UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment

No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to Section 240.14a-12 |

Sigma

Additive Solutions, Inc.

(Exact

name of registrant as specified in its charter)

N/A

(Name

of person(s) filing proxy statement, if other than the registrant)

Payment

of Filing Fee (check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

SIGMA

ADDITIVE SOLUTIONS, INC.

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS.

To

Be Held on March 8, 2024

YOUR

VOTE IS VERY IMPORTANT

PLEASE

VOTE YOUR SHARES PROMPTLY

Notice

is hereby given, that you are cordially invited to attend a Special Meeting of stockholders (the “Special Meeting”)

of Sigma Additive Solutions, Inc., a Nevada corporation (referred to herein as “SASI,” “Sigma,”

the “Company,” “we,” “us” or “our”), to be held virtually,

via live webcast on March 8, 2024, at 10:00 a.m. Mountain Time. In order to attend the Special Meeting, you must register at https://agm.issuerdirect.com/sasi

by 11:59 p.m. Eastern Time on March 7, 2024. Stockholders attending the Special Meeting will be afforded substantially the same rights and

opportunities to participate as they would at an in-person meeting. We encourage you to join us and participate online. We recommend

that you log in a few minutes before 10:00 a.m., Mountain Time, on March 8, 2024 to ensure you are logged in when the Special Meeting

starts. You will not be able to attend the Special Meeting in person.

The

purpose of the Special Meeting is to consider and vote upon:

| |

1. |

the

approval of an amendment to our Amended and Restated Articles of Incorporation, as amended (our “Charter”), to

change the Company’s corporate name to “NextTrip, Inc.” (the “Name Change” and the “Name

Change Proposal”); |

| |

|

|

| |

2. |

the

approval of an amendment to our Charter to increase the authorized shares of our common stock (the “Capital Increase”

and “Capital Increase Proposal”) from 1,200,000 shares to 250,000,000 shares; and |

| |

|

|

| |

3. |

the

adjournment of the Special Meeting by the chairman thereof to a later date to permit further solicitation and vote of proxies

if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Name Change Proposal

or the Capital Increase Proposal (the “Adjournment Proposal”). |

The

accompanying proxy statement can be accessed directly at the following Internet address: www.iproxydirect.com/SASI.

Only

holders of record of the Company’s common stock, Series G Convertible Preferred Stock (“Series G Preferred”)

and Series H Convertible Preferred Stock (“Series H Preferred”) at the close of business on January 29, 2024, the

record date of the Special Meeting, are entitled to notice of the Special Meeting and to vote and have their votes counted at the Special

Meeting and any adjournment or postponement of the Special Meeting. We intend to mail these proxy materials beginning on or about February

9, 2024 to all stockholders of record entitled to vote at the Special Meeting.

A

complete list of the stockholders entitled to vote at the Special Meeting will be available for examination during regular business hours

for the ten (10) days prior to the Special Meeting by request. You may email us at frank.orzechowski@sigmaadditive.com to coordinate

arrangements to view the stockholder list.

After

careful consideration, the Board unanimously recommends that you vote, or instruct your broker or the agent to vote:

| |

● |

“FOR”

the Name Change Proposal; |

| |

● |

“FOR”

the Capital Increase Proposal; and |

| |

● |

“FOR”

the Adjournment Proposal, if presented. |

YOUR

VOTE IS IMPORTANT

WHETHER

OR NOT YOU EXPECT TO ATTEND THE SPECIAL MEETING IN PERSON, WE ENCOURAGE YOU TO SUBMIT YOUR PROXY AS PROMPTLY AS POSSIBLE (1) THROUGH

THE INTERNET, (2) BY PHONE, (3) BY FAX, OR (4) BY MARKING, SIGNING AND DATING THE ENCLOSED PROXY CARD AND RETURNING IT IN THE POSTAGE-PAID

ENVELOPE PROVIDED. You may revoke your proxy or change your vote at any time before the closing of voting at the Special Meeting. If

your shares are held in the name of a bank, broker or other nominee, please follow the instructions on the voting instruction card furnished

to you by such bank, broker or other nominee, which is considered the stockholder of record, in order to vote. As a beneficial owner,

you have the right to direct your broker or other agent on how to vote the shares in your account. Without your instructions, your broker

can vote your shares only with respect to discretionary matters such as the Name Change Proposal and the Adjournment Proposal. Without

your instructions, your broker or other agent cannot vote on the Capital Increase Proposal.

If

you fail to return your proxy card, grant your proxy electronically over the Internet, submit your vote over the phone or by fax, or

vote virtually at the Special Meeting, your shares will not be counted for purposes of determining whether a quorum is present at the

Special Meeting. If you held shares of the Company’s common stock, Series G Preferred or Series H Preferred as of the close

of business on January 29, 2024, the record date of the Special Meeting, voting virtually at the Special Meeting will revoke any

proxy that you previously submitted. If you hold your shares through a bank, broker or other nominee, you must obtain from the record

holder a valid “legal” proxy issued in your name in order to vote virtually at the Special Meeting.

We

encourage you to read the accompanying proxy materials carefully. If you have any questions concerning the Special Meeting or the accompanying

proxy materials, would like additional copies of the proxy materials or need help voting your shares of common stock, Series G Preferred

or Series H Preferred, as applicable, please contact our Chief Financial Officer and Secretary, Frank Orzechowski, at (203) 733-1356

or frank.orzechowski@sigmaadditive.com.

