0001759631FALSE00017596312024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2024

HYLIION HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38823 | | 83-2538002 |

(State or Other Jurisdiction

of Incorporation) | | (Commission File Number) | | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

1202 BMC Drive, Suite 100 Cedar Park,TX | | 78613 |

| (Address of principal executive offices) | | (Zip Code) |

(833) 495-4466

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240-13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | | HYLN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 13, 2024, Hyliion Holdings Corp. (the “Company”) issued a press release announcing certain financial and other results for the quarter and year ended December 31, 2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused the report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | HYLIION HOLDINGS CORP. |

| | | | |

| | | By: | /s/ Thomas Healy |

| Date: | February 13, 2024 | | Thomas Healy |

| | | | Chief Executive Officer |

Hyliion Holdings Corp.

press@hyliion.com

(833) 495-4466

ir@hyliion.com

HYLIION HOLDINGS REPORTS FOURTH-QUARTER AND FULL-YEAR 2023 FINANCIAL RESULTS

AUSTIN, Texas, February 13, 2024 – Hyliion Holdings Corp. (NYSE: HYLN) (“Hyliion”), a developer of sustainable electricity-producing technology, today reported its fourth-quarter and full-year 2023 financial results.

Key Business Highlights

•Announced today, the KARNOTM generator is expected to qualify for up to a 40% tax credit under the Inflation Reduction Act’s Infrastructure Tax Credit (ITC)

•Announced today, Detmar Logistics executed a letter of intent for an initial KARNO unit to be deployed in the Permian Basin to operate on waste flare gas

•Executed a letter of intent to provide KARNO generators to GTL Leasing

•Confirmed plans to deliver initial KARNO generator units to customers in late 2024

•Began printing production-intent design components of the KARNO generator

•Successfully tested KARNO reactor technology on unprocessed Permian Basin gas; results surpassed emissions standards by 98% for CO and 76% for NOx

•Appointed Govindaraj Ramasamy as Chief Commercial Officer

•Announced $20 million Stock Repurchase Program

•Ended the year with $291 million of total cash and investments

•Guidance of $40 to $50 million cash expenditures for KARNO development in 2024

Executive Commentary

“I’m pleased to report that the company’s strategic shift to wind down powertrain operations and focus on our KARNO generator is on track, with significant achievements made in advancing our generator technology and engaging prospective customers during the quarter,” said Hyliion’s Founder and CEO, Thomas Healy. “We expect to deliver the initial KARNO generator deployment units with customers late in 2024 followed by a ramp-up in production and additional deliveries in 2025.”

KARNO Commercial Updates

Today, the company announced that, under the Inflation Reduction Act, the KARNO generator is expected to be characterized the same as a fuel cell, enabling customers to qualify for up to a 40% tax credit under the current ITC.

Hyliion is addressing the commercial power market first with a locally-deployable 200kW generating system which it intends to deliver to initial deployment customers in late 2024. To

lead these efforts, Hyliion recently hired former Cummins powergen executive, Govi Ramasamy, as Chief Commercial Officer.

Hyliion also announced today that Detmar Logistics has executed a non-binding letter of intent for a KARNO generator and to be part of Hyliion’s early adopter program. Detmar, who supplied Hyliion with test gas from the Permian Basin, intends to operate their unit on waste flare gas to produce electricity at oil & gas sites, without the need for pre-treating the gas.

In addition to Detmar, Hyliion also announced a non-binding letter of intent with GTL Leasing to deliver two KARNO generators for their portable electric vehicle recharging business. Other customers’ letters of intent are in place or being finalized to represent the remaining planned deployments in 2024 and initial deliveries in 2025. Hyliion plans for initial deployments to represent a broad range of applications, including vehicle charging, waste gas fuel sourcing, and prime power generation.

KARNO Generator Development

Hyliion is developing a revolutionary new electrical generator powered by a linear heat motor that is expected to deliver step-change improvements in performance characteristics compared to conventional generating systems, including efficiency, emissions, maintenance requirements, noise levels and fuel flexibility. The KARNO generator is enabled by the latest advances in additive manufacturing technology. Hyliion hosted a Technology Fireside Chat in December 2023 during which Thomas Healy and Josh Mook, Chief Technology Officer, explained the capabilities and advantages of the generator.

