UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

|

☒

|

Filed by the Registrant ☐ Filed by a Party other than the Registrant

|

Check the appropriate box:

|

☒

|

Preliminary Proxy Statement

|

| |

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| |

|

|

☐

|

Definitive Proxy Statement

|

| |

|

|

☐

|

Definitive Additional Materials

|

| |

|

|

☐

|

Soliciting Material under §240.14a-12

|

WINDTREE THERAPEUTICS, INC.

(Name of Registrant as Specified In Its Charter)

| |

Payment of Filing Fee (Check all boxes that apply):

|

|

☒

|

No fee required.

|

| |

|

|

☐

|

Fee paid previously with preliminary materials.

|

| |

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED FEBRUARY 12, 2024

2600 Kelly Road, Suite 100

Warrington, Pennsylvania 18976

2024 SPECIAL MEETING OF STOCKHOLDERS

To be Held on March 28, 2024

, 2024

Dear Stockholder:

We are pleased to invite you to attend a Special Meeting of Stockholders (the “Special Meeting”), of Windtree Therapeutics, Inc. (“Windtree”, the “Company”, “we”, or “us”), which will be held virtually at 9:00 A.M., Eastern Time, on March 28, 2024 for the following purposes:

| |

1.

|

to approve an amendment to our Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to effect a reverse stock split of our outstanding shares of common stock, par value $0.001 per share ( “Common Stock”) by a ratio of any whole number between 1-for-5 and 1-for-25, the implementation and timing of which shall be subject to the discretion of our Board of Directors (the “Board”); and

|

| |

2.

|

to approve adjournment of the Special Meeting to the extent there are insufficient votes at the Special Meeting to approve the preceding proposal or to establish a quorum.

|

The Special Meeting can be accessed via the Internet at: https://www.cstproxy.com/windtreetx/sm2024. This Proxy Statement (as defined below) and enclosed proxy card are first being mailed to stockholders on or about February 23, 2024.

Details regarding admission to the Special Meeting and the business to be conducted are more fully described in the accompanying Notice of 2024 Special Meeting of Stockholders (the “Notice”), and the 2024 Special Meeting Proxy Statement (the “Proxy Statement”). You are entitled to vote at our Special Meeting and any adjournments thereof only if you were a stockholder as of February 20, 2024.

Your vote is important. Whether or not you plan to virtually attend the Special Meeting, we hope you will vote as soon as possible. Information about voting methods is set forth in the accompanying Notice and Proxy Statement. If you have any questions regarding the attached proxy statement or need assistance in voting your shares of Common Stock, please contact our Vice President, Controller & Chief Accounting Officer, and Corporate Secretary, Jamie McAndrew, at (215) 488-9300, or our proxy solicitor, Morrow Sodali LLC, by telephone at via telephone, call Morrow at 1-800-662-5200.

| |

|

Sincerely,

|

| |

|

|

| |

|

Craig E. Fraser

|

| |

|

Chairman of the Board, President and

Chief Executive Officer

|

PRELIMINARY PROXY STATEMENT, SUBJECT TO COMPLETION, DATED FEBRUARY 12, 2024

THIS PROXY STATEMENT AND THE ENCLOSED PROXY CARD ARE

FIRST BEING MAILED TO STOCKHOLDERS ON OR ABOUT FEBRUARY 23, 2024.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

Dear Stockholders:

You are invited to attend Windtree’s Special Meeting. At the Special Meeting, stockholders will vote:

| |

1.

|

to approve an amendment to the Charter to effect a reverse stock split of our outstanding shares of Common Stock by a ratio of any whole number between 1-for-5 and 1-for-25, the implementation and timing of which shall be subject to the discretion of our Board (the “Reverse Stock Split Proposal”); and

|

| |

2.

|

to approve adjournment of the Special Meeting to the extent there are insufficient votes at the Special Meeting to approve the preceding proposal or to establish a quorum (the “Adjournment Proposal”).

|

Stockholders also will transact any other business that may properly come before the Special Meeting or any adjournment or postponement of the Special Meeting.

MEETING INFORMATION

|

Date:

|

March 28, 2024

|

|

Time:

|

9:00 A.M., Eastern Time

|

|

Location:

|

Via the Internet: https://www.cstproxy.com/windtreetx/sm2024

|

|

Record Date:

|

You can vote if you were a stockholder of record on February 20, 2024

|

The Board has fixed the close of business on February 20, 2024 as the record date for the Special Meeting (the “Record Date”). Only stockholders of record on the Record Date are entitled to receive notice of the Special Meeting and to vote at the Special Meeting or at any adjournment(s) of the Special Meeting.

Your vote matters. Whether or not you plan to virtually attend the Special Meeting, please ensure that your shares are represented by voting, signing, dating and returning your proxy in the enclosed envelope, which requires no postage if mailed in the United States.

| |

By Order of the Board of Directors

|

| |

|

| |

|

| |

Jamie McAndrew

Vice President, Controller & Chief Accounting

Officer, and Corporate Secretary

, 2024

|

IMPORTANT NOTICE REGARDING AVAILABILITY OF PROXY MATERIALS. This Proxy Statement and the proxy card are being mailed to our stockholders on or about February 23, 2024. This Proxy Statement is available to stockholders at https://www.cstproxy.com/windtreetx/sm2024.

To assist you in reviewing this meeting’s proposals, we call your attention to the following proxy summary. This is only a summary; please review this 2024 Special Meeting Proxy Statement (the “Proxy Statement”) in full.

Summary of Stockholder Voting Matters

|

PROPOSAL

|

|

FOR MORE

INFORMATION

|

|

BOARD OF DIRECTORS

RECOMMENDATION

|

|

Item 1: Approval of an amendment to the Charter to effect a reverse stock split of our outstanding shares of Common Stock by a ratio of any whole number between 1-for-5 and 1-for-25, the implementation and timing of which shall be subject to the discretion of our Board

|

|

Page 8

|

|

✓FOR

|

|

Item 2: Approval of adjournment of the Special Meeting to the extent there are insufficient votes at the Special Meeting to approve the preceding proposal or to establish a quorum

|

|

Page 14

|

|

✓FOR

|

This Proxy Statement, with the enclosed proxy card, is being mailed to stockholders of Windtree Therapeutics, Inc. (“Windtree”, the “Company”, “we” or “us”) in connection with the solicitation by our Board of Directors (the “Board”) of proxies to be voted at our Special Meeting of Stockholders (the “Special Meeting”) and at any postponements or adjournments thereof. The Special Meeting will be held on March 28, 2024, at 9:00 A.M., Eastern Time, via the Internet at https://www.cstproxy.com/windtreetx/sm2024.

