UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-41225

VIZSLA SILVER CORP.

(Registrant)

Suite 1723, 595 Burrard Street

Vancouver, British Columbia V7X 1J1 Canada

(Address of Principal Executive Offices)

Indicate by check mark whether the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the Registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

VIZSLA SILVER CORP. |

| |

(Registrant) |

| |

|

|

| Date: February 20, 2024 |

By |

/s/ Michael Konnert |

| |

|

Michael Konnert |

| |

|

Chief Executive Officer |

EXHIBIT INDEX

Technical Report

On The

Updated Mineral Resource Estimate for the

Panuco Ag-Au-Pb-Zn Project, Sinaloa State,

Mexico

NAD83 UTM Zone 13, 404200 m E; 2588000 m N

LATITUDE 23° 25' N, LONGITUDE 105° 56' W

Prepared for:

Vizsla Silver Corp.

595 Burrard Street, Suite 1723

Vancouver, B.C., Canada, V7X 1J1

Report Date: February 12, 2024

Effective Date: September 1, 2023

| Qualified Persons |

Company |

| Allan Armitage, Ph. D., P. Geo., |

SGS Geological Services ("SGS") |

| Ben Eggers, B.Sc.(Hons), MAIG, P.Geo. |

SGS Geological Services ("SGS") |

| Peter Mehrfert, P.Eng. |

Ausenco Engineering Canada ULC ("Ausenco") |

| |

|

| SGS Project # 20000-01 |

|

| Technical Report – Updated Mineral Resource Estimate - Panuco Ag-Au-Pb-Zn Project, Mexico |

Page i |

| |

|

| TABLE OF CONTENTS |

PAGE |

| TABLE OF CONTENTS |

i |

| LIST OF FIGURES |

iii |

| LIST OF TABLES |

v |

| 1 SUMMARY |

7 |

| 1.0 Property Description, Location, Access, and Physiography |

7 |

| 1.1 History of Exploration, Drilling |

8 |

| 1.2 Geology and Mineralization |

10 |

| 1.3 Mineral Processing, Metallurgical Testing and Recovery Methods |

11 |

| 1.4 Mineral Resource Estimate |

12 |

| 1.4.1 Panuco Project Updated Mineral Resource Estimate Notes: |

14 |

| 1.5 Recommendations |

15 |

| 2 INTRODUCTION |

17 |

| 2.1 Sources of Information |

17 |

| 2.2 Site Visit |

18 |

| 2.2.1 2023 Site Visits |

18 |

| 2.3 Units of Measure |

19 |

| 2.4 Effective Date |

19 |

| 2.5 Units and Abbreviations |

19 |

| 3 Reliance on Other Experts |

21 |

| 4 PROPERTY DESCRIPTION AND LOCATION |

22 |

| 4.1 Location |

22 |

| 4.2 Land Tenure and Mining Concessions |

22 |

| 4.3 Underlying Agreements |

27 |

| 4.3.1 Canam Alpine Ventures Ltd. |

27 |

| 4.3.2 Silverstone Resources S.A. de C.V. |

27 |

| 4.3.3 Minera Rio Panuco S.A. de C.V. |

27 |

| 4.3.4 Strategic Investment in Prismo Metals |

28 |

| 4.3.5 Royalty Spin Out |

28 |

| 4.4 Surface Rights |

28 |

| 4.4.1 Canam and Ejido Panuco |

29 |

| 4.4.2 Silverstone Resources S.A. de C.V., Canam, and Ejido Platanar de los Ontiveros |

29 |

| 4.4.3 Canam and Comunidad Copala |

29 |

| 4.4.4 Canam and El Habal Ejido |

30 |

| 4.4.5 Short-Term Ejido Agreements |

30 |

| 4.5 Permits |

30 |

| 4.6 Environmental Considerations |

30 |

| 4.7 Other Relevant Factors |

31 |

| 5 ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE, AND PHYSIOGRAPHY |

32 |

| 5.1 Accessibility |

32 |

| 5.2 Local Resources and Infrastructure |

32 |

| 5.3 Climate |

32 |

| 5.4 Physiography |

32 |

| 5.5 Vegetation and Wildlife |

32 |

| 6 HISTORY |

33 |

| 6.1 Previous Mineral Resource Estimates |

34 |

| 6.2 Maiden Mineral Resource Estimate, March 2022 |

34 |

| 6.3 Updated Mineral Resource Estimate, January 2023 |

36 |

| 7 GEOLOGICAL SETTING AND MINERALIZATION |

39 |

| 7.1 Regional Geology |

39 |

| 7.2 Property Geology |

43 |

| 7.3 Mineralization |

47 |

| 7.3.1 Animas-Refugio Corridor |

49 |

| 7.3.2 Cordon del Oro Corridor |

52 |

| 7.3.3 Cinco Señores and Napoleon Corridor |

53 |

| Technical Report – Updated Mineral Resource Estimate - Panuco Ag-Au-Pb-Zn Project, Mexico |

Page ii |

| |

|

| 7.3.4 Other Mineralized Structures |

59 |

| 7.4 Structural Controls |

61 |

| 7.5 Alteration |

61 |

| 7.6 Mineral Petrology |

62 |

| 8 DEPOSIT TYPES |

64 |

| 8.1 Epithermal Systems |

64 |

| 9 EXPLORATION |

67 |

| 9.1 Geological Mapping |

67 |

| 9.2 2019-2021 Rock and Soil Geochemistry |

68 |

| 9.3 Geophysics |

69 |

| 9.4 2023 LiDAR Survey |

71 |

| 9.5 2022 Surface Sampling |

72 |

| 9.6 2023 Surface Sampling |

73 |

| 10 DRILLING |

76 |

| 10.1 2019 Drilling |

77 |

| 10.2 2020 Drilling |

78 |

| 10.3 2021 Drilling |

81 |

| 10.4 2022 Drilling |

85 |

| 10.5 2023 Drilling |

86 |

| 11 SAMPLE PREPARATION, ANALYSES, AND SECURITY |

88 |

| 11.1 2019 – 2023 Rock Sampling (Vizsla Silver) |

89 |

| 11.2 2019 – 2023 Drilling Programs (Vizsla Silver) |

89 |

| 11.2.1 Sample Preparation and Security |

89 |

| 11.2.2 Sample Analyses |

91 |

| 11.2.3 Bulk Density |

91 |

| 11.2.4 Data Management |

91 |

| 11.2.5 Quality Assurance/Quality Control |

91 |

| 11.2.6 Certified Reference Material |

92 |

| 11.2.7 Blank Material |

103 |

| 11.2.8 Duplicate Material |

105 |

| 11.2.9 Umpire Laboratory |

110 |

| 11.3 Sample Storage and Security |

113 |

| 11.4 QP’s Comments |

113 |

| 12 DATA VERIFICATION |

114 |

| 12.1 Drill Sample Database |

114 |

| 12.2 Site Visit |

114 |

| 12.2.1 2023 Site Visits |

114 |

| 12.3 Conclusion |

115 |

| 13 MINERAL PROCESSING AND METALLURGICAL TESTING |

116 |

| 13.1 The following is a summary of results of metallurgical testing completed on core from the Project as of the effective date of this report. Preliminary Metallurgical Testing on the Napoleon Deposit |

116 |

| 13.1.1 Sample Origin and Sample Characteristics |

117 |

| 13.1.2 Metallurgical Testing |

119 |

| 13.1.3 Additional Metallurgical Testing |

121 |

| 13.1.4 Conclusions |

122 |

| 13.2 Preliminary Metallurgical Testing on the Tajitos Deposit |

124 |

| 13.2.1 Sample Origin and Sample Characteristics |

124 |

| 13.2.2 Metallurgical Testing |

126 |

| 13.2.3 Conclusions |

129 |

| 13.3 Metallurgical Testing on the Copala Deposit |

130 |

| 13.3.1 Sample Origin and Sample Characteristics |

130 |

| 13.3.2 Metallurgical Testing |

132 |

| 13.3.3 Conclusions |

136 |

| 14 MINERAL RESOURCE ESTIMATES |

138 |

| 14.1 Introduction |

138 |

| 14.2 Drill Hole Database |

138 |

| Technical Report – Updated Mineral Resource Estimate - Panuco Ag-Au-Pb-Zn Project, Mexico |

