United States; the influence of a single investor group over our policies and procedures; work stoppages; obligations under certain employee retirement benefit plans; currency fluctuations; and consolidation in the metals industry. Forward-looking statements should, therefore, be considered in light of various factors, including those set forth above and those set forth under “Risk Factors” in our most recent our annual report on Form 10-K and in our other filings with the Securities and Exchange Commission. Moreover, we caution against placing undue reliance on these statements, which speak only as of the date they were made. The Company does not undertake any obligation to publicly update or revise any forward-looking statements to reflect future events or circumstances, new information or otherwise. Non-GAAP Measures Certain measures contained in these slides or the related presentation are not measures calculated in accordance with generally accepted accounting principles (“GAAP”). They should not be considered a replacement for GAAP results. Non-GAAP financial measures appearing in these slides are identified in the footnotes. �A reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures is included in the Appendix.

Q4 and Full-Year 2023 Achieved fourth quarter Net Income attributable to Ryerson Holding Corporation of $26 million and Adjusted EBITDA1, excluding LIFO of $26 million Delivered fourth quarter Diluted Earnings Per Share of $0.74 on revenue of $1.1 billion Generated fourth quarter Operating Cash Flow of $90 million and Free Cash Flow of $65 million Acquired three businesses in the fourth quarter: two value-added processors (Norlen Incorporated and TSA Processing) as well as a tool steel processor and distributor (Hudson Tool Steel Corporation) Published 2023 Sustainability Report Announced first quarter 2024 dividend of $0.1875 per share, our tenth consecutive dividend increase Maintained fourth quarter Net Leverage ratio within target range at 1.7x, with debt of $436 million and net debt2 of $382 million as of December 31, 2023 Earned full-year Net Income attributable to Ryerson Holding Corporation of $146 million and Adjusted EBITDA1, excluding LIFO of $231 million Delivered full-year Diluted Earnings Per Share of $4.10 on revenue of $5.1 billion Generated full-year Operating Cash Flow of $365 million and Free Cash Flow of $244 million Completed second year of an investment cycle in next-stage operating model growth and shareholder returns through cumulative investments of $422 million in acquisitions and capex and returns to shareholders of $209 million in share buybacks and dividends since 2022 1For EBITDA, Adjusted EBITDA and Adj EBITDA excluding LIFO please see Appendix; 2Net Debt is defined as Long Term Debt plus Short-Term Debt less Cash and Cash Equivalents and excludes Restricted Cash

Global PMIs World PMI remained in contraction territory in Q4, marking 16 consecutive months of contraction Source: S&P Global, as of January 24, 2024

Commodity Prices Since Dec. 2017 U.S. ISM Purchasing Managers Index Macro and Commodities Macroeconomic headwinds challenging commodity mix and slowing longer term emergent trends Sources: Bloomberg: prices through Dec 31, 2023; Futures prices as of Feb 19, 2024; Bloomberg, US Industrial Production Index Month YoY Change; Bloomberg, U.S. Manufacturing PMI Futures U.S. Industrial Production

Sequential Q4 2023 End-Market Trends North American volumes experienced seasonal slowdown 12023 Sales Mix by tons Excludes Other Industry Sectors which represent approximately 4% of Ryerson sales mix;�Sales Mix based on 2023 results as disclosed in Ryerson’s Annual Report on Form 10-K for the year ended December 31, 2023 Metal Fab and Machine Shop Industrial Equipment Commercial Ground Transportation Food & Ag Consumer Durable Construction/Heavy Equipment HVAC Oil & Gas 2023 Sales Mix1 Commentary QoQ Volume 25% 17% 17% 9% 9% 8% 7% 4% Ryerson’s fourth quarter North American shipments reflected seasonal buying patterns as well as easing customer demand from industrial manufacturing and consumer goods related sectors. For the full-year 2023, volumes increased in our commercial ground transportation and oil & gas end-markets, while decreasing across other end-markets .

