Consolidated revenue: €1,315.6 m (-0.7%

excluding scope effects1)

Consolidated EBITA: €300.7 m

Operating margin: 22.9%

Net profit: €237.1 m (+42.9%)

Regulatory News:

(€ millions)

2023

2022

% change

Consolidated revenue2

1,315.6

1,356.9

-3.0%

Group advertising revenue

1,067.0

1,083.6

-1.5%

- of which TV advertising revenue

905.0

925.1

-2.2%

- of which other advertising revenue

162.0

158.5

+2.2%

Group non-advertising revenue

248.6

273.3

-9.0%

Consolidated profit from recurring operations (EBITA)4

300.7

336.2

-10.6%

Margin from recurring operations

22.9%

24.8%

-1.9pp

Capital gains/(losses) on asset disposals

24.6

(11.0)

n.a

0.0

Operating income and expenses related to business combinations

(19.9)

(13.2)

-50.6%

Operating profit (EBIT)

305.5

312.0

-2.1%

Net financial income/(expense)

10.9

(0.1)

n.a

Share of profit/(loss) of joint ventures and associates

8.3

(70.7)

+111.8%

Income tax

(87.6)

(75.3)

-16.3%

Net profit for the period

237.1

165.9

+42.9%

Net profit for the period - Group share

234.1

161.5

+45.0%

In 2023, M6 Group (Paris:MMT) achieved consolidated revenue2

of €1,315.6 million, down 0.7% at constant scope of

consolidation. Group advertising revenue was down 1.5% in

relation to 2022, mainly due to the decline in TV advertising

revenue which stood at €905.0 million, down 2.2%, in keeping with

the market trend.

Non-advertising revenue increased by 2.5% on a constant scope

basis. The 9.0% decline was primarily due to the deconsolidation of

Best Of TV, M6 Digital Services’ thematic online media and services

division, and Ctzar.

TV Programming costs were stable, totalling €502.6 million

for the year ended 31 December 2023 compared with €504.9

million3 for the year to 31 December 2022, whilst enabling the

broadcast of major sporting events (Women’s Football World Cup,

Rugby World Cup) as well as an increase in exclusive programmes for

6Play (VOD).

Other operating expenses totalled €512.3 million, down 0.7%,

including a decline of €32.2 million related to changes in scope

and an increase of €28.7 million mainly made up of the amortisation

of films released by SND in 2023 and the rise in technical and

commercial costs related to VOD.

Profit from recurring operations (EBITA)4 totalled

€300.7 million, down 10.6%, and representing an operating

margin of 22.9%.

In 2023, the Group continued to streamline its diversification

portfolio, recording capital gains of €24.6 million (51% held in

Ctzar and 100% in M6 Digital Services’ thematic online media and

services division), and a €6.7 million increase in net expenses

related to business combinations. These transactions had a net

positive impact of €4.7 million on EBIT compared with a negative

impact of €24.2 million in 2022.

As such, EBIT totalled €305.5 million (down 2.1% compared

with 2022).

The share of profit of joint ventures and associates stood at

€8.3 million, as against a loss of €70.7 million in 2022. The

winding up of SALTO made a positive contribution of €2.4 million,

after a negative impact of €46.1 million in 2022, which was due to

the operating loss recorded and the provision for closure costs.

GSG contributed €22.5 million, reflecting the improvement in its

profitability due to the key acquisition of Pepper.com in January

2023 which resulted in a dilution profit. Lastly, Bedrock continued

its investments in its video streaming technology platform.

Net profit attributable to the Group was €234.1

million, an increase of 45% compared with 2022.

*

* *

In accordance with IFRS 8, the contribution of the Group’s four

operating segments to consolidated revenue and EBITA was as

follows:

9 months Q4 FY (€

millions)

2023

2022

% change

2023

2022

% change

2023

2022

% TV

725.8

746.0

-2.7%

318.7

323.8

-1.6%

1,044.5

1,069.7

-2.4%

Radio

113.2

109.1

+3.7%

51.7

48.5

+6.7%

164.9

157.6

+4.7% Production & Audiovisual Rights

48.9

42.5

+15.0%

18.7

13.6

+36.9%

67.6

56.2

+20.3% Diversification

29.3

55.9

-47.6%

8.4

16.5

-48.8%

37.7

72.3

-47.9%

Other revenue

0.7

0.8

-10.3%

0.2

0.3

-33.9%

0.9

1.1

-17.4%

Consolidated revenue

917.9

954.2

-3.8%

397.7

402.6

-1.2%

1,315.6

1,356.9

-3.0%

TV

235.2

265.0

-11.2%

Radio

41.0

34.1

+20.2% Production & Audiovisual Rights

10.5

13.4

-21.8%

Diversification

15.8

21.2

-25.1%

Eliminations and unallocated items

(1.8)

2.5

n.a

Consolidated profit from recurring operations (EBITA)

190.8

216.9

-12.0%

109.9

119.3

-7.9%

300.7

336.2

-10.6%

Operating margin

20.8%

22.7%

27.6%

29.6%

22.9%

24.8%

Television

In 2023, individual viewing time stood at 3 hours 12 minutes5

across the public as a whole. Despite a slight decline compared to

2022 (down 3.5%), television remained the most popular format as it

reaches 75% of people daily (stable in relation to 2022).