Page iii |

| |

|

| 14.3 Mineral Resource Modelling and Wireframing |

140 |

| 14.4 Bulk Density |

143 |

| 14.5 Compositing |

144 |

| 14.6 Grade Capping |

149 |

| 14.7 Block Model Parameters |

151 |

| 14.8 Grade Interpolation |

154 |

| 14.9 Mineral Resource Classification Parameters |

157 |

| 14.10 Reasonable Prospects of Eventual Economic Extraction |

158 |

| 14.11 Mineral Resource Statement |

159 |

| 14.12 Model Validation and Sensitivity Analysis |

168 |

| 14.12.1 Sensitivity to Cut-off Grade |

170 |

| 14.13 Comparison of the current MRE to the January 2023 MRE |

174 |

| 14.14 Disclosure |

175 |

| 15 MINERAL RESERVE ESTIMATE |

176 |

| 16 MINING METHODS |

177 |

| 17 RECOVERY METHODS |

178 |

| 18 PROJECT INFRASTRUCTURE |

179 |

| 19 MARKET STUDIES AND CONTRACTS |

180 |

| 20 ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT. 181 |

181 |

| 21 CAPITAL AND OPERATING COSTS |

182 |

| 22 ECONOMIC ANALYSIS |

183 |

| 23 ADJACENT PROPERTIES |

184 |

| 24 OTHER RELEVANT DATA AND INFORMATION. 185 |

185 |

| 25 INTERPRETATION AND CONCLUSIONS |

186 |

| 25.1 Diamond Drilling |

186 |

| 25.2 Metallurgy |

188 |

| 25.3 Mineral Resource Estimate |

189 |

| 25.3.1 Panuco Project Updated Mineral Resource Estimate Notes: |

190 |

| 25.4 Risk and Opportunities |

191 |

| 25.4.1 Risks |

192 |

| 25.4.2 Opportunities |

192 |

| 26 RECOMMENDATIONS |

192 |

| 27 REFERENCES |

195 |

| 28 DATE AND SIGNATURE PAGE |

199 |

| 29 CERTIFICATES OF QUALIFIED PERSONS |

200 |

LIST OF FIGURES

| Figure 4-1 Property Location Map |

22 |

| Figure 4-2 Mining Concessions (WGS 84 UTM Zone 13N) |

23 |

| Figure 4-3 Location of Ejidos and Outline of Panuco Project |

29 |

| Figure 7-1 Metallogenic Setting Map. Illustrates Geological Setting of Western Mexico with Main Porphyry and Epithermal Deposits of the Sierra Madre Occidental |

40 |

| Figure 7-2 Regional Geologic Setting Map. Illustrates Regional Geological Central Sierra Madre Occidental |

41 |

| Figure 7-3 Regional Geology Map |

42 |

| Figure 7-4 Stratigraphic Column for the Project Area |

43 |

| Figure 7-5 Property Geology Map Showing Claim Outline and Known Mineralized Structures |

45 |

| Figure 7-6 Schematic Cross-Section of Panuco Veining Illustrating that Veins May Be Listric Faults Developed from Reactivated Laramide Thrust Faults (Starling 2019) |

46 |

| Figure 7-7 Panuco Project Claims Showing Known Veins, Including the Four Resource Areas Comprising Eleven Veins Included in the Mineral Resource Estimate |

48 |

| Figure 7-8 Animas-Refugio Geology and Silver Geochemistry (Section A-A' Shown in Figure 7-10) |

50 |

| Figure 7-9 Animas-Refugio Geology and Gold Geochemistry (Section A-A' Shown in Figure 7-10) |

51 |

| Figure 7-10 Animas-Refugio Vein Cross-Section Looking Northwest |

52 |

| Figure 7-11 Cordon del Oro Geology and Silver Geochemistry |

53 |

| Technical Report – Updated Mineral Resource Estimate - Panuco Ag-Au-Pb-Zn Project, Mexico |

Page iv |

| |

|

| Figure 7-12 Cinco Señores-Napoleon Geology and Silver Geochemistry |

54 |

| Figure 7-13 Cinco Señores-Napoleon Geology and Gold Geochemistry |

55 |

| Figure 7-14 Descubridora Mine Geology and Geochemistry |

56 |

| Figure 7-15 Drill-hole intercepts showing tilted-mineralization on Napoleon main vein |

57 |

| Figure 7-16 Panuco Project Area with Veins |

59 |

| Figure 8-1 Genetic model for epithermal deposits |

65 |

| Figure 8-2 Schematic of Alteration and Mineralization in Low Sulphidation Precious Metal Deposits |

66 |

| Figure 9-1 Panuco Property Mapped Areas at 1:1,000 Scale as of September 2023 |

67 |

| Figure 9-2 Surface sampling at Panuco Project between 2019 and 2022 |

69 |

| Figure 9-3 Airborne Magnetics RTP from 2016 with Known Veining and Possible Fault Offset Shown in Diorite |

70 |

| Figure 9-4 Results from 2021 Airborne Magnetics RTP Geophysical Survey Over the Napoleon Area |

71 |

| Figure 9-5 Surface Sampling at Panuco Project in 2022 |

73 |

| Figure 9-6 Surface Sampling at Panuco Project in 2023 |

75 |

| Figure 10-1 Resource Models and Location of Drill Holes on the Panuco Project from 2019-2023 |

77 |

| Figure 10-2 Resource Models and Location of 2019 - 2020 Drill Holes on the Panuco Project |

78 |

| Figure 10-3 Resource Models and Location of Drill Holes on the Panuco Project from 2021 |

81 |

| Figure 10-4 Resource Models and Location of Drill Holes on the Panuco Project from 2022 |

85 |

| Figure 10-5 Resource Models and Location of Drill Holes on the Panuco Project from 2023 (to September 1, 2023) |

87 |

| Figure 11-1 Vizsla Silver Core-Logging Facility in Concordia, Sinaloa. Left: Core logging area; Right: Long-Term, Covered and Fenced, Core Storage Area |

90 |

| Figure 11-2 CRM Control Chart for Silver for the 2020 Drill Program |

95 |

| Figure 11-3 CRM Control Chart for Gold for the 2020 Drill Program |

96 |

| Figure 11-4 CRM Control Chart for Lead for the 2020 Drill Program |

96 |

| Figure 11-5 CRM Control Chart for Zinc for the 2020 Drill Program |

97 |

| Figure 11-6 CRM Control Chart for Silver for the 2021 Drill Program |

97 |

| Figure 11-7 CRM Control Chart for Gold for the 2021 Drill Program |

98 |

| Figure 11-8 CRM Control Chart for Lead for the 2021 Drill Program |

98 |

| Figure 11-9 CRM Control Chart for Zinc for the 2021 Drill Program |

99 |

| Figure 11-10 CRM Control Chart for Silver for the 2022 Drill Program |

99 |

| Figure 11-11 CRM Control Chart for Gold for the 2022 Drill Program |

100 |

| Figure 11-12 CRM Control Chart for Lead for the 2022 Drill Program |

100 |

| Figure 11-13 CRM Control Chart for Zinc for the 2022 Drill Program |

101 |

| Figure 11-14 CRM Control Chart for Silver for the 2023 Drill Program |

101 |

| Figure 11-15 CRM Control Chart for Gold for the 2023 Drill Program |

102 |

| Figure 11-16 CRM Control Chart for Lead for the 2023 Drill Program |

102 |

| Figure 11-17 CRM Control Chart for Zinc for the 2023 Drill Program |

103 |

| Figure 11-18 Blank Sample Chart for Silver for the 2020 Drill Program |

104 |

| Figure 11-19 Blank Sample Chart for Silver for the 2021 Drill Program |

104 |

| Figure 11-20 Blank Sample Chart for Silver for the 2022 Drill Program |

105 |

| Figure 11-21 Blank Sample Chart for Silver for the 2023 Drill Program |

105 |

| Figure 11-22 Plot of Field Duplicate Samples for Silver from the 2019-2023 Drill Program |

106 |

| Figure 11-23 Plot of Field Duplicate Samples for Gold from the 2019-2023 Drill Program |

107 |

| Figure 11-24 Plot of Field Duplicate Samples for Lead from the 2019-2023 Drill Program |

107 |

| Figure 11-25 Plot of Field Duplicate Samples for Zinc from the 2019-2023 Drill Program |

108 |

| Figure 11-26 Plot of Pulp Duplicate Samples for Silver from the 2019-2023 Drill Program |

108 |

| Figure 11-27 Plot of Pulp Duplicate Samples for Gold from the 2019-2023 Drill Program |

109 |

| Figure 11-28 Plot of Pulp Duplicate Samples for Lead from the 2019-2023 Drill Program |

109 |

| Figure 11-29 Plot of Pulp Duplicate Samples for Zinc from the 2019-2023 Drill Program |

110 |

| Figure 11-30 Plot of SGS Umpire Check Samples for Silver Assayed in 2022 |

111 |

| Figure 11-31 Plot of SGS Umpire Check Samples for Gold Assayed in 2022 |

112 |

| Figure 11-32 Plot of SGS Umpire Check Samples for Silver Assayed in 2023 |

112 |

| Figure 11-33 Plot of SGS Umpire Check Samples for Gold Assayed in 2023 |

113 |

| Technical Report – Updated Mineral Resource Estimate - Panuco Ag-Au-Pb-Zn Project, Mexico |

Page v |

| |

|

| Figure 14-1 Plan View: Distribution of Surface Drill Holes on the Property (WGS 84), on Topography |

139 |

| Figure 14-2 Isometric View Looking Northwest: Distribution of Surface Drill Holes in the Copala-Napoleon-Cruz-Luisa Area (WGS84) |

140 |

| Figure 14-3 Plan View: Property Mineral Resource Models |

142 |

| Figure 14-4 Isometric View Looking Northeast: Property Mineral Resource Models |

142 |

| Figure 14-5 Isometric View Looking Northwest: Property Mineral Resource Models, Copala-Napoleon-Luisa Areas |

143 |

| Figure 14-6 Plan View: Distribution of Mineral Resource Block Models and Mineralization Domains |

152 |

| Figure 14-7 Isometric View looking NW: Distribution of Mineral Resource Block Models and Mineralization Domains on the Property |