Thank

you for your participation. We look forward to your continued support.

| |

By

Order of the Board of Directors, |

| |

|

| |

Sigma

Additive Solutions, Inc. |

| |

|

| |

/s/

William Kerby |

| |

William

Kerby |

| |

Chief Executive Officer |

TABLE

OF CONTENTS

QUESTIONS

AND ANSWERS ABOUT THE PROPOSALS AND THE SPECIAL MEETING

| Q: |

Why

am I receiving this proxy statement? |

| |

|

| A: |

The

Board is soliciting your proxy to vote at the Special Meeting because you owned shares of

Sigma common stock, Series G Preferred and/or Series H Preferred, as applicable, at the close

of business on January 29, 2024 (the “Record Date”) and are therefore entitled to vote at the Special Meeting. This proxy statement summarizes

the information that you need to know in order to cast your vote at the Special Meeting.

You do not need to attend the Special Meeting to vote your securities of Sigma.

Under

rules adopted by the SEC, we have mailed the full set of our proxy materials, including this proxy statement and the proxy card,

to our stockholders of record as of the Record Date, beginning on or around February 9, 2024. The proxy materials are also

available to view and download at www.iproxydirect.com/SASI. |

| |

|

| Q: |

When

and how will the Special Meeting be held? |

| |

|

| |

The

Special Meeting will be held virtually at 10:00 a.m. Mountain Time on March 8, 2024. In order

to attend the meeting, you must register at https://agm.issuerdirect.com/sasi by 11:59 p.m.

Eastern Time on March 7, 2024. You will not be able to attend the Special Meeting in person.

|

| Q: |

How

do I attend and participate in the Special Meeting online?

|

| A: |

The

Special Meeting will be a completely virtual meeting of stockholders and will be webcast

live over the Internet. Any stockholder can attend the virtual meeting live by registering

at https://agm.issuerdirect.com/sasi. The webcast will start at 10:00 a.m. Mountain Time.

Stockholders as of the Record Date may vote and submit questions while attending the Special

Meeting online. Stockholders attending the Special Meeting online will be afforded substantially

the same rights and opportunities to participate as they would at an in-person meeting.

To

enter the Special Meeting, you will need the control number, which is included in your proxy materials if were are a stockholder

of record of shares of our common stock, Series G Preferred and/or Series H Preferred, as applicable, as of the Record Date,

or included with your voting instructions and materials received from your broker, bank or other agent if you hold your shares in

a “street name.” Instructions on how to attend and participate are available at https://agm.issuerdirect.com/sasi. We

recommend that you log in a few minutes before 10:00 a.m. Mountain Time to ensure you are logged in when the Special Meeting starts.

The webcast will open 15 minutes before the start of the Special Meeting.

If

you would like to submit a question during the Special Meeting, you may log in to the virtual meeting using your control number,

type your question into the “Ask a Question” field, and click “Submit.” |

| |

|

| Q: |

Will

a list of record stockholders as of the Record Date be available? |

| |

|

| A: |

For

the ten days prior to the Special Meeting, the list of stockholders of record on the Record Date will be available for examination

by any stockholder of record for a legally valid purpose by request. You can contact our Chief Financial Officer and Secretary, Frank

Orzechowski, at (203) 733-1356 or at frank.orzechowski@sigmaadditive.com to coordinate arrangements to view the stockholder list. |

| |

|

| Q: |

On

what matters will I be voting? |

| |

|

| A: |

Sigma’s

stockholders are being asked to consider and vote upon the following: |

| |

● |

the

Name Change Proposal; |

| |

|

|

| |

● |

the

Capital Increase Proposal; and |

| |

|

|

| |

● |

the

Adjournment Proposal. |

| Q: |

How

does the Board recommend that I vote? |

| |

|

| A: |

Our

Board of Directors recommends that Sigma stockholders vote, or instruct their broker or other agent to vote: |

| |

“FOR”

the Name Change Proposal; |

| |

|

| |

“FOR”

the Capital Increase Proposal; and |

| |

|

| |

“FOR”

the Adjournment Proposal, if presented. |

| Q: |

What

happens if I sell my shares after the Record Date, but before the Special Meeting? |

| |

|

| A: |

If

you sell or transfer your shares of the Company after the Record Date but before the Special Meeting, you will retain your right

to vote at the Special Meeting, but will transfer ownership of the shares and will not hold an interest in the Company. |

| |

|

| Q: |

How

do I vote? |

| A:

|

After

you have carefully read this proxy statement and have decided how you wish to vote your shares

of Sigma common stock, Series G Preferred and/or Series H Preferred, as applicable, please

vote promptly.

Stockholders

of Record and Voting

If

your shares of Sigma stock are registered directly in your name with Sigma’s transfer agent, Issuer Direct Corporation, or

the Company, as applicable, you are the stockholder of record of those shares and these proxy materials have been mailed or e-mailed

to you by the Company. You may vote your shares by Internet, telephone, fax or by mail as further described below. Your vote authorizes

William Kerby, Chief Executive Officer of the Company, as your proxy, with the power to appoint his substitute, to represent

and vote your shares as you direct. |

| |

● |

To

vote online during the Special Meeting, follow the provided instructions to join the meeting at https://agm.issuerdirect.com/sasi, starting

at 10:00 a.m. Mountain Time on March 8, 2024. The webcast will open 15 minutes before the start of the Special Meeting. |

| |

|

|

| |

● |

To

vote in advance of the Special Meeting through the internet, go to https://www.iproxydirect.com/SASI to complete an electronic

proxy card. You will be asked to provide the company number and control number from the printed proxy card. Your internet vote must

be received by 11:59 p.m. Eastern Time on March 7, 2024 to be counted. |

| |

|

|

| |

● |

To

vote in advance of the Special Meeting by telephone, dial 1-866-752-8683 and follow the recorded instructions. You will be asked

to provide the company number and control number from the printed proxy card. Your telephone vote must be received by 11:59 p.m.

