UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934 (Amendment No. )

| Filed

by the Registrant ☒ |

Filed

by a Party other than the Registrant ☐ |

Check

the appropriate box:

| ☐ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

Minim,

Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| ☐ |

Fee

paid previously with preliminary materials. |

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

MINIM,

INC.

848

ELM STREET

MANCHESTER,

NEW HAMPSHIRE 03101

February

9, 2024

Dear

Stockholder:

You

are cordially invited to attend a Special Meeting of Stockholders of Minim, Inc. (the “Company”) to be held on Tuesday,

February 27, 2024. This Special Meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively

via online audio-only broadcast. You will be able to participate in the Special Meeting, vote your shares and submit your questions during

the meeting via the Internet by visiting http://www.virtualshareholdermeeting.com/MINM2024. The Special Meeting will be held in

virtual format only and will begin at 9:00 a.m. Eastern Time.

The

official Notice of Special Meeting, together with a Proxy Statement and form of proxy, are enclosed.

On

January 23, 2024, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with David Lazar (“Lazar”),

a member of our Board of Directors, whereby, at the closing of the transactions contemplated by the Purchase Agreement (the “Closing”),

subject to satisfaction of certain closing conditions, including our stockholders voting in favor of the transaction at this Special

Meeting, we will sell and Lazar (or to any transferee of Lazar’s which acquires the Securities Purchase Rights, as defined below,

hereinafter a “Lazar Transferee”) will purchase two million 2,000,000 shares of the Company’s preferred stock, $0.001

par value per share (the “Preferred Stock”), at a price per share of $1.40, for an aggregate purchase price of $2,800,000,

subject to the conditions described below, pursuant to the exemptions afforded by the Securities Act of 1933, as amended, and Regulation

S thereunder. Under the Purchase Agreement, we have agreed to designate 2,000,000 of the Preferred Stock as Series A Preferred Stock

(the “Series A Preferred Stock”) for the sale to Lazar (or a Lazar Transferee). Each share of Series A Preferred Stock shall

be convertible, at the option of the holder, into 1.4 shares of common stock of the Company, $.01 par value per share (the “Common

Stock”), and vote on an “as-if-converted” basis and shall have full ratchet protection in any subsequent offerings.

Pursuant to the Purchase Agreement, we shall also issue Lazar (or a Lazar Transferee) warrants to purchase up to an additional 2,800,000

shares of Common Stock, with an exercise price equal to $1.00 per share, subject to adjustment therein (the “Warrants”, and

together with the Series A Preferred Stock, the “Purchased Securities”). The Closing occured on January 29, 2024.

Under

the applicable Nasdaq rules and the Purchase Agreement, in the absence of shareholder approval, we may only issue to Lazar (or a Lazar

Transferee) upon conversion of the Series A Preferred Stock and/or upon exercise of the Warrants such number of shares of Common Stock,

equal to the lower of either, (X) the maximum percentage of the number of shares of the Common Stock outstanding immediately after giving

effect to the issuance of shares of Common Stock issuable upon conversion of the Preferred Stock and/or exercise of the Warrants that

can be issued to the Holder without requiring a vote of our shareholders under the rules and regulations of the Trading Market on which

the Common Stock trades on such date and applicable securities laws; or, (Y) 19.99% of the number of shares of the Common Stock outstanding

immediately prior to the date of issuance.

The

Purchase Agreement contains customary representations, warranties and agreements of the Company and Lazar, limitations and conditions

regarding sales of the Purchased Securities or underlying Common Stock, indemnification rights and other obligations of the parties.

Furthermore, the Purchase Agreement contains certain conditions to closing, including, shareholder approval of: (i) a one for three reverse

stock split of the Common Stock, (ii) the increase in authorized shares of Preferred Stock to 10,000,000, (iii) the Certificate of Designation

of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares, (iv) the issuance of the Common Stock underlying the

Purchased Securities to Lazar or any transferee of Lazar’s which acquires the Securities Purchase Rights (as defined below), and,

(v) removal from the Company’s Certificate of Incorporation and By-Laws of limitations on adopting shareholder resolutions via

majority without holding a shareholders meeting.

At

the Special Meeting, we will ask stockholders to authorize the above noted items (i) through (v), and for purposes of complying with

Nasdaq Listing Rule 5635(d), the potential issuance of shares of our Common Stock that may be issued upon the conversion of the Series

A Preferred Stock and the exercise of the Warrants issued pursuant to the terms of the Purchase Agreement, in an amount that ultimately

may equal or be in excess of 20% of our Common Stock outstanding before the issuance of such Series A Preferred Stock and Warrants (including

by the operation of anti-dilution provisions contained in the the Series A Preferred Stock or the Warrants). We will also transact

any other business that may properly come before the Special Meeting or at any adjournments or postponements of the Special Meeting.

Lazar

has agreed that he will not engage in or effect, directly or indirectly, any short sales involving our securities or any hedging transaction

that transfers the economic risk of ownership of the Common Stock. Additionally, our Board of Directors unanimously adopted resolutions

(i) exempting Lazar’s acquisition of the Purchased Securities from Section 16(b) of the Exchange Act pursuant to Rule 16b-3 and

(ii) granting Lazar the right to sell, assign or otherwise transfer either the Purchased Securities (as well as any Common Stock underlying

any such Purchased Securities) and/or his rights to acquire the Purchased Securities (as well as any Common Stock underlying any such

Purchased Securities) pursuant to the Purchase Agreement (the “Securities Purchase Rights”), including by way of option for

Lazar to sell and/or a transferee thereof to purchase, the Securities Purchase Rights.

If

the issuance of the Purchased Securities to Lazar (or to a Lazar Transferee) is approved by our stockholders, following the Closing,

Lazar (or a Lazar Transferee) will become our majority shareholder, owning approximately 50.1% of our Common Stock. Our Common Stock

will continue to be listed on Nasdaq, and the Company will continue as a public reporting company under the rules of the Securities and

Exchange Commission.

The

proxy statement attached to this letter provides you with more specific information concerning the Special Meeting, the Purchase Agreement,

the transactions contemplated by the Purchase Agreement, and other related matters, including information as to how to cast your vote.

We encourage you to read the entire proxy statement, the copy of the Purchase Agreement attached as Annex A to the proxy statement, and

the other annexes to the proxy statement carefully and in their entirely. The proposals being presented for approval of our stockholders

are more fully described in the Proxy Statement accompanying this Notice. Please refer to the Proxy Statement for further information

with respect to the business to be transacted at the Special Meeting. The Board of Directors unanimously recommends that you vote “FOR”

the Nasdaq Proposal.

Whether

or not you plan to participate in the Virtual Special Meeting, we urge you to vote your shares by using one of the voting options available

to you as described in the accompanying Proxy Statement. If you wish to revoke your proxy at the meeting, you can withdraw your proxy

and vote your shares electronically during the meeting.

The

Board of Directors has fixed the close of business on January 19, 2024 as the record date for determination of stockholders entitled

to notice of, and to vote at, the Special Meeting and any adjournments or postponements thereof.