Over 2023 as a whole, M6 Group’s free-to-air channels

(M6, W9, 6ter and Gulli), achieved the

highest year-on-year growth on the key commercial target

of 25-49 year olds with a 20.5% audience

share (up 0.2 percentage

point).

The M6 channel maintained its ranking as the second biggest

national channel amongst 25-49 year olds with a 12.9% audience

share (down 0.1 point). Its longstanding entertainment and news

programmes performed very well again this year – L’Amour est dans

le Pré (29% audience share amongst 25-49 year olds), Capital and

Zone Interdite (19%) – while new brands such as The Traitors (33%)

consolidated their success. In addition, 2023 was full of sporting

events with, in particular, the broadcast of the Women’s Football

World Cup and the Rugby World Cup.

On DTT, W9 was ranked the second most popular DTT channel

amongst 25-49 year olds while the channels 6ter and Gulli set new

records – 6ter achieved a record year in primetime with viewers

aged 25-49 and Gulli had its best ever year on the commercial

target with viewers under 50.

The 6play platform broke records in 2023 and confirmed its

popularity amongst young people, with a third of 6play users under

35 years old, thus making it the youngest platform on the

market. In addition, it is also the leader in terms of

viewing time per user amongst the under 35s, who spend 53

minutes on 6play per day6. As such, the on-demand Video activity

(streaming) accounts for 518.2 million7 hours viewed, representing

5.5% of total hours consumed on the Group’s networks.

TV advertising revenue totalled €905.0 million over the

full year, a decline of 2.2% compared with 2022. The

economic environment, marked by inflation, impacted advertisers’

investments in commercials. Streaming revenue8 accounted for 7.1%

of the TV division’s total revenue for the year to 31 December

2023.

TV EBITA stood at €235.2 million, down €29.8 million,

impacted by the decline in revenue and the rise in technical and

commercial costs of VOD. An operating margin of 22.5% was

achieved.

Radio

In 2023, radio continued to reach more than 70% of the French

population aged over 13 with a significant daily listening time of

2hrs409 (up 3 minutes compared with 2022). The RTL radio division

recorded an audience share of 17.6% with listeners aged 13 and over

and thereby maintained its position as the leading commercial radio group. In 2023, the

Group continued the digitalisation of its listening formats,

resulting in RTL being ranked as the leading commercial podcast producer in France

with 29.5 million listens.

In 2023, Radio revenue totalled €164.9 million, up

4.7% in comparison with 2022, benefitting from a dynamic

radio advertising market over the full year.

EBITA totalled €41.0 million, up €6.9 million in

comparison with the previous year. Operating margin was

24.9%, compared with 21.7% in 2022.

Production and Audiovisual Rights

Revenue from the Production & Audiovisual Rights activity

grew €11.4 million in relation to 2022 and thus totalled €67.6

million, driven by the strong cinema and rights disposal

activities. SND’s film business recorded 8.3 million10 cinema admissions over the

course of 2023 (compared with 6.2 million in 2022), in a year

marked by numerous successes, including the animation Ladybug &

Cat Noir: The Movie, which achieved the best ever launch for a

French animated film during its release in July, recording 1.6

million admissions. The films L’Abbé Pierre: A Century of Devotion,

The Braid, Jungle Bunch 2: World Tour and Toto on School Trip all

posted impressive performances.

Divisional EBITDA totalled €10.5 million (down €2.9

million compared with 2022). This decline was due to a higher

number of cinema releases than in 2022 (15 films compared with 12

in 2022), which led to a rise in related costs (amortisation,

marketing, etc.).

Diversification

Diversification revenue stood at €37.7 million for

2023, down €34.6 million, including €26.1 million due to the

deconsolidation of Best of TV, sold in November 2022. The remainder

of the decline was primarily due to the disposal of M6 Digital

Services’ thematic online media and services division on 30

September 2023 as well as the slowdown in the property market which

impacted Stéphane Plaza Immobilier’s business.

EBITA from Diversification was €15.8 million (down €5.3

million).

*

* *

Financial position

The Group had shareholders’ equity of €1,305.1 million at 31

December 2023, compared with €1,199.2 million at 31 December 2022,

reflecting the performance over the full year.

The net cash position increased by €61.6 million, standing at

€343.6 million11, compared with €282.0 million at 31 December

2022.

Outlook

While continuing to strengthen linear programming, the Group

plans to ramp up the development of its streaming business by

launching a new platform to realise its vision. This platform will

feature a free range of powerful content, accessible from all

screens, and offering an ever more innovative experience, driven by

the expertise of its subsidiary Bedrock. Moreover, the platform

will strengthen the Group’s value proposition for advertisers.