This Proxy Statement and the enclosed proxy card are first being mailed to our stockholders on or about February 23, 2024.

|

GENERAL INFORMATION ABOUT THE MEETING

|

PROXY SOLICITATION

The Company is soliciting your vote on matters that will be presented at the Special Meeting and at any adjournment thereof. This Proxy Statement contains information on these matters to assist you in voting your shares.

This Proxy Statement and the proxy card are being mailed to our stockholders on or about February 23, 2024. This Proxy Statement is available to stockholders at https://www.cstproxy.com/windtreetx/sm2024.

STOCKHOLDERS ENTITLED TO VOTE

Stockholders of record, including holders of our common stock, par value $0.001 per share (“Common Stock”), at the close of business on February 20, 2024 (the “Record Date”) are entitled to receive the Notice of 2024 Special Meeting of Stockholders, (the “Notice”) and to vote their shares at the Special Meeting. There were shares of Common Stock outstanding on the Record Date. Pursuant to the rights of our stockholders contained in our governing documents, each share of our Common Stock is entitled to one vote on all matters listed in this proxy statement.

VOTING METHODS

You may vote at the Special Meeting by delivering a proxy card in person or you may cast your vote in any of the following ways:

|

|

|

|

| |

|

|

|

MAIL

|

INTERNET

|

ONLINE AT THE MEETING

|

|

Mailing your signed proxy card or

voter instruction card.

|

Using the Internet

at www.cstproxyvote.com.

|

You can vote at the meeting at

https://www.cstproxy.com/windtreetx/sm2024

|

HOW YOUR SHARES WILL BE VOTED

In each case, your shares will be voted as you instruct. If you return a signed card, but do not provide voting instructions, your shares will be voted FOR each of the proposals. If you are the record holder of your shares, you may revoke or change your vote any time before the proxy is exercised. To do so, you must do one of the following:

| |

•

|

Vote over the Internet as instructed above. Only your latest Internet vote is counted. You may not revoke or change your vote over the Internet after 11:59 p.m., Eastern Time, on March 27, 2024.

|

| |

•

|

Sign a new proxy card and submit it by mail, which must be received no later than March 27, 2024. Only your latest dated proxy card will be counted.

|

| |

•

|

Virtually attend the Special Meeting at https://www.cstproxy.com/windtreetx/sm2024. Virtually attending the Special Meeting will not by itself revoke a previously granted proxy.

|

| |

•

|

Give our Corporate Secretary written notice before or at the meeting that you want to revoke your proxy.

|

If your shares are held by your broker, bank or other holder of record as a nominee or agent (i.e., the shares are held in “street name”), you should follow the instructions provided by your broker, bank or other holder of record.

Deadline for Voting. The deadline for voting by Internet, other than by virtually attending the Special Meeting, is 11:59 p.m. Eastern Time on March 27, 2024. If you are a registered stockholder and virtually attend the Special Meeting, you may vote online during the Special Meeting.

|

GENERAL INFORMATION ABOUT THE MEETING

|

BROKER VOTING AND VOTES REQUIRED FOR EACH PROPOSAL

If your shares are held in a stock brokerage account or by a bank or other holder of record, you are considered the “beneficial owner” of shares held in street name. The Notice has been forwarded to you by your broker, bank or other holder of record who is considered the stockholder of record of those shares. As the beneficial owner, you may direct your broker, bank or other holder of record on how to vote your shares by using the proxy card included in the materials made available or by following their instructions for voting on the Internet.

The following table summarizes how broker non-votes, votes withheld, and abstentions are treated with respect to our proposals:

|

PROPOSAL

|

|

VOTES REQUIRED

|

|

TREATMENT OF

VOTES WITHHELD,

ABSTENTIONS, AND

BROKER

NON-VOTES

|

|

BROKER

DISCRETIONARY

VOTING

|

|

Proposal 1: Approval of an amendment to the Charter to effect a reverse stock split of our outstanding shares of Common Stock by a ratio of any whole number between 1-for-5 and 1-for-25, the implementation and timing of which shall be subject to the discretion of the Board

|

|

The votes cast for the amendment exceed the votes cast against the amendment

|

|

Abstentions and broker non-votes have no effect on the outcome of the proposal

|

|

Yes

|

|

Proposal 2: Approval of adjournment of the Special Meeting to the extent there are insufficient votes at the Special Meeting to approve the preceding proposal or to establish a quorum

|

|

Assuming the presence of a quorum, the majority of the total votes cast

In the absence of a quorum, the majority of the votes present in person or by proxy and entitled to vote

|

|

Assuming the presence of a quorum. abstentions and broker non-votes have no effect on the outcome of the proposal

In the absence of a quorum, abstentions will have the same effect as a vote against the proposal. Broker non-votes have no effect on the outcome of the proposal

|

|

Yes

|

Proposal One: Approval of an amendment to the Charter to effect a reverse stock split of our outstanding shares of Common Stock by a ratio of any whole number between 1-for-5 and 1-for-25, the implementation and timing of which shall be subject to the discretion of the Board. The approval of the amendment to the Charter to effect a reverse stock split requires that the votes cast for amendment exceed the votes cast against amendment.

Proposal Two: Adjournment. Assuming the presence of a quorum, the approval of the adjournment requires the affirmative vote of a majority of the total votes cast by the holders of shares present in person or represented by proxy at the Special Meeting and entitled to vote on the proposal. In the absence of a quorum, the approval of the adjournment requires the affirmative vote of the holders of a majority of the votes of the shares of stock present in person or by proxy at the Special Meeting and entitled to vote.

|

GENERAL INFORMATION ABOUT THE MEETING

|

QUORUM AND APPROVAL

We must have a quorum to conduct business at the Special Meeting. A quorum consists of the presence at the Special Meeting either attending the meeting virtually or represented by proxy of the holders of one-third (1/3) of the votes of the shares of our stock issued and outstanding and entitled to vote at the Special Meeting. For the purpose of establishing a quorum, broker non-votes and abstentions, including brokers holding customers’ shares of record who cause abstentions to be recorded at the meeting, are considered stockholders who are present and entitled to vote, and count toward the quorum. If there is no quorum, the holders of a majority of the votes of the shares of stock present in person or by proxy at the Special Meeting and entitled to vote, or if no stockholder entitled to vote is present, then the chairman of the meeting, as determined by our Amended and Restated By-laws (the “Bylaws”), may adjourn the Special Meeting to another date.