153 |

| Figure 14-8 Isometric View looking NW: Distribution of Mineral Resource Block Models and Mineralization Domains in the Napoleon-Copala Areas |

153 |

| Figure 14-9 Plan View: Mineral Resource Block Grades and Block Class for the Copala-Cristiano-Tajitos Deposit Area |

162 |

| Figure 14-10 Isometric View Looking West: Mineral Resource Block Grades and Block Class for the Copala-Cristiano-Tajitos Deposit Area |

163 |

| Figure 14-11 Isometric View Looking NNE: Mineral Resource Block Grades and Block Class for the Copala-Cristiano-Tajitos Deposit Area |

164 |

| Figure 14-12 Plan View: Mineral Resource Block Grades and Block Class for the Napoleon, Cruz, Josephine and Luisa Areas |

165 |

| Figure 14-13 Isometric View Looking Northwest: Mineral Resource Block Grades and Block Class for the Napoleon, Cruz, Josephine and Luisa Areas |

166 |

| Figure 14-14 Isometric View Looking NNE: Mineral Resource Block Grades and Block Class for the Napoleon, Cruz, Josephine and Luisa Areas |

167 |

| Figure 14-15 Comparison of ID3, ID2 & NN Models for the Napoleon-Josephine-Cruz Deposit Area |

169 |

| Figure 14-16 Comparison of ID3, ID2 & NN Models for the Copala-Cristiano Deposit Area |

170 |

| Figure 26-1 Plan Map of the Panuco District Highlighting Primary 2024 Exploration Targets Relative to Mapped and Sampled Mineralized Veins: |

194 |

LIST OF TABLES

| Table 1-1 Panuco Project Mineral Resource Estimate, September 1, 2023 |

13 |

| Table 1-2 Panuco Project Mineral Resource Estimate by Area, September 1, 2023 |

14 |

| Table 2-1 List of Abbreviations |

20 |

| Table 4-1 Property Mineral Concessions held 100% By Vizsla |

23 |

| Table 6-1 2022 Panuco Mineral Resource Estimate Summary by Resource Classification (150 g/t AgEq Cut-Off Grade), March 1, 2022 (Maunula and Murray, 2022) |

35 |

| Table 6-2: Panuco Mineral Resource Estimate Summary by Vein (150 g/t AgEq Cut-Off Grade), March 1, 2022 (Maunula and Murray, 2022) |

35 |

| Table 6-3: Cut-Off Grade Sensitivity (AgEq Cut-Off Grade), March 1, 2022 (Maunula and Murray, 2022) |

36 |

| Table 6-4 Panuco Project Mineral Resource Estimate, January 19, 2023 |

37 |

| Table 6-5 Panuco Project Mineral Resource Estimate by Zone, January 19, 2023 |

37 |

| Table 7-1 General Description of Estimated Veins Included in the Mineral Resources Estimate for the Panuco Project |

47 |

| Table 9-1 Summary of Surface and Underground Rock and Soil Geochemistry Samples between 2019 and 2021 |

68 |

| Table 9-2 Panuco Project Surface Samples in 2022 |

72 |

| Table 9-3 Selected High-Grade Samples Taken During 2022 Surface Exploration |

72 |

| Table 9-4 Panuco Project Surface Samples in 2023 |

74 |

| Table 9-5 Selected High-Grade Samples Taken During 2023 Surface Exploration |

74 |

| Table 10-1: Summary Drilling Conducted by Vizsla Silver on the Panuco Project, to September 2023 |

76 |

| Table 10-2 Highlights of the 2021 Drilling |

82 |

| Table 10-3 Highlights of the 2022 Drilling (to September) |

86 |

| Table 10-4 Highlights of the 2023 Drilling (to September) |

87 |

| Technical Report – Updated Mineral Resource Estimate - Panuco Ag-Au-Pb-Zn Project, Mexico |

Page vi |

| |

|

| Table 11-1 Summary of Drilling Samples Included in the MRE by Year |

88 |

| Table 11-2 Summary of Drill Core Analytical Labs and Analysis Methods 2019 - 2023 |

88 |

| Table 11-3 QC Sample Statistics for Vizsla Core Sampling 2019 - 2023 |

92 |

| Table 11-4 CRM Sample Silver Performance for the 2019-2023 Drill Programs |

93 |

| Table 11-5 CRM Sample Gold Performance for the 2019-2023 Drill Programs |

94 |

| Table 11-6 CRM Sample Lead Performance for the 2019-2023 Drill Programs |

94 |

| Table 11-7 CRM Sample Zinc Performance for the 2019-2023 Drill Programs |

95 |

| Table 11-8 Average Relative Error of Duplicate Samples from 2019-2023 |

106 |

| Table 11-9 Relative Bias - SGS Umpire Check Samples from 2019-2023 |

110 |

| Table 11-10 Average Relative Error - SGS Umpire Check Samples from 2019-2023 |

111 |

| Table 13-1 Chemical Content Summary (ALS, 2021) |

118 |

| Table 13-2 Mineral Content Summary (ALS, 2021) |

118 |

| Table 13-3 Gold and Silver Recovery/Extraction Summary (ALS, 2022A) |

123 |

| Table 13-4 Master Composite Head Assay Summary |

125 |

| Table 13-5 Master Composite Mineral Content Summary |

125 |

| Table 13-6 Potential Flowsheet Comparison (ALS, 2022B) |

130 |

| Table 13-7 Head Assay Summary (ALS, 2023) |

131 |

| Table 13-8 Mineral Content Summary (ALS, 2023) |

131 |

| Table 13-9 Master Composite 1 Whole Feed Cyanidation Vs. Flotation - Cyanidation |

137 |

| Table 14-1 Project Drill Hole Totals |

139 |

| Table 14-2 Property Domain Descriptions |

141 |

| Table 14-3 Statistical Analysis of the Drill Assay Data from Within the Deposit Mineral Domains - by Area |

144 |

| Table 14-4 Statistical Analysis of the 1.5 M Composite Data from Within the Deposit Mineral Domains - by Area |

147 |

| Table 14-5 Composite Capping Summary - by Domain/Deposit Area |

150 |

| Table 14-6 Deposit Block Model Geometry |

151 |

| Table 14-7 Grade Interpolation Parameters by Area and Domain |

154 |

| Table 14-8 Parameters used for Underground Cut-off Grade Calculation |

159 |

| Table 14-9 Panuco Project Mineral Resource Estimate, September 1, 2023 |

159 |

| Table 14-10 Panuco Project Mineral Resource Estimate by Area, September 1, 2023 |

160 |

| Table 14-11 Comparison of Average Composite Grades with Block Model Grades |

168 |

| Table 14-12 Underground Mineral Resource Estimate at Various AgEq Cut-off Grades, September 1, 2023 |

171 |

| Table 14-13 Comparison of the January 2023 MRE to the September 2023 MRE for the Project |

174 |

| Table 25-1 Highlights of the 2023 Drilling (to September 1, 2023) |

188 |

| Table 25-2 Panuco Project Mineral Resource Estimate, September 1, 2023 |

189 |

| Table 25-3 Panuco Project Mineral Resource Estimate by Area, September 1, 2023 |

190 |

1 SUMMARY

SGS Geological Services Inc. ("SGS") was contracted by Vizsla Silver Corp., ("Vizsla" or the "Company") to complete an updated Mineral Resource Estimate ("MRE") for the Panuco Ag-Au Project ("Panuco" or "Project") in Sinaloa, Mexico, and to prepare a National Instrument 43-101 ("NI 43-101") Technical Report written in support of the updated MRE. The Project is considered an early-stage exploration project.

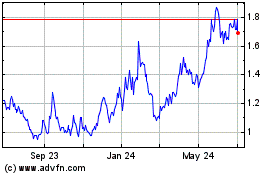

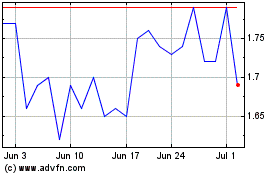

Vizsla Silver Corp. was incorporated as Vizsla Capital Corp. under the Business Corporations Act (British Columbia) on September 26, 2017. On March 8, 2018, the Company changed its name to Vizsla Resources Corp. On February 5, 2021, the Company changed its name to Vizsla Silver Corp. The Company's principal business activity is the exploration of mineral properties. The Company currently conducts its operations in Mexico and Canada. It is trading on the TSX Venture Exchange ("TSXV") under the symbol VZLA.

On January 21, 2022, Vizsla Silver Corp was listed on the NYSE American exchange and commenced trading under the symbol "VZLA".

The current report is authored by Allan Armitage, Ph.D., P. Geo., ("Armitage") and Ben Eggers, MAIG, P.Geo. ("Eggers") of SGS (collectively, the "Authors"). The Authors are independent Qualified Persons as defined by NI 43-101 and are responsible for all sections of this report. The updated MRE presented in this report was estimated by Armitage.

The reporting of the updated MRE complies with all disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects. The classification of the updated MRE is consistent with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards (2014 CIM Definitions) and adhere to the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (2019 CIM Guidelines).

The current Technical Report will be used by Vizsla in fulfillment of their continuing disclosure requirements under Canadian securities laws, including National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). This Technical Report is written in support of an updated MRE completed for Vizsla.