This ambition will leverage additional investments in content,

technology, distribution and marketing between 2024 and 2028. Thus,

the Group will invest up to € 100 million in its streaming

operational expenses with the aim to double the Group’s streaming

revenues as well as the number of hours viewed on the platform by

2028. The break-even is expected in 2027.

In addition, 2024 will also be marked by the broadcast of Euro

2024 for which, as official broadcaster, the Group will show

exclusively, free-to-air and live, half of the top 25 matches

including the final, a semi-final and two quarter finals (including

France’s match if they qualify).

Dividend

The performance achieved in 2023 leads to propose to the Annual

General Meeting a dividend of €1.25, corresponding to a pay-out of

67%, equal to the average of the last 5 dividends paid. Confident

in its foundations and its ability to self-finance its investment

plan in its streaming OPEX to accelerate its transformation, the

Group plans to maintain a similar dividend for 2024. In the longer

term, the Group intends to return to its usual payout policy.

CSR commitments

Committed to improving the gender balance within managerial and

leadership roles for several years, the Group was ranked 30th in

the 2023 Awards for female representation in the management bodies

of SBF120 companies12, climbing 12 places from the previous

year.

As part of the measures implemented to reduce the various types

of energy consumption within the Group, in particular with an

Energy Sobriety plan introduced in late 2022, the Group cut its

carbon footprint by 20%13 between 2022 and 2023 to 1,214

tonnes of CO2 equivalent.

More specifically regarding the carbon footprint associated with

the production of its programmes, the Group, having led training

campaigns on green production in 2022 and 2023, was awarded the

Ecoprod Label14 for its flagship cookery show produced by

Studio 89. Top Chef therefore becomes the first primetime

entertainment programme in France to receive this

certification. In 2023, the Group complied with its

broadcasting obligations and was not sanctioned by French media

regulator Arcom.

Results will be presented to financial

analysts in a webcast starting at 18:30 (CET) on 13 February

2024.

Details on how to access the webcast are

available at https://www.groupem6.fr

Both the slideshow and annual consolidated

financial statements will be available online at 18:00 (CET), it

being specified that the audit procedures have been carried out and

the Statutory Auditors’ report on the financial statements is being

prepared.

Next release: First quarter 2024 financial

information: 23 April 2024 before start of trading.

M6 Métropole Télévision is listed on Euronext

Paris, Compartment A. Ticker: MMT, ISIN Code: FR0000053

1 Excluding the deconsolidation of Best Of TV, sold on 30

November 2022, Ctzar, sold on 1 July 2023 and M6 Digital Services’

thematic online media and services division, sold on 30 September

2023. 2 The information provided is intended to highlight the

breakdown of consolidated revenue between advertising and

non-advertising revenue. Group advertising revenue includes TV

advertising revenue (advertising revenue of free-to-air channels

M6, W9, 6ter and Gulli, and the platforms 6play and Gulli Replay,

as well as the share of advertising revenue from pay channels), the

advertising revenue of radio stations RTL, RTL2 and Fun, and the

share of advertising revenue generated by diversification

activities. 3 2022 programming costs were restated to include the

non-linear programming costs and provide a pro forma comparison

basis in relation to 2023. 4 Consolidated profit from recurring

operations (EBITA) is defined as operating profit (EBIT) before

amortisation and impairment of intangible assets (excluding

audiovisual rights) related to acquisitions and capital gains and

losses on the disposal of financial assets and subsidiaries. 5

Médiamétrie Mediamat 6 Médiamétrie – TV Audience across 4 screens –

6play/Gulli MNQ_SE and TV Aggregate across 4 screens (Catch-up) –

France – 4 screens viewing anywhere - Base: Over 4s 7 Mediamétrie –

TV rating across 4 screens (channels) – not including viewing of

6play exclusive programmes 8 Total revenue from digital advertising

revenues (AVOD) and revenues from subscriptions related to SVOD

(6playMax and GulliMax) 9 Source: Médiamétrie National Radio

Audience Study - FY 23 - In combination with M6 Group -

Monday-Friday, 05:00-24:00 10 Source: CBO Box-office 11 The net

cash position does not take into account lease liabilities

resulting from the application of IFRS 16 - Leases 12 Study carried

out by the French Ministry for Gender Equality to rank the 120

largest French companies according to their commitment to increase

female representation in their management bodies and, more

generally, to promoting gender equality at work. 13 Total Group

carbon footprint (location-based approach) 14 The Ecoprod Label

helps to certify the quality of an audiovisual production’s green

production policy following completion of an assessment by Afnor

Certification, an independent body that verifies the

appropriateness of the environmental policies implemented.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240213732332/en/

INVESTOR RELATIONS Myriam Pinot +33 (0)1 41 92 57 73

/ myriam.pinot@m6.fr

PRESS Paul Mennesson +33 (0)1 41 92 61 36

/ paul.mennesson@m6.fr

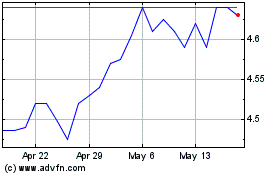

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Apr 2023 to Apr 2024