There was shares of Common Stock outstanding on the Record Date. A quorum shall consist of the presence, virtually in person or by proxy, of at least shares of Common Stock. The approval of the Reverse Stock Split Proposal requires that the votes cast for the proposal exceed the votes cast against the proposal.

Assuming the presence of a quorum, the approval of the Adjournment Proposal requires the affirmative vote of a majority of the total votes cast by the holders of shares present in person or represented by proxy at the Special Meeting and entitled to vote on the proposal. In the absence of a quorum, the approval of the adjournment requires the affirmative vote of the holders of a majority of the votes of the shares of stock present in person or by proxy at the Special Meeting and entitled to vote

PROXY SOLICITATION COSTS

We pay the cost of soliciting proxies. Proxies will be solicited on behalf of the Board by mail, telephone and other electronic means or in person. Directors and employees will not be paid any additional compensation for soliciting proxies. We have engaged Morrow Sodali LLC to assist with the solicitation of proxies for an estimated fee of $9,500, plus any additional expenses. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

The following table sets forth certain information regarding the beneficial ownership of Common Stock as of February 1, 2024 by (a) each person known by us to be the beneficial owner of more than 5% of the outstanding shares of Common Stock, (b) each named executive officer of the Company, (c) each director of the Company, and (d) all executive officers and directors as a group.

The percentage of Common Stock outstanding is based on 8,501,864 shares of our Common Stock outstanding as of February 1, 2024. For purposes of the table below, and in accordance with the rules of the Securities and Exchange Commission (the “SEC”), we deem shares of Common Stock subject to options and warrants that are currently exercisable or exercisable within sixty days of February 1, 2024 to be outstanding and to be beneficially owned by the person holding the options or warrants for the purpose of computing the percentage ownership of that person, but we do not treat them as outstanding for the purpose of computing the percentage ownership of any other person. Except as otherwise noted, each of the persons or entities in this table has sole voting and investing power with respect to all of the shares of Common Stock beneficially owned by them, subject to community property laws, where applicable. Except as otherwise noted below, the street address of each beneficial owner is c/o Windtree Therapeutics, Inc., 2600 Kelly Road, Suite 100, Warrington, Pennsylvania 18976.

| |

|

SHARES BENEFICIALLY OWNED

|

|

|

|

|

NAME OF BENEFICIAL OWNER

|

|

NUMBER OF

SHARES OF

COMMON

STOCK

|

|

|

|

|

PERCENTAGE

OF COMMON

STOCK

|

|

|

|

|

5% or Greater Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deerfield Entities(1)

|

|

|

608,272

|

|

|

|

|

|

7.15%

|

|

|

|

|

Lincoln Park Capital Fund, LLC (2)

|

|

|

614,334

|

|

|

|

|

|

6.97%

|

|

|

|

|

The Lind Partners (3)

|

|

|

580,204

|

|

|

|

|

|

6.60%

|

|

|

|

|

Named Executive Officers and Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Daniel Geffken(4)

|

|

|

1,232

|

|

|

|

|

|

*

|

|

|

|

|

Robert Scott, M.D.(5)

|

|

|

850

|

|

|

|

|

|

*

|

|

|

|

|

Mark Strobeck, Ph.D.

|

|

|

-

|

|

|

|

|

|

*

|

|

|

|

|

Leslie J. Williams(5)

|

|

|

850

|

|

|

|

|

|

*

|

|

|

|

|

Craig E. Fraser(6)

|

|

|

28,151

|

|

|

|

|

|

*

|

|

|

|

|

Steven G. Simonson, M.D.(7)

|

|

|

9,624

|

|

|

|

|

|

*

|

|

|

|

|

Eric Curtis(8)

|

|

|

7,009

|

|

|

|

|

|

*

|

|

|

|

|

All executive officers and directors as a group (8 persons)

|

|

|

48,864

|

|

|

|

|

|

0.56%

|

|

|

|

|

(1)

|

Includes 324,817 shares of common stock issued to Deerfield PDI Financing II, L.P. and 283,455 shares of common stock issued to Deerfield Private Design Fund II, L.P. for a total of 608,272 shares of common stock. Deerfield Mgmt, L.P. is the general partner of Deerfield PDI Financing II, L.P. and Deerfield Private Design Fund II, L.P. (collectively, the “Deerfield Entities”). Deerfield Management Company, L.P. is the investment manager of the Deerfield Entities. James E. Flynn is the sole member of the general partner of each of Deerfield Mgmt, L.P. and Deerfield Management Company, L.P. Each of Deerfield Mgmt, L.P., Deerfield Management Company, L.P. and Mr. James E. Flynn may be deemed to beneficially own the shares of common stock of the Company beneficially owned by the Deerfield Entities. The selling stockholder’s address is c/o Deerfield Management Company, L.P., 345 Park Avenue South, 12th Floor, New York, NY 10010.

|

|

(2)

|

Includes 307,167 shares of common stock and 307,167 April 2023 Warrants to purchase 307,167 shares of common stock exercisable within 60 days of March 14, 2024. The April 2023 Warrants are subject to a 4.99% ownership cap (or, at the election of each holder prior to the date of issuance, 9.99%). Lincoln Park Capital, LLC, or LPC, is the Managing Member of Lincoln Park Capital Fund, LLC, or LPC Fund. Rockledge Capital Corporation, or RCC, and Alex Noah Investors, Inc., or Alex Noah, are the Managing Members of LPC. Joshua B. Scheinfeld is the president and sole shareholder of RCC, as well as a principal of LPC. Jonathan I. Cope is the president and sole shareholder of Alex Noah, as well as a principal of LPC. As a result of the foregoing, Mr. Scheinfeld and Mr. Cope have shared voting and shared investment power over the shares of common stock held directly by LPC Fund. Pursuant to Section 13(d) of the Act and the rules thereunder, each of LPC, RCC, Mr. Scheinfeld, Alex Noah, and Mr. Cope may be deemed to be a beneficial owner of the shares of Common Stock of the Issuer beneficially owned directly by LPC Fund. Pursuant to Rule 13(d)(4) of the Exchange Act, each of LPC, RCC, Mr. Scheinfeld, Alex Noah, and Mr. Cope disclaims beneficial ownership of the shares of common stock held directly by LPC Fund. The address for LPC Fund, LPC, RCC, Mr. Scheinfeld, Alex Noah, and Mr. Cope is 440 North Wells, Suite 410, Chicago, Illinois 60654.

