false

0001506983

0001506983

2024-02-16

2024-02-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 16, 2024

GLUCOTRACK,

INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41141 |

|

98-0668934 |

(State

or other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

301

Rte 17 North, Ste. 800

Rutherford,

NJ |

|

07070 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (201) 842-7715

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Common

Stock, par value $0.001 |

|

GCTK |

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.01 Completion of Acquisition or Disposition of Assets

On

February 13, 2024, GlucoTrack, Inc., a Delaware corporation (the “Company”) entered into an Exchange Agreement (the “Exchange

Agreement”) with certain shareholders (the “Holders”), pursuant to which the Company and the Holders agreed to exchange

(the “Exchange”) common stock purchase warrants (the “Warrants”) owned by the Holders for shares of the Company’s

common stock, par value $0.001 per share (the “Common Stock”) to be issued by the Company.

On

February 13, 2024, the Company closed the Exchange and issued to the Holders an aggregate of 3,593,203 shares of Common Stock

in exchange for 4,381,953 Warrants.

The

description of the Exchange Agreement set forth herein is qualified in its entirety by reference to the full text of the Exchange Agreement,

a copy of which is filed herewith as Exhibit 10.1.

Item

3.02 Unregistered Sales of Equity Securities

The

information in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02. The agreement to issue

the Common Stock to the Holders was made pursuant to the exemption from registration contained in Section 3(a)(9) of the Securities Act

of 1933, as amended, and/or Regulation D promulgated thereunder.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

| Exhibit

No. |

|

Document |

| 10.1†* |

|

Form of Exchange Agreement |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

| † |

Certain

of the exhibits and schedules to this Exhibit have been omitted in accordance with Regulation S-K Item 601(a)(5). The Registrant

agrees to furnish a copy of all omitted exhibits and schedules to the SEC upon its request. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

GlucoTrack,

Inc. |

| |

|

|

| Date:

February 16, 2024 |

By: |

/s/

Paul Goode |

| |

|

Paul

Goode |

| |

|

Chief

Executive Officer |

Exhibit

10.1

EXCHANGE

AGREEMENT

This

EXCHANGE AGREEMENT (the “Agreement”) is made as of the 13th day of February 2024, by and among Glucotrack,

Inc., a Delaware corporation (the “Company”), and the parties identified on Schedule A hereto and/or its designees

(each a “Holder” and collectively, “Holders”).

WHEREAS,

the Holders are the beneficial owners of Common Stock Purchase Warrants in the amounts and on the dates set forth on Exhibit A

(the “Warrants”) annexed hereto; and

WHEREAS,

the Company has determined that it is in the best interest of the Company’s stockholders to induce the Holders to exchange

the Warrants for shares of the Company’s common stock as set forth on Exhibit A to be issued by the Company (the “Shares”);

WHEREAS,

the Holders have agreed to exchange the Warrants for the Shares; and

WHEREAS,

subject to the terms and conditions set forth in this Agreement and pursuant to Section 4(a)(2) of the Securities Act of 1933, as

amended (the “Securities Act”), and in reliance on Section 3(a)(9) of the Securities Act, the Company desires to exchange

with the Holders, and the Holders desire to exchange with the Company the Warrants in consideration for the Shares, without any additional

consideration except for the exchange of the Warrants for the Shares.

NOW,

THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and in consideration

of the premises and the mutual agreements, representations and warranties, provisions and covenants contained herein, the parties hereto,

intending to be legally bound hereby, agree as follows:

1.

