SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 6-K

REPORT OF A FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 14, 2024

Commission File Number 0-28800

______________________

DRDGOLD Limited

Constantia Office Park

Cnr 14th Avenue and Hendrik Potgieter Road

Cycad House, Building 17, Ground Floor

Weltevreden Park 1709

(Address of principal executive offices)

______________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F Form 40-F

Exhibit

99.1 Release dated February, 14 2024 “CONDENSED CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE SIX MONTHS ENDED 31 DECEMBER 2023 AND CASH DIVIDEND DECLARATION”

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

DRDGOLD LIMITED

Date: February 14, 2024 By: /s/ Riaan Davel

Name: Riaan Davel

Title: Chief Financial Officer

Exhibit 99.1

DRDGOLD LIMITED

(Incorporated in the Republic of South Africa)

(Registration number: 1895/000926/06)

JSE and A2X share code: DRD

NYSE trading symbol: DRD

ISIN: ZAE000058723

(“DRDGOLD” or the “Company”)

CONDENSED CONSOLIDATED UNAUDITED INTERIM RESULTS FOR THE SIX MONTHS ENDED 31 DECEMBER 2023 AND CASH DIVIDEND DECLARATION

INTRODUCTION

The contents of this announcement are the responsibility of the board of directors of DRDGOLD (“Board”).

As the information in this announcement does not provide all of the details, any investment decisions should be based on the full results which are available through the following JSE cloudlink https://senspdf.jse.co.za/documents/2024/JSE/ISSE/DRD/Interim_24.pdf and also available for viewing on the Company’s website at https://www.drdgold.com/downloads?task=download.send&id=330&catid=127&m=0.

KEY FINANCIAL RESULTS SUMMARY

| | | | | | | | | | | |

| Six months ended 31 December 2023 | Six months ended 31 December 2022 | % change |

| Revenue – R million | 2,974.2 | 2,654.3 | 12 |

| Operating profit – R million | 909.3 | 792.4 | 15 |

Earnings per share – South African (“SA”) cents per share (“cps”) | 68.4 | 62.3 | 10 |

| Headline earnings per share – SA cps | 68.4 | 62.3 | 10 |

| Interim dividend – SA cps | 20 | 20 | 0 |

CASH DIVIDEND DECLARATION

The Board has declared an interim cash dividend of 20 SA cps for the six months ended 31 December 2023 as follows:

•The dividend has been declared out of income reserves

•The local Dividend Withholding Tax rate is 20% (twenty percent)

•The gross local dividend amount is 20 SA cps for shareholders exempt from Dividend Withholding Tax

•The net local dividend amount is 16 SA cps for shareholders liable to pay Dividend Withholding Tax

•DRDGOLD currently has 864 588 711 ordinary shares in issue (which includes 3 090 081 treasury shares)

•DRDGOLD’s income tax reference number is 9160/013/60/4

In compliance with the requirements of Strate Proprietary Limited (“Strate”) and the JSE Limited Listings Requirements, given the Company’s primary listing on the exchange operated by the JSE Limited, the salient dates for payment of the dividend are as follows:

•Last date to trade ordinary shares cum-dividend: Tuesday, 5 March 2024

•Ordinary shares trade ex-dividend: Wednesday, 6 March 2024

•Record date: Friday, 8 March 2024

•Payment date: Monday, 11 March 2024

On payment date, dividends due to holders of certificated ordinary shares on the SA share register will either be electronically transferred to such shareholders’ bank accounts or, in the absence of suitable mandates, dividends will be held in escrow by the Company until suitable mandates are received to electronically transfer dividends to such shareholders.

Dividends in respect of dematerialised shareholdings will be credited to such shareholders’ accounts with the relevant Central Securities Depository Participant (CSDP) or broker.

To comply with the further requirements of Strate, between Wednesday, 6 March 2024 and Friday, 8 March 2024, both days inclusive, no transfers between the SA share register and any other share register will be permitted and no ordinary shares pertaining to the SA share register may be dematerialised or rematerialised.

The currency conversion date for the Australian and United Kingdom share registers will be Monday, 11 March 2024.

The holders of American Depositary Receipts (“ADRs”) should confirm dividend details with the depository bank.

ADR information is tentative and subject to confirmation by the depository bank. Assuming an exchange rate of R18.00/$1, the net dividend payable on an ADR is equivalent to 9 United States cents per share for ADR holders liable to pay Dividend Withholding Tax. However, the actual rate of payment will depend on the exchange rate on the date for currency conversion.

On behalf of the Board

TJ Cumming DJ Pretorius

Non-Executive Chairman Chief Executive Officer

Johannesburg

14 February 2024

DIRECTORS

#Independent

^Lead Independent

Executives:

DJ (Niël) Pretorius (Chief Executive Officer)

AJ (Riaan) Davel (Chief Financial Officer)

Non-executives:

TJ Cumming (Non-Executive Chairman); EA Jeneker#^; JA Holtzhausen#, TVBN Mnyango#, JJ Nel#, KP Lebina# and CD Flemming#

Company Secretary:

K Mbanyele

MEDIA AND INVESTOR RELATIONS:

Jane Kamau

Tel: +27 11 880 3924

Website: www.drdgold.com

REGISTERED OFFICE:

Constantia Office Park

Cnr 14th Avenue and Hendrik Potgieter Road

Cycad House, Building 17, Ground Floor

Weltevreden Park, 1709

South Africa

SPONSOR:

