0001130713false00011307132024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

FEBRUARY 16, 2024

Date of Report (date of earliest event reported)

Beyond, Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 000-41850 | | 87-0634302 |

| (State or other jurisdiction of | | (Commission File Number) | | (I.R.S. Employer |

| incorporation or organization) | | | | Identification Number) |

799 W. Coliseum Way

Midvale, Utah 84047

(Address of principal executive offices)

(801) 947-3100

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | BYON | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Executive Chairman of the Board of Beyond

On February 16, 2024, the Board of Directors (the “Board”) of Beyond, Inc. (“Beyond”) appointed Marcus Lemonis to serve as the Executive Chairman of the Board of Beyond, effective February 20, 2024. Mr. Lemonis joined the Board of Beyond on October 2, 2023, and has served as Chairman of the Board since December 10, 2023.

In connection with Mr. Lemonis’ commencement of service as Chairman of the Board in December 2023, the Compensation Committee of the Board and the Board considered the compensation package for Mr. Lemonis. Following deliberation, the Board determined that his compensation package for his role as Chairman of the Board, and commencing February 20, 2024, as Executive Chairman, would be comprised entirely of performance-based stock options with rigorous stock price hurdles to clearly align his compensation with the creation of meaningful, long-term stockholder value above the trading price of Beyond’s common stock at the time Mr. Lemonis first joined the Board. The performance-based stock option award to Mr. Lemonis is being granted to him for his services as Executive Chairman and will be a stand-alone award and will not be granted under Beyond’s 2005 Equity Incentive Plan. Mr. Lemonis will not receive any guaranteed compensation, whether in the form of cash or equity compensation, nor will he receive the cash or equity compensation paid to other non-employee members of the Board under Beyond’s non-employee director compensation program.

Beyond has created a performance-based stock option award for Mr. Lemonis that incentivizes him to not only continue to lead the company over the long term, but also to realize significant value for Beyond’s stockholders. On February 20, 2024, the Board granted to Mr. Lemonis, the “Executive Chairman Performance Award,” which is a stock option award that recognizes the large potential that Beyond’s Board believes could be achievable under Mr. Lemonis’ leadership. The closing price of Beyond’s common stock on the date that Mr. Lemonis was appointed to the Board, October 2, 2023, was $15.04, and the closing price of Beyond’s Common Stock on February 16, 2024 was $25.89, an approximately 72% increase.

The Executive Chairman Performance Award consists of stock options to purchase up to 2,250,000 shares of Beyond common stock with exercise prices and vesting conditions that represent ambitious stock price growth milestones above the trading price of Beyond common stock at the time Mr. Lemonis joined the Board. As a result, the Executive Chairman Performance Award will have value only in the event Beyond’s stock price equals or exceeds the stock price hurdles as follows:

•$45.00 Stock Price Hurdle: 500,000 of the stock options granted to Mr. Lemonis (“Tranche 1”) have an exercise price of $45.00 per share and will only vest if the average per-share closing price of Beyond’s common stock over any 20 consecutive trading day period following the grant date but prior to the second anniversary of the grant date equals or exceeds $45.00, subject to continued service through the vesting date.

•$50.00 Stock Price Hurdle: 750,000 of the stock options granted to Mr. Lemonis (“Tranche 2”) have an exercise price of $50.00 per share and will only vest if the average per-share closing price of Beyond’s common stock over any 20 consecutive trading day period following the grant date but prior to the third anniversary of the grant date equals or exceeds $50.00, subject to continued service through the vesting date.

•$60.00 Stock Price Hurdle: 1,000,000 of the stock options granted to Mr. Lemonis (“Tranche 3”) have an exercise price of $60.00 per share and will only vest if the average per-share closing price of Beyond’s common stock over any 20 consecutive trading day period following the grant date but prior to the fourth anniversary of the grant date equals or exceeds $60.00, subject to continued service through the vesting date.

Each tranche will also be subject to a minimum time vesting condition. The Compensation Committee and the Board granted the Executive Chairman Performance Award after a deliberate review process, in which the Compensation Committee and the Board received advice from a leading independent compensation consultant, as well as discussions with Mr. Lemonis, who otherwise recused himself from the Board’s deliberations.

At Mr. Lemonis’ request, the Executive Chairman Performance Award will be subject to stockholder approval. As a result, at the 2024 annual meeting of stockholders, the Board will recommend that Beyond’s stockholders approve the Executive Chairman Performance Award. In the event the stockholders do not approve the Executive Chairman Performance Award at the 2024 annual meeting, the Executive Chairman Performance Award will be forfeited.

To the extent one or more of the price hurdles have been achieved but the time-vesting condition has not yet been achieved, the earned portion of the Executive Chairman Performance Award will vest in the event Mr. Lemonis is removed as Executive Chairman of the Board without cause or is not nominated for reelection at any annual meeting of stockholders, or in the event of his death or disability. In addition, the Executive Chairman Performance Award will vest upon a change in control of Beyond to the extent a price hurdle is achieved based on the stock price at the time of the change in control. It is not currently expected that Mr. Lemonis will receive any new equity awards during the performance period of the Executive Chairman Performance Award, except where deemed appropriate by the Board.

The foregoing discussion of the proposed Executive Chairman Performance Award to be submitted for stockholder approval at Beyond’s 2024 annual meeting of stockholders is qualified in its entirety by the description of the Executive Chairman Performance Award and the form of award agreement to be included in Beyond’s definitive proxy statement to be filed with respect to such annual meeting.

