false000076889900007688992024-02-212024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 21, 2024

TrueBlue, Inc.

(Exact Name of Registrant as Specified in Its Charter)

Washington

(State or Other Jurisdiction

of Incorporation)

| | | | | | | | |

| 001-14543 | | 91-1287341 |

(Commission

File Number) | | (IRS Employer

Identification No.) |

1015 A Street, Tacoma, Washington 98402

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (253) 383-9101

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, no par value | TBI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On February 21, 2024, TrueBlue, Inc. (the “company”) issued a press release (the “Press Release”) reporting its financial results for the fourth quarter ended December 31, 2023, and certain outlook information for the first quarter and fiscal year 2024, a copy of which is attached hereto as Exhibit 99.1 and the contents of which are incorporated herein by this reference. Also attached to this report as Exhibit 99.2 is a slide presentation relating to the financial results for the fourth quarter ended December 31, 2023 (the “Earnings Results Presentation”), which will be discussed by management of the company on a live conference call at 2:30 p.m. Pacific Time (5:30 p.m. Eastern Time) on Wednesday, February 21, 2024. The Earnings Results Presentation is also available on the company’s website at www.trueblue.com.

In accordance with General Instruction B.2. of Form 8-K, the information contained above in this report (including the Press Release and the Earnings Results Presentation) shall not be deemed “Filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall the Press Release or the Earnings Results Presentation be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This report will not be deemed a determination or an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

We are also attaching our Investor Roadshow Presentation to this report as Exhibit 99.3, which we will reference in our Q4 2023 earnings results discussion and which may be used in future investor conferences. The Investor Roadshow Presentation is also available on the company’s website at www.trueblue.com.

In accordance with General Instruction B.2. of Form 8-K, the information contained above in this report (including the Investor Roadshow Presentation) shall not be deemed “Filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall the Investor Roadshow Presentation be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing. This report will not be deemed a determination or an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d)Exhibits

| | | | | | | | |

Exhibit

Number | Exhibit Description | Filed Herewith |

| 99.1 | | X |

| 99.2 | | X |

| 99.3 | | X |

| 104 | Cover page interactive data file - The cover page from this Current Report on Form 8-K is formatted as Inline XBRL | X |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | |

| | | TRUEBLUE, INC. |

| | (Registrant) |

| | |

| Date: | February 21, 2024 | By: | | /s/ Carl R. Schweihs |

| | | | Carl R. Schweihs |

| | | | Chief Financial Officer and Executive Vice President |

TRUEBLUE REPORTS FOURTH QUARTER AND FULL-YEAR 2023 RESULTS

Strong performance in renewable energy and disciplined cost management delivered results at high end of company outlook

TACOMA, WASH. - Feb. 21, 2024 -- TrueBlue (NYSE:TBI) today announced its fourth quarter and full-year results for 2023.

Fourth Quarter 2023 Financial Highlights

•Revenue decreased 12 percent to $492 million compared to prior year period

◦Fiscal fourth quarter consisted of 14 weeks versus 13 weeks in the fiscal fourth quarter of 2022

◦Revenue decreased 15 percent on a comparable 13-week basis

•Net loss of $3 million

◦Adjusted EBITDA1 of $5 million and adjusted net income of $3 million

• Zero debt, cash of $62 million and $86 million of borrowing availability

◦Renewal of 5-year credit facility effective February 9, 2024 increased borrowing availability to approximately $140 million

Commentary

“We are managing through this market cycle with agility and discipline,” said Taryn Owen, President and CEO of TrueBlue. “While general market demand remains soft with hiring trends impacted by reduced business spend, we are capitalizing on attractive verticals, such as renewable energy, and maintaining a high level of engagement with clients to ensure we are well positioned as conditions improve.”

“As we enter 2024, we are laser-focused on leveraging our inherent strengths to capture market share and managing our cost structure with discipline to enhance our long-term profitability,” continued Ms. Owen. “Key components to this strategy include advancement of our digital transformation, expansion in high-growth and under-penetrated end markets, and enhanced focus through a simplified organizational structure. These priorities position us to drive efficiencies and secure opportunities to deliver long-term, profitable growth.”

Results

Fourth quarter revenue was $492 million, a decrease of 12 percent compared to revenue of $558 million in the fourth quarter of 2022. Net loss per diluted share was $0.08 compared to net income per diluted share of $0.21 in the prior year period. Adjusted net income1 per diluted share was $0.08 compared to adjusted net income per diluted share of $0.39 in the prior year period.

Full-year revenue was $1.9 billion, a decrease of 15 percent compared to revenue of $2.3 billion in 2022. Net loss per diluted share was $0.45 compared to net income per diluted share of $1.86 in 2022. Adjusted net income per diluted share was $0.28 compared to adjusted net income per diluted share of $2.36 in 2022.

2024 Outlook

TrueBlue is providing certain forward-looking information to help investors form their own estimates, which can be found in the quarterly earnings presentation filed today.

Management will discuss fourth quarter 2023 results on a webcast at 2:00 p.m. PT (5:00 p.m. ET), today, Wednesday, Feb. 21, 2024. The webcast can be accessed on the Investor Relations section of the TrueBlue website: investor.trueblue.com.

About TrueBlue

TrueBlue (NYSE: TBI) is a leading provider of specialized workforce solutions that help clients achieve business growth and improve productivity. In 2023, TrueBlue served approximately 67,000 clients and connected approximately 464,000 people with work. Its PeopleReady segment offers on-demand, industrial staffing, PeopleScout offers recruitment process outsourcing (RPO) and managed service provider (MSP) solutions, and

PeopleManagement offers contingent, on-site industrial staffing and commercial driver services. Learn more at www.trueblue.com.

1 Refer to the financial statements accompanying this release for more information regarding non-GAAP terms.

Forward-looking statements and non-GAAP financial measures

This document contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, expectations regarding stabilization in demand, and expected growth from our digital investments, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this release and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions which can be negatively impacted by factors such as rising interest rates, inflation, political instability, epidemics and global trade uncertainty, (2) our ability to maintain profit margins, (3) our ability to successfully execute on business strategies and further digitalize our business model, (4) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (5) our ability to attract and retain clients, (6) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, (7) new laws, regulations, and government incentives that could affect our operations or financial results, (8) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit, and (9) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC.

In addition, we use several non-GAAP financial measures when presenting our financial results in this document. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this document and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

Contact

Investor Relations

InvestorRelations@trueblue.com

TRUEBLUE, INC.