One Capital

17 Fricker Road, Illovo, 2196

HIGHLIGHTS Operating profit increased by 15% to R909.3 million Headline earnings of R589.3 million Interim cash dividend of 20 SA cps R1 074.7 million of capital expenditure All-in sustaining costs margin1 of 19% Gold production decreased by 7% to 2 547 kilograms 1 All-in sustaining costs is based on the guidance note on non-GAAP Metrics issued by the World Gold Council on 27 June 2013. For a reconciliation, please see page 8. REVIEW OF OPERATIONS Six months ended 31 Dec 2023 Six months ended 31 Dec 2022 % change1 Gold production kg 2 547 2 731 (7) oz 81 888 87 804 (7) Gold sold kg 2 535 2 762 (8) oz 81 502 88 801 (8) Cash operating costs R per kg 814 540 674 113 21 US$ per oz 1 356 1 210 12 All-in sustaining costs R per kg 945 899 797 972 19 US$ per oz 1 575 1 432 10 Average gold price received R per kg 1 173 245 961 022 22 US$ per oz 1 954 1 725 13 Average exchange rate R/US$ 18.68 17.33 8 Operating profit R million 909.3 792.4 15 Operating margin % 30.6 29.9 2 All-in sustaining costs margin % 19.4 17.0 14 Headline earnings R million 589.3 535.0 10 SA cents per share ("cps") 68.4 62.3 10 1 Percentage change is rounded to the nearest percent and is based on the amounts as presented. Rounding of figures may result in computational discrepancies. SHAREHOLDER INFORMATION DRDGOLD Limited Incorporated in the Republic of South Africa Registration number: 1895/000926/06 JSE and A2X share code: DRD NYSE trading symbol: DRD ISIN: ZAE000058723 (“DRDGOLD” or the “Company” or the “Group”) Price of stock traded JSE (R) NYSE (US$)1 • 6-month intra-day high 21.47 1.20 • 6-month intra-day low 14.02 0.75 • Close 15.77 0.80 1 This data represents per share data and not American Depository Receipt ("ADR") data: one ADR reflects 10 ordinary shares. Issued capital as at 31 December 2023 864 588 711 ordinary shares of no par value (30 June 2023: 864 588 711) 3 090 081 treasury shares held within the Group (30 June 2023: 3 896 663) 5 000 000 cumulative preference shares (30 June 2023: 5 000 000) Market capitalisation Rm US$m 31 December 2023 13 635 691 30 June 2023 17 223 915 RESULTS The condensed consolidated unaudited interim financial statements of DRDGOLD for the six months ended 31 December 2023 are available on DRDGOLD’s website (www.drdgold.com) as well as at the Company’s registered office. FORWARD LOOKING STATEMENTS Many factors could cause the actual results, performance or achievements to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including, among others, adverse changes or uncertainties in general economic conditions in the markets we serve, a drop in the gold price, a sustained strengthening of the Rand against the US Dollar, regulatory developments adverse to DRDGOLD or difficulties in maintaining necessary licenses or other governmental approvals, changes in DRDGOLD’s competitive position, changes in business strategy, any major disruption in production at key facilities or adverse changes in foreign exchange rates and various other factors. These risks include, without limitation, those described in the section entitled “Risk Factors” included in our annual report for the fiscal year ended 30 June 2023, which we filed with the United States Securities and Exchange Commission on 30 October 2023 on Form 20-F. You should not place undue reliance on these forward-looking statements, which speak only as of the date thereof. We do not undertake any obligation to publicly update or revise these forward-looking statements to reflect events or circumstances after the date of this report or to the occurrence of unanticipated events. Any forward-looking statements and financial information included in this announcement have not been reviewed and reported on by DRDGOLD’s auditors. DIRECTORS FOR FURTHER INFORMATION (#Independent) (^Lead Independent) Tel: +27(0) 11 470 2600 Executive directors Fax: +27(0) 86 524 3061 DJ Pretorius (Chief Executive Officer) Website: www.drdgold.com AJ Davel (Chief Financial Officer) Registered address: Non-executive directors Constantia Office Park TJ Cumming (Non-executive Chairman) Cnr 14th Avenue and Hendrik JA Holtzhausen # Potgieter Road KP Lebina # Cycad House, Building 17, TVBN Mnyango # Ground Floor JJ Nel # Weltevreden Park, 1709 EA Jeneker #^ South Africa CD Flemming # Registered postal address: PO Box 390 Sponsor Maraisburg, 1700 One Capital South Africa Exhibit 99.2