Eastern Time on March 7, 2024 to be counted. |

| |

|

|

| |

● |

To

vote by fax, complete, sign and date the enclosed proxy card and fax it to 202-521-3464. Your vote by fax must be received by 11:59

p.m. Eastern Time on March 7, 2024 to be counted. If no directions are given, the proxy will vote your shares in accordance with

our Board’s recommendations. |

| |

|

|

| |

● |

To

vote using the enclosed proxy card, complete, sign and date the enclosed proxy card and return it promptly in the accompanying postage-paid

envelope. If you return your signed proxy card to us before the Special Meeting, the proxy will vote your shares as you direct. If

no directions are given, the proxy will vote your shares in accordance with our Board’s recommendations. |

| |

Beneficial

Owners

If

your shares of Sigma stock are held in a stock brokerage account, by a bank, broker or other nominee, you are considered the beneficial

owner of shares held in street name and these proxy materials are being forwarded to you by your bank, broker or nominee that is

considered the holder of record of those shares. As the beneficial owner, you have the right to direct your bank, broker, trustee

or nominee on how to vote your shares via the Internet or by telephone or fax if the bank, broker, trustee or nominee offers these

options. You can also sign and return a proxy card. Your bank, broker, trustee or nominee will send you instructions for voting your

shares. Please note that you may not vote shares held in street name by returning a proxy card directly to Sigma or by voting at

the Special Meeting unless you provide a “legal proxy,” which you must obtain from your broker, bank or nominee. Furthermore,

brokers, banks and nominees who hold shares of Sigma stock on your behalf may not give a proxy to Sigma to vote those shares on non-discretionary

matters without specific instructions from you.

For

a discussion of the rules regarding the voting of shares held by beneficial owners, please see the question below entitled “If

I am a beneficial owner of shares of Sigma stock, what happens if I do not provide voting instructions?” |

| |

|

| Q: |

How

many shares must be present to hold the Special Meeting? |

| |

|

| A: |

The

presence in person or by proxy of at least one-third of the voting power of the shares of Sigma stock, including its common stock,

Series G Preferred and Series H Preferred, outstanding as of the Record Date, is necessary to constitute a quorum at the Special

Meeting. The inspector of election will determine whether a quorum is present. If you are a beneficial owner (as defined above) of

shares of the Company’s stock and you do not instruct your bank, broker or other nominee how to vote your shares on any of

the proposals, your shares will nonetheless be counted as present at the Special Meeting for purposes of determining whether a quorum

exists so long as they are voted by such bank, broker or other nominee on one of the discretionary proposals. Stockholders of record

who are present at the Special Meeting in person or by proxy will be counted as present at the Special Meeting for purposes of determining

whether a quorum exists even if such stockholders abstain from voting. |

| |

|

| Q: |

How

many votes do I and others have? |

| |

|

| A: |

You

are entitled to one vote for each share of Sigma common stock, Series G Preferred and Series

H Preferred, as applicable, that you held as of the Record Date. Holders of Series G Preferred

and Series H Preferred will vote together with holders of Sigma common stock as a single

class on each of the proposals being presented to stockholders for approval at the Special

Meeting.

As

of the close of business on the Record Date, there were 936,430 shares of Sigma common stock outstanding, 100,000 shares of Series

G Preferred outstanding, and 150,000 shares of Series H Preferred outstanding. |

| |

|

| Q: |

What

vote is required to approve each proposal? |

| |

|

| A:

|

The

affirmative vote of stockholders holding shares of Sigma stock (including common stock, Series G Preferred and Series H Preferred)

representing at least a majority of the voting power outstanding as of the Record Date is required to approve the Name Change Proposal

and the Capital Increase Proposal. If presented, the Adjournment Proposal will be approved, whether or not a quorum is present at

the Special Meeting, if the number of votes cast for the Adjournment Proposal exceeds the number of votes cast against the proposal. |

| |

|

| Q: |

What

will happen if I fail to vote, or I abstain from voting? |

| |

|

| A: |

Your

failure to vote or your abstention from voting will have the same effect as a vote against the Name Change Proposal and the Capital

Increase Proposal. Abstentions will not have any effect on the outcome of the vote on the Adjournment

Proposal, if presented for a vote. |

| Q: |

If

I am a beneficial owner of shares of Sigma stock, what happens if I do not provide voting instructions? What is discretionary voting?

What is a broker non-vote? |

| |

|

| A: |

If

you are a beneficial owner and you do not provide voting instructions to your broker, bank

or other holder of record holding shares for you, your shares will not be voted with respect

to any proposal for which your broker does not have discretionary authority to vote. Even

though Sigma’s common stock is listed on Nasdaq, the rules of the New York Stock Exchange

determine whether proposals presented at stockholder meetings are “discretionary”

or “non-discretionary.” If a proposal is determined to be discretionary, your

broker, bank or other holder of record is permitted under New York Stock Exchange rules to

vote on the proposal without receiving voting instructions from you. If a proposal is determined

to be non-discretionary, your broker, bank or other holder of record is not permitted under

New York Stock Exchange rules to vote on the proposal without receiving voting instructions

from you. A “broker non-vote” occurs when a bank, broker or other holder of record

holding shares for a beneficial owner does not vote on a non-discretionary proposal because

the holder of record has not received voting instructions from the beneficial owner.

We

are advised that the Name Change Proposal and the Adjournment Proposal are discretionary proposals; however, the Capital Increase

Proposal is a non-discretionary proposal. Accordingly, if you are a beneficial owner and you do not provide voting instructions to

your broker, bank or other holder of record holding shares for you, your shares may not be voted with respect to the Capital Increase

Proposal. A broker non-vote would have the same effect as a vote against the Name Change Proposal and the Capital Increase Proposal.

