0000006281--11-022024Q1FALSE21300000062812023-10-292024-02-0300000062812024-02-03xbrli:sharesiso4217:USD00000062812022-10-302023-01-28iso4217:USDxbrli:shares00000062812023-10-280000006281us-gaap:CommonStockMember2023-10-280000006281us-gaap:AdditionalPaidInCapitalMember2023-10-280000006281us-gaap:RetainedEarningsMember2023-10-280000006281us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-280000006281us-gaap:RetainedEarningsMember2023-10-292024-02-030000006281us-gaap:CommonStockMember2023-10-292024-02-030000006281us-gaap:AdditionalPaidInCapitalMember2023-10-292024-02-030000006281us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-292024-02-030000006281us-gaap:CommonStockMember2024-02-030000006281us-gaap:AdditionalPaidInCapitalMember2024-02-030000006281us-gaap:RetainedEarningsMember2024-02-030000006281us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-02-030000006281us-gaap:CommonStockMember2022-10-290000006281us-gaap:AdditionalPaidInCapitalMember2022-10-290000006281us-gaap:RetainedEarningsMember2022-10-290000006281us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-290000006281us-gaap:RetainedEarningsMember2022-10-302023-01-280000006281us-gaap:CommonStockMember2022-10-302023-01-280000006281us-gaap:AdditionalPaidInCapitalMember2022-10-302023-01-280000006281us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-302023-01-280000006281us-gaap:CommonStockMember2023-01-280000006281us-gaap:AdditionalPaidInCapitalMember2023-01-280000006281us-gaap:RetainedEarningsMember2023-01-280000006281us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-2800000062812022-10-2900000062812023-01-280000006281us-gaap:AccumulatedTranslationAdjustmentMember2023-10-280000006281us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-10-280000006281us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-10-280000006281us-gaap:AccumulatedTranslationAdjustmentMember2023-10-292024-02-030000006281us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-10-292024-02-030000006281us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-10-292024-02-030000006281us-gaap:AccumulatedTranslationAdjustmentMember2024-02-030000006281us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-02-030000006281us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-02-030000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMember2023-10-292024-02-030000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:ForeignExchangeContractMember2022-10-302023-01-280000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateContractMember2023-10-292024-02-030000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMemberus-gaap:InterestRateContractMember2022-10-302023-01-280000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-10-292024-02-030000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMemberus-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-302023-01-280000006281us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-10-292024-02-030000006281us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMemberus-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-10-302023-01-280000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2023-10-292024-02-030000006281us-gaap:ReclassificationOutOfAccumulatedOtherComprehensiveIncomeMember2022-10-302023-01-280000006281adi:GlobalRepositioningActionsMember2023-10-280000006281adi:Q42023PlanMember2023-10-280000006281adi:GlobalRepositioningActionsMember2023-10-292024-02-030000006281adi:Q42023PlanMember2023-10-292024-02-030000006281adi:GlobalRepositioningActionsMember2024-02-030000006281adi:Q42023PlanMember2024-02-030000006281adi:IndustrialMember2023-10-292024-02-03xbrli:pure0000006281adi:IndustrialMember2022-10-302023-01-280000006281adi:AutomotiveMember2023-10-292024-02-030000006281adi:AutomotiveMember2022-10-302023-01-280000006281adi:CommunicationsMember2023-10-292024-02-030000006281adi:CommunicationsMember2022-10-302023-01-280000006281adi:ConsumerMember2023-10-292024-02-030000006281adi:ConsumerMember2022-10-302023-01-280000006281us-gaap:SalesChannelThroughIntermediaryMember2023-10-292024-02-030000006281us-gaap:SalesChannelThroughIntermediaryMember2022-10-302023-01-280000006281us-gaap:SalesChannelDirectlyToConsumerMember2023-10-292024-02-030000006281us-gaap:SalesChannelDirectlyToConsumerMember2022-10-302023-01-280000006281adi:SalesChannelOtherMember2023-10-292024-02-030000006281adi:SalesChannelOtherMember2022-10-302023-01-280000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-02-030000006281us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-02-030000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2024-02-030000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberadi:CorporateObligationsMember2024-02-030000006281us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberadi:CorporateObligationsMember2024-02-030000006281us-gaap:FairValueMeasurementsRecurringMemberadi:CorporateObligationsMember2024-02-030000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2024-02-030000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2024-02-030000006281us-gaap:FairValueMeasurementsRecurringMember2024-02-030000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-10-280000006281us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-10-280000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:MoneyMarketFundsMember2023-10-280000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-10-280000006281us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-10-280000006281us-gaap:FairValueMeasurementsRecurringMember2023-10-280000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2024Member2024-02-030000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2024Member2023-10-280000006281us-gaap:SeniorNotesMemberadi:NotesDueApril2025Member2024-02-030000006281us-gaap:SeniorNotesMemberadi:NotesDueApril2025Member2023-10-280000006281us-gaap:SeniorNotesMemberadi:NotesDueDecember2026Member2024-02-030000006281us-gaap:SeniorNotesMemberadi:NotesDueDecember2026Member2023-10-280000006281us-gaap:SeniorNotesMemberadi:NotesDueJune2027Member2024-02-030000006281us-gaap:SeniorNotesMemberadi:NotesDueJune2027Member2023-10-280000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2028Member2024-02-030000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2028Member2023-10-280000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2031Member2024-02-030000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2031Member2023-10-280000006281adi:NotesDueOctober2032Memberus-gaap:SeniorNotesMember2024-02-030000006281adi:NotesDueOctober2032Memberus-gaap:SeniorNotesMember2023-10-280000006281adi:NotesDueDecember2036Memberus-gaap:SeniorNotesMember2024-02-030000006281adi:NotesDueDecember2036Memberus-gaap:SeniorNotesMember2023-10-280000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2041Member2024-02-030000006281us-gaap:SeniorNotesMemberadi:NotesDueOctober2041Member2023-10-280000006281adi:NotesDueDecember2045Memberus-gaap:SeniorNotesMember2024-02-030000006281adi:NotesDueDecember2045Memberus-gaap:SeniorNotesMember2023-10-280000006281adi:NotesDueOctober2051Memberus-gaap:SeniorNotesMember2024-02-030000006281adi:NotesDueOctober2051Memberus-gaap:SeniorNotesMember2023-10-280000006281us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForwardContractsMember2024-02-030000006281us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:ForwardContractsMember2023-10-280000006281us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMember2024-02-030000006281us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMember2023-10-280000006281us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMember2024-02-030000006281us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:AccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMember2023-10-280000006281us-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2024-02-030000006281us-gaap:ForwardContractsMemberus-gaap:NondesignatedMember2023-10-280000006281us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-02-030000006281us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-10-280000006281us-gaap:AccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2024-02-030000006281us-gaap:AccruedLiabilitiesMemberus-gaap:ForeignExchangeContractMemberus-gaap:NondesignatedMember2023-10-280000006281adi:AccruedLiabilitiesCurrentMemberus-gaap:InterestRateSwapMember2023-10-292024-02-030000006281us-gaap:InterestRateSwapMemberadi:UnsecuredLongTermDebtNoncurrentMember2023-10-292024-02-030000006281us-gaap:SettlementWithTaxingAuthorityMemberadi:MaximIntegratedProductsIncMember2024-02-030000006281us-gaap:SubsequentEventMemberus-gaap:CommonStockMember2024-02-202024-02-200000006281adi:JamesMollicaMember2023-10-292024-02-030000006281adi:JamesMollicaMember2024-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form 10-Q

(Mark One) | | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended February 3, 2024

OR | | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 1-7819

Analog Devices, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Massachusetts | | 04-2348234 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | |

| One Analog Way, | Wilmington, | MA | | 01887 |

| (Address of principal executive offices) | | (Zip Code) |

(781) 935-5565

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

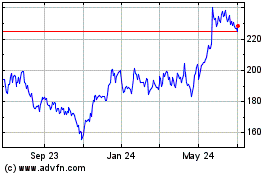

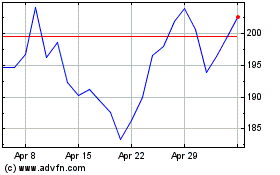

| Common Stock $0.16 2/3 par value per share | ADI | Nasdaq Global Select Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act. | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | | ☑ | | Accelerated filer | | ☐ |

| | | | | | |

| Non-accelerated filer | | ☐ | | Smaller reporting company | | ☐ |

| | | | | | |

| | | | Emerging growth company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

As of February 3, 2024 there were 495,908,150 shares of common stock of the registrant, $0.16 2/3 par value per share, outstanding.