|

|

(3)

|

Includes 290,102 shares of common stock and 290,102 April 2023 Warrants to purchase 290,102 shares of common stock exercisable within 60 days of March 14, 2024. The April 2023 Warrants are subject to a 4.99% ownership cap (or, at the election of each holder prior to the date of issuance, 9.99%). The address for The Lind Partners, LLC is 444 Madison Avenue, Floor 41, New York, New York 10022.

|

|

(4)

|

Includes 141 shares of common stock, 41 May 2020 Warrants to purchase 41 shares of common stock exercisable within 60 days of February 1, 2024 and options to purchase 1,050 shares of common stock exercisable within 60 days of February 1, 2024. The May 2020 Warrants are subject to a 4.99% ownership cap (or, at the election of each holder prior to the date of issuance, 9.99%), except that upon at least sixty-one (61) days’ prior notice to us, each holder may increase the ownership cap after exercising such holder’s May 2020 Warrants up to 9.99% (or up to 19.99% upon prior written approval by us).

|

|

(5)

|

Includes 100 shares of common stock and options to purchase 750 shares of common stock exercisable within 60 days of February 1, 2024.

|

|

(6)

|

Includes 10,901 shares of common stock, 2 Series A-1 Warrants to purchase 2 shares of common stock exercisable within 60 days of February 1, 2024, 41 May 2020 Warrants to purchase 41 shares of common stock exercisable within 60 days of February 1, 2024, 30 March 2021 Warrants to purchase 30 shares of common stock exercisable within 60 days of February 1, 2024, and options to purchase 18,290 shares of common stock exercisable within 60 days of February 1, 2024. The May 2020 Warrants are subject to a 4.99% ownership cap (or, at the election of each holder prior to the date of issuance, 9.99%), except that upon at least sixty-one (61) days’ prior notice to us, each holder may increase the ownership cap after exercising such holder’s May 2020 Warrants up to 9.99% (or up to 19.99% upon prior written approval by us).

|

|

(7)

|

Includes 1,137 shares of common stock, 1 Series A-1 Warrant to purchase 1 share of common stock exercisable within 60 days of February 1, 2024, 10 May 2020 Warrants to purchase 10 shares of common stock exercisable within 60 days of February 1, 2024, 30 March 2021 Warrants to purchase 30 shares of common stock exercisable within 60 days of February 1, 2024, and options to purchase 8,888 shares of common stock exercisable within 60 days of February 1, 2024. The May 2020 Warrants are subject to a 4.99% ownership cap (or, at the election of each holder prior to the date of issuance, 9.99%), except that upon at least sixty-one (61) days’ prior notice to us, each holder may increase the ownership cap after exercising such holder’s May 2020 Warrants up to 9.99% (or up to 19.99% upon prior written approval by us).

|

| |

|

|

(8)

|

Includes 811 shares of common stock and options to purchase 6,640 shares of common stock exercisable within 60 days of February 1, 2024.

|

ITEM 1: APPROVAL OF AN AMENDMENT TO THE CHARTER TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY A RATIO OF ANY WHOLE NUMBER BETWEEN 1-FOR-5 AND 1-FOR-25, THE IMPLEMENTATION AND TIMING OF WHICH SHALL BE SUBJECT TO THE DISCRETION OF THE BOARD

We are seeking stockholder approval to grant the Board discretionary authority to amend the Charter, if at all, to effect a reverse stock split of our outstanding shares of Common Stock, at any time before July 31, 2024, by a ratio of any whole number between 1-for-5 and 1-for-25 (the “Reverse Split”), provided, our Board will not select a reverse split ratio that will result in us having fewer than 500,000 publicly held shares under Nasdaq continued listing standards.

The Reverse Split will not change the number of authorized shares of Common Stock or the relative voting power of such holders of our outstanding Common Stock. The number of authorized but unissued shares of our Common Stock will materially increase and will be available for reissuance by the Company. The Reverse Split, if effected, would affect all of our stockholders uniformly.

The Board unanimously approved, and recommended seeking stockholder approval of the Reverse Split, on February 12, 2024. If this Reverse Split is approved by the stockholders, the Board will have the authority, in its sole discretion, without further action by the stockholders, to effect the Reverse Split. The Board’s decision as to whether and when to effect the Reverse Split, if approved by the stockholders, will be based on a number of factors, including prevailing market conditions, existing and expected trading prices for our Common Stock, actual or forecasted results of operations, and the likely effect of such results on the market price of our Common Stock.

The Reverse Split will also affect our outstanding stock options, restricted stock units and shares of Common Stock, including those issued under our 2011 and 2020 equity incentive plans, or as inducement grants under Nasdaq rules, as well as our outstanding warrants. Under these plans and securities, the number of shares of Common Stock deliverable upon exercise or grant must be appropriately adjusted and appropriate adjustments must be made to the purchase price per share to reflect the Reverse Split.

The Reverse Split is not being proposed in response to any effort of which we are aware to accumulate our shares of Common Stock or obtain control of the Company, nor is it a plan by management to recommend a series of similar actions to the Board or our stockholders.

There are certain risks associated with a reverse stock split, and we cannot accurately predict or assure the Reverse Split will produce or maintain the desired results (for more information on the risks see the section below entitled “Certain Risks Associated with a Reverse Stock Split”). The Board believes that the benefits to the Company outweigh the risks and recommends that you vote in favor of granting the Board the discretionary authority to effect the Reverse Split.

|

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF AN AMENDMENT TO THE CHARTER TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY A RATIO OF ANY WHOLE NUMBER BETWEEN 1-FOR-5 AND 1-FOR-25, THE IMPLEMENTATION AND TIMING OF WHICH SHALL BE SUBJECT TO THE DISCRETION OF THE BOARD

|

|

|

Reasons for the Reverse Stock Split

The Board believes that effecting the Reverse Split would increase the price of our Common Stock which would, among other things, help us to:

| |

•

|

Meet certain continued listing requirements of the Nasdaq Capital Market;

|

| |

•

|

Appeal to a broader range of investors to generate greater interest in the Company; and

|

| |

•

|

Improve perception of our Common Stock as an investment security.

|

Meet Listing Requirements – Our Common Stock is listed on the Nasdaq Capital Market under the symbol WINT. On January 22, 2024, we received a deficiency letter from the Nasdaq Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”), notifying us that, for the last 31 consecutive business days, the closing bid price for our Common Stock was below the minimum $1.00 per share required for continued listing on the Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (“Rule 5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were given 180 calendar days, or until July 22, 2024, to regain compliance with Rule 5550(a)(2). If at any time before July 22, 2024, the bid price of our Common Stock closes at $1.00 per share or more for a minimum of 10 consecutive business days, Nasdaq will provide written confirmation to the Company that the Company has achieved compliance. If we do not regain compliance with Rule 5550(a)(2) by July 22, 2024, we may be afforded a second 180 calendar day period to regain compliance and intend to request such additional compliance period. Although we believe that implementing the Reverse Split is likely to lead to compliance with the Rule 5550(a)(2), there can be no assurance that the closing share price after implementation of the Reverse Split will succeed in restoring such compliance.