Exchange. On the Closing Date, subject to the terms and conditions of this Agreement, the Holder shall, and the Company shall,

pursuant to Section 3(a)(9) of the Securities Act, exchange the Warrants for the Shares. Subject to the conditions set forth below, the

exchange shall take place electronically or at the offices of Ellenoff Grossman & Schole LLP, at such time and place as the Company

and the Holders mutually agree (the “Closing” and the “Closing Date”). At the Closing, the following

transactions shall occur (such transactions in this Section 1, the “Exchange”):

1.1

On the Closing Date, in exchange for the Warrants and for no other consideration whatsoever, the Company shall deliver the Shares to

the Holders in accordance with the Holders’ delivery instructions set forth on the Holder signature page hereto. Upon receipt of

the Warrants in accordance with this Section 1.1, the Company will cancel the Warrants and all of the Holders’ rights under the

Warrants shall be extinguished except for rights to indemnification.

1.2

On the Closing Date, the Holders shall be deemed for all corporate purposes to have become the holder of record of the Shares.

1.3

The Company and the Holders shall execute and/or deliver such other documents and agreements as are customary and reasonably necessary

to effectuate the Exchange.

2.

Closing Conditions.

2.1

Conditions to Holders’ Obligations. The obligation of the Holders to consummate the Exchange is subject to the fulfillment,

to the Holders’ reasonable satisfaction, prior to or at the Closing, of each of the following conditions:

(a)

Representations and Warranties. The representations and warranties of the Company contained in this Agreement shall be true and

correct in all material respects on the date hereof and on and as of the Closing Date as if made on and as of such date.

(b)

No Actions. No action, proceeding, investigation, regulation or legislation shall have been instituted, threatened or proposed

before any court, governmental agency or authority or legislative body to enjoin, restrain, prohibit or obtain substantial damages in

respect of, this Agreement or the consummation of the transactions contemplated by this Agreement.

(c)

Proceedings and Documents. All proceedings in connection with the transactions contemplated hereby and all documents and instruments

incident to such transactions shall be satisfactory in substance and form to the Holders, and the Holders shall have received all such

counterpart originals or certified or other copies of such documents as they may reasonably request.

2.2

Conditions to the Company’s Obligations. The obligation of the Company to consummate the Exchange is subject to the fulfillment,

to the Company’s reasonable satisfaction, prior to or at the Closing, of each of the following conditions:

(a)

Representations and Warranties. The representations and warranties of the Holders contained in this Agreement shall be true and

correct in all material respects on the date hereof and on and as of the Closing Date as if made on and as of such date.

(b)

No Actions. No action, proceeding, investigation, regulation or legislation shall have been instituted, threatened or proposed

before any court, governmental agency or authority or legislative body to enjoin, restrain, prohibit, or obtain substantial damages in

respect of, this Agreement or the consummation of the transactions contemplated by this Agreement.

(c)

Proceedings and Documents. All proceedings in connection with the transactions contemplated hereby and all documents and instruments

incident to such transactions shall be satisfactory in substance and form to the Company and the Company shall have received all such

counterpart originals or certified or other copies of such documents as the Company may reasonably request.

3.

Representations and Warranties of the Company. The Company hereby represents and warrants to Holders that:

3.1

Organization, Good Standing and Qualification. The Company is a corporation duly organized, validly existing and in good standing

under the laws of the State of Delaware. The Company is duly qualified to transact business and is in good standing in each jurisdiction

in which the failure to so qualify would have a material adverse effect on its business or properties.

3.2

Authorization. All corporate action on the part of the Company, its officers, directors and stockholders necessary for the authorization,

execution and delivery of this Agreement and the performance of all obligations of the Company hereunder, and the authorization of the

Exchange, and the issuance of the Shares have been taken on or prior to the date hereof.

3.3

Valid Issuance of the Shares. The Shares, when issued and delivered in accordance with the terms of this Agreement (the Shares

are also referred to herein as the “Securities”) will be duly and validly issued, fully paid and nonassessable, subject

to the truth and accuracy of the Holders’ representations set forth in Section 4 of this Agreement.

3.4

Compliance with Laws. except as set forth in the reports filed by the Company it under the Securities Exchange Act of 1934, as

amended (the “Exchange Act”) with the Securities and Exchange Commission in the twelve (12) months preceding the date

hereof, the Company has not violated any law or any governmental regulation or requirement which violation has had or would reasonably

be expected to have a material adverse effect on its business, and the Company has not received written notice of any such violation.

