UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO/A

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1)

OR 13(e)(1) OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 3)

MANCHESTER UNITED

plc

(Name of Subject Company (Issuer))

TRAWLERS LIMITED

(Offeror)

a company limited

by shares incorporated under the laws of the Isle of Man and wholly owned by

JAMES A. RATCLIFFE

(Offeror)

(Names of Filing Persons (identifying status

as offeror, issuer or other person))

Class A Ordinary Shares, Par Value $0.0005

Per Share

(Title of Class of Securities)

G5784H106

(CUSIP Number of Class of Securities)

Tristan Head, Officer

Trawlers Limited

Fort Anne

Douglas, IM1 5PD, Isle of Man

Tel. (+44) 1624 826200

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

Copies to:

|

Andrew Jolly, Esq.

Hywel Davis, Esq.

Slaughter and May

One Bunhill Row

London EC1Y 8YY, United Kingdom |

|

Krishna Veeraraghavan, Esq.

Benjamin Goodchild, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison

1285 6th Ave

New York, NY 10019, United States |

|

| ¨ | Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to

which the statement relates:

| x | third-party tender offer subject to Rule 14d-1. |

| ¨ | issuer tender offer subject to Rule 13e-4. |

| ¨ | going-private transaction subject to Rule 13e-3. |

| ¨ | amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting

the results of the tender offer. ¨

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ | Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This Amendment No. 3 (this “Amendment

No. 3”) amends and supplements the Tender Offer Statement on Schedule TO originally filed with the Securities and Exchange

Commission (the “SEC”) on January 17, 2024 (together with any amendments or supplements thereto, the “Schedule TO”)

related to the offer (the “Offer”) by Trawlers Limited (“Purchaser”), a company limited by shares

incorporated under the laws of the Isle of Man and wholly owned by James A. Ratcliffe, a natural person (together with the Purchaser,

the “Offerors”), to purchase up to 13,237,834 Class A ordinary shares, par value $0.0005 per share (“Class

A Shares”), of Manchester United plc (the “Company”), a Cayman Islands exempted company, which, based on

information provided by the Company, represents 25.0% of the issued and outstanding Class A Shares as of the close of business on December

22, 2023, rounded up to the nearest whole Class A Share, at a price of $33.00 per Class A Share, in cash (subject to certain adjustments

as described in Section 13 — “Summary of the Transaction Agreement and Certain Other Agreements” of the Offer

to Purchase (as defined below)), without interest thereon, less any required tax withholding, as described in the Offer to Purchase,

dated January 17, 2024 (together with any amendments or supplements thereto, the “Offer to Purchase”) and in the related

Letter of Transmittal (together with any amendments or supplements thereto, the “Letter of Transmittal”), which are

attached to the Schedule TO as Exhibits (a)(1)(A) and (a)(1)(B), respectively (which collectively constitute the “Offer Documents”). Capitalized terms used, but not otherwise defined, in this Amendment No. 3 shall have the meanings ascribed to them in the Schedule TO.

The information set forth in the Offer Documents

is hereby expressly incorporated herein by reference in response to all items of information required to be included in, or covered by,

the Schedule TO, and is supplemented by the information specifically provided herein. Except as specifically provided herein, this Amendment

No. 3 does not modify any of the information previously reported on the Schedule TO.

ITEMS 1 THROUGH 9 AND 11.

The Offer to Purchase and Items 1 through 9 and Item

11 of the Schedule TO, as amended, to the extent such Items incorporate by reference the information contained in the Offer to Purchase,

is hereby amended and supplemented to include the following:

The Offer and withdrawal rights expired as scheduled at

one minute after 11:59 p.m. Eastern Time on February 16, 2024.

Because the aggregate number of Class A Shares tendered into

the Offer exceeded the Offer Cap, Class A Shares have been accepted on a pro rata basis pursuant to the terms of the Offer. The Offerors

have been advised by Computershare Trust Company, N.A., the depositary for the Offer, that the proration factor for the Offer is approximately 26.2%.

As each of the Offer Conditions have been satisfied or waived,

Purchaser has irrevocably accepted for payment and purchase, and will pay for, 13,237,834 Class A Shares that were validly tendered (not

validly withdrawn).

On February 20, 2024, the Company and the Offerors issued

a joint press release announcing, among other things, the expiration and results of the Offer, a copy of which is attached as Exhibit

(a)(5)(C) hereto.

Item 12 of the Schedule TO is hereby amended and supplemented by adding

the following exhibit:

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: February 20, 2024

| |

TRAWLERS LIMITED |

| |

|

|

| |

By: |

/s/ Tristan Head |

| |

Name: |

Tristan Head |

| |

Title: |

Officer |

| |

JAMES A. RATCLIFFE |

| |

|

|

| |

By: |

/s/ James A. Ratcliffe |

| |

Name: |

James A. Ratcliffe |

EXHIBIT LIST

| Index No. |

|

| |

|

| (a)(1)(A)* |

Offer to Purchase, dated January 17, 2024. |

| (a)(1)(B)* |

Form of Letter of Transmittal. |

| (a)(1)(C)* |

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(D)* |

Form of Letter to Clients for Use by Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees. |

| (a)(1)(E)* |

Form of Summary Advertisement, published January 17, 2024, in the New York Times. |

| (a)(5)(A)* |

Letter to Shareholders, dated February 12, 2024. |

| (a)(5)(B)* |

Press Release, dated February 14, 2024. |

| (a)(5)(C)** |

Press Release, dated February 20, 2024. |

| (b) |

Not applicable. |

| (d)(1) |

Transaction Agreement, dated as of December 24, 2023, by and among Purchaser, Sellers and the Company (incorporated by reference to Exhibit 99.1 of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (d)(2) |