1.0 Property Description, Location, Access, and Physiography

The Panuco Project is in the Panuco-Copala mining district (the Property; the Project) in the municipality of Concordia, southern Sinaloa state, along the western margin of the Sierra Madre Occidental physiographic province in western Mexico. The Project is centred at 23 25' north latitude and 105 56' west longitude on map sheets F13A-37.

The Project comprises 117 approved mining concessions in nineteen blocks, covering a total area of 5,869.87 ha, and two mineral concessions covering 1,321.15 ha. The mineral concessions are held 100% by Vizsla Silver. The concessions are valid for 50 years, provided semi-annual property tax payments are made in January and July each year and if minimum annual investment requirements are met, or if there is minimum annual production equal to the amount of the annual investment requirement. The concession owner may apply for a second 50-year term. Annual payments of 2.03 million Mexican Pesos were made in January of 2023 and 2.03 million Pesos were made in July of 2023 by Vizsla.

The Panuco Project area is accessed from Mazatlán via Federal Highway 15 to Villa Union, then on Highway 40 for 56 km (one-hour drive) (Figure 4-1). Highway 40 crosscuts the Project area and most of the vein structures. Toll Highway 40D also crosses the Project. In addition, local dirt roads provide access to most of the workings, but some require repairs or are overgrown, and four-wheel-drive vehicles are recommended in the wet season.

The Project is in the Concordia municipality, which has a population of approximately 27,000 inhabitants. Public services, including health clinics and police, are in the town of Concordia. Residents provide an experienced mine labour force. Contractors in Durango and Hermosillo have a strong mining tradition and provide the Project with a local source of knowledgeable labour and contract mining services. Drilling companies and mining contractors are available in Mazatlán, Durango, Hermosillo, Zacatecas, Fresnillo, and other areas of Mexico. The Project area is also used for cattle grazing, with limited agricultural use.

Two power lines connecting Durango and Mazatlán cross the Project, with 400 kV and 240 kV capacities.

Vizsla Silver owns the 500 tonnes per day Coco mill on its property. In addition, there are some mineral processing plants held by third parties in the district that range from 200 to 700 tonnes per day in capacity.

1.1 History of Exploration, Drilling

Capitan Francisco de Ibarra founded Concordia in 1565, and gold and silver veins in Panuco and Copala were first exploited in the centuries that followed Sim (2008) and Robinson (2019). Although production has been carried out on the Panuco Project over the last 460 years, no production records are available to Vizsla.

The first recorded modern mining activity commenced late in the 20th century. The Mineral Resources Council (Consejo de Recursos Minerales [CRM], the predecessor of the Mexican Geological Service [SGM]) carried out 1:50,000 scale mapping on map sheet F13-A37 and fine-fraction stream sediment sampling in 1999. In 2003, the CRM published additional 1:50,000 scale mapping on map sheet F13-A36, and fine-fraction stream sediment sampling (Polanco-Salas et al., 2003). In 2019 the SGM conducted 1:50,000 scale geological mapping and fine-fraction stream sediment sampling on map sheet F13-A46.

In 1989 the CRM optioned and sold several mineral concessions in the district, including to Grupo Minera Bacis (Bacis) in 1989. Bacis subsequently acquired claims from other parties active in the area, including Minas del Oro y del Refugio S.A. de C.V. Bacis drilled 19 holes totalling 2,822.8 m along the Animas-Refugio corridor, but only collar and survey records exist of this work.

From 1999 to 2001, Minera Rio Panuco S.A. de C.V. (Rio Panuco) explored the Animas-Refugio and Cordon del Oro structures culminating in 45 holes for 8,358.6 m. No geological drill logs, downhole survey data, downhole sample data, or geochemical assay data have been preserved. Graphic drill-hole sections are available, with limited downhole geology and geochemical data.

Capstone Mining Corp. (Capstone) optioned the Bacis concessions in 2004 and carried out geologic mapping and sampling of the Animas-Refugio and Cordon del Oro structures. In 2005, Capstone drilled 15,374 m in 131 holes on down-dip extensions of the Clemens and El Muerto mines on the Animas-Refugio vein. In 2007, Capstone explored the La Colorada structure with surface mapping and sampling, followed by 6,659 m of drilling in 64 holes.

Also, in 2007, Capstone transferred the claims of the Copala, Claudia, Promontorio, Montoros, and Martha projects to Silverstone Corp. (Silverstone). Capstone and Silverstone completed 21,641 m of drilling in 200 holes from 2005 to 2008.

Silverstone merged with Silver Wheaton Ltd. (Silver Wheaton) in 2009, and Silver Wheaton subsequently sold the shares of concession owner Silverstone to Mexican owners. The Silverstone owners mined out a portion of the Mineral Resource defined in 2008 over the next decade. Silverstone mined parts of the Clemens, El Muerto, La Pipa, Mariposa, El 40, and San Martin ore shoots until mining encountered the water table, preventing further mining. Silverstone or unauthorized mining activity in the intervening years exploited most of the Mineral Resources estimated by Christopher and Sim (2008).

MRP contracted Geophysical Surveys S.A. de C.V. of Mexico City in 2016 to conduct an airborne magnetics survey. However, no data are available, and no survey or flight specifications are included in the report. The survey was flown in two blocks.

Since acquiring the Property in November 2019, Vizsla has conducted a number of significant drill campaigns in the Napoleon, Copala-Tajitos, Animas and San Antonio areas. Up to September 2023 (data cut-off date for the current MRE), Vizsla has completed 822 surface diamond drill holes totalling 302,931 m and collected 47,694 assay intervals representing 55,368 m of drilling. Vizsla has continued to drill at the Project since the data cut off for the Mineral Resource estimate of September 1, 2023.

In November 2019, Vizsla began drilling on the Panuco Project on the Animas-Refugio corridor near the La Pipa and Mariposa mine areas. A total of 820.50 m in three drill holes was completed in 2019. The three drill holes targeted the La Pipa structure to test below the old historic ore shoot. Results showed low-grade and narrow widths, and no further test work was carried out.

Drill holes AMS-19-01A and AMS-19-02 were drilled to test the downdip extension of the La Pipa ore shoot that has seen extensive mining. The first hole intersected historic workings and a footwall vein over 5.5 m at 135.0 m downhole. Deeper in the hole a 2.0 m wide quartz-amethyst vein was intersected at 241.5 m downhole. The second hole was completed 77 m down dip on the same section and intersected a shallow hanging wall vein with 3 m grading 125.3 g/t Ag and 0.59 g/t Au and a zone of low-grade veinlets in the projection of the Animas Vein.

Drilling for 2020 totaled 28,643.42 m in 129 drill holes. The four main corridors of Napoleon, Cinco Senores, Cordon del Oro, and Animas-Refugio were tested.

In January 2020, drilling resumed at the Mariposa mine area, another historically mined area. Other targets in the Animas-Refugio corridor included, from south to north, Mojocuan, San Carlos, Paloma, and Honduras veins.

Drilling at the Napoleon corridor began in June 2020. A total of 64 drill holes tested the Napoleon structure, for 12,546.02 m. Targets were in the central part of the north-south-trending structure, below old mine workings, and 650 m north in the Papayo area.

At the Cordon del Oro corridor, drilling totalled 6,432.05 m in 28 drill holes. The drilling targeted the Mojocuan, San Carlos, and Peralta mine areas, in addition to the Aguita Zarca vein.

Cinco Senores corridor saw 2,927.10 m of drilling in 14 drill holes. The Tajitos vein was the drilling target, and previously unknown workings were encountered in the first four holes.

Drilling at the Panuco Project in 2021 totalled 100,242.55 m in 318 drill holes. The drilling focussed along the Napoleon and Tajitos vein areas, with 54,759.15 m in 180 drill holes and 34,769.35 m in 102 drill holes, respectively (Table 10-1). Additionally, 4,438.50 m in 14 drill holes were drilled in the Animas-Refugio corridor, and 6,275.55 m in 22 drill holes in the Cordon del Oro corridor. Highlights of the 2021 drilling are presented below.

At Napoleon, infill and delineation drilling focussed on denser drilling to inform the Mineral Resource estimate and expand the structure's strike length. The Josephine vein, a subparallel system to Napoleon which was identified initially as an electromagnetic geophysical target, was first intersected in Hole NP-21-132, leading to additional targeting in the area and its inclusion in the Mineral Resource estimate. Further drill testing included the Cruz Negra and Alacran vein areas.

Drilling at the Tajitos vein area focussed on delineation and infilling, with additional exploration drilling to the north. The Tajitos resource drilling led to the discovery of the Copala vein -- a relatively thick sub horizontal structure on the Tajitos northeastern extent. Other exploration drilling along the Cinco Senores corridor included the Cinco Senores and Colorada veins to the north of Tajitos.

In the Animas-Refugio corridor, drilling tested the Rosarito segment included in the Mineral Resource estimate, in addition to the Peralta and Cuevillas veins.

Drilling at the Cordon del Oro corridor targeted the San Antonio structure included in the Mineral Resource estimate, in addition to exploration near the Aguita Zarca vein.

Drilling for 2022 totalled 113,487 m in 271 drill holes. The four main corridors of Napoleon, Cinco Senores, Cordon del Oro, and Animas-Refugio were tested.