3.5

Consents: Waivers. No consent, waiver, approval or authority of any nature, or other formal action, by any Person, not already

obtained, is required in connection with the execution and delivery of this Agreement by the Company or the consummation by the Company

of the transactions provided for herein and therein.

3.6

Acknowledgment Regarding Holder’s Purchase of Shares. The Company acknowledges and agrees that the Holders are acting solely

in the capacity of an arm’s length Holder with respect to this Agreement and the other documents entered into in connection herewith

(collectively, the “Exchange Documents”), with the only consideration being exchange of the existing Warrants and

the transactions contemplated hereby and thereby and that the Holders are each not (i) an officer or director of the Company, (ii) except

to the extent that [_], is a control person of [_], an “affiliate” of the Company (as defined in Rule 144 promulgated

under the Securities Act (“Rule 144”)), or (iii) to the knowledge of the Company, a “beneficial owner”

of more than 10% of the shares of common stock (as defined for purposes of Rule 13d-3 of the Exchange Act). The Company further acknowledges

that each Holder is not acting as a financial advisor or fiduciary of the Company (or in any similar capacity) with respect to the Exchange

Documents and the transactions contemplated hereby and thereby, and any advice given by each Holder or any of its representatives or

agents in connection with the Exchange and the transactions contemplated hereby and thereby is merely incidental to such Holder’s

acceptance of the Shares. The Company further represents to each Holder that the Company’s decision to enter into the Exchange

Documents has been based solely on the independent evaluation by the Company and its representatives.

3.7

Absence of Litigation. except as set forth in the reports filed by the Company it under the Exchange Act with the Securities and

Exchange Commission in the twelve (12) months preceding the date hereof there is no action, suit, proceeding, inquiry or investigation

before or by any court, public board, government agency, self-regulatory organization or body pending or, to the knowledge of the Company,

threatened against or affecting the Company, the Exchange Securities or any of the Company’s officers or directors in their capacities

as such.

3.8

No Group. The Company acknowledges that, to the Company’s knowledge, the Holder is acting independently in connection with

this Agreement and the transactions contemplated hereby, and is not acting as part of a “group” as such term is defined under

Section 13(d) of the Securities Act and the rules and regulations promulgated thereunder.

3.9

Validity; Enforcement; No Conflicts. This Agreement and each Exchange Document to which the Company is a party have been duly

and validly authorized, executed and delivered on behalf of the Company and shall constitute the legal, valid and binding obligations

of the Company enforceable against the Company in accordance with their respective terms, except as such enforceability may be limited

by general principles of equity or to applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws

relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies. The execution, delivery and

performance by the Company of this Agreement and each Exchange Document to which the Company is a party and the consummation by the Company

of the transactions contemplated hereby and thereby will not (i) result in a violation of the organizational documents of the Company

or (ii) conflict with, or constitute a default (or an event which with notice or lapse of time or both would become a default) under,

or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which

the Company is a party or by which it is bound, or (iii) result in a violation of any law, rule, regulation, order, judgment or decree

(including federal and state securities or “blue sky” laws) applicable to the Company, except in the case of clause (ii)

above, for such conflicts, defaults or rights which would not, individually or in the aggregate, reasonably be expected to have a material

adverse effect on the ability of the Company to perform its obligations hereunder.

4.

Representations and Warranties of the Holder. Each Holder hereby represents, warrants and covenants that:

4.1

Authorization. The Holder has full power and authority to enter into this Agreement, to perform its obligations hereunder and

to consummate the transactions contemplated hereby and has taken all action necessary to authorize the execution and delivery of this

Agreement, the performance of its obligations hereunder and the consummation of the transactions contemplated hereby.

4.2

Accredited Holder Status; Investment Experience. The Holder is an “accredited Holder” as that term is defined in Rule

501(a) of Regulation D. The Holder can bear the economic risk of its investment in the Securities, and has such knowledge and experience

in financial and business matters that it is capable of evaluating the merits and risks of an investment in the Securities.