Item 7.01. Regulation FD Disclosure

On February 20, 2024, Beyond, issued a press release announcing the appointment described above.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The information contained in this Item 7.01 and the press release furnished as Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is not incorporated by reference into any of Beyond’s filings under the Securities Act of 1933, as amended (the “Securities Act”), whether made before or after the date hereof, except as shall be expressly set forth by specific reference in any such filing.

Forward-Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act and the Exchange Act. Such forward-looking statements include all statements other than statements of historical fact, including but not limited to statements about the grant of, and the expected terms of, the proposed Executive Chairman Performance Award described herein. Additional information regarding factors that could materially affect results and the accuracy of the forward-looking statements contained herein may be found in Beyond’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on February 24, 2023, as updated by Beyond’s Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on October 31, 2023, and in our subsequent filings with the SEC.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

Exhibit No. | Description of Exhibit |

| Press Release dated February 20, 2024 |

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

| | | | | | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | |

| | BEYOND, INC. |

| | |

| By: | /s/ E. Glen Nickle |

| | E. Glen Nickle |

| | Chief Legal Officer |

| Date: | February 20, 2024 |

Exhibit 99.1

Marcus Lemonis Appointed Executive Chairman of Beyond, Inc.

MIDVALE, Utah, February 20, 2024 — Beyond, Inc. (NYSE: BYON), owner of Bed Bath & Beyond, Overstock.com, and other online retail brands designed to unlock your home’s potential, today announced that on February 16, 2024, it appointed Marcus Lemonis as Executive Chairman of the board of directors, effective today. Lemonis has been a director of Beyond since October 2023 and the Chairman of its board since December 2023. As Executive Chairman, Lemonis will work closely with the management team to lead and execute Beyond's strategic priorities, including expanding customer offerings, driving operational excellence, and enhancing shareholder value.

"We look forward to continuing to work with Marcus in his new role as Executive Chairman of the board," said William Nettles, Independent Board Member and Chair of the Audit Committee. "His extensive experience and strategic insight have been instrumental in evolving our company since he joined the board. We are confident that his leadership will position us for the next phase of growth to deliver value to our employees, customers, and shareholders through what we anticipate will be an exciting blend of new brands and services.”

With more than 25 years of experience in business development and retail growth, Lemonis brings broad expertise in growing and scaling companies from the inside out. He is currently the Chairman and Chief Executive Officer of Camping World Holdings, Inc., responsible for growing both Camping World and its sister membership and services company Good Sam from the ground up to become the World’s Largest RV and outdoor retail affinity group. He’s well-known for his business acumen highlighted on CNBC’s The Profit where he famously advised small businesses to focus on their people, process, and products to achieve stability and profitability. Lemonis also helps homeowners improve the value and function of their homes on his hit TV show, The Renovator.

"I am honored to be taking on the role as Executive Chairman of the Beyond Board of Directors," said Lemonis. "I’ve enjoyed getting to know the talented team at Beyond over the past several months and I look forward to working with them more closely to capitalize on growth opportunities and set us up for the future.”

In connection with Lemonis’s service as Executive Chairman, he will receive no salary or guaranteed equity. Rather, his compensation will be comprised entirely of performance-based stock options with rigorous stock price hurdles to clearly align his compensation with the creation of meaningful, long-term stockholder value above the trading price of Beyond’s common stock when Lemonis joined the Board.

About Beyond

Beyond, Inc. (NYSE:BYON), based in Midvale, Utah, is an ecommerce expert with a singular focus: connecting consumers with products they love. The Company owns the Bed Bath & Beyond brand and associated intellectual property. Bed Bath & Beyond is an online furniture and home furnishings retailer in the United States and Canada. The leading ecommerce website sells a broad range of quality, on-trend home products at competitive prices, including furniture, bedding and bath, patio and outdoor, area rugs, tabletop and cookware, décor, storage and organization, small appliances, home improvement, and more. The online shopping site features millions of products that tens of millions of customers visit each month. Beyond regularly posts information about the Company and other related matters on the Newsroom and Investor Relations pages on its website.

Beyond, Bed Bath & Beyond, Welcome Rewards, Overstock and Overstock Government are trademarks of Beyond, Inc. Other service marks, trademarks and trade names which may be referred to herein are the property of their respective owners.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Such forward-looking statements include all statements other than statements of historical fact, including but not limited to statements regarding our future performance and the achievement of performance targets. Additional information regarding factors that could materially affect results and the accuracy of the forward-looking statements contained herein may be found in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2022, filed with the SEC on February 24, 2023, as updated by the Form 10-Q for the quarter ended September 30, 2023, filed with the SEC on October 31, 2023, and in our subsequent filings with the SEC.

Beyond, Inc. Media Relations:

Sarah Factor

pr@beyond.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

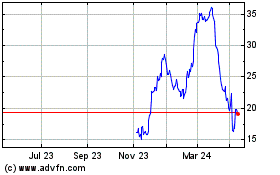

Beyond (NYSE:BYON)

Historical Stock Chart

From Mar 2024 to Apr 2024

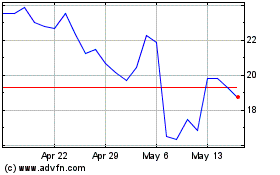

Beyond (NYSE:BYON)

Historical Stock Chart

From Apr 2023 to Apr 2024