Drilling at the Napoleon corridor included 106 drill holes tested the Napoleon structure, for 52,306.40 m. At the Cordon del Oro corridor, drilling totalled 4,251.8 m in 19 drill holes. Drilling at the Copala/Tajitos veins included 135 drill holes for 52,045.10 m. Additionally, 4,883.70 m in 11 drill holes were drilled in the Animas-Refugio corridor.

The bulk of 2022 drilling was centred on the western portion of the district, focused on upgrading and expanding resources at the Copala and Napoleon areas. At Copala, mineralization has now been traced over 1,150 meters along strike, 400 m down dip, and remains open to the north and southeast.

At Napoleon, drilling throughout 2022 successfully expanded mineralization along strike and down plunge to the south, several vein splays were identified in the hanging wall and footwall of the main structure.

Other notable discoveries include the Cristiano Vein; marked by high precious metal grades up to 1,935 g/t Ag and 15.47 g/t Au over 1.46 m, located immediately adjacent to Copala; and La Luisa Vein, located ~700 m west of Napoleon which continues to display similar silver and gold zonation as that seen at Napoleon.

Drilling for 2023 (to September) totalled 60,432.95 m in 103 drill holes. The main Napoleon and Cinco Senores corridors were tested.

Drilling at the Napoleon corridor included 44 drill holes testing the Napoleon structure, for 25,298.30 m. Drilling at the Copala/Tajitos veins included 59 drill holes for 35,134.65 m.

The 2023 drilling was centred on the western portion of the district, focused on upgrading and expanding resources at the Copala and Napoleon areas. At Copala, mineralization has now been traced over 1,700 m along strike and to depths of 450 to 550 m and remains open to the north and southeast.

At Napoleon, drilling throughout 2023 successfully expanded mineralization along strike and down plunge/dip to the south, several vein splays were identified in the hanging wall and footwall of the main structure.

1.2 Geology and Mineralization

The Project is on the western margin of the Sierra Madre Occidental (SMO), a high plateau and physiographic province that extends from the U.S.A.-Mexico border to the east-trending Trans-Mexican Volcanic Belt. The SMO is a Large Igneous Province (LIP) recording continental magmatic activity from the Late Cretaceous to the Miocene in three main episodes. The first episode, termed the Lower Volcanic Complex (LVC), comprises a suite of intrusive bodies, including the Sonora, Sinaloa, and Jalisco batholiths and andesitic volcanic rock units with minor dacite and rhyolite tuffs and ignimbrites that are correlative with the Tarahumara Formation in Sonora of Late Cretaceous to Eocene age. The second magmatic episode is dominated by rhyolitic ignimbrites and tuffs that built one of the earth's largest silicic volcanic provinces and has been termed the Upper Volcanic Supergroup (UVS). These dominantly rhyolitic units were extruded in two episodes, from about 32 to 28 Ma and 24 to 20 Ma. These two periods of magmatic activity are associated with the subduction of the Farallon plate under North America and the Laramide orogeny that occurred between the Upper Cretaceous - Paleocene and the Eocene. The third episode comprises post-subduction alkali basalts and ignimbrites associated with the opening of the Gulf of California between the late Miocene and Pleistocene - Quaternary.

The western part of the SMO in Sonora and Sinaloa is cut by north-northwest-trending normal fault systems developed during the opening of the Gulf of California between 27 and 15 Ma. The normal fault systems favoured the formation of elongated basins that were subsequently filled with continental sedimentary rocks. The basins occur in a north-northwest-trending belt extending from western Sonora to most of Sinaloa.

The basement to the SMO is locally exposed in northern Sinaloa, near Mazatlan and on small outcrops within the project area. It comprises folded metasedimentary and metavolcanic rocks, deformed granitoids, phyllitic sandstones, quartzites, and schists of the Tahue terrane of Jurassic to Early Cretaceous age (Montoya-Lopera et al., 2019, Sedlock et al., 1993 and Campa and Coney 1982).

In the broader Project area, the LVC comprises granite, granodiorite, and diorite intrusive phases correlative with the Late Cretaceous to Early Paleocene San Ignacio and Eocene Piaxtla batholiths in San Dimas district. The andesite lavas, rhyolite-dacite tuffs, and ignimbrites are locally intruded by the Late Cretaceous to Early Paleocene intrusive phases and younger Eocene-Oligocene felsic dikes and domes. Northwest trending intermontane basins filled with continental conglomerates and sandstones incise the UVS and LVC in the Project area. The Oligocene age ignimbrites of the UVS occur east of the property towards Durango state.

The structure of the Project area is dominated by north-northwest-trending extensional and transtensional faults developed or reactivated during the Basin and Range tectonic event (~28 to 18 Ma). The extensional belt is associated with aligned rhyolite domes and dikes and Late Oligocene to Middle Miocene grabens.

Mineralization on the Panuco Property comprises several epithermal quartz veins. Previous workers and recent mapping and prospecting works conducted by Vizsla's geologists determined a cumulate length of veins traces of 86 km. Individual vein corridors are up to 7.6 km long, and individual veins range from decimetres to greater than 10 m wide. Veins have narrow envelopes of silicification, and local argillic alteration, commonly marked by clay gouge. Propylitic alteration consisting of chlorite-epidote in patches and veins affecting the andesites and diorite are common either proximal or distal to the veins.

The primary mineralization along the vein corridors comprises hydrothermal quartz veins and breccias with evidence of four to five different quartz stages: generally white, grey, and translucent and varying grain size from amorphous-microcrystalline-coarse. A late stage of amethyst quartz is also observed in some veins. The grey colour in quartz is due to the presence of fine-grained disseminated sulphides, believed to be mainly pyrite and acanthite. Vizsla Silver has delineated several hydrothermal breccias with grey quartz occurring more commonly at lower levels of the vein structures. Barren to low grade, quartz is typically white and is more common in the upper parts of the veins and breccias. Locally, mineralized structures are cut by narrow, banded quartz veins with thin, dark argentite/acanthite, sphalerite, galena, and pyrite bands. Bladed and lattice quartz pseudomorphs after calcite have been noted at several locations within the veins and indicate boiling conditions during mineral deposition. Later quartz veinlets cut all the mineralized zones with a mix of white quartz and purple amethyst. The amethyst is related to mixing near-surface waters as the hydrothermal system is collapsing, as has been noted in the nearby San Dimas district (Montoya-Lopera et al., 2019).

The Mineral Resource includes ten mineralized vein systems: the Napoleon, Napoleon hanging wall, Josephine, and Cruz Negra veins; the Copala, Cristiano, Tajitos and Copala 2 veins; the San Antonio vein; and the Rosarito vein. These trends are west to east within the Napoleon, Cinco Senores, Cordon del Oro, and Animas-Refugio corridors. The bulk of the resource veins strike north-northwest to north-northeast, with thicknesses varying from 1.5 m to over 10 m.

1.3 Mineral Processing, Metallurgical Testing and Recovery Methods

Preliminary metallurgical test programs have been completed on each of the 3 main deposits that form the Panuco resource. All test programs were conducted at ALS Metallurgy in Kamloops, BC, Canada.

The Napoleon test program was conducted in 2021 on samples obtained from 7 drill holes in the 2020 and 2021 drill programs. The selected intervals ranged from depths of 46 to 201 meters down the drill holes.

The Tajitos test program was conducted in 2022 on samples from 22 drill holes in the 2020 and 2021 drill programs. The selected intervals ranged from depths of 51 to 345 meters down the drill holes.

The Copala test program was conducted in 2023 on samples from 8 drill holes in the 2022 drill program. The selected intervals ranged from depths of 111 to 385 meters down the drill holes.

The sample selections covered a range of identified lithologies. Master composites were assembled to obtain feed grades that were similar to the expected average resource grades, variability composites were assembled to cover ranges of grades and lithologies. The majority of the testing was completed on the master composites of each deposit.

Comminution testing was completed which suggested that the materials were somewhat hard with respect to both impact and attrition breakage. Drop Weight tests (SMC) were only conducted on the Copala samples and returned an average Axb value of 33. Bond ball mill tests conducted on samples from all three deposits measured ball mill work index (BMWi) values ranging from 16.4 to 18.9 kWhr/tonne.

Mineralogical assessments on the feed samples using QEMSCAN indicated that the host rock was primarily quartz and feldspars. Quartz contents ranged from 55 to 86%. The samples contained generally low levels of sulphide minerals, with pyrite as the most abundant sulphide mineral. The Napoleon samples contained elevated levels of galena and sphalerite, these base metal mineral contents were generally quite low in the Tajitos and Copala samples. Analyses on the Tajitos and Copala samples indicated that silver was mostly present in the form of a silver sulphide mineral acanthite, although small amounts were present in silver-copper sulphides. Detailed analyses on the Copala samples indicated a significant portion of the silver bearing sulphide minerals were quite fine grained and poorly liberated, suggesting that somewhat fine primary grind sizes may be required to achieve high silver recoveries.