4.3

Reliance on Exemptions. The Holder understands that the Securities are being offered and issued to it in reliance on specific

exemptions from the registration requirements of United States federal and state securities laws and that the Company is relying in part

upon the truth and accuracy of, and the Holder’s compliance with, the representations, warranties, agreements, acknowledgments

and understandings of the Holder set forth herein in order to determine the availability of such exemptions and the eligibility of the

Holder to acquire the Securities.

4.4

Information. The Holder and its advisors, if any, have been furnished with all materials relating to the business, finances and

operations of the Company and materials relating to the issuance of the Securities which have been requested by the Holder. The Holder

has had the opportunity to review the Company’s filings with the Securities and Exchange Commission. The Holder and its advisors,

if any, have been afforded the opportunity to ask questions of the Company. Neither such inquiries nor any other due diligence investigations

conducted by the Holder or its advisors, if any, or its representatives shall modify, amend or affect the Holder’s right to rely

on the Company’s representations and warranties contained herein. The Holder understands that its investment in the Securities

involves a high degree of risk. The Holder has sought such accounting, legal and tax advice as it has considered necessary to make an

informed investment decision with respect to its acquisition of the Securities. The Holder is relying solely on its own accounting, legal

and tax advisors, and not on any statements of the Company or any of its agents or representatives, for such accounting, legal and tax

advice with respect to its acquisition of the Securities and the transactions contemplated by this Agreement.

4.5

No Governmental Review. The Holder understands that no United States federal or state agency or any other government or governmental

agency has passed on or made any recommendation or endorsement of the Securities or the fairness or suitability of the Securities nor

have such authorities passed upon or endorsed the merits of the Securities.

4.6

Validity; Enforcement; No Conflicts. This Agreement and each Exchange Document to which the Holder is a party have been duly and

validly authorized, executed and delivered on behalf of the Holder and shall constitute the legal, valid and binding obligations of the

Holder enforceable against the Holder in accordance with their respective terms, except as such enforceability may be limited by general

principles of equity or to applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating

to, or affecting generally, the enforcement of applicable creditors’ rights and remedies. The execution, delivery and performance

by the Holder of this Agreement and each Exchange Document to which the Holder is a party and the consummation by the Holder of the transactions

contemplated hereby and thereby will not (i) result in a violation of the organizational documents of the Holder or (ii) conflict with,

or constitute a default (or an event which with notice or lapse of time or both would become a default) under, or give to others any

rights of termination, amendment, acceleration or cancellation of, any agreement, indenture or instrument to which the Holder is a party,

or (iii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities or “blue

sky” laws) applicable to the Holder, except in the case of clause (ii) above, for such conflicts, defaults or rights which would

not, individually or in the aggregate, reasonably be expected to have a material adverse effect on the ability of the Holder to perform

its obligations hereunder.

4.7

Ownership of Warrants. The Holder owns and holds, beneficially and of record, the entire right, title, and interest in and to

the Warrants. The Holder has full power and authority to transfer and dispose of the Warrants to the Company free and clear of any right

or Lien. Other than the transactions contemplated by this Agreement, there is no outstanding vote, plan, pending proposal, or other right,

of any Person to acquire all or any part of the Warrants. As used herein, “Liens” shall mean any security or

other property interest or right, claim, lien, pledge, option, charge, security interest, contingent or conditional sale, or other title

claim or retention agreement, interest or other right or claim of third parties, whether perfected or not perfected, voluntarily incurred

or arising by operation of law, and including any agreement (other than this Agreement) to grant or submit to any of the foregoing in

the future.

4.8

No Consideration Paid. No commission or other remuneration has been paid by the Holder (or any of its agents or affiliates) to

the Company related to the Exchange.