Broker non-votes will have no effect on the outcome of the vote on the Adjournment Proposal, if presented for a vote. |

| |

|

| Q: |

What

will happen if I return my proxy card without indicating how to vote? |

| |

|

| A: |

If

you sign and return your proxy card without indicating how to vote on one or more of the proposals, the Sigma stock represented by

your proxy will be voted in favor of each such proposal. Proxy cards that are returned without a signature will not be counted as

present at the Special Meeting and cannot be voted. |

| |

|

| Q: |

Can

I change my vote after I have returned a proxy or voting instruction card? |

| |

|

| A: |

Yes.

You can change your vote at any time before your proxy is voted at the Special Meeting. You can do this in one of four ways: |

| |

● |

you

can grant a new, valid proxy bearing a later date; |

| |

|

|

| |

● |

you

can send a signed notice of revocation; |

| |

|

|

| |

● |

if

you are a holder of record, you can attend the Special Meeting and vote at the Special Meeting, which will automatically cancel any

proxy previously given, or you may revoke your proxy in person, but your attendance alone will not revoke any proxy that you have

previously given; or |

| |

|

|

| |

● |

if

your shares of Sigma stock are held in an account with a broker, bank or other nominee, you must follow the instructions on the voting

instruction card you received in order to change or revoke your instructions. |

| |

If

you choose either of the first two methods, you must submit your written notice of revocation or your new proxy to the Secretary

of Sigma, as specified below under “What is the deadline to propose actions for consideration at this year’s annual

meeting of stockholders or to nominate individuals to serve as directors?” no later than the beginning of the Special Meeting.

If your shares are held in street name by your broker, bank or nominee, you should contact them to change your vote. |

| |

|

| Q: |

Do

I need identification to attend the Special Meeting? |

| |

|

| A: |

Yes.

You will be asked to provide the company number and control number from the printed proxy card. |

| Q: |

Are

Sigma stockholders entitled to dissenters’ or appraisal rights? |

| |

|

| A: |

No.

Sigma stockholders do not have dissenters’ or appraisal rights in connection with any of the proposals under Chapter 78 of

Nevada Revised Statutes (the “NRS”) and will not be afforded any such rights. |

| |

|

| Q: |

What

do I do if I receive more than one set of voting materials? |

| |

|

| A:

|

You

may receive more than one set of voting materials for the Special Meeting, including multiple copies of this proxy statement, proxy

cards and/or voting instruction forms. This can occur if you hold your shares of Sigma stock in more than one brokerage account,

if you hold shares of Sigma stock directly as a record holder and also in street

name, or otherwise through a nominee. Other circumstances may apply. If you receive more than one set of voting materials, each should

be voted and/or returned separately in order to ensure that all of your shares of common stock, Series G Preferred and Series H Preferred,

as applicable, are voted. |

| |

|

| Q: |

How

can I find out the results of the voting at the Special Meeting? |

| |

|

A:

|

Preliminary

voting results will be announced at the Special Meeting. In addition, final voting results will be published in a Current Report

on Form 8-K that we intend to file with the Securities and Exchange Commission (“SEC”) within four business days after the Special Meeting. |

| |

|

| Q:

|

What

proxy materials are available on the internet? |

| |

|

| A: |

This

proxy statement is available at www.iproxydirect.com/SASI. |

| |

|

| Q: |

Whom

may I call with questions about the Special Meeting and the Proposals? |

| |

|

| A: |

Sigma

stockholders should contact our Chief Financial Officer and Secretary, Frank Orzechowski, via email at frank.orzechowski@sigmaadditive.com

or by telephone at (203) 733-1356 with any questions regarding the Special Meeting or any of the proposals to be presented at the

Special Meeting. |

| |

|

| Q: |

What

is the deadline to propose actions for consideration at this year’s annual meeting of stockholders or to nominate individuals

to serve as directors? |

| |

|

| A: |

Stockholders

may present proper proposals for inclusion in our proxy statement and for consideration at

the next annual meeting of stockholders by submitting their proposals in writing to our Corporate

Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in

our proxy statement for our 2024 annual meeting of stockholders, our Corporate Secretary

must receive the written proposal at our principal executive offices not later than August

2, 2024, which is 120 days prior to the first anniversary of the mailing date of our proxy

statement for our 2023 annual meeting of stockholders. In addition, stockholder proposals

must comply with the requirements of Rule 14a-8 regarding the inclusion of stockholder proposals

in company-sponsored proxy materials. Stockholder proposals should be addressed to:

Sigma

Additive Solutions, Inc.

Attention:

Corporate Secretary

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

As

for stockholders who wish to present a proposal or to nominate a director candidate at the 2024 annual meeting of stockholders, but

not to include the proposal or nomination in our proxy statement, our amended and restated bylaws state that the proposal or nomination

must be received by us no later than August 2, 2024, which is 120 days prior to the first anniversary of the mailing date of this

proxy statement. The proposal or nomination must also contain the information required by our amended and restated bylaws. A proposal

or nomination to be presented directly at the 2024 annual meeting should be addressed to us as set forth above. For the 2024 annual

meeting, we will be required pursuant to Rule 14a-19 under the Securities Exchange Act of 1934, as amended, to include on our proxy

card all nominees for director for whom we have received notice under the rule, which must be received no later than 60 calendar

days prior to the anniversary of our 2023 annual Meeting. For any such director nominee to be included on our proxy card for this

year’s annual meeting, notice must be received no later than October 28, 2024. |

PROPOSAL

1: APPROVAL OF THE NAME CHANGE

In

connection with the Company’s recent acquisition of NextTrip Holdings, Inc. (“NextTrip”), the Board has adopted

resolutions approving, declaring advisable and recommending that our stockholders approve a change in the Company’s corporate name

(the “Name Change”) from “Sigma Additive Solutions, Inc.” to “NextTrip, Inc.” and directing

that a proposal to approve the Name Change (the “Name Change Proposal”) be submitted to our stockholders for approval

at the Special Meeting. If approved by our stockholders, the Name Change will be effected by the filing of a certificate of amendment,

in substantially the form attached hereto as Annex A (the “Amendment”), to our current Charter with the Secretary of State of the State of Nevada.

