DANA INC false 0000026780 0000026780 2024-02-20 2024-02-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 20, 2024

Dana Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-1063 |

|

26-1531856 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

3939 Technology Drive, Maumee, Ohio 43537

(Address of principal executive offices) (Zip Code)

(419) 887-3000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

|

|

| Title of Each Class |

|

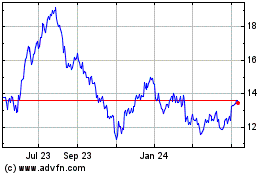

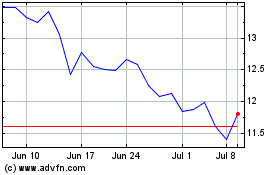

Trading

Symbol |

|

Name of Each Exchange

on which Registered |

| Common Stock, $.01 par value |

|

DAN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Items 2.02 and 7.01 Results of Operations and Financial Condition and Regulation FD Disclosure

Dana Incorporated today issued a news release announcing its results for the quarter ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information in this report is being “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, is not subject to the liabilities of that section and is not deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. The following item is furnished with this report.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

DANA INCORPORATED |

|

|

|

|

| Date: February 20, 2024 |

|

|

|

By: |

|

/s/ Douglas H. Liedberg |

|

|

|

|

Name: |

|

Douglas H. Liedberg |

|

|

|

|

Title: |

|

Senior Vice President, General Counsel and Secretary |

3

Exhibit 99.1

IMMEDIATE

Dana Incorporated Reports 2023 Record Sales and Profit Growth of 21 Percent,

Including Margin Improvement of 110 Basis Points;

Company Increases New Business Sales Backlog to Record $950 Million

Full-year Results

| |

• |

|

Sales of $10.6 billion, an increase of $0.4 billion

or 4 percent over last year |

| |

• |

|

Net income of $38 million, compared with a net loss of $242 million in

2022 |

| |

• |

|

Adjusted EBITDA of $845 million, an increase of $145 million over

last year |

| |

• |

|

Adjusted EBITDA margin of 8 percent, a

110-basis-point improvement compared with 2022 |

| |

• |

|

Operating cash flow of $476 million |

| |

• |

|

Record three-year new business sales backlog of $950 million, a

$50 million increase over prior backlog |

| |

• |

|

2024 guidance of approximately 3 percent increase in sales, 10 percent

increase in adjusted EBITDA, $75 million increase in free cash flow |

MAUMEE, Ohio, Feb. 20, 2024 – Dana

Incorporated (NYSE: DAN) today announced financial results for the fourth quarter and full-year 2023.

“With record sales reaching

$10.6 billion for 2023, Dana continues its strong trajectory built on our balanced approach of supplying both conventional and clean-energy solutions to nearly every vehicle manufacturer around the globe. The Dana team successfully launched a

company-record number of programs across all markets we serve, while delivering substantial profit conversion on our growth,” said James Kamsickas, chairman and chief executive officer.

“We are building on this strong momentum, as we expect to further expand sales and profit margin into 2024. Our record three-year new business backlog

has grown to $950 million, marking the seventh consecutive year we have recorded an increase. This reflects our team’s relentless commitment to being a leading supplier to the world’s top vehicle manufacturers for internal combustion,

hybrid, and electric vehicles.”

Fourth-quarter 2023 Financial Results

Sales for the fourth quarter of 2023 totaled $2.5 billion, compared with $2.6 billion in the same period of 2022. Lower sales in 2023 were driven

by the impact of the UAW strike on our Light Vehicle Driveline segment, which was partially offset by cost-recovery actions and conversion of the sales backlog.

Adjusted EBITDA for the fourth quarter of 2023 was $156 million, compared with $176 million for the same period in 2022. Strong efficiency

improvements partially offset the margin impact of the UAW strike and higher spending on development for electric-vehicle products.

The net loss

attributable to Dana was $39 million, or $0.27 per share, compared with a net loss of $179 million, or $1.25 per share, in the fourth quarter of 2022 due primarily to the impact of the UAW strike, lower earnings from equity-method

affiliates, and the devaluation of the Argentine peso. The loss in 2022 resulted primarily from the recording of non-cash tax valuation allowances.

The adjusted net loss attributable to Dana was $11 million, or $0.08 per share, for the fourth quarter of 2023, compared with an adjusted net loss of

$15 million or $0.10 earnings per share in 2022. Operating cash flow in the fourth quarter of 2023 was $278 million, compared with $342 million in the same period of 2022. Free cash flow was $136 million, compared with

$202 million in the fourth quarter of 2022. The decrease was driven by higher working capital requirements.

Full-year 2023 Financial

Results

Sales for 2023 were $10.6 billion, compared with $10.2 billion in 2022. The increase of $399 million

resulted from improved overall market demand and conversion of the sales backlog, combined with pricing actions and cost recoveries partially offset by the UAW strike.

1

Adjusted EBITDA for 2023 was $845 million, compared with $700 million in 2022 driven by

refreshed and new programs, efficiency improvement actions, and more stable customer order patterns.

The net income attributable to Dana for 2023

was $38 million or $0.26 per share, compared with a net loss of $242 million or a loss of $1.69 per share in 2022. The loss in 2022 resulted from a one-time

non-cash goodwill impairment charge and from non-cash tax valuation allowances.

Adjusted net income attributable to Dana was $122 million and diluted adjusted earnings per share were $0.84 in 2023, compared

with an adjusted net income of $54 million and $0.37 per share in 2022.

The company reported operating cash flow of $476 million in

2023. Free cash flow was a use of $25 million, compared with free cash flow of $209 million in 2022. Cash flow use this year was driven by increased working capital requirements and higher capital spending partially offset by higher

operating earnings.

“Finishing 2023 with strong results has set the stage for continued profitable growth,” said Timothy Kraus, Dana

senior vice president and chief financial officer. “In 2024, we expect another record sales year, further improved margins, and higher free cash flow as we leverage the improved cross-company efficiencies and begin to benefit from the record

number of new and refreshed vehicle programs.”