DEAR SHAREHOLDER SIX MONTHS ENDED 31 DECEMBER 2023 VS SIX MONTHS ENDED 31 DECEMBER 2022 OVERVIEW The first half of the 2024 financial year ("HY1 FY2024") started well for us with solid throughput and good plant efficiencies, bolstered by a very attractive gold price. Our share-price responded favourably and DRDGOLD achieved second place in the Sunday Times Top 100 Companies 2023 awards, based on total shareholder returns over a five-year period measured as at 31 August 2023. We had, however, fallen behind on the starting up of new reclamation sites to replace high volume sites that had in the recent past become depleted. In the 24 months preceding December 2023, three major production clusters contributing 25 000 tonnes per day, came to their end-of-life. They were due to be replaced by four new sites scheduled to come into operation from October 2022 onwards, to ensure a smooth overlap and steady throughput. Delays in the processing of water usage licenses ("WULs") on two sites, the lodging of appeal proceedings by a community forum on a third, and community-related interferences with the construction of a pipe-column to the fourth site, put pay to these ambitions, and the 2023 calendar year became a scramble to source material from legacy and clean-up sites. The higher grade material from these legacy and clean-up sites partially offset lower throughput, and the commissioning of the high-grade Valley Silts and high volume Rooikraal site brought some relief midway through the 2023 calendar year. By October 2023, most of the legacy and clean-up sites were down to red-earth, and with two new major sites still outstanding, one pending a WUL and the second in final stages of pipe- column construction with community “concerns” finally having been addressed, throughput came under significant pressure, with the better part of 500 000 tonnes and 90 kg of production lost due to these delays. The result was a 13% drop in throughput compared to the first half of the 2023 financial year ("HY1 FY2023"), and a 7% decline in production. This notwithstanding, Ergo Mining Proprietary Limited ("Ergo") managed to generate an operating profit of R431.5 million, and combined with Far West Gold Recoveries Proprietary Limited ("FWGR"), which hit full stride with the newly commissioned Driefontein 3, the Group returned an operating profit of R909.3 million, and headline earnings per share of 68.4 SA cents. A total of R1 074.7 million was reinvested in capital infrastructure in HY1 FY2024, the bulk of which paid for the solar power plant ("SPP") at Ergo, scheduled for substantial completion in March 2024, with battery storage scheduled to be complete by October 2024. As we are utilising our cash savings to finance the reinvestment of capital, our cash balance reduced from R2 471.4 million as at 30 June 2023 to R1 529.4 million as at 31 December 2023, and we are therefore still in a position to distribute a portion of earnings by way of an interim cash dividend of 20 cps. This makes it the 17th uninterrupted year that DRDGOLD will have paid a dividend. We are very grateful that there were no serious instances of violent crime nor serious injury in the period under review. A particular highlight for the period under review saw the recovery and return to work of one of our security officials, following an armed robbery at FWGR in June 2022 wherein he sustained near fatal wounds. OPERATIONAL REVIEW Groupwide, gold production decreased by 7% to 2 547kg (HY1 FY2023: 2 731kg). Throughput was 13% lower at 11.2Mt (HY1 FY2023: 12.8Mt), while the average yield increased by 7% to 0.228g/t (HY1 FY2023: 0.213g/t). Group cash operating unit costs were 21% higher at R814 540/kg (HY1 FY2023: R674 113/kg). Group all-in sustaining unit costs were 19% higher at R945 899/kg (HY1 FY2023: R797 972/kg). ERGO MINING PROPRIETARY LIMITED Gold production at Ergo decreased by 6% to 1 884kg (HY1 FY2023: 1 996kg) as a result of a decrease in tonnage throughput from 9.8Mt in HY1 FY2023 to 8.1Mt stemming from the continued reclamation of legacy and clean-up sites and reduced third-party material being sourced at Knights. Significant delays were experienced in obtaining a WUL for the 4L3 site. The license was eventually received on Thursday, 18 January 2024. Furthermore, community-related interferences to the construction of the pipe-column to 5L27 led to production from this site being delayed until late January 2024. The decrease in tonnages was offset by yield which increased by 15% to 0.233g/t (HY1 FY2023: 0.203g/t) as a result of the reclamation of remnant material on the legacy and clean-up and the reclamation of high-grade material at Valley Silts. Cash operating unit costs increased by 18% to R940 949/kg (HY1 FY2023: R796 422/kg) due to the double digit increases in machine hire costs and contract reclamation costs driven by the reclamation of remnant material on legacy and clean-up sites and increased diesel prices. The reduction in gold production also contributed to an increase in cash operating unit costs. Specialist studies required for the environmental and WUL authorisation for the expansion of the Brakpan/Withok Tailings Storage Facility ("TSF") are ongoing, and we expect the design to be submitted to the Department of Water and Sanitation ("DWS") by the end of the 2024 financial year ("FY2024"). FAR WEST GOLD RECOVERIES PROPRIETARY LIMITED Gold production at FWGR decreased by 10% to 663kg (HY1 FY2023: 735kg) due to the lower head grade and lower yield achieved in the reclamation of the new major site, Driefontein 3 compared to material previously processed at Driefontein 5. This resulted in a decrease in yield by 12% to 0.215g/t (HY1 FY2023: 0.245g/t). Cash operating unit costs increased by 39% to R457 620/kg (HY1 FY2023: R328 393/kg) due to increases mainly in reagent usage, in particular lime and steel balls in response to the increased acidity and coarser material reclaimed from Driefontein 3. Electricity costs have also increased as a result of the reclamation of Driefontein 3 and the installation of a high shear agitator at the Driefontein 2 plant to release more gold. Machine hire costs were higher due to the continued clean up of Driefontein 5 and increased diesel prices. A reduction in gold produced also contributed to an increase in cash operating unit costs. FINANCIAL REVIEW Group revenue increased by 12% to R2 974.2 million (HY1 FY2023: R2 654.3 million) mainly due to a 22% increase in the average Rand gold price received to R1 173 245/kg (HY1 FY2023: R961 022/kg). Group operating profit increased by 15% to R909.3 million (HY1 FY2023: R792.4 million), after accounting for cash operating costs which increased by 14% to R2 097.1 million (HY1 FY2023: R1 839.5 million). The operating margin of the Group was 30.6%, compared to 29.9% in HY1 FY2023. Headline earnings of R589.3 million (68.4 SA cps) were reported compared with headline earnings of R535.0 million (62.3 SA cps) in the previous comparative period. The Group ended the first half of FY2024 with cash and cash equivalents 38% lower at R1 529.4 million compared to R2 471.4 million as at 30 June 2023 (31 December 2022: R2 392.2 million), after paying cash dividends of R559.4 million (HY1 FY2023: R342.5 million). The Group remains free of bank debt as at 31 December 2023. SHAREHOLDER LETTER Page 2