PART I — FINANCIAL INFORMATION

| | | | | |

| ITEM 1. | Financial Statements |

ANALOG DEVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(in thousands, except per share amounts)

| | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | | | |

| Revenue | $ | 2,512,704 | | | $ | 3,249,630 | | | | | |

| Cost of sales | 1,038,763 | | | 1,125,289 | | | | | |

| Gross margin | 1,473,941 | | | 2,124,341 | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 391,427 | | | 414,095 | | | | | |

| Selling, marketing, general and administrative | 290,078 | | | 326,284 | | | | | |

| Amortization of intangibles | 190,332 | | | 253,142 | | | | | |

| Special charges, net | 16,140 | | | — | | | | | |

| Total operating expenses | 887,977 | | | 993,521 | | | | | |

| Operating income: | 585,964 | | | 1,130,820 | | | | | |

| Nonoperating expense (income): | | | | | | | |

| Interest expense | 77,141 | | | 60,453 | | | | | |

| Interest income | (9,169) | | | (10,829) | | | | | |

| Other, net | 4,574 | | | 7,723 | | | | | |

| Total nonoperating expense (income) | 72,546 | | | 57,347 | | | | | |

| Income before income taxes | 513,418 | | | 1,073,473 | | | | | |

| Provision for income taxes | 50,691 | | | 111,999 | | | | | |

| Net income | $ | 462,727 | | | $ | 961,474 | | | | | |

| | | | | | | |

| Shares used to compute earnings per common share – basic | 495,765 | | | 507,121 | | | | | |

| Shares used to compute earnings per common share – diluted | 498,741 | | | 511,184 | | | | | |

| | | | | | | |

| Basic earnings per common share | $ | 0.93 | | | $ | 1.90 | | | | | |

| Diluted earnings per common share | $ | 0.93 | | | $ | 1.88 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

See accompanying notes.

ANALOG DEVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | |

| Three Months Ended | | |

| February 3, 2024 | | January 28, 2023 | | | | |

| Net income | $ | 462,727 | | | $ | 961,474 | | | | | |

| Foreign currency translation adjustments | 385 | | | 2,499 | | | | | |

| | | | | | | |

| Change in fair value of derivative instruments designated as cash flow hedges, net | 8,020 | | | 25,467 | | | | | |

| Changes in pension plans, net actuarial gain/loss and foreign currency translation adjustments, net | (1,388) | | | 452 | | | | | |

| Other comprehensive income | 7,017 | | | 28,418 | | | | | |

| Comprehensive income | $ | 469,744 | | | $ | 989,892 | | | | | |

| | | | | | | |

See accompanying notes.

ANALOG DEVICES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands, except share and per share amounts)

| | | | | | | | | | | |

| February 3, 2024 | | October 28, 2023 |

| ASSETS | | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 1,303,560 | | | $ | 958,061 | |

| | | |

| Accounts receivable | 1,196,721 | | | 1,469,734 | |

| Inventories | 1,553,221 | | | 1,642,214 | |

| | | |

| | | |

| | | |

| Prepaid expenses and other current assets | 362,375 | | | 314,013 | |

| Total current assets | 4,415,877 | | | 4,384,022 | |

| Non-current Assets | | | |

| | | |

| Net property, plant and equipment | 3,281,937 | | | 3,219,157 | |

| Goodwill | 26,913,134 | | | 26,913,134 | |

| Intangible assets, net | 10,871,054 | | | 11,311,957 | |

| Deferred tax assets | 2,172,174 | | | 2,223,272 | |

| | | |

| Other assets | 734,288 | | | 742,936 | |

| Total non-current assets | 43,972,587 | | | 44,410,456 | |

| TOTAL ASSETS | $ | 48,388,464 | | | $ | 48,794,478 | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 398,107 | | | $ | 493,041 | |

| | | |

| | | |

| Income taxes payable | 410,013 | | | 309,046 | |

| Debt, current | 499,322 | | | 499,052 | |

| Commercial paper notes | 544,444 | | | 547,224 | |

| | | |

| Accrued liabilities | 1,071,480 | | | 1,352,608 | |

| Total current liabilities | 2,923,366 | | | 3,200,971 | |

| Non-current Liabilities | | | |

| Long-term debt | 5,946,673 | | | 5,902,457 | |

| Deferred income taxes | 2,975,815 | | | 3,127,852 | |

| | | |

| Income taxes payable | 415,535 | | | 417,076 | |

| | | |

| Other non-current liabilities | 579,002 | | | 581,000 | |

| Total non-current liabilities | 9,917,025 | | | 10,028,385 | |

| | | |

| Shareholders’ Equity | | | |

Preferred stock, $1.00 par value, 471,934 shares authorized, none outstanding | — | | | — | |

Common stock, $0.16 2/3 par value, 1,200,000,000 shares authorized, 495,908,150 shares outstanding (496,261,678 on October 28, 2023) | 82,653 | | | 82,712 | |

| Capital in excess of par value | 25,253,256 | | | 25,313,914 | |

| Retained earnings | 10,393,449 | | | 10,356,798 | |

| Accumulated other comprehensive loss | (181,285) | | | (188,302) | |

| Total shareholders’ equity | 35,548,073 | | | 35,565,122 | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 48,388,464 | | | $ | 48,794,478 | |

See accompanying notes.

ANALOG DEVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

(Unaudited)

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended February 3, 2024 |

| | | | | Capital in | | | | Accumulated

Other |

| | Common Stock | | Excess of | | Retained | | Comprehensive |

| Shares | | Amount | | Par Value | | Earnings | | Loss |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