2024 Financial Targets

| |

• |

|

Sales of $10.65 to $11.15 billion; |

| |

• |

|

Adjusted EBITDA of $875 to $975 million, an implied adjusted EBITDA margin of approximately

8.5 percent at the midpoint of the range; |

| |

• |

|

Operating cash flow of approximately $475 to $525 million; and |

| |

• |

|

Free cash flow of $25 to $75 million; |

| |

• |

|

Diluted EPS of $0.35 to $0.85. |

Dana to Host Conference Call at 10 a.m. Tuesday, Feb. 20

Dana will discuss its fourth-quarter and full-year results in a conference call at 10 a.m. EST on Tuesday, Feb. 20. The conference call can be

accessed by telephone from both domestic and international locations using the information provided below:

Conference ID: 9943139

Participant Toll-Free Dial-In Number: 1 (888) 440-5873

Participant Toll Dial-In Number: 1 (646) 960-0319

Audio streaming and slides will be available online via a link provided on the Dana investor website:

www.dana.com/investors. Phone registration will be available beginning at 9:30 a.m. EST.

A webcast replay can be accessed via Dana’s investor website following the call.

Non-GAAP Financial Information

Adjusted EBITDA is a non-GAAP financial measure which we have defined as net income (loss) before interest, income

taxes, depreciation, amortization, equity grant expense, restructuring expense, non-service cost components of pension and other postretirement benefit costs and other adjustments not related to our core

operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to invest in our operations and provide shareholder returns. We use adjusted

EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In addition to its use by management, we also believe adjusted EBITDA is a

measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA should not be considered a substitute for earnings (loss) before income

taxes, net income (loss) or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Adjusted net income (loss) attributable to the parent company is a non-GAAP financial measure which we have defined

as net income (loss) attributable to the parent company, excluding any discrete income tax items, restructuring charges, amortization expense and other adjustments not related to our core operations

2

(as used in adjusted EBITDA), net of any associated income tax effects. This measure is considered useful for purposes of providing investors, analysts and other interested parties with an

indicator of ongoing financial performance that provides enhanced comparability to net income attributable to the parent company reported by other companies. Adjusted net income (loss) attributable to the parent company is neither intended to

represent nor be an alternative measure to net income (loss) attributable to the parent company reported in accordance with GAAP.

Diluted adjusted

EPS is a non-GAAP financial measure which we have defined as adjusted net income (loss) attributable to the parent company divided by adjusted diluted shares. We define adjusted diluted shares as diluted

shares as determined in accordance with GAAP based on adjusted net income (loss) attributable to the parent company. This measure is considered useful for purposes of providing investors, analysts and other interested parties with an indicator of

ongoing financial performance that provides enhanced comparability to EPS reported by other companies. Diluted adjusted EPS is neither intended to represent nor be an alternative measure to diluted EPS reported in accordance with GAAP.

Free cash flow is a non-GAAP financial measure which we have defined as net cash provided by (used in) operating

activities less purchases of property, plant and equipment. We believe free cash flow is useful to investors in evaluating the operational cash flow of the company inclusive of the spending required to maintain the operations. Free cash flow is not

intended to represent nor be an alternative to the measure of net cash provided by (used in) operating activities reported in accordance with GAAP. Free cash flow may not be comparable to similarly titled measures reported by other companies.

The accompanying financial information provides reconciliations of adjusted EBITDA, diluted adjusted EPS and free cash flow to the most directly

comparable financial measures calculated and presented in accordance with GAAP. We have not provided a reconciliation of our adjusted EBITDA and diluted adjusted EPS outlook to the most comparable GAAP measures of net income (loss) and diluted EPS.

Providing net income (loss) and diluted EPS guidance is potentially misleading and not practical given the difficulty of projecting event driven transactional and other non-core operating items that are

included in net income (loss) and diluted EPS, including restructuring actions, asset impairments and certain income tax adjustments. The accompanying reconciliations of these non-GAAP measures with the most

comparable GAAP measures for the historical periods presented are indicative of the reconciliations that will be prepared upon completion of the periods covered by the non-GAAP guidance.

Forward-Looking Statements

Certain statements

and projections contained in this news release are, by their nature, forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations, estimates, and

projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as “anticipates,”

“expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,” “would,” “could,”

“potential,” “continue,” “ongoing,” and similar expressions, and variations or negatives of these words. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties, and

assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement.

Dana’s Annual Report on Form 10-K, subsequent Quarterly Reports on Form

10-Q, recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business, results of

operations and financial condition. The forward-looking statements in this news release speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason.

About Dana Incorporated

Dana is a leader in

the design and manufacture of highly efficient propulsion and energy-management solutions that power vehicles and machines in all mobility markets across the globe. The company is shaping sustainable progress through its conventional and

clean-energy solutions that support nearly every vehicle manufacturer with drive and motion systems; electrodynamic technologies, including software and controls; and thermal, sealing, and digital solutions.

3

Based in Maumee, Ohio, USA, the company reported sales of $10.6 billion in 2023 with 42,000 people

in 31 countries across six continents. With a history dating to 1904, Dana was named among the “World’s Most Ethical Companies” for 2023 by Ethisphere and as one of “America’s Most Responsible Companies 2023” by

Newsweek. The company is driven by a high-performance culture that focuses on valuing others, inspiring innovation, growing responsibly, and winning together, earning it global recognition as a top employer. Learn more at

dana.com.

###

|

|

|

|

|

| Contact: |

|

Craig Barber |

|

|

|

|

+1-419-887-5166 |

|

|

|

|

craig.barber@dana.com |

|

|

4

DANA INCORPORATED

Consolidated Statement of Operations (Unaudited)

For

the Three Months Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions, except per share amounts) |

|

Three Months Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net sales |

|

$ |

2,494 |

|

|

$ |

2,555 |

|

| Costs and expenses |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

2,330 |

|

|

|

2,375 |

|

| Selling, general and administrative expenses |

|

|

139 |

|

|

|

121 |

|

| Amortization of intangibles |

|

|

3 |

|

|

|

4 |

|

| Restructuring charges, net |

|

|

4 |

|

|

|

|

|

| Other income (expense), net |

|

|

(7 |

) |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

| Earnings before interest and income taxes |

|

|

11 |

|

|

|

62 |

|

| Interest income |

|

|

3 |

|

|

|

5 |

|

| Interest expense |

|

|

40 |

|

|

|

33 |

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) before income taxes |

|

|

(26 |

) |

|

|

34 |

|

| Income tax expense |

|

|

3 |

|

|

|

217 |

|

| Equity in earnings (loss) of affiliates |

|

|

(15 |

) |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

(44 |

) |

|

|

(178 |

) |

| Less: Noncontrolling interests net income |

|

|

5 |

|

|

|

4 |

|

| Less: Redeemable noncontrolling interests net loss |

|

|

(10 |

) |

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

| Net loss attributable to the parent company |

|

$ |

(39 |

) |

|

$ |

(179 |

) |

|

|

|

|

|

|

|

|

|

| Net loss per share available to common stockholders |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