SUMMARY CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2023 | | Q4 2022 | | 2023 | | 2022 |

| 14 weeks ended (1) | | 13 weeks ended | | 53 weeks ended (1) | | 52 weeks ended |

| (in thousands, except per share data) | Dec 31, 2023 | | Dec 25, 2022 | | Dec 31, 2023 | | Dec 25, 2022 |

| Revenue from services | $ | 492,171 | | | $ | 557,695 | | | $ | 1,906,243 | | | $ | 2,254,184 | |

| Cost of services | 363,889 | | | 409,846 | | | 1,400,184 | | | 1,652,040 | |

| Gross profit | 128,282 | | | 147,849 | | | 506,059 | | | 602,144 | |

| Selling, general and administrative expense | 129,961 | | | 133,733 | | | 494,603 | | | 500,686 | |

| Depreciation and amortization | 6,946 | | | 7,258 | | | 25,821 | | | 29,273 | |

| Goodwill and intangible asset impairment charge | — | | | — | | | 9,485 | | | — | |

| Income (loss) from operations | (8,625) | | | 6,858 | | | (23,850) | | | 72,185 | |

Interest and other income (expense), net | 1,223 | | | 133 | | | 3,205 | | | 1,231 | |

Income (loss) before tax expense (benefit) | (7,402) | | | 6,991 | | | (20,645) | | | 73,416 | |

| Income tax expense (benefit) | (4,851) | | | (54) | | | (6,472) | | | 11,143 | |

| Net income (loss) | $ | (2,551) | | | $ | 7,045 | | | $ | (14,173) | | | $ | 62,273 | |

| | | | | | | |

| Net (loss) income per common share: | | | | | | | |

| Basic | $ | (0.08) | | | $ | 0.22 | | | $ | (0.45) | | | $ | 1.89 | |

| Diluted | $ | (0.08) | | | $ | 0.21 | | | $ | (0.45) | | | $ | 1.86 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 31,079 | | | 32,486 | | | 31,317 | | | 32,889 | |

| Diluted | 31,079 | | | 33,014 | | | 31,317 | | | 33,447 | |

(1)Our fiscal period ends on the Sunday closest to the last day of Dec. In fiscal years consisting of 53 weeks, the final quarter consists of 14 weeks, while in fiscal years consisting of 52 weeks, all quarters consist of 13 weeks.

TRUEBLUE, INC.

SUMMARY CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | |

| (in thousands) | Dec 31, 2023 | | Dec 25, 2022 |

| ASSETS | | | |

| Cash and cash equivalents | $ | 61,885 | | | $ | 72,054 | |

| Accounts receivable, net | 252,538 | | | 314,275 | |

| Other current assets | 40,570 | | | 43,883 | |

| Total current assets | 354,993 | | | 430,212 | |

| Property and equipment, net | 104,906 | | | 95,823 | |

| Restricted cash and investments | 192,985 | | | 213,734 | |

| Goodwill and intangible assets, net | 94,639 | | | 109,989 | |

| Other assets, net | 151,860 | | | 169,650 | |

| Total assets | $ | 899,383 | | | $ | 1,019,408 | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Accounts payable and other accrued expenses | $ | 56,401 | | | $ | 76,644 | |

| Accrued wages and benefits | 80,120 | | | 92,237 | |

| Current portion of workers’ compensation claims reserve | 44,866 | | | 50,005 | |

| | | |

| Other current liabilities | 22,712 | | | 23,989 | |

| Total current liabilities | 204,099 | | | 242,875 | |

| Workers’ compensation claims reserve, less current portion | 151,649 | | | 201,005 | |

| | | |

| Other long-term liabilities | 85,762 | | | 79,213 | |

| Total liabilities | 441,510 | | | 523,093 | |

| Shareholders’ equity | 457,873 | | | 496,315 | |

| Total liabilities and shareholders’ equity | $ | 899,383 | | | $ | 1,019,408 | |

TRUEBLUE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

| | | | | | | | | | | |

| 53 weeks ended |

| (in thousands) | Dec 31, 2023 | | Dec 25, 2022 |

| Cash flows from operating activities: | | | |

| Net income (loss) | $ | (14,173) | | | $ | 62,273 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation and amortization | 25,821 | | | 29,273 | |

| Goodwill and intangible asset impairment charge | 9,485 | | | — | |

| Provision for credit losses | 4,972 | | | 4,462 | |

| Stock-based compensation | 13,907 | | | 9,687 | |

| Deferred income taxes | (9,902) | | | 3,933 | |

| Non-cash lease expense | 12,591 | | | 12,920 | |

| Other operating activities | (3,831) | | | 7,862 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 56,761 | | | 34,765 | |

| Income taxes receivable and payable | (1,317) | | | (2,665) | |

| Operating lease right-of-use-asset | — | | | 118 | |

| Other assets | 31,366 | | | (16,142) | |

| Accounts payable and other accrued expenses | (19,210) | | | (1,501) | |

| Accrued wages and benefits | (12,113) | | | (7,938) | |

| | | |

| Workers’ compensation claims reserve | (54,495) | | | (5,184) | |

| Operating lease liabilities | (12,796) | | | (13,052) | |

| Other liabilities | 7,688 | | | 1,692 | |

| Net cash provided by operating activities | 34,754 | | | 120,503 | |

| Cash flows from investing activities: | | | |

| Capital expenditures | (31,276) | | | (30,626) | |

| | | |

| | | |

| Payments for company-owned life insurance | (2,347) | | | — | |

| Proceeds from company-owned life insurance | 1,662 | | | — | |

| | | |

| | | |

| Purchases of restricted held-to-maturity investments | (34,110) | | | (18,031) | |

| Maturities of restricted held-to-maturity investments | 33,749 | | | 27,712 | |

| | | |

| Net cash used in investing activities | (32,322) | | | (20,945) | |

| Cash flows from financing activities: | | | |

| Purchases and retirement of common stock | (34,178) | | | (60,939) | |

| Net proceeds from employee stock purchase plans | 856 | | | 980 | |

| Common stock repurchases for taxes upon vesting of restricted stock | (4,161) | | | (4,480) | |

| | | |

| | | |

| | | |

| Other | (100) | | | (253) | |

| Net cash used in financing activities | (37,583) | | | (64,692) | |

Change in cash, cash equivalents and restricted cash reclassified to assets held-for-sale | (300) | | | — | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (874) | | | (2,420) | |

| Net change in cash, cash equivalents, and restricted cash | (36,325) | | | 32,446 | |

| Cash, cash equivalents and restricted cash, beginning of period | 135,631 | | | 103,185 | |

| Cash, cash equivalents and restricted cash, end of period | $ | 99,306 | | | $ | 135,631 | |

TRUEBLUE, INC.