We

look forward to seeing those of you who will be able to participate in the Special Meeting in its virtual format.

| |

Very

truly yours, |

| |

|

| |

/s/

Jeremy Hitchcock |

| |

Jeremy

Hitchcock |

| |

Chief

Executive Officer |

IMPORTANT:

YOU ARE URGED TO SUBMIT YOUR PROXY BY INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS AVAILABLE IN THE ACCOMPANYING PROXY STATEMENT.

EVEN IF YOU HAVE SUBMITTED YOUR PROXY, YOUR PROXY MAY BE REVOKED AT ANY TIME PRIOR TO EXERCISE BY FILING WITH THE COMPANY A WRITTEN REVOCATION,

BY EXECUTING A PROXY AT A LATER DATE, OR BY PARTICIPATING IN AND VOTING AT THE MEETING. THANK YOU FOR ACTING PROMPTLY.

MINIM,

INC.

848

Elm Street

Manchester,

New Hampshire 03101

NOTICE

OF VIRTUAL SPECIAL MEETING OF STOCKHOLDERS

NOTICE

IS HEREBY GIVEN that a Virtual Special Meeting of Stockholders (the “Special Meeting”) of Minim, Inc. (the “Company”)

will be held on Tuesday, February 27, 2024 at 9:00 a.m. Eastern Time. The meeting will be held for the following purposes:

| |

(1) |

To

approve: (i) the issuance of shares of our common stock, par value $0.01 per share (“Common Stock”) upon conversion of

Series A Preferred Stock or exercise of the Warrants to be issued at Closing of the Purchase Agreement, which conversions or exercise

would result in a “change of control” of the Company under the applicable rules of Nasdaq; (ii) an amendment to the Company’s

Amended and Restated Certificate of Incorporation to effect the increase in authorized shares of Preferred Stock to 10,000,000; (iii)

the Certificate of Designation of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares; and (iv) an amendment

to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of the outstanding shares

of Common Stock, at a ratio of 1-for-3, with the effective time of the reverse stock split to be determined by our Board of Directors.

We refer to this proposal as the “Change of Control Proposal” or “Proposal 1.” |

| |

|

|

| |

(2) |

To

approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to remove from the Company’s

Certificate of Incorporation and By-Laws any limitations on adopting shareholder resolutions via majority without holding a shareholders

meeting. We refer to this proposal as the “Written Consent Authorization Proposal” or “Proposal 2.”; and |

| |

|

|

| |

(3) |

To

approve the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are

not sufficient votes to approve any of the above Proposals. We refer to this proposal as the “Adjournment Proposal” or

“Proposal 3.” |

The

Board of Directors has fixed the close of business on January 19, 2024 as the record date for determining the stockholders entitled to

receive notice of and to vote at the Special Meeting and any continuation or adjournment thereof.

To

participate in the meeting, be deemed present, vote, examine the stockholders list and ask questions, go to http://www.virtualshareholdermeeting.com/MINM2024.

You will need the 16-digit confirmation number included on your proxy card or on the instructions that accompany your proxy materials.

Because the Special Meeting is virtual and being conducted over the Internet, stockholders will not be able to attend the Special Meeting

in person.

All

stockholders are cordially invited to participate in the Virtual Special Meeting. Whether or not you plan to participate in the Special

Meeting, you are urged to vote by proxy in accordance with the instructions included in the accompanying Proxy Statement. Any stockholder

participating in the Special Meeting may vote electronically during the meeting even if she or he has voted by proxy.

| |

BY

ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

/s/

Jeremy Hitchcock |

| |

Jeremy

Hitchcock |

| |

Chief

Executive Officer |

Manchester,

New Hampshire

February

9, 2024

Important

Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be Held on February 27, 2024:

The Proxy Statement for the Special Meeting is available at www.proxyvote.com.

MINIM,

INC.

PROXY

STATEMENT FOR THE SPECIAL MEETING OF STOCKHOLDERS

TO

BE HELD ON TUESDAY, FEBRUARY 27, 2024

INFORMATION

CONCERNING SOLICITATION AND VOTING

General

The

enclosed proxy is solicited on behalf of the Board of Directors of Minim, Inc., for use at the Virtual Special Meeting of Stockholders

to be held on Tuesday, February 27, 2024 (the “Record Date”) at 9:00 a.m. Eastern Time (the “Special

Meeting”), or at any continuation or adjournment thereof, for the purposes set forth herein and in the accompanying Notice of Special

Meeting of Stockholders. This Proxy Statement, the form of proxy and accompanying materials are being first delivered or sent to stockholders

on or about [X], 2024. Stockholders can participate in the Virtual Special Meeting by visiting http://www.virtualshareholdermeeting.com/MINM2024.

In this proxy statement we refer to Minim, Inc., as “Minim,” the “Company,” “we,” or “us.”

On

January 23, 2024, we entered into a Securities Purchase Agreement (the “Purchase Agreement”) with David Lazar (“Lazar”),

a member of our Board of Directors, whereby, at the closing of the transactions contemplated by the Purchase Agreement (the “Closing”),

subject to satisfaction of certain closing conditions, including our stockholders voting in favor of the transaction at this Special

Meeting, we will sell and Lazar (or to any transferee of Lazar’s which acquires the Securities Purchase Rights, as defined below,

hereinafter a “Lazar Transferee”) will purchase two million 2,000,000 shares of the Company’s preferred stock, $0.01

par value per share (the “Preferred Stock”), at a price per share of $1.40, for an aggregate purchase price of $2,800,000,

subject to the conditions described below, pursuant to the exemptions afforded by the Securities Act of 1933, as amended, and Regulation

S thereunder. Under the Purchase Agreement, we have agreed to designate 2,000,000 of the Preferred Stock as Series A Preferred Stock

(the “Series A Preferred Stock”) for the sale to Lazar (or a Lazar Transferee). Each share of Series A Preferred Stock shall

be convertible, at the option of the holder, into 1.4 shares of common stock of the Company, $.01 par value per share (the “Common

Stock”), and vote on an “as-if-converted” basis and shall have full ratchet protection in any subsequent offerings.

Pursuant to the Purchase Agreement, we shall also issue Lazar (or a Lazar Transferee) warrants to purchase up to an additional 2,800,000

shares of Common Stock, with an exercise price equal to $1.00 per share, subject to adjustment therein (the “Warrants”, and

together with the Series A Preferred Stock, the “Purchased Securities”). The Closing occured on January 29, 2024.

Under

the applicable Nasdaq rules and the Purchase Agreement, in the absence of shareholder approval, we may only issue to Lazar (or a Lazar

Transferee) upon conversion of the Series A Preferred Stock and/or upon exercise of the Warrants such number of shares of Common Stock,

equal to the lower of either, (X) the maximum percentage of the number of shares of the Common Stock outstanding immediately after giving

effect to the issuance of shares of Common Stock issuable upon conversion of the Preferred Stock and/or exercise of the Warrants that

can be issued to the Holder without requiring a vote of our shareholders under the rules and regulations of the Trading Market on which

the Common Stock trades on such date and applicable securities laws; or, (Y) 19.99% of the number of shares of the Common Stock outstanding

immediately prior to the date of issuance.