BALANCE, OCTOBER 28, 2023 | 496,262 | | | $ | 82,712 | | | $ | 25,313,914 | | | $ | 10,356,798 | | | $ | (188,302) | |

| | | | | | | | | |

| Net income | | | | | | | 462,727 | | | |

Dividends declared and paid - $0.86 per share | | | | | | | (426,076) | | | |

| | | | | | | | | |

| Issuance of stock under stock plans and other | 676 | | | 113 | | | 49,706 | | | | | |

| Stock-based compensation expense | | | | | 69,815 | | | | | |

| Other comprehensive income | | | | | | | | | 7,017 | |

| Common stock repurchased | (1,030) | | | (172) | | | (180,179) | | | | | |

BALANCE, FEBRUARY 3, 2024 | 495,908 | | | $ | 82,653 | | | $ | 25,253,256 | | | $ | 10,393,449 | | | $ | (181,285) | |

| | | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended January 28, 2023 |

| | | | | Capital in | | | | Accumulated

Other |

| Common Stock | | Excess of | | Retained | | Comprehensive |

| Shares | | Amount | | Par Value | | Earnings | | Loss |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| BALANCE, OCTOBER 29, 2022 | 509,296 | | | $ | 84,880 | | | $ | 27,857,270 | | | $ | 8,721,325 | | | $ | (198,152) | |

| | | | | | | | | |

| Net income | | | | | | | 961,474 | | | |

Dividends declared and paid - $0.76 per share | | | | | | | (385,452) | | | |

| Issuance of stock under stock plans and other | 617 | | | 103 | | | 41,135 | | | | | |

| Stock-based compensation expense | | | | | 75,041 | | | | | |

| Other comprehensive income | | | | | | | | | 28,418 | |

| Common stock repurchased | (4,061) | | | (677) | | | (653,880) | | | | | |

BALANCE, JANUARY 28, 2023 | 505,852 | | | $ | 84,306 | | | $ | 27,319,566 | | | $ | 9,297,347 | | | $ | (169,734) | |

| | | | | | | | | |

| |

| | | | | | | | | |

| | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

See accompanying notes.

ANALOG DEVICES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

| | | | | | | | | | | |

| Three Months Ended |

| | February 3, 2024 | | January 28, 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 462,727 | | | $ | 961,474 | |

| Adjustments to reconcile net income to net cash provided by operations: | | | |

| Depreciation | 84,348 | | | 85,321 | |

| Amortization of intangibles | 440,903 | | | 502,177 | |

| | | |

| Stock-based compensation expense | 69,815 | | | 75,041 | |

| | | |

| | | |

| | | |

| Deferred income taxes | (102,149) | | | (146,354) | |

| | | |

| Other | 4,684 | | | 9,732 | |

| Changes in operating assets and liabilities | 178,504 | | | (81,086) | |

| Total adjustments | 676,105 | | | 444,831 | |

| Net cash provided by operating activities | 1,138,832 | | | 1,406,305 | |

| Cash flows from investing activities: | | | |

| | | |

| | | |

| | | |

| Additions to property, plant and equipment | (222,978) | | | (176,158) | |

| | | |

| | | |

| | | |

| Other | 3,877 | | | 102 | |

| Net cash used for investing activities | (219,101) | | | (176,056) | |

| Cash flows from financing activities: | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Proceeds from commercial paper notes | 2,779,494 | | | — | |

| Payments of commercial paper notes | (2,782,274) | | | — | |

| Repurchase of common stock | (180,351) | | | (654,557) | |

| Dividend payments to shareholders | (426,076) | | | (385,452) | |

| Proceeds from employee stock plans | 49,819 | | | 41,238 | |

| | | |

| Other | (14,844) | | | (31,588) | |

| Net cash used for financing activities | (574,232) | | | (1,030,359) | |

| | | |

| Net increase in cash and cash equivalents | 345,499 | | | 199,890 | |

| Cash and cash equivalents at beginning of period | 958,061 | | | 1,470,572 | |

| Cash and cash equivalents at end of period | $ | 1,303,560 | | | $ | 1,670,462 | |

| | | |

See accompanying notes.

ANALOG DEVICES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

FOR THE THREE MONTHS ENDED FEBRUARY 3, 2024 (UNAUDITED)

(all tabular amounts in thousands except per share amounts and percentages)

Note 1 – Basis of Presentation

In the opinion of management, the information furnished in the accompanying condensed consolidated financial statements reflects all normal recurring adjustments that are necessary to fairly state the results for these interim periods and should be read in conjunction with Analog Devices, Inc.’s (the Company) Annual Report on Form 10-K for the fiscal year ended October 28, 2023 (fiscal 2023) and related notes. The results of operations for the interim periods shown in this report are not necessarily indicative of the results that may be expected for the fiscal year ending November 2, 2024 (fiscal 2024) or any future period.

The Company has a 52-53 week fiscal year that ends on the Saturday closest to the last day in October. Fiscal 2024 is a 53-week fiscal year and fiscal 2023 was a 52-week fiscal year. The additional week in fiscal 2024 is included in the first quarter ended February 3, 2024. Therefore, the first quarter of fiscal 2024 included 14 weeks of operations and the first quarter of fiscal 2023 included 13 weeks of operations.

Note 2 – Shareholders' Equity

As of February 3, 2024, the Company had repurchased a total of approximately 206.2 million shares of its common stock for approximately $14.7 billion under the Company's share repurchase program. As of February 3, 2024, an additional $2.0 billion remains available for repurchase of shares under the current authorized program. The Company also repurchases shares in settlement of employee tax withholding obligations due upon the vesting of restricted stock units/awards or the exercise of stock options as well as for the Company's employee stock purchase plan. Future repurchases of common stock will be dependent upon the Company's financial position, results of operations, outlook, liquidity and other factors deemed relevant by the Company.

Note 3 – Accumulated Other Comprehensive (Loss) Income

The following table provides the changes in accumulated other comprehensive (loss) income (AOCI) by component and the related tax effects during the first three months of fiscal 2024. | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Foreign currency translation adjustment | | | | | | Unrealized holding gains (losses) on derivatives | | Pension plans | | Total |

| October 28, 2023 | $ | (72,544) | | | | | | | $ | (102,043) | | | $ | (13,715) | | | $ | (188,302) | |

| Other comprehensive income before reclassifications | 385 | | | | | | | 6,795 | | | (1,904) | | | 5,276 | |

| Amounts reclassified out of other comprehensive income | — | | | | | | | 2,699 | | | 516 | | | 3,215 | |

| Tax effects | — | | | | | | | (1,474) | | | — | | | (1,474) | |

| Other comprehensive income | 385 | | | | | | | 8,020 | | | (1,388) | | | 7,017 | |

| | | | | | | | | | | |

| February 3, 2024 | $ | (72,159) | | | | | | | $ | (94,023) | | | $ | (15,103) | | | $ | (181,285) | |

The amounts reclassified out of AOCI into the Condensed Consolidated Statements of Income and the Condensed Consolidated Statements of Shareholders' Equity with presentation location during each period were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | | | |

| Comprehensive (Loss) Income Component | | February 3, 2024 | | January 28, 2023 | | | | | | Location |

| Unrealized holding (gains) losses on derivatives: | | | | | |

| Currency forwards | | $ | (71) | | | $ | (1,059) | | | | | | | Cost of sales |

| | (69) | | | (447) | | | | | | | Research and development |

| | (891) | | | (1,297) | | | | | | | Selling, marketing, general and administrative |

| | | | | | | | | | |

| Interest rate derivatives | | 3,730 | | | 3,727 | | | | | | | Interest expense |

| | | | | | | | | | |

| | 2,699 | | | 924 | | | | | | | Total before tax |

| | (848) | | | (802) | | | | | | | Tax |

| | | | | | | | | | |

| | $ | 1,851 | | | $ | 122 | | | | | | | Net of tax |

| | | | | | | | | | |

| Amortization of pension components included in the computation of net periodic pension cost: |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Actuarial losses | | $ | 516 | | | $ | 370 | | | | | | | Net of tax |

| | | | | | | | | | |

| Total amounts reclassified out of AOCI, net of tax | | $ | 2,367 | | | $ | 492 | | | | | | | |

