UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14C Information

Information

Statement Pursuant to Section 14 (c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

| ☐ |

Preliminary

Information Statement |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14c-5 (d)(2)) |

| ☒ |

Definitive

Information Statement |

|

|

| WeTrade

Group Inc. |

| (Name

of Registrant as Specified in Its Charter) |

| |

| Payment

of Filing Fee (Check the appropriate box): |

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

computed on table below per Exchange Act Rules 14c-5(g) and 0-11. |

| |

1) |

Title of each class of securities to which transaction

applies: |

| |

|

|

| |

2) |

Aggregate number of securities to which transaction

applies: |

| |

|

|

| |

3) |

Per unit price or other underlying value of transaction

computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

| |

4) |

Proposed maximum aggregate value of transaction: |

| |

|

|

| |

5) |

Total fee paid: |

| ☐ |

Fee paid previously with preliminary materials. |

| |

|

| ☐ |

Check box if any part of the fee is offset as provided

by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing

by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) |

Amount Previously Paid: |

| |

|

|

| |

2) |

Form, Schedule or Registration Statement No: |

| |

|

|

| |

3) |

Filing Party: |

| |

|

|

| |

4) |

Date Filed: |

WeTrade

Group Inc.

Room

519, 05/F, Block T3, Qianhai Premier Finance Centre Unit 2,

Guiwan

Area, Nanshan District, Shenzhen, China

INFORMATION

STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES

EXCHANGE ACT OF 1934 AND REGULATION 14C THEREUNDER

WE

ARE NOT ASKING YOU FOR A PROXY

AND

YOU ARE REQUESTED NOT TO SEND US A PROXY

To

the Holders of Common Stock of WeTrade Group Inc.:

This

Information Statement has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the holders (the “Stockholders”) of common

stock, with no par value (the “Common Stock”), of WeTrade Group Inc., a Wyoming corporation (the “Company”),

to notify the Stockholders that on January 17, 2024, the Company received a majority written consent in lieu of a special meeting of

the Stockholders of 50.05% of the Company’s Common Stock (the “Majority Stockholders”), together holding in the aggregate

more than a majority of the total voting power of all issued and outstanding voting capital of the Company. The Majority Stockholders

authorized the change of name and Nasdaq Trading Symbol of the Company.

On

January 17, 2024, the Board of Directors of the Company (the “Board”) approved, and recommended to the Majority Stockholder

that they approve the change of name and Nasdaq Trading Symbol of the Company.

The

written consent by the Majority Stockholders was obtained pursuant to Section 17-16-704 of the Wyoming Business Corporation Act.

For

further information regarding the matters as to which Majority Stockholders’ consent was given, we urge you to carefully read the

accompanying Information Statement.

| |

|

By Order of

the Board of Directors, |

|

| |

|

|

|

| February

9, 2024 |

|

/s/

Lichen Dong |

|

| |

|

Lichen

Dong

Chairman

of the Board |

|

WeTrade

Group Inc.

Room

519, 05/F, Block T3, Qianhai Premier Finance Centre Unit 2,

Guiwan

Area, Nanshan District, Shenzhen, China

INFORMATION

STATEMENT PURSUANT TO SECTION 14(C) OF THE

SECURITIES

EXCHANGE ACT OF 1934

February

9, 2024

GENERAL

INFORMATION

This

Information Statement has been filed with the Securities and Exchange Commission and is being furnished, pursuant to Section 14C of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), to the holders (the “Stockholders”) of common

stock, with no par value (the “Common Stock”), of WeTrade Group Inc., a Wyoming corporation (the “Company”),

to notify the Stockholders that on January 17, 2024, the Company received a majority written consent in lieu of a special meeting of

the Stockholders of 50.05% of the Company’s Common Stock (the “Majority Stockholders”), together holding in the aggregate

more than a majority of the total voting power of all issued and outstanding voting capital of the Company. The Majority Stockholders

authorized that the Company changes its name from “WeTrade Group Inc.” to “Next Technology Holding Inc”; and

be it further, authorized that the Company changes its Nasdaq Trading Symbol from “WETG” to “NXTT”; and be it

further, authorized that the first article of the Company’s Articles of Incorporation is revised to read as follows: “I.

The name of the corporation is: Next Technology Holding Inc.” (the “Changes”).

Dissenting

Stockholders do not have any statutory appraisal rights as a result of the action taken. The Board of Directors of the Company (the “Board”)

does not intend to solicit any proxies or consents from any other Stockholders in connection with this action.

There

will not be a meeting of Stockholders and none is required under Wyoming Business Corporation Act when an action has been approved by

written consent of the holders of a majority of the outstanding shares of our Common Stock as permitted by the Articles of Incorporation

of the Company.