4.9

Transfer or Re-sale. Each Holder understands that (i) the sale or re-sale of the Securities has not been and is not being registered

under the Securities Act or any applicable state securities laws, and the Securities may not be transferred unless (a) the Securities

are sold pursuant to an effective registration statement under the Securities Act, (b) the Holder shall have delivered to the Company,

at the cost of the Company, an opinion of counsel that shall be in form, substance and scope customary for opinions of counsel in comparable

transactions to the effect that the Securities to be sold or transferred may be sold or transferred pursuant to an exemption from such

registration, which opinion shall be accepted by the Company, (c) the Securities are sold or transferred to an “affiliate”

(as defined in Rule 144)) of the Holder who agrees to sell or otherwise transfer the Securities only in accordance with this Section

2(f) and who is an Accredited Holder, or (d) the Securities are sold pursuant to Rule 144, and the Holder shall have delivered to the

Company, an opinion of counsel that shall be in form, substance and scope customary for opinions of counsel in corporate transactions,

which opinion shall be accepted by the Company; (ii) any sale of such Securities made in reliance on Rule 144 may be made only in accordance

with the terms of said Rule 144 and further, if said Rule 144 is not applicable, any re-sale of such Securities under circumstances in

which the seller (or the person through whom the sale is made) may be deemed to be an underwriter (as that term is defined in the Securities

Act) may require compliance with some other exemption under the Securities Act or the rules and regulations of the Securities and Exchange

Commission thereunder; and (iii) neither the Company nor any other person is under any obligation to register such Securities under the

Securities Act or any state securities laws or to comply with the terms and conditions of any exemption thereunder (in each case). Notwithstanding

the foregoing or anything else contained herein to the contrary, the Securities may be pledged as collateral in connection with a bona

fide margin account or other lending arrangement.

4.10

Unlocated Warrant Affidavit. To the extent Warrants cannot be located by the Holder, such Holder represents to the Company that

such Holder is the owner of the Warrants, such Warrants have not been transferred, sold, encumbered or pledged and Holder agrees to indemnify

and hold the Company harmless from any damage or loss caused by the loss of such Warrants.

5.

Additional Covenants.

5.1

Disclosure. The Company shall file a Current Report on Form 8-K (collectively, the “8-K Filing”), with the

Commission within four (4) business days after the Closing.

5.2

Listing and Electronic Transfer. The Company shall use its best efforts to maintain the listing or designation for quotation (as

applicable) of its common stock upon each national securities exchange and automated quotation system on which the common stock is currently

listed or designated while such securities are outstanding. The Company shall pay all fees and expenses in connection with satisfying

its obligations under this Section 5.2. The Company agrees to maintain the eligibility of the common stock for electronic transfer through

the Depository Trust Company or another established clearing corporation, including, without limitation, by timely payment of fees to

the Depository Trust Company or such other established clearing corporation in connection with such electronic transfer.

5.3

Tacking. Subject to the truth and accuracy of the Holder’s representations set forth in Section 5 of this Agreement, the

parties acknowledge and agree that in accordance with Section 3(a)(9) of the Securities Act, the Amended and Restated Warrants issued

in exchange for the Warrants will tack back to the original issue date of the Warrants or the respective date such Warrants should have

been issued, all pursuant to Rule 144 and the Company agrees not to take a position to the contrary.

5.4

Fees and Expenses. The parties are each responsible for the costs of its fees and expenses of its respective advisers, counsel,

accountants and other experts, if any, and all other expenses incurred in connection with the negotiation, preparation, execution, delivery

and performance of this Agreement,

5.5

Acknowledgment of Dilution. The Company acknowledges that the issuance of the Shares may result in dilution of the outstanding

shares of common stock, which dilution may be substantial under certain market conditions. The Company further acknowledges that its

obligations under the Exchange Documents, including, without limitation, its obligation to issue the Shares issued in the Exchange pursuant

to the Exchange Documents, are unconditional and absolute and not subject to any right of set off, counterclaim, delay or reduction,

regardless of the effect of any such dilution or any claim the Company may have against the Holder and regardless of the dilutive effect

that such issuance may have on the ownership of the other stockholders of the Company.

