UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14C INFORMATION

Information Statement Pursuant to Section 14(c)

of the Securities Exchange Act of 1934 (Amendment No. )

Check the appropriate box:

| x |

Preliminary Information Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(e)(2)) |

| ¨ |

Definitive Information Statement |

Sunshine Biopharma , Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

(1) |

Title of each class of securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration Statement No.: |

| |

|

|

Sunshine Biopharma, Inc.

1177 Avenue of the Americas

5th Floor

New York, NY 10036

NOTICE OF ACTION BY WRITTEN CONSENT OF STOCKHOLDERS

NOTICE IS HEREBY GIVEN that

the holder of a majority of the voting power of the stockholders of Sunshine Biopharma, Inc. (the “Company” “we,”

“us,” or “our”), has approved the following action without a meeting of stockholders:

The approval of the Warrant Stockholder Approval

Provisions described in detail in this Information Statement.

The action will become effective on the 20th day

after the definitive information statement is mailed to our stockholders.

The enclosed information statement contains information

pertaining to the matters acted upon.

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE

REQUESTED NOT TO SEND US A PROXY.

| |

By |

Order of the Board of Directors |

| |

|

|

| |

|

Dr. Steve Slilaty |

| |

|

Chief Executive Officer and Chairman |

| |

|

|

| February 21, 2024 |

|

|

Sunshine Biopharma, Inc.

1177 Avenue of the Americas, 5th Floor

New York, NY 10036

INFORMATION STATEMENT

Action by Written Consent of Stockholders

GENERAL INFORMATION

WE ARE NOT ASKING YOU FOR A PROXY, AND YOU ARE

REQUESTED NOT TO SEND US A PROXY

This information statement is being furnished

in connection with the action by written consent of stockholders taken without a meeting to approve the actions described in this information

statement. We are mailing this information statement to our stockholders on or about March__, 2024.

What action was taken by written consent?

We obtained stockholder consent for the Warrant

Stockholder Approval Provisions described in detail in this Information Statement.

What vote was obtained to approve the Warrant Stockholder Approval

Provisions described in this information statement?

On February 13, 2024, we obtained the approval

of Dr. Steve Slilaty, our Chief Executive Officer, to approve the Warrant Stockholder Approval Provisions. As of February 13, 2024, Dr.

Slilaty held 58.3% of the total voting power of the Company’s stockholders.

Who is paying the cost of this information statement?

We will pay for preparing, printing and mailing

this information statement. Our costs are estimated at approximately $10,000.

WARRANT STOCKHOLDER APPROVAL PROVISIONS

Under the terms of the Underwriting Agreement (defined

below) we are required to seek such stockholder approval as may be required by the applicable rules and regulations of the Nasdaq Capital

Market (“Nasdaq”) for certain provisions (the “Warrant Stockholder Approval Provisions”) of the Series A Warrants

and Series B Warrants (collectively, the “Warrants”) issued under the Underwriting Agreement, which are described below, to

become effective (the “Warrant Stockholder Approval”).

On February 13, 2024, the

Company entered into an underwriting agreement (the “Underwriting Agreement”) with Aegis Capital Corp. (the “Underwriter”),

in connection with a firm commitment underwritten public offering (the “Offering”) of 71,428,571 Units (defined herein), consisting

of (i) 26,428,571 common units (“Common Units”), each consisting of one share of common stock of the Company, 0.1 of a Series

A warrant (the “Series A Warrants”) to purchase one share of common stock at an exercise price of $2.10 per share or pursuant

to an alternative cashless exercise option (described below), which warrant will expire two-and-a-half years from the closing of the Offering,

and 0.2 of a Series B warrant (the “Series B Warrants” and together with the Series A Warrants, the “Warrants”)

to purchase one share of common stock at an exercise price of $2.38 per share, which warrant will expire on the five-year anniversary

of the closing of the Offering; and (ii) 45,000,000 Pre-Funded Units (the “Pre-Funded Units” and together with the Common

Units, the “Units”), each Pre-Funded Unit consisting of one pre-funded warrant (the “Pre-Funded Warrants”) to

purchase one share of common stock, 0.1 of a Series A Warrant and 0.2 of a Series B Warrant. The purchase price of each Common Unit was

$0.14, and the purchase price of each Pre-Funded Unit was $0.139. The Pre-Funded Warrants are immediately exercisable, have an exercise

price of $0.001 per share and may be exercised at any time until all Pre-Funded Warrants are exercised in full.