Note 4 – Earnings Per Share

The following table sets forth the computation of basic and diluted earnings per share: | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | | | |

| Net income | $ | 462,727 | | | $ | 961,474 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic shares: | | | | | | | |

| Weighted-average shares outstanding | 495,765 | | | 507,121 | | | | | |

| Earnings per common share basic: | $ | 0.93 | | | $ | 1.90 | | | | | |

| Diluted shares: | | | | | | | |

| Weighted-average shares outstanding | 495,765 | | | 507,121 | | | | | |

| Assumed exercise of common stock equivalents | 2,976 | | | 4,063 | | | | | |

| Weighted-average common and common equivalent shares | 498,741 | | | 511,184 | | | | | |

| Earnings per common share diluted: | $ | 0.93 | | | $ | 1.88 | | | | | |

| Anti-dilutive shares related to: | | | | | | | |

| Outstanding stock-based awards | 214 | | | 322 | | | | | |

Note 5 – Special Charges, Net

Liabilities related to special charges, net are included in Accrued liabilities and Other non-current liabilities in the Condensed Consolidated Balance Sheets. The activity is detailed below: | | | | | | | | | | | | | | | | | | | | | |

| Accrued Special Charges | | | | | | | Global Repositioning Actions | | Q4 2023 Plan | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance at October 28, 2023 | | | | | | | $ | 36,981 | | | $ | 110,446 | | | |

| Employee severance and benefit costs | | | | | | | — | | | 11,977 | | | |

| | | | | | | | | | | |

| Severance and benefit payments | | | | | | | (4,420) | | | (87,013) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Balance at February 3, 2024 | | | | | | | $ | 32,561 | | | $ | 35,410 | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Accrued liabilities | | | | | | | $ | 9,425 | | | $ | 35,410 | | | |

| Other non-current liabilities | | | | | | | $ | 23,136 | | | $ | — | | | |

Note 6 – Commitments and Contingencies

On March 17, 2022, Walter E. Ryan and Ryan Asset Management, LLC, purported stockholders of Maxim Integrated Products, Inc. (Maxim), filed a putative class action in the Court of Chancery of the State of Delaware (C.A. No. 2022—0255) against the Company and the former directors of Maxim. The complaint alleges breaches of fiduciary duties by the individual defendants in connection with Maxim’s agreement, as part of the merger negotiations with the Company, to suspend Maxim dividends for up to four quarters prior to the closing of the Company's acquisition of Maxim. The complaint further alleges that the Company aided and abetted those alleged breaches of fiduciary duties. The plaintiffs seek damages in an amount to be determined at trial, plaintiffs’ costs and disbursements, including reasonable attorneys’ and experts’ fees, costs and other expenses. On May 2, 2023, the Court of Chancery entered an order dismissing the action in its entirety and with prejudice. On May 9, 2023, the plaintiffs filed a Motion for Reargument, which the Court denied on May 30, 2023. On June 21, 2023, the plaintiffs filed a Notice of Appeal to the Delaware Supreme Court. The appeal is fully briefed, and the Delaware Supreme Court heard argument on February 14, 2024. The Company believes that it and the other defendants have meritorious arguments in response to the appeal and defenses to the underlying allegations; however, the Company is currently unable to determine the ultimate outcome of this matter or determine an estimate, or a range of estimates, of potential losses, if any.

Note 7 – Revenue

Revenue Trends by End Market

The following table summarizes revenue by end market. The categorization of revenue by end market is determined using a variety of data points including the technical characteristics of the product, the “sold to” customer information, the “ship to” customer information and the end customer product or application into which the Company’s product will be incorporated. As data systems for capturing and tracking this data and the Company's methodology evolves and improves, the categorization of products by end market can vary over time. When this occurs, the Company reclassifies revenue by end market for prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each end market. | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| | February 3, 2024 | | January 28, 2023 |

| | Revenue | | % of Revenue* | | Y/Y% | | Revenue | | % of Revenue* |

| Industrial | $ | 1,196,832 | | | 48 | % | | (31) | % | | $ | 1,740,780 | | | 54 | % |

| Automotive | 739,158 | | | 29 | % | | 9 | % | | 680,637 | | | 21 | % |

| Communications | 302,573 | | | 12 | % | | (37) | % | | 477,266 | | | 15 | % |

| Consumer | 274,141 | | | 11 | % | | (22) | % | | 350,947 | | | 11 | % |

| | | | | | | | | |

| | | | | | | | | |

| Total revenue | $ | 2,512,704 | | | 100 | % | | (23) | % | | $ | 3,249,630 | | | 100 | % |

| | | | | | | | | |

| | | | | | | | | |

| |

| | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| * The sum of the individual percentages may not equal the total due to rounding. |

Revenue by Sales Channel

The following table summarizes revenue by channel. The Company sells its products globally through a direct sales force, third party distributors, independent sales representatives and via its website. Distributors are customers that buy products with the intention of reselling them. Direct customers are non-distributor customers and consist primarily of original equipment manufacturers. Other customers include the U.S. government, government prime contractors and certain commercial customers for which revenue is recorded over time. | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| February 3, 2024 | | January 28, 2023 |

| Channel | Revenue | | % of Revenue* | | Revenue | | % of Revenue* |

| Distributors | $ | 1,535,210 | | | 61 | % | | $ | 2,011,323 | | | 62 | % |

| Direct customers | 939,975 | | | 37 | % | | 1,195,534 | | | 37 | % |

| Other | 37,519 | | | 1 | % | | 42,773 | | | 1 | % |

| Total revenue | $ | 2,512,704 | | | 100 | % | | $ | 3,249,630 | | | 100 | % |

| | | | | | | |

| | | | | | | |

| |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| * The sum of the individual percentages may not equal the total due to rounding. |

Note 8 – Fair Value

Assets and Liabilities Recorded at Fair Value on a Recurring Basis

The tables below, set forth by level, present the Company’s financial assets and liabilities, excluding accrued interest components that were accounted for at fair value on a recurring basis as of February 3, 2024 and October 28, 2023. The tables exclude cash on hand and assets and liabilities that are measured at historical cost or any basis other than fair value. As of February 3, 2024 and October 28, 2023, the Company held $721.4 million and $642.1 million, respectively, of cash that is excluded from the tables below. | | | | | | | | | | | | | | | | | | | |

| | February 3, 2024 |

| | Fair Value Measurement at Reporting Date Using: | | |

| | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | | | Total |

| Assets | | | | | | | |

| Cash equivalents: | | | | | | | |

| Available-for-sale: | | | | | | | |

| Government and institutional money market funds | $ | 512,453 | | | $ | — | | | | | $ | 512,453 | |

| Corporate obligations (1) | — | | | 69,755 | | | | | 69,755 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other assets: | | | | | | | |

Forward foreign currency exchange contracts (2) | $ | — | | | $ | 4,044 | | | | | 4,044 | |

| Deferred compensation plan investments | 89,267 | | | — | | | | | 89,267 | |

| | | | | | | |

| Total assets measured at fair value | $ | 601,720 | | | $ | 73,799 | | | | | $ | 675,519 | |

| Liabilities | | | | | | | |

| | | | | | | |

Forward foreign currency exchange contracts (2) | $ | — | | | $ | 11,282 | | | | | $ | 11,282 | |

Interest rate derivatives (3) | — | | | 37,074 | | | | | 37,074 | |

| Total liabilities measured at fair value | $ | — | | | $ | 48,356 | | | | | $ | 48,356 | |

(1)The amortized cost of the Company's investments classified as available-for-sale as of February 3, 2024 was $69.8 million.

(2)The Company has master netting arrangements by counterparty with respect to derivative contracts. See Note 9, Derivatives, in these Notes to Condensed Consolidated Financial Statements for more information related to the Company's master netting arrangements.