Value-Add Sales Organic growth investments and acquisitions contributing to value-add sales growing to 18% 7

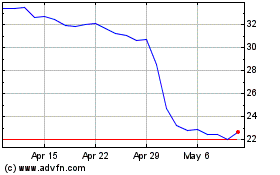

Q1 2024 Guidance Anticipate seasonal pickup in Q1 volumes and pricing Net Sales Net Income1 Adj. EBITDA, excl. LIFO $1.21 - 1.25B $8 - 11M $58 - 62M First quarter revenue guidance of $1.21B to $1.25B assumes: Average Selling Prices increase 1% to 3% Shipments increase between 8% to 10% Diluted Earnings per Share 1Net Income attributable to Ryerson Holding Corporation; 2Diluted EPS of $0.29 represents the midpoint of our $0.24 - $0.34 guidance range. See Ryerson’s 8-K filed on February 21, 2024 2

Q4 2023 Selected Financial and Operating Metrics See Ryerson’s 8-K filed on February 21, 2024. 1YTD Free Cash Flow Yield is calculated based on Full Year 2023 free cash flow divided by period end market capitalization Capital Investment Expense Management Compared to Q3 2023 Inventory Days of Supply Cash Conversion Cycle 89 85 Asset Management Cash Flow Service Center modernization investments in new service centers, expanded service centers and value-added capex. Expenses increased $10.7M, or 5.5%, sequentially driven by higher operating expenses from acquisitions, higher depreciation, and higher reorganization costs. Excluding reorganization costs, same store expenses lower year over year. Fourth quarter cash flow generation driven by net income generation as well as working capital release. The increase in the Company’s cash conversion cycle was driven by an increase in inventory days of supply on restocking and targeted service level objectives. Cash from Operating activities YTD Free Cash Flow Yield1 $90.1 20.6% Q4 2023 Investment FY 2024 $25M $122M Expense Expense/Sales +$11M +280bps

Liquidity remained strong and Net Leverage within target range Net Leverage of 1.7x in Q4 ’23 within target leverage range of 0.5x to 2.0x Global liquidity remained strong at $656M in Q4 ’23 Liquidity and Leverage Cash and Cash Equivalents Foreign Availability North American Availability 1A reconciliation of Net Debt as well as other non-GAAP financial measures to comparable GAAP measures is included in the Appendix. See Ryerson’s 8-K filed on February 21, 2024 1

Capital Allocation Plan Strong free cash flow generation $122M in ’23;� $110M in ’24E Modernization and and Value-Add Quarterly �dividend raised�to $0.1875 per share for Q1’24 Track record of successful acquisitions $114M repurchased in ’23; $39M �remains of $100M authorization CAPEX DIVIDENDS BUYBACKS M&A Supported our four key pillars of Capital Allocation 11

Ryerson distributed its tenth quarterly cash dividend and completed ~$6.3M in share repurchases in the fourth quarter. On February 21, 2024, the Board of Directors approved a tenth consecutive dividend increase, raising the Company’s first quarter of 2024 dividend to $0.1875 per share $0.1850 per Share Return of capital to investors and $6.3M Share repurchases completed in Q4 2023 Q4 2023 Allocation: $0.1875 per Share Return of capital to investors Q1 2024 Announced: Ryerson’s dividend increase is enabled by a transformed balance sheet and continued prioritization of shareholder returns as part of a balanced capital allocation strategy Capital Allocation Plan Update

1 Net Income attributable to Ryerson Holding Corporation; A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. See Ryerson’s 8-K filed on February 21, 2024 Q4 2023 Key Financial Metrics Net Sales Gross Margin Net Income1 Diluted Earnings per Share Debt $1.1B 22.2% $25.8M $0.74 $436M -10.8% �QoQ +220 bps �QoQ -$9.2M �QoQ -$0.26 �QoQ +$70M �QoQ Tons Shipped Gross Margin, excl. LIFO Adj. EBITDA excl. LIFO Adjusted Diluted Earnings per Share Net Debt 450k 16.9% $25.9M $0.73 $382M -5.9% �QoQ -40 bps� QoQ -$19.1M� QoQ -$0.27� QoQ +53M� QoQ