The

Purchase Agreement contains customary representations, warranties and agreements of the Company and Lazar, limitations and conditions

regarding sales of the Purchased Securities or underlying Common Stock, indemnification rights and other obligations of the parties.

Furthermore, the Purchase Agreement contains certain conditions to closing, including, shareholder approval of: (i) a one for three reverse

stock split of the Common Stock, (ii) the increase in authorized shares of Preferred Stock to 10,000,000, (iii) the Certificate of Designation

of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares, (iv) the issuance of the Common Stock underlying the

Purchased Securities to Lazar or any transferee of Lazar’s which acquires the Securities Purchase Rights (as defined below), and,

(v) removal from the Company’s Certificate of Incorporation and By-Laws of limitations on adopting shareholder resolutions via

majority without holding a shareholders meeting.

At

the Special Meeting, we will ask stockholders to authorize the above noted items (i) through (v), and for purposes of complying with

Nasdaq Listing Rule 5635(d), the potential issuance of shares of our Common Stock that may be issued upon the conversion of the Series

A Preferred Stock and the exercise of the Warrants issued pursuant to the terms of the Purchase Agreement, in an amount that ultimately

may equal or be in excess of 20% of our Common Stock outstanding before the issuance of such notes and warrant (including by the operation

of anti-dilution provisions contained in the the Series A Preferred Stock or the Warrants). We will also transact any other business

that may properly come before the Special Meeting or at any adjournments or postponements of the Special Meeting.

Lazar

has agreed that he will not engage in or effect, directly or indirectly, any short sales involving our securities or any hedging transaction

that transfers the economic risk of ownership of the Common Stock. Additionally, our Board of Directors unanimously adopted resolutions

(i) exempting Lazar’s acquisition of the Purchased Securities from Section 16(b) of the Exchange Act pursuant to Rule 16b-3 and

(ii) granting Lazar the right to sell, assign or otherwise transfer either the Purchased Securities (as well as any Common Stock underlying

any such Purchased Securities) and/or his rights to acquire the Purchased Securities (as well as any Common Stock underlying any such

Purchased Securities) pursuant to the Purchase Agreement (the “Securities Purchase Rights”), including by way of option for

Lazar to sell and/or a transferee thereof to purchase, the Securities Purchase Rights.

If

the issuance of the Purchased Securities to Lazar (or to a Lazar Transferee) is approved by our stockholders, following the Closing,

Lazar (or a Lazar Transferee) will become our majority shareholder, owning approximately 50.1% of our Common Stock. Our Common Stock

will continue to be listed on Nasdaq, and the Company will continue as a public reporting company under the rules of the Securities and

Exchange Commission.

This

Proxy Statement summarizes the information you need to know in order to vote on the proposals to be considered at the Special Meeting

in an informed manner.

We

urge you to read carefully the remainder of this Proxy Statement because the information in this section may not provide all the information

that you may consider important in determining how to vote your shares at the Special Meeting.

Record

Date, Stock Ownership and Voting

Only

stockholders of record at the close of business on January 19, 2024, are entitled to receive notice of and to vote at the Special Meeting.

At the close of business on January 19, 2024, there were outstanding and entitled to vote 2,789,020 shares of common stock, par value

$.01 per share (“Common Stock”). Each stockholder is entitled to one vote for each share of Common Stock.

One-third

of the shares of Common Stock outstanding and entitled to vote is required to be present or represented by proxy at the Special Meeting

in order to constitute the quorum necessary to take action at the Special Meeting. Votes cast by proxy or in person at the Special Meeting

will be tabulated by the inspector of elections appointed for the Special Meeting. The inspector of elections will treat abstentions

as shares of Common Stock that are present and entitled to vote for purposes of determining a quorum. Shares of Common Stock held of

record by brokers who do not return a signed and dated proxy or do not comply with the voting instructions will not be considered present

at the Special Meeting, will not be counted towards a quorum and will not be voted on any proposal. Shares of Common Stock held of record

by brokers which comply with the voting instructions but fail to vote on a proposal (“broker non-votes”) will be considered

present at the Special Meeting and will count toward the quorum but will be deemed not to have voted on any proposal.

An

affirmative vote of a majority of the outstanding shares of Common Stock entitled to vote thereon will be necessary to approve Proposal

2.

Any

shares not voted for a Proposal (whether by abstention, broker non-vote or otherwise) will have the same effect as a vote against the

applicable Proposal. Accordingly, it is important that beneficial owners instruct their brokers how they wish to vote their shares at

the Special Meeting.

We

do not intend to submit any other proposals to the stockholders at the Special Meeting. The Board of Directors was not aware, a reasonable

time before mailing of this proxy statement to stockholders, of any other business that may properly be presented for action at the Special

Meeting. If any other business should properly come before the Special Meeting, shares represented by all proxies received by us will

be voted with respect thereto in accordance with the best judgment of the persons named as attorneys in the proxies.

QUESTIONS

AND ANSWERS ABOUT THESE PROXY MATERIALS

AND THE SPECIAL MEETING

The

following questions and answers address questions you may have regarding the Special Meeting. Please refer to the more detailed information

contained elsewhere in this Proxy Statement, the annexes to this Proxy Statement and the documents referred to and/or incorporated by

reference in this Proxy Statement, which you should read carefully in their entirety, as well as any amendments thereto or other related

documents filed with the Securities and Exchange Commission (the “SEC”).

Why

am I receiving this Proxy Statement?

The

Board is inviting you to vote at the Special Meeting, including any adjournments or postponements of the Special Meeting, because you

were a stockholder of record at the close of business on the Record Date and are entitled to vote at the Special Meeting.

This

Proxy Statement, along with the accompanying Notice of Special Meeting of Stockholders, summarizes the information you need to know to

vote by proxy or in person at the Special Meeting. The following are answers to certain questions that you may have regarding the Special

Meeting. You are invited to virtually attend the Special Meeting to vote on the proposals described in this Proxy Statement. However,

you do not need to attend the Special Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your

proxy.

Where

will the Special Meeting be held?

The

Special Meeting will be held in a completely virtual format. There will be no physical location for the Special Meeting. You may attend,

vote and submit questions during the Special Meeting via the Internet at http://www.virtualshareholdermeeting.com/MINIM2024.

Why

are we holding a virtual Special Meeting rather than an in-person Special Meeting?

We

have designed the virtual format of our Special Meeting to enhance, rather than constrain, stockholder access, participation and communication.

For example, the virtual format allows stockholders to communicate with us in advance of, and during, the Special Meeting so they can

ask questions of our Board or management. During the live Q&A session of the Special Meeting, we may answer questions as they come

in and address those asked in advance, to the extent relevant to the business of the Special Meeting, as time permits.

What

is the purpose of the Special Meeting?

