FALSE000138419500013841952024-02-122024-02-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________________________________________________________________________________________________________

FORM 8-K

_____________________________________________________________________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report: February 12, 2024

(Date of earliest event reported)

______________________________________________________________________________________

RING ENERGY, INC.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________________________________

| | | | | | | | | | | | | | |

Nevada | | 001-36057 | | 90-0406406 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

1725 Hughes Landing Blvd., Suite 900

The Woodlands, TX 77380

(Address of principal executive offices) (Zip Code)

(281) 397-3699

(Registrant’s telephone number, including area code)

Not Applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, $0.001 par value | REI | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 12, 2024, Ring Energy, Inc. (the “Company”), Truist Bank (“Truist”) as the Administrative Agent and Issuing Bank, and the lenders party thereto (the “Lenders”) entered into an amendment (the “Amendment”) to the Second Amended and Restated Credit Agreement dated August 31, 2022, by and among the Company, as Borrower, Truist as Administrative Agent and Issuing Bank, and the Lenders (together with all amendments or other modifications, the “Credit Agreement”). Among other things, the Amendment amends the definition of Free Cash Flow so amounts used by the Company for acquisitions will no longer be subtracted from the calculation of Free Cash Flow.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment, which is attached as Exhibit 10.1 to this Current Report on Form 8-K and incorporated in this Item 1.01 by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | | | | | | | |

Exhibit No. | | Description |

| 10.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | RING ENERGY, INC.

|

| | | |

Date: | February 16, 2024 | By: | /s/ Travis T. Thomas |

| | | Travis T. Thomas |

| | | Chief Financial Officer |

Exhibit 10.1

Execution Version

FIRST AMENDMENT TO

SECOND AMENDED AND RESTATED CREDIT AGREEMENT

This FIRST AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) is dated as of February 12, 2024, by and among RING ENERGY, INC., a Nevada corporation (the “Borrower”), each of the LENDERS party hereto and TRUIST BANK, as the Administrative Agent for the Lenders (in such capacity, together with its successors in such capacity, the “Administrative Agent”) and as the Issuing Bank under the Credit Agreement referred to below.

WITNESSETH:

WHEREAS, the Borrower, the Administrative Agent and the Lenders are parties to that certain Second Amended and Restated Credit Agreement dated as of August 31, 2022 (the “Existing Credit Agreement”, as amended by this Amendment and as further amended, modified or restated from time to time, the “Credit Agreement”), whereby upon the terms and conditions therein stated the Lenders have agreed to make certain loans to the Borrower upon the terms and conditions set forth therein; and

WHEREAS, the Borrower has requested that the Lenders amend the Existing Credit Agreement as set forth below, subject to the terms and conditions set forth herein, and the Lenders party hereto have agreed to such request on the terms and conditions hereinafter set forth.

NOW, THEREFORE, for and in consideration of the mutual covenants and agreements herein contained, the parties hereto agree as follows:

Section 1. Defined Terms. Each capitalized term used herein but not otherwise defined herein has the meaning given such term in the Existing Credit Agreement, as amended by this Amendment (unless otherwise indicated). The interpretive provisions set forth in Sections 1.2, 1.3 and 1.4 of the Credit Agreement shall apply to this Amendment.

Section 2. Amendments to Existing Credit Agreement. Effective on the Amendment Effective Date, the following definition in Section 1.1 of the Existing Credit Agreement shall be amended and restated in its entirety to read as follows:

“Free Cash Flow” shall mean, for the Borrower and its Subsidiaries, for any Fiscal Quarter, (a) Consolidated EBITDAX for such Fiscal Quarter minus (b) the increase (or plus the decrease) in non-cash working capital (excluding, for the avoidance of doubt, non-cash assets and non-cash obligations in each case under ASC 815) from the preceding Fiscal Quarter minus (c) the sum, in each case without duplication, of the following amounts for such Fiscal Quarter: (i) the aggregate amount of all voluntary, mandatory and scheduled cash repayments of Indebtedness by the Borrower or any of its Subsidiaries (other than the Indebtedness created pursuant to the Loan Documents or to the extent any such repayment is funded or financed with net cash proceeds from an issuance of Capital Stock) which cannot be reborrowed pursuant to the terms of such Indebtedness, (ii) the aggregate amount actually paid by the Borrower or any of its Subsidiaries in cash during such Fiscal Quarter on account of capital expenditures (other than to the extent any such amounts are funded or financed with net cash proceeds from an issuance of Capital Stock), (iii) Consolidated Interest Expense paid in cash during such Fiscal Quarter by the Borrower or any of its subsidiaries, (iv) income taxes paid in cash during such Fiscal Quarter by the Borrower or any of its Subsidiaries, (v) exploration expenses paid in cash during such Fiscal Quarter by the Borrower or any of its Subsidiaries (other than to the extent any such amounts are funded or financed with net cash proceeds from an issuance of Capital Stock), (vi) other Restricted

Payments paid in cash such Fiscal Quarter (other than restricted payments of Available Free Cash Flow), and (vii) to the extent not included in the foregoing and added back in the calculation of Consolidated EBITDAX, any other cash charge during such Fiscal Quarter that reduces the earnings of the Borrower and its Subsidiaries.