SEGMENT DATA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2023 | | Q4 2022 | | 2023 | | 2022 |

| 14 weeks ended (1) | | 13 weeks ended | | 53 weeks ended (1) | | 52 weeks ended |

| (in thousands) | Dec 31, 2023 | | Dec 25, 2022 | | Dec 31, 2023 | | Dec 25, 2022 |

| Revenue from services: | | | | | | | |

| PeopleReady | $ | 285,185 | | | $ | 314,580 | | | $ | 1,096,318 | | | $ | 1,272,852 | |

| PeopleScout | 47,204 | | | 68,676 | | | 229,334 | | | 317,518 | |

| PeopleManagement | 159,782 | | | 174,439 | | | 580,591 | | | 663,814 | |

| Total company | $ | 492,171 | | | $ | 557,695 | | | $ | 1,906,243 | | | $ | 2,254,184 | |

| | | | | | | |

Segment profit (2): | | | | | | | |

| PeopleReady | $ | 7,920 | | | $ | 22,467 | | | $ | 26,606 | | | $ | 87,743 | |

| PeopleScout | 2,910 | | | 2,499 | | | 26,922 | | | 44,771 | |

| PeopleManagement | 2,781 | | | 4,141 | | | 6,963 | | | 15,811 | |

| Total segment profit | 13,611 | | | 29,107 | | | 60,491 | | | 148,325 | |

| Corporate unallocated expense | (8,462) | | | (8,101) | | | (31,507) | | | (31,326) | |

Total company Adjusted EBITDA (3) | 5,149 | | | 21,006 | | | 28,984 | | | 116,999 | |

| Third-party processing fees for hiring tax credits (4) | 67 | | | (108) | | | (253) | | | (594) | |

| Amortization of software as a service assets (5) | (1,233) | | | (810) | | | (4,117) | | | (2,985) | |

| | | | | | | |

| Goodwill and intangible asset impairment charge | — | | | — | | | (9,485) | | | — | |

| | | | | | | |

| PeopleReady technology upgrade costs (6) | (440) | | | (1,779) | | | (1,342) | | | (7,935) | |

| Executive leadership transition (7) | (3,296) | | | — | | | (5,788) | | | 1,422 | |

| Other adjustments, net (8) | (1,926) | | | (4,193) | | | (6,028) | | | (5,449) | |

EBITDA (3) | (1,679) | | | 14,116 | | | 1,971 | | | 101,458 | |

| Depreciation and amortization | (6,946) | | | (7,258) | | | (25,821) | | | (29,273) | |

Interest and other income (expense), net | 1,223 | | | 133 | | | 3,205 | | | 1,231 | |

Income (loss) before tax benefit (expense) | (7,402) | | | 6,991 | | | (20,645) | | | 73,416 | |

| Income tax benefit (expense) | 4,851 | | | 54 | | | 6,472 | | | (11,143) | |

| Net income (loss) | $ | (2,551) | | | $ | 7,045 | | | $ | (14,173) | | | $ | 62,273 | |

(1)Our fiscal period ends on the Sunday closest to the last day of Dec. In fiscal years consisting of 53 weeks, the final quarter consists of 14 weeks, while in fiscal years consisting of 52 weeks, all quarters consist of 13 weeks.

(2)We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes depreciation and amortization expense, unallocated corporate general and administrative expense, interest expense, other income, income taxes, and other adjustments not considered to be ongoing.

(3)See the Non-GAAP Financial Measures table on the next page for definitions of EBITDA and Adjusted EBITDA.

(4)These third-party processing fees are associated with generating hiring tax credits.

(5)Amortization of software as a service assets is reported in selling, general and administrative expense.

(6)Costs associated with upgrading legacy PeopleReady technology.

(7)Cost associated with our CEO and CFO transitions, including accelerated vesting of stock awards and other separation related payments.

(8)Other adjustments for the 14 and 53 weeks ended December 31, 2023 primarily include workforce reduction costs of $1.8 million and $5.1 million, respectively. The 53 weeks ended December 31, 2023 also includes adjustments to COVID-19 government subsidies of $0.5 million. Other adjustments for the 13 and 52 weeks ended December 25, 2022 primarily include accelerated software costs of $4.2 million. The 52 weeks ended December 25, 2022 also includes costs of $1.1 million incurred while transitioning to a new third party administrator for workers’ compensation.

TRUEBLUE, INC.

NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS

In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies.

| | | | | | | | | | | | | | |

| Non-GAAP measure | | Definition | | Purpose of adjusted measures |

| | | | |

Adjusted net income and

Adjusted net income per diluted share | | Net income (loss) and net income (loss) per diluted share, excluding: –amortization of intangibles, –amortization of software as a service assets, –goodwill and intangible asset impairment charge, –accelerated depreciation, –PeopleReady technology upgrade costs, –executive leadership transition, –other adjustments, net, and –tax effect of the adjustments to U.S. GAAP.

| | –Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. –Used by management to assess performance and effectiveness of our business strategies. –Provides a measure, among others, used in the determination of incentive compensation for management. |

EBITDA and

Adjusted EBITDA | | EBITDA excludes from net income (loss): –income tax expense (benefit), –interest and other (income) expense, net, and –depreciation and amortization.

Adjusted EBITDA, further excludes: –third-party processing fees for hiring tax credits, –amortization of software as a service assets, –goodwill and intangible asset impairment charge, –PeopleReady technology upgrade costs, –executive leadership transition, –other adjustments, net.

| | –Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. –Used by management to assess performance and effectiveness of our business strategies. –Provides a measure, among others, used in the determination of incentive compensation for management. |

| Adjusted SG&A expense | | Selling, general and administrative expense excluding: –third-party processing fees for hiring tax credits, –amortization of software as a service assets, –PeopleReady technology upgrade costs, –executive leadership transition, –other adjustments, net. | | –Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. |