We

plan to file the Amendment as soon as reasonably practicable if this proposal is approved by our stockholders. The text of Appendix A

remains subject to modification to include such changes as may be required by the Nevada Secretary of State and we deem necessary or

advisable to implement the Name Change.

Rationale

for the Name Change

The

change in our corporate name is intended to better align the Company’s corporate name with the business of NextTrip, which is now

the primary business of the Company. The new corporate name reflects the evolution of the Company from serving as provider of quality

assurance software to the commercial 3D printing industry to now serving as an innovative technology-driven travel company that offers

comprehensive solutions across the travel landscape, including through its proprietary booking solutions for leisure, business and

group travel worldwide and robust product offering of air, accommodations, activities and more. Accordingly, our Board has concluded

that it is in the Company’s best interests to change our corporate name to “NextTrip, Inc.”

In

anticipation of the change in our corporate name, we may elect to begin doing business under the “NextTrip” name before the

Special Meeting, in which case we will file the appropriate documentation with the Nevada Secretary of State to do business under such

name, and may also change the ticker symbol under which our common stock trades on the Nasdaq Capital Market to “NTRP.”

Effects

of the Amendment

If

approved by stockholders, the name change will not have any material effect on our business, operations, or reporting requirements or

affect the validity or transferability of any existing stock certificates that bear the name “Sigma Additive Solutions, Inc.”

If the Name Change is approved, stockholders with certificated shares may continue to hold their existing stock certificates,

and will not be required to submit their stock certificates for exchange. The rights of stockholders holding certificated shares under

existing stock certificates and the number of shares represented by those certificates will remain unchanged. Direct registration accounts

and any new stock certificates that are issued after the name change becomes effective will bear the name “NextTrip, Inc.”

If

the Name Change is not approved, the Amendment will not be filed with the Nevada Secretary of State and our corporate name will not change.

However, as noted above, we may elect to do business under the NextTrip name regardless of the outcome of the stockholder vote at the

Special Meeting.

Required

Vote

Approval

of the Name Change Proposal will require the affirmative vote of stockholders holding shares of Sigma stock (including common stock,

Series G Preferred and Series H Preferred) representing at least a majority of the voting power outstanding as of the Record Date. The

Name Change Proposal is considered a discretionary matter on which brokers can vote in their discretion, so we do not expect broker

non-votes on the proposal. However, any broker non-votes and abstentions will have the same effect as a vote against the Name

Change Proposal.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE NAME CHANGE PROPOSAL.

PROPOSAL

2: APPROVAL OF THE CAPITAL INCREASE

The

Board has adopted resolutions approving, declaring advisable and recommending that our stockholders approve an amendment to our Charter to increase the authorized number of shares of our common stock from 1,200,000

shares to 250,000,000 shares (the “Capital Increase”) and directing that a proposal to approve the Capital Increase

(the “Capital Increase Proposal”) be submitted for approval at the Special Meeting. If approved by our stockholders,

the Capital Increase will be effected by the filing of the Amendment, in substantially the form attached hereto as Annex A,

with the Nevada Secretary of State following the Special Meeting.

We

plan to file the Amendment as soon as reasonably practicable if this proposal is approved by our stockholders. The text of Appendix A

remains subject to modification to include such changes as may be required by the Nevada Secretary of State and we deem necessary or

advisable to implement the Capital Increase.

Purpose

and Rationale for the Capital Increase

On

September 22, 2023, we effected a 1-for-20 reverse stock split of our outstanding shares of common stock and authorized but unissued

shares of common stock in order to seek to regain compliance with the minimum bid price requirement for continued listing of our common

stock on Nasdaq. As a result of the reverse stock split, the number of shares of common stock that we are authorized to issue was decreased

to 1,200,000 shares.

As

of the Record Date, there were 936,430 shares of our common stock issued and outstanding, and 263,570 shares reserved for issuance upon

exercise or conversion of certain outstanding securities. In addition to the foregoing, as of the Record Date, we had outstanding securities

exercisable for or convertible into an aggregate of 411,462 shares of common stock in excess of the 1,200,000 shares of common

stock currently authorized for issuance, the exercise and conversion of which are contingent upon the Company amending its Charter to

increase the number of shares of common stock authorized for issuance thereunder by at least a sufficient amount to cover such exercise

and conversions, as applicable.

In

addition to the foregoing, the Share Exchange Agreement entered into by and among the Company, NextTrip and certain other parties on

October 12, 2023, as amended (the “Exchange Agreement”), in connection with our acquisition of NextTrip provides

for the issuance of up to 5,842,993 shares (the “Contingent Shares”) of Company common stock to the sellers of

NextTrip upon NextTrip’s satisfaction of certain future milestones. In the event that we do not have sufficient authorized

shares of common stock available for issuance of the Contingent Shares, in lieu thereof, we will issue the relevant individuals

shares of our Series F Convertible Preferred Stock instead, which, among other things, will provide for voting on an

as-converted basis and will be automatically converted (on a one-for-one basis) into shares of our common stock once stockholder

approval for an increase in our authorized shares of common stock has been obtained. We do not currently have sufficient shares

of common stock authorized or reserved for issuance to issue the Contingent Shares issuable pursuant to the Exchange Agreement, if

the relevant milestones are achieved.

Accordingly,

the Capital Increase is necessary in order to provide us with sufficient authorized shares to permit the exercise and conversion of certain

of our outstanding derivative securities and to issue the Contingent Shares, if and when the relevant milestones are achieved.