(0.27 |

) |

|

$ |

(1.25 |

) |

| Diluted |

|

$ |

(0.27 |

) |

|

$ |

(1.25 |

) |

| Weighted-average shares outstanding - Basic |

|

|

144.5 |

|

|

|

143.4 |

|

| Weighted-average shares outstanding - Diluted |

|

|

144.5 |

|

|

|

143.4 |

|

DANA INCORPORATED

Consolidated Statement of Operations

For the Year

Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions, except per share amounts) |

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net sales |

|

$ |

10,555 |

|

|

$ |

10,156 |

|

| Costs and expenses |

|

|

|

|

|

|

|

|

| Cost of sales |

|

|

9,655 |

|

|

|

9,393 |

|

| Selling, general and administrative expenses |

|

|

549 |

|

|

|

495 |

|

| Amortization of intangibles |

|

|

13 |

|

|

|

14 |

|

| Restructuring charges, net |

|

|

25 |

|

|

|

(1 |

) |

| Impairment of goodwill |

|

|

|

|

|

|

(191 |

) |

| Other income (expense), net |

|

|

3 |

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

| Earnings before interest and income taxes |

|

|

316 |

|

|

|

86 |

|

| Loss on extinguishment of debt |

|

|

(1 |

) |

|

|

|

|

| Interest income |

|

|

17 |

|

|

|

11 |

|

| Interest expense |

|

|

154 |

|

|

|

128 |

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) before income taxes |

|

|

178 |

|

|

|

(31 |

) |

| Income tax expense |

|

|

121 |

|

|

|

284 |

|

| Equity in earnings (loss) of affiliates |

|

|

(9 |

) |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

|

48 |

|

|

|

(311 |

) |

| Less: Noncontrolling interests net income |

|

|

22 |

|

|

|

15 |

|

| Less: Redeemable noncontrolling interests net loss |

|

|

(12 |

) |

|

|

(84 |

) |

|

|

|

|

|

|

|

|

|

| Net income (loss) attributable to the parent company |

|

$ |

38 |

|

|

$ |

(242 |

) |

|

|

|

|

|

|

|

|

|

| Net income (loss) per share available to common stockholders |

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.26 |

|

|

$ |

(1.69 |

) |

| Diluted |

|

$ |

0.26 |

|

|

$ |

(1.69 |

) |

| Weighted-average shares outstanding - Basic |

|

|

144.4 |

|

|

|

143.6 |

|

| Weighted-average shares outstanding - Diluted |

|

|

144.6 |

|

|

|

143.6 |

|

DANA INCORPORATED

Consolidated Statement of Comprehensive Income (Unaudited)

For the Three Months Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Three Months Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net loss |

|

$ |

(44 |

) |

|

$ |

(178 |

) |

| Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

| Currency translation adjustments |

|

|

36 |

|

|

|

32 |

|

| Hedging gains and losses |

|

|

2 |

|

|

|

19 |

|

| Defined benefit plans |

|

|

(16 |

) |

|

|

48 |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income |

|

|

22 |

|

|

|

99 |

|

|

|

|

|

|

|

|

|

|

| Total comprehensive loss |

|

|

(22 |

) |

|

|

(79 |

) |

| Less: Comprehensive income attributable to noncontrolling interests |

|

|

(6 |

) |

|

|

(4 |

) |

| Less: Comprehensive (income) loss attributable to redeemable noncontrolling interests |

|

|

6 |

|

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

| Comprehensive loss attributable to the parent company |

|

$ |

(22 |

) |

|

$ |

(85 |

) |

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Consolidated Statement of Comprehensive Income

For the

Year Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net income (loss) |

|

$ |

48 |

|

|

$ |

(311 |

) |

| Other comprehensive income (loss), net of tax: |

|

|

|

|

|

|

|

|

| Currency translation adjustments |

|

|

30 |

|

|

|

(102 |

) |

| Hedging gains and losses |

|

|

(1 |

) |

|

|

17 |

|

| Defined benefit plans |

|

|

(16 |

) |

|

|

53 |

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

13 |

|

|

|

(32 |

) |

|

|

|

|

|

|

|

|

|

| Total comprehensive income (loss) |

|

|

61 |

|

|

|

(343 |

) |

| Less: Comprehensive income attributable to noncontrolling interests |

|

|

(22 |

) |

|

|

(10 |

) |

| Less: Comprehensive loss attributable to redeemable noncontrolling interests |

|

|

10 |

|

|

|

95 |

|

|

|

|

|

|

|

|

|

|

| Comprehensive income (loss) attributable to the parent company |

|

$ |

49 |

|

|

$ |

(258 |

) |

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Consolidated Balance Sheet

As of December 31,

2023 and December 31, 2022

|

|

|

|

|

|

|

|

|

| (In millions, except share and per share amounts) |

|

December 31,

2023 |

|

|

December 31,

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

529 |

|

|

$ |

425 |

|

| Accounts receivable |

|

|

|

|

|

|

|

|

| Trade, less allowance for doubtful accounts of $16 in 2023 and $11 in 2022 |

|

|

1,371 |

|

|

|

1,374 |

|

| Other |

|

|

280 |

|

|

|

202 |

|

| Inventories |

|

|

1,676 |

|

|

|

1,609 |

|

| Other current assets |

|

|

247 |

|

|

|

219 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

4,103 |

|

|

|

3,829 |

|

| Goodwill |

|

|

263 |

|

|

|

259 |

|

| Intangibles |

|

|

182 |

|

|

|

201 |

|

| Deferred tax assets |

|

|

516 |

|

|

|

397 |

|

| Other noncurrent assets |

|

|

140 |

|

|

|

123 |

|

| Investments in affiliates |

|

|

123 |

|

|

|

136 |

|

| Operating lease assets |

|

|

327 |

|

|

|

311 |

|

| Property, plant and equipment, net |

|

|

2,311 |

|

|

|

2,193 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

7,965 |

|

|

$ |

7,449 |

|

|

|

|

|

|

|

|

|

|

| Liabilities, redeemable noncontrolling interests and equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Short-term debt |