Froth flotation tests were conducted on all samples, investigating the potential to sequentially float lead and zinc, as well as simply recovering a bulk sulphide concentrate. Open circuit cleaner testing on the Napoleon master composite demonstrated that production of lead and zinc concentrates that meet typical marketing grade targets would be possible using typical processing conditions. In this flowsheet, about 70 and 80 percent of the silver and gold, respectively, would report to the lead concentrate. The zinc concentrates contained approximately 0.4% cadmium, which may be of concern for marketing, otherwise no other deleterious elements were measured at penalty levels.

Lead-zinc sequential flotation was only investigated in rougher flotation protocols on the Tajitos and Copala samples, distributions of silver and gold to the rougher concentrates were similar to the Napoleon material. Bulk sulphide flotation on all three deposits indicated that bulk sulphide concentrates containing 50-60 g/t gold could be generated on each material, silver concentrations ranged from 1500 to over 8000 g/t depending on the sulphide mineral contents in the feed. In general, about 80-90% of the silver and gold reported to bulk rougher concentrates at the primary grind sizes tested, recoveries to cleaner concentrates were not confirmed as tests were only conducted in open circuit.

Cyanide leaching of the rougher flotation tails was investigated on the Tajitos and Copala samples. Approximately 60-70% of the silver and 80-85% of the gold remaining in the rougher tails could be extracted in tests conducted over 48 and 72 hours. Leaching of rougher flotation concentrates was investigated on all deposits, but most extensively on the Copala samples. Silver extractions ranged from 85 to 98% and gold extractions ranged from 93 to 97% after 48 hours of leaching the concentrates, depending on the level of regrinding applied.

Whole feed leaching was investigated on samples from all deposits, which indicated that about 83-86% of the silver and 90-94% of the gold could be extracted after 96 hours of leaching. These tests were conducted at primary grind sizes ranging from 63 to 100µm P80.

1.4 Mineral Resource Estimate

Completion of the updated MREs for the Napoleon-Luisa and Copala-Tajitos deposit areas involved the assessment of an updated drill hole database, which included all data for surface drilling completed between November 2019 and September 2023. The MREs for the Animas and San Antonio deposit areas included data for surface drilling completed between November 2019 and September 2022; there has been no new drilling on the Animas and San Antonio deposit areas and these MREs previously published are considered current. Completion of the MREs also included the assessment of updated three-dimensional (3D) mineral resource models (resource domains), 3D topographic surface models, 3D models of historical underground workings, and available written reports.

The Inverse Distance Squared ("ID2") calculation method restricted to mineralized domains was used to interpolate grades for Ag (g/t), Au (g/t), Pb (ppm) and Zn (ppm) into block models for all deposit areas.

Indicated and Inferred mineral resources are reported in the summary tables in Section 14.11. The MREs presented below take into consideration that all deposits on the Property may be mined by underground mining methods.

The reporting of the updated MRE complies with all disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects. The classification of the updated MRE is consistent with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards (2014 CIM Definitions) and adheres as best as possible to the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (2019 CIM Guidelines).

The updated MRE for the Project is presented in Table 1-1 and Table 1-2.

Highlights of the Project Mineral Resource Estimate are as follows:

-

Indicated Mineral Resources are estimated at 9.48 Mt grading 289 g/t silver, 2.41 g/t gold, 0.27% lead, and 0.84% zinc (511 AgEq). The current MRE includes indicated mineral resources of 88.2 Moz of silver, 736 koz of gold, 56 Mlbs of lead, and 176 Mlbs of zinc (155.8 Moz AgEq).

-

Inferred Mineral Resources are estimated at 12.19 Mt grading 239 g/t silver, 1.93 g/t gold, 0.29% lead, and 1.03% zinc (433 g/t AgEq). The current MRE includes inferred mineral resources of 93.7 Moz of silver, 758 koz of gold, 78 Mlbs of lead, and 276 Mlbs of zinc (169.6 Moz AgEq).

Table 1-1 Panuco Project Mineral Resource Estimate, September 1, 2023

| Resource Class |

Tonnes

(MT) |

Grade |

Total Metal |

| Au g/t |

Ag g/t |

Pb % |

Zn % |

AgEq

(g/t) |

Au

(koz) |

Ag

(koz) |

Pb

(Mlbs) |

Zn

(Mlbs) |

AgEq*

(koz) |

| Indicated |

9.48 |

2.41 |

289 |

0.27 |

0.84 |

511 |

736 |

88,192 |

56.0 |

176.1 |

155,841 |

| Inferred |

12.19 |

1.93 |

239 |

0.29 |

1.03 |

433 |

758 |

93,653 |

78.1 |

276.2 |

169,647 |

* AgEq = Ag ppm + (((Au ppm x Au price/gram) + (Pb% x Pb price/t) + (Zn% x Zn price/t))/Ag price/gram) with price assumptions of $24.00/oz Ag, $1800/oz Au, $1.10/lb Pb and $1.35/lb Zn

Table 1-2 Panuco Project Mineral Resource Estimate by Area, September 1, 2023

Copala Area: Copala, Tajitos and Cristiano

| Area |

Resource

Class |

Tonnes

(MT) |

Grade |

Total Metal |

| Au g/t |

Ag g/t |

Pb % |

Zn % |

AgEq

(g/t) |

Au

(koz) |

Ag (koz) |

Pb

(Mlbs) |

Zn

(Mlbs) |

AgEq

(koz) |

| Copala |

Indicated |

4.52 |

2.46 |

380 |

0.08 |

0.15 |

573 |

358 |

55,201 |

8.2 |

15.3 |

83,270 |

| Inferred |

3.16 |

1.77 |

332 |

0.12 |

0.20 |

476 |

179 |

33,722 |

8.2 |

13.6 |

48,320 |

| Tajitos |

Indicated |

0.63 |

2.24 |

358 |

0.12 |

0.21 |

538 |

46 |

7,295 |

1.6 |

2.9 |

10,953 |

| Inferred |

1.04 |

2.04 |

365 |

0.22 |

0.39 |

540 |

69 |

12,260 |

5.2 |

8.9 |

18,140 |

| Cristiano |

Indicated |

0.21 |

3.37 |

581 |

0.25 |

0.43 |

858 |

23 |

3,961 |

1.1 |

2.0 |

5,851 |

| Inferred |

0.72 |

2.54 |

443 |

0.15 |

0.29 |

650 |

59 |

10,213 |

2.4 |

4.5 |

14,974 |

| Total |

Indicated |

5.37 |

2.48 |

385 |

0.09 |

0.17 |

580 |

427 |

66,457 |

11 |

20 |

100,074 |

| Inferred |

4.92 |

1.94 |

355 |

0.15 |

0.25 |

515 |

307 |

56,195 |

16 |

27 |

81,434 |

Napoleon Area: Napoleon, Cruz, Josephine and Luisa

| Area |

Resource

Class |

Tonnes

(MT) |

Grade |

Total Metal |

| Au g/t |

Ag g/t |

Pb % |

Zn % |

AgEq

(g/t) |

Au

(koz) |

Ag

(koz) |

Pb

(Mlbs) |

Zn

(Mlbs) |

AgEq

(koz) |

| Luisa |

Indicated |

0.27 |

2.56 |

177 |

0.39 |

2.01 |

459 |

22 |

1,556 |

2.3 |

12.1 |

4,027 |

| Inferred |

2.04 |

2.13 |

159 |

0.30 |

1.51 |

386 |

139 |

10,439 |

13.3 |

67.9 |

25,326 |

| Cruz/Negra |

Indicated |

0.03 |

2.01 |

144 |

0.37 |

1.71 |

373 |

2 |

153 |

0.3 |

1.2 |

396 |

| Inferred |

0.31 |

3.75 |

170 |

0.31 |

1.48 |

519 |

37 |

1,698 |

2.1 |

10.1 |

5,169 |

| Josephine |

Indicated |

0.07 |

2.88 |

221 |

0.39 |

1.11 |

492 |

6 |

491 |

0.6 |

1.7 |

1,092 |

| Inferred |

0.22 |

2.05 |

161 |

0.33 |

1.00 |

364 |

15 |

1,161 |

1.6 |

4.9 |

2,618 |

| Napoleon_HW(4) |

Indicated |

0.43 |

1.72 |

164 |

0.42 |

1.53 |

365 |

24 |

2,259 |

4.0 |

14.4 |

5,029 |

| Inferred |

0.85 |

2.17 |

220 |

0.59 |

2.02 |

479 |

59 |

5,976 |

10.9 |

37.6 |

13,027 |

Napoleon+

Splays |

Indicated |

3.31 |

2.39 |

162 |

0.52 |

1.73 |

425 |

255 |

17,276 |

37.8 |

126.5 |

45,223 |

| Inferred |

3.18 |

1.64 |

137 |

0.45 |

1.76 |

342 |

168 |

14,045 |

31.8 |

123.2 |

35,063 |

| Total |

Indicated |

4.12 |

2.34 |

164 |

0.50 |

1.72 |

421 |

309 |

21,735 |

45 |

156 |

55,767 |

| Inferred |

6.60 |

1.97 |

157 |

0.41 |

1.68 |

383 |

418 |

33,319 |

60 |

244 |

81,203 |

San Antonio Area: Generales and Animas Area: Cuevillas and Rosarito

| Area |

Resource

Class |

Tonnes

(MT) |

Grade |

Total Metal |

| Au g/t |

Ag g/t |

Pb % |

Zn % |

AgEq

(g/t) |

Au

(koz) |

Ag

(koz) |

Pb

(Mlbs) |

Zn

(Mlbs) |

AgEq

(koz) |

| San Antonio |

Inferred |

0.28 |

1.30 |

226 |

0.01 |

0.03 |

325 |

12 |

2,038 |

0.1 |

0.2 |

2,936 |

| Animas |

Inferred |

0.39 |

1.68 |

169 |

0.29 |

0.60 |

327 |

21 |

2,101 |

2.5 |

5.2 |

4,074 |

1.4.1 Panuco Project Updated Mineral Resource Estimate Notes:

- The classification of the Updated Mineral Resource Estimate into indicated and inferred mineral resources is consistent with current 2014 CIM Definition Standards for Mineral Resources and Mineral Reserves. The effective date for the Updated Mineral Resource Estimate is September 1, 2023.