Recent technological advancements include beginning to print production-intent design parts of the BETA design of the KARNO generator. The BETA generator design will go through validation throughout 2024 and then is expected to be ready for customer deployments later this year.

The company also tested unprocessed flare gas that was collected from the Permian Basin and confirmed the ability for the KARNO reactor to operate on this fuel, showcasing the fuel agnostic characteristics of the generator. Recent test results on this fuel highlight that the KARNO’s flameless oxidation process is expected to surpass current EPA Tier 4 emissions standards by 98% for CO and 76% for NOx with no additional aftertreatment or catalyst needed.

Powertrain Wind-Down

In November 2023, Hyliion announced that it was winding down its powertrain business segment to maintain the company’s strong cash position as it furthers development of the KARNO generator technology. The company intends to retain the powertrain technology, enabling it to explore future use or sale of the technology and tangible assets. Most wind-down activities are expected to be completed in the first quarter of 2024 while efforts to monetize powertrain assets and technology continue.

Financial Highlights and Guidance

Fourth quarter operating expenses totaled $32.6 million, compared to $31.6 million in the prior-year quarter as the company initiated powertrain wind-down actions. Fourth quarter expenses include $11.5 million of charges directly related to the wind-down, including employee severance, contract cancellation costs, and accelerated depreciation of assets.

Full-year expenses totaled $136.3 million, compared to $152.4 million for the full year in 2022. Expenses in 2022 include $28.8 million of one-time charges associated with the purchase of KARNO generator technology from GE. Cash expenditures for 2023 were $131 million, including net losses and capital investments. The company ended the year with $291 million in unrestricted cash, and short-term and long-term investments.

For 2024, total cash consumed by the KARNO generator business is expected to be between $40 and $50 million, down compared to $131 million in capital consumed by the company in 2023. This estimate excludes cash payments associated with the stock repurchase program, payments associated with the ongoing wind-down of powertrain operations, and cash generated from the sale of powertrain assets and technology. Hyliion expects to achieve commercialization of the KARNO generator with the capital on hand.

Projections for 2025 include growth of KARNO generator deliveries with proceeds from sales in the low double-digit millions of dollars. The company also projects gross margins to be approximately break-even or slightly negative and cash spending to grow modestly compared to 2024.

About Hyliion

Hyliion is committed to creating innovative solutions that enable clean, flexible and affordable electricity production. The Company’s primary focus is to provide distributed power generators that can operate on various fuel sources to future-proof against an ever-changing energy economy. Headquartered in Austin, Texas, and with research and development in Cincinnati, OH, Hyliion is addressing the commercial space first with a locally-deployable generator that can offer prime power, peak shaving, and renewables matching. Beyond stationary power, Hyliion will address mobile applications such as vehicles and marine. The KARNO generator is a fuel-agnostic solution, enabled by additive manufacturing, that leverages a linear heat generator architecture. The Company aims to offer innovative, yet practical solutions that contribute positively to the environment in the energy economy. For further information, please visit www.hyliion.com.

Forward Looking Statements

The information in this press release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of present or historical fact included in this press release, regarding Hyliion and its future financial and operational performance, as well as its strategy, future operations, estimated financial position, estimated revenues, and losses, projected costs, prospects, plans and objectives of management are forward looking statements. When used in this press release, including any oral statements made in connection therewith, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events. Except as otherwise required by applicable law, Hyliion expressly disclaims any duty to update any forward-looking statements, all of which are expressly qualified by the statements herein, to reflect events or circumstances after the date of this press release. Hyliion cautions you that these forward-looking statements are subject to numerous risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Hyliion. These risks include,

but are not limited to, our status as an early stage the Company with a history of losses, and our expectation of incurring significant expenses and continuing losses for the foreseeable future; our ability to develop to develop key commercial relationships with suppliers and customers; our ability to retain the services of Thomas Healy, our Chief Executive Officer; the expected performance of the KARNO generator and system; the execution of the strategic shift from our powertrain business to our KARNO business, and the other risks and uncertainties described under the heading “Risk Factors” in our SEC filings including in our Annual Report (See item 1A. Risk Factors) on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 13, 2024 for the year ended December 31, 2023. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Should one or more of the risks or uncertainties described in this press release occur, or should underlying assumptions prove incorrect, actual results and plans could different materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that may impact Hyliion’s operations and projections can be found in its filings with the SEC. Hyliion’s SEC Filings are available publicly on the SEC’s website at www.sec.gov, and readers are urged to carefully review and consider the various disclosures made in such filings.