In

addition to the foregoing, we do not currently have shares available for issuance to our officers, employees or directors as compensation

under our recently adopted 2023 Equity Incentive Plan (the “2023 Plan”), or outside of such plan, nor have any shares

been reserved to permit us to issue shares under the 2023 Plan.

Furthermore,

we believe that the Capital Increase is essential to support the future growth and success of the Company, through potential strategic

transactions or otherwise, and for future financing needs and other general corporate purposes. We intend to seek to expand the NextTrip

platform and product offerings, which will require additional capital. If the Capital Increase is approved by our stockholders, we may

elect to raise such additional capital through the sale of shares of our common stock or other equity securities exercisable for or convertible

into shares of our common stock. Such expansion may also be accomplished through acquisitions in which we may choose to issue shares

of our common stock or common stock equivalents in payment for all or a portion of the acquisition price, although we have no present

plan or arrangement for such acquisitions. In addition, we may seek to raise additional capital for general business purposes through

future issuances of share of common stock or securities exercisable for or convertible into shares of common stock. Our ability to complete

any of the foregoing will be severely limited if the Capital Increase is not approved by our stockholders at the Special Meeting.

Effect

on Outstanding Stock

If

this proposal is approved by our stockholders, the additional authorized shares of common stock resulting from the Capital Increase will

have the same rights and privileges as the currently authorized common stock. Once authorized, the additional shares of common stock

resulting from the Capital Increase generally may be issued with approval of the Board but without further approval of the stockholders.

Accordingly, unless stockholder approval is required by applicable law, rule or regulation, stockholders will not have approval rights

in connection with the issuance of such additional shares.

Upon

filing of the Amendment, the outstanding shares of Series G Preferred and Series H Preferred will automatically convert into an aggregate

of 250,000 shares of our common stock (the “Conversion Shares”). Except as a result of the conversion of such shares of preferred stock, the Capital Increase

itself would not have any immediate dilutive effect on the proportionate rights of our existing stockholders. However, any subsequent

issuance, or the possibility of such issuance, of shares of our common stock (including the issuance of the Contingent Shares, exercise

of stock options and warrants, or conversion of convertible securities) would reduce each stockholder’s proportionate interest

in the Company and may depress the market price of our common stock.

Other

than with respect to the issuance of the Conversion Shares, the exercise and/or conversion of our other outstanding derivative securities

(as discussed above), the Contingent Shares (if earned pursuant to the Exchange Agreement), and possible future awards under the 2023 Plan, we have no present

plan or arrangement to issue any of the additional shares if the Capital Increase is approved.

The

Capital Increase will not affect the number of preferred shares that we are authorized to issue under our Charter, nor will it

impact the number of shares of preferred stock that are current issued and outstanding, other than as a result of the automatic conversion

of the outstanding shares of Series G Preferred and Series H Preferred into shares of our common stock upon effecting the Capital Increase.

Anti-takeover

Effects

SEC

rules and regulations require disclosure of the possible anti-takeover effects of an increase in authorized capital stock and other charter

and bylaw provisions that could have an anti-takeover effect. Although our Board of Directors has not proposed the Capital Increase with

the intent of using the additional shares to prevent or discourage any actual or threatened takeover of the Company, under certain circumstances,

such shares could have an anti-takeover effect. The additional shares of authorized common stock could be issued to dilute the stock

ownership or voting rights of persons seeking to obtain control of the Company or could be issued to persons allied with the Board or

management and, thereby, have the effect of making it more difficult to remove directors or members of management by diluting the stock

ownership or voting rights of persons seeking to effect a change in control of the Company. Accordingly, if the proposed Capital Increase

is approved, the additional shares of authorized common stock may render more difficult or discourage a merger, tender offer or proxy

contest, the assumption of control by a holder of a large block of common stock, or the replacement or removal of the Board or management.

The

Capital Increase Proposal is not prompted by any takeover threat perceived by our Board of Directors or management.

Required

Vote

The

Capital Increase Proposal will require the affirmative vote of stockholders holding shares of Sigma stock (including common stock, Series

G Preferred and Series H Preferred) representing at least a majority of the voting power outstanding as of the Record Date. Any broker

non-votes and abstentions will have the same effect as a vote against the Capital Increase Proposal.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE CAPITAL INCREASE PROPOSAL.

PROPOSAL

3: THE ADJOURNMENT PROPOSAL

The

Adjournment Proposal allows the chairman of the Special Meeting to submit a proposal to adjourn the Special Meeting to a later

date or dates, if necessary, to permit further solicitation of proxies in the event, based on the tabulated votes at the Special Meeting,

there are not sufficient votes to approve the Name Change Proposal or Capital Increase Proposal. In no event will the chairman

adjourn the Special Meeting beyond the date by which it may properly do so under the NRS. If the Special Meeting is adjourned, the time

and place of the adjourned Special Meeting will be announced at the time the adjournment is taken. Any adjournment of the Special Meeting

for the purpose of soliciting additional proxies will allow our stockholders who have already sent in their proxies to revoke them at

any time prior to their use at the Special Meeting, as adjourned.

In

addition to an adjournment of the Special Meeting upon approval of the Adjournment Proposal, our Board of Directors is empowered under

the NRS law to postpone the meeting at any time prior to the meeting being called to order. In such event, Sigma will issue a press release

and take such other steps as it believes are necessary and practical in the circumstances to inform its stockholders of the postponement.

Any postponement of the Special will allow our stockholders who have already sent in their proxies to revoke them at any time prior to

their use at the Special Meeting, as postponed.

Consequences

if the Adjournment Proposal is not Approved

If

an Adjournment Proposal is presented and not approved at the Special Meeting, the chairman of the Special Meeting may not be able

to adjourn the Special Meeting to a later date and Sigma may not be able to implement the Name Change and/or the Capital Increase.

