0000009984false00000099842024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2024

BARNES GROUP INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| | | | | | | | |

| | | |

| 1-4801 | | 06-0247840 |

| (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | |

| 123 Main Street | | |

| Bristol | | |

| Connecticut | | 06010 |

| (Address of principal executive offices) | | (Zip Code) |

(860) 583-7070

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report)

| | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | | B | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| | | | | | | | |

| Item 2.02 | | Results of Operations and Financial Condition.

On February 16, 2024, Barnes Group Inc. issued a press release announcing the financial results of operations for the fourth quarter and year ended December 31, 2023. A copy is attached hereto as Exhibit 99.1 and is incorporated by reference herein. The information in this Current Report on Form 8-K and the exhibit attached hereto, as it pertains to this Item 2.02 herein, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Exchange Act or Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing. |

| Item 9.01 | | Financial Statements and Exhibits.

|

SIGNATURES

| | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | | | | | | | |

| Dated: February 16, 2024 | BARNES GROUP INC. |

| (Registrant) |

| | |

| By: | /s/ JULIE K. STREICH |

| | Julie K. Streich

Senior Vice President, Finance and

Chief Financial Officer |

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Document Description |

| | Press Release, dated February 16, 2024 |

| Exhibit 104 | | Cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

| | | | | | | | | | | | | | |

| | | | Exhibit 99.1

Barnes

860.583.7070 | info@onebarnes.com onebarnes.com |

BARNES REPORTS FOURTH QUARTER AND FULL YEAR 2023 FINANCIAL RESULTS

Results Reflect Execution of Portfolio Optimization and Focus on Long-term Profitable Growth Strategy

Comparisons are year-over-year unless noted otherwise

Fourth Quarter 2023:

•Sales of $416 million, up 33%; Organic Sales up 2%

•Operating Margin of 7.1%; Adjusted Operating Margin of 11.5%, up 30 bps

•Adjusted EBITDA Margin of 18.8%, up 50 bps

•GAAP EPS of $0.14; Adjusted EPS of $0.41, down 21% on acquisition-related interest

Full Year 2023:

•Sales of $1,451 million, up 15% ; Organic Sales up 5%

•Operating Margin of 6.1%; Adjusted Operating Margin of 11.5%, down 10 bps

•Adjusted EBITDA Margin of 18.6%, up 20 bps

•GAAP EPS of $0.31; Adjusted EPS of $1.65, down 17% on acquisition-related interest

2024 Outlook:

•Sales Growth of 12% to 16%; Organic Sales Growth of 4% to 8%

•Adjusted EBITDA Margin of 20% to 22%

•GAAP EPS of $0.94 to $1.19; Adjusted EPS of $1.55 to $1.80

Financial Disclosure Update

•The Company is introducing Adjusted EBITDA metrics to its reporting and outlook, which management believes are useful measures to evaluate the operating performance and cash generation of the overall business and segments following the MB Aerospace acquisition(1)

February 16, 2024

BRISTOL, Conn., — Barnes Group Inc. (NYSE: B), a global provider of highly engineered products, differentiated industrial technologies, and innovative solutions, today reported financial results for the fourth quarter and full year 2023.

"Barnes has made meaningful progress executing our business transformation and long-term profitable growth strategy. We delivered full year organic sales growth in our Aerospace business, and the acquisition of MB Aerospace further enhances our capabilities and scale as we deepen and broaden our customer relationships,” said Thomas J. Hook, President and Chief Executive Officer of Barnes. “With the recent announcement of the divestiture of our Associated Spring™ and Hänggi™ businesses, we continue to shift our portfolio to a high growth, high margin, and value-driven business. As we enter 2024, I am

123 Main Street, Bristol, CT 06010-6376

confident in our ability to position Barnes for sustainable, profitable growth and create value for all our stakeholders.”

Fourth Quarter 2023 Highlights

Comparisons are year-over-year unless noted otherwise

Sales of $416 million were up 33% compared to the prior year, supported by organic growth(2) of 2%, acquisition-related growth of 28%, and favorable foreign exchange of 2%. Operating income of $29.7 million was up 23%, and operating margin of 7.1% was down 60 bps.

Adjusted operating income of $47.7 million was up 36% and adjusted operating margin of 11.5% was up 30 bps. Adjustments excluded restructuring charges of $4.8 million, acquisition and divestiture expenses of $2.0 million, and MB Aerospace short-term purchase accounting adjustments of $11.2 million. Adjusted EBITDA was $78.2 million, up 36% from a year ago and adjusted EBITDA margin was 18.8%, up 50 bps.

Interest expense was $23.6 million versus $4.4 million primarily due to higher average borrowings from the purchase of MB Aerospace and a higher average interest rate given the recapitalization of the Company’s debt structure.

The Company’s annual effective tax rate was 52% compared with 65% last year. During the quarter, the Company completed an intercompany transaction between related entities in several tax jurisdictions which, based on the tax law in those jurisdictions, provided a favorable tax benefit.

Net income was $7.2 million, or $0.14 per share, compared to $15.6 million, or $0.30 per share. On an adjusted basis, net income per share of $0.41 was down 21% from $0.52. Adjusted net income per share excludes $0.07 of restructuring charges, acquisition and divestiture expenses of $0.03, and MB Aerospace short-term purchase accounting adjustments of $0.17.

Full Year 2023 Highlights

Comparisons are year-over-year unless noted otherwise

Sales of $1,451 million, were up 15% compared to 2022, supported by organic growth of 5%, acquisition-related growth of 9%, and favorable foreign exchange of 1%. Operating income of $89.0 million was up 56%, and operating margin increased 160 bps to 6.1%.