There

are a number of proposals being presented for stockholder approval, for which such approvals are necessary in order for the Closing of

the Purchase Agreement to occur:

| |

(1) |

To

approve: (i) the issuance of shares of our common stock, par value $0.01 per share (“Common Stock”) upon conversion of

Series A Preferred Stock or exercise of the Warrants to be issued at Closing of the Purchase Agreement, which conversions or exercise

would result in a “change of control” of the Company under the applicable rules of Nasdaq; (ii) an amendment to the Company’s

Amended and Restated Certificate of Incorporation to effect the increase in authorized shares of Preferred Stock to 10,000,000; (iii)

the Certificate of Designation of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares; and (iv) an amendment

to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of the outstanding shares

of Common Stock, at a ratio of 1-for-3, with the effective time of the reverse stock split to be determined by our Board of Directors.

We refer to this proposal as the “Change of Control Proposal” or “Proposal 1.” |

| |

|

|

| |

(2) |

To

approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to remove from the Company’s

Certificate of Incorporation and By-Laws any limitations on adopting shareholder resolutions via majority without holding a shareholders

meeting. We refer to this proposal as the “Written Consent Authorization Proposal” or “Proposal 2.”; and |

| |

|

|

| |

(3) |

To

approve the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are

not sufficient votes to approve any of the above Proposals. We refer to this proposal as the “Adjournment Proposal” or

“Proposal 3.” |

What

are the primary terms of the Purchase Agreement with David Lazar?

Under

the terms and conditions of the Purchase Agreement we will sell to Lazar (or to any Lazar Transferee) and such will purchase two million

2,000,000 shares of Series A Preferred Stock, $0.01 par value per share (the “Preferred Stock”), at a price per share

of $1.40, for an aggregate purchase price of $2,800,000, subject to the conditions described below pursuant to the exemptions afforded

by the Securities Act and Regulation S thereunder. Each share of Series A Preferred Stock shall be convertible, at the option of the

holder, into 1.4 shares of Common Stock of the Company, $.01 par value per share, and vote on an “as-if-converted” basis

and shall have full ratchet protection in any subsequent offerings. Pursuant to the Purchase Agreement, we shall also issue Lazar (or

a Lazar Transferee) warrants to purchase up to an additional 2,800,000 shares of Common Stock, with an exercise price equal to $1.00

per share, subject to adjustment therein (the “Warrants”, and together with the Series A Preferred Stock, the “Purchased

Securities”).

Under

the applicable Nasdaq rules and the Purchase Agreement, in the absence of shareholder approval, we may only issue to Lazar (or a Lazar

Transferee) upon conversion of the Series A Preferred Stock and/or upon exercise of the Warrants such number of shares of Common Stock,

equal to the lower of either, (X) the maximum percentage of the number of shares of the Common Stock outstanding immediately after giving

effect to the issuance of shares of Common Stock issuable upon conversion of the Preferred Stock and/or exercise of the Warrants that

can be issued to the Holder without requiring a vote of our shareholders under the rules and regulations of the Trading Market on which

the Common Stock trades on such date and applicable securities laws; or, (Y) 19.99% of the number of shares of the Common Stock outstanding

immediately prior to the date of issuance.

The

Purchase Agreement contains customary representations, warranties and agreements of the Company and Lazar, limitations and conditions

regarding sales of the Purchased Securities or underlying Common Stock, indemnification rights and other obligations of the parties.

Furthermore, the Purchase Agreement contains certain conditions to closing, including, shareholder approval of: (i) a one for three reverse

stock split of the Common Stock, (ii) the increase in authorized shares of Preferred Stock to 10,000,000, (iii) the Certificate of Designation

of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares, (iv) the issuance of the Purchased Securities to Lazar

or any transferee of Lazar’s which acquires the Securities Purchase Rights (as defined below), and, (v) removal from the Company’s

Certificate of Incorporation and By-Laws of limitations on adopting shareholder resolutions via majority without holding a shareholders

meeting.

At

the Special Meeting, we will ask stockholders to authorize the above noted items (i) through (v), and for purposes of complying with

Nasdaq Listing Rule 5635(d), the potential issuance of shares of our Common Stock that may be issued upon the conversion of the Series

A Preferred Stock and the exercise of the Warrants issued pursuant to the terms of the Purchase Agreement, in an amount that ultimately

may equal or be in excess of 20% of our Common Stock outstanding before the issuance of the Series A Preferred Stock and Warrants (including

by the operation of anti-dilution provisions contained in the Series A Preferred Stock or the Warrants). We will also transact

any other business that may properly come before the Special Meeting or at any adjournments or postponements of the Special Meeting.

Lazar

has agreed that he will not engage in or effect, directly or indirectly, any short sales involving our securities or any hedging transaction

that transfers the economic risk of ownership of the Common Stock. Additionally, our Board of Directors unanimously adopted resolutions

(i) exempting Lazar’s acquisition of the Purchased Securities from Section 16(b) of the Exchange Act pursuant to Rule 16b-3 and

(ii) granting Lazar the right to sell, assign or otherwise transfer either the Purchased Securities (as well as any Common Stock underlying

any such Purchased Securities) and/or his rights to acquire the Purchased Securities (as well as any Common Stock underlying any such

Purchased Securities) pursuant to the Purchase Agreement (the “Securities Purchase Rights”), including by way of option for

Lazar to sell and/or a transferee thereof to purchase, the Securities Purchase Rights.

If

stockholders approve the Change of Control Proposal, will I be required to sell my Common Stock?

The

approval of the Proposals involves the purchase by David Lazar (or a Lazar Transferee) of newly issued shares of our Series A Preferred

Stock and Warrants, all of which are convertible or exercisable into Shares of Common Stock. You will not be required to sell any of

your Common Stock.

If

stockholders approve the Proposals, will we remain a public company?

Whether

or not any of the Proposals are approved, we will continue to remain a public company, with our shares listed for trading on Nasdaq and

the requirement to file our annual reports (including the audited financial statements contained therein) and other reports with the

SEC.

What

is the effect to us and our other stockholders of having David Lazar (or a Lazar Transferee) as our largest stockholder?

Because

of David Lazar’s (or a Lazar Transferee’s) significant ownership of our Common Stock, any transaction or arrangement between

us, on the one hand, and David Lazar (or a Lazar Transferee) or any of their respective affiliates, on the other hand, will need to be

approved by the Board consistent with its fiduciary duties to all of our stockholders. This will entail full disclosure of any relationships,

transactions or other arrangements between us and David Lazar (or a Lazar Transferee) and/or their respective affiliates in our filings

with the SEC.

Following

the approval of the Change of Control Proposal, and the conversion of the Series A Preferred Shares, David Lazar (or a Lazar Transferee)

will be our largest stockholder, and it would own a majority of the outstanding shares of our Common Stock and we would be treated as

a “controlled company” under the rules of Nasdaq. As a controlled company, we would not be required to have a majority independent

Board and our Compensation Committee and Nominating and Corporate Governance Committee would no longer be required to be composed solely

of independent directors. Further, if David Lazar (or a Lazar Transferee) owns a majority of our Common Stock, he will then have sufficient

votes to elect all of our directors and to approve any other corporate action requiring the affirmative vote of holders of a majority

of the outstanding shares of our Common Stock.