Appeal to a Broader Range of Investors to Generate Greater Investor Interest in the Company – An increase in our stock price may make our Common Stock more attractive to investors. Brokerage firms may be reluctant to recommend lower-priced securities to their clients. Many institutional investors have policies prohibiting them from holding lower-priced stocks in their portfolios, which reduces the number of potential purchasers of our Common Stock. Investment funds may also be reluctant to invest in lower-priced stocks. Investors may also be dissuaded from purchasing lower-priced stocks because the brokerage commissions, as a percentage of the total transaction, tend to be higher for such stocks. Moreover, the analysts at many brokerage firms do not monitor the trading activity or otherwise provide coverage of lower-priced stocks. Giving the Board the ability to effect the Reverse Split, and thereby increase the price of our Common Stock, would give the Board the ability to address these issues if it is deemed necessary.

Improve the Perception of Our Common Stock as an Investment Security – The Board believes that effecting the Reverse Split is one potential means of increasing the share price of our Common Stock to improve the perception of our Common Stock as a viable investment security. Lower-priced stocks have a perception in the investment community as being risky and speculative, which may negatively impact not only the price of our Common Stock, but also our market liquidity.

Certain Risks Associated with the Reverse Split

The Reverse Split May Not Increase the Price of our Common Stock over the Long-Term – As noted above, the principal purpose of the Reverse Split is to increase the trading price of our Common Stock to meet the minimum stock price standards of Nasdaq. However, the effect of the Reverse Split on the market price of our Common Stock cannot be predicted with any certainty, and we cannot assure you that the Reverse Split will accomplish this objective for any meaningful period of time, or at all. While we expect that the reduction in the number of outstanding shares of Common Stock will proportionally increase the market price of our Common Stock, we cannot assure you that the Reverse Split will increase the market price of our Common Stock by a multiple of the Reverse Split ratio, or result in any permanent or sustained increase in the market price of our Common Stock. The market price of our Common Stock may be affected by other factors which may be unrelated to the number of shares outstanding, including the Company’s business and financial performance, general market conditions, and prospects for future success.

The Reverse Split May Decrease the Liquidity of our Common Stock – The Board believes that the Reverse Split may result in an increase in the market price of our Common Stock, which could lead to increased interest in our Common Stock and possibly promote greater liquidity for our stockholders. However, the Reverse Split will also reduce the total number of outstanding shares of Common Stock, which may lead to reduced trading and a smaller number of market makers for our Common Stock, particularly if the price per share of our Common Stock does not increase as a result of the Reverse Split.

The Reverse Split May Result in Some Stockholders Owning “Odd Lots” That May Be More Difficult to Sell or Require Greater Transaction Costs per Share to Sell – If the Reverse Split is implemented, it will increase the number of stockholders who own “odd lots” of less than 100 shares of Common Stock. A purchase or sale of less than 100 shares of Common Stock (an “odd lot” transaction) may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers.

Therefore, those stockholders who own fewer than 100 shares of Common Stock following the Reverse Split may be required to pay higher transaction costs if they sell their Common Stock.

The Reverse Split May Lead to a Decrease in our Overall Market Capitalization – The Reverse Split may be viewed negatively by the market and, consequently, could lead to a decrease in our overall market capitalization. If the per share market price of our Common Stock does not increase in proportion to the Reverse Split ratio, or following such increase does not maintain or exceed such price, then the value of our Company, as measured by our market capitalization, will be reduced. Additionally, any reduction in our market capitalization may be magnified as a result of the smaller number of total shares of Common Stock outstanding following the Reverse Split.

Determination of the Reverse Stock Split Ratio

The Board believes that stockholder approval of a range of potential Reverse Split ratios is in the best interests of our Company and stockholders because it is not possible to predict market conditions at the time the Reverse Split would be implemented. We believe that a range of Reverse Split ratios provides us with the most flexibility to achieve the desired results of the Reverse Split. The Reverse Split ratio to be selected by our Board will be not more than 1-for-25, provided, our Board will not select a reverse split ratio that will result in us having fewer than 500,000 publicly held shares under Nasdaq continued listing standards.

The selection of the specific Reverse Split ratio will be based on several factors, including, among other things:

| |

•

|

our ability to maintain the listing of our Common Stock on The Nasdaq Capital Market;

|

| |

•

|

the per share price of our Common Stock immediately prior to the Reverse Split;

|

| |

•

|

the expected stability of the per share price of our Common Stock following the Reverse Split;

|

| |

•

|

the likelihood that the Reverse Split will result in increased marketability and liquidity of our Common Stock;

|

| |

•

|

prevailing market conditions;

|

| |

•

|

general economic conditions in our industry; and

|

| |

•

|

our market capitalization before and after the Reverse Split.

|

We believe that granting our Board the authority to set the ratio for the Reverse Split is essential because it allows us to take these factors into consideration and to react to changing market conditions. If the Board chooses to implement the Reverse Split, the Company will make a public announcement regarding the determination of the Reverse Split ratio.

Effects of the Reverse Split

If our stockholders approve the proposed Reverse Split and the Board elects to effect the Reverse Split, our issued and outstanding shares of Common Stock, for example, would decrease at a rate of approximately one (1) share of Common Stock for every five (5) shares of Common Stock currently outstanding in a 1-for-5 split. The Reverse Split would be effected simultaneously for all of our Common Stock, and the exchange ratio would be the same for all shares of Common Stock. The Reverse Split would affect all of our stockholders uniformly and would not affect any stockholders’ percentage ownership interests in the Company. The Reverse Split would not affect the relative voting or other rights that accompany the shares of our Common Stock. Common Stock issued pursuant to the Reverse Split would remain fully paid and non-assessable. The Reverse Split would not affect our securities law reporting and disclosure obligations, and we would continue to be subject to the periodic reporting requirements of the Securities Exchange Act of 1934, as amended.

In addition to the change in the number of shares of Common Stock outstanding, the Reverse Split would have the following effects:

Increase the Per Share Price of our Common Stock – By effectively condensing a number of pre-split shares into one share of Common Stock, the per share price of a post-split share is generally greater than the per share price of a pre-split share. The amount of the initial increase in per share price and the duration of such increase, however, is uncertain. The Board may utilize the Reverse Split as part of its plan to maintain the required minimum per share price of the Common Stock under the Nasdaq listing standards.