(3)The carrying value of the related debt was adjusted by an equal and offsetting amount. The fair value of interest rate derivatives is estimated using a discounted cash flow analysis based on the contractual terms of the derivatives. See Note 9, Derivatives, in these Notes to Condensed Consolidated Financial Statements.

| | | | | | | | | | | | | | | | | | | |

| | October 28, 2023 |

| | Fair Value Measurement at Reporting Date Using: | | |

| | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Other Observable Inputs (Level 2) | | | | Total |

| Assets | | | | | | | |

| Cash equivalents: | | | | | | | |

| Available-for-sale: | | | | | | | |

| Government and institutional money market funds | $ | 315,980 | | | $ | — | | | | | $ | 315,980 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other assets: | | | | | | | |

| Forward foreign currency exchange contracts (1) | — | | | 1,940 | | | | | 1,940 | |

| Deferred compensation plan investments | 78,246 | | | — | | | | | 78,246 | |

| | | | | | | |

| Total assets measured at fair value | $ | 394,226 | | | $ | 1,940 | | | | | $ | 396,166 | |

| Liabilities | | | | | | | |

| | | | | | | |

| Forward foreign currency exchange contracts (1) | $ | — | | | $ | 13,515 | | | | | $ | 13,515 | |

| Interest rate derivatives (2) | — | | | 81,602 | | | | | 81,602 | |

| Total liabilities measured at fair value | $ | — | | | $ | 95,117 | | | | | $ | 95,117 | |

(1)The Company has master netting arrangements by counterparty with respect to derivative contracts. See Note 9, Derivatives, in these Notes to Condensed Consolidated Financial Statements for more information related to the Company's master netting arrangements.

(2)The carrying value of the related debt was adjusted by an equal and offsetting amount. The fair value of interest rate derivatives is estimated using a discounted cash flow analysis based on the contractual terms of the derivatives. See Note 9, Derivatives, in these Notes to Condensed Consolidated Financial Statements.

Assets and Liabilities Not Recorded at Fair Value on a Recurring Basis

The table below presents the estimated fair values of certain financial instruments not recorded at fair value on a recurring basis. Given the short tenure of the Company's commercial paper notes, the carrying value of the outstanding commercial paper notes approximates the fair values, and therefore, are excluded from the table below ($544.4 million and $547.2 million as of February 3, 2024 and October 28, 2023, respectively). The fair values of the senior unsecured notes are obtained from broker prices and are classified as Level 1 measurements according to the fair value hierarchy. | | | | | | | | | | | | | | | | | | | | | | | |

| February 3, 2024 | | October 28, 2023 |

| Principal Amount Outstanding | | Fair Value | | Principal Amount Outstanding | | Fair Value |

| 2024 Notes, due October 2024 | $ | 500,000 | | | $ | 500,183 | | | $ | 500,000 | | | $ | 499,473 | |

| 2025 Notes, due April 2025 | 400,000 | | | 391,161 | | | 400,000 | | | 385,231 | |

| 2026 Notes, due December 2026 | 900,000 | | | 874,033 | | | 900,000 | | | 851,023 | |

| | | | | | | |

| 2027 Notes, due June 2027 | 440,212 | | | 420,472 | | | 440,212 | | | 408,595 | |

| 2028 Notes, due October 2028 | 750,000 | | | 659,548 | | | 750,000 | | | 628,999 | |

| 2031 Notes, due October 2031 | 1,000,000 | | | 836,328 | | | 1,000,000 | | | 773,404 | |

| 2032 Notes, due October 2032 | 300,000 | | | 286,680 | | | 300,000 | | | 269,828 | |

| 2036 Notes, due December 2036 | 144,278 | | | 128,570 | | | 144,278 | | | 118,554 | |

| 2041 Notes, due October 2041 | 750,000 | | | 545,101 | | | 750,000 | | | 479,078 | |

| 2045 Notes, due December 2045 | 332,587 | | | 326,610 | | | 332,587 | | | 292,248 | |

| 2051 Notes, due October 2051 | 1,000,000 | | | 685,693 | | | 1,000,000 | | | 590,666 | |

Total senior unsecured notes | $ | 6,517,077 | | | $ | 5,654,379 | | | $ | 6,517,077 | | | $ | 5,297,099 | |

| | | | | | | |

Note 9 – Derivatives

Foreign Exchange Exposure Management — The total notional amounts of forward foreign currency derivative instruments designated as hedging instruments of cash flow hedges denominated in Euros, British Pounds, Philippine Pesos, Thai Baht, South Korean Won and Japanese Yen as of February 3, 2024 and October 28, 2023 were $292.7 million and $322.6 million, respectively. The fair values of forward foreign currency derivative instruments designated as hedging instruments in the Company’s Condensed Consolidated Balance Sheets as of February 3, 2024 and October 28, 2023 were as follows: | | | | | | | | | | | | | | | | | |

| | | Fair Value At |

| Balance Sheet Location | | February 3, 2024 | | October 28, 2023 |

| Forward foreign currency exchange contracts | Prepaid expenses and other current assets | | $ | 1,724 | | | $ | 471 | |

| Forward foreign currency exchange contracts | Accrued liabilities | | $ | 4,637 | | | $ | 9,897 | |

As of February 3, 2024 and October 28, 2023, the total notional amounts of undesignated hedges related to forward foreign currency exchange contracts were $293.1 million and $334.7 million, respectively. The fair values of undesignated hedges in the Company’s Condensed Consolidated Balance Sheets as of February 3, 2024 and October 28, 2023 were as follows: | | | | | | | | | | | | | | | | | |

| | | Fair Value At |

| Balance Sheet Location | | February 3, 2024 | | October 28, 2023 |

Undesignated hedges related to forward foreign currency exchange contracts | Prepaid expenses and other current assets | | $ | 2,320 | | | $ | 1,469 | |

Undesignated hedges related to forward foreign currency exchange contracts | Accrued liabilities | | $ | 6,645 | | | $ | 3,618 | |

Interest Rate Exposure Management — The Company does not consider the risk of counterparty default to be significant. The gain or loss on the Company's interest rate swap transactions attributable to the hedged benchmark interest rate risk and the offsetting gain or loss on the related interest rate swaps were recorded as follows:

| | | | | | | | | | | | | | | | | | |

| | February 3, 2024 | | |

| Balance Sheet Location | | Loss on Swaps | | Gain on Note | | | | |

| Accrued liabilities | | $ | 37,074 | | | $ | — | | | | | |

Long-term debt | | $ | — | | | $ | 37,074 | | | | | |

For information on the unrealized holding gains (losses) on derivatives included in and reclassified out of AOCI into the Condensed Consolidated Statements of Income related to forward foreign currency exchange contracts, see Note 3, Accumulated Other Comprehensive (Loss) Income, in these Notes to Condensed Consolidated Financial Statements for further information.

Note 10 – Inventories

Inventories at February 3, 2024 and October 28, 2023 were as follows: | | | | | | | | | | | |

| February 3, 2024 | | October 28, 2023 |

| Raw materials | $ | 125,131 | | | $ | 128,142 | |

| Work in process | 1,108,667 | | | 1,125,819 | |

| Finished goods | 319,423 | | | 388,253 | |

| Total inventories | $ | 1,553,221 | | | $ | 1,642,214 | |

| | | |

Note 11 – Income Taxes

The Company’s effective tax rates for the three-month periods ended February 3, 2024 and January 28, 2023 were below the U.S. statutory tax rate of 21.0%, due to lower statutory tax rates applicable to the Company's operations in the foreign jurisdictions in which it earns income. The Company's effective tax rate also includes the effects of the mandatory capitalization and amortization of research and development expenses which began in fiscal 2023 under the Tax Cuts and Jobs Act of 2017. The mandatory capitalization requirement decreases the Company's effective tax rate primarily by increasing the foreign-derived intangible income deduction.