Does

the Board recommend stockholder approval of the Change of Control Proposal?

After

careful consideration, the Board determined that the Purchase Agreement and the transactions contemplated thereby, including the issuances

of Series A Preferred Shares and the Warrants, are advisable and in the best interests of the Company and its stockholders.

Accordingly,

the Board unanimously recommends that our stockholders vote “FOR” each of Proposals 1 through 3.

What

factors did the Board consider and what were its reasons for approving the Securities Purchase Agreement and recommending that the stockholders

approve the Change of Control Proposal?

After

careful consideration, the Board determined that the Purchase Agreement and the transactions contemplated thereby, including the including

the issuances of Series A Preferred Shares and the Warrants, are advisable and in the best interests of the Company and its stockholders,

and determined to recommend that our stockholders approve the matters which need to be approved pursuant to the Purchase Agreement.

In

making its determinations, the Board considered various factors, including:

| |

● |

The immediate and long-term benefit to the Company’s

financial condition of receiving approximately $2.8 million in cash from the sale of the Preferred Stock and Warrants, in light of the

Company’s current cash position and longer-term liquidity needs. |

| |

|

|

| |

● |

The Company management’s analysis of the likelihood of

securing alternative sources of capital, of a potential public or private sales of common stock, warrants, or convertible or nonconvertible

debt securities and the likely price and other terms and conditions of such sales, which revealed a low likelihood of consummation of

any alternatives, as well as a significant cost of such financing, assuming it could be obtained, to the Company and the associated significant

dilution to its shareholders, which the Board determined was substantially less favorable to the Company than pursuing the transactions

contemplated by the Purchase Agreement. |

| |

|

|

| |

● |

The significant likelihood that, without the consummation of

the transactions contemplated by the Purchase Agreement, the Company will need to seek bankruptcy protection in the near term, which

may result in the Company’s shareholders receiving no or very little value in respect of their shares of the Company’s stock. |

| |

● |

The funding that David Lazar has provided and that David Lazar

(or a Lazar Transferee) would provide would allow us to explore strategic alternatives to maximize stockholder value. |

| |

|

|

| |

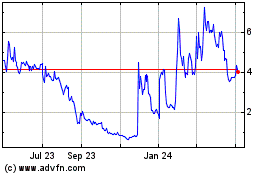

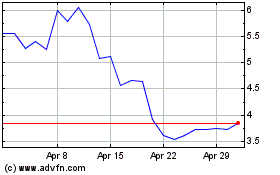

● |

The recent performance of the Company’s stock price on

Nasdaq and the capital markets as a whole, including the Company’s inability to secure any alternative offers to finance the Company

via an investment in the Company’s equity or to acquire the Company outright. |

| |

|

|

| |

● |

The investment by Lazar (or a Lazar Transferee) would serve

to increase stockholders’ equity and support the Company’s efforts to satisfy the minimum $2,500,000 stockholders’

equity requirement for continued listing on The Nasdaq Capital Market. |

| |

|

|

| |

● |

The Company’s extensive exploration, both by the Company’s

internal business development team as well as through its strategic advisors of opportunities for strategic partnership and/or investment,

based on which the Board believes that the Purchase Agreement offers the best opportunity with greatest financial benefit, including

after considering the risks that any such anticipated benefits could ultimately not materialize. |

| |

|

|

| |

● |

The fact that, we have covenanted under the Purchase Agreement,

to have the Proposals approved by our stockholders; |

| |

|

|

| |

● |

The terms and conditions of the Purchase Agreement, including,

among other things, the representations, warranties, covenants and agreements of the parties, the conditions to closing, the form and

governance of the Company post-closing and the termination rights of the parties, taken as a whole, which the Board determined were more

favorable to the Company and its shareholders than those terms and conditions which could have been negotiated with or offered by other

potential strategic partners and/or investors. |

| |

|

|

| |

● |

Potential risks associated with alternatives to the Purchase

Agreement, including the potential impact on the price of the Company’s common stock and ability to generate sufficient capital

to support our ongoing operation. |

| |

|

|

| |

● |

Potential risks associated with David Lazar’s (or a Lazar

Transferee’s) significant ownership percentage following the Closing, including their right to designate a majority of directors

to the Board, which will enable them to affect the outcome of, or exert significant influence over, all matters requiring Board or stockholder

approval, including the election and removal of directors and any change in control, and could have the effect of delaying or preventing

a change in control of the Company or otherwise discouraging or preventing a potential acquirer from attempting to obtain control of

the Company, which, in turn, could have a negative effect on the market price of the Company’s Common Stock and could impact the

low trading volume and volatility of the Company’s Common Stock. |

How

do I attend the Special Meeting?

You

may attend the virtual Special Meeting only if you were a stockholder as of the close of business on the Record Date, or if you hold

a valid proxy for the Special Meeting. To attend online and participate in the Special Meeting, stockholders of record will need to use

their 16-digit control number included in your Notice to log into http://www.virtualshareholdermeeting.com/MINIM2024. Beneficial

owners will also need to use their control number to attend the virtual Special Meeting. Instructions should also be provided on the

voting instruction card provided by the beneficial owner’s broker, bank, or other nominee.

The

Special Meeting will begin promptly on at 9:00 a.m. Eastern Time, on Tuesday, February 27, 2024. We encourage you to access

the Special Meeting prior to start time. Please allow time for online check-in, which will begin at 8:45 a.m. Eastern Time.

Who

can vote at the Special Meeting?

Only

stockholders of record at the close of business on the Record Date will be entitled to vote at the Special Meeting. On the Record Date,

there were 2,789,020 shares of our Common Stock outstanding and entitled to vote.

Stockholder

of Record: Shares Registered in Your Name

If

on the Record Date, your shares were registered directly in your name with our transfer agent, Computershare U.S. (“Computershare”),

then you are a stockholder of record. As a stockholder of record, you may attend and vote virtually at the Special Meeting, vote by proxy

over the telephone or through the Internet, or vote by proxy using a proxy card that you may request or that we may elect to deliver

at a later time. Whether or not you plan to attend the Special Meeting, we urge you to vote by proxy to ensure your vote is counted.

Beneficial

Owner: Shares Registered in the Name of a Broker, Bank or Other Nominee

If

on the Record Date, your shares are held in an account at a brokerage firm, bank or other agent, then you are the beneficial owner of

shares held in “street name” and the proxy materials and proxy card are being forwarded to you by that organization. The

organization holding your account is considered the stockholder of record for purposes of voting at the Special Meeting. As a beneficial

owner, you have the right to direct your broker, bank or other agent on how to vote the shares in your account. Your brokerage firm,

bank or other agent will not be able to vote in the election of directors unless they have your voting instructions, so it is very important

that you indicate your voting instructions to the institution holding your shares.