5.6

Integration. The Company shall not sell, offer for sale or solicit offers to buy or otherwise negotiate in respect of any security

(as defined in Section 2 of the Securities Act) that would be integrated with the issuance of the Exchange Securities for purposes of

the rules and regulations of any Trading Market such that it would require shareholder approval prior to the closing of such other transaction

unless shareholder approval is obtained before the closing of such subsequent transaction. “Trading Market” means the NYSE

American, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock Exchange, the OTC

Bulletin Board, the OTCQB, or the OTCQX (or any successors to any of the foregoing).

5.7

Reservation. The Company shall maintain a reserve from its duly authorized shares of common stock for issuance pursuant to the

Exchange in such amount as may then be required to fulfill its obligations in full under the Exchange.

5.8

Indemnification of Holder. Any indemnification previously granted to each Holder pursuant to any other agreement shall remain

in full force and effect and shall apply with respect to the Shares, mutatis mutandis.

5.9

Shareholder Rights Plan. No claim will be made or enforced by the Company or, with the consent of the Company, any other person,

that any Holder is an “Acquiring Person” under any control share acquisition, business combination, poison pill (including

any distribution under a rights agreement) or similar anti-takeover plan or arrangement in effect or hereafter adopted by the Company,

or that any Holder could be deemed to trigger the provisions of any such plan or arrangement, by virtue of receiving the Securities under

the Exchange Documents or under any other agreement between the Company and the Holder.

5.10

Transfer Agent Instructions. The Company shall issue irrevocable instructions to its transfer agent to issue certificates, registered

in the name of the Holder or its nominee, for the Shares in such amounts as specified on Exhibit A annexed hereto (the “Irrevocable

Transfer Agent Instructions”). Prior to registration of the Shares under the Securities Act or the date on which the Shares

may be sold pursuant to Rule 144 without any restriction, all Shares certificates shall bear a restrictive legend. The Company warrants

that: (i) no instruction other than the Irrevocable Transfer Agent Instructions referred to in this Section will be given by the Company

to its transfer agent and that the Securities shall otherwise be freely transferable on the books and records of the Company as and to

the extent provided in this Agreement. Nothing in this Section shall affect in any way the Holder’s obligations to comply with

all applicable prospectus delivery requirements, if any, upon re-sale of the Securities. If the Holder provides the Company, at the cost

of the Company, with (i) an opinion of counsel in form, substance and scope customary for opinions in comparable transactions, to the

effect that a public sale or transfer of such Securities may be made without registration under the Securities Act and such sale or transfer

is effected or (ii) the Holder provides reasonable assurances that the Securities can be sold pursuant to Rule 144, the Company shall

permit the transfer in such name and in such denominations as specified by the Holder. The Company acknowledges that a breach by it of

its obligations hereunder will cause irreparable harm to the Holder, by vitiating the intent and purpose of the transactions contemplated

hereby. Accordingly, the Company acknowledges that the remedy at law for a breach of its obligations under this Section may be inadequate

and agrees, in the event of a breach or threatened breach by the Company of the provisions of this Section, that the Holder shall be

entitled, in addition to all other available remedies, to an injunction restraining any breach and requiring immediate transfer, without

the necessity of showing economic loss and without any bond or other security being required.

5.11

Maintenance of Registration. Until the time that no Holder owns the Securities, the Company covenants to maintain the registration

of the common stock under Section 12(b) or 12(g) of the Exchange Act and to timely file (or obtain extensions in respect thereof and

file within the applicable grace period) all reports required to be filed by the Company after the date hereof pursuant to the Exchange

Act even if the Company is not then subject to the reporting requirements of the Exchange Act.

6.

Lock-Up.