1 Net Income attributable to Ryerson Holding Corporation; A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in the Appendix. See Ryerson’s 8-K filed on February 21, 2024 FY 2023 Key Financial Metrics Net Sales Gross Margin Net Income1 Diluted Earnings per Share Debt $5.1B 20.0% $145.7M $4.10 $436M -19.2% �YoY -70 bps �YoY -$245.3M �YoY -$6.11 �YoY +$69M �YoY Tons Shipped Gross Margin, excl. LIFO Adj. EBITDA excl. LIFO Adjusted Diluted Earnings per Share Net Debt 1,943k 18.1% $231.1M $4.08 $382M -4.2% �YoY -170 bps� YoY -$350.9M� YoY -$6.46� YoY +$54M� YoY

Intelligent Network of Service Centers Diversified (metals mix, ~40k customers, ~75k products) Availability, speed, ease, consistency Hundreds of “virtual” locations 24/7 e-commerce Digitalized customer experience Building the value chain of the future $5.1B Net Sales 2023 $4.10 Diluted Earnings per Share 2023 15

Appendix

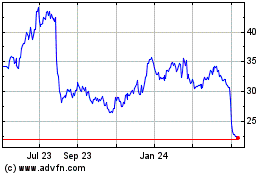

Dividend Payments Stronger capital structure allows for greater returns to shareholders 1Yield for 2022 is based on closing share price as of December 31, 2022, of $30.26. Yield for 2023 is based on closing share price as of December 29, 2023, of $34.68 18 Dividend per Share 1

Tons Sold (000’s) Quarterly Financial Highlights 1 Net Income attributable to Ryerson Holding Corporation A reconciliation of non-GAAP financial measures to the comparable GAAP measure is included in this Appendix Average Selling Price Per Ton Gross Margin & Gross Margin, excl. LIFO Adj EBITDA, excl. LIFO & Net Income Margin %1

Non-GAAP Reconciliation: Adjusted EBITDA, excl. LIFO 20

Non-GAAP Reconciliation: Adjusted Net Income

Non-GAAP Reconciliation: Net Debt

31 Note: EBITDA represents net income before interest and other expense on debt, provision for income taxes, depreciation, and amortization. Adjusted EBITDA gives further effect to, among other things, reorganization expenses, benefit plan curtailment gain, purchase consideration and other transaction costs, and foreign currency transaction gains and losses. We believe that the presentation of EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), provides useful information to investors regarding our operational performance because they enhance an investor’s overall understanding of our core financial performance and provide a basis of comparison of results between current, past, and future periods. We also disclose the metric Adjusted EBITDA, excluding LIFO expense (income), to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), are three of the primary metrics management uses for planning and forecasting in future periods, including trending and analyzing the core operating performance of our business without the effect of U.S. generally accepted accounting principles, or GAAP, expenses, revenues, and gains (losses) that are unrelated to the day to day performance of our business. We also establish compensation programs for our executive management and regional employees that are based upon the achievement of pre-established EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), targets. We also use EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), to benchmark our operating performance to that of our competitors. EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), do not represent, and should not be used as a substitute for, net income or cash flows from operations as determined in accordance with generally accepted accounting principles, and neither EBITDA, Adjusted EBITDA, and Adjusted EBITDA, excluding LIFO expense (income), is necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. This release also presents gross margin, excluding LIFO expense (income), which is calculated as gross profit minus LIFO expense (income), divided by net sales. We have excluded LIFO expense (income) from gross margin and Adjusted EBITDA as a percentage of net sales metrics in order to provide a means of comparison amongst our competitors who may not use the same basis of accounting for inventories as we do. Our definitions of EBITDA, Adjusted EBITDA, Adjusted EBITDA, excluding LIFO expense (income), gross margin, excluding LIFO expense (income), and Adjusted EBITDA, excluding LIFO expense (income), as a percentage of sales may differ from that of other companies. Non-GAAP Reconciliation 23

v3.24.0.1

Document And Entity Information

|

Feb. 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 21, 2024

|

| Entity Registrant Name |

Ryerson Holding Corporation

|

| Entity Central Index Key |

0001481582

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-34735

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

26-1251524

|

| Entity Address, Address Line One |

227 W. Monroe St.

|

| Entity Address, Address Line Two |

27th Floor

|

| Entity Address, City or Town |

Chicago

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60606

|

| City Area Code |

(312)

|

| Local Phone Number |

292-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value, 100,000,000 shares authorized

|

| Trading Symbol |

RYI

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12