It is reasonably possible that the balance of gross unrealized tax benefits, including accrued interest and penalties, could decrease by as much as approximately $136.0 million within the next twelve months due to the completion of tax audits, including any administrative appeals.

The Company has numerous audits ongoing throughout the world including: an IRS income tax audit for the fiscal years ended November 2, 2019 and November 3, 2018; a pre-acquisition IRS income tax audit for Maxim's fiscal years ended June 27, 2015 through August 26, 2021; various U.S. state and local audits and international audits, including an Irish corporate tax audit for the fiscal year ended November 2, 2019. The Company's U.S. federal income tax returns prior to the fiscal year ended November 3, 2018 are no longer subject to examination, except for the applicable Maxim pre-acquisition fiscal years noted above.

Note 12 – New Accounting Pronouncements

Standards Implemented

Acquired Contract Assets and Contract Liabilities

In October 2021, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2021-08, Business Combinations (Topic 805): Accounting for Acquired Contract Assets and Contract Liabilities. Under this guidance (ASC 805-20-30-28), the acquirer should determine what contract assets and/or contract liabilities it would have recorded under ASC 606 (the revenue guidance) as of the acquisition date, as if the acquirer had entered into the original contract at the same date and on the same terms as the acquiree. The recognition and measurement of those contract assets and contract liabilities will likely be comparable to what the acquiree has recorded on its books under ASC 606 as of the acquisition date. ASU 2021-08 is effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. The Company adopted ASU 2021-08 in the first quarter of fiscal 2024. Upon adoption, ASU 2021-08 did not have a material impact on the Company's financial position and results of operations.

Standards to be Implemented

Segment Reporting

In November 2023, the FASB issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which enhances the disclosure requirements for reportable segments. ASU 2023-07 requires segment disclosure to include significant segment expense categories and amounts, and qualitative detail of other segment items. Disclosure of multiple measures of segment profit and loss may also be reported. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact, if any, adoption will have on its financial position and results of operations.

Income Taxes

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. ASU 2023-09 requires the disaggregation of information in existing income tax disclosures related to the effective tax rate reconciliation and income taxes paid. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact, if any, adoption will have on its financial position and results of operations.

Note 13 – Subsequent Events

On February 20, 2024, the Board of Directors of the Company declared a cash dividend of $0.92 per outstanding share of common stock. The dividend will be paid on March 15, 2024 to all shareholders of record at the close of business on March 5, 2024 and is expected to total approximately $456.2 million.

| | | | | |

| ITEM 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

This information should be read in conjunction with the unaudited condensed consolidated financial statements and related notes included in Part I, Item 1 of this Quarterly Report on Form 10-Q and the audited consolidated financial statements and related notes and Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended October 28, 2023 (fiscal 2023).

This Quarterly Report on Form 10-Q, including the following discussion, contains forward-looking statements regarding future events and our future results that are subject to the safe harbor created under the Private Securities Litigation Reform Act of 1995 and other safe harbors under the Securities Act of 1933 and the Securities Exchange Act of 1934. All statements other than statements of historical fact are statements that could be deemed forward-looking statements. These statements are based on current expectations, estimates, forecasts and projections about the industries in which we operate and the beliefs and assumptions of our management. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “potential,” “may,” “could” and “will,” and variations of such words and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections regarding our future financial performance or results; our anticipated growth and trends in our businesses; the effects of business, economic, political, legal and regulatory impacts or conflicts upon our global operations; changes in demand for semiconductors and the related changes in demand and supply for our products; manufacturing delays, product availability and supply chain disruptions; our ability to recruit or retain our key personnel; our future liquidity, capital needs and capital expenditures; our development of technologies and processes and research and development investments; our future market position and expected competitive changes in the marketplace for our products; the anticipated result of litigation matters; our plans to pay dividends or repurchase stock; servicing our outstanding debt; our plans to borrow under our third amended and restated revolving credit agreement, as amended, and issue notes under our commercial paper program and the planned use of proceeds from such borrowing and issuing; our expected tax rate; expected cost savings; the effect of new accounting pronouncements; our plans to integrate or realize the benefits or synergies expected of acquired businesses and technologies; our Global Repositioning Actions and Q4 2023 Plan; and other characterizations of future events or circumstances are forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various factors.

The following important factors and uncertainties, among others, could cause results to differ materially from those described in the forward-looking statements: economic, political, legal and regulatory uncertainty or conflicts; changes in demand for semiconductor products; manufacturing delays, product and raw materials availability and supply chain disruptions; products that may be diverted from our authorized distribution channels; changes in export classifications, import and export regulations or duties and tariffs; our development of technologies and research and development investments; our future liquidity, capital needs and capital expenditures; our ability to compete successfully in the markets in which we operate; our ability to recruit and retain key personnel; risks related to acquisitions or other strategic transactions; security breaches or other cyber incidents; adverse results in litigation matters; reputational damage; changes in our estimates of our expected tax rates based on current tax law; risks related to our indebtedness; unanticipated difficulties or expenditures relating to integrating Maxim; the discretion of our board of directors to declare dividends and our ability to pay dividends in the future; factors impacting our ability to repurchase shares; and uncertainty as to the long-term value of our common stock. Additional factors that could cause actual results to differ materially from those in these forward-looking statements include the risk factors included in Part I, Item 1A, “Risk Factors” of our Annual Report on Form 10-K for fiscal 2023. We undertake no obligation to revise or update any forward-looking statements, including to reflect events or circumstances occurring after the date of the filing of this report, except to the extent required by law.

Results of Operations

Overview

(all tabular amounts in thousands except per share amounts and percentages) | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | |

| Revenue | $ | 2,512,704 | | | $ | 3,249,630 | | | $ | (736,926) | | | (23) | % | | |

| Gross margin % | 58.7 | % | | 65.4 | % | | | | | | |

| Net income | $ | 462,727 | | | $ | 961,474 | | | $ | (498,747) | | | (52) | % | | |

| Net income as a % of revenue | 18.4 | % | | 29.6 | % | | | | | | |

| Diluted EPS | $ | 0.93 | | | $ | 1.88 | | | $ | (0.95) | | | (51) | % | | |

| | | | | | | | | |

| | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

Revenue Trends by End Market

The following table summarizes revenue by end market. The categorization of revenue by end market is determined using a variety of data points including the technical characteristics of the product, the “sold to” customer information, the “ship to” customer information and the end customer product or application into which our product will be incorporated. As data systems for capturing and tracking this data and our methodology evolves and improves, the categorization of products by end market can vary over time. When this occurs, we reclassify revenue by end market for prior periods. Such reclassifications typically do not materially change the sizing of, or the underlying trends of results within, each end market.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| | February 3, 2024 | | January 28, 2023 |

| | Revenue | | % of

Revenue* | | Y/Y% | | Revenue | | % of

Revenue* |

| Industrial | $ | 1,196,832 | | | 48 | % | | (31) | % | | $ | 1,740,780 | | | 54 | % |

| Automotive | 739,158 | | | 29 | % | | 9 | % | | 680,637 | | | 21 | % |

| Communications | 302,573 | | | 12 | % | | (37) | % | | 477,266 | | | 15 | % |

| Consumer | 274,141 | | | 11 | % | | (22) | % | | 350,947 | | | 11 | % |

| | | | | | | | | |

| | | | | | | | | |

| Total revenue | $ | 2,512,704 | | | 100 | % | | (23) | % | | $ | 3,249,630 | | | 100 | % |

| | | | | | | | | |

| |

| | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| * The sum of the individual percentages may not equal the total due to rounding. |

Revenue decreased 23% in the three-month period ended February 3, 2024 as compared to the same period of the prior fiscal year, primarily as a result of broad-based decline in demand for our products, partially offset by increased demand in the Automotive end market, namely in cabin electronics, as well as an additional week of operations in the first quarter of fiscal 2024 as compared to the first quarter of fiscal 2023.