ENVIRONMENTAL, SOCIAL AND GOVERNANCE ("ESG") The Group spent a total of R11.2 million on environmental rehabilitation in HY1 FY2024, while R18.2 million was spent in HY1 FY2023. At Ergo, 1.6ha (HY1 FY2023: 4.0ha) was vegetated at the Brakpan/Withok TSF. The hectares vegetated were limited due to the establishment of the step in and new raise on the TSF. Installation of storm water measures and launders then followed. We are expecting cladding to re-commence on the Brakpan/Withok TSF in the upcoming quarter and are relooking at the service contractors at Crown complex to resume some vegetation. At FWGR, 13.2ha (HY1 FY2023: 3.5ha) was vegetated at Driefontein 5 and Driefontein 4. A total of 632 dust fall-out samples were evaluated and analysed for exceedance in the period under review, compared to 689 dust samples in HY1 FY2023. At Ergo, three exceedances were detected (0.53% of sample) compared to eight in HY1 FY2023, and at FWGR one exceedance was recorded, compared to two in HY1 FY2023. Dust exceedances have reduced at Ergo and FWGR due to the various efforts to continuously reduce dust fall-out through our rehabilitation programmes and mitigation measures. The Group's externally sourced potable water consumption has decreased significantly by 61% to 536Ml (HY1 FY2023: 1 388Ml), with 483Ml (HY1 FY2023: 1 314Ml) at Ergo and 53Ml (HY1 FY2023: 74Ml) at FWGR. There was great improvement in the use of potable water at Ergo due to the fact that the material milled at the Knights plant is now sent to the Ergo plant for gold extraction. In addition to this, the water management circuit was remodeled at City Deep to reduce potable water overflow to process water storage tanks. During the first quarter of the 2023 financial year, FWGR started using process water for flocculant makeup in the plant which has also contributed to the decrease in potable water consumption. The Group’s socio-economic development spend for the first half of FY2024 was R27.2 million (HY1 FY2023: R28.9 million). Total women in mining remained unchanged at 24% of total staff. DIVIDEND The DRDGOLD board of directors (“Board”) has declared an interim cash dividend of 20 South African (“SA”) cents per ordinary share for the six months ended 31 December 2023 as follows: • The dividend has been declared out of income reserves • The local Dividend Withholding Tax rate is 20% (twenty percent) • The gross local dividend amount is 20 SA cents per ordinary share for shareholders exempt from Dividend Withholding Tax • The net local dividend amount is 16 SA cents per ordinary share for shareholders liable to pay Dividend Withholding Tax • DRDGOLD currently has 864 588 711 ordinary shares in issue (which includes 3 090 081 treasury shares) • DRDGOLD’s income tax reference number is 9160/013/60/4 In compliance with the requirements of Strate Proprietary Limited (“Strate”) and the JSE Limited Listings Requirements ("Listings Requirements"), given the Company’s primary listing on the exchange operated by the JSE Limited (“JSE”), the salient dates for payment of the dividend are as follows: • Last date to trade in ordinary shares cum-dividend: Tuesday, 5 March 2024 • Ordinary shares trade ex-dividend: Wednesday, 6 March 2024 • Record date: Friday, 8 March 2024 • Payment date: Monday, 11 March 2024 On payment date, dividends due to holders of certificated ordinary shares on the SA share register will either be electronically transferred to such shareholders’ bank accounts or, in the absence of suitable mandates, dividends will be held in escrow by the Company until suitable mandates are received to electronically transfer dividends to such shareholders. Dividends in respect of dematerialised shareholdings will be credited to such shareholders’ accounts with the relevant Central Securities Depository Participant ("CSDP") or broker. To comply with the further requirements of Strate, between Wednesday, 6 March 2024 and Friday, 8 March 2024, both days inclusive, no transfers between the SA share register and any other share register will be permitted and no ordinary shares pertaining to the SA share register may be dematerialised or rematerialised. The currency conversion date for the Australian and United Kingdom share registers will be Monday, 11 March 2024. The holders of American Depositary Receipts (“ADRs”) should confirm dividend details with the depository bank. ADR information is tentative and subject to confirmation by the depository bank. Assuming an exchange rate of R18.00/$1, the net dividend payable on an ADR is equivalent to 9 United States (“US”) cents per share for ADR holders liable to pay Dividend Withholding Tax. However, the actual rate of payment will depend on the exchange rate on the date of currency conversion. LOOKING AHEAD With work on the 5L27 pipe-column completed early in January 2024 and the WUL for 4L3 issued on Thursday, 18 January 2024, all of our new sites are up and running. As a result, the remainder of FY2024 looks far better from a throughput perspective than HY1 FY2024. In addition, the rate at which we processed closure and legacy sites in 2023 means that a large portion of this work has now come to an end, which in practice means fewer yellow machines and trucks moving earth, less diesel and therefore lower total costs. The effect of the SPP on costs will also become more apparent as the year progresses. Pending the tie-in of the SPP with the 88kv substation at the Brakpan/Withok TSF, we are not drawing more than the 14MW required by the Ergo Plant from the SPP. Once the switchover is completed, which is imminent, power will also be fed into the Brakpan substation and surplus power into the Eskom grid. By October 2024, we hope to have the 160MW power storage facility in place to take full advantage of the power we generate. We are therefore emerging from the frustrations and disruptions of 2023 very well positioned for the near term to take advantage of a still very favourable gold price climate. As the SPP goes into final stages, the next big capital investment project, Phase II of FWGR (to double the capacity at the Driefontein 2 Plant and build the 800 million tonne Regional Tailings Storage Facility) kicks off. We are taking the learnings from the last two years in terms of licensing into this process, to better anticipate the requirements of the regulator, ensuring that our turnaround times improve while holding the regulator to the timelines that it is required to work to. A big improvement compared to the situation in 2018, is the fact that very senior officials of the Department of Water and Sanitation are now making themselves available for “pre-submission” conversations and are quite prepared to share with us the standards and conditions that they require in our submissions. We are already seeing a big improvement in turnaround time, and these engagements seem altogether more constructive. There is also keen awareness amongst senior management and our project consultants in respect of the scale of what we are taking on, and its strategic significance. The growth project we are pursuing in respect of Sibanye-Stillwater’s platinum metal group tailings has still not been given the go-ahead. I mentioned in an earlier letter that whilst the project is technically straightforward, the supply dynamics of the chrome market and complexities in the operational and corporate setup of the programme need to be properly considered and understood before we are likely to be given the go-ahead. In the meantime, we have started to look beyond the Group for other tailings opportunities, both to optimise our established infrastructure and to take our model of sustainable environmental restoration through tailings retreatment to other metals, sites and jurisdictions. We hope to be able to report in this regard by the end of FY2024. In the Company's 2023 integrated annual report, published on 30 October 2023, the Company issued a production guidance for the year ended 30 June 2024 of between 165 000 ounces and 175 000 ounces. With the new reclamation sites now in operation at Ergo, DRDGOLD expects to remain within range, albeit to the lower end. Although we expect the cost pressures experienced in the first half of the financial year to ease going forward, the Group has increased its cash operating unit cost guidance from R770 000/kg to R800 000/kg. Capital expenditure has been revised to R3.0 billion. Niël Pretorius Chief Executive Officer 14 February 2024 SHAREHOLDER LETTER (continued) Page 3