6.1

Lock-Up Restrictions. The Holder will not, during the period (“Lock-Up Period”) (i) offer, pledge, announce the intention

to sell, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option,

right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, any Shares, (ii) enter into any swap or other

agreement that transfers, in whole or in part, any of the economic consequences of ownership of the Shares of, whether any such transaction

described in clause (i) or (ii) above is to be settled by delivery of Shares or such other securities, in cash or otherwise, (iii) make

any demand for or exercise any right with respect to, the registration of any Shares or any security convertible into or exercisable

or exchangeable for shares of common stock, or (iv) publicly announce an intention to effect any transaction specific in clause (i),

(ii) or (iii) above, provided however that the Holder, during the Lock-Up Period, may (a) sell or contract to sell Shares at a price

higher than $0.50 per Share on any trading day up to 10% of the daily volume of Shares or (b) sell or contract to sell Shares at a price

higher than $0.80 per Share on any trading day with no limitation on volume.

6.2

Lock-Up Period. The Lock-Up Period shall expire at the earliest of (i) 365 days after the date hereof or (ii) until the Shares

trade above $1.00 per Share for five consecutive trading days.

7.

Miscellaneous.

7.1

Successors and Assigns. Except as otherwise provided herein, the terms and conditions of this Agreement shall inure to the benefit

of and be binding upon the parties hereto and the respective successors and assigns of the parties. Nothing in this Agreement, express

or implied, is intended to confer upon any party, other than the parties hereto or their respective successors and assigns, any rights,

remedies, obligations or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement.

7.2

Governing Law: Jurisdiction; Jury Trial. All questions concerning the construction, validity, enforcement and interpretation of

this Agreement shall be governed by the internal laws of the State of Delaware, without giving effect to any choice of law or conflict

of law provision or rule (whether of the State of New York or any other jurisdictions) that would cause the application of the laws of

any jurisdictions other than the State of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state

or federal courts sitting in The City of New York, Borough of Manhattan, for the adjudication of any dispute hereunder or in connection

herewith or with any transaction contemplated hereby or discussed herein, and hereby irrevocably waives, and agrees not to assert in

any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court,that such suit, action

or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. Each party hereby

irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing

a copy thereof to such party at the address for such notices to it under this Agreement and agrees that such service shall constitute

good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to

serve process in any manner permitted by law. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST,

A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION

CONTEMPLATED HEREBY.

7.3

Titles and Subtitles. The titles and subtitles used in this Agreement are used for convenience only and are not to be considered

in construing or interpreting this Agreement.

7.4

Notices. Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Agreement

must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered personally; (ii) upon receipt, when sent

by facsimile (provided confirmation of transmission is mechanically or electronically generated and kept on file by the sending party)

or by electronic mail; or (iii) one (1) business day after deposit with an overnight courier service, in each case properly addressed

to the party to receive the same. The addresses, facsimile numbers and email addresses for such communications shall be:

If

to the Company:

Glucotrack,

Inc.

301

Route 17N, Suite 800

Rutherford,

NJ 07070

Attn:

Mr. Paul Goode, CEO

201-842-7715

with

copies (which shall not constitute notice) to:

Ellenoff

Grossman & Schole LLP

1345

Avenue of the Americas, 11th Floor

Attn:

Sarah Williams, Esq.

New

York, New York 10105

Fax:

(212) 705-3071

If

to any Holders:

To

the names, addresses and email addresses identified on Schedule A hereto

If

to the Holder, to its address, facsimile number and email address set forth on its signature page hereto, or to such other address, facsimile

number and/or email address and/or to the attention of such other Person as the recipient party has specified by written notice given

to each other party five (5) days prior to the effectiveness of such change. Written confirmation of receipt (A) given by the recipient

of such notice, consent, waiver or other communication, (B) mechanically or electronically generated by the sender’s facsimile

machine or email containing the time, date, recipient facsimile number and an image of the first page of such transmission or (C) provided

by an overnight courier service shall be rebuttable evidence of personal service.