Increase in the Number of Shares of Common Stock Available for Future Issuance – By reducing the number of shares outstanding without reducing the number of shares of available but unissued Common Stock, the Reverse Split will increase the number of authorized but unissued shares. The Board believes the increase is appropriate for use to fund the future operations of the Company. Although the Company does not have any pending acquisitions for which shares are expected to be used, the Company may also use authorized shares in connection with the financing of future acquisitions.

The following table contains approximate information relating to our Common Stock, based on share information as of February 1, 2024. The following table is for illustrative purposes only. The number of shares of our common stock may increase prior to us effecting the Reverse Split. Our Board will not select a reverse split ratio that will result in us having fewer than 500,000 publicly held shares under Nasdaq continued listing standards.

| |

|

Current

|

|

|

After the

Reverse Split

if the

Minimum

1:5 Ratio is

Selected

|

|

|

After the

Reverse Split

if the

Maximum

1:25 Ratio is

Selected

|

|

|

Authorized common stock

|

|

|

120,000,000

|

|

|

|

120,000,000

|

|

|

|

120,000,000

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issued and outstanding

|

|

|

8,501,864

|

|

|

|

1,700,373

|

|

|

|

340,075

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants to purchase common stock outstanding

|

|

|

4,671,783

|

|

|

|

934,357

|

|

|

|

186,872

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock issuable upon exercise of outstanding stock options, and settlement of restricted stock units

|

|

|

424,693

|

|

|

|

84,939

|

|

|

|

16,988 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock reserved for issuance for future grants under 2011 and 2020 equity incentive plans

|

|

|

338,477

|

|

|

|

67,696

|

|

|

|

13,540

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Treasury stock issued

|

|

|

1

|

|

|

|

1

|

|

|

|

1

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock authorized but unissued and unreserved/unallocated

|

|

|

106,063,182

|

|

|

|

117,212,634

|

|

|

|

119,442,524

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized Preferred Stock

|

|

|

5,000,000

|

|

|

|

5,000,000

|

|

|

|

5,000,000

|

|

Although the Reverse Split would not have any dilutive effect on our stockholders, the Reverse Split without a reduction in the number of shares authorized for issuance would reduce the proportion of shares owned by our stockholders relative to the number of shares authorized for issuance, giving the Board an effective increase in the authorized shares available for issuance, in its discretion. The Board from time to time may deem it to be in the best interests of the Company to enter into transactions and other ventures that may include the issuance of shares of our Common Stock. If the Board authorizes the issuance of additional shares subsequent to the Reverse Split, the dilution to the ownership interest of our existing stockholders may be greater than would occur had the Reverse Split not been effected.

Require Adjustment to Currently Outstanding Securities Exercisable or Convertible into Shares of our Common Stock – The Reverse Split would effect a reduction in the number of shares of Common Stock issuable upon the exercise or conversion of our outstanding stock options, settlement of restricted stock units and exercise of our outstanding warrants in proportion to the reverse stock split ratio. The exercise price of outstanding options and warrants would increase, likewise in proportion to the reverse stock split ratio.

Require Adjustment to the Number of Shares of Common Stock Available for Future Issuance Under our 2011 and 2020 equity incentive plans – In connection with any reverse stock split, the Board would also make a corresponding reduction in the number of shares available for future issuance under the foregoing plan so as to avoid the effect of increasing the number of authorized but unissued shares available for future issuance under such plans.

Procedure for Effecting Reverse Stock Split

If the Reverse Split is approved by our stockholders, the Board, in its sole discretion, would determine whether to implement the Reverse Split, taking into consideration the factors discussed above, and, if implemented, determine the ratio of the Reverse Split. We would then file a Certificate of Amendment amending the Charter with the Secretary of State of the State of Delaware. The form of the Certificate of Amendment is attached to this Proxy Statement as Appendix A and is considered a part of this Proxy Statement. Upon the filing of the Certificate of Amendment, without any further action on our part or our stockholders, the issued shares of Common Stock held by stockholders of record as of the effective date of the Reverse Split would be converted into a lesser number of shares of Common Stock calculated in accordance with the Reverse Split ratio of any whole number between 1-for-5 and 1-for-25.

Effect on Beneficial Holders (i.e., Stockholders Who Hold in “Street Name”)

If the proposed Reverse Split is approved and effected, we intend to treat Common Stock held by stockholders in “street name,” through a bank, broker or other nominee, in the same manner as stockholders whose shares are registered in their own names. Banks, brokers or other nominees will be instructed to effect the Reverse Split for their customers holding Common Stock in “street name.” However, these banks, brokers or other nominees may have different procedures than registered stockholders for processing the Reverse Split. If you hold shares of Common Stock with a bank, broker or other nominee and have any questions in this regard, you are encouraged to contact your bank, broker or other nominee.

Effect on Registered “Book-Entry” Holders (i.e., Stockholders That are Registered on the Transfer Agent’s Books and Records but do not Hold Certificates)

All of our registered holders of Common Stock hold their shares electronically in book-entry form with our transfer agent, Continental Stock Transfer and Trust Company. These stockholders do not have stock certificates evidencing their ownership of Common Stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts. If a stockholder holds registered shares in book-entry form with our transfer agent, no action needs to be taken to receive post-reverse stock split shares. If a stockholder is entitled to post-reverse stock split shares, a transaction statement will automatically be sent to the stockholder’s address of record indicating the number of shares of Common Stock held following the Reverse Split.

Fractional Shares

No fractional shares will be issued in connection with the Reverse Split. In lieu of any fractional shares, we will issue to stockholders of record who would otherwise hold a fractional share because the number of shares of Common Stock they hold of record before the Reverse Split is not evenly divisible by the Reverse Split ratio that number of shares of Common Stock as rounded up to the nearest whole share. No stockholders will receive cash in lieu of fractional shares.

Accounting Matters

The par value of our Common Stock would remain unchanged at $0.001 per share, if the Reverse Split is effected.

The Company’s stockholders’ equity in its consolidated balance sheet would not change in total. However, the Company’s stated capital (i.e., $0.001 par value times the number of shares issued and outstanding), would be proportionately reduced based on the reduction in shares of Common Stock outstanding. Additional paid in capital would be increased by an equal amount, which would result in no overall change to the balance of stockholders’ equity.

Additionally, net income or loss per share for all periods would increase proportionately as a result of the Reverse Split since there would be a lower number of shares outstanding. We do not anticipate that any other material accounting consequences would arise as a result of the Reverse Split.