1.RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2023 | | Q4 2022 | | | | 2023 | | 2022 |

| 14 weeks ended (1) | | 13 weeks ended | | | | 53 weeks ended (1) | | 52 weeks ended |

| (in thousands, except for per share data) | Dec 31, 2023 | | Dec 25, 2022 | | | | Dec 31, 2023 | | Dec 25, 2022 |

| Net income (loss) | $ | (2,551) | | | $ | 7,045 | | | | | $ | (14,173) | | | $ | 62,273 | |

| | | | | | | | | |

| Amortization of intangible assets | 1,355 | | | 1,265 | | | | | 5,175 | | | 5,746 | |

| Amortization of software as a service assets (2) | — | | | 810 | | | | | — | | | 2,985 | |

| | | | | | | | | |

| Goodwill and intangible asset impairment charge | — | | | — | | | | | 9,485 | | | — | |

| Accelerated depreciation (3) | — | | | — | | | | | — | | | 1,658 | |

| PeopleReady technology upgrade costs (4) | 440 | | | 1,779 | | | | | 1,342 | | | 7,935 | |

| Executive leadership transition costs (5) | 3,296 | | | — | | | | | 5,788 | | | (1,422) | |

| Other adjustments, net (6) | 1,926 | | | 4,193 | | | | | 6,028 | | | 5,449 | |

| Tax effect of adjustments to net income (loss) (7) | (1,824) | | | (2,092) | | | | | (4,920) | | | (5,811) | |

Adjusted net income | $ | 2,642 | | | $ | 13,000 | | | | | $ | 8,725 | | | $ | 78,813 | |

| | | | | | | | | |

| Adjusted net income per diluted share | $ | 0.08 | | | $ | 0.39 | | | | | $ | 0.28 | | | $ | 2.36 | |

| | | | | | | | | |

| Diluted weighted average shares outstanding | 31,450 | | | 33,014 | | | | | 31,590 | | | 33,447 | |

| | | | | | | | | |

| Margin / % of revenue: | | | | | | | | | |

| Net income (loss) | (0.5)% | | 1.3% | | | | (0.7)% | | 2.8% |

| Adjusted net income | 0.5% | | 2.3% | | | | 0.5% | | 3.5% |

2.RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2023 | | Q4 2022 | | | | 2023 | | 2022 |

| 14 weeks ended (1) | | 13 weeks ended | | | | 53 weeks ended (1) | | 52 weeks ended |

| (in thousands) | Dec 31, 2023 | | Dec 25, 2022 | | | | Dec 31, 2023 | | Dec 25, 2022 |

| Net income (loss) | $ | (2,551) | | | $ | 7,045 | | | | | $ | (14,173) | | | $ | 62,273 | |

Income tax expense (benefit) | (4,851) | | | (54) | | | | | (6,472) | | | 11,143 | |

Interest and other (income) expense, net | (1,223) | | | (133) | | | | | (3,205) | | | (1,231) | |

| Depreciation and amortization | 6,946 | | | 7,258 | | | | | 25,821 | | | 29,273 | |

| EBITDA | (1,679) | | | 14,116 | | | | | 1,971 | | | 101,458 | |

| Third-party processing fees for hiring tax credits (8) | (67) | | | 108 | | | | | 253 | | | 594 | |

| Amortization of software as a service assets (2) | 1,233 | | | 810 | | | | | 4,117 | | | 2,985 | |

| | | | | | | | | |

| Goodwill and intangible asset impairment charge | — | | | — | | | | | 9,485 | | | — | |

| | | | | | | | | |

| PeopleReady technology upgrade costs (4) | 440 | | | 1,779 | | | | | 1,342 | | | 7,935 | |

| Executive leadership transition costs (5) | 3,296 | | | — | | | | | 5,788 | | | (1,422) | |

| Other adjustments, net (6) | 1,926 | | | 4,193 | | | | | 6,028 | | | 5,449 | |

| Adjusted EBITDA | $ | 5,149 | | | $ | 21,006 | | | | | $ | 28,984 | | | $ | 116,999 | |

| | | | | | | | | |

| Margin / % of revenue: | | | | | | | | | |

| Net income (loss) | (0.5)% | | 1.3% | | | | (0.7)% | | 2.8% |

| Adjusted EBITDA | 1.0% | | 3.8% | | | | 1.5% | | 5.2% |

3.RECONCILIATION OF U.S. GAAP SELLING, GENERAL AND ADMINISTRATIVE EXPENSE TO ADJUSTED SG&A EXPENSE

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Q4 2023 | | Q4 2022 | | 2023 | | 2022 |

| 14 weeks ended (1) | | 13 weeks ended | | 53 weeks ended (1) | | 52 weeks ended |

| (in thousands) | Dec 31, 2023 | | Dec 25, 2022 | | Dec 31, 2023 | | Dec 25, 2022 |

| Selling, general and administrative expense | $ | 129,961 | | | $ | 133,733 | | | $ | 494,603 | | | $ | 500,686 | |

| Third-party processing fees for hiring tax credits (8) | 67 | | | (108) | | | (253) | | | (594) | |

| Amortization of software as a service assets (2) | (1,233) | | | (810) | | | (4,117) | | | (2,985) | |

| | | | | | | |

| | | | | | | |

| PeopleReady technology upgrade costs (4) | (440) | | | (1,779) | | | (1,342) | | | (7,935) | |

| Executive leadership transition costs (5) | (3,296) | | | — | | | (5,788) | | | 1,422 | |

| Other adjustments, net (6) | (1,246) | | | (4,193) | | | (4,145) | | | (5,449) | |

| Adjusted SG&A expense | $ | 123,813 | | | $ | 126,843 | | | $ | 478,958 | | | $ | 485,145 | |

| | | | | | | |

| % of revenue: | | | | | | | |

| Selling, general and administrative expense | 26.4% | | 24.0% | | 25.9% | | 22.2% |

| Adjusted SG&A expense | 25.2% | | 22.7% | | 25.1% | | 21.5% |

(1)Our fiscal period ends on the Sunday closest to the last day of December. In fiscal years consisting of 53 weeks, the final quarter consists of 14 weeks, while in fiscal years consisting of 52 weeks, all quarters consist of 13 weeks.

(2)Amortization of software as a service assets is reported in selling, general and administrative expense. Note, amortization of software as a service assets was included as an adjustment to net income during transitory periods ending with fiscal 2022 and is only considered an adjustment to EBITDA going forward to be consistent with the treatment of depreciation and amortization.

(3)Accelerated depreciation for the existing systems being replaced by the upgraded PeopleReady technology platform.

(4)Costs associated with upgrading legacy PeopleReady technology.

(5)Cost associated with our CEO and CFO transitions, including accelerated vesting of stock awards and other separation related payments.