You

are also invited to attend the Special Meeting. However, since you are not the stockholder of record, you may not vote your shares electronically

over the Internet at the Special Meeting unless you request and obtain a valid proxy from your broker, bank or other agent.

How

to Vote

BY

THE INTERNET

| |

● |

Go

to http://www.virtualshareholdermeeting.com/MINIM2024. You may vote via the Internet during the meeting. Have the information that

is available on the proxy card and follow the instructions. |

BY

TELEPHONE

| |

● |

Use

any touch-tone telephone to dial 1-800-690-6903 to transmit your voting instructions up until 11:59 p.m. Eastern Time the day before

the meeting date. Have your proxy card in hand when you call and then follow the instructions. |

BY

MAIL

| |

● |

To

vote by written proxy, complete, sign and date your proxy card and return it promptly in the postage-paid envelope to Vote Processing,

c/o Broadridge, 51 Mercedes Way, Edgewood NY 11717. |

How

many votes do I have?

On

each matter to be voted upon, you have one vote for each share of Common Stock you owned as of the close of business on the Record Date.

What

happens if I do not vote?

Stockholder

of Record: Shares Registered in Your Name

If

you are a stockholder of record and do not vote through the Internet, by completing your proxy card, by telephone or virtually at the

Special Meeting, your shares will not be voted.

Beneficial

Owner: Shares Registered in the Name of Broker or Bank

If

you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, your broker, bank or other

agent may still be able to vote your shares in its discretion. In this regard, brokers, banks and other securities intermediaries voting

on behalf of beneficial owners of Nasdaq-listed companies, may use their discretion to vote your “uninstructed” shares with

respect to matters considered to be “routine”, but not with respect to “non-routine” matters, which are matters

that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors

(even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency

of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. For these

“non-routine” matters for which a broker, bank or other agent has not received voting instructions, a “broker non-vote”

occurs.

In

this regard, we believe that each of the Proposals are “non-routine” items and that your broker, bank or other agent may

not vote your shares on Proposals 1 through 3 without your instructions (resulting in “broker non-votes” for such matters).

Accordingly, if you own shares through a nominee, such as a broker, bank or other agent, please be sure to instruct your nominee how

to vote to ensure that your vote is counted on all of the Proposals. If you do not give your broker instructions, your shares will be

treated as broker non-votes with respect to all Proposals. Abstentions and broker non-votes will be considered present for the purposes

of establishing a quorum and will have the same effect as votes “AGAINST” Proposal 1, but will not count as votes cast for

Proposals 2 and 3.

What

if I return a proxy card or otherwise vote but do not make specific choices?

If

you return a signed and dated proxy card or otherwise vote without marking your voting selections, your shares will be voted, as applicable:

“For” Proposals 1 through 3.

Do

stockholders have any dissenters’ right with regards to the matters proposed to be acted upon?

There

are no rights of appraisal or other similar rights of dissenters under the laws of the State of Delaware with respect to any of the matters

proposed to be acted upon herein.

Are

any of the Company stockholders already committed to vote in favor of the proposals?

Jeremy

P. Hitchcock, Elizabeth Cash Hitchcock, Orbit Group LLC (“Orbit”), Hitchcock Capital Partners, LLC (“HCP”), Zulu

Holdings LLC (“Zulu”), Slingshot Capital, LLC (“Slingshot”) are a stockholders group pursuant to Section 13(d)(3)

of the Securities Exchange Act of 1934. Such group holds 1,447,567 shares of Common Stock as of the Record Date, representing a majority

of the issued and outstanding shares our Common Stock.

On

December 28, 2023, we, Mr. David Lazer, an individual (the “Proxy”), and each of Mr. Jeremy P. Hitchcock, an individual,

Orbit Group LLC, Hitchcock Capital Partners, LLC, Zulu Holdings, LLC, Slingshot Capital, LLC, affiliates of Jeremy Hitchcock, and Elizabeth

Cash Hitchcock, an individual (the “Stockholders”), entered into a Voting Agreement (the “Voting Agreement”)

with respect to the Purchase Agreement then being negotiated between David Lazar and the Company. Upon execution of the Purchase Agreement,

the Voting Agreement was released from escrow to the benefit of the Proxy. The Stockholders have disclaimed the formation of a group

with David Lazar, and of any shared beneficial ownership with him.

The

Voting Agreement governs the vote of 1,447,567 shares of Common Stock, representing the aggregate voting interest of the Stockholders

taken as a whole as of the Record Date, by the Proxy with respect to any and all matters concerning a shareholder vote with respect to

actions to be taken pursuant to the terms of the Purchase Agreement, including but not limited to Proposals 1 through 3 as well as electing

new members to the board of directors as may be appointed by the Proxy. The Stockholders agrees that at any meeting of our shareholders

and/or in connection with any corporate action by our shareholders, all of his/her/its respective shares of the will be voted by them

or the Proxy in the manner and to the effect determined by the Proxy in his discretion with respect to actions proposed to be taken pursuant

to the terms of the Purchase Agreement.

In

view of the Voting Agreement, we anticipate that the Stockholders will vote the shares held by them in favor of Proposals 1 through 3.

In light of the fact that such shares represent a majority of the shares of our Common Stock issued and outstanding, we expect that each

of the Proposals 1 through 3 will be approved at the Special Meeting. The reason we are calling this Special Meeting despite the fact

a majority of our shareholders have already provided their votes in favor of the Proposals is that our Amended and Restated Certificate

of Incorporation and our By-Laws contain limitations on adopting shareholder resolutions via majority without holding a shareholders

meeting. For more information on these limitations please see below under Proposal 2 where we discuss our proposal to approve an amendment

to the Company’s Amended and Restated Certificate of Incorporation to remove from the Company’s Certificate of Incorporation

and By-Laws any limitations on adopting shareholder resolutions via majority without holding a shareholders meeting.

What

happens if I sell my shares of Common Stock before the Special Meeting?

The

Record Date for stockholders entitled to vote at the Special Meeting is earlier than the date of the Special Meeting. If you transfer

your shares of Common Stock after the Record Date but before the Special Meeting, you will, unless special arrangements are made to confer

the voting rights with respect to such shares to the transferee, retain your right to vote at the Special Meeting.

Who

is paying for this proxy solicitation?

We

will pay for the entire cost of soliciting proxies and have paid the entire expense of preparing, printing, and mailing this proxy statement

and any additional materials furnished to shareholders. In addition to solicitations by mail, our officers, directors, and employees

may also solicit proxies in person, by telephone, or by other means of communication. Any officers, directors, and employees will not

be paid any additional compensation for soliciting proxies. We will also reimburse brokerage firms, banks, and other agents for the cost

of forwarding proxy materials to beneficial owners. We may engage a professional proxy solicitation firm to assist in the proxy solicitation

and, if so, will pay such solicitation firm customary fees plus expenses.

What

does it mean if I receive more than one set of proxy materials?