Governance Agreement, dated as of December 24, 2023, by and among Purchaser, Sellers and the Company (incorporated by reference to Exhibit 99.2 of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (d)(3) |

Voting Agreement, dated as of December 24, 2023, by and between Sellers and the Company (incorporated by reference to Exhibit 99.3 of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (d)(4)* |

Equity Commitment Letter, dated as of December 24, 2023, by and between the Offerors. |

| (d)(5) |

Limited Guarantee, dated as of December 24, 2023, entered into by and among James A. Ratcliffe, the Company and Sellers (incorporated by reference to Exhibit 99.4 of the Company’s Current Report on Form 6-K filed December 26, 2023). |

| (g) |

Not applicable. |

| (h) |

Not applicable. |

| 107* |

Filing Fee Table |

Exhibit (a)(5)(c)

| CORPORATE RELEASE |

20 February 2024 |

Manchester United

plc and Trawlers Ltd Announce the

Successful Completion

of Sir Jim Ratcliffe’s Minority Investment

MANCHESTER, England – (BUSINESS WIRE) –20

February 2024 – Manchester United plc (NYSE: MANU), and Trawlers Limited, an entity wholly-owned by Sir Jim Ratcliffe, are pleased

to confirm that Sir Jim Ratcliffe has completed his acquisition of 25% of the club’s Class B shares and 25% of the club’s

Class A shares, following the satisfaction of all conditions, including approvals from the Football Association and the Premier League.

The tender offer (the “Offer”) by

Trawlers Limited for up to 25% of the Class A shares, at a price of $33.00 per share, expired one minute after 11:59 pm Eastern Time on

16 February 2024. Following the expiration, Trawlers Limited accepted for payment 13,237,834 Class A shares validly tendered in the Offer

(and not validly withdrawn), representing 25% of the total outstanding Class A shares as of expiration. Computershare Trust Company N.A.,

the depositary for the Offer, has advised that the proration factor for the Offer is approximately 26.2%.

Following the closing of the Offer and the acquisition

of the Class B shares, Sir Jim has invested $200 million into the club for additional Class A and Class B shares via a primary issuance,

resulting in ownership of approximately 27.7% of the club’s Class A shares and 27.7% of the club’s Class B shares, with a

further $100 million to be invested by 31 December 2024. These funds are intended to enable future investment in infrastructure at Old

Trafford.

Sir Jim Ratcliffe said: “To become co-owner

of Manchester United is a great honour and comes with great responsibility. This marks the completion of the transaction, but just the

beginning of our journey to take Manchester United back to the top of English, European and world football, with world-class facilities

for our fans. Work to achieve those objectives will accelerate from today.”

Joel Glazer, Executive Co-Chairman, said: “I

would like to welcome Sir Jim as co-owner and look forward to working closely with him and INEOS Sport to deliver a bright future for

Manchester United.”

About Manchester United

Manchester United

is one of the most popular and successful sports teams in the world, playing one of the most popular spectator sports on Earth. Through

our 146-year football heritage we have won 67 trophies, enabling us to develop what we believe is one of the world’s leading sports

and entertainment brands with a global community of 1.1 billion fans and followers. Our large, passionate and highly engaged fan base

provides Manchester United with a worldwide platform to generate significant revenue from multiple sources, including sponsorship, merchandising,

product licensing, broadcasting and matchday initiatives which in turn, directly fund our ability to continuously reinvest in the club.

Cautionary Notice Regarding Forward-Looking

Statements

This press

release contains “forward-looking statements,” including, but not limited to, statements about the beliefs and expectations

of Manchester United and Sir Jim Ratcliffe (together with Trawlers Limited, the “Offerors”), the benefits sought to be achieved

by the transactions discussed herein, and the potential effects of the completed transactions on both Manchester United and the Offerors.

In some cases, forward-looking statements may be identified by terminology such as “believe,” “may,” “will,”

“should,” “predict,” “goal,” “strategy,” “potentially,” “estimate,”

“continue,” “anticipate,” “intend,” “could,” “would,” “project,”

“plan,” “expect,” “seek” and similar expressions and variations thereof. These words are intended

to identify forward-looking statements. These forward-looking statements are based on current expectations and projections about future

events, but there can be no guarantee that such expectations and projections will prove accurate in the future. All statements other

than statements of historical fact are forward-looking statements. Actual results may differ materially from current expectations due

to a number of factors. These factors are more fully discussed in the “Risk Factors” section and elsewhere in Manchester

United’s Registration Statement on Form F-1, as amended (File No. 333-182535) and Manchester United’s Annual Report on Form

20-F (File No. 001-35627) as supplemented by the risk factors contained in Manchester United’s other filings with the Securities

and Exchange Commission. Undue reliance should not be placed on these forward-looking statements, which speak only as of the date they

are made. Except as required by law, Manchester United and the Offerors undertake no obligation to publicly release any revisions to

the forward-looking statements after the date hereof to conform these statements to actual results or revised expectations.

Contacts

|

Investor Relations:

Corinna Freedman

Head of Investor Relations

+44 738 491 0828

Corinna.Freedman@manutd.co.uk |

Media Relations:

Andrew Ward

Director of Media Relations & Public Affairs

+44 161 676 7770

andrew.ward@manutd.co.uk |

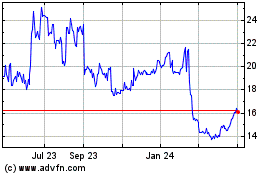

Manchester United (NYSE:MANU)

Historical Stock Chart

From Mar 2024 to Apr 2024

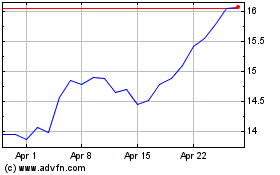

Manchester United (NYSE:MANU)

Historical Stock Chart

From Apr 2023 to Apr 2024