Adjusted operating profit of $167.3 million was up 15% and adjusted operating margin of 11.5% was down 10 bps. Full year adjusted operating profit excludes restructuring charges of $45.8 million, acquisition and divestiture expenses of $13.3 million, and MB Aerospace short-term purchase accounting

adjustments of $19.2 million. Adjusted EBITDA was $270.2 million, up 16% from a year ago and adjusted EBITDA margin was 18.6%, up 20 bps.

Interest expense was $58.2 million versus $14.6 million, primarily due to higher average borrowings from the purchase of MB Aerospace and a higher average interest rate. Full year interest expense also includes one-time bridge financing fees of $9.6 million from the MB Aerospace acquisition.

Other Income was $2.4 million versus last year’s expense of $4.3 million, primarily driven by a reduction in non-operating pension expense.

The Company’s effective tax rate was 52% compared with 65% last year. The 2023 effective tax rate reflects the non-deductibility of a portion of our interest expense, transaction costs associated with the MB Aerospace acquisition that are capitalized for tax, and a change in the geographic mix of earnings.

Net income was $16.0 million, or $0.31 per share, compared to $13.5 million, or $0.26 per share. On an adjusted basis, net income per share of $1.65 was down 17% and excludes $0.66 of restructuring charges, acquisition and divestiture expenses of $0.39, and MB Aerospace short-term purchase accounting adjustments of $0.29.

Full year cash provided by operating activities was $112.4 million versus $75.6 million. The increase from the prior year was due to a lower increase in working capital. Capital expenditures of $55.7 million increased $20.7 million over the prior year, driven by investments related to the Company’s restructuring program and tied to productivity improvement. Free cash flow increased $16.2 million to $56.7 million.

Segment Performance

Comparisons are year-over-year unless noted otherwise

Aerospace

Fourth quarter sales were $213 million, up 96%. Organic sales increased 15% and acquisition-related sales added 81%. Aerospace total original equipment manufacturing (“OEM”) sales increased 109% and aftermarket sales increased 77%. On an organic basis, OEM sales increased 17% and aftermarket sales increased 12%. Operating profit was $14.0 million, down 22%. Adjusted operating profit of $27.2 million was up 53%, while adjusted operating margin declined 360 bps to 12.8%. Adjustments to operating profit exclude restructuring and transformation-related charges of $1.3 million, acquisition transaction costs of $0.8 million, and MB Aerospace short-term purchase accounting adjustments of $11.2 million. Adjusted operating profit benefited from the contribution of higher organic sales volumes, inclusive of pricing, and the contribution of MB Aerospace sales, partially offset by the amortization of long term acquired intangibles for the MB Aerospace acquisition, lower productivity, and unfavorable OEM mix. Aerospace adjusted EBITDA was $45.7 million, up 69%, and adjusted EBITDA margin was 21.5% versus 24.9% a year ago.

Full year 2023 sales were $608 million, up 42%. Organic sales increased by 15% and acquisition-related sales added 27%. Operating profit was $53.0 million, down 30%, while operating margin was 8.7% versus 17.7% a year ago. Operating profit includes approximately $8.2 million of long-term purchase accounting adjustments related to the MB Aerospace acquisition. Adjusted operating profit was $91.9 million, up 21%, and adjusted operating margin was 15.1%, down 260 bps. Adjusted operating profit excludes restructuring and transformation charges of $7.6 million, acquisition transaction costs of $12.2 million, and short-term purchase accounting adjustments of $19.2 million. Adjusted EBITDA was $142.8 million, up 19%, and adjusted EBITDA margin was 23.5% versus 27.9% a year ago.

Aerospace OEM backlog ended the year at $1.23 billion, down 1% sequentially from September 2023. The Company expects to convert approximately 50% of this backlog to revenue over the next 12 months.

Industrial

Fourth quarter sales were $203 million, down 1%. Organic sales decreased 4%, which was partly offset by favorable foreign exchange rates of 3%. Operating profit was $15.7 million versus $6.1 million in the prior year. Adjusted operating profit was $20.4 million, up 19% and adjusted operating margin was 10.1%, up 170 bps. Adjusted operating profit reflects lower organic sales volumes and unfavorable mix, partially offset by positive pricing and favorable productivity. Adjusted operating profit excludes restructuring charges of $3.5 million and divestiture-related costs of $1.2 million. Adjusted EBITDA was $32.5 million, up 4% from a year ago, and adjusted EBITDA margin was 16.0%, up 80 bps.

Full year 2023 sales were $843 million, up 1%. Organic sales were flat while favorable foreign exchange had a positive impact of 1%. Full year operating profit was $36.0 million versus operating loss of $19.1 million last year. Adjusted operating profit was $75.5 million, up 8% and adjusted operating margin was 9.0%, up 60 bps. Adjusted operating profit excludes restructuring charges of $38.3 million and divestiture-related costs of $1.2 million. Adjusted EBITDA was $126.1 million, up 9%, and adjusted EBITDA margin was 15.0% versus 13.8% a year ago.

Balance Sheet and Liquidity

As of December 31, 2023, the Company had $90 million in cash and $357 million available capacity under its revolving credit facility. The “Net Debt to EBITDA” ratio, as defined in our credit agreements, was approximately 3.64, down from 3.77 times at the end of third quarter. Barnes remains committed to achieving a leverage ratio of 3.0x or lower by the end of 2024 and reaffirms its long-term leverage goal of 2.5x by 2025.

“In 2022, we set a strategic course to reposition Barnes for long-term value creation and we made considerable progress during 2023. For 2024, we stay focused on profitable growth and disciplined cost management to drive margin expansion and cash flow, which will support our commitment to reduce debt,” said Julie K. Streich, Senior Vice President, Finance and Chief Financial Officer, Barnes.