HYLIION HOLDINGS CORP.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollar amounts in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (Unaudited) | | | | |

| Revenues | | | | | | | |

| Product sales and other | $ | — | | | $ | 1,095 | | | $ | 672 | | | $ | 2,106 | |

| Total revenues | — | | | 1,095 | | | 672 | | | 2,106 | |

| Cost of revenues | | | | | | | |

| Product sales and other | 41 | | | 1,618 | | | 1,716 | | | 8,778 | |

| Total cost of revenues | 41 | | | 1,618 | | | 1,716 | | | 8,778 | |

| Gross loss | (41) | | | (523) | | | (1,044) | | | (6,672) | |

| Operating expenses | | | | | | | |

| Research and development | 8,768 | | | 21,827 | | | 82,240 | | | 110,370 | |

| Selling, general and administrative | 12,346 | | | 9,733 | | | 42,611 | | | 41,988 | |

| Exit and termination costs | 11,474 | | | — | | | 11,474 | | | — | |

| Total operating expenses | 32,588 | | | 31,560 | | | 136,325 | | | 152,358 | |

| Loss from operations | (32,629) | | | (32,083) | | | (137,369) | | | (159,030) | |

| | | | | | | |

| Interest income | 3,463 | | | 2,658 | | | 13,808 | | | 5,724 | |

| Gain (loss) on impairment and disposal of assets | — | | | 70 | | | 1 | | | (19) | |

| Other income (expense), net | 36 | | | (32) | | | 50 | | | (32) | |

| Net loss | $ | (29,130) | | | $ | (29,387) | | | $ | (123,510) | | | $ | (153,357) | |

| | | | | | | |

| Net loss per share, basic and diluted | $ | (0.16) | | | $ | (0.16) | | | $ | (0.68) | | | $ | (0.87) | |

| | | | | | | |

| Weighted-average shares outstanding, basic and diluted | 182,885,328 | | | 179,719,018 | | | 181,411,069 | | | 175,400,486 | |

HYLIION HOLDINGS CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Dollar amounts in thousands, except share data)

| | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 12,881 | | | $ | 119,468 | |

| Accounts receivable, net | 40 | | | 1,136 | |

| Inventory | — | | | 74 | |

| Prepaid expenses and other current assets | 18,483 | | | 9,795 | |

| Short-term investments | 150,297 | | | 193,740 | |

| Total current assets | 181,701 | | | 324,213 | |

| | | |

| Property and equipment, net | 9,987 | | | 5,606 | |

| Operating lease right-of-use assets | 7,070 | | | 6,470 | |

| Intangible assets, net | — | | | 200 | |

| Other assets | 1,439 | | | 1,686 | |

| Long-term investments | 128,186 | | | 108,568 | |

| Total assets | $ | 328,383 | | | $ | 446,743 | |

| | | |

| Liabilities and stockholders’ equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 4,224 | | | $ | 2,800 | |

| Current portion of operating lease liabilities | 847 | | | 347 | |

| Accrued expenses and other current liabilities | 10,051 | | | 11,535 | |

| Total current liabilities | 15,122 | | | 14,682 | |

| | | |

| Operating lease liabilities, net of current portion | 6,792 | | | 6,972 | |

| Other liabilities | 203 | | | 1,515 | |

| Total liabilities | 22,117 | | | 23,169 | |

| | | |

| Commitments and contingencies | | | |

| | | |

| Stockholders’ equity | | | |

Common stock, $0.0001 par value; 250,000,000 shares authorized; 183,071,317 and 179,826,309 shares issued and outstanding at December 31, 2023 and 2022, respectively | 18 | | | 18 | |