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME Six months ended 31 Dec 2023 Six months ended 31 Dec 2022 Rm Rm Notes Unaudited Unaudited Revenue 2 974.2 2 654.3 Cost of sales (2 211.7) (1 985.7) Gross profit from operating activities 762.5 668.6 Other income 0.6 — Administration expenses and other costs (103.5) (80.7) Results from operating activities 659.6 587.9 Finance income 4, 5 154.9 157.6 Finance expenses (37.1) (33.5) Profit before tax 777.4 712.0 Income tax 2 (188.1) (177.0) Profit for the period 589.3 535.0 Other comprehensive income ("OCI") Items that will not be reclassified to profit or loss, net of tax Net fair value adjustment on equity investments at fair value through other comprehensive income 4, 6 (5.3) (15.0) Total other comprehensive income for the period (5.3) (15.0) Total comprehensive income for the period 584.0 520.0 Basic earnings per share1 3 68.4 62.3 Diluted basic earnings per share1 3 68.1 62.2 1 All per share financial information is presented in South African cents per share (cps) and is rounded to the nearest one decimal point based on the results as presented, which are rounded to the nearest million Rand. These condensed consolidated unaudited interim financial statements for the six months ended 31 December 2023 have not been audited or reviewed by DRDGOLD'S auditor's and have been prepared under the supervision of DRDGOLD’s Chief Financial Officer, Mr AJ Davel CA(SA). The condensed consolidated unaudited interim financial statements were authorised by the directors on 9 February 2024 for issue on 14 February 2024. CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY Six months ended 31 Dec 2023 Six months ended 31 Dec 2022 Rm Rm Notes Unaudited Unaudited Balance at the beginning of the period 6 274.1 5 439.9 Total comprehensive income Profit for the period 589.3 535.0 Other comprehensive income 4, 6 (5.3) (15.0) Transactions with the owners of the parent Dividend on ordinary share capital (559.4) (343.2) Equity-settled share-based payment expense 13.6 10.2 Equity-settled share based payment income tax impact on equity (11.7) — Equity-settled share based payment vesting impact on equity 0.2 3.7 Balance at the end of the period 6 300.8 5 630.6 CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION As at As at As at 31 Dec 2023 30 Jun 2023 31 Dec 2022 Rm Rm Rm Notes Unaudited Audited Unaudited Assets Non-current assets 5 517.0 4 940.3 4 325.8 Property plant and equipment 4 427.7 3 909.5 3 366.3 Investments in rehabilitation and other funds 858.5 789.7 762.1 Payments made under protest 47.1 39.7 48.5 Other investments 4 163.3 168.6 138.6 Deferred tax asset 20.4 32.8 10.3 Current assets 2 778.3 3 214.2 2 947.0 Inventories 494.1 413.6 373.2 Current tax receivable 27.7 40.6 — Trade and other receivables1 727.1 288.6 181.6 Cash and cash equivalents 1 529.4 2 471.4 2 392.2 Total assets 8 295.3 8 154.5 7 272.8 Equity and liabilities Equity 6 300.8 6 274.1 5 630.6 Non-current liabilities 1 237.5 1 161.7 1 091.4 Provision for environmental rehabilitation 585.8 562.1 539.3 Deferred tax liability 2 620.6 560.7 517.6 Liability for post-retirement medical benefits 10.4 10.5 10.4 Lease liabilities 20.7 28.4 24.1 Current liabilities 757.0 718.7 550.8 Trade and other payables 600.4 700.5 523.7 Current portion of lease liabilities 13.7 11.3 18.1 Current tax liability 142.9 6.9 9.0 Total liabilities 1 994.5 1 880.4 1 642.2 Total equity and liabilities 8 295.3 8 154.5 7 272.8 1 Included in trade and other receivables is prepayments made towards capital projects of R609.9 million (30 June 2023: R185.5 million) of which the majority relates to the solar project. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS Page 4