2024 Full Year Outlook

The Company is providing full year 2024 guidance as follows:

| | | | | | | | |

| | 2024 Guidance |

| Organic sales growth | | 4% to 8% |

| Adjusted operating margin | | 12% to 14% |

| Adjusted EBITDA margin | | 20% to 22% |

| Adjusted earnings per share | | $1.55 to $1.80 |

| Capital expenditures | | $60 million to $70 million |

| Free cash flow | | $75 million to $85 million |

| Adjusted effective tax rate | | 30% to 32% |

The Company’s 2024 Adjusted EPS guidance excludes $0.17 related to restructuring and transformation activities, $0.06 of MB Aerospace short-term purchase accounting adjustments, and $0.38 of estimated divestiture impacts related to the pending sale of the Associated Spring™ and Hänggi™ businesses.

The Company’s outlook assumes that the announced divestiture of the Associated Spring™ and Hänggi™ businesses closes at the end of the first quarter (Link). Accordingly, the outlook includes three months of financial performance forecasted for these businesses.

Conference Call Information

Barnes will conduct a conference call with investors to discuss the fourth quarter and full year 2023 results at 8:30 a.m. ET today, February 16, 2024. The public may access the conference through a live audio webcast available on the Investor Relations section of Barnes’ website at www.onebarnes.com.

The conference is also available by direct dial at (888) 510-2379 in the U.S. or (646) 960-0691 outside of the U.S.; Conference ID 1137078. Supplemental materials will be posted to the Investor Relations section of the Company's website prior to the conference call.

In addition, the call will be recorded and available for playback from 12:00 p.m. (ET) on Friday, February 16, 2024, until 11:59 p.m. (ET) on Friday, February 23, 2024, by dialing (647) 362-9199; Conference ID 1137078.

Notes:

(1) While Barnes reports financial results in accordance with U.S. generally accepted accounting principles (GAAP), beginning with this earnings release, the Company will provide additional information with respect to a non-GAAP measure, “Adjusted Earnings Before Interest, Income Tax, Depreciation and Amortization” (Adjusted EBITDA). With the acquisition of MB Aerospace, the largest transaction in Barnes’

history, the Company incurred related expenses, including acquired intangible assets and additional interest expense from the debt-funded acquisition. Accordingly, the Company uses Adjusted EBITDA, among other measures, to monitor our business performance. While EBITDA is not a U.S. GAAP measure, nor is it a substitute for a U.S. GAAP measure, we believe it provides helpful information to investors in understanding the ongoing operating performance of the Company. Investors should consider non-GAAP measures in addition to, not as a substitute for, or as superior to, measures of financial performance prepared in accordance with U.S. GAAP. Tables reconciling non-GAAP to GAAP financial measures, including forward looking outlook information, are presented at the end of this press release.

(2) Organic sales growth represents the total reported sales increase within the Company’s ongoing business less the impact of foreign currency translation and acquisition and divestitures completed in the preceding twelve months.

About Barnes

Barnes Group Inc. (NYSE: B) leverages world-class manufacturing capabilities and market-leading engineering to develop advanced processes, automation solutions, and applied technologies for industries ranging from aerospace and medical & personal care to mobility and packaging. With a celebrated legacy of pioneering excellence, Barnes delivers exceptional value to customers through advanced manufacturing capabilities and cutting-edge industrial technologies. Barnes Aerospace specializes in the production and servicing of intricate fabricated and precision-machined components for both commercial and military turbine engines, nacelles, and airframes. Barnes Industrial excels in advancing the processing, control, and sustainability of engineered plastics and delivering innovative, custom-tailored solutions for industrial automation and metal forming applications. Established in 1857 and headquartered in Bristol, Connecticut, USA, the Company has manufacturing and support operations around the globe. For more information, visit please visit www.onebarnes.com.

Forward-Looking Statements

This press release contains forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future operating and financial performance and financial condition, and often contain words such as "anticipate," "believe," "expect," "plan," "estimate," "project," "continue," "will," "should," "may," and similar terms. These forward-looking statements do not constitute guarantees of future performance and are subject to a variety of risks and uncertainties that may cause actual results to differ materially from those expressed in the forward-looking statements. These risks and uncertainties include, among others: the Company’s ability to manage economic, business and geopolitical conditions, including rising interest rates, global price inflation and shortages impacting the availability of materials; the duration and severity of unforeseen events such as an epidemic or a pandemic, including their impacts across our business on demand, supply chains, operations and liquidity; failure to successfully negotiate collective bargaining agreements or potential strikes, work stoppages or other similar events; changes in market demand for our products and services; rapid technological and market change; the ability to protect and avoid infringing upon intellectual property rights; challenges associated with the introduction or development of new products or transfer

of work; higher risks in global operations and markets; the impact of intense competition; the physical and operational risks from natural disasters, severe weather events, and climate change which may limit accessibility to sufficient water resources, outbreaks of contagious diseases and other adverse public health developments; acts of war, terrorism and other international conflicts; the failure to achieve anticipated cost savings and benefits associated with workforce reductions and restructuring actions; currency fluctuations and foreign currency exposure; impacts from goodwill impairment and related charges; our dependence upon revenues and earnings from a small number of significant customers; a major loss of customers; inability to realize expected sales or profits from existing backlog due to a range of factors, including changes in customer sourcing decisions, material changes, production schedules and volumes of specific programs; the impact of government budget and funding decisions; our ability to successfully integrate and achieve anticipated synergies associated with recently announced and future acquisitions, including the acquisition of MB Aerospace; government-imposed sanctions, tariffs, trade agreements and trade policies; changes or uncertainties in laws, regulations, rates, policies or interpretations that impact the Company’s business operations or tax status, including those that address climate change, environmental, health and safety matters, and the materials processed by our products or their end markets; fluctuations in the pricing or availability of raw materials, freight, transportation, energy, utilities and other items required by our operations; labor shortages or other business interruptions at transportation centers, shipping ports, our suppliers’ facilities or our facilities; disruptions in information technology systems, including as a result of cybersecurity attacks or data security breaches; the ability to hire and retain senior management and qualified personnel; the continuing impact of prior acquisitions and divestitures, and any ongoing and future strategic actions, and our ability to achieve the financial and operational targets set in connection with any such actions; the ability to achieve social and environmental performance goals; the outcome of pending and future litigation and governmental proceedings; the impact of actual, potential or alleged defects or failures of our products or third-party products within which our products are integrated, including product liabilities, product recall costs and uninsured claims; future repurchases of common stock; future levels of indebtedness; the impact of shareholder activism; and other risks and uncertainties described in documents filed with or furnished to the Securities and Exchange Commission ("SEC") by the Company, including, among others, those in the Management's Discussion and Analysis of Financial Condition and Results of Operations and Risk Factors sections of the Company's filings. The Company assumes no obligation to update its forward-looking statements.