|

$ |

22 |

|

|

$ |

52 |

|

| Current portion of long-term debt |

|

|

35 |

|

|

|

8 |

|

| Accounts payable |

|

|

1,756 |

|

|

|

1,838 |

|

| Accrued payroll and employee benefits |

|

|

288 |

|

|

|

214 |

|

| Taxes on income |

|

|

86 |

|

|

|

54 |

|

| Current portion of operating lease liabilities |

|

|

42 |

|

|

|

36 |

|

| Other accrued liabilities |

|

|

373 |

|

|

|

277 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

2,602 |

|

|

|

2,479 |

|

| Long-term debt, less debt issuance costs of $24 in 2023 and $22 in 2022 |

|

|

2,598 |

|

|

|

2,348 |

|

| Noncurrent operating lease liabilities |

|

|

284 |

|

|

|

277 |

|

| Pension and postretirement obligations |

|

|

334 |

|

|

|

298 |

|

| Other noncurrent liabilities |

|

|

319 |

|

|

|

249 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

6,137 |

|

|

|

5,651 |

|

|

|

|

|

|

|

|

|

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Redeemable noncontrolling interests |

|

|

191 |

|

|

|

195 |

|

| Parent company stockholders’ equity |

|

|

|

|

|

|

|

|

| Preferred stock, 50,000,000 shares authorized, $0.01 par value, no shares outstanding |

|

|

— |

|

|

|

— |

|

| Common stock, 450,000,000 shares authorized, $0.01 par value, 144,386,484 and 143,366,482 shares

outstanding |

|

|

2 |

|

|

|

2 |

|

| Additional paid-in capital |

|

|

2,255 |

|

|

|

2,229 |

|

| Retained earnings |

|

|

317 |

|

|

|

321 |

|

| Treasury stock, at cost (474,981 and zero shares) |

|

|

(9 |

) |

|

|

— |

|

| Accumulated other comprehensive loss |

|

|

(990 |

) |

|

|

(1,001 |

) |

|

|

|

|

|

|

|

|

|

| Total parent company stockholders’ equity |

|

|

1,575 |

|

|

|

1,551 |

|

| Noncontrolling interests |

|

|

62 |

|

|

|

52 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

1,637 |

|

|

|

1,603 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities, redeemable noncontrolling interests and equity |

|

$ |

7,965 |

|

|

$ |

7,449 |

|

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Consolidated Statement of Cash Flows (Unaudited)

For

the Three Months Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Three Months Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(44 |

) |

|

$ |

(178 |

) |

| Depreciation |

|

|

106 |

|

|

|

95 |

|

| Amortization |

|

|

6 |

|

|

|

6 |

|

| Amortization of deferred financing charges |

|

|

1 |

|

|

|

1 |

|

| Earnings of affiliates, net of dividends received |

|

|

15 |

|

|

|

(6 |

) |

| Stock compensation expense |

|

|

7 |

|

|

|

6 |

|

| Deferred income taxes |

|

|

(58 |

) |

|

|

209 |

|

| Pension expense, net |

|

|

(1 |

) |

|

|

(1 |

) |

| Change in working capital |

|

|

239 |

|

|

|

220 |

|

| Change in other noncurrent assets and liabilities |

|

|

11 |

|

|

|

3 |

|

| Other, net |

|

|

(4 |

) |

|

|

(13 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

278 |

|

|

|

342 |

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Purchases of property, plant and equipment |

|

|

(142 |

) |

|

|

(140 |

) |

| Proceeds from sale of property, plant and equipment |

|

|

2 |

|

|

|

3 |

|

| Proceeds from sales of marketable securities |

|

|

|

|

|

|

12 |

|

| Settlements of undesignated derivatives |

|

|

(3 |

) |

|

|

(2 |

) |

| Other, net |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(145 |

) |

|

|

(129 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Net change in short-term debt |

|

|

(15 |

) |

|

|

(179 |

) |

| Repayment of long-term debt |

|

|

(2 |

) |

|

|

(5 |

) |

| Dividends paid to common stockholders |

|

|

(15 |

) |

|

|

(15 |

) |

| Distributions to noncontrolling interests |

|

|

|

|

|

|

(1 |

) |

| Contributions from redeemable noncontrolling interests |

|

|

4 |

|

|

|

21 |

|

| Other, net |

|

|

(1 |

) |

|

|

(1 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(29 |

) |

|

|

(180 |

) |

|

|

|

|

|

|

|

|

|

| Net increase in cash, cash equivalents and restricted cash |

|

|

104 |

|

|

|

33 |

|

| Cash, cash equivalents and restricted cash - beginning of period |

|

|

440 |

|

|

|

390 |

|

| Effect of exchange rate changes on cash balances |

|

|

19 |

|

|

|

19 |

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash - end of period |

|

$ |

563 |

|

|

$ |

442 |

|

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Consolidated Statement of Cash Flows

