false

0001398805

0001398805

2024-02-16

2024-02-16

0001398805

us-gaap:CommonStockMember

2024-02-16

2024-02-16

0001398805

BEEM:WarrantsMember

2024-02-16

2024-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

February 16, 2024

BEAM

GLOBAL

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

000-53204 |

|

26-1342810 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| 5660 Eastgate Drive, San Diego, CA |

92121 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: (858) 799-4583

___________________________________________________

(Former name or Former Address, if Changed Since

Last Report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. o

Securities registered pursuant to Section 12(b) of the Act:

| |

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock |

|

BEEM |

|

NASDAQ Capital Market |

| Warrants |

|

BEEMW |

|

NASDAQ Capital Market |

| Item 1.01. | Entry into a Material Definitive Agreement. |

As

previously disclosed, on October 20, 2023, Beam Global (“Beam”) completed its previously announced acquisition of Amiga

DOO Kraljevo (“Amiga”), pursuant to a Share Sale and Purchase Agreement dated

October 6, 2023 (the “Purchase Agreement”) by and among Beam and the two owners of Amiga (the “Sellers”).

Pursuant to the term terms of the Purchase Agreement, the Sellers are eligible to earn additional shares of Beam common stock if such

Seller (i) is providing services to Amiga and (ii) Amiga meets certain revenue milestones for fiscal years 2024 and 2025 (the “Earnout

Consideration”). On February 16, 2024, Beam and the Sellers entered into an amendment to the Purchase Agreement (the “Amendment”)

to remove the requirement that the Sellers shall be providing services to Amiga as a condition to receive the Earnout Consideration.

A copy of the Amendment is attached hereto as Exhibit

10.1 and incorporated in Item 1.01 of this Current Report on Form 8-K by reference. The foregoing description of the Amendment does not

purport to be complete and is qualified in its entirety by reference to the full text of the Amendment.

| Item 9.01 |

Financial Statements and Exhibits |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BEAM GLOBAL |

| |

|

|

| Dated: February 16, 2024 |

By: |

/s/ Lisa A. Potok |

| |

Name: |

Lisa A. Potok |

| |

Title: |

Chief Financial Officer |

Exhibit 10.1

AMENDMENT TO SHARE SALE AND PURCHASE

AGREEMENT

THISAMENDMENTTOSHARESALEANDPURCHASEAGREEMENT

(“Amendment”), dated as of February 16, 2024 (the “Effective Date”), is made by and among Beam

Global, a Nevada corporation (“Purchaser”), and Mr. Ivan Tlačinac and Ms. Jelena Spasojević

(collectively, the “Sellers”), who agree as follows:

1.

Background and Purpose. Purchaser and Sellers entered into that certain Share Sale and Purchase Agreement dated as of

October 6, 2023 (the “Original Agreement”), by which the Sellers sold to Purchaser 100% of the equity of Amiga DOO

Kraljevo (“Amiga”). The Original Agreement required the Purchaser to make certain earnout payments to Sellers if (i)

Amiga achieved certain financial milestones and (ii) if the Sellers are providing services to Amiga on the date the earnout payments are

payable. The parties now desire to amend the Original Agreement to provide that the Sellers are no longer required to be providing services

to Amiga on the date the earnout is payable, as more particularly set forth in this Amendment.

2.

Amendments to the Original Agreement. The Original Agreement is hereby amended as follows:

2.1

Definition of Additional Purchase Price Condition 1. The definition of “Additional Purchase Price Condition 1”

as defined in Section 1.1 of the Original Agreement is hereby amended and restated to read in full as follows: “Means the fulfillment

of the following: the Operating Revenue of the Company for the fiscal year 2024 exceeds EUR 13,500,000.”

2.2

Definition of Additional Purchase Price Condition 2. The definition of “Additional Purchase Price Condition 2”

as defined in Section 1.1 of the Original Agreement is hereby amended and restated to read in full as follows: “Means the fulfillment

of the following: the Operating Revenue of the Company for the fiscal year 2025 exceeds the greater of either EUR 18,225,000 or 135% of

the 2024 Operating Revenue.”

3.

Further Assurances. Each party agrees to execute and deliver such other assurances, instructions, instruments of transfer

and other documents as may be reasonably requested by the other party to carry out the purpose and intent of this Amendment.

4.

No Third-Party Beneficiaries. This Amendment is for the sole and exclusive benefit of Purchaser and Seller and their

respective permitted successors and assigns, as applicable, and no third party is intended to, or shall have, any rights hereunder.

5.

Successors and Assigns. Except as otherwise provided in the Agreement, this Amendment shall be binding upon and inure

to the benefit of the parties hereto, the heirs, and the permitted successors, transferees and assigns.

6.

Conflict. If any conflict exists between the terms or provisions of the Original Agreement and the terms or provisions

of this Amendment, the terms and provisions of this Amendment shall govern and control. If any term or provision of this Amendment or

any application of this Amendment shall be held invalid or unenforceable, the remaining provisions in this Amendment and any application

of its terms and provision shall remain valid and enforceable under this Amendment and the Original Agreement.

7.

Agreement in Full Force. As amended by this Amendment, the Original Agreement and all of its terms shall remain in full

force and effect and is ratified by Purchaser and Seller.

8.

Entire Agreement. This Amendment, together with the Original Agreement and all related exhibits, contains the entire

agreement of the parties hereto, and supersedes any prior written or oral agreements between them concerning the subject matter contained

herein, including, without limitation, any letters of intent or letters of interest between the parties. The provisions of this Amendment

may be modified at any time by agreement of the parties. Any such agreement shall be ineffective to modify this Amendment in any respect

unless in writing and signed by both Purchaser and Seller.

9.

Counterparts. This Amendment may be executed in counterparts, each of which shall be deemed an original (including copies

sent to a party by electronic transmission) as against the party signing such counterpart, but which together shall constitute one and

the same instrument.

IN WITNESS WHEREOF, the parties

hereto have executed this Amendment as of the Effective Date.

BEAM GLOBAL

| /s/ Desmond Wheatley |

|

| Signatory: Desmond Wheatley |

|

| Title: CEO |

|

| |

|

| |

|

| SELLERS: |

|

| |

|

| /s/ Ivan Tlačinac |

|

| Ivan Tlačinac |

|

| |

|

| |

|

| /s/ Jelena Spasojević |

|

| Jelena Spasojević |

|

| |

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=BEEM_WarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

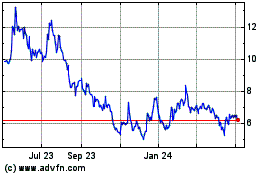

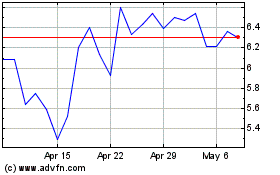

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Beam Global (NASDAQ:BEEM)

Historical Stock Chart

From Apr 2023 to Apr 2024