Section 3. Conditions of Effectiveness. This Amendment shall become effective as of the date on which each of the following conditions precedent shall have been satisfied or waived in accordance with Section 10.2 of the Credit Agreement (such date, the “Amendment Effective Date”):

3.1 Execution and Delivery. The Administrative Agent shall have received (which may be by electronic transmission), in form and substance satisfactory to the Administrative Agent, a counterpart of this Amendment which shall have been executed by the Administrative Agent, the Issuing Bank, the Borrower and the requisite Lenders (which may be by PDF transmission).

3.2 Fees and Expenses. The Borrower shall have paid all fees and expenses due to the Lenders party hereto and the Administrative Agent (including, but not limited to, reasonable attorneys’ fees of counsel to the Administrative Agent), in each case, for which invoices were submitted at least one (1) Business Day prior to the Amendment Effective Date.

3.3. No Default. No Default or Event of Default shall have occurred and be continuing.

3.4 Other Documents. The Administrative Agent shall have received such other instruments and documents incidental and appropriate to the transactions provided for herein as the Administrative Agent may reasonably request, and all such documents shall be in form and substance reasonably satisfactory to the Administrative Agent.

Without limiting the generality of the provisions of Sections 3.1 and 3.2 of the Credit Agreement, for purposes of determining compliance with the conditions specified in this Section 3, each Lender that has signed this Amendment (and its permitted successors and assigns) shall be deemed to have consented to, approved or accepted, or to be satisfied with, each document or other matter required hereunder to be consented to or approved by or acceptable or satisfactory to a Lender unless the Administrative Agent shall have received written notice from such Lender prior to the proposed Amendment Effective Date specifying its objection thereto.

Section 4. Representations and Warranties. The Borrower represents and warrants to the Administrative Agent and the Lenders, with full knowledge that such Persons are relying on the following representations and warranties in executing this Amendment, as follows:

4.1 Organizational Power and Authority. The Borrower has the organizational power and authority to execute, deliver and perform this Amendment, and all organizational action on the part of it requisite for the due execution, delivery and performance of this Amendment has been duly and effectively taken.

4.2 Enforceability. The Credit Agreement, as amended by this Amendment, the Loan Documents and each and every other document executed and delivered to the Administrative Agent and the Lenders in connection with this Amendment to which it is a party constitute the legal, valid and binding obligations of the Borrower, enforceable against the Borrower in accordance with their respective terms except as enforceability may be limited by applicable bankruptcy, insolvency, or similar laws affecting the enforcement of creditors’ rights generally or by equitable principles relating to enforceability.

4.3 No Conflict. This Amendment does not and will not conflict with any provisions of any of the articles or certificate of incorporation, bylaws, and other organizational and governing documents of the Borrower.

4.4 No Approval or Action by Governmental Authority. No approval, consent, exemption, authorization, or other action by, or notice to, or filing with, any Governmental Authority is necessary or required in connection with the execution, delivery or performance by, or enforcement against, the Borrower of this Amendment.

4.5 Loan Documents. At the time of and immediately after giving effect to this Amendment, the representations and warranties of the Borrower contained in Article IV of the Credit Agreement or in any other Loan Document are true and correct in all material respects (other than those representations and warranties that are expressly qualified by a Material Adverse Effect or other materiality, in which case such representations and warranties shall be true and correct in all respects), except that any representation and warranty which by its terms is made as of a specified date shall be required to be so true and correct in all material respects only as of such specified date.

4.6 No Default. At the time of and immediately after giving effect to this Amendment, no Default, Event of Default or Borrowing Base Deficiency exists.

4.7 No Material Adverse Effect. Since December 31, 2022, there has been no event or circumstance which has had or could reasonably be expected to have a Material Adverse Effect.