In addition, the Company granted

the Underwriter a 45-day option to purchase up to an additional 10,714,285 shares of common stock and/or Pre-Funded Warrants, representing

up to 15% of the number of common stock and Pre-Funded Warrants sold in the Offering, and/or an additional 1,071,429 Series A Warrants

representing up to 15% of the Series A Warrants sold in the Offering, and/or an additional 2,142,857 Series B Warrants representing up

to 15% of the Series B Warrants sold in the Offering, solely to cover over-allotments, if any.

The Offering closed on February

15, 2024. The aggregate gross proceeds to the Company were approximately $10.0 million, before deducting underwriting discounts and other

expenses payable by the Company. On February 15, 2024, the Underwriter also partially exercised its over-allotment option with

respect to 830,357 Series A Warrants and 1,660,714 Series B Warrants.

On February 13, 2024, Dr. Steve Slilaty, as the

holder of the majority of the voting power of the stockholders of the Company, approved by written consent the Warrant Stockholder Approval

Provisions, consisting of the following:

| · | to give full effect to alternative cashless exercises pursuant

to Section 2.3 of the Series A Warrants; |

| · | to any adjustment to the exercise price or number of shares

of common stock underlying the Series A Warrants or the Series B Warrants in the event of a Share Combination Event (as defined in the

Series A Warrants and Series B Warrants) in Section 3.7 of the Series A Warrants and 3.8 of the Series B Warrants; |

| · | to the voluntary adjustment, from time to time, of the exercise

price of any and all currently outstanding Warrants pursuant to Section 3.8 of the Series A Warrants and 3.9 of the Series B Warrants; |

| · | to render inapplicable clause (i) of the definition of the

Floor Price (as defined in the Series B Warrant) in Section 3.2 of the Series B Warrants; and |

| · | to give full effect to the adjustment in the exercise price

and number of underlying shares following a Dilutive Issuance (as defined in the Series B Warrants) pursuant to Section 3.2 of the Series

B Warrants. |

Description of Warrants

The following is a description

of the provisions of the Warrants issued in the Offering.

Exercisability. The

Series A Warrants and Series B Warrants are exercisable immediately and at any time up to the date that is two-and-a-half years (with

respect to the Series A Warrants) or five years (with respect to the Series B Warrants) after their original issuance. The Series A Warrants

and Series B Warrants are exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise

notice and, at any time a registration statement registering the issuance of the shares of common stock underlying the Series A Warrants

and Series B Warrants under the Securities Act is effective and available for the issuance of such shares, by payment in full in immediately

available funds for the number of shares of common stock purchased upon such exercise. If a registration statement registering the issuance

of the shares of common stock underlying the Series A Warrants or Series B Warrants under the Securities Act is not effective, the holder

may elect to exercise the Series A Warrants or Series B Warrants through a cashless exercise, in which case the holder would receive upon

such exercise the net number of shares of common stock determined according to the formula set forth in the warrant.

On or after receipt of the

Warrant Stockholder Approval, a holder may also effect an “alternative cashless exercise” at any time while the Series A Warrants

are outstanding. In such event, the aggregate number of shares issuable in such alternative cashless exercise will be equal to the number

of Series A Warrants being exercised multiplied by two.

Exercise Limitation.

A holder will not have the right to exercise any portion of the Series A Warrants or Series B Warrants if the holder (together with its

affiliates) would beneficially own in excess of 4.99% of the number of shares of our common stock outstanding immediately after giving

effect to the exercise, as such percentage ownership is determined in accordance with the terms of the Series A Warrants and Series B

Warrants. However, any holder may increase or decrease such percentage to any other percentage not in excess of 9.99%, provided that any

increase in such percentage shall not be effective until 61 days following notice from the holder to us.

Exercise Price. The

exercise price per whole share of common stock purchasable upon exercise of the Series A Warrants is $2.10, and the exercise price per

whole share of common stock purchasable upon exercise of the Series B Warrants is $2.38. The exercise price is subject to appropriate

adjustment in the event of certain stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events

affecting our common stock and also upon any distributions of assets, including cash, stock or other property to our stockholders.

Subsequent Financing.

Subject to certain exemptions, if we sell, enter into an agreement to sell, or grant any option to purchase, or sell, enter into an agreement

to sell, or grant any right to reprice, or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase

or other disposition) any shares of common stock, at an effective price per share less than the exercise price of the Series B Warrants

then in effect, the exercise price of the Series B Warrants will be reduced to such price (subject to a floor of $0.10 prior to the Warrant

Stockholder Approval), and the number of shares issuable upon exercise will be proportionately adjusted such that the aggregate exercise

price will remain unchanged (the “Ant-Dilution Provision”).

