false

0001509261

0001509261

2024-02-13

2024-02-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

February 13, 2024

REZOLUTE, INC.

(Exact Name of Registrant as Specified in Charter)

| Nevada |

|

001-39683 |

|

27-3440894 |

|

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

275 Shoreline Drive, Suite 500, Redwood City,

CA 94065

(Address of Principal Executive Offices, and

Zip Code)

650-206-4507

Registrant’s Telephone Number, Including

Area Code

Not Applicable

(Former Name

or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| |

¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

RZLT |

Nasdaq Capital Market |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02 |

Results of Operations and Financial Condition. |

On

February 13, 2024, Rezolute, Inc. issued a press release announcing its financial results for the second quarter ended December 31,

2023. A copy of this press release is attached hereto as Exhibit 99.1.

The

information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability

of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange

Act, whether made before or after the date hereof, except as expressly set forth by specific reference in such filing to this Current

Report on Form 8-K.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

REZOLUTE, INC. |

| |

|

|

| DATE: February 13, 2024 |

By: |

/s/ Nevan Charles Elam |

| |

|

Nevan Charles Elam |

| |

|

Chief Executive Officer |

Exhibit 99.1

Rezolute Reports Second Quarter Fiscal 2024

Results and Provides Business Update

Phase 3 clinical study of RZ358 underway in

patients with congenital hyperinsulinism (cHI); topline results expected in mid-2025

Benefit shown in individual patient cases with

RZ358 for tumor-associated hyperinsulinism (taHI) under Expanded Access Program (EAP); drives alignment with FDA on unmet need and potential

to move into late-stage clinical development to further evaluate RZ358 in this population

Redwood City, Calif.,

February 13, 2024 -- Rezolute, Inc. (Nasdaq: RZLT) (“Rezolute” or the “Company”), a clinical-stage biopharmaceutical

company committed to developing novel, transformative therapies for serious metabolic and rare diseases, today announced its financial

results for the second quarter of fiscal 2024 ended December 31, 2023, and provided an update on recent business developments and

outlook.

“2024 is an

exciting year of execution and milestones across our pipeline, with RZ358 continuing to demonstrate benefit to patients with

hypoglycemia resulting from varying causes of hyperinsulinism, and in different indications,” said Nevan Charles Elam, Chief

Executive Officer and Founder of Rezolute. “We recently initiated sunRIZE, a global, pivotal, Phase 3 clinical study in

patients with congenital hyperinsulinism, and we also continue to see favorable outcomes from our Expanded Access Program with

RZ358, in patients with tumor-associated hyperinsulinism caused by insulinomas, for which we are evaluating a potential development

program. Additionally, we completed enrollment in the Phase 2 study of RZ402 in patients with diabetic macular edema and look

forward to reporting topline data from that program in the second quarter of 2024.”

Clinical and Regulatory

Highlights

RZ358 is a monoclonal antibody for

the treatment of hyperinsulinism.

| o | Rezolute

initiated sunRIZE, a global, pivotal, Phase 3 clinical study in participants with cHI, in

Europe and other geographies outside of the U.S. |

| § | Topline

results expected mid-2025. |

| o | Innovation

and Licensing Application Passport (ILAP) designation awarded to RZ358 for the treatment

of cHI by the U.K. Medicines and Healthcare products Regulatory Agency (MHRA). |

| § | Designation

was granted based on the recognition of substantial unmet medical need in this condition

and the potential benefit to patients as evidenced by the Phase 2b RIZE study results in

cHI, which safely demonstrated significant improvements in hypoglycemia. |

| § | Supplements

analogous PRIME designation status already granted by the European Medicines Agency (EMA)

in E.U. |

| o | RZ358

has been shown to counteract excessive insulin action downstream, at the insulin-receptor

on target organs. The unique mechanism of action of RZ358 makes the therapy a potential universal

treatment for hypoglycemia resulting from any cause of hyperinsulinism, including neuroendocrine

tumors (insulinomas). |

| o | Given

the unmet need in taHI and the potential therapeutic benefit of RZ358 as demonstrated in