Category: Earnings

Investors:

Barnes Group Inc.

William Pitts

Vice President, Investor Relations

ir@onebarnes.com

860.583.7070

BARNES GROUP INC.

CONSOLIDATED STATEMENTS OF INCOME

(Dollars in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Net sales | $ | 415,542 | | | $ | 313,473 | | | 32.6 | | | $ | 1,450,871 | | | $ | 1,261,868 | | | 15.0 | |

| | | | | | | | | | | | |

| Cost of sales | 304,426 | | | 211,402 | | | 44.0 | | | 1,008,786 | | | 839,996 | | | 20.1 | |

| Selling and administrative expenses | 81,405 | | | 77,914 | | | 4.5 | | | 353,093 | | | 296,559 | | | 19.1 | |

| Goodwill impairment charge | — | | | — | | | NM | | — | | | 68,194 | | | NM |

| | 385,831 | | | 289,316 | | | 33.4 | | | 1,361,879 | | | 1,204,749 | | | 13.0 | |

| Operating income | 29,711 | | | 24,157 | | | 23.0 | | | 88,992 | | | 57,119 | | | 55.8 | |

| | | | | | | | | | | |

| Operating margin | 7.1 | % | | 7.7 | % | | | | 6.1 | % | | 4.5 | % | | |

| | | | | | | | | | | | |

| Interest expense | 23,559 | | | 4,375 | | | 438.5 | | | 58,171 | | | 14,624 | | | 297.8 | |

| Other expense (income), net | (14) | | | 660 | | | (102.1) | | | (2,443) | | | 4,310 | | | (156.7) | |

| Income before income taxes | 6,166 | | | 19,122 | | | (67.8) | | | 33,264 | | | 38,185 | | | (12.9) | |

| Income taxes | (1,050) | | | 3,553 | | | NM | | 17,268 | | | 24,706 | | | (30.1) | |

| Net income | $ | 7,216 | | | $ | 15,569 | | | (53.7) | | | $ | 15,996 | | | $ | 13,479 | | | 18.7 | |

| | | | | | | | | | | |

| Common dividends | $ | 8,109 | | | $ | 8,094 | | | 0.2 | | | $ | 32,412 | | | $ | 32,376 | | | 0.1 | |

| | | | | | | | | | | |

| Per common share: | | | | | | | | | | | |

| Net income: | | | | | | | | | | | |

| Basic | $ | 0.14 | | | $ | 0.31 | | | (54.8) | | | $ | 0.31 | | | $ | 0.26 | | | 19.2 | |

| Diluted | 0.14 | | | 0.30 | | | (53.3) | | | 0.31 | | | 0.26 | | | 19.2 | |

| Dividends | 0.16 | | | 0.16 | | | — | | | 0.64 | | | 0.64 | | | — | |

| | | | | | | | | | | |

| Weighted average common shares outstanding: | | | | | | | | | | | |

| Basic | 51,112,969 | | | 50,904,802 | | | 0.4 | | | 51,052,963 | | | 50,962,447 | | | 0.2 | |

| Diluted | 51,152,276 | | | 51,057,653 | | | 0.2 | | | 51,205,888 | | | 51,084,167 | | | 0.2 | |

| NM - Not meaningful | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

BARNES GROUP INC.

OPERATIONS BY REPORTABLE BUSINESS SEGMENT

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, | |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change | |

| Net sales | | | | | | | | | | | | |

| Aerospace | $ | 212,688 | | | $ | 108,504 | | | 96.0 | | | $ | 608,050 | | | $ | 429,153 | | | 41.7 | | |

| Industrial | 202,854 | | | 204,969 | | | (1.0) | | | 842,831 | | | 832,715 | | | 1.2 | | |

| Intersegment sales | — | | | — | | | | | (10) | | | — | | | | |

| Total net sales | $ | 415,542 | | | $ | 313,473 | | | 32.6 | | | $ | 1,450,871 | | | $ | 1,261,868 | | | 15.0 | | |

| | | | | | | | | | | | |

| Operating profit (loss) | | | | | | | | | | | | |

| Aerospace | $ | 14,000 | | | $ | 18,012 | | | (22.3) | | | $ | 52,953 | | | $ | 76,174 | | | (30.5) | | |

| Industrial | 15,711 | | | 6,145 | | | 155.7 | | | 36,039 | | | (19,055) | | | NM | |

| Total operating profit | $ | 29,711 | | | $ | 24,157 | | | 23.0 | | | $ | 88,992 | | | $ | 57,119 | | | 55.8 | | |

| | | | | | | | | | | | |

| Operating margin | | | | | Change | | | | | | Change | |

| Aerospace | 6.6 | % | | 16.6 | % | | (1,000) | | bps. | 8.7 | % | | 17.7 | % | | (900) | | bps. |

| Industrial | 7.7 | % | | 3.0 | % | | 470 | | bps. | 4.3 | % | | -2.3 | % | | 660 | | bps. |

| Total operating margin | 7.1 | % | | 7.7 | % | | (60) | | bps. | 6.1 | % | | 4.5 | % | | 160 | | bps. |

| NM - Not meaningful | | | | | | | | | | | | |

BARNES GROUP INC.