4.8 Flood Insurance Regulations. As of the Amendment Effective Date, notwithstanding any provision in any Collateral Document to the contrary, no Building (as defined in the applicable Flood Insurance Regulation) or Manufactured (Mobile) Home (as defined in the applicable Flood Insurance Regulation) included in the definition of “Mortgaged Property” or “collateral” or similar definition in any Collateral Document and no Building or Manufactured (Mobile) Home is encumbered by any Collateral Document. As used in this paragraph, “Building” means any Building or Manufactured (Mobile) Home, in each case as defined in the applicable Flood Insurance Regulations); and “Flood Insurance Regulations” means (I) the National Flood Insurance Act of 1968 as now or hereafter in effect or any successor statute thereto, (II) the Flood Disaster Protection Act of 1973 as now or hereafter in effect or any successor statute thereto, (III) the National Flood Insurance Reform Act of 1994 (amending 42 USC § 4001, et seq.), as the same may be amended or recodified from time to time, and (IV) the Flood Insurance Reform Act of 2004 and any regulations promulgated thereunder.

Section 5. Miscellaneous.

5.1 Reference to the Credit Agreement. Upon the effectiveness hereof, on and after the date hereof, each reference in the Credit Agreement to “this Agreement,” “hereunder,” “hereof,” “herein,” or words of like import, shall mean and be a reference to the Credit Agreement as amended hereby.

5.2 Effect on the Credit Agreement; Ratification. Except as specifically amended by this Amendment, the Credit Agreement shall remain in full force and effect and is hereby ratified and confirmed. By its acceptance hereof, the Borrower hereby ratifies and confirms each Loan Document to which it is a party in all respects, after giving effect to the amendments set forth herein.

5.3 Extent of Amendments. Except as otherwise expressly provided herein, the Credit Agreement and the other Loan Documents are not amended, modified or affected by this Amendment. The Borrower hereby ratifies and confirms that (i) except as expressly amended hereby, all of the terms, conditions, covenants, representations, warranties and all other provisions of the Credit Agreement remain in full force and effect, (ii) each of the other Loan Documents are and remain in full force and

effect in accordance with their respective terms, and (iii) the Collateral and the Liens on the Collateral securing the Obligations are unimpaired by this Amendment and remain in full force and effect.

5.4 Loan Documents. The Loan Documents, as such may be amended in accordance herewith, are and remain legal, valid and binding obligations of the parties thereto, enforceable in accordance with their respective terms. This Amendment is a Loan Document.

5.5 Claims. As additional consideration to the execution, delivery, and performance of this Amendment by the parties hereto and to induce the Administrative Agent and Lenders to enter into this Amendment, the Borrower represents and warrants that, as of the date hereof, it does not know of any defenses, counterclaims or rights of setoff to the payment of any Obligations of the Borrower to the Administrative Agent, the Issuing Bank or any Lender.

5.6 Execution and Counterparts. This Amendment may be executed by one or more of the parties hereto in any number of separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute but one and the same instrument. Delivery of an executed counterpart of a signature page of this Amendment by facsimile, electronic communications, as an attachment to an email or other similar electronic means shall be effective as delivery of a manually executed counterpart of this Amendment.

5.7 COMPLETE AGREEMENT; NO ORAL AGREEMENTS. THE RIGHTS AND OBLIGATIONS OF EACH OF THE PARTIES TO THE LOAN DOCUMENTS SHALL BE DETERMINED SOLELY FROM WRITTEN AGREEMENTS, DOCUMENTS, AND INSTRUMENTS, AND ANY PRIOR ORAL AGREEMENTS BETWEEN SUCH PARTIES ARE SUPERSEDED BY AND MERGED INTO SUCH WRITINGS. THIS AMENDMENT, THE CREDIT AGREEMENT AND THE OTHER WRITTEN LOAN DOCUMENTS EXECUTED BY THE BORROWER, THE ADMINISTRATIVE AGENT, THE ISSUING BANK AND/OR THE LENDERS REPRESENT THE FINAL AGREEMENT BETWEEN SUCH PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS BY SUCH PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN SUCH PARTIES.

5.8 GOVERNING LAW. THIS AMENDMENT and any claims, controversy, dispute or cause of action (whether in contract or tort or otherwise) based upon, arising out of or relating to this Amendment and the transactions contemplated hereby and thereby SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS (without giving effect to the conflict of law principles thereof) OF THE STATE OF NEW YORK.

5.9 Headings. Section headings in this Amendment are included herein for convenience and reference only and shall not constitute a part of this Amendment for any other purpose.

5.10 Loan Document. This Amendment is a “Loan Document” as defined and described in the Credit Agreement and all of the terms and provisions of the Credit Agreement relating to Loan Documents shall apply hereto.