7.5

Finder’s Fees. Each party represents that it neither is nor will be obligated for any finders’ fee or commission in

connection with this transaction. The Company shall indemnify and hold harmless the Holders from any liability for any commission or

compensation in the nature of a finders’ fee (and the costs and expenses of defending against such liability or asserted liability)

for which the Company or any of its officers, employees or representatives is responsible.

7.6

Amendments and Waivers. Any term of this Agreement may be amended and the observance of any term of this Agreement may be waived

(either generally or in a particular instance and either retroactively or prospectively), only with the written consent of the Company

and the Holders. Any amendment or waiver effected in accordance with this paragraph shall be binding upon Holders and the Company, provided

that no such amendment shall be binding on a holder that does not consent thereto to the extent such amendment treats such party differently

than any party that does consent thereto.

7.7

Severability. If one or more provisions of this Agreement are held to be unenforceable under applicable law, such provision shall

be excluded from this Agreement and the balance of the Agreement shall be interpreted as if such provision were so excluded and shall

be enforceable in accordance with its terms.

7.8

Entire Agreement. This Agreement and the other Exchange Documents represents the entire agreement and understanding between the

parties concerning the Exchange and the other matters described herein and therein and supersedes and replaces any and all prior agreements

and understandings solely with respect to the subject matter hereof and thereof.

7.9

Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of

which together shall constitute one and the same instrument.

7.10

Interpretation. Unless the context of this Agreement clearly requires otherwise, (a) references to the plural include the singular,

the singular the plural, the part the whole, (b) references to any gender include all genders, (c) “including” has the inclusive

meaning frequently identified with the phrase “but not limited to” and (d) references to “hereunder” or “herein”

relate to this Agreement.

7.11

No Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted

successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

7.12

Survival. The representations, warranties and covenants of the Company and the Holder contained herein shall survive the Closing

and delivery of the Securities.

7.13

Further Assurances. Each party shall do and perform, or cause to be done and performed, all such further acts and things, and

shall execute and deliver all such other agreements, certificates, instruments and documents, as any other party may reasonably request

in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated

hereby.

7.14

No Strict Construction. The language used in this Agreement will be deemed to be the language chosen by the parties to express

their mutual intent, and no rules of strict construction will be applied against any party.

[SIGNATURES

ON THE FOLLOWING PAGES]

IN WITNESS

WHEREOF, the parties have caused this Agreement to be duly executed and delivered as of the date provided above.

| |

GLUCOTRACK,

INC. |

| |

|

|

| |

By: |

/s/

Paul Goode |

| |

Name: |

Paul

Goode |

| |

Title: |

CEO |

IN

WITNESS WHEREOF, the parties have caused this Agreement to be duly executed and delivered as of the date provided above.

HOLDER

| Name

of Holder: |

|

|

| |

|

|

| Signature

of Authorized Signatory of Holder: |

|

|

| |

|

|

| Name

of Authorized Signatory: |

|

|

| |

|

|

| Title

of Authorized Signatory: |

|

|

| |

|

|

| Email

Address of Authorized Signatory: |

|

|

| |

|

|

| Address

for Notice to Holder: |

|

|

v3.24.0.1

Cover

|

Feb. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 16, 2024

|

| Entity File Number |

001-41141

|

| Entity Registrant Name |

GLUCOTRACK,

INC.

|

| Entity Central Index Key |

0001506983

|

| Entity Tax Identification Number |

98-0668934

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

301

Rte 17 North

|

| Entity Address, Address Line Two |

Ste. 800

|

| Entity Address, City or Town |

Rutherford

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07070

|

| City Area Code |

(201)

|

| Local Phone Number |

842-7715

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.001

|

| Trading Symbol |

GCTK

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

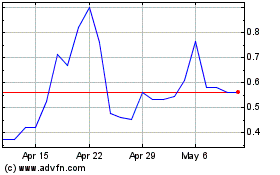

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Apr 2024 to May 2024

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From May 2023 to May 2024