the individual case reports from the EAP, the Company met with FDA in January 2024 (January Meeting)

and received a favorable opinion from the Agency on the feasibility of RZ358 being studied

in a late-stage clinical trial as a new development program and second rare disease indication

for RZ358. |

| o | In

the January Meeting, FDA indicated that current dose caps on cHI studies would not be

applicable to taHI studies. Therefore, considering the indication is primarily adult, current

partial clinical holds pertaining to cHI studies would be largely irrelevant in taHI. |

| o | The

Company remains engaged with FDA in the attempt to resolve ongoing partial clinical holds

on clinical studies in the cHI indication. |

RZ402 is a selective and potent oral

plasma kallikrein inhibitor for the treatment of diabetic macular edema (DME).

| · | Completed enrollment

in Phase 2 U.S., multi-center, randomized, double-masked, placebo-controlled, parallel-arm

study evaluating the safety, efficacy, and pharmacokinetics of RZ402 administered as an oral

monotherapy over a 12-week treatment period in participants with DME who are naïve to

or have received limited anti-VEGF injections. |

| · | Topline results expected

in the second quarter of 2024. |

Corporate Highlights

| · | Expanded

leadership team with appointment of Daron Evans, M.S., M.B.A, as Chief Financial Officer. |

| o | Mr. Evans

has substantial experience leading public and private life science companies, with expertise

in corporate finance, capital markets, and strategic transactions. He will help shepherd

Rezolute through its next chapter in late-stage development. |

Second Quarter Fiscal

2024 Financial Results

| · | Cash,

cash equivalents and investments in marketable debt securities totaled $96.0 million as of

December 31, 2023, compared

to $118.4 million as of June 30, 2023 |

| · | Research

and development expenses were $12.0 million for the second quarter of fiscal 2024, compared

to $10.9 million for the same period in fiscal 2023, with the increase primarily attributable

to increased expenditures in clinical trial activities and manufacturing costs |

| · | General

and administrative expenses were $3.2 million for the second quarter of fiscal 2024, compared

to $3.4 million for the same period in fiscal 2023, with the decrease primarily attributable

to lower personnel-related expenses |

| · | Net

loss was $13.9 million for the second quarter of fiscal 2024, compared to $13.6 million for

the same period in fiscal 2023 |

About Rezolute, Inc.

Rezolute strives to disrupt current treatment

paradigms by developing transformative therapies for devastating rare and chronic metabolic diseases. Its novel therapies hold the potential

to both significantly improve outcomes and reduce the treatment burden for patients, treating physicians, and the healthcare system.

Rezolute is steadfast in its mission to create profound, positive, and lasting impacts on patients’ lives. Patient, clinician,

and advocate voices are integrated in the Company’s drug development process. Rezolute places an emphasis on understanding the

patient’s lived experiences, enabling the Company to boldly address a range of severe conditions. For more information, visit www.rezolutebio.com.

Forward-Looking Statements

This release, like many written and oral communications

presented by Rezolute and our authorized officers, may contain certain forward-looking statements regarding our prospective performance

and strategies within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934,

as amended. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained

in the Private Securities Litigation Reform Act of 1995 and are including this statement for purposes of said safe harbor provisions.

Forward-looking statements, which are based on certain assumptions and describe future plans, strategies, and expectations of Rezolute,

are generally identified by use of words such as "anticipate," "believe," "estimate," "expect,"

"intend," "plan," "project," "seek,"

"strive," "try," or future or conditional verbs such as "could," "may," "should," "will,"

"would," or similar expressions. These forward-looking statements include, but are not limited to statements regarding the

appointment of Daron Evans as Chief Financial Officer, the sunRIZE Phase 3 clinical study, Phase 2 study of RZ402, the Expanded Access

Program with RZ358, the ability of RZ358 to become an effective treatment for congenital hyperinsulinism, the effectiveness or future

effectiveness of RZ358 for the treatment of congenital hyperinsulinism, and statements regarding clinical trial timelines for RZ358.