Revenue by Sales Channel

The following table summarizes revenue by sales channel. We sell our products globally through a direct sales force, third party distributors, independent sales representatives and via our website. Distributors are customers that buy products with the intention of reselling them. Direct customers are non-distributor customers and consist primarily of original equipment manufacturers. Other customers include the U.S. government, government prime contractors and certain commercial customers for which revenue is recorded over time. | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| February 3, 2024 | | January 28, 2023 |

| Revenue | | % of Revenue* | | Revenue | | % of Revenue* |

| Channel | | | | | | | |

| Distributors | $ | 1,535,210 | | | 61 | % | | $ | 2,011,323 | | | 62 | % |

| Direct customers | 939,975 | | | 37 | % | | 1,195,534 | | | 37 | % |

| Other | 37,519 | | | 1 | % | | 42,773 | | | 1 | % |

| Total revenue | $ | 2,512,704 | | | 100 | % | | $ | 3,249,630 | | | 100 | % |

| | | | | | | |

| |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| * The sum of the individual percentages may not equal the total due to rounding. |

As indicated in the table above, the percentage of total revenue sold via each channel has remained relatively consistent in the periods presented, but can fluctuate from time to time based on end customer demand.

Gross Margin | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | | | | | | | |

| Gross margin | $ | 1,473,941 | | | $ | 2,124,341 | | | $ | (650,400) | | | (31) | % | | | | | | | | |

| Gross margin % | 58.7 | % | | 65.4 | % | | | | | | | | | | | | |

Gross margin percentage decreased by 670 basis points in the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year, primarily due to lower utilization of our factories due to decreased customer demand and unfavorable product mix.

Research and Development (R&D) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | | | | | | | |

| R&D expenses | $ | 391,427 | | | $ | 414,095 | | | $ | (22,668) | | | (5) | % | | | | | | | | |

| R&D expenses as a % of revenue | 16 | % | | 13 | % | | | | | | | | | | | | |

R&D expenses decreased in the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year. The decrease was primarily as a result of lower R&D employee-related variable compensation expenses, partially offset by higher salary and benefit expenses, as well as an additional week of operations in the first quarter of fiscal 2024 as compared to the first quarter of fiscal 2023.

R&D expenses as a percentage of revenue will fluctuate from year-to-year depending on the amount of revenue and the success of new product development efforts, which we view as critical to our future growth. We expect to continue the development of innovative technologies and processes for new products. We believe that a continued commitment to R&D is essential to maintain product leadership with our existing products as well as to provide innovative new product offerings.

Selling, Marketing, General and Administrative (SMG&A) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | | | | | | | |

| SMG&A expenses | $ | 290,078 | | | $ | 326,284 | | | $ | (36,206) | | | (11) | % | | | | | | | | |

| SMG&A expenses as a % of revenue | 12 | % | | 10 | % | | | | | | | | | | | | |

SMG&A expenses decreased in the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year, primarily as a result of lower SMG&A employee-related variable compensation expenses and discretionary spending, partially offset by higher salary and benefit expenses, as well as an additional week of operations in the first quarter of fiscal 2024 as compared to the first quarter of fiscal 2023.

Amortization of Intangibles

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | | | | | | | |

| Amortization expenses | $ | 190,332 | | | $ | 253,142 | | | $ | (62,810) | | | (25) | % | | | | | | | | |

| Amortization expenses as a % of revenue | 8 | % | | 8 | % | | | | | | | | | | | | |

Amortization expenses decreased in the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year as a result of a portion of our acquired intangible assets becoming fully amortized during fiscal 2023.

Special Charges, Net

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | | | | | | | |

| Special charges, net | $ | 16,140 | | | $ | — | | | $ | 16,140 | | | n/a | | | | | | | | |

| Special charges, net as a % of revenue | 1 | % | | — | % | | | | | | | | | | | | |

Special charges, net increased in the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year, primarily as a result of the charges recorded for our plan, committed to during fiscal 2023, to reorganize our business (the Q4 2023 Plan). The Q4 2023 Plan, consisting of voluntary and involuntary reductions-in-force, and other cost-savings initiatives, was commenced to adjust our cost structure and business activities to better align with weaker market demand and continued economic uncertainty in our end markets, as well as make certain strategic shifts in our workforce necessary to achieve our long-term vision.

See Note 5, Special Charges, Net, in the Notes to Condensed Consolidated Financial Statements in Part I, Item 1 of this Quarterly Report on Form 10-Q for further discussion.

Operating Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | | | | | | | |

| Operating income | $ | 585,964 | | | $ | 1,130,820 | | | $ | (544,856) | | | (48) | % | | | | | | | | |

| Operating income as a % of revenue | 23.3 | % | | 34.8 | % | | | | | | | | | | | | |

The year-over-year decrease in operating income in the three-month period ended February 3, 2024 was primarily the result of a decrease in revenue, which contributed to a decrease in gross margin of $650.4 million, and an increase of $16.1 million in special charges, net, partially offset by decreases of $62.8 million in amortization expenses, $36.2 million in SMG&A expenses and $22.7 million in R&D expenses.

Nonoperating Expense (Income) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Total nonoperating expense (income) | $ | 72,546 | | | $ | 57,347 | | | $ | 15,199 | | | | | | | |

The year-over-year increase in nonoperating expense (income) in the three-month period ended February 3, 2024 as compared to the same period of the prior fiscal year was primarily the result of higher interest expense related to our commercial paper obligations and higher interest rates on certain of our existing debt obligations.

Provision for Income Taxes | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | | | | | |

| Provision for income taxes | $ | 50,691 | | | $ | 111,999 | | | $ | (61,308) | | | | | | | |

| Effective income tax rate | 9.9 | % | | 10.4 | % | | | | | | | | |

The effective tax rates for the three-month periods ended February 3, 2024 and January 28, 2023 were below the U.S. statutory tax rate of 21% due to lower statutory tax rates applicable to our operations in the foreign jurisdictions in which we earn income. Our pretax income for the three-month periods ended February 3, 2024 and January 28, 2023 was primarily generated in Ireland at a tax rate of 12.5%.

See Note 11, Income Taxes, in the Notes to Condensed Consolidated Financial Statements in Part I, Item 1 of this Quarterly Report on Form 10-Q for further discussion.

Net Income | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | February 3, 2024 | | January 28, 2023 | | $ Change | | % Change | | | | | | | | |

| Net income | $ | 462,727 | | | $ | 961,474 | | | $ | (498,747) | | | (52) | % | | | | | | | | |

| Net income as a % of revenue | 18.4 | % | | 29.6 | % | | | | | | | | | | | | |

| Diluted EPS | $ | 0.93 | | | $ | 1.88 | | | | | | | | | | | | | |

Net income decreased in the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year as the result of a $544.9 million decrease in operating income and a $15.2 million increase in nonoperating expense (income), partially offset by a $61.3 million decrease in provision for income taxes.

