Form 8-K - Current report

February 16 2024 - 9:10AM

Edgar (US Regulatory)

Date of report (Date of earliest event reported):

February 15, 2024

NORTH EUROPEAN OIL

ROYALTY TRUST

(Exact Name of

Registrant as Specified in Charter)

Delaware

1-8245

22-2084119

State

or Other Jurisdiction (Commission

(I.R.S. Employer

of Incorporation

File Number)

Identification No.)

5 N. Lincoln Street, Keene, NH

03431

(Address of Principal Executive Office and Zip Code)

(732) 741-4008

(Registrant's Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation

of the registrant under any of the following provisions (see General

Instruction A.2.below):

[ ] Written communications

pursuant to Rule 425 under the Securities Act

(17 CFR 230.425)

[ ] Soliciting material pursuant

to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

[ ] Pre-commencement

communication pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communication pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

Title of each

class

Trading Symbol(s) Name of each exchange on which

registered

Units

of Beneficial Interest NRT

New York Stock Exchange

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act

of 1933 (17 CFR Section 230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR Section 240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

Item 2.02. Results of

Operations and Financial Condition.

On February 15, 2024, North European Oil Royalty Trust issued a press

release via PR Newswire announcing the Trust's net income for the

first quarter of fiscal 2024. Furnished herewith is a copy of the press

release, which is incorporated by reference herein.

Item 9.01. Financial

Statements and Exhibits.

(c) Exhibits

The following exhibit is furnished herewith:

Exhibit 99. A press release

dated February 15, 2024 disseminated through PR Newswire

announcing the net income for North European Oil Royalty Trust

for the first quarter of fiscal 2024.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

NORTH EUROPEAN OIL ROYALTY TRUST

(Registrant)

/s/ John R. Van Kirk

John R. Van Kirk

Managing Director

February 16, 2024

Keene, N.H. February 15, 2024 -- North

European Oil Royalty Trust

(NYSE-NRT) (the "Trust") reported its net income for the first quarter

of fiscal 2024 which appears in the table below compared to its net

income for the first quarter of fiscal 2023. Total royalty income

often includes positive and negative adjustments that the operators

make during the quarter based upon their adjusted royalty calculations

for the prior periods as required by the Mobil and OEG Royalty

Agreements. Total royalty income for the first quarter of fiscal 2024

was reduced by prior period negative adjustments of Euros 1,988,530

and increased by Mobil sulfur royalties of $68,205. Total royalty

income for the first quarter of fiscal 2023 was not affected because

there were no prior period adjustments and no Mobil sulfur royalties.

|

1st Fiscal Quarter

Ended 1/31/2024 |

1st Fiscal Quarter

Ended 1/31/2023 |

Percentage Change |

| Total Royalty Income |

$424,910 |

$9,765,883 |

-95.6% |

| Net Income |

$179,085 |

$9,536,014 |

-98.1% |

| Distributions per Unit |

$0.05 |

$1.00 |

-95.0% |

Following a prolonged decline in gas prices

starting with the second quarter of fiscal 2023 and the need to

offset a series of overpayments by the operating companies, gas

prices applicable to the royalty calculations for the first

quarter of fiscal 2024 have, as of this time, stabilized. The

bulk of the overpayments from 2023 have largely been offset and

will be fully offset with OEG's scheduled royalty payment in

mid-February. The scheduled royalty payments in March and April

2024 will not be encumbered by negative carryover adjustments.

Based on these factors, the Trustees anticipate a higher

distribution in the second quarter of 2024 compared to the first

quarter of fiscal 2024.

Under the Mobil Agreement for the first quarter

of fiscal 2024, gas prices, gas sales, and the average exchange

rate showed percentage changes of -72.8%, -8.4% and +1.0%,

respectively, in comparison to the first quarter of fiscal 2023.

In a corresponding comparison under the OEG Agreement, gas prices

and gas sales showed percentage changes of -72.8% and -13.9%,

respectively, in comparison to the first quarter of fiscal 2023.

Since no royalties were paid under the OEG Agreement in the first

quarter of fiscal 2024, there was no average exchange rate.

Trust expenses for the first quarter of fiscal 2024

were essentially unchanged at $253,285 compared to $252,792 for the

first quarter of fiscal 2023.

The previously declared distribution of $0.05 per

unit will be paid on February 28, 2024 to owners of record as of

February 16, 2024. Comprehensive details will be available in the

Trust's 10-Q filing available through the SEC or on the Trust's

website, www.neort.com, on or about February 29, 2024. For further

information, contact John R. Van Kirk, Managing Director, at (732)

741-4008 or via e-mail at jvankirk@neort.com. The Trust's press

releases and other pertinent information are also available on the

Trust's website.

Forward-Looking Statements

This press release may contain forward-looking

statements intended to qualify for the safe harbor from liability

established by the Private Securities Litigation Reform Act of 1995.

Such statements address future expectations and events or conditions

concerning the Trust, such as statements concerning future gas

prices, royalty payments and cash distributions. Many of these

statements are based on information provided to the Trust by the

operating companies or by consultants using public information

sources. These statements are subject to certain risks and

uncertainties that could cause actual results to differ materially

from those anticipated in any forward-looking statements. These

include:

• the fact that the assets of

the Trust are depleting assets and, if the operators developing the

concession do not perform additional development projects, the

assets may deplete faster than expected;

• risks and uncertainties

concerning levels of gas production and gas sale prices, general

economic conditions, currency exchange rates;

• the ability or willingness

of the operating companies to perform under their

contractual obligations with the Trust;

• potential disputes with the

operating companies and the resolution thereof; and

• political and economic

uncertainty arising from geopolitical conflict, such as Russia's

invasion of Ukraine.

All such factors are difficult to predict, contain

uncertainties that may materially affect actual results, and are

generally beyond the control of the Trust. New factors emerge from

time to time and it is not possible for the Trust to predict all

such factors or to assess the impact of each such factor on the

Trust. Any forward-looking statement speaks only as of the date on

which such statement is made, and the Trust does not undertake any

obligation to update any forward-looking statement to reflect events

or circumstances after the date on which such statement is made.

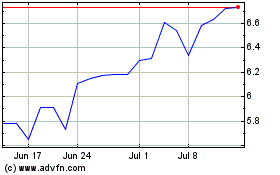

North European Oil Royalty (NYSE:NRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

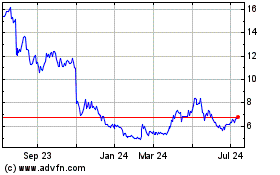

North European Oil Royalty (NYSE:NRT)

Historical Stock Chart

From Apr 2023 to Apr 2024