Our ability to predict results or the actual effects of our plans or strategies is inherently uncertain. Accordingly, actual results

may differ materially from anticipated results. Readers are cautioned not to place undue reliance on these forward-looking statements,

which speak only as of the date of this release. Except as required by applicable law or regulation, Rezolute undertakes no obligation

to update these forward-looking statements to reflect events or circumstances that occur after the date on which such statements were

made. Important factors that may cause such a difference include any other factors discussed in our filings with the SEC, including the

Risk Factors contained in the Rezolute’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, which are available

at the SEC’s website at www.sec.gov. You are urged to consider these factors carefully in evaluating the forward-looking statements

in this release and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety

by this cautionary statement.

Investors & Media:

Christen Baglaneas

Rezolute, Inc.

cbaglaneas@rezolutebio.com

(508)272-6717

Investors:

Stephanie Carrington

ICR Westwicke

RezoluteIR@westwicke.com

(646)277-1282

Rezolute, Inc.

Condensed Consolidated Financial Statements Data

(in thousands, except per share data)

| | |

Three Months Ended | | |

Six Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Condensed Consolidated Statements of Operations Data: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 12,039 | | |

$ | 10,945 | | |

$ | 24,253 | | |

$ | 18,649 | |

| General and administrative | |

| 3,155 | | |

| 3,447 | | |

| 6,855 | | |

| 5,961 | |

| Total operating expenses | |

| 15,194 | | |

| 14,392 | | |

| 31,108 | | |

| 24,610 | |

| Loss from operations | |

| (15,194 | ) | |

| (14,392 | ) | |

| (31,108 | ) | |

| (24,610 | ) |

| Non-operating income, net | |

| 1,285 | | |

| 836 | | |

| 2,675 | | |

| 1,223 | |

| Net loss | |

$ | (13,909 | ) | |

$ | (13,556 | ) | |

$ | (28,433 | ) | |

$ | (23,387 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Basic and diluted net loss per common share | |

$ | (0.27 | ) | |

$ | (0.26 | ) | |

$ | (0.55 | ) | |

$ | (0.46 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Shares used to compute basic and diluted net loss per common share | |

| 51,408 | | |

| 51,410 | | |

| 51,409 | | |

| 50,969 | |

| | |

December 31, | | |

June 30, | |

|

|

|

|

|

|

|

|

| | |

2023 | | |

2023 | |

|

|

|

|

|

|

|

|

| | |

| | |

| |

|

|

|

|

|

|

|

|

| Condensed Consolidated Balance Sheets Data: | |

| | | |

| | |

|

|

|

|

|

|

|

|

| Cash and cash equivalents | |

$ | 12,504 | | |

$ | 16,036 | |

|

|

|

|

|

|

|

|

| Investments in marketable debt securities | |

| 83,446 | | |

| 102,330 | |

|

|

|

|

|

|

|

|

| Working capital | |

| 88,077 | | |

| 99,710 | |

|

|

|

|

|

|

|

|

| Total assets | |

| 102,150 | | |

| 123,721 | |

|

|

|

|

|

|

|

|

| Accumulated deficit | |

| (289,418 | ) | |

| (260,985 | ) |

|

|

|

|

|

|

|

|

| Total stockholders’ equity | |

| 91,728 | | |

| 116,172 | |

|

|

|

|

|

|

|

|

v3.24.0.1

Cover

|

Feb. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 13, 2024

|

| Entity File Number |

001-39683

|

| Entity Registrant Name |

REZOLUTE, INC.

|

| Entity Central Index Key |

0001509261

|

| Entity Tax Identification Number |

27-3440894

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

275 Shoreline Drive

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Redwood City

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94065

|

| City Area Code |

650

|

| Local Phone Number |

206-4507

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

RZLT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

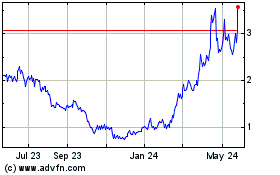

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

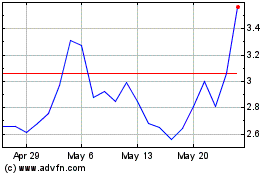

Rezolute (NASDAQ:RZLT)

Historical Stock Chart

From Apr 2023 to Apr 2024