-

All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

-

All mineral resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

-

Mineral resources are not mineral reserves. Mineral resources which are not mineral reserves, do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

-

The database comprises a total of 822 drill holes for 302,931 m of drilling completed by Vizsla Silver between November 2019 and September 2023.

-

The mineral resource estimate is based on 28 three-dimensional ("3D") resource models, constructed in Leapfrog, representing the Napoleon area (15 wireframes), the Copala area (7 wireframes), Tajitos (1 wireframe), Animas (5 wireframes) and San Antonio (1 wireframe).

-

Silver, gold, lead, and zinc were estimated for each mineralization domain in the Panuco Project. Blocks within each mineralized domain were interpolated using 1.5 m capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains. All estimates are based on variable block dimensions (by deposit area) and estimation search parameters (by domain).

-

Average density values were assigned per zone based on 1,919 samples analysed by ALS in Zacatecas, Mexico or inhouse with 5% checks by ALS.

-

It is envisioned that the Panuco Project deposits may be mined using underground mining methods. Mineral resources are reported at a base case cut-off grade of 150 g/t AgEq. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface and within the constraining mineralized wireframes.

-

The base-case AgEq Cut-off grade considers metal prices of $24.00/oz Ag, $1800/oz Au, $1.10/lb Pb and $1.35/lb Zn and considers metal recoveries of 93% for silver, 90% for gold, 94% for Pb and 94% for Zn.

-

The base case cut-off grade of 150 g/t AgEq considers a mining cost of US$45.00/t rock and processing, treatment and refining, transportation, and G&A cost of US$50.00/t of mineralized material.

-

The Updated Mineral Resource Estimate may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

1.5 Recommendations

The Deposits of the Panuco Project contain underground Indicated and Inferred Mineral Resources that are associated with well-defined mineralized trends and models. All deposits are open along strike and at depth.

Armitage considers that the Project has potential for delineation of additional Mineral Resources and that further exploration is warranted. Given the prospective nature of the Panuco Property, it is the opinion of Armitage that the Property merits further exploration and that a proposed plan for further work by Vizsla is justified.

Armitage is recommending Vizsla conduct further exploration, subject to funding and any other matters which may cause the proposed exploration program to be altered in the normal course of its business activities or alterations which may affect the program as a result of exploration activities themselves.

For 2024, the company plans to drill ~65,000 m on current resource areas, priority targets proximal to current resources in the west, as well as on other high-priority targets in the eastern portion of the district.

Resource Extension Targets

-

The Copala structure remains open along strike to the north and down dip to the south. In 2024, Vizsla plans to continue 1) upgrading inferred resources in south Copala and 2) continue expanding Copala and its footwall splays down dip.

-

At Napoleon, Vizsla plans to upgrade inferred resources and to conduct resource expansion drilling along the hanging wall-4 vein (HW4) to the east, as well as to explore three potential vein feeders along the main Napoleon structure at depth.

Proximal Targets

-

At La Luisa, the team plans to continue expanding the footprint of the high-grade shoot on the south and infill drilling the recently defined 400 m gap between the northern most drill-hole intercepts and the high-grade shoot on the south.

-

The EL Molino Vein reported significant silver and gold grades close to surface, and Vizsla plans to explore the vein along strike and at depth to add additional high-grade resources close to planned infrastructure in 2024.

-

Vizsla plans to drill-test a conceptual target at the projected northern intersection of the Copala fault with the Napoleon vein system near La Estrella area.

District Targets

New mapping efforts completed in 2023 have highlighted an abundance of historic workings in the northeastern portion of the district. This new area named "Camelia" is marked by serval high-grade surface samples grading up to 400 g/t Ag and 5.0 g/t Au. Given, the overall density of veins mapped on surface and the abundance of surface samples related to historic workings this has become a high priority district target in the east.

Bulk Sample / Test Mine

Vizsla has received permits to develop and operate a test mine program at its Panuco project to extract a combined 25,000 tonne bulk sample from the Copala and Napoleon structures. Initial engineering for the bulk sample test mine has already begun with plans to begin underground development in early 2024.

Key objectives for 2024:

-

Deliver an updated MRE for the project in January 2024

-

Deliver maiden PEA in H1 2024

-

Complete updated metallurgical testing in H2 2024

-

Advance Bulk Sample / Test Mine program

-

Complete +65,000 meters of resource/discovery focused drilling

-

Complete a ~1,100 line-kilometre EM survey and acquire high-resolution multispectral satellite imagery for the whole district.

The total cost of the planned work program by Vizsla is estimated at ~CAD$25.0 million.

2 INTRODUCTION

SGS Geological Services Inc. ("SGS") was contracted by Vizsla Silver Corp., ("Vizsla" or the "Company") to complete an updated Mineral Resource Estimate ("MRE") for the Panuco Ag-Au Project ("Panuco" or "Project") in Sinaloa, Mexico, and to prepare a National Instrument 43-101 ("NI 43-101") Technical Report written in support of the updated MRE. The Project is considered an advanced-stage exploration project.

Vizsla Silver Corp. was incorporated as Vizsla Capital Corp. under the Business Corporations Act (British Columbia) on September 26, 2017. On March 8, 2018, the Company changed its name to Vizsla Resources Corp. On February 5, 2021, the Company changed its name to Vizsla Silver Corp. The Company's principal business activity is the exploration of mineral properties. The Company currently conducts its operations in Mexico and Canada. It is trading on the TSX Venture Exchange ("TSXV") under the symbol VZLA.

On January 21, 2022, Vizsla Silver Corp was listed on the NYSE American exchange and commenced trading under the symbol "VZLA".

The head office and principal address of the Company is located at #1723-595 Burrard St., Vancouver, B.C. V7X 1J1.

The current report is authored by Allan Armitage, Ph.D., P. Geo., ("Armitage") and Ben Eggers, MAIG, P.Geo. ("Eggers") of SGS (collectively, the "Authors"). The Authors are independent Qualified Persons as defined by NI 43-101 and are responsible for all sections of this report. The updated MRE presented in this report was estimated by Armitage.

The reporting of the updated MRE complies with all disclosure requirements for Mineral Resources set out in the NI 43-101 Standards of Disclosure for Mineral Projects. The classification of the updated MRE is consistent with the 2014 Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards (2014 CIM Definitions) and adhere to the 2019 CIM Estimation of Mineral Resources & Mineral Reserves Best Practice Guidelines (2019 CIM Guidelines).

The current Technical Report will be used by Vizsla in fulfillment of their continuing disclosure requirements under Canadian securities laws, including National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"). This Technical Report is written in support of an updated MRE completed for Vizsla.

2.1 Sources of Information

In preparing the current updated MRE and the current technical report, the Authors utilized a digital database, provided to the Authors by Vizsla, and technical reports provided by Vizsla. All background information regarding the Property has been sourced from previous technical reports and revised or updated as required.

-

The Property was the subject of a NI 43-101 technical report by Allan Armitage, Ben Eggers and Yann Camus of SGS in 2023 titled "Mineral Resource Estimate Update for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico" for Vizsla Silver Corp. Dated: March 10, 2023, and with an Effective Date: January 19, 2023. (Posted on SEDAR+ under Vizsla's profile).

-

The Property was the subject of a NI 43-101 technical report by Tim Maunula, P.Geo. and Kevin Murray, P.Eng. in 2022 titled "National Instrument 43-101 Technical Report for the Panuco Project Mineral Resource Estimate, Concordia, Sinaloa, Mexico" for Vizsla Silver Corp. Dated: April 7, 2022 and with an Effective Date: March 1, 2022. (Posted on SEDAR+ under Vizsla's profile).

-

The Property was the subject of a NI 43-101 technical report by Stewart Harris, P.Geo. in 2020 titled "Technical Report On The Panuco Silver-Gold Project Concordia, Sinaloa, Mexico" Vizsla Resources Corp. Dated: June 15, 2020, with an Amended Effective Date: June 15, 2020. (Posted on SEDAR+ under Vizsla's profile).

- The Property was the subject of a NI 43-101 technical report by M. Robinson, M.A.Sc., P.Eng. in 2019 titled "Technical Report On The Panuco-Copala Project Concordia, Sinaloa, Mexico" Vizsla Resources Corp. Dated: November 6, 2019, with an Effective Date: October 22, 2019. (Posted on SEDAR+ under Vizsla's profile).