(6)Other adjustments for the 14 and 53 weeks ended December 31, 2023 primarily include workforce reduction costs of $1.8 million and $5.1 million, respectively. The 53 weeks ended December 31, 2023 also includes adjustments to COVID-19 government subsidies of $0.5 million. Other adjustments for the 13 and 52 weeks ended December 25, 2022 primarily include accelerated software costs of $4.2 million. The 52 weeks ended December 25, 2022 also includes costs of $1.1 million incurred while transitioning to a new third party administrator for workers’ compensation.

(7)Tax effect of the adjustments to U.S. GAAP net income (loss). The tax effect includes the application of our statutory rate of 26% to all taxable / deductible adjustments. Note, prior periods were reported using the effective rate for the respective period and have been recast to conform to the current presentation for comparability. Please refer to the reconciliations on the financial results page under the investor relations section of our website for additional information on comparable historical periods.

(8)These third-party processing fees are associated with generating hiring tax credits.

Q4 2023 EARNINGS

2 Forward-looking statements and non-GAAP financial measures This presentation contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, expectations regarding stabilization in demand, and expected growth from our digital investments, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this presentation and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions which can be negatively impacted by factors such as rising interest rates, inflation, political instability, epidemics and global trade uncertainty, (2) our ability to maintain profit margins, (3) our ability to successfully execute on business strategies and further digitalize our business model, (4) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (5) our ability to attract and retain clients, (6) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, (7) new laws, regulations, and government incentives that could affect our operations or financial results, (8) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit, and (9) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. In addition, we use several non-GAAP financial measures when presenting our financial results in this presentation. Please refer to the reconciliations between our GAAP and non-GAAP financial measures in the appendix to this presentation and on our website at www.trueblue.com under the Investor Relations section for additional information on both current and historical periods. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

3 Q4 2023 Overview Total revenue -12% ▪ Clients continued to be cost conscious and selective in the roles they chose to fill ▪ Softness in revenue trends for staffing businesses with the exception of renewable energy projects ▪ Q4 2023 included 14th week — Revenue -15% on comparable 13-week basis and at the high end of company outlook Net loss was $3 million v. net income of $7 million in Q4 2022 ▪ Revenue decline was partially offset by continued cost management ▪ Disciplined pricing — Positive spread between bill- and pay-rate inflation ▪ Adjusted EBITDA1 was $5 million v. $21 million in Q4 2022 Strong balance sheet and liquidity position ▪ Zero debt, cash of $62 million and $86 million of borrowing availability ▪ Renewal of 5-year credit facility effective February 9, 2024 increased borrowing availability to approximately $140 million 1 Refer to the appendix to this presentation for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results for both current and historical periods.

4 Financial summary Amounts in millions, except per share data Q4 2023 Change FY 2023 Change Revenue $492 -12 % $1,906 -15 % Revenue on comparable 13- and 52-week basis $472 -15% $1,886 -16% Net loss -$2.6 NM -$14.2 NM Net loss per diluted share -$0.08 NM -$0.45 NM Net loss margin -0.5 % -180 bps -0.7 % -350 bps Adjusted net income1,2 $2.6 -80 % $8.7 -89 % Adj. net income per diluted share $0.08 -79 % $0.28 -88 % Adj. net income margin 0.5 % -180 bps 0.5 % -300 bps Adjusted EBITDA $5.1 -75 % $29.0 -75 % Adjusted EBITDA margin 1.0 % -280 bps 1.5 % -370 bps Notes: ▪ The change in adjusted net income margin was more favorable than that of GAAP net loss margin primarily due to costs associated with the executive leadership transitions and the Q1 non-cash impairment charge, which were excluded from adjusted results. NM - Not meaningful 1 Refer to the appendix to this presentation for a definition and full reconciliation of non-GAAP financial measures to GAAP financial results. 2 Prior period adjusted net income (loss) measures have been recast to conform to the current presentation for comparability. Refer to the reconciliations in the appendix to this presentation and on our website for additional information.

5 Gross margin and SG&A bridges Gr os s m ar gi n 26.5% 0.3% -0.7% 26.1% Q4 2022 Bill / Pay spread Mix Q4 2023 SG &A $134 -$10 -$1 $7 $130 Q4 2022 Core business Q4 2023 Amounts in millions 1 Represents the year-over-year change in Adjusted EBITDA exclusions impacting SG&A. Refer to the adjusted EBITDA reconciliation in the appendix to this presentation for more information. 2 Our 2023 fiscal fourth quarter includes a 14th week compared to the 13 weeks in the prior year period. Adjusted EBITDA exclusions1 14th week impact2

6 Q4 2023 Results by segment Amounts in millions PeopleReady PeopleScout PeopleManagement Revenue $285 $47 $160 % Change -9% -31% -8% Segment profit1 $8 $3 $3 % Change -65% +16% -33% % Margin 2.8% 6.2% 1.7% Change -430 bps +260 bps -70 bps Notes: ▪ Revenue: • -13% on comparable 13-week basis • Outperformance in renewable energy work partially offset softness across most verticals ▪ Segment profit margin: ▪ Contraction due to lower operating leverage as revenue declined, partially offset by favorable bill / pay spreads ▪ Revenue: • -32% on comparable 13-week basis • Reduced client hiring due to continued cost pressures following elevated volumes last year ▪ Segment profit margin: ▪ Expansion primarily driven by cost actions taken this year and a non-repeated revenue reserve adjustment in the prior year ▪ Revenue: • -13% on comparable 13-week basis • Lower client volume in retail and transportation, including commercial drivers ▪ Segment profit margin: ▪ Contraction due to lower operating leverage as revenue declined 1 We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment.

7 Strong balance sheet with zero debt and ample liquidity $224 $344 $365 $148 $161 $294 $293 $86 $63 $50 $72 $62 Borrowing availability Cash 2020 2021 2022 2023 Amounts in millions Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Borrowing availability is based on maximum borrowing availability under our most restrictive covenant. 2 Buyback ratio calculated as the dollar value of share repurchases during the period divided by our market capitalization at the beginning of the fiscal period. Liquidity Share repurchases 1 $52 $17 $61 $34 6% 2% 6% 5% Share repurchases Buyback ratio 2020 2021 2022 2023 2

Outlook

9 Select outlook information Item Q1 2024 Commentary Revenue $392M to $417M -16% to -10% v. prior year Assumes current market conditions continue into Q1 with a less challenging prior year comparison. Gross margin -210 to -170 bps v. prior year Gross margin decline due to changes in business mix and prior year workers’ compensation reserve adjustments not expected to repeat. SG&A $109M to $113M SG&A decline driven by disciplined cost management. Refer to the EBITDA adjustments for additional information on expected expense. EBITDA adjustments1 ~$2M • ~$1M in PeopleReady technology upgrade costs • ~$1M in SaaS amortization Shares ~31.3M Reflects basic weighted average shares outstanding and does not include the impact of any potential share repurchases. Item FY 2024 Commentary CapEx2 $23M to $27M Depreciation expected to be $25M to $29M. Tax Rate 24% to 28% Reflects our statutory income tax rate before job tax credits. We expect job tax credits of $5M to $9M. 1 Refer to the appendix to this presentation for a definition of non-GAAP financial measures. 2 Includes planned investments in software as a service (SaaS) assets capitalized in other long-term assets with the related amortization recorded in SG&A.