For the Year

Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Operating activities |

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

48 |

|

|

$ |

(311 |

) |

| Depreciation |

|

|

393 |

|

|

|

365 |

|

| Amortization |

|

|

23 |

|

|

|

23 |

|

| Amortization of deferred financing charges |

|

|

5 |

|

|

|

5 |

|

| Write-off of deferred financing costs |

|

|

1 |

|

|

|

|

|

| Earnings of affiliates, net of dividends received |

|

|

11 |

|

|

|

23 |

|

| Stock compensation expense |

|

|

26 |

|

|

|

19 |

|

| Deferred income taxes |

|

|

(104 |

) |

|

|

153 |

|

| Pension expense, net |

|

|

3 |

|

|

|

(1 |

) |

| Impairment of goodwill |

|

|

|

|

|

|

191 |

|

| Change in working capital |

|

|

70 |

|

|

|

199 |

|

| Change in other noncurrent assets and liabilities |

|

|

11 |

|

|

|

9 |

|

| Other, net |

|

|

(11 |

) |

|

|

(26 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

476 |

|

|

|

649 |

|

|

|

|

|

|

|

|

|

|

| Investing activities |

|

|

|

|

|

|

|

|

| Purchases of property, plant and equipment |

|

|

(501 |

) |

|

|

(440 |

) |

| Proceeds from sale of property, plant and equipment |

|

|

2 |

|

|

|

3 |

|

| Acquisition of business, net of cash acquired |

|

|

|

|

|

|

(1 |

) |

| Purchases of marketable securities |

|

|

|

|

|

|

(15 |

) |

| Proceeds from sales of marketable securities |

|

|

|

|

|

|

30 |

|

| Settlements of undesignated derivatives |

|

|

(13 |

) |

|

|

(8 |

) |

| Other, net |

|

|

(16 |

) |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(528 |

) |

|

|

(426 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities |

|

|

|

|

|

|

|

|

| Net change in short-term debt |

|

|

(30 |

) |

|

|

33 |

|

| Proceeds from long-term debt |

|

|

458 |

|

|

|

2 |

|

| Repayment of long-term debt |

|

|

(209 |

) |

|

|

(24 |

) |

| Deferred financing payments |

|

|

(9 |

) |

|

|

|

|

| Dividends paid to common stockholders |

|

|

(58 |

) |

|

|

(58 |

) |

| Repurchases of common stock |

|

|

|

|

|

|

(25 |

) |

| Distributions to noncontrolling interests |

|

|

(10 |

) |

|

|

(9 |

) |

| Contributions from redeemable noncontrolling interests |

|

|

22 |

|

|

|

51 |

|

| Payments to acquire noncontrolling interests |

|

|

|

|

|

|

(4 |

) |

| Other, net |

|

|

(4 |

) |

|

|

(8 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

|

160 |

|

|

|

(42 |

) |

|

|

|

|

|

|

|

|

|

| Net increase in cash, cash equivalents and restricted cash |

|

|

108 |

|

|

|

181 |

|

| Cash, cash equivalents and restricted cash - beginning of period |

|

|

442 |

|

|

|

287 |

|

| Effect of exchange rate changes on cash balances |

|

|

13 |

|

|

|

(26 |

) |

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and restricted cash - end of period |

|

$ |

563 |

|

|

$ |

442 |

|

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Reconciliation of Net Cash Provided By Operating Activities to Free Cash Flow (Unaudited)

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Three Months Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net cash provided by operating activities |

|

$ |

278 |

|

|

$ |

342 |

|

| Purchases of property, plant and equipment |

|

|

(142 |

) |

|

|

(140 |

) |

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

$ |

136 |

|

|

$ |

202 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net cash provided by operating activities |

|

$ |

476 |

|

|

$ |

649 |

|

| Purchases of property, plant and equipment |

|

|

(501 |

) |

|

|

(440 |

) |

|

|

|

|

|

|

|

|

|

| Free cash flow |

|

$ |

(25 |

) |

|

$ |

209 |

|

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Segment Sales and Segment EBITDA (Unaudited)

For the

Three Months Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Three Months Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Sales |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

923 |

|

|

$ |

1,030 |

|

| Commercial Vehicle |

|

|

509 |

|

|

|

504 |

|

| Off-Highway |

|

|

762 |

|

|

|

740 |

|

| Power Technologies |

|

|

300 |

|

|

|

281 |

|

|

|

|

|

|

|

|

|

|

| Total Sales |

|

$ |

2,494 |

|

|

$ |

2,555 |

|

|

|

|

|

|

|

|

|

|

| Segment EBITDA |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

22 |

|

|

$ |

34 |

|

| Commercial Vehicle |

|

|

13 |

|

|

|

5 |

|

| Off-Highway |

|

|

106 |

|

|

|

113 |

|

| Power Technologies |

|

|

19 |

|

|

|

23 |

|

| Total Segment EBITDA |

|

|

160 |

|

|

|

175 |

|

| Corporate expense and other items, net |

|

|

(4 |

) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

156 |

|

|

$ |

176 |

|

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Segment Sales and Segment EBITDA

For the Year Ended

December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Sales |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

4,035 |

|

|

$ |

4,090 |

|

| Commercial Vehicle |

|

|

2,092 |

|

|

|

1,979 |

|

| Off-Highway |

|

|

3,185 |

|

|

|

2,946 |

|

| Power Technologies |

|

|

1,243 |

|

|

|

1,141 |

|

|

|

|

|

|

|

|

|

|

| Total Sales |

|

$ |

10,555 |

|

|

$ |

10,156 |

|

|

|

|

|

|

|

|

|

|

| Segment EBITDA |

|

|

|

|

|

|

|

|

| Light Vehicle |

|

$ |

212 |

|

|

$ |

158 |

|

| Commercial Vehicle |

|

|

87 |

|

|

|

43 |

|

| Off-Highway |

|

|

465 |

|

|

|

404 |

|

| Power Technologies |

|

|

89 |

|

|

|

94 |

|

| Total Segment EBITDA |

|

|

853 |

|

|

|

699 |

|

| Corporate expense and other items, net |

|

|

(8 |

) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

845 |

|

|

$ |

700 |

|

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Reconciliation of Segment and Adjusted EBITDA to Net Loss (Unaudited)

For the Three Months Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Three Months Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Segment EBITDA |

|

$ |

160 |

|

|

$ |

175 |

|

| Corporate expense and other items, net |

|

|

(4 |

) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

156 |

|

|

|

176 |

|

| Depreciation |

|

|

(106 |

) |

|

|

(95 |

) |

| Amortization |

|

|

(6 |

) |

|

|

(6 |

) |

| Non-service cost components of pension and OPEB

costs |

|

|

(3 |

) |

|

|

(4 |

) |

| Restructuring charges, net |

|

|

(4 |

) |

|

|

|

|

| Stock compensation expense |

|

|

(7 |

) |

|

|

(6 |

) |

| Strategic transaction expenses |

|

|

(1 |

) |

|

|

(2 |

) |

| Distressed supplier costs |

|

|

(18 |

) |

|

|

|

|

| Amounts attributable to previously divested/closed operations |

|

|

|

|

|

|

(2 |

) |

| Other items |

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Earnings before interest and income taxes |

|

|

11 |

|

|

|

62 |

|

| Interest income |

|

|

3 |

|

|

|

5 |

|

| Interest expense |

|

|

40 |

|

|

|

33 |

|

| Earnings (loss) before income taxes |

|

|

(26 |

) |

|

|

34 |

|

|

|

|

|

|

|

|

|

|

| Income tax expense |

|

|

3 |

|

|

|

217 |

|

| Equity in earnings (loss) of affiliates |

|

|

(15 |

) |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(44 |

) |

|

$ |

(178 |

) |

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Reconciliation of Segment and Adjusted EBITDA to Net Income (Loss)