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS Six months ended 31 Dec 2023 Six months ended 31 Dec 2022 Rm Rm Notes Unaudited Unaudited Net cash inflow from operating activities 736.5 636.9 Cash generated from operations 600.3 601.4 Finance income received 88.0 81.4 Dividends received 4 29.3 48.4 Finance expense paid (2.4) (2.3) Income tax received/(paid) 21.3 (92.0) Net cash outflow from investing activities (1 107.2) (421.5) Acquisition of property, plant and equipment1 (1 074.7) (387.3) Investment in other funds (27.9) (29.3) Environmental rehabilitation payments to reduce decommissioning liabilities (4.6) (4.9) Net cash outflow from financing activities (569.2) (351.4) Dividends paid on ordinary shares (559.4) (342.5) Repayment of lease liabilities (9.8) (8.9) Net decrease in cash and cash equivalents (939.9) (136.0) Effect of exchange rate fluctuations on cash (2.1) 2.6 Opening cash and cash equivalents 2 471.4 2 525.6 Closing cash and cash equivalents 5 1 529.4 2 392.2 RECONCILIATION OF CASH GENERATED FROM OPERATIONS Profit for the period 589.3 535.0 Adjusted for: Income tax 188.1 177.0 Depreciation 141.2 108.9 Environmental rehabilitation payments to reduce restoration liabilities (0.1) — Movement in gold in process (32.2) 22.4 Share-based payment expense 13.6 10.2 Finance income (154.9) (157.6) Finance expense 37.1 33.5 Insurance claim received — 31.7 Other non-cash items (2.5) 2.1 Changes in: (179.3) (161.8) Trade and other receivables (24.5) (64.1) Payment made under protest (8.4) (9.5) Consumable stores and stock piles (48.5) (6.5) Trade and other payables (97.9) (81.7) Cash generated from operations 600.3 601.4 1 Acquisition of property, plant and equipment includes prepayments of capital projects of R418.0 million. NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS The accompanying notes are an integral part of the condensed consolidated unaudited interim financial statements. 1. BASIS OF PREPARATION The condensed consolidated unaudited interim financial statements for the six months ended 31 December 2023 are prepared in accordance with the JSE Limited Listings Requirements ("Listings Requirements") for interim financial results and the requirements of the Companies Act of South Africa, No. 71 of 2008 ("Companies Act"). The Listings Requirements require interim financial results to be prepared in accordance with and contain the information required by IAS 34: Interim Financial Reporting, as well as the South African Institute of Chartered Accountants Financial Reporting Guides as issued by the Accounting Practices Committee and the Financial Pronouncements as issued by the Financial Reporting Standards Council. The accounting policies applied in the preparation of the condensed consolidated unaudited interim financial statements are in terms of International Financial Reporting Standards (“IFRS”) and are consistent with those applied in the previous consolidated annual financial statements. The condensed consolidated unaudited interim financial statements have been prepared on a going concern basis. 2. DEFERRED TAX The deferred tax liability increased from R560.7 million at 30 June 2023 to R620.6 million at 31 December 2023 mainly due to the acquisition of property, plant and equipment that have been fully claimed as accelerated capital deductions for income tax. Six months ended 31 Dec 2023 Six months ended 31 Dec 2022 Rm Rm Unaudited Unaudited 3. EARNINGS PER SHARE Reconciliation of headline earnings Profit for the period 589.3 535.0 Headline earnings 589.3 535.0 Weighted average number of ordinary shares in issue adjusted for treasury shares 860 985 749 858 404 448 Diluted weighted average number of ordinary shares adjusted for treasury shares 865 364 387 859 688 266 Basic earnings per share 1 68.4 62.3 Diluted basic earnings per share 1 68.1 62.2 Headline earnings per share 1 68.4 62.3 Diluted headline earnings per share 1 68.1 62.2 1 All per share financial information is presented in SA cps and is rounded to the nearest one decimal point based on the results which are rounded to the nearest million Rand. 4. INVESTMENT IN RAND REFINERY PROPRIETARY LIMITED ("RAND REFINERY") The fair value of DRDGOLD’s 11.3% interest in Rand Refinery at 31 December 2023 is estimated at R151.4 million (30 June 2023: R156.3 million). In accordance with IFRS 13 Fair Value Measurement, the income approach has been established to be the most appropriate basis to estimate the fair value of the investment in Rand Refinery. This method relies on the future budgeted cash flows as estimated by Rand Refinery. Management used a model developed by an external expert to perform the valuation. Rand Refinery’s refining operations (excluding Prestige Bullion) were valued using the Free Cash Flow model, whereby an enterprise value using a Gordon Growth formula for the terminal value was estimated. The forecasted dividend income to be received from Prestige Bullion was valued using a finite-life dividend discount model as Rand Refinery’s shareholding will be reduced to nil in 2032 per agreement with the South African Mint (partner in Prestige Bullion). CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued) Page 5