| Additional paid-in capital | 404,045 | | | 397,810 | |

Treasury stock, at cost; 37,062 and no shares as of December 31, 2023 and 2022, respectively | (33) | | | — | |

| (Accumulated deficit) retained earnings | (97,764) | | | 25,746 | |

| Total stockholders’ equity | 306,266 | | | 423,574 | |

| Total liabilities and stockholders’ equity | $ | 328,383 | | | $ | 446,743 | |

HYLIION HOLDINGS CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollar amounts in thousands)

| | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | |

| Cash flows from operating activities | | | | | |

| Net loss | $ | (123,510) | | | $ | (153,357) | | | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | | | |

| Depreciation and amortization | 3,511 | | | 1,227 | | | |

| Amortization and accretion of investments, net | (2,868) | | | 1,250 | | | |

| | | | | |

| Noncash lease expense | 1,496 | | | 1,244 | | | |

| Inventory write-down | 1,139 | | | 5,641 | | | |

| (Gain) loss on impairment and disposal of assets | (1) | | | 19 | | | |

| | | | | |

| | | | | |

| Share-based compensation | 6,217 | | | 6,979 | | | |

| Provision for doubtful accounts | — | | | 114 | | | |

| | | | | |

| | | | | |

| Acquired in-process research and development | — | | | 28,752 | | | |

| Change in operating assets and liabilities, net of effects of business acquisition: | | | | | |

| Accounts receivable | 1,096 | | | (1,180) | | | |

| Inventory | (1,065) | | | (5,601) | | | |

| Prepaid expenses and other assets | 463 | | | (571) | | | |

| Accounts payable | 1,356 | | | (4,660) | | | |

| Accrued expenses and other liabilities | (3,020) | | | 4,571 | | | |

| Operating lease liabilities | (1,776) | | | (1,305) | | | |

| Net cash used in operating activities | (116,962) | | | (116,877) | | | |

| | | | | |

| Cash flows from investing activities | | | | | |

| Purchase of property and equipment and other | (7,401) | | | (2,885) | | | |

| Proceeds from sale of property and equipment | 2 | | | 152 | | | |

| Purchase of in-process research and development | — | | | (14,428) | | | |

| Payments for security deposit, net | (45) | | | — | | | |

| Purchase of investments | (189,670) | | | (268,584) | | | |

| Proceeds from sale and maturity of investments | 215,422 | | | 263,723 | | | |

| Net cash provided by (used in) investing activities | 18,308 | | | (22,022) | | | |

| | | | | |

| Cash flows from financing activities | | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Proceeds from exercise of common stock options | 257 | | | 79 | | | |

| Taxes paid related to net share settlement of equity awards | (239) | | | (157) | | | |

| Repurchase of treasury stock | (33) | | | — | | | |

| Net cash used in financing activities | (15) | | | (78) | | | |

| | | | | |

| Net decrease in cash and cash equivalents and restricted cash | (98,669) | | | (138,977) | | | |

| Cash and cash equivalents and restricted cash, beginning of period | 120,133 | | | 259,110 | | | |

| Cash and cash equivalents and restricted cash, end of period | $ | 21,464 | | | $ | 120,133 | | | |

Cover

|

Feb. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 13, 2024

|

| Entity Registrant Name |

HYLIION HOLDINGS CORP.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38823

|

| Entity Tax Identification Number |

83-2538002

|

| Entity Address, Address Line One |

1202 BMC Drive,

|

| Entity Address, Address Line Two |

Suite 100

|

| Entity Address, City or Town |

Cedar Park,

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78613

|

| City Area Code |

833

|

| Local Phone Number |

495-4466

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

HYLN

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001759631

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

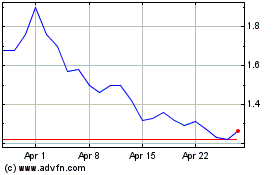

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hyliion (NYSE:HYLN)

Historical Stock Chart

From Apr 2023 to Apr 2024