5.11 Payment of Expenses. In accordance with Section 10.3 of the Credit Agreement, the Borrower agrees to pay or reimburse the Administrative Agent for all of its reasonable and documented out-of-pocket costs and expenses incurred in connection with this Amendment, any other documents prepared in connection herewith and the transactions contemplated hereby, including, without limitation, the reasonable fees and disbursements of counsel to the Administrative Agent.

5.12 Severability. Any provision of this Amendment or any other Loan Document held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof or thereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

5.13 Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

5.14 No Waiver. The Borrower hereby agrees that no Event of Default and no Default has been waived or remedied by the execution of this Amendment by the Administrative Agent or any Lender. Nothing contained in this Amendment nor any past indulgence by the Administrative Agent, the Issuing Bank or any Lender, nor any other action or inaction on behalf of the Administrative Agent, the Issuing Bank or any Lender, (i) shall constitute or be deemed to constitute a waiver of any Defaults or Events of Default which may exist under the Credit Agreement or the other Loan Documents, or (ii) shall constitute or be deemed to constitute an election of remedies by the Administrative Agent, the Issuing Bank or any Lender, or a waiver of any of the rights or remedies of the Administrative Agent, the Issuing Bank or any Lender provided in the Credit Agreement, the other Loan Documents, or otherwise afforded at law or in equity.

[Signature Pages Follow]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed and delivered by their proper and duly authorized officer(s) as of the day and year first above written.

BORROWER:

RING ENERGY, INC.

By: /s/ Travis T. Thomas

Name: Travis T. Thomas

Title: Executive Vice President and Chief Financial

Officer

Signature Page to First Amendment to

Second Amended and Restated Credit Agreement

ADMINISTRATIVE AGENT, ISSUING BANK,

AND LENDER:

TRUIST BANK

as the Administrative Agent, as the Issuing Bank and

as a Lender

By: /s/ Farhan Iqbal

Name: Farhan Iqbal

Title: Director

Signature Page to First Amendment to

Second Amended and Restated Credit Agreement

LENDER:

CITIZENS BANK, N.A.

as a Lender

By: /s/ David Baron

Name: David Baron

Title: Senior Vice President

LENDER:

KEYBANK NATIONAL ASSOCIATION

as a Lender

By: /s/ David M. Bornstein

Name: David M. Bornstein

Title: Senior Vice President

LENDER:

MIZUHO BANK, LTD.

as a Lender

By: /s/ Edward Sacks

Name: Edward Sacks

Title: Executive Director

LENDER:

FIFTH THIRD BANK, NATIONAL

ASSOCIATION

as a Lender

By: /s/ Dan Condley

Name: Dan Condley

Title: Managing Director

LENDER:

U.S. BANK NATIONAL ASSOCIATION

as a Lender

By: /s/ John C. Springer

Name: John C. Springer

Title: Vice President

Signature Page to First Amendment to

Second Amended and Restated Credit Agreement

LENDER:

CATHAY BANK

as a Lender

By: /s/ Dale T Wilson

Name: Dale T Wilson

Title: Senior Vice President

LENDER:

FIRST HORIZON BANK, A TENNESSEE

STATE BANK

as a Lender

By: /s/ Stacy Goldstein

Name: Stacy Goldstein

Title: Senior Vice President

LENDER:

ZIONS BANCORPORATION, N.A. DBA

AMEGY BANK

as a Lender

By: /s/ John Moffitt

Name: John Moffit

Title: Senior Vice President

LENDER:

GOLDMAN SACHS LENDING PARTNERS

LLC

as a Lender

By: /s/ Priyankush Goswami

Name: Priyankush Goswami

Title: Authority Signatory

Signature Page to First Amendment to

Second Amended and Restated Credit Agreement

Cover

|

Feb. 12, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 12, 2024

|

| Entity Registrant Name |

RING ENERGY, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

001-36057

|

| Entity Tax Identification Number |

90-0406406

|

| Entity Address, Address Line One |

1725 Hughes Landing Blvd

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

The Woodlands

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77380

|

| City Area Code |

281

|

| Local Phone Number |

397-3699

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

REI

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001384195

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

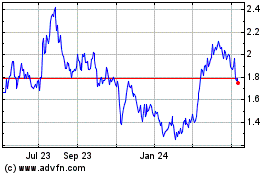

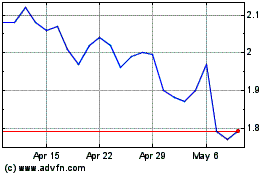

Ring Energy (AMEX:REI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ring Energy (AMEX:REI)

Historical Stock Chart

From Apr 2023 to Apr 2024