Appendix

11 NON-GAAP FINANCIAL MEASURES AND NON-GAAP RECONCILIATIONS In addition to financial measures presented in accordance with U.S. GAAP, we monitor certain non-GAAP key financial measures. The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with U.S. GAAP, and may not be comparable to similarly titled measures of other companies. Non-GAAP measure Definition Purpose of adjusted measures Adjusted net income and Adjusted net income per diluted share Net income (loss) and net income (loss) per diluted share, excluding: – amortization of intangibles, – amortization of software as a service assets, – goodwill and intangible asset impairment charge, – accelerated depreciation, – PeopleReady technology upgrade costs, – executive leadership transition, – other adjustments, net, and – tax effect of the adjustments to U.S. GAAP. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. EBITDA and Adjusted EBITDA EBITDA excludes from net income (loss): – income tax expense (benefit), – interest and other (income) expense, net, and – depreciation and amortization. Adjusted EBITDA, further excludes: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – goodwill and intangible asset impairment charge, – PeopleReady technology upgrade costs, – executive leadership transition, – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business. – Used by management to assess performance and effectiveness of our business strategies. – Provides a measure, among others, used in the determination of incentive compensation for management. Adjusted SG&A expense Selling, general and administrative expense excluding: – third-party processing fees for hiring tax credits, – amortization of software as a service assets, – PeopleReady technology upgrade costs, – executive leadership transition, – other adjustments, net. – Enhances comparability on a consistent basis and provides investors with useful insight into the underlying trends of the business.

12 1. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO ADJUSTED NET INCOME AND ADJUSTED NET INCOME PER DILUTED SHARE (Unaudited) Q4 2023 Q4 2022 2023 2022 14 weeks ended (1) 13 weeks ended 53 weeks ended (1) 52 weeks ended (in thousands, except for per share data) Dec 31, 2023 Dec 25, 2022 Dec 31, 2023 Dec 25, 2022 Net income (loss) $ (2,551) $ 7,045 $ (14,173) $ 62,273 Amortization of intangible assets 1,355 1,265 5,175 5,746 Amortization of software as a service assets (2) — 810 — 2,985 Goodwill and intangible asset impairment charge — — 9,485 — Accelerated depreciation (3) — — — 1,658 PeopleReady technology upgrade costs (4) 440 1,779 1,342 7,935 Executive leadership transition costs (5) 3,296 — 5,788 (1,422) Other adjustments, net (6) 1,926 4,193 6,028 5,449 Tax effect of adjustments to net income (loss) (7) (1,824) (2,092) (4,920) (5,811) Adjusted net income $ 2,642 $ 13,000 $ 8,725 $ 78,813 Adjusted net income per diluted share $ 0.08 $ 0.39 $ 0.28 $ 2.36 Diluted weighted average shares outstanding 31,450 33,014 31,590 33,447 Margin / % of revenue: Net income (loss) (0.5) % 1.3 % (0.7) % 2.8 % Adjusted net income 0.5 % 2.3 % 0.5 % 3.5 % Refer to the last slide of the appendix for footnotes.

13 2. RECONCILIATION OF U.S. GAAP NET INCOME (LOSS) TO EBITDA AND ADJUSTED EBITDA (Unaudited) Refer to the last slide of the appendix for footnotes. Q4 2023 Q4 2022 2023 2022 14 weeks ended (1) 13 weeks ended 53 weeks ended (1) 52 weeks ended (in thousands) Dec 31, 2023 Dec 25, 2022 Dec 31, 2023 Dec 25, 2022 Net income (loss) $ (2,551) $ 7,045 $ (14,173) $ 62,273 Income tax expense (benefit) (4,851) (54) (6,472) 11,143 Interest and other (income) expense, net (1,223) (133) (3,205) (1,231) Depreciation and amortization 6,946 7,258 25,821 29,273 EBITDA (1,679) 14,116 1,971 101,458 Third-party processing fees for hiring tax credits (8) (67) 108 253 594 Amortization of software as a service assets (2) 1,233 810 4,117 2,985 Goodwill and intangible asset impairment charge — — 9,485 — PeopleReady technology upgrade costs (4) 440 1,779 1,342 7,935 Executive leadership transition costs (5) 3,296 — 5,788 (1,422) Other adjustments, net (6) 1,926 4,193 6,028 5,449 Adjusted EBITDA $ 5,149 $ 21,006 $ 28,984 $ 116,999 Margin / % of revenue: Net income (loss) (0.5) % 1.3 % (0.7) % 2.8 % Adjusted EBITDA 1.0 % 3.8 % 1.5 % 5.2 %

14 3. RECONCILIATION OF U.S. GAAP SELLING, GENERAL AND ADMINISTRATIVE EXPENSE TO ADJUSTED SG&A EXPENSE (Unaudited) Refer to the last slide of the appendix for footnotes. Q4 2023 Q4 2022 2023 2022 14 weeks ended (1) 13 weeks ended 53 weeks ended (1) 52 weeks ended (in thousands) Dec 31, 2023 Dec 25, 2022 Dec 31, 2023 Dec 25, 2022 Selling, general and administrative expense $ 129,961 $ 133,733 $ 494,603 $ 500,686 Third-party processing fees for hiring tax credits (8) 67 (108) (253) (594) Amortization of software as a service assets (2) (1,233) (810) (4,117) (2,985) PeopleReady technology upgrade costs (4) (440) (1,779) (1,342) (7,935) Executive leadership transition costs (5) (3,296) — (5,788) 1,422 Other adjustments, net (6) (1,246) (4,193) (4,145) (5,449) Adjusted SG&A expense $ 123,813 $ 126,843 $ 478,958 $ 485,145 % of revenue: Selling, general and administrative expense 26.4 % 24.0 % 25.9 % 22.2 % Adjusted SG&A expense 25.2 % 22.7 % 25.1 % 21.5 %