The

Board of Directors has fixed the close of business on January 17, 2024, as the record date (the “Record Date”) for the determination

of Stockholders who are entitled to receive this Information Statement.

WHAT

VOTE WAS REQUIRED TO APPROVE THE CHANGES?

For

the approval of the Changes, the affirmative vote of at least 50% of the outstanding voting stock was required for approval.

CONSENTING

STOCKHOLDERS

On

January 17, 2024, our Board unanimously adopted resolutions declaring the advisability of, and recommended that Stockholders approve

the Changes. In connection with the adoption of these resolutions, the Board selected to seek the written consent of the holders of a

majority of our outstanding voting stock. As of January 17, 2024, there were issued and outstanding 2,625,130 shares of our Common Stock

with no par value.

On

January 17, 2024, the Majority Stockholders which/who collectively own 50.05% of the Company’s outstanding Common Stock, consented

in writing to the Changes.

| the Majority

Stockholders |

Amount of

Beneficial Ownership of Common Stock |

Percentage

Ownership

of

Common Stock |

| Perfect Linkage Group Limited |

231,164 |

8.81% |

| Blue Rose Worldwide Limited |

231,164 |

8.81% |

| Golden Genius Development

Limited |

245,012 |

9.33% |

| Fubao Group Limited |

245,011 |

9.33% |

| Green Ally Enterprises Limited |

128,000 |

4.88% |

| Winning Mission Group Limited |

128,000 |

4.88% |

| Huang Ye |

52,700 |

2.01% |

| Sau Kiew Ng |

52,700 |

2.01% |

Under

the Wyoming Business Corporation Act, we are required to give all Stockholders written notice of any actions that are taken by written

consent without a Stockholder meeting.

We

are not seeking written consent from any of our Stockholders and our other Stockholders will not be given an opportunity to vote with

respect to the Changes. All necessary corporate approvals have been obtained, and this Information Statement is furnished solely for

the purposes of advising Stockholders of the action taken by written consent, as required by the Wyoming Business Corporation Act.

Stockholders

who were not afforded an opportunity to consent or otherwise vote with respect to the actions taken have no right under Wyoming Business

Corporation Act to dissent or require a vote of all our Stockholders.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth, as of January 17, 2024, the number and percentage of shares of outstanding Common Stock of the Company, owned

of record and beneficially, by each person known by the Company to own 5% or more of such stock, each director of the Company, and by

all executive officers and directors of the Company. Unless otherwise indicated below, the address of each person listed in the table

below is

| Directors and Named Executive

Officers |

Amount

of Beneficial Ownership

of

Common Stock |

Percentage

Ownership of Common Stock |

| Lichen Dong |

- |

- |

| Lim Kian Wee |

- |

- |

| Mahesh Thapaliya |

- |

- |

| Jianbo Sun |

- |

- |

| Ken Tsang |

- |

- |

| Nan Ding |

- |

- |

| All executive officers

and directors as a group (6 persons) |

0 |

0% |

| |

|

|

| 5% or Greater Shareholders |

|

|

| Huang Xiumei |

256,849 |

9.78% |

| Perfect Linkage Group Limited |

231,164 |

8.81% |

| Blue Rose Worldwide Limited |

231,164 |

8.81% |

| Golden Genius Development

Limited |

245,012 |

9.33% |

| Fubao Group Limited |

245,011 |

9.33% |

DISSENTER’S

RIGHTS OF APPRAISAL

Holders

of our voting securities do not have dissenter’s rights under the Wyoming Business Corporation Act in connection with our Proposal.

WHERE

YOU CAN FIND MORE INFORMATION

We

are subject to the information and reporting requirements of the Securities Exchange Act of 1934, as amended, and in accordance with

the Securities Exchange Act, we file periodic reports, documents, and other information with the Securities and Exchange Commission relating

to our business, financial statements, and other matters. These reports and other information may be inspected and are available for

copying at the offices of the Securities and Exchange Commission, 100 F Street, N.E., Washington, DC 20549. Our SEC filings are

also available to the public on the SEC’s website at http://www.sec.gov.

| |

|

By Order of

the Board of Directors, |

|

| |

|

|

|

| |

|

/s/ Lichen

Dong |

|

| |

|

Lichen

Dong

Chairman

of the Board |

|

February

9, 2024

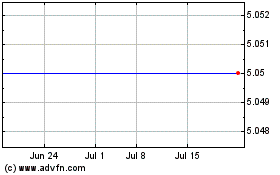

WeTrade (NASDAQ:WETG)

Historical Stock Chart

From Apr 2024 to May 2024

WeTrade (NASDAQ:WETG)

Historical Stock Chart

From May 2023 to May 2024