If

you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please

follow the voting instructions in each proxy card in the proxy materials, as applicable, to ensure that all of your shares are voted.

Can

I change my vote or revoke my proxy after submission?

Stockholder

of Record: Shares Registered in Your Name

Yes.

You may revoke your proxy and change your vote at any time before the final vote at the Special Meeting. The cutoff time for voting through

the internet or by telephone will be 11:59 P.M., Eastern Time, on February 26, 2024, the day before the Special Meeting. You may

change your vote on the internet or by telephone (only your latest internet or telephone proxy submitted prior to the Special Meeting

will be counted); by signing and returning a new proxy card with a later date; by sending a timely written notice that you

are revoking your proxy to Minim, Inc., 848 Elm Street, Manchester, New Hampshire 03101; or by attending the Special Meeting and

voting in person. However, your attendance at the Special Meeting will not automatically revoke your proxy unless you vote again at the

Special Meeting or specifically request in writing that your prior proxy be revoked.

Beneficial

Owner: Shares Registered in the Name of a Broker, Bank or Other Nominee

If

your shares are held in street name, you must contact your broker, bank or other nominee for instructions as to how to change your vote.

Your attendance at the Special Meeting does not revoke your proxy. Your last vote, whether prior to or at the Special Meeting, is the

vote that we will count.

How

are votes counted?

Votes

generally. Votes will be counted by the inspector of election appointed for the Special Meeting, who will separately count, for each

proposal, votes “For” and “Against,” abstentions, and, if applicable, broker non-votes.

Abstentions

and Broker Non-Votes. Abstentions will count towards the quorum. Shares constituting broker “non-votes” are not counted

or deemed to be present or represented for the purpose of determining whether shareholders have approved a matter or, unless the beneficial

holder has provided voting instructions on at least one proposal, whether a quorum exists at the Special Meeting.

Required

Vote. The following table summarizes the minimum vote needed to approve each proposal and the effect of abstentions and broker non-votes.

| Proposal

Number |

|

Proposal

Description |

|

Vote

Required for Approval |

|

Effect

of Abstentions |

|

Effect

of Broker Non-Votes |

| 1 |

|

To

approve: (i) the issuance of shares of our common stock, par value $0.01 per share (“Common Stock”) upon conversion of

Series A Preferred Stock or exercise of the Warrants to be issued at Closing of the Purchase Agreement, which conversions or exercise

would result in a “change of control” of the Company under the applicable rules of Nasdaq; (ii) an amendment to the Company’s

Amended and Restated Certificate of Incorporation to effect the increase in authorized shares of Preferred Stock to 10,000,000; (iii)

the Certificate of Designation of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares; and (iv) an amendment

to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of the outstanding shares

of Common Stock, at a ratio of 1-for-3, with the effective time of the reverse stock split to be determined by our Board of Directors. |

|

The

number of shares that cast a vote “For” the proposal must exceed the number of shares that cast a vote “Against”

the proposal. |

|

No

effect |

|

No

effect |

| |

|

|

|

|

|

|

|

|

| 2 |

|

To

approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to remove from the Company’s

Certificate of Incorporation and By-Laws any limitations on adopting shareholder resolutions via majority without holding a shareholders

meeting. |

|

The

number of shares that cast a vote “For” the proposal must be a majority of the outstanding shares entitled to vote. |

|

No

effect |

|

No

effect |

| |

|

|

|

|

|

|

|

|

| 3 |

|

To

approve the adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are

not sufficient votes to approve any of the above Proposals. |

|

The

number of shares that cast a vote “For” the proposal must exceed the number of shares that cast a vote “Against”

the proposal. |

|

No

effect |

|

No

effect |

What

is the quorum requirement?

A

quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least one-third of the

outstanding shares entitled to vote are present at the Special Meeting in person or represented by proxy. On the Record Date, there were

2,789,020 shares of Common Stock outstanding and entitled to vote. Thus, the holders of at least 929,674 shares must be present in person

or represented by proxy at the Special Meeting to have a quorum.

Your

shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or

other nominee) or if you vote virtually at the Special Meeting. Abstentions, if any, will be counted towards the quorum requirement.

If there is no quorum present, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn

the meeting to another date.

Could

other matters be decided at the Special Meeting?

The

Board knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought

before the Special Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance

with their best judgment.

How

can I find out the results of the voting at the Special Meeting?

We

will announce preliminary voting results at the Special Meeting. We expect to announce final voting results in a Current Report on Form

8-K filed with the SEC no later than the fourth business day after the Special Meeting. If final voting results are not available at

that time, we will disclose the preliminary results in the Current Report on Form 8-K and, within four business days after the final

voting results are known to us, file an amended Current Report on Form 8-K to disclose the final voting results.

How

do the Company’s insiders intend to vote their shares?

All

of the Company’s current directors and executive officers and the Stockholders holding a majority of the outstanding shares entitled

to vote are present at the Special Meeting in person or represented by proxy, are expected to vote their shares of common stock in favor

of all Proposals, and as such all of the Proposals are expected to pass. On the Record Date, the Company’s current directors and

executive officers and the Stockholders holding a majority of the outstanding Shares entitled to vote beneficially owned and were entitled

to vote an aggregate of 1,447,567 shares, representing approximately 51.9% of the Company’s issued and outstanding common stock

as of the Record Date.

CAUTIONARY

STATEMENT CONCERNING FORWARD-LOOKING INFORMATION

This

Proxy Statement contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, as amended.

All statements in this Proxy Statement other than statements of historical fact could be deemed forward looking including, but not limited

to, statements regarding the Company’s future expectations, plans and prospects, including statements about our beliefs or current

expectations of our future financial prospects, operations and corporate governance procedures following the completion of the transactions

with Lazar and the approval of the Proposals, as well as our current beliefs of our future prospects if the approval of the Proposals

does not occur, whether as a result of a failure of our stockholders to approve the Change of Control Proposal or otherwise. Words such

as “plans,” “expects,” “will,” “shall,” “anticipates,” “continue,”

“expand,” “advance,” “believes,” “guidance,” “target,” “may,”

“remain,” “project,” “outlook,” “intend,” “estimate,” “could,”

“should,” and other words and terms of similar meaning and expression are intended to identify forward-looking statements,

although not all forward-looking statements contain such terms. Forward-looking statements are based on management’s current beliefs

and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Actual results could differ

materially from those contained in any forward-looking statement as a result of various factors, including, without limitation:; the

occurrence of any event, change or other circumstances that could give rise to the termination of the Securities Purchase Agreement;

significant transaction costs, fees, expenses and charges; the risks associated with Lazar’s significant ownership percentage following

the Closing; and the risk of litigation and/or regulatory actions related to the issuance. Given these risks and uncertainties, you are

cautioned not to place undue reliance on such forward-looking statements. For a discussion of other risks and uncertainties, and other

important factors, any of which could cause the Company’s actual results to differ from those contained in the forward-looking

statements, see the section titled “Risk Factors” in the Company’s 2022 Annual Report on Form 10-K for the year ended

December 31, 2022, filed with the SEC on March 31, 2023. All information in this Proxy Statement is as of the date of the release, and

the Company undertakes no duty to update this information or to publicly announce the results of any revisions to any of such statements

to reflect future events or developments, except as required by law.