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued) 4. INVESTMENT IN RAND REFINERY PROPRIETARY LIMITED ("RAND REFINERY") continued The fair value of Rand Refinery decreased as a result of a decrease in expected forecasted dividends from Prestige Bullion. The value of the forecasted dividends for Prestige Bullion decreased as a result of a lower demand for Krugerrands. The enterprise value of the refining operations of Rand Refinery increased as a result of an increase in forecast commodity prices despite increases in forecast operating costs and forecast capital costs. The fair value measurement uses significant unobservable inputs and relates to a fair value hierarchy level 3 financial instrument. Marketability and minority discounts (both unobservable inputs) of 15.3% and 16.9% (31 December 2022: 16.5% and 17.0%), respectively, were applied. The latest budgeted cash flow forecasts provided by Rand Refinery as at 31 December 2023 were used, and therefore classified as an unobservable input into the models. Six months ended 31 Dec 2023 Six months ended 31 Dec 2022 Rm Rm Unaudited Unaudited Reconciliation of investment in Rand Refinery: Balance at the beginning of the period 156.3 136.1 Fair value adjustment on equity investments at fair value through other comprehensive income (4.9) (11.0) Balance at the end of the period 151.4 125.1 Dividends received 29.3 47.5 Key observable/unobservable inputs into the model include: Rand Refinery refining operations Average gold price1 R/kg 1 105 222 Average silver price1 R/kg 14 209 Average South African CPI1 % 4.5 Terminal growth rate2 % 4.5 South African long-term government bond rate1 % 9.9 Weighted average cost of capital2 % 16.0 Investment in Prestige Bullion Discount period2 years 10 Weighted average cost of capital2 % 17.0 1 Observable input 2 Unobservable input The fair value measurement is most sensitive to the Rand denominated gold price and operating costs. The higher the gold price, the higher the fair value of the Rand Refinery investment. The higher the operating costs, the lower the fair value of the Rand Refinery investment. The fair value measurement is also sensitive to the discount rate, minority and marketability discounts applied. The alongside table indicates the extent of sensitivity of the Rand Refinery equity value to the inputs: Sensitivity Increase/ (decrease) % Change in OCI, net of tax Rand Refinery refining operations Rand US Dollar exchange rate 1 1%/(1%) 2.9/(2.9) Commodity prices (gold and silver) 1 1%/(1%) 2.0/(2.0) Operating costs 2 1%/(1%) (3.4)/3.4 Weighted average cost of capital 2 1%/(1%) (3.0)/3.0 Minority discount 2 1%/(1%) (1.2)/1.2 Marketability 2 1%/(1%) (1.2)/1.2 Investment in Prestige Bullion Weighted average cost of capital 2 1%/(1%) (0.5)/0.5 Prestige dividend forecast 2 1%/(1%) 0.2/(0.2) 1 Observable input 2 Unobservable input 5. FINANCIAL RISK MANAGEMENT FRAMEWORK COMMODITY PRICE SENSITIVITY The Group’s profitability and cash flows are primarily affected by changes in the market price of gold which is sold in US Dollars and then converted to Rand. In line with our long-term strategy of being an unhedged gold producer, we generally do not enter into forward gold sales contracts to reduce our exposure to market fluctuations in the US Dollar gold price or the exchange rate movements. However, during periods when medium- term debt is incurred to fund growth projects and hence introduce liquidity risk to the Group, we may mitigate this liquidity risk by entering into facilities to achieve price protection. No such facilities were entered into during the current reporting period. LIQUIDITY MANAGEMENT DRDGOLD ended the current reporting period with cash and cash equivalents of R1 529.4 million (30 June 2023: R2 471.4 million). The Group earned interest of R88.0 million during the current reporting period, compared to R81.4 million for the six months ended 31 December 2022 reflected by more favourable interest rates. Furthermore, the Group remains free of bank debt as at 31 December 2023 (30 June 2023: Rnil). Liquidity is further enhanced by sustained high Rand gold price levels. 6. FAIR VALUES The Group’s assets that are measured at fair value at reporting date consist of equity instruments at fair value through other comprehensive income and are included in other investments in the statement of financial position. Of this line item, R6.8 million (30 June 2023: R7.2 million) relates to fair value hierarchy level 1 instruments. This balance decreased due mainly to a decrease in the share price of West Wits Mining Limited. R156.5 million (30 June 2023: R161.4 million) relates to fair value hierarchy level 3 instruments, mainly the investment in Rand Refinery, refer to note 4. 7. SUBSEQUENT EVENTS There were no subsequent events between the reporting date of 31 December 2023 and the date of issue of these condensed consolidated unaudited interim financial statements other than included in the notes above and described below: DIVIDEND On 14 February 2024, the Board declared an interim gross dividend for the six months ended 31 December 2023 of 20 SA cents per share, payable on Monday, 11 March 2024. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued) Page 6

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued) 8. OPERATING SEGMENTS The Group has one material revenue stream, the sale of gold to South African Bullion banks. The following summary describes the operations in the Group’s reportable operating segments: • Ergo is a surface gold retreatment operation which treats old slime dams and sand dumps to the south of Johannesburg’s central business district as well as the East and Central Rand goldfields. The operation comprises three plants. The Ergo plant as a metallurgical plant and the City Deep and Knights plants as a pump/milling station feeding the Ergo plant. • FWGR is a surface gold retreatment operation which treats old slime dams in the West Rand goldfields. The operation comprises the Driefontein 2 plant and relevant infrastructure to process tailings from the Driefontein 5 and 3 slimes dam and deposit residues on the Driefontein 4 TSF. • Corporate office and other reconciling items (collectively referred to as "Other reconciling items") represent the items to reconcile to the condensed consolidated financial statements. This does not represent a separate segment as it does not generate mining revenue. Six months ended 31 December 2023 Six months ended 31 December 2022 Unaudited Unaudited Ergo FWGR Other reconciling items Total Ergo FWGR Other reconciling items Total Rm Rm Rm Rm Rm Rm Rm Rm Revenue (External) 2 193.0 781.2 — 2 974.2 1 958.5 695.8 — 2 654.3 Cash operating costs (1 792.0) (305.1) — (2 097.1) (1 594.2) (245.3) — (1 839.5) Movement in gold in process and finished inventories - Gold Bullion 30.5 1.7 — 32.2 (30.6) 8.2 — (22.4) Segment operating profit 431.5 477.8 — 909.3 333.7 458.7 — 792.4 Additions to property, plant and equipment (604.6) (50.5) (0.7) (655.8) (267.6) (123.6) (1.2) (392.4) Reconciliation of segment operating profit to profit after tax Segment operating profit 431.5 477.8 — 909.3 333.7 458.7 — 792.4 Depreciation (76.3) (63.9) (1.0) (141.2) (58.4) (49.9) (0.6) (108.9) Ongoing rehabilitation expenditure (5.1) (1.0) (0.4) (6.5) (12.6) (0.7) — (13.3) Care and maintenance — — (0.1) (0.1) — — (0.5) (0.5) Other operating costs 1.0 — — 1.0 (1.1) — — (1.1) Other income 0.6 — — 0.6 — — — — Administration expenses and other costs (5.4) (1.6) (96.5) (103.5) (3.5) (1.5) (75.7) (80.7) Finance income 20.6 23.0 111.3 154.9 16.3 13.8 127.5 157.6 Finance expense (28.2) (5.9) (3.0) (37.1) (27.3) (4.9) (1.3) (33.5) Current tax — (124.7) (0.4) (125.1) — (99.7) (7.1) (106.8) Deferred tax (46.5) (9.2) (7.3) (63.0) (37.2) (28.4) (4.6) (70.2) Profit after tax 292.2 294.5 2.6 589.3 209.9 287.4 37.7 535.0 Reconciliation of cost of sales to cash operating costs Cost of sales (1 841.9) (368.3) (1.5) (2 211.7) (1 696.9) (287.7) (1.1) (1 985.7) Depreciation 76.3 63.9 1.0 141.2 58.4 49.9 0.6 108.9 Movement in gold in process and finished inventories - Gold Bullion (30.5) (1.7) — (32.2) 30.6 (8.2) — 22.4 Ongoing rehabilitation expenditure 5.1 1.0 0.4 6.5 12.6 0.7 — 13.3 Care and maintenance — — 0.1 0.1 — — 0.5 0.5 Other operating costs (1.0) — — (1.0) 1.1 — — 1.1 Cash operating costs (1 792.0) (305.1) — (2 097.1) (1 594.2) (245.3) — (1 839.5) CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (continued) Page 7