For the Year Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions) |

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Segment EBITDA |

|

$ |

853 |

|

|

$ |

699 |

|

| Corporate expense and other items, net |

|

|

(8 |

) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

|

845 |

|

|

|

700 |

|

| Depreciation |

|

|

(393 |

) |

|

|

(365 |

) |

| Amortization |

|

|

(23 |

) |

|

|

(23 |

) |

| Non-service cost components of pension and OPEB

costs |

|

|

(13 |

) |

|

|

(7 |

) |

| Restructuring charges, net |

|

|

(25 |

) |

|

|

1 |

|

| Stock compensation expense |

|

|

(26 |

) |

|

|

(19 |

) |

| Strategic transaction expenses |

|

|

(5 |

) |

|

|

(8 |

) |

| Distressed supplier costs |

|

|

(44 |

) |

|

|

|

|

| Amounts attributable to previously divested/closed operations |

|

|

|

|

|

|

(2 |

) |

| Impairment of goodwill |

|

|

|

|

|

|

(191 |

) |

|

|

|

|

|

|

|

|

|

| Earnings before interest and income taxes |

|

|

316 |

|

|

|

86 |

|

| Loss on extinguishment of debt |

|

|

(1 |

) |

|

|

|

|

| Interest income |

|

|

17 |

|

|

|

11 |

|

| Interest expense |

|

|

154 |

|

|

|

128 |

|

|

|

|

|

|

|

|

|

|

| Earnings (loss) before income taxes |

|

|

178 |

|

|

|

(31 |

) |

| Income tax expense |

|

|

121 |

|

|

|

284 |

|

| Equity in earnings (loss) of affiliates |

|

|

(9 |

) |

|

|

4 |

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

48 |

|

|

$ |

(311 |

) |

|

|

|

|

|

|

|

|

|

DANA INCORPORATED

Reconciliation of Net Loss Attributable to the Parent Company to Adjusted Net Loss Attributable to the Parent Company and

Diluted Adjusted EPS (Unaudited)

For the Three Months Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions, except per share amounts) |

|

Three Months

Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net loss attributable to the parent company |

|

$ |

(39 |

) |

|

$ |

(179 |

) |

| Items impacting loss before income taxes: |

|

|

|

|

|

|

|

|

| Amortization |

|

|

5 |

|

|

|

5 |

|

| Restructuring charges, net |

|

|

3 |

|

|

|

|

|

| Strategic transaction expenses |

|

|

1 |

|

|

|

|

|

| Distressed supplier costs |

|

|

18 |

|

|

|

|

|

| Other items |

|

|

(1 |

) |

|

|

2 |

|

| Items impacting income taxes: |

|

|

|

|

|

|

|

|

| Net income tax benefit on items above |

|

|

6 |

|

|

|

2 |

|

| Income tax expense (benefit) attributable to various discrete tax matters |

|

|

(4 |

) |

|

|

155 |

|

|

|

|

|

|

|

|

|

|

| Adjusted net loss attributable to the parent company |

|

$ |

(11 |

) |

|

$ |

(15 |

) |

|

|

|

|

|

|

|

|

|

| Diluted shares - as reported |

|

|

144.5 |

|

|

|

143.4 |

|

| Adjusted diluted shares |

|

|

144.5 |

|

|

|

143.4 |

|

| Diluted adjusted EPS |

|

$ |

(0.08 |

) |

|

$ |

(0.10 |

) |

DANA INCORPORATED

Reconciliation of Net Income (Loss) Attributable to the Parent Company to Adjusted Net Income Attributable to the Parent

Company and Diluted Adjusted EPS (Unaudited)

For the Year Ended December 31, 2023 and 2022

|

|

|

|

|

|

|

|

|

| (In millions, except per share amounts) |

|

Year Ended

December 31, |

|

| |

|

2023 |

|

|

2022 |

|

| Net income (loss) attributable to the parent company |

|

$ |

38 |

|

|

$ |

(242 |

) |

| Items impacting income (loss) before income taxes: |

|

|

|

|

|

|

|

|

| Amortization |

|

|

20 |

|

|

|

20 |

|

| Restructuring charges, net |

|

|

24 |

|

|

|

(1 |

) |

| Strategic transaction expenses |

|

|

5 |

|

|

|

8 |

|

| Distressed supplier costs |

|

|

44 |

|

|

|

|

|

| Impairment of goodwill |

|

|

|

|

|

|

118 |

|

| Other items |

|

|

1 |

|

|

|

2 |

|

| Items impacting income taxes: |

|

|

|

|

|

|

|

|

| Net income tax expense on items above |

|

|

(20 |

) |

|

|

(8 |

) |

| Income tax expense attributable to various discrete tax matters |

|

|

10 |

|

|

|

157 |

|

|

|

|

|

|

|

|

|

|

| Adjusted net income attributable to the parent company |

|

$ |

122 |

|

|

$ |

54 |

|

|

|

|

|

|

|

|

|

|

| Diluted shares - as reported |

|

|

144.6 |

|

|

|

143.6 |

|

| Adjusted diluted shares |

|

|

144.6 |

|

|

|

144.3 |

|

| Diluted adjusted EPS |

|

$ |

0.84 |

|

|

$ |

0.37 |

|

February 20, 2024 2023

Fourth-quarter & Full-year Earnings Conference Call

Safe Harbor Statement Certain

statements and projections contained in this presentation are, by their nature, forward-looking within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on our current expectations,

estimates and projections about our industry and business, management’s beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as

“anticipates,” “expects,” “intends,” “plans,” “predicts,” “believes,” “seeks,” “estimates,” “may,” “will,” “should,”

“would,” “could,” “potential,” “continue,” “ongoing,” similar expressions, and variations or negatives of these words. These forward-looking statements are not guarantees of future results

and are subject to risks, uncertainties and assumptions that could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement. Dana’s Annual Report on Form 10-K, subsequent Quarterly

Reports on Form 10-Q, recent Current Reports on Form 8-K, and other Securities and Exchange Commission filings discuss important risk factors that could affect our business, results of operations and financial condition. The forward-looking

statements in this presentation speak only as of this date. Dana does not undertake any obligation to revise or update publicly any forward-looking statement for any reason.

