MWA Nearly Doubles its Farmland Management Portfolio, Eclipses 40,000 Acres

February 15 2024 - 7:10AM

Business Wire

Murray Wise Associates (MWA) announced today that it has added

approximately 19,200 acres under the company’s farmland management

portfolio in the past four months, bringing the total acres managed

to more than 40,000 across 10 states.

MWA President Eric Sarff said growing the firm’s management

business has been a point of emphasis over the past several

months.

“There are companies out there that manage more acres than MWA,

but we believe that our team’s experience, attention to detail, and

client service give us an advantage in the marketplace, which is

why we’re working hard to grow in this area,” Sarff said.

MWA manages farmland for a variety of clients, ranging from

individuals who own a single farm to institutional asset managers

with large farmland portfolios.

“We’re going to continue working to expand the number of acres

we manage,” Sarff added, “because it provides a recurring,

diversified revenue stream for the company, and we believe it can

lead to future opportunities for our core brokerage and auction

business.”

Among the farm management services MWA provides its clients:

negotiating and securing leases; regularly visiting farms and

interacting with tenants; overseeing necessary maintenance;

preparing business plans, estimates, and financial statements for

the property; assisting with commodity marketing; leveraging buying

power to help lower farm input costs; and providing on-farm

technical assistance as needed. In addition, MWA can support its

management clients with brokerage services, either expanding their

farmland holdings or selling properties.

MWA’s management portfolio currently includes farms in Colorado,

Illinois, Indiana, Iowa, Louisiana, Mississippi, Missouri, North

Carolina, Ohio, and South Carolina. Illinois and Iowa account for

the most acres managed by MWA with more than 10,000 acres each.

MWA, which is headquartered in Champaign and has a satellite

office in Clarion, Iowa, is a leading national agricultural real

estate auction and brokerage company. MWA was acquired by Farmland

Partners Inc. (NYSE: FPI) in November 2021. Additional information:

www.murraywiseassociates.com or (800) 607-6888.

Forward-Looking Statements

This communication includes "forward-looking statements" within

the meaning of the federal securities laws, including, without

limitation, statements with respect to the outlook of Farmland

Partners Inc. ("FPI") and Murray Wise Associates LLC ("MWA") and

proposed and pending farmland auction, brokerage, financing and

asset management activities. Forward-looking statements generally

can be identified by the use of forward-looking terminology such as

"may," "should," "could," "would," "predicts," "potential,"

"continue," "expects," "anticipates," "future," "intends," "plans,"

"believes," "estimates" or similar expressions or their negatives,

as well as statements in future tense. Although FPI and MWA believe

that the expectations reflected in such forward-looking statements

are based upon reasonable assumptions, beliefs and expectations,

such forward-looking statements are not predictions of future

events or guarantees of future performance and actual results could

differ materially from those set forth in the forward-looking

statements. Any forward-looking information presented herein is

made only as of the date of this communication, and FPI and MWA do

not undertake any obligation to update or revise any

forward-looking information to reflect changes in assumptions, the

occurrence of unanticipated events, or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240215748744/en/

Eric Sarff eric@mwallc.com

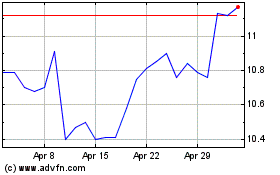

Farmland Partners (NYSE:FPI)

Historical Stock Chart

From Mar 2024 to Apr 2024

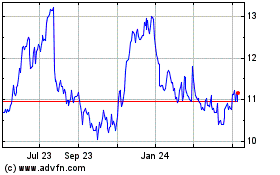

Farmland Partners (NYSE:FPI)

Historical Stock Chart

From Apr 2023 to Apr 2024