CONSOLIDATED BALANCE SHEETS

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 89,827 | | | $ | 76,858 | |

| Accounts receivable | 353,923 | | | 291,883 | |

| Inventories | 365,221 | | | 283,402 | |

| Prepaid expenses and other current assets | 97,749 | | | 80,161 | |

| | | |

| Total current assets | 906,720 | | | 732,304 | |

| | | | |

| Deferred income taxes | 10,295 | | | 18,028 | |

| Property, plant and equipment, net | 402,697 | | | 320,139 | |

| Goodwill | 1,183,624 | | | 835,472 | |

| Other intangible assets, net | 706,471 | | | 442,492 | |

| Other assets | 98,207 | | | 65,295 | |

| | | |

| Total assets | $ | 3,308,014 | | | $ | 2,413,730 | |

| | | | |

| Liabilities and Stockholders' Equity | | | |

| Current liabilities | | | |

| Notes and overdrafts payable | $ | 16 | | | $ | 8 | |

| Accounts payable | 164,264 | | | 145,060 | |

| Accrued liabilities | 221,462 | | | 158,568 | |

| Long-term debt - current | 10,868 | | | 1,437 | |

| | | |

| Total current liabilities | 396,610 | | | 305,073 | |

| | | | |

| Long-term debt | 1,279,962 | | | 569,639 | |

| Accrued retirement benefits | 45,992 | | | 54,352 | |

| Deferred income taxes | 120,608 | | | 62,562 | |

| Long-term tax liability | 21,714 | | | 39,086 | |

| Other liabilities | 80,865 | | | 36,691 | |

| | | |

| | | | |

| Total stockholders' equity | 1,362,263 | | | 1,346,327 | |

| Total liabilities and stockholders' equity | $ | 3,308,014 | | | $ | 2,413,730 | |

BARNES GROUP INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| Twelve months ended December 31, |

| 2023 | | 2022 |

| Operating activities: | | | |

| Net income | $ | 15,996 | | | $ | 13,479 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 115,818 | | | 92,150 | |

| Loss on disposition of property, plant and equipment | (1,197) | | | (821) | |

| Stock compensation expense | 10,201 | | | 12,804 | |

| Non-cash goodwill impairment charge | — | | | 68,194 | |

| Changes in assets and liabilities, net of the effects of acquisition: | | | |

| Accounts receivable | (6,074) | | | (39,484) | |

| Inventories | 622 | | | (48,591) | |

| Prepaid expenses and other current assets | 1,321 | | | (9,257) | |

| Accounts payable | (5,493) | | | 15,998 | |

| Accrued liabilities | 22,673 | | | (25,659) | |

| Deferred income taxes | (16,058) | | | 2,645 | |

| Long-term retirement benefits | (17,256) | | | (1,474) | |

| Long-term tax liability | (13,029) | | | (6,948) | |

| Other | 4,891 | | | 2,523 | |

| Net cash provided by operating activities | 112,415 | | | 75,559 | |

| | | | |

| Investing activities: | | | |

| Proceeds from disposition of property, plant and equipment | 7,921 | | | 1,825 | |

| Capital expenditures | (55,739) | | | (35,082) | |

| Business acquisitions, net of cash acquired | (718,782) | | | — | |

| Other | (921) | | | (2,729) | |

| Net cash used by investing activities | (767,521) | | | (35,986) | |

| | | | |

| Financing activities: | | | |

| Net change in other borrowings | (257) | | | (1,333) | |

| Payments on long-term debt | (314,167) | | | (108,415) | |

| Proceeds from the issuance of long-term debt | 1,019,708 | | | 98,285 | |

| Payments of debt issuance costs | (11,341) | | | — | |

| Proceeds from the issuance of common stock | 353 | | | 513 | |

| Common stock repurchases | — | | | (6,721) | |

| Dividends paid | (32,412) | | | (32,376) | |

| Withholding taxes paid on stock issuances | (908) | | | (1,144) | |

| Other | 5,586 | | | (13,638) | |

| Net cash provided (used) financing activities | 666,562 | | | (64,829) | |

| | | | |

| Effect of exchange rate changes on cash flows | (545) | | | (5,525) | |

| Increase (decrease) in cash, cash equivalents and restricted cash | 10,911 | | | (30,781) | |

| | | |

| Cash, cash equivalents and restricted cash at beginning of the year | 81,128 | | | 111,909 | |

| Cash, cash equivalents and restricted cash at end of year | 92,039 | | | 81,128 | |

| Less: Restricted cash, included in Prepaid expenses and other current assets | (2,212) | | | (2,135) | |

| Less: Restricted cash, included in Other assets | — | | | (2,135) | |

| Cash and cash equivalents at end of year | $ | 89,827 | | | $ | 76,858 | |

BARNES GROUP INC.

RECONCILIATION OF NET CASH PROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

(Dollars in thousands)

(Unaudited)

| | | | | | | | | | | |

| Twelve months ended December 31, |

| 2023 | | 2022 |

| Free cash flow: | | | |

| Net cash provided by operating activities | $ | 112,415 | | | $ | 75,559 | |

| Capital expenditures | (55,739) | | | (35,082) | |

Free cash flow (1) | $ | 56,676 | | | $ | 40,477 | |

| | | |

| Free cash flow to net income cash conversion ratio (as adjusted): | | | |

| Net income | $ | 15,996 | | | $ | 13,479 | |

| Goodwill impairment charge | — | | | 68,194 | |

Net income (as adjusted) (2) | $ | 15,996 | | | $ | 81,673 | |

| | | |

Free cash flow to net income cash conversion ratio (as adjusted) (2) | 354 | % | | 50 | % |

Notes:

(1) The Company defines free cash flow as net cash provided by operating activities less capital expenditures. The Company believes that the free cash flow metric is useful to investors and management as a measure of cash generated by business operations that can be used to invest in future growth, pay dividends, repurchase stock and reduce debt. This metric can also be used to evaluate the Company's ability to generate cash flow from business operations and the impact that this cash flow has on the Company's liquidity.