15 Footnotes: (1) Our fiscal period ends on the Sunday closest to the last day of December. In fiscal years consisting of 53 weeks, the final quarter consists of 14 weeks, while in fiscal years consisting of 52 weeks, all quarters consist of 13 weeks. (2) Amortization of software as a service assets is reported in selling, general and administrative expense. Note, amortization of software as a service assets was included as an adjustment to net income during transitory periods ending with fiscal 2022 and is only considered an adjustment to EBITDA going forward to be consistent with the treatment of depreciation and amortization. (3) Accelerated depreciation for the existing systems being replaced by the upgraded PeopleReady technology platform. (4) Costs associated with upgrading legacy PeopleReady technology. (5) Cost associated with our CEO and CFO transitions, including accelerated vesting of stock awards and other separation related payments. (6) Other adjustments for the 14 and 53 weeks ended December 31, 2023 primarily include workforce reduction costs of $1.8 million and $5.1 million, respectively. The 53 weeks ended December 31, 2023 also includes adjustments to COVID-19 government subsidies of $0.5 million. Other adjustments for the 13 and 52 weeks ended December 25, 2022 primarily include accelerated software costs of $4.2 million. The 52 weeks ended December 25, 2022 also includes costs of $1.1 million incurred while transitioning to a new third party administrator for workers’ compensation. (7) Tax effect of the adjustments to U.S. GAAP net income (loss). The tax effect includes the application of our statutory rate of 26% to all taxable / deductible adjustments. Note, prior periods were reported using the effective rate for the respective period and have been recast to conform to the current presentation for comparability. Please refer to the reconciliations on the financial results page under the investor relations section of our website for additional information on comparable historical periods. (8) These third-party processing fees are associated with generating hiring tax credits.

Investor Roadshow Presentation FEBRUARY 2024

Forward-Looking Statements This presentation contains forward-looking statements relating to our plans and expectations including, without limitation, statements regarding the future performance and operations of our business, expectations regarding stabilization in demand, and expected growth from our digital investments, all of which are subject to risks and uncertainties. Such statements are based on management’s expectations and assumptions as of the date of this presentation and involve many risks and uncertainties that could cause actual results to differ materially from those expressed or implied in our forward-looking statements including: (1) national and global economic conditions which can be negatively impacted by factors such as rising interest rates, inflation, political instability, epidemics and global trade uncertainty, (2) our ability to maintain profit margins, (3) our ability to successfully execute on business strategies and further digitalize our business model, (4) our ability to attract sufficient qualified candidates and employees to meet the needs of our clients, (5) our ability to attract and retain clients, (6) our ability to access sufficient capital to finance our operations, including our ability to comply with covenants contained in our revolving credit facility, (7) new laws, regulations, and government incentives that could affect our operations or financial results, (8) any reduction or change in tax credits we utilize, including the Work Opportunity Tax Credit, and (9) the timing and amount of common stock repurchases, if any, which will be determined at management’s discretion and depend upon several factors, including market and business conditions, the trading price of our common stock and the nature of other investment opportunities. Other information regarding factors that could affect our results is included in our Securities Exchange Commission (SEC) filings, including the company’s most recent reports on Forms 10-K and 10-Q, copies of which may be obtained by visiting our website at www.trueblue.com under the Investor Relations section or the SEC’s website at www.sec.gov. We assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Any other references to future financial estimates are included for informational purposes only and subject to risk factors discussed in our most recent filings with the SEC. Any comparisons made herein to other periods are based on a comparison to the same period in the prior year unless otherwise stated.

Investment Highlights Return of Capital Market leader in U.S. industrial staffing and global RPO with increasingly diverse service offerings to meet evolving client needs Highly fragmented industry with strong secular growth drivers Strong balance sheet and cash flow to support future growth opportunities and the return of excess capital to shareholders Advancing technology applications and expanding in high-growth end markets with a simplified structure to deliver long-term, profitable growth Experienced Leadership Team Deep human capital expertise with proven success driving growth and delivering value to stakeholders

Our Mission: Connecting People and Work Returning Value to Shareholders 2023 Revenue (Share repurchases last 5 years) $203M $1.9B 67,000 Clients served annually with strong diversity1 464,000 People connected to work during 2023 One of the largest U.S. industrial staffing providers One of the largest global RPO providers HRO Today magazine repeatedly recognizes PeopleScout as a global market leader Thousands of veterans hired each year via internal programs as well as Hiring Our Heroes and Wounded Warriors Recognized for breakthrough board practices that promote greater diversity and inclusion All segments earned the Top Workplaces USA Award issued by Energage 1 No single client accounted for more than 4% of total revenue for FY 2023

Solving Workforce Challenges Workforce Complexity Many factors, including globalization, the “gig” economy and diversity are changing the world of work requiring a disciplined approach to hiring. Artificial Intelligence Companies are seeking ways to become more nimble and efficient Deploying AI to source human capital will be a competitive differentiator. Digital Engagement The worker supply chain is becoming increasingly decentralized. TrueBlue’s digital strategy connects people anywhere at any time. Companies turn to human capital experts with innovative workforce solutions to solve growing talent challenges A robust value proposition with high-touch, specialized, digital solutions for industrial staffing and recruitment process outsourcing.

PeopleReady PeopleScout PeopleManagement Incremental Segment profit margin2 15 – 20% 27 – 32% 8 – 13% Revenue mix1 Segment profit mix1 1 Revenue and segment profit calculations based on FY 2023. We evaluate performance based on segment revenue and segment profit. Segment profit includes revenue, related cost of services, and ongoing operating expenses directly attributable to the reportable segment. Segment profit excludes depreciation and amortization expense, unallocated corporate general and administrative expense, interest expense, other income, income taxes, and other adjustments not considered to be ongoing. ² Average, estimated margin associated with additional organic revenue. 58% 44% 12% 45% 30% 11% PeopleReady PeopleScout PeopleManagement Three specialized segments meet diverse client needs On-demand general and skilled labor for industrial jobs Talent solutions for outsourcing the recruiting process for permanent employees Contingent, on-site industrial staffing and commercial driver services

7 US Industrial Staffing: A Large and Attractive Market Why Industrial Staffing? One of the largest segments of the U.S. staffing industry ($36B in 2023) Highly fragmented with no dominant competition Digital adoption by the industry can expand growth opportunity, like rideshare companies did for the taxi industry Unique growth opportunity to fill key skilled trades positions as baby boomers retire The Biden Administration’s infrastructure and clean energy plans are expected to inject billions into the labor market The industry rebounds quickly in the early stages of a recovery Represents ~30% of $640B global staffing market United States Staffing Market ~$200B1 One of the largest U.S. segments (~20%) Industrial temporary staffing ($36B) Skilled Trades On-site Hourly General On Demand Labor On-site Cost Per Unit Trucking 1 Source: Staffing Industry Analysts Note, industrial temporary staffing includes various occupations such as: laborers, packers, construction workers, skilled trades, machinists, janitors, etc.