Potential Anti-Takeover Effect

Even though the proposed Reverse Split would result in an increased proportion of unissued authorized shares to issued shares, which could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of the Board or contemplating a tender offer or other transaction for the combination of us with another company), the Reverse Split is not being proposed in response to any effort of which we are aware to accumulate shares of our Common Stock or obtain control of us, nor is it part of a plan by management to recommend a series of similar amendments to the Board and our stockholders.

No Appraisal Rights

Our stockholders are not entitled to appraisal rights with respect to the Reverse Split, and we will not independently provide stockholders with any such right.

Federal Income Tax Consequences of a Reverse Stock Split

The following discussion is a summary of certain U.S. federal income tax consequences of the reverse stock split to the Company and to stockholders that hold shares of Common Stock as capital assets for U.S. federal income tax purposes. This discussion is based upon provisions of the U.S. Internal Revenue Code of 1986, as amended (the “Code”), the Treasury regulations promulgated under the Code, and U.S. administrative rulings and court decisions, all as in effect on the date hereof and all of which are subject to change, possibly with retroactive effect, and differing interpretations. Changes in these authorities may cause the U.S. federal income tax consequences of the reverse stock split to vary substantially from the consequences summarized below.

This summary does not address all aspects of U.S. federal income taxation that may be relevant to stockholders in light of their particular circumstances or to stockholders who may be subject to special tax treatment under the Code, including, without limitation, dealers in securities, commodities or foreign currency, persons who are treated as non-U.S. persons for U.S. federal income tax purposes, certain former citizens or long-term residents of the United States, insurance companies, tax-exempt organizations, banks, financial institutions, small business investment companies, regulated investment companies, real estate investment trusts, retirement plans, persons that are partnerships or other pass-through entities for U.S. federal income tax purposes, persons whose functional currency is not the U.S. dollar, traders that mark-to-market their securities, persons subject to the alternative minimum tax, persons who hold their shares of Common Stock as part of a hedge, straddle, conversion or other risk reduction transaction, or who acquired their shares of Common Stock pursuant to the exercise of compensatory stock options, the vesting of previously restricted shares of stock or otherwise as compensation. If a partnership or other entity classified as a partnership for U.S. federal income tax purposes holds shares of Common Stock, the tax treatment of a partner thereof will generally depend upon the status of the partner and upon the activities of the partnership. If you are a partner in a partnership holding shares of the Company’s Common Stock, you should consult your tax advisor regarding the tax consequences of the Reverse Split.

The Company has not sought and will not seek an opinion of counsel or a ruling from the Internal Revenue Service (the “IRS”), regarding the federal income tax consequences of the Reverse Split. The state and local tax consequences of the Reverse Split may vary as to each stockholder, depending on the jurisdiction in which such stockholder resides. This discussion should not be considered as tax or investment advice, and the tax consequences of the reverse stock split may not be the same for all stockholders. Stockholders should consult their own tax advisors to know their individual federal, state, local and foreign tax consequences.

Tax Consequences to the Company – We believe that the Reverse Split will constitute a reorganization under Section 368(a)(1)(E) of the Code. Accordingly, we should not recognize taxable income, gain or loss in connection with the Reverse Split. In addition, we do not expect the Reverse Split to affect our ability to utilize our net operating loss carryforwards.

Tax Consequences to Stockholders – Stockholders should not recognize any gain or loss for U.S. federal income tax purposes as a result of the Reverse Split. Each stockholder’s aggregate tax basis in the Common Stock received in the Reverse Split should equal the stockholder’s aggregate tax basis in the Common Stock exchanged in the Reverse Split. In addition, each stockholder’s holding period for the Common Stock it receives in the Reverse Split should include the stockholder’s holding period for the Common Stock exchanged in the Reverse Split.

Interests of Directors and Executive Officers

Our directors and executive officers have no substantial interests, directly or indirectly, in the matters set forth herein regarding the proposed Reverse Split except to the extent of their ownership of shares of our Common Stock.

Reservation of Right to Abandon Reverse Stock Split

At any time before July 31, 2024, we reserve the right to abandon the Reverse Split without further action by our stockholders before the effectiveness of the filing with the Secretary of State of the State of Delaware the Certificate of Amendment to the Charter, even if the authority to effect the Reverse Split has been approved by our stockholders at the Special Meeting. By voting in favor of the Reverse Split, you are expressly also authorizing the Board to delay, not to proceed with, and abandon, the Reverse Split if it should so decide, in its sole discretion, that such action is in the best interests of the Company and its stockholders.

|

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF AN AMENDMENT TO THE CHARTER TO EFFECT A REVERSE STOCK SPLIT OF OUR OUTSTANDING SHARES OF COMMON STOCK BY A RATIO OF ANY WHOLE NUMBER BETWEEN 1-FOR-5 AND 1-FOR-25, THE IMPLEMENTATION AND TIMING OF WHICH SHALL BE SUBJECT TO THE DISCRETION OF THE BOARD

|

|

|

ITEM 2: APPROVAL OF ADJOURNMENT OF THE SPECIAL MEETING TO THE EXTENT THERE ARE INSUFFICIENT VOTES AT THE SPECIAL MEETING TO APPROVE THE PRECEDING PROPOSAL OR TO ESTABLISH A QUORUM

In the event that the number of shares of Common Stock present virtually or represented by proxy at the Special Meeting and voting “FOR” the adoption of the foregoing proposal in this Proxy Statement is insufficient to approve such proposal or in the absence of a quorum, we may move to adjourn the Special Meeting in order to enable us to solicit additional proxies in favor of the adoption of such proposal or in the absence of a quorum. If the adjournment is for more than thirty (30) days, a notice of the adjourned meeting shall be given to each stockholder of record entitled to vote at the Special Meeting.

For the avoidance of doubt, any proxy authorizing the adjournment of the Special Meeting shall also authorize successive adjournments thereof, at any meeting so adjourned, to the extent necessary for us to solicit additional proxies in favor of the adoption of such proposal.

|

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL OF ADJOURNMENT OF THE SPECIAL MEETING TO THE EXTENT THERE ARE INSUFFICIENT VOTES AT THE SPECIAL MEETING TO APPROVE THE PRECEDING PROPOSAL OR TO ESTABLISH A QUORUM

|

|

|

OTHER MATTERS

The Special Meeting is only called for the purposes set forth in the Notice. The Board does not know of any other matters to be considered by the stockholders at the Special Meeting other than the matters described in the Notice. However, the enclosed proxy confers discretionary authority on the persons named in the proxy card with respect to matters that may properly come before the Special Meeting and that are not known to the Board at the date this Proxy Statement was printed. It is the intention of the persons named in the proxy card to vote in accordance with their best judgment on any such matter.