(2) For the purpose of calculating the cash conversion ratio, the Company has excluded the goodwill impairment charge recorded in the second quarter of 2022 related to the Automation reporting unit from 2022 net income.

BARNES GROUP INC.

NON-GAAP FINANCIAL MEASURE RECONCILIATION

ADJUSTED OPERATING PROFIT AND ADJUSTED DILUTED EARNINGS PER SHARE

(Dollars in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Twelve months ended December 31, | |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change | |

| SEGMENT RESULTS | | | | | | | | | | | | |

| Operating Profit - Aerospace Segment (GAAP) | $ | 14,000 | | | $ | 18,012 | | | (22.3) | | | $ | 52,953 | | | $ | 76,174 | | | (30.5) | | |

| Restructuring/reduction in force and transformation related charges | 1,295 | | | (250) | | | | | 7,557 | | | (255) | | | | |

| Acquisition transaction costs | 776 | | | — | | | | | 12,152 | | | — | | | | |

| MB Short-term purchase accounting adjustments | 11,173 | | | — | | | | | 19,192 | | | — | | | | |

Operating Profit - Aerospace Segment as adjusted (Non-GAAP) (1) | $ | 27,244 | | | $ | 17,762 | | | 53.4 | | | $ | 91,854 | | | $ | 75,919 | | | 21.0 | | |

| | | | | | | | | | | | |

| Operating Margin - Aerospace Segment (GAAP) | 6.6 | % | | 16.6 | % | | (1,000) | | bps. | 8.7 | % | | 17.7 | % | | (900) | | bps. |

Operating Margin - Aerospace Segment as adjusted (Non-GAAP) (1) | 12.8 | % | | 16.4 | % | | (360) | | bps. | 15.1 | % | | 17.7 | % | | (260) | | bps. |

| | | | | | | | | | | | |

| Operating Profit (Loss) - Industrial Segment (GAAP) | $ | 15,711 | | | $ | 6,145 | | | 155.7 | | | $ | 36,039 | | | $ | (19,055) | | | NM | |

| Restructuring/reduction in force and transformation related charges | 3,548 | | | 11,052 | | | | | 38,259 | | | 20,853 | | | | |

| Divestiture transaction costs | 1,174 | | | — | | | | | 1,174 | | | — | | | | |

| Goodwill impairment charge | — | | | — | | | | | — | | | 68,194 | | | | |

Operating Profit - Industrial Segment as adjusted (Non-GAAP) (1) | $ | 20,433 | | | $ | 17,197 | | | 18.8 | | | $ | 75,472 | | | $ | 69,992 | | | 7.8 | | |

| | | | | | | | | | | | |

| Operating Margin - Industrial Segment (GAAP) | 7.7 | % | | 3.0 | % | | 470 | | bps. | 4.3 | % | | -2.3 | % | | 660 | | bps. |

Operating Margin - Industrial Segment as adjusted (Non-GAAP) (1) | 10.1 | % | | 8.4 | % | | 170 | | bps. | 9.0 | % | | 8.4 | % | | 60 | | bps. |

| | | | | | | | | | | | |

| CONSOLIDATED RESULTS | | | | | | | | | | | | |

| Operating Income (GAAP) | $ | 29,711 | | | $ | 24,157 | | | 23.0 | | | $ | 88,992 | | | $ | 57,119 | | | 55.8 | | |

| Restructuring/reduction in force and transformation related charges | 4,843 | | | 10,802 | | | | | 45,816 | | | 20,598 | | | | |

| Acquisition transaction costs | 776 | | | — | | | | | 12,152 | | | — | | | | |

| Divestiture transaction costs | 1,174 | | | — | | | | | 1,174 | | | — | | | | |

| MB Short-term purchase accounting adjustments | 11,173 | | | — | | | | | 19,192 | | | — | | | | |

| Goodwill impairment charge | — | | | — | | | | | — | | | 68,194 | | | | |

Operating Income as adjusted (Non-GAAP) (1) | $ | 47,677 | | | $ | 34,959 | | | 36.4 | | | $ | 167,326 | | | $ | 145,911 | | | 14.7 | | |

| | | | | | | | | | | | |

| Operating Margin (GAAP) | 7.1 | % | | 7.7 | % | | (60) | | bps. | 6.1 | % | | 4.5 | % | | 160 | | bps. |

Operating Margin as adjusted (Non-GAAP) (1) | 11.5 | % | | 11.2 | % | | 30 | | bps. | 11.5 | % | | 11.6 | % | | (10) | | bps. |

| | | | | | | | | | | | |

| Diluted Net Income per Share (GAAP) | $ | 0.14 | | | $ | 0.30 | | | (53.3) | | | $ | 0.31 | | | $ | 0.26 | | | 19.2 | | |

| Restructuring/reduction in force and transformation related charges | 0.07 | | | 0.16 | | | | | 0.66 | | | 0.33 | | | | |

| Acquisition transaction costs | 0.01 | | | — | | | | | 0.37 | | | — | | | | |

| Divestiture transaction costs | 0.02 | | | — | | | | | 0.02 | | | — | | | | |

| MB Short-term purchase accounting adjustments | 0.17 | | | — | | | | | 0.29 | | | — | | | | |

| Tax related CEO transition costs | — | | | 0.06 | | | | | — | | | 0.06 | | | | |