Required

Vote

The

Adjournment Proposal will be approved, whether or not a quorum is present, if the number of votes cast for the Adjournment Proposal exceeds

the number of votes cast against the proposal. The Adjournment Proposal is considered a discretionary matter on which brokers can vote

in their discretion, so we do not expect broker non-votes on the proposal. Any broker non-votes, however, and abstentions will have no

effect on the outcome of the vote on the Adjournment Proposal.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE APPROVAL OF THE ADJOURNMENT PROPOSAL.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The

following tables set forth certain information regarding beneficial ownership of our common stock, Series G Preferred and Series H Preferred

as of the Record Date (a) by each person known by us to own beneficially 5% or more of the outstanding shares of each class of the outstanding

securities, (b) by our named executive officers and each of our directors (and director nominees) and (c) by all executive officers and

directors of the Company as a group.

The

number of shares beneficially owned by each stockholder is determined in accordance with SEC rules. Under these rules, beneficial ownership

includes any shares as to which a person has sole or shared voting power or investment power. At the close of business on the Record

Date, there were 936,430 shares of Sigma common stock outstanding, 100,000 shares of Series G Preferred outstanding, and 150,000 shares

of Series H Preferred outstanding.

In addition to the foregoing, at the close of business on the Record Date there were 316 shares of the Company’s

Series E Preferred Stock (“Series E Preferred”) outstanding, which, including accrued dividends thereon, were convertible

into an aggregate of 3,138 shares of Company common stock. The Series E Preferred do not have any voting rights with respect to the matters

to be presented to our stockholders at the Special Meeting, and therefor are not included in a separate table, below.

In

computing the number of shares of common stock beneficially owned by a person and the percentage ownership of that person, shares of

common stock subject to stock options, warrants, convertible preferred stock or other rights held by such person that are currently convertible

or exercisable or will become convertible or exercisable within 60 days of the Record Date are considered outstanding, although these

shares are not considered outstanding for purposes of computing the percentage ownership of any other person.

We

believe, based on information provided to us, that each of the stockholders listed below has sole voting and investment power with respect

to the shares beneficially owned by the stockholder unless noted otherwise, subject to community property laws where applicable.

Common

Stock

The

Company is not aware of any person that beneficially owned 5% or more of the outstanding share of Company common stock as of the record

date.

| Name of Beneficial Owner | |

Number of Shares Beneficially Owned | | |

Percentage of Shares Beneficially Owned(1) | |

| Named Executive Officers and Directors: | |

| | | |

| | |

| William Kerby(2) | |

| 44,011 | | |

| 4.7 | % |

| Frank Orzechowski(3) | |

| 9,482 | | |

| 1.0 | % |

| Donald P. Monaco(4) | |

| 41,745 | | |

| 4.5 | % |

| Jacob Brunsberg(5) | |

| 13,977 | | |

| 1.5 | % |

| Salvatore Battinelli(6) | |

| 6,060 | | |

| * | |

| Dennis Duitch(7) | |

| 5,767 | | |

| * | |

| Kent J. Summers(8) | |

| 5,730 | | |

| * | |

| All executive officers and directors as a group (7 persons)(9) | |

| 126,772 | | |

| 13.0 | % |

*Less

than 1%.

| (1) |

Based

on 936,430 shares outstanding at January 29, 2024, the Record Date. |

| (2) |

Includes

11,386 shares held by Travel and Media Tech, LLC (“TMT”). Mr. Kerby is a 50% member of TMT, and is deemed to beneficially

own the shares held by TMT. Mr. Kerby disclaims beneficial ownership of all securities held by TMT in excess of his pecuniary interest,

if any. |

| (3) |

Includes

9,434 shares issuable upon the exercise of stock options. |

| (4) |

Includes

(i) 1,733 shares held by Monaco Investment Partners, LP (“MIP”); (ii) 28,626 shares held by the Donald P. Monaco

Insurance Trust (the “Trust”); and (iii) 11,386 shares held by TMT. Mr. Monaco is the managing general partner

of MI Partners, is the trustee of the Trust and is a 50% member of TMT, and as such is deemed to beneficially own the securities

held by the MI Partners, Trust and TMT, respectively. Mr. Monaco disclaims beneficial ownership of all securities held by MIP, the

Trust and TMT in excess of his pecuniary interest, if any. |

| (5) |

Includes

13,882 shares issuable upon the exercise of stock options. |

| (6) |

Includes

(i) 5,105 shares issuable upon the exercise of stock options, (ii) 166 shares issuable upon the conversion of shares

of the Company’s Series E Preferred Stock, and (iii) 122 shares issuable upon exercise of Class A Warrants. |

| (7) |

Includes

5,105 shares issuable upon the exercise of stock options. |

| (8) |

Includes

5,105 shares issuable upon the exercise of stock options. |

| (9) |

Includes

(i) 38,631 shares issuable upon the exercise of stock options, (ii) 166 shares issuable upon the conversion of the

shares of the Company’s Series E Preferred Stock, and (iii) 122 shares issuable upon exercise of Class A Warrants. |

Series

G Preferred

None

of the Company’s officers or directors beneficially own any shares of the outstanding shares of Series G Preferred, and therefore

have been excluded from the following table.

| Name of Beneficial Owner(1) | |

Number of Shares Beneficially Owned | | |

Percentage of Shares Beneficially Owned(1) | |

| 5% Beneficial Owners: | |

| | | |

| | |

Promethean TV, Inc. c/o

Sigma Additive Solutions, Inc.

| |

| 100,000 | | |

| 100 | % |

| (1) |

Based

on 100,000 shares of Series G Preferred outstanding at January 29, 2024, the Record Date. |

| (2) |

The

holder of Series G Preferred is entitled to vote on all matters presented to our stockholders on an as-converted basis. Each share

of Series G Preferred is convertible, at the option of each respective holder, one share of our common stock. |