Agenda Craig Barber Senior

Director, Investor Relations and Corporate Communications Introduction James Kamsickas Chairman and Chief Executive Officer Business Review Timothy Kraus Senior Vice President and Chief Financial Officer Financial Review

Business Results and Outlook

Successful Execution of Company-wide Transformation Leading to Profitable Growth 2023 Highlights 2023 Results 2024 Outlook sales $10.6 billion $399M from prior year adjusted EBITDA $845 million $145M from prior year free cash flow $(25) million

$234M from prior year Sales growth up 4% vs. 2022 Record annual sales 81% increase since 2016 Profit growth up 20% vs. 2022 Converted over 40% on incremental sales Roll-on business and efficiency gains Significant investment: > 100 new program

launches Upgraded manufacturing capabilities Complete in-house EV product portfolio Strong momentum into 2024… Increased sales, profit, and FCF Improved operating environment Improved market Gaining market share Improved pricing Partially

offset by lower volume in CV & OH Record sales backlog 3-year net new business of $950M $50M higher than prior backlog Balanced growth: energy-source agnostic Product: ICE & EV Mobility markets Geography Customers See appendix for comments

regarding the presentation of non-GAAP measures

2024 Operating Environment Cost

inflation moderating Labor costs increasing Monitoring ocean freight Pricing and cost-reduction actions muting inflation impact Net commodities expected to be sales and profit headwind Steel prices expected to be mostly flat in 2024 with lower

volatility Commodity recoveries reversing as input costs decline Slight margin headwinds from foreign currency Improved customer production stability Continued efficiency improvements Launch costs lower than last year Refreshed Programs, New

Business Backlog, and Efficiency Improvements Driving Profitable Growth Supply Chain & Currency Operational Impacts Cost Inflation

2024 Market Outlook North America

South America Impact +$135M Asia Pacific Europe Off-Highway Light Vehicle Commercial Vehicle >+2% Primary Third-Party Sources >-5% >-5% >-5% >+2% <-2% >+5% <-2% Full-frame Truck Medium Duty Heavy Duty Agriculture Construction

& Material Handling Mining Above-market Growth Driven by Market Share Gains and Market Mix

2023 Launch Performance >100

Program Launches Record number of launches fully industrialized Outstanding customer satisfaction >$2.5B Includes many of our largest programs Successful Execution Company-wide One Dana Collaboration: a Key Enabler of Differentiated New Program

Launch Execution Annualized Sales

2024-2026 Sales Backlog: $950

Million MOBILITY MARKET Note: $ in millions. Backlog includes booked incremental new business net of any lost replacement business = EV Program Record Three-year Backlog. Seventh Consecutive Year of Increased Sales Backlog Achieved Through

Exceptional Customer Satisfaction and Technology Differentiation Global LV OEM On track to Achieve long-term sales target in 2025

Off-Highway: Hyster-Yale

Warehousing Equipment New Market Expansion Utilizing Proven Dana Electric Propulsion Technology Electric Vertical Motor Drive Unit (MDU)

Commercial & Construction

Equipment: Volvo EV Platforms Electric Motors

Commercial Vehicle: PACCAR,

Traton, Volvo Market Share Gains Customer Satisfaction and Across Dana Execution Leading to Incremental Growth Market Share Gains Gaining and balancing market share across customers Achieved highest sales since 2011, or ~70% increase since 2016

Positioned for increased sales in 2024 Navigating the most challenging industrial environment in decades Supply-chain constraints Labor shortages OEM production volatility Launching >100 complex, high-volume vehicle platforms, i.e. Ford Super

Duty Jeep Wrangler GM Ultium Launched significant incremental driveline volume under compressed timing While… Over the past 12 months… Dana Commercial Vehicle results…

Light Vehicle: Electrification

New Business Win EXPANDED! Dana vertically integrated complete e-Propulsion system Leveraging Mechanical, Electric, and Thermal Scale Across Platforms and End Markets 4x content-per-vehicle compared to ICE NEW Electric SUV Added!

Drivers of Continued Profit

Expansion Fixed-cost savings and asset utilization Reduced customer schedule volatility Highest relevance to profit expansion Profit Drivers Inflation recovery Supply chain and product- design savings +$145M +21% Adjusted EBITDA Impact ~+$80M ~+10%

Company-wide Transformation Continues Drive Toward Long-term Profit Targets ~+$225M or ~+32% Refreshed, conquest, and new business growth Efficiency improvements See appendix for comments regarding the presentation of non-GAAP measures

Financial Review

See appendix for comments

regarding the presentation of non-GAAP measures Lower sales in the fourth quarter driven by impact of UAW strike Full-year sales growth primarily due to increased demand in all our end-markets and recovery of cost inflation, partially offset by UAW

strike Increased production efficiency, operational improvement actions, and more stable customer order patterns drove higher profitability 2022 net loss due to Q4 valuation allowance adjustment on U.S. tax assets and Q3 goodwill impairment charge

Lower FCF driven by higher working capital requirements and higher capital spending ($ in millions, except EPS) Q4 ‘23 Q4 ‘22 Change FY ‘23 FY ‘22 Change Sales $2,494 $2,555 $(61) $10,555 $10,156 $399 Adjusted EBITDA 156 176

(20) 845 700 145 Margin 6.3% 6.9% (60) bps 8.0% 6.9% 110 bps EBIT 11 62 (51) 316 86 230 Interest Expense, Net 37 28 9 137 117 20 Income Tax Expense 3 217 (214) 121 284 (163) Net Income (Loss) (attributable to Dana) (39) (179) 140 38 (242) 280

Diluted Adjusted EPS $(0.08) $(0.10) $0.02 $0.84 $0.37 $0.47 Operating Cash Flow 278 342 (64) 476 649 (173) Capital Spending (142) (140) (2) (501) (440) (61) Free Cash Flow 136 202 (66) (25) 209 (234) Changes from Prior Year 2023 Financial Results

Sales and Profit Improvement while Continuing to Build for Future Growth

Lower organic growth driven by

UAW strike at key customers Company-wide efficiencies mostly offset strike profit impact Cost inflation offset by customer recoveries Translation of foreign currencies, primarily the strengthening euro, to U.S. dollar was a modest benefit to sales

and profit Lower commodity costs resulting in lower sales recoveries; profit benefit of lower input costs offset by the timing of commodity cost true-ups with customers Sales Adjusted EBITDA 6.9% Margin 6.3% Margin ~10 bps ~(60) bps ~(10) bps ~0 bps

2023 Q4 Sales and Profit Changes Strike Drove Lower Sales, Company-wide Efficiencies Mostly Offset Profit Impact See appendix for comments regarding the presentation of non-GAAP measures

Organic growth driven by strong

sales and pricing actions, partially offset by UAW strike impact Cost savings actions, improved efficiency, and customer recoveries more than offset cost inflation EV growth remains strong in core heavy-vehicle markets Lower spending on EV

engineering and related program costs compared to 2022 drove a slight profit benefit Translation of foreign currencies to U.S. dollars, primarily the euro, rupee, and baht, was a headwind to sales, profit, and margin Lower commodity costs and

moderating recoveries benefited margin Sales Adjusted EBITDA 2023 FY Sales and Profit Changes 8.0% Margin ~80 bps ~(10) bps ~50 bps ~(10) bps 6.9% Margin Profit Improvement from Refreshed and New Business Growth, Efficiencies, and Lower Commodities