Reverse Stock Split.

Conditioned upon the receipt of the Warrant Stockholder Approval, if at any time on or after the date of issuance there occurs any share

split, share dividend, share combination recapitalization or other similar transaction involving our common stock and the lowest daily

volume weighted average price during the period commencing five consecutive trading days immediately preceding and the five consecutive

trading days immediately following such event is less than the exercise price of the Series A Warrants or Series B Warrants then in effect,

then the exercise price of the Series A Warrants and Series B Warrants will be reduced to the lowest daily volume weighted average price

during such period and the number of shares issuable upon exercise will be proportionately adjusted such that the aggregate price will

remain unchanged (the “Share Combination Event Provision”).

Transferability. Subject

to applicable laws, the Series A Warrants and Series B Warrants may be offered for sale, sold, transferred or assigned without our consent.

Warrant Agent. The

Series A Warrants and Series B Warrants were issued in registered form under a warrant agency agreement between Equiniti Trust Company,

LLC, as warrant agent, and us. The Series A Warrants and Series B Warrants are initially represented only by one or more global warrants

deposited with the warrant agent, as custodian on behalf of The Depository Trust Company (DTC) and registered in the name of Cede &

Co., a nominee of DTC, or as otherwise directed by DTC.

Fundamental Transactions.

In the event of a fundamental transaction, as described in the Series A Warrants and Series B Warrants and generally including any reorganization,

recapitalization or reclassification of our common stock, the sale, transfer or other disposition of all or substantially all of our properties

or assets, our consolidation or merger with or into another person, the acquisition of more than 50% of our outstanding common stock,

or any person or group becoming the beneficial owner of 50% of the voting power represented by our outstanding common stock, the holders

of the Series A Warrants and Series B Warrants will be entitled to receive upon exercise of the Series A Warrants and Series B Warrants

the kind and amount of securities, cash or other property that the holders would have received had they exercised the Series A Warrants

and Series B Warrants immediately prior to such fundamental transaction. The holders of the Series A Warrants and Series B Warrants may

also require us to purchase the Series A Warrants and Series B Warrants from the holders by paying to each holder an amount equal to the

Black Scholes value of the remaining unexercised portion of the Series A Warrants and Series B Warrants on the date of the fundamental

transaction.

Rights as a Stockholder.

Except as otherwise provided in the Series A Warrants or Series B Warrants or by virtue of such holder’s ownership of shares of

our common stock, the holder of a Series A Warrants or Series B Warrants does not have the rights or privileges of a holder of our common

stock, including any voting rights, until the holder exercises the Series A Warrant or Series B Warrants.

Governing Law. The

Series A Warrants, Series B Warrants, and the warrant agency agreement are governed by New York law.

Reverse Stock Split.

The Company will effect a reverse stock split within seven (7) business days after the Warrant Stockholder Approval has been received

in accordance with the applicable laws and corporate governing documents of the Company (the “First Reverse Split Date”).

No reverse stock split will be effectuated before the First Reverse Split Date, except if the consent has been obtained from purchasers

of the majority of the Units.

Purpose of the Warrant Stockholder Approval

Our common stock is listed

on Nasdaq under the symbol “SBFM.” Nasdaq Listing Rule 5635(d) requires stockholder approval of transactions other than public

offerings of greater than 20% of the outstanding common stock of the issuer prior to the offering. In determining whether an offering

qualifies as a public offering, Nasdaq considers all relevant factors, including the extent of any discount to the market price of the

common stock being offered. In determining discount, Nasdaq generally attributes a value of $0.125 for each whole warrant offered with

a share of common stock. The price per Unit in the Offering attributed the foregoing value to the Warrants.

However, since the Warrant

Stockholder Approval Provisions would require that we attribute additional value to the Warrants (over the value already attributed),

in order to ensure that the Offering qualified as a public offering under Rule 5635, such provisions in the Warrants are not effective

unless and until our stockholders approve the Warrant Stockholder Approval Provisions. We have obtained such approval, which will be effective

20 days after the mailing of the definitive information statement to stockholders.

While we believe the securities

were sold in a public offering, as that term is construed by Nasdaq, we obtained the Warrant Stockholder Approval and will have such Warrant

Stockholder Approval become effective pursuant to the filing and mailing of this information statement in a surfeit of caution to assure

continued compliance with the Nasdaq Listing Rules.