Six months ended 31 December 2023 Six months ended 31 December 2022 Unaudited Unaudited Ergo FWGR Other reconciling items Total Ergo FWGR Other reconciling items Total Rm Rm Rm Rm Rm Rm Rm Rm Ore milled (000’t) 8 079 3 086 - 11 165 9 842 3 000 - 12 842 Yield (g/t) 0.233 0.215 - 0.228 0.203 0.245 - 0.213 Cash operating costs (R/t) 222 99 - 188 162 82 - 143 (US$/t) 12 5 - 10 9 5 - 8 Gold produced (kg) 1 884 663 - 2 547 1 996 735 - 2 731 Gold sold (kg) 1 872 663 - 2 535 2 040 722 - 2 762 Reconciliation of All-in sustaining costs (All amounts presented in R million unless otherwise indicated) Cash operating costs (1 792.0) (305.1) - (2 097.1) (1 594.2) (245.3) - (1 839.5) Movement in gold in process 30.5 1.7 - 32.2 (30.6) 8.2 - (22.4) Administration expenses and general costs (sustaining) (5.4) (1.6) (96.1) (103.1) (3.5) (1.4) (73.2) (78.1) Other operating costs excluding care and maintenance costs (21.2) (11.4) 33.1 0.5 (18.8) (9.3) 26.8 (1.3) Unwinding of provision for environmental rehabilitation (22.2) (5.8) (0.4) (28.4) (21.4) (4.7) (0.4) (26.5) Capital expenditure (sustaining) (151.2) (50.1) (0.7) (202.0) (135.0) (100.0) (1.2) (236.2) All-in sustaining costs (1 961.5) (372.3) (64.1) (2 397.9) (1 803.5) (352.5) (48.0) (2 204.0) Care and maintenance costs - - (0.1) (0.1) - - (0.5) (0.5) Ongoing rehabilitation expenditure (5.1) (1.0) (0.4) (6.5) (12.6) (0.7) - (13.3) Administration expenses and general costs (non-sustaining) - - - - - (0.1) (2.5) (2.6) Capital expenditure (non-sustaining) (453.4) (0.4) - (453.8) (132.6) (23.6) - (156.2) All-in costs (2 420.0) (373.7) (64.6) (2 858.3) (1 948.7) (376.9) (51.0) (2 376.6) Cash operating costs (R/kg) 940 949 457 620 - 814 540 796 422 328 393 - 674 113 Cash operating costs (US$/oz) 1 567 762 - 1 356 1 430 590 - 1 210 All-in sustaining costs (R/kg)1 1 047 805 561 512 - 945 899 883 971 488 227 - 797 972 All-in sustaining costs (US$/oz)1 1 745 935 - 1 575 1 587 876 - 1 432 All-in cost (R/kg)1 1 292 753 563 595 - 1 127 526 955 245 522 022 - 860 463 All-in cost (US$/oz)1 2 153 938 - 1 877 1 714 937 - 1 544 1 All-in sustaining costs and All-in cost definitions are based on the guidance note on non-GAAP Metrics issued by the World Gold Council on 27 June 2013. There have been no material changes to the technical information relating to, inter alia, the Group’s Mineral Resources and Mineral Reserves, legal title to its mining and prospecting rights and legal proceedings relating to its mining and exploration activities as disclosed in DRDGOLD’s annual report for the year ended 30 June 2023. The technical information referred to in this report is in accordance with The South African Code for Reporting of Exploration Results, Mineral Resources and Mineral Reserves 2016 (SAMREC Code) and has been reviewed by Messrs Mpfariseni Mudau (Pr. Sci.Nat.), Vaughn Duke (Pr Eng), Professor Steven Rupprecht (FSAIMM) and Ms Diana van Buren (Pr.Sci.Nat.). All are independent contractors of DRDGOLD. They approved this information in writing before the publication of the report. OPERATIONAL PERFORMANCE Page 8

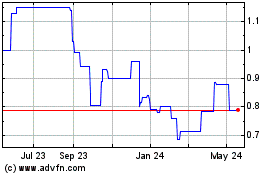

DRD Gold (PK) (USOTC:DRDGF)

Historical Stock Chart

From Mar 2024 to Apr 2024

DRD Gold (PK) (USOTC:DRDGF)

Historical Stock Chart

From Apr 2023 to Apr 2024