REQUIREMENTS FOR SUBMISSION OF STOCKHOLDER PROPOSALS FOR NEXT YEAR’S ANNUAL MEETING

Stockholders intending to present a proposal to be considered for inclusion in our proxy statement for our 2024 Annual Meeting of Stockholders must comply with the requirements set forth in our Bylaws. Stockholder proposals must be received by us no later than February 14, 2024. If we change the date of the 2024 Annual Meeting of Stockholders by more than 30 days from the anniversary of the 2023 Annual Meeting, stockholder proposals must be received a reasonable time before we begin to make available the proxy materials for the 2024 Annual Meeting in order to be considered for inclusion in our proxy statement. Proposals must be sent via registered, certified, or express mail (or other means that allows the stockholder to determine when the proposal was received by the Corporate Secretary) to the Corporate Secretary, Windtree Therapeutics, Inc., 2600 Kelly Road, Suite 100, Warrington, PA 18976. Proposals must contain the information required under our Bylaws, a copy of which is available upon request to our Corporate Secretary, and also must comply with the SEC’s regulations regarding the inclusion of stockholder proposals in Company-sponsored proxy materials.

Stockholders intending to present a proposal or nominate a director for election at our 2024 Annual Meeting of Stockholders without having the proposal or nomination included in our proxy statement must comply with the requirements set forth in our Bylaws. Our Bylaws require, among other things, that our Corporate Secretary receive the proposal or nomination no earlier than the close of business on the 150th day, and no later than the close of business on the 120th day, prior to the first anniversary of the preceding year’s Annual Meeting. Accordingly, for our 2024 Annual Meeting of Stockholders, our Corporate Secretary must receive the proposal or nomination no earlier than March 18, 2024 and no later than the close of business on April 17, 2024. The proposal or nomination must contain the information required by the Bylaws, a copy of which is available upon request to our Corporate Secretary. If the stockholder does not meet the applicable deadlines or comply with the requirements of SEC Rule 14a-4, we may exercise discretionary voting authority under proxies we solicit to vote, in accordance with our best judgment, on any such proposal.

STOCKHOLDER COMMUNICATIONS TO THE BOARD

Stockholders and other interested parties may communicate with the Board by writing to the Corporate Secretary, Windtree Therapeutics, Inc., 2600 Kelly Road, Suite 100, Warrington, PA 18976. Communications intended for a specific director or directors should be addressed to their attention to the Corporate Secretary at the address provided above. Communications received from stockholders are forwarded directly to Board members as part of the materials mailed in advance of the next scheduled Board meeting following receipt of the communications. The Board has authorized the Corporate Secretary, in his discretion, to forward communications on a more expedited basis if circumstances warrant or to exclude a communication if it is illegal, unduly hostile or threatening, or similarly inappropriate. Advertisements, solicitations for periodical or other subscriptions, and other similar communications generally will not be forwarded to the directors.

AVAILABILITY OF MATERIALS

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, including the financial statements and financial statement schedules, has been filed with the SEC and provides additional information about us, which is incorporated by reference herein. It is available on the internet at https://ir.windtreetx.com/filings/sec-filings and is available in paper form (other than exhibits thereto) by first class mail or other equally prompt means to beneficial owners of our Common Stock, without charge, upon written request to the Corporate Secretary, Windtree Therapeutics, Inc., 2600 Kelly Road, Suite 100, Warrington, Pennsylvania 18976. In addition, it is available to beneficial and record holders of our Common Stock at https://www.cstproxy.com/windtreetx/sm2024.

APPENDIX A

CERTIFICATE OF AMENDMENT TO

THE AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

WINDTREE THERAPEUTICS, INC.

(Pursuant to Sections 228 and 242 of the

General Corporation Law of the State of Delaware)

The Company was originally incorporated on November 6, 1992, under the name “Ansan, Inc.” The Company changed its name on November 25, 1997, to Discovery Laboratories, Inc. The Company changed its name again on April 15, 2016, to Windtree Therapeutics, Inc.

This Certificate of Amendment (this “Certificate of Amendment”) to the Amended and Restated Certificate of Incorporation was duly adopted in accordance with Sections 228 and 242 of the General Corporation Law of the State of Delaware (“Delaware Corporation Law”) and the amendments set forth below shall become effective upon the filing and effectiveness pursuant to the Delaware Corporation Law of this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Company:

1. Article Four of the Amended and Restated Certificate of Incorporation of the Company is hereby amended by adding the following paragraph at the end thereof:

“Upon the filing and effectiveness (the “Third Effective Time”) pursuant to the Delaware Corporation Law of this Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Corporation, as amended, each share(s) of the Corporation’s common stock, par value $0.001 per share (the “Common Stock”), issued and outstanding immediately prior to the Third Effective Time shall automatically be combined into one (1) validly issued, fully paid and non-assessable share of Common Stock without any further action by the Corporation or the holder thereof (the “Third Reverse Stock Split”). No fractional shares will be issued as a result of the Third Reverse Stock Split. Each certificate that immediately prior to the Third Effective Time represented shares of Common Stock (“Third Old Certificates”), shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Third Old Certificate shall have been combined. Holders who otherwise would be entitled to receive fractional share interests of Common Stock upon the effectiveness of the Third Reverse Stock Split shall be entitled to receive a whole share of Common Stock in lieu of any fractional share created as a result of the Third Reverse Stock Split.”

2. This Certificate of Amendment shall become effective on , 2024 at 12:01 a.m. Eastern Time.

3. Except as set forth in this Certificate of Amendment, the Amended and Restated Certificate of Incorporation, as amended, remains in full force and effect.

[Rest of Page Left Blank]

IN WITNESS WHEREOF, Windtree Therapeutics, Inc. has caused this Certificate of Amendment to be signed by its duly authorized officer this th day of , 2024.

| |

WINDTREE THERAPEUTICS, INC.

|

| |

|

|

| |

|

|

| |

By:

|

|

|

| |

|

Craig E. Fraser

President and Chief Executive Officer

|

[Signature Page to Certificate of Amendment]

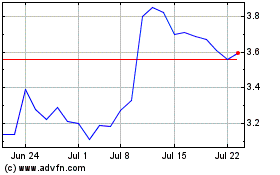

Windtree Therapeutics (NASDAQ:WINT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Windtree Therapeutics (NASDAQ:WINT)

Historical Stock Chart

From Apr 2023 to Apr 2024