Potential Adverse Effects of the Approval of

the Warrant Stockholder Approval Provisions

Following effectiveness of

the Warrant Stockholder Approval, existing stockholders will suffer dilution in their ownership interests in the future as a result of

the potential issuance of shares of common stock upon exercise of the Warrants. Assuming the full exercise of the Warrants, and assuming

the Series A Warrants are exercised on an alternative cashless exercise basis, an aggregate of 31,892,856 additional shares of common

stock will be outstanding and the ownership interest of our existing stockholders would be correspondingly reduced.

The number of shares of common

stock described above does not give effect to potential additional shares underlying the Warrants that may be issuable after effectiveness

of the Warrant Stockholder Approval from the Share Combination Event Provision (for both the Series A Warrants and Series B Warrants)

or Anti-Dilution Provision for the Series B Warrants.

The sale into the public market

of these shares also could materially and adversely affect the market price of our common stock.

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth

certain information regarding the ownership of common stock as of February 13, 2024, by (i) each of our directors, (ii) each of our executive

officers, (iii) all of our directors and executive officers as a group, and (iv) any person or group as those terms are used in Section

13(d)(3) of the Exchange Act, believed by us to beneficially own more than 5% of our common stock. Unless otherwise indicated, all shares

are owned directly and the indicated person has sole voting and investment power. The percentages listed are based upon 28,024,290 common

shares and 30,000 Series B Preferred shares outstanding as of February 13, 2024. Unless otherwise indicated, the address of each holder

is c/o Sunshine Biopharma, Inc., 1177 Avenue of the Americas, 5th Floor, New York, NY 10036.

| Title of Class |

|

Name and Address of Beneficial Owner |

|

Amount and Nature of Beneficial Ownership |

|

|

Percent of Class |

|

| |

|

|

|

|

|

|

|

|

| Common |

|

Dr. Steve N. Slilaty(1) |

|

|

3,821,024 |

(3) |

|

|

13.7% |

|

| Preferred |

|

|

|

|

30,000 |

(2) |

|

|

100% |

|

| |

|

|

|

|

|

|

|

|

|

|

| Common |

|

Camille Sebaaly(1) |

|

|

174,465 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

|

| Common |

|

Dr. Abderrazzak Merzouki(1) |

|

|

116,720 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

|

| Common |

Dr. Andrew Keller(1) |

|

|

0 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

| Common |

David Natan(1) |

|

|

0 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

| Common |

Dr. Rabi Kiderchah(1) |

|

|

1,625 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

| Common |

|

Malek Chamoun(1) |

|

|

3,700,000 |

(3) |

|

|

13.2% |

|

| |

|

|

|

|

|

|

|

|

|

|

| Common |

|

Marc Beaudoin(1) |

|

|

0 |

|

|

|

* |

|

| |

|

|

|

|

|

|

|

|

|

|

| Common |

|

All Officers and Directors as Group (8 persons): |

|

|

4,113,834 |

(2)(3) |

|

|

14.7% |

|

___________________

* Less than 1%.

| |

(1) |

Officer and/or director of our Company. |

| |

(2) |

Includes 30,000 shares of the Company’s Series B Preferred Stock. Each share of Series B Preferred Stock is entitled to 1,000 votes. |

| |

(3) |

Includes 3,700,000 common shares owned by Malek Chamoun, the President of Nora Pharma Inc., a company acquired by the Company in October 2022. Dr. Slilaty controls the voting of Mr. Chamoun’s shares through a voting agreement between Mr. Chamoun and Dr. Slilaty dated October 20, 2022. |

ADDITIONAL AVAILABLE INFORMATION

We are subject to the information and reporting

requirements of the Securities Exchange Act of 1934, as amended, and in accordance with such act we file periodic reports, documents and

other information with the SEC relating to our business, financial statements and other matters. Such reports and other information are

available at the SEC’s website at www.sec.gov.

| |

By |

Order of the Board of Directors |

| |

|

|

| |

|

Dr. Steve Slilaty |

| |

|

Chief Executive Officer and Chairman

February 21, 2024 |

| |

|

|

| |

|

|

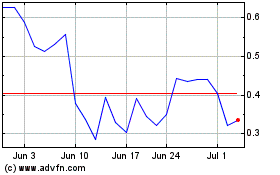

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Apr 2023 to Apr 2024