Information regarding the Property accessibility, climate, local resources, infrastructure, and physiography, exploration history, previous mineral resource estimates, regional property geology, deposit type, recent exploration and drilling, metallurgical test work, and sample preparation, analyses, and security for previous drill programs (Sections 5-13) have been sourced from the recent internal technical reports and updated where required. The Authors believe the information used to prepare the current Technical Report is valid and appropriate considering the status of the Project and the purpose of the Technical Report.

2.2 Site Visit

2.2.1 2023 Site Visits

Armitage conducted a site visit to the Project on May 29, 2023, accompanied by Martin Dupuis, COO, Jesus Velador, VP of Exploration and Steve Mancell, Director of Mineral Resources, of Vizsla Silver. During the site visit, Armitage inspected the core logging and core sampling facilities and core storage areas in the City of Concordia. The following facilities were inspected:

-

Office Area

-

Area used for the geologists to log core.

-

Area used to make pictures of the core with controlled light (core both wet and dry)

-

Area used to measure density (by drying, measuring unwaxed weight, waxed weight and weight in water)

-

Area for cutting the core.

-

Area for sampling the core.

-

Area to update geological sections on paper.

-

Core storage area

During the site visit Armitage examined several selected mineralized core intervals from recently completed (2019-2022) diamond drill holes from the Property. Armitage examined accompanying drill logs and assay certificates and assays were examined against the drill core mineralized zones. The author reviewed current core sampling, QA/QC and core security procedures. Core boxes for drill holes reviewed are properly stored in the warehouse, easily accessible and well labelled. Sample tags are present in the boxes, and it was possible to validate sample numbers and confirm the presence of mineralization in witness half-core samples from the mineralized zones.

As drilling and core logging was in progress during the time of the site visit, Armitage had the opportunity to review and discuss the entire path of the drill core, from the drill rig to the logging and sampling facility and finally to the laboratory. Armitage is of the opinion that current protocols in place, as have been described and documented by Vizsla, is adequate.

The Author participated in a field tour of the Property area including visits to several outcrops to review the local Geology, the drill, and recent drill sites. All areas were easily accessible by road.

Armitage conducted a second site visit to the Project on November 6 to November 8, 2023, accompanied by Henri Gouin, Mining Engineer with SGS, and Martin Dupuis, Fernando Martínez, Director of Projects, Hernando Rueda, Country Manager and Steve Mancell, of Vizsla Silver. During the second site visit, Armitage again inspected the core logging and core sampling facilities and core storage areas in the City of Concordia.

Armitage examined several selected mineralized core intervals from recently completed (2023) diamond drill holes from the Property. Armitage examined accompanying drill logs and assay certificates and assays were examined against the drill core mineralized zones. The author reviewed current core sampling, QA/QC and core security procedures. Core boxes for drill holes reviewed are properly stored in the warehouse, easily accessible and well labelled. Sample tags are present in the boxes, and it was possible to validate sample numbers and confirm the presence of mineralization in witness half-core samples from the mineralized zones.

As drilling and core logging was in progress during the time of the second site visit, Armitage had the opportunity to review and discuss the entire path of the drill core, from the drill rig to the logging and sampling facility and finally to the laboratory. Armitage is of the opinion that current protocols in place, as have been described and documented by Vizsla, is adequate.

The Author participated in a field tour of the Property area including visits to several outcrops to review the local Geology, the drill, and recent (2023) drill sites.

As a result of the two site visits, Armitage was able to become familiar with conditions on the Property. Armitage was able to observe and gain an understanding of the geology and various styles mineralization, which helped guide the current mineral resource modeling, was able to verify the work done and, on that basis, can review and recommend to Vizsla an appropriate exploration program.

Armitage considers the site visit completed in November 2023 as current, per Section 6.2 of NI 43-101CP. To the Authors knowledge there is no new material scientific or technical information about the Property since that personal inspection. The technical report contains all material information about the Property.

2.3 Units of Measure

Units used in the report are metric units unless otherwise noted. Monetary units are in United States dollars (US$) unless otherwise stated.

2.4 Effective Date

The Effective Date of the current MRE is September 1, 2023.

2.5 Units and Abbreviations

All units of measurement used in this technical report are in metric. All currency is in US dollars (US$), unless otherwise noted.

Table 2-1 List of Abbreviations

| $ |

Dollar sign |

m2 |

Square metres |

| % |

Percent sign |

m3 |

Cubic meters |

| ° |

Degree |

masl |

Metres above sea level |

| °C |

Degree Celsius |

mm |

millimetre |

| °F |

Degree Fahrenheit |

mm2 |

square millimetre |

| µm |

micron |

mm3 |

cubic millimetre |

| AA |

Atomic absorption |

Moz |

Million troy ounces |

| Ag |

Silver |

MRE |

Mineral Resource Estimate |

| AgEq |

Silver equivalent |

Mt |

Million tonnes |

| Au |

Gold |

NAD 83 |

North American Datum of 1983 |

| Az |

Azimuth |

mTW |

metres true width |

| CAD$ |

Canadian dollar |

NI |

National Instrument |

| CAF |

Cut and fill mining |

NN |

Nearest Neighbor |

| cm |

centimetre |

NQ |

Drill core size (4.8 cm in diameter) |

| cm2 |

square centimetre |

NSR |

Net smelter return |

| cm3 |

cubic centimetre |

oz |

Ounce |

| Cu |

Copper |

OK |

Ordinary kriging |

| DDH |

Diamond drill hole |

Pb |

Lead |

| ft |

Feet |

ppb |

Parts per billion |

| ft2 |

Square feet |

ppm |

Parts per million |

| ft3 |

Cubic feet |

QA |

Quality Assurance |

| g |

Grams |

QC |

Quality Control |

| GEMS |

Geovia GEMS 6.8.3 Desktop |

QP |

Qualified Person |

| g/t or gpt |

Grams per Tonne |

RC |

Reverse circulation drilling |

| GPS |

Global Positioning System |

RQD |

Rock quality designation |

| Ha |

Hectares |

SD |

Standard Deviation |

| HQ |

Drill core size (6.3 cm in diameter) |

SG |

Specific Gravity |

| ICP |

Induced coupled plasma |

SLS |

Sub-level stoping |

| ID2 |

Inverse distance weighting to the power of two |

t.oz |

Troy ounce (31.1035 grams) |

| ID3 |

Inverse distance weighting to the power of three |

Ton |

Short Ton |

| kg |

Kilograms |

Zn |

Zinc |

| km |

Kilometres |

Tonnes or T |

Metric tonnes |

| km2 |

Square kilometre |

TPM |

Total Platinum Minerals |

| kt |

Kilo tonnes |

US$ |

US Dollar |

| m |

Metres |

μm |

Micron |

| |

|

UTM |

Universal Transverse Mercator |

3 RELIANCE ON OTHER EXPERTS

Final verification of information concerning Property status and ownership, which are presented in Section 4 below, have been provided to the Author by Steve Mancell for Vizsla, by way of E-mail on January 16 and 17, 2024. The Author only reviewed the land tenure in a preliminary fashion and has not independently verified the legal status or ownership of the Property or any underlying agreements or obligations attached to ownership of the Property. However, the Author has no reason to doubt that the title situation is other than what is presented in this technical report (Section 4). The Author is not qualified to express any legal opinion with respect to Property titles or current ownership.

4 PROPERTY DESCRIPTION AND LOCATION

4.1 Location

The Panuco Project is in the Panuco-Copala mining district in the municipality of Concordia, southern Sinaloa state, along the western margin of the Sierra Madre Occidental physiographic province in western Mexico. The Project is centred at 23⁰ 25' north latitude and 105⁰ 56' west longitude on map sheets F13A-37. The Project location is shown in Figure 4-1.

4.2 Land Tenure and Mining Concessions

The Project comprises 117 approved mining concessions in nineteen blocks, covering a total area of 5,869.87 ha, and two mineral concessions covering 1,321.15 ha. The mineral concessions are held 100% by Vizsla Silver. The mineral concessions are presented in Figure 4-2 and Table 4-1. The concessions are valid for 50 years, provided semi-annual property tax payments are made in January and July each year and if minimum annual investment requirements are met, or if there is minimum annual production equal to the amount of the annual investment requirement. The concession owner may apply for a second 50-year term. Annual payments of 2.03 million Mexican Pesos were made in January of 2023 and 2.03 million Pesos were made in July of 2023 by Vizsla.

Figure 4-1 Property Location Map

Figure 4-2 Mining Concessions (WGS 84 UTM Zone 13N)

Table 4-1 Property Mineral Concessions held 100% By Vizsla

| Title Name |

Title Number |

Issue Date |

Expiry Date |

Area (ha) |

| San Carlos* |

151204 |

26-Mar-69 |

25-Mar-69 |

98 |

| Amp. a la Casualidad* |

153220 |

30-Jul-20 |

29-Jul-70 |

14 |

| La Esmeralda* |

158378 |

29-Mar-23 |

28-Mar-73 |

2.9728 |

| Mazatlan* |

158416 |

30-Mar-23 |

29-Mar-73 |

23.7804 |

| Clemens* |

165452 |

18-Oct-79 |

17-Oct-29 |

11.6195 |

| Nuevo Refugio III* |

187494 |