See appendix for comments regarding the presentation of non-GAAP measures

2023 FY Free Cash Flow Higher

profit offset by increased working capital requirements and higher capital spending Increased working capital requirements due to increased sales and higher launch cadence, and UAW strike Higher capital spending to support new business backlog,

replacement business, and electrification programs 1 Includes costs associated with business acquisitions and divestitures and restructuring. 2 Changes in working capital relating to interest, taxes, restructuring, and transaction costs are included

in those respective categories. See appendix for comments regarding the presentation of non-GAAP measures. Changes from Prior Year ($ in millions) 2023 2022 Change Adjusted EBITDA $ 845 $ 700 $145 One-time Costs1 (20) (16) (4) Interest, Net (116)

(107) (9) Taxes (148) (132) (16) Working Capital / Other² (85) 204 (289) Capital Spending (501) (440) (61) Free Cash Flow $(25) $209 $(234) FCF Use Driven by Higher Working Capital Requirements and Capital Spending

Sales Adjusted EBITDA Implied

Profit Margin Free Cash Flow Diluted EPS 2024 FY Financial Guide Sales growth driven by new business backlog, improved end-market demand, new/refreshed programs, and market share gains Company-wide efficiency improvements drive higher margins Free

cash flow improvement driven by higher profit, improved working capital efficiency, and lower capital spending Free cash flow includes significant capital investment to support market growth and new business in ICE and EV ~8.2% - 8.7% ~$925M

~$10,900M ±$250M ±$50M Change from Prior Year Guidance Ranges ~1% $190 ~2% +$345M +$80M +50 bps +$75M Balanced End-market Demand Growth and Improved Operating Environment ~$50M ±$25M 2024 Currency Assumptions Euro: 1.07/USD Rupee:

82.0/USD Real: 5.0/USD Baht: 36.0/USD ~$0.60 ±$0.25 2024 EPS Assumptions Compared to 2023 Depreciation & Amortization: Higher Net Interest Expense: Higher Tax Expense: Lower Noncontrolling Interests: Flat +$0.34 See appendix for comments

regarding the presentation of non-GAAP measures

Organic growth driven by strong

sales, pricing, and market share gains Strong conversion on organic growth due to improved efficiencies and cost savings actions Cost recovery actions expected to mostly offset inflation Continued investment in EV business offsetting profit

contribution Translation of foreign currency expected to be a headwind to sales and profit Lower commodity costs driving lowering sales recoveries; profit impacted by commodity cost true-ups with customers as input commodities decline Sales Adjusted

EBITDA 2024 FY Sales and Profit Changes ~$10,900M ~$925M 8.5% Margin ~110 bps ~(40) bps ~(20) bps ~0 bps 8.0% Margin Sales Growth with Improved Profit Driven by Company-wide Efficiencies and Cost Savings See appendix for comments regarding the

presentation of non-GAAP measures

2024 FY Free Cash Flow Higher

profit and lower capital investment requirements Increase in net interest payments due to higher rates and payment timing due to refinancing More efficient use of working capital 1 Includes costs associated with business acquisitions and

divestitures and restructuring. 2 Changes in working capital relating to interest, taxes, restructuring, and transaction costs are included in those respective categories. See appendix for comments regarding the presentation of non-GAAP measures.

Changes from Prior Year ($ in millions) 2024 2023 Change Adjusted EBITDA $~925 $ 845 $~80 One-time Costs1 (40) (20) (20) Interest, Net (150) (116) (35) Taxes (160) (148) (10) Working Capital / Other² (75) (85) 10 Capital Spending (450) (501) 50

Free Cash Flow $~50 $(25) $~75 Positive Free Cash Flow Driven by Higher Profit and Lower Capital Spending

Appendix

2023 FY Sales and Profit Change

by Segment See appendix for comments regarding the presentation of non-GAAP measures 10.3% 10.1% 6.3% 13.5% 11.9% Light Vehicle Drive Systems Commercial Vehicle Drive and Motion Systems Off-Highway Drive and Motion Systems Power Technologies Sales

Adjusted EBITDA 10.3% 10.1% Sales Adjusted EBITDA 10.3% Sales Adjusted EBITDA 10.3% Sales Adjusted EBITDA 3.9% 5.3% 13.7% 14.6% 2.2% 4.2% 8.2% 7.2%

Segment Profiles CUSTOMER SALES

REGIONAL SALES Light Vehicle Drive Systems Commercial Vehicle Drive and Motion Systems Off Highway Drive and Motion Systems Power Technologies Year to Date 12/31/2023 Year to Date 12/31/2023 Year to Date 12/31/2023 Year to Date 12/31/2023 * Includes

sales to systems integrators for driveline products in Stellantis vehicles

Diluted Adjusted EPS

Segment Data

Segment Data

Continued

Cash Flow

Non-GAAP Financial Information

Adjusted EBITDA is a non-GAAP financial measure which we have defined as net income (loss) before interest, income taxes, depreciation, amortization, equity grant expense, restructuring expense, non-service cost components of pension and other

postretirement benefit costs and other adjustments not related to our core operations (gain/loss on debt extinguishment, pension settlements, divestitures, impairment, etc.). Adjusted EBITDA is a measure of our ability to maintain and continue to

invest in our operations and provide shareholder returns. We use adjusted EBITDA in assessing the effectiveness of our business strategies, evaluating and pricing potential acquisitions and as a factor in making incentive compensation decisions. In

addition to its use by management, we also believe adjusted EBITDA is a measure widely used by securities analysts, investors and others to evaluate financial performance of our company relative to other Tier 1 automotive suppliers. Adjusted EBITDA

should not be considered a substitute for earnings (loss) before income taxes, net income (loss) or other results reported in accordance with GAAP. Adjusted EBITDA may not be comparable to similarly titled measures reported by other companies.

Adjusted net income (loss) attributable to the parent company is a non-GAAP financial measure which we have defined as net income (loss) attributable to the parent company, excluding any discrete income tax items, restructuring charges, amortization

expense and other adjustments not related to our core operations (as used in adjusted EBITDA), net of any associated income tax effects. This measure is considered useful for purposes of providing investors, analysts and other interested parties