| Goodwill impairment charge | — | | | — | | | | | — | | | 1.33 | | | | |

Diluted Net Income per Share as adjusted (Non-GAAP) (1) | $ | 0.41 | | | $ | 0.52 | | | (21.2) | | | $ | 1.65 | | | $ | 1.98 | | | (16.7) | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | Full-Year 2024 Outlook | | | | | | | |

| Operating Margin (GAAP) | | | 11.5 | % | to | 13.5 | % | | | | | | | |

| | | | | | | | | | | | |

| Restructuring/reduction in force and transformation related charges | | | | 0.7% | | | | | | | | |

| Divestiture related impacts | | | | -0.5% | | | | | | | | |

| MB Short-term purchase accounting adjustments | | | | 0.2% | | | | | | | | |

| | | | | | | | | | | | |

Operating Margin as adjusted (Non-GAAP) (1) | | | 12.0 | % | to | 14.0 | % | | | | | | | |

| | | | | | | | | | | | |

| Diluted Net Income per Share (GAAP) | | | $ | 0.94 | | to | $ | 1.19 | | | | | | | |

| | | | | | | | | | | | |

| Restructuring/reduction in force and transformation related charges | | | | 0.17 | | | | | | | | |

| Divestiture related impacts | | | | 0.38 | | | | | | | | |

| MB Short-term purchase accounting adjustments | | | | 0.06 | | | | | | | | |

| | | | | | | | | | | | |

Diluted Net Income per Share as adjusted (Non-GAAP) (1) | | | $ | 1.55 | | to | $ | 1.80 | | | | | | | |

| | | | | | | | | | | | |

| NM - Not meaningful | | | | | | | | | | | | |

| | | | | | | | | | | | |

Notes:

(1) The Company has excluded the following from its "as adjusted" financial measurements for 2023: 1) charges related to restructuring/reduction in force actions at certain businesses and business transformation costs (consulting fees related to transformation initiatives), including $45.8M reflected within operating profit ($4.8M in the fourth quarter) and ($1.1M) reflected within other expense (income), net ($0.0 in the fourth quarter), 2) acquisition transaction costs related to the acquisition of MB Aerospace, including $12.2M reflected within operating profit ($0.8M in the fourth quarter) and $9.6M reflected within interest expense, 3) divestiture transaction costs related to the planned divestiture of the Associated Spring™ and Hänggi™ businesses, including $1.2M reflected within operating profit in the fourth quarter, and 4) short-term purchase accounting adjustments related to its MB Aerospace acquisition, including $19.2M reflected within operating profit ($11.2M in the fourth quarter). The Company has excluded the following from its "as adjusted" financial measurements for 2022: 1) charges related to restructuring activities and actions at certain businesses, including $20.6M reflected within operating profit ($10.8M in the fourth quarter) and $1.4M reflected within other expense (income), net ($0.0M in the fourth quarter), 2) tax charges resulting from the CEO transition in 2022 and 3) the goodwill impairment charge recorded in the second quarter of 2022 related to the Automation reporting unit. The tax effects of the restructuring related actions and acquisition related actions were calculated based on the respective tax jurisdictions and ranged from approximately 15% to approximately 30%. The goodwill impairment charge did not have a tax effect as it is not deductible for book purposes. The majority of the transaction costs did not have a tax effect as costs were capitalized for tax purposes. Management believes that these adjustments provide the Company and its investors with an indication of our baseline performance excluding items that are not considered to be reflective of our ongoing results. Management does not intend results excluding the adjustments to represent results as defined by GAAP, and the reader should not consider it as an alternative measurement calculated in accordance with GAAP, or as an indicator of the Company's performance. Accordingly, the measurements have limitations depending on their use.

BARNES GROUP INC.

NON-GAAP FINANCIAL MEASURE RECONCILIATION

EBITDA, EBITDA MARGIN, ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

(Dollars in thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, |

| 2023 | | 2022 |

| Aerospace | | Industrial | | Other (1) | | Total | | Aerospace | | Industrial | | Other (1) | | Total |

| Net Sales | $ 212,688 | | 202,854 | | - | | $ 415,542 | | $ 108,504 | | 204,969 | | - | | $ 313,473 |

| | | | | | | | | | | | | | | |

| Net Income | | | | | | | $ 7,216 | | | | | | | | $ 15,569 |

| Interest expense | | | | | | | 23,559 | | | | | | | | 4,375 |

| Other expense (income), net | | | | | | | (14) | | | | | | | | 660 |

| Income taxes | | | | | | | (1,050) | | | | | | | | 3,553 |

| Operating Profit (GAAP) | $ | 14,000 | | | $ | 15,711 | | | $ | — | | | $ | 29,711 | | | $ | 18,012 | | | $ | 6,145 | | | $ | — | | | $ | 24,157 | |

| Operating Margin (GAAP) | 6.6% | | 7.7% | | | | 7.1% | | 16.6% | | 3.0% | | | | 7.7% |

| | | | | | | | | | | | | | | |

| Other expense (income), net | - | | - | | 14 | | 14 | | - | | - | | (660) | | (660) |

Depreciation (2) | 8,785 | | 6,191 | | - | | 14,976 | | 4,419 | | 7,640 | | - | | 12,059 |

Amortization (3) | 15,545 | | 6,101 | | - | | 21,646 | | 4,784 | | 6,285 | | - | | 11,069 |

EBITDA (Non-GAAP) (4) | $ | 38,330 | | | $ | 28,003 | | | $ | 14 | | | $ | 66,347 | | | $ | 27,215 | | | $ | 20,070 | | | $ | (660) | | | $ | 46,625 | |