Recruitment Process Outsourcing: High margin plus double-digit revenue growth Why RPO? Nascent market with no single dominant player Traditionally sticky business model with high client retention and engagement Industry produced double-digit annual revenue growth historically and recovered swiftly from recent recession Industry poised for growth as companies seek new solutions to increasing labor challenges Global RPO Market ~$6B1 1 Source: Everest Group Strong history of growth with a 2017-2023 market CAGR of ~10% North America represents ~50% followed by EMEA (~30%) and APAC (~20%) Further market expansion expected largely driven by first-generation buyers representing ~90% of new deals

Strong position to capitalize on growth opportunities PEOPLE 5,000+ talented, dedicated and mission driven people EXPERIENCE > 30 years of industry experience and deep client relationships TECHNOLOGY Sophisticated technology providing a differentiated user experience MARKET PRESENCE Significant scale and expansive local market presence Tremendous strengths and assets to drive our success, capitalizing on growth opportunities, enhancing shareholder value and advancing our mission to connect people and work

Focused strategy, leveraging our strengths to deliver long-term, profitable growth Position our contingent staffing business to compete in a digital-forward future Provide a differentiated experience with proprietary technology Drive efficiencies to optimize our reach and engagement Increase focus on operational excellence, cross-selling and innovation Drive efficiencies and bring our teams closer to clients and associates Leverage strengths and synergies to deliver profitable growth Expand in high-growth, less- cyclical and underpenetrated end markets Capitalize on secular growth opportunities to deliver long- term, sustainable growth Diversify our business to increase market share and revenue potential DIGITAL TRANSFORMATION MARKET EXPANSION SIMPLIFIED STRUCTURE

Digitally transform our business model 11 Position our contingent staffing business to compete in a digital-forward future o We control our roadmap with new, proprietary JobStack app o Advancement of our digital capabilities through competitive enhancements and quick response to evolving user needs Provide a differentiated experience with proprietary technology o Meeting our clients and associates where they are, with a customized experience combining the power of our technology and local market expertise o Connecting clients and candidates using AI, machine learnings, predictive analytics and a superior candidate experience with Affinix Drive efficiencies to optimize our reach and engagement o Digitalization enables operational efficiencies, allowing for more time focused on engaging with clients to drive results

Expand our share in attractive end markets Expand in high-growth, less-cyclical and underpenetrated end markets o Strong position to capture further growth opportunities with a proven track record in renewable energy work o Focused growth in attractive end markets like healthcare Capitalize on secular growth opportunities to deliver long-term, sustainable growth o Well-positioned to fill structural staffing shortages in areas like skilled trades o Powerful secular forces that play to our strengths Diversify our business to increase market share and revenue potential o Targeting RPO expansion in higher skill placements and more attractive product offerings SECULAR GROWTH UNDERPENETRATED DIVERSIFY

Streamline our organizational structure Increase focus on operational excellence, cross-selling and innovation Capitalize on opportunities to leverage strengths and synergies to deliver profitable growth Drive efficiencies and bring our teams closer to clients and associates Eliminate silos to take advantage of synergies and expertise Unlock the full value of our assets Reduce organizational complexity to better serve our clients Maximize our efforts while reducing costs to enhance profitability Enhanced agility to capitalize on evolving market dynamics Create increased opportunities to collaborate across well-established brands with deep expertise

ESG principles help us make sound decisions AAA Rating Risk Ranking: Low Risk Exposure: Low Risk Management: Average Key Statistics: 78% of board members are women or racially diverse 50% of senior management are women 88% of voting shareholders approved executive compensation How ESG guides our decision making: Code of conduct and business ethics framework Board of directors oversight & governance Executive compensation structure Enterprise risk management program External ESG Ratings

Strong balance sheet with zero debt and ample liquidity Note: Figures may not sum to consolidated totals due to rounding. Balances as of fiscal period end. 1 Borrowing availability is based on maximum borrowing availability under our most restrictive covenant. 2 Buyback ratio calculated as the dollar value of share repurchases during the period divided by our market capitalization at the beginning of the fiscal period. $161 $294 $293 $86 $63 $50 $72 $62 $224 $344 $365 $148 2020 2021 2022 2023 Borrowing availability Cash *Amounts in millions 1 $52 $17 $61 $34 6% 2% 6% 5% -20% -15% -10% -5% 0% 5% 10% 0 10 20 30 40 50 60 70 80 90 100 2020 2021 2022 2023 Share Repurchases Buyback ratio2

Focused capital strategy Investing in technology and returning excess capital to shareholders 18% 47% 35% (2019 - 2023) Net debt reductions Share repurchases Capital expenditures Historical use of capitalCapital allocation priorities Strategic technology investments to further digitalize our business model Return excess capital to shareholders through share repurchases Disciplined acquisition strategy to supplement organic revenue growth

TARYN OWEN PRESIDENT AND CEO Leadership with Deep Expertise 20+ years of industry experience 10+ years as business leader TrueBlue President since 2022 CARL SCHWEIHS EVP AND CFO 10+ years of industry experience 10+ years of finance experience TrueBlue CFO since 2023 KRISTY WILLIS EVP AND PRESIDENT, PEOPLEREADY 20+ years of industry experience RICK BETORI EVP AND PRESIDENT. PEOPLESCOUT 20+ years of industry experience JERRY WIMER SVP AND ACTING PRESIDENT. PEOPLEMANAGEMENT 20+ years of industry experience

TrueBlue Highlights Mission Driven Connecting People and Work

THANK YOU

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

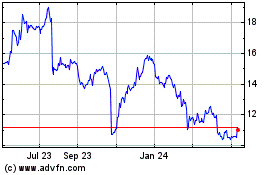

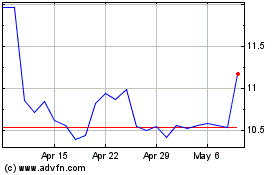

TrueBlue (NYSE:TBI)

Historical Stock Chart

From Apr 2024 to May 2024

TrueBlue (NYSE:TBI)

Historical Stock Chart

From May 2023 to May 2024