Series

H Preferred

None

of the Company’s officers or directors beneficially own any shares of the outstanding shares of Series H Preferred, and therefore

have been excluded from the following table.

| Name of Beneficial Owner | |

Number of Shares Beneficially Owned | | |

Percentage of Shares Beneficially Owned(1) | |

| 5% Beneficial Owners: | |

| | | |

| | |

Procopio Cory Hargreaves & Savitch LLP c/o

Sigma Additive Solutions, Inc.

| |

| 100,000 | | |

| 66.7 | % |

Balencic Creative Group, LLC c/o

Sigma Additive Solutions, Inc.

| |

| 50,000 | | |

| 33.3 | % |

| (1) |

Based

on 150,000 shares of Series H Preferred outstanding at January 29, 2024, the Record Date. |

| (2) |

Holders

of Series H Preferred are entitled to vote on all matters presented to our stockholders on an as-converted basis. Each share of Series

H Preferred is convertible, at the option of each respective holder, one share of our common stock. |

INTERESTS

OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except

to the extent of their ownership in shares of our common stock and securities convertible or exercisable for common stock, and to the

extent that they may be granted equity awards from time to time in the future if the Capital Increase is approved, none of our directors,

executive officers, any person who has served as a director or executive officer since the beginning of the last fiscal year, or their

associates have any interest, direct or indirect, by security holdings or otherwise, in any of the matters to be acted upon at the Special

Meeting as described in this proxy statement.

OTHER

MATTERS

As

of the date of this proxy statement, the Board knows of no matters that will be presented for consideration at the Special Meeting other

than as described in this proxy statement. If any other matters properly come before the Special Meeting or any adjournment or postponement

of the meeting and are voted upon, your proxy will confer discretionary authority on the individuals named as proxy holders to vote the

shares represented by the proxy as to any other matters.

MISCELLANEOUS

The

Company will bear all costs incurred in the solicitation of proxies. In addition to solicitation by mail, our officers and employees

may solicit proxies by telephone, the Internet or personally, without additional compensation. We may also make arrangements with proxy

solicitation firms, brokerage houses and other custodians, nominees and fiduciaries for the forwarding of solicitation materials to the

beneficial owners of shares of our common stock, Series G Preferred and/or Series H Preferred held of record by such persons, and we

may pay fees and/or reimburse such proxy solicitation firms, brokerage houses and other custodians, nominees and fiduciaries for their

out-of-pocket expenses incurred in connection therewith.

The

SEC has adopted rules that permit companies and intermediaries such as brokers to satisfy delivery requirements for proxy statements

with respect to two or more stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders.

This process, which is commonly referred to as “householding,” potentially provides extra convenience for stockholders and

cost savings for companies. The Company and some brokers household proxy materials and may deliver a single proxy statement to multiple

stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received

notice from your broker or the Company that they or the Company will be householding materials to your address, householding will continue

until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in householding

and would prefer to receive a separate copy of our proxy materials, please notify your broker if your shares are held in a brokerage

account or the Company if you hold registered shares of common stock, Series G Preferred or Series H Preferred. We will also deliver

a separate copy of this proxy statement to any stockholder upon written request. Similarly, stockholders who have previously received

multiple copies of disclosure documents may write to the address or call the phone number listed below to request delivery of a single

copy of these materials in the future. You can notify the Company by sending a written request to Sigma Additive Solutions, Inc., 3900

Paseo del Sol, Santa Fe, New Mexico 87507, Attn: Secretary, by registered, certified or express mail or by calling the Company at (203)

733-1356.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other documents with the SEC under the Exchange Act. Stockholders may

obtain free copies of certain documents filed with the SEC by Sigma through the “SEC Filings” section of our website. You

also may obtain any of the documents we file with the SEC, including exhibits to the documents, without charge, by requesting them in

writing or by telephone at the following address or telephone number:

Sigma

Additive Solutions, Inc.

3900

Paseo del Sol

Santa

Fe, New Mexico 87507

(203)

733-1356

| By

Order of the Board of Directors |

|

| |

|

| /s/

William Kerby |

|

| William

Kerby |

|

| Chief

Executive Officer |

|

ANNEX

A

AMENDMENT

TO

AMENDED AND RESTATED ARTICLES OF INCORPORATION, AS AMENDED,

OF

SIGMA ADDITIVE SOLUTIONS, INC.

1.

The first paragraph of ARTICLE I of the Amended and Restated Articles of Incorporation, as amended, of Sigma Additive Solutions, Inc.

is hereby amended to read in its entirety as follows:

“The

name of the Corporation shall be NextTrip, Inc.”

2.

The first two paragraphs of ARTICLE IV of the Amended and Restated Articles of Incorporation, as amended, of Sigma Additive Solutions,

Inc. are hereby amended to read in their entirety as follows:

“The

total number of shares of all classes of capital stock which the corporation shall have authority to issue is 260,000,000 shares. Stockholders

shall not have any preemptive rights, nor shall stockholders have the right to cumulative voting in the election of directors or for

any other purpose.

The

classes and the aggregate number of shares of stock of each class which the corporation shall have authority to issue are as follows:

(a)

250,000,000 shares of common stock, $0.001 par value (“Common Stock”);

(b)

10,000,000 shares of preferred stock, $0.001 par value (“Preferred Stock”).”

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Mar 2024 to Apr 2024

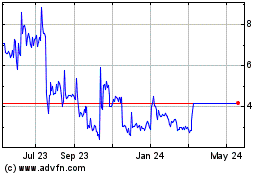

Sigma Additive Solutions (NASDAQ:SASI)

Historical Stock Chart

From Apr 2023 to Apr 2024