EBITDA Margin (Non-GAAP) (4) | 18.0% | | 13.8% | | | | 16.0% | | 25.1% | | 9.8% | | | | 14.9% |

| | | | | | | | | | | | | | | |

| Restructuring/reduction in force and transformation related charges | 1,295 | | 3,328 | | - | | 4,623 | | (250) | | 11,052 | | - | | 10,802 |

| Acquisition transaction costs | 776 | | - | | - | | 776 | | - | | - | | - | | - |

| MB Short-term purchase accounting adjustments | 5,299 | | - | | - | | 5,299 | | - | | - | | - | | - |

| Divestiture transaction costs | - | | 1,174 | | - | | 1,174 | | - | | - | | - | | - |

Adjusted EBITDA (Non-GAAP) (4) | $ | 45,700 | | | $ | 32,505 | | | $ | 14 | | | $ | 78,219 | | | $ | 26,965 | | | $ | 31,122 | | | $ | (660) | | | $ | 57,427 | |

Adjusted EBITDA Margin (Non-GAAP) (4) | 21.5% | | 16.0% | | | | 18.8% | | 24.9% | | 15.2% | | | | 18.3% |

| | | | | | | | | | | | | | | |

| Twelve months ended December 31, |

| 2023 | | 2022 |

| Aerospace | | Industrial | | Other (1) | | Total | | Aerospace | | Industrial | | Other (1) | | Total |

| Net Sales | $ 608,050 | | 842,831 | | (10) | | $ 1,450,871 | | $ 429,153 | | 832,715 | | - | | $ 1,261,868 |

| | | | | | | | | | | | | | | |

| Net Income | | | | | | | $ 15,996 | | | | | | | | $ 13,479 |

| Interest expense | | | | | | | 58,171 | | | | | | | | 14,624 |

| Other expense (income), net | | | | | | | (2,443) | | | | | | | | 4,310 |

| Income taxes | | | | | | | 17,268 | | | | | | | | 24,706 |

| Operating Profit (Loss) (GAAP) | $ | 52,953 | | | $ | 36,039 | | | $ | — | | | $ | 88,992 | | | $ | 76,174 | | | $ | (19,055) | | | $ | — | | | $ | 57,119 | |

| Operating Margin (GAAP) | 8.7% | | 4.3% | | | | 6.1% | | 17.7% | | -2.3% | | | | 4.5% |

| | | | | | | | | | | | | | | |

| Other expense (income), net | - | | - | | 2,443 | | 2,443 | | - | | - | | (4,310) | | (4,310) |

Depreciation (2) | 23,504 | | 28,582 | | - | | 52,086 | | 18,075 | | 29,088 | | - | | 47,163 |

Amortization (3) | 38,304 | | 25,428 | | - | | 63,732 | | 25,644 | | 19,343 | | - | | 44,987 |

EBITDA (Non-GAAP) (4) | $ | 114,761 | | | $ | 90,049 | | | $ | 2,443 | | | $ | 207,253 | | | $ | 119,893 | | | $ | 29,376 | | | $ | (4,310) | | | $ | 144,959 | |

EBITDA Margin (Non-GAAP) (4) | 18.9% | | 10.7% | | | | 14.3% | | 27.9% | | 3.5% | | | | 11.5% |

| | | | | | | | | | | | | | | |

| Restructuring/reduction in force and transformation related charges | 7,557 | | 34,854 | | - | | 42,411 | | (255) | | 17,668 | | - | | 17,413 |

| Acquisition transaction costs | 12,152 | | - | | - | | 12,152 | | - | | - | | - | | - |

| MB Short-term purchase accounting adjustments | 8,318 | | - | | - | | 8,318 | | - | | - | | - | | - |

| Divestiture transaction costs | - | | 1,174 | | - | | 1,174 | | - | | - | | - | | - |

| Pension related (gain)/loss | - | | - | | (1,144) | | (1,144) | | - | | - | | 1,417 | | 1,417 |

| Goodwill impairment charge | - | | - | | - | | - | | - | | 68,194 | | - | | 68,194 |

Adjusted EBITDA (Non-GAAP) (4) | $ | 142,788 | | | $ | 126,077 | | | $ | 1,299 | | | $ | 270,164 | | | $ | 119,638 | | | $ | 115,238 | | | $ | (2,893) | | | $ | 231,983 | |

Adjusted EBITDA Margin (Non-GAAP) (4) | 23.5% | | 15.0% | | | | 18.6% | | 27.9% | | 13.8% | | | | 18.4% |

| | | | | | | | | | | | | | | |

Notes:

(1) "Other" includes intersegment sales and items that are included within Other expense (income), net that are not allocated to the Company's reportable business segments.

(2) Depreciation expense in 2023 includes $3.4 million ($0.2M related to the fourth quarter) of accelerated depreciation charges related to restructuring actions. Depreciation in 2022 includes $3.2 million ($0.0M related to the fourth quarter) of similar accelerated depreciation charges.

(3) Amortization expense in 2023 includes $10.9 million ($5.9M related to the fourth quarter) of short-term purchase accounting adjustments related to backlog amortization, attributed to the acquisition of MB Aerospace.

(4) The Company defines EBITDA as net income plus interest expense, income taxes, and depreciation and amortization which the Company incurs in the normal course of business; in addition to these adjustments, the Company also excludes the impact of its "as adjusted items" above ("Adjusted EBITDA"). The Company does not intend EBITDA nor Adjusted EBITDA to represent cash flows from operations as defined by GAAP, and the reader should not consider it as an alternative to net income, net cash provided by operating activities or any other items calculated in accordance with GAAP, or as an indicator of the Company's operating performance. Accordingly, the measurements have limitations depending on their use.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

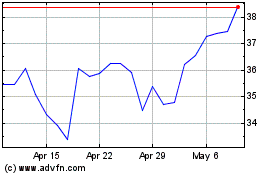

Barnes (NYSE:B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Barnes (NYSE:B)

Historical Stock Chart

From Apr 2023 to Apr 2024