Liquidity and Capital Resources

At February 3, 2024, our principal source of liquidity was $1.3 billion of cash and cash equivalents, of which approximately $597.8 million was held in the United States, and the balance of our cash and cash equivalents was held outside the United States in various foreign subsidiaries. We manage our worldwide cash requirements by, among other things, reviewing available funds held by our foreign subsidiaries and the cost effectiveness by which those funds can be accessed in the United States. We do not expect current regulatory restrictions or taxes on repatriation to have a material adverse effect on our overall liquidity, financial condition or results of operations. Our cash and cash equivalents consist of highly liquid investments with maturities of three months or less, including money market funds. We maintain these balances with counterparties with high credit ratings, and continually monitor the amount of credit exposure to any one issuer and diversify our investments in order to minimize our credit risk.

We believe that our existing sources of liquidity and cash expected to be generated from future operations, together with existing and anticipated available short- and long-term financing, will be sufficient to fund operations, capital expenditures, research and development efforts and dividend payments (if any) in the immediate future and for at least the next twelve months. | | | | | | | | | | | |

| | Three Months Ended |

| | February 3, 2024 | | January 28, 2023 |

| Net cash provided by operating activities | $ | 1,138,832 | | | $ | 1,406,305 | |

| Net cash provided by operations as a % of revenue | 45 | % | | 43 | % |

| Net cash used for investing activities | $ | (219,101) | | | $ | (176,056) | |

| Net cash used for financing activities | $ | (574,232) | | | $ | (1,030,359) | |

The following changes contributed to the net change in cash and cash equivalents in the three-month period ended February 3, 2024 as compared to the same period in fiscal 2023.

Operating Activities

Cash provided by operating activities is net income adjusted for certain non-cash items and changes in operating assets and liabilities. The decrease in cash provided by operating activities during the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year, was mainly the result of lower net income adjusted for noncash items offset by changes in working capital.

Investing Activities

Investing cash flows generally consist of capital expenditures and cash used for acquisitions. The increase in cash used for investing activities during the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year, was primarily the result of an increase in cash used for capital expenditures.

Financing Activities

Financing cash flows generally consist of payments of dividends to stockholders, repurchases of common stock, issuance and repayment of debt and proceeds from the sale of shares of common stock pursuant to employee equity incentive plans. The decrease in cash used for financing activities during the three-month period ended February 3, 2024, as compared to the same period of the prior fiscal year, was primarily the result of lower common stock repurchases, partially offset by higher dividend payments.

Working Capital | | | | | | | | | | | | | | | | | | | | | | | |

| February 3, 2024 | | October 28, 2023 | | $ Change | | % Change |

| Accounts receivable | $ | 1,196,721 | | | $ | 1,469,734 | | | $ | (273,013) | | | (19) | % |

| Days sales outstanding* | 52 | | | 52 | | | | | |

| Inventory | $ | 1,553,221 | | | $ | 1,642,214 | | | $ | (88,993) | | | (5) | % |

| Days cost of sales in inventory* | 151 | | | 143 | | | | | |

_______________________________________

*We use the average of the current quarter and prior quarter ending net accounts receivable and ending inventory balance in our calculation of days sales outstanding and days cost of sales in inventory, respectively. The first quarter of fiscal 2024 included an additional week of operations as compared to the first quarter of 2023.

The decrease in accounts receivable in dollars was primarily the result of variations in the timing of collections and billings and decreased revenue levels in the first quarter of fiscal 2024 as compared to the fourth quarter of fiscal 2023.

Inventory decreased primarily as a result of our efforts to balance manufacturing production, demand and inventory levels. Our inventory levels are impacted by our need to support forecasted sales demand and variations between those forecasts and actual demand.

Current liabilities decreased to $2,923.4 million at February 3, 2024 as compared to $3,201.0 million at the end of fiscal 2023 due to lower accrued liabilities and accounts payable, partially offset by higher income taxes payable.

Debt

As of February 3, 2024, our debt obligations consisted of the following: | | | | | | |

| | Principal Amount Outstanding |

| Commercial paper notes | | $ | 544,444 | |

| 2024 Notes, due October 2024 | | 500,000 | |

| 2025 Notes, due April 2025 | | 400,000 | |

| 2026 Notes, due December 2026 | | 900,000 | |

| 2027 Notes, due June 2027 | | 440,212 | |

| 2028 Notes, due October 2028 | | 750,000 | |

| 2031 Notes, due October 2031 | | 1,000,000 | |

| 2032 Notes, due October 2032 | | 300,000 | |

| 2036 Notes, due December 2036 | | 144,278 | |

| 2041 Notes, due October 2041 | | 750,000 | |

| 2045 Notes, due December 2045 | | 332,587 | |

| 2051 Notes, due October 2051 | | 1,000,000 | |

| Total debt | | $ | 7,061,521 | |

The indentures governing our outstanding notes contain covenants that may limit our ability to: incur, create, assume or guarantee any debt for borrowed money secured by a lien upon a principal property; enter into sale and lease-back transactions with respect to a principal property; and consolidate with or merge into, or transfer or lease all or substantially all of our assets to, any other party. As of February 3, 2024, we were in compliance with these covenants.

Commercial Paper Program

Under our commercial paper program, we may issue short-term, unsecured commercial paper notes in amounts up to a maximum aggregate face amount of $2.5 billion outstanding at any time, with maturities of up to 397 days from the date of issuance. As of February 3, 2024, we had $544.4 million of outstanding borrowings under the commercial paper program recorded in the Condensed Consolidated Balance Sheet. We use the net proceeds of the commercial paper program for general corporate purposes, including without limitation, repayment of indebtedness, stock repurchases, acquisitions, capital expenditures and working capital.

Revolving Credit Facility

Our Third Amended and Restated Revolving Credit Agreement, dated as of June 23, 2021 and as amended (Revolving Credit Agreement), provides for a five year unsecured revolving credit facility in an aggregate principal amount not to exceed $2.5 billion (subject to certain terms and conditions).

We may borrow under this revolving credit facility in the future and use the proceeds for repayment of existing indebtedness, stock repurchases, acquisitions, capital expenditures, working capital and other lawful corporate purposes. The terms of the Revolving Credit Agreement impose restrictions on our ability to undertake certain transactions, to create certain liens on assets and to incur certain subsidiary indebtedness. In addition, the Revolving Credit Agreement contains a consolidated leverage ratio covenant of total consolidated funded debt to consolidated earnings before interest, taxes, depreciation, and amortization (EBITDA) of not greater than 3.5 to 1.0. As of February 3, 2024, we were in compliance with these covenants.

Stock Repurchase Program

In the aggregate, our Board of Directors has authorized us to repurchase $16.7 billion of our common stock under our common stock repurchase program. Unless terminated earlier by resolution of our Board of Directors, the repurchase program will expire when we have repurchased all shares authorized under the program. As of February 3, 2024, an additional $2.0 billion remains available for repurchase under the current authorized program. The repurchased shares are held as authorized but unissued shares of common stock. We also repurchase shares in settlement of employee tax withholding obligations due upon the vesting of restricted stock units/awards or the exercise of stock options as well as for our employee stock purchase plan. Future repurchases of common stock will be dependent upon our financial position, results of operations, outlook, liquidity and other factors we deem relevant.

Capital Expenditures

Net additions to property, plant and equipment were $223.0 million in the first three months of fiscal 2024. We expect capital expenditures for fiscal 2024 to be between approximately $600 million and $800 million. These capital expenditures will be funded with a combination of cash on hand and cash expected to be generated from future operations, together with existing and anticipated available short- and long-term financing.

Dividends