PROPOSAL

NO. 1

THE

CHANGE OF CONTROL Proposal

APPROVAL

OF: (i) the issuance of shares of our common stock, par value $0.01 per share (“Common Stock”) upon conversion of Series

A Preferred Stock or exercise of the Warrants to be issued at Closing of the Purchase Agreement, which conversions or exercise would

result in a “change of control” of the Company under the applicable rules of Nasdaq; (ii) an amendment to the Company’s

Amended and Restated Certificate of Incorporation to effect the increase in authorized shares of Preferred Stock to 10,000,000; (iii)

the Certificate of Designation of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares; and (iv) an amendment

to the Company’s Amended and Restated Certificate of Incorporation to effect a reverse stock split of the outstanding shares of

Common Stock, at a ratio of 1-for-3, with the effective time of the reverse stock split to be determined by our Board of Directors. We

refer to this proposal as the “Change of Control Proposal” or “Proposal 1.”

Under

the terms and conditions of the Purchase Agreement we will sell to Lazar (or to any Lazar Transferee) and such will purchase two million

eight hundred thousand 2,000,000 shares of Series A Preferred Stock, $0.01 par value per share (the “Preferred Stock”), at

a price per share of $1.40, for an aggregate purchase price of $2,800,000, subject to the conditions described below pursuant to the

exemptions afforded by the Securities Act and Regulation S thereunder. Each share of Series A Preferred Stock shall be convertible, at

the option of the holder, into one share of Common Stock of the Company, $.01 par value per share, and vote on an “as-if-converted”

basis and shall have full ratchet protection in any subsequent offerings. Pursuant to the Purchase Agreement, we shall also issue Lazar

(or a Lazar Transferee) warrants to purchase up to an additional 2,800,000 shares of Common Stock, with an exercise price equal to $1.00

per share, subject to adjustment therein (the “Warrants”, and together with the Series A Preferred Stock, the “Purchased

Securities”). The Closing occured on or about January 29, 2024.

Under

the applicable Nasdaq rules and the Purchase Agreement, in the absence of shareholder approval, we may only issue to Lazar (or a Lazar

Transferee) upon conversion of the Series A Preferred Stock and/or upon exercise of the Warrants such number of shares of Common Stock,

equal to the lower of either, (X) the maximum percentage of the number of shares of the Common Stock outstanding immediately after giving

effect to the issuance of shares of Common Stock issuable upon conversion of the Preferred Stock and/or exercise of the Warrants that

can be issued to the Holder without requiring a vote of our shareholders under the rules and regulations of the Trading Market on which

the Common Stock trades on such date and applicable securities laws; or, (Y) 19.99% of the number of shares of the Common Stock outstanding

immediately prior to the date of issuance.

The

Purchase Agreement contains customary representations, warranties and agreements of the Company and Lazar, limitations and conditions

regarding sales of the Purchased Securities or underlying Common Stock, indemnification rights and other obligations of the parties.

Furthermore, the Purchase Agreement contains certain conditions to closing, including, shareholder approval of: (i) a one for three reverse

stock split of the Common Stock, (ii) the increase in authorized shares of Preferred Stock to 10,000,000, (iii) the Certificate of Designation

of the rights and privileges of the Series A Preferred Stock of 2,000,000 shares, (iv) the issuance of the Common Stock underlying the

Purchased Securities to Lazar or any transferee of Lazar’s which acquires the Securities Purchase Rights (as defined below), and,

(v) removal from the Company’s Certificate of Incorporation and By-Laws of limitations on adopting shareholder resolutions via

majority without holding a shareholders meeting.

At

the Special Meeting, we will ask stockholders to authorize the above noted items (i) through (v), and for purposes of complying with

Nasdaq Listing Rule 5635(d), the potential issuance of shares of our Common Stock that may be issued upon the conversion of the Series

A Preferred Stock and the exercise of the Warrants issued pursuant to the terms of the Purchase Agreement, in an amount that ultimately

may equal or be in excess of 20% of our Common Stock outstanding before the issuance of the Series A Preferred Stock and Warrants (including

by the operation of anti-dilution provisions contained in the Series A Preferred Stock or the Warrants). We will also transact

any other business that may properly come before the Special Meeting or at any adjournments or postponements of the Special Meeting.

The

Certificate of Amendment attached hereto as Appendix A reflects the changes that will be implemented to our Amended and Restated Certificate

of Incorporation if this Proposal No. 1 is approved by the stockholders.

The

Certificate of Designation attached hereto as Appendix B reflects the filing previously submitted to the Secretary of State of the State

of Delaware.

Lazar

has agreed that he will not engage in or effect, directly or indirectly, any short sales involving our securities or any hedging transaction

that transfers the economic risk of ownership of the Common Stock. Additionally, our Board of Directors unanimously adopted resolutions

(i) exempting Lazar’s acquisition of the Purchased Securities from Section 16(b) of the Exchange Act pursuant to Rule 16b-3 and

(ii) granting Lazar the right to sell, assign or otherwise transfer either the Purchased Securities (as well as any Common Stock underlying

any such Purchased Securities) and/or his rights to acquire the Purchased Securities (as well as any Common Stock underlying any such

Purchased Securities) pursuant to the Purchase Agreement (the “Securities Purchase Rights”), including by way of option for

Lazar to sell and/or a transferee thereof to purchase, the Securities Purchase Rights.

The

approval of the Proposals involves the purchase by David Lazar (or a Lazar Transferee) of newly issued shares of our Series A Preferred

Stock and Warrants, all of which are convertible or exercisable into Shares of Common Stock. You will not be required to sell any of

your Common Stock.

Whether

or not any of the Proposals are approved, we will continue to remain a public company, with our shares listed for trading on Nasdaq and

the requirement to file our annual reports (including the audited financial statements contained therein) and other reports with the

SEC.

Because

of David Lazar’s (or a Lazar Transferee’s) significant ownership of our Common Stock, any transaction or arrangement between

us, on the one hand, and David Lazar (or a Lazar Transferee) or any of their respective affiliates, on the other hand, will need to be

approved by the Board consistent with its fiduciary duties to all of our stockholders. This will entail full disclosure of any relationships,

transactions or other arrangements between us and David Lazar (or a Lazar Transferee) and/or their respective affiliates in our filings

with the SEC.

Following

the approval of the Change of Control Proposal and the conversion of the Series A Preferred Shares, David Lazar (or a Lazar Transferee)

will be our largest stockholder, and it would own a majority of the outstanding shares of our Common Stock and we would be treated as

a “controlled company” under the rules of Nasdaq. As a controlled company, we would not be required to have a majority independent

Board and our Compensation Committee and Nominating and Corporate Governance Committee would no longer be required to be composed solely

of independent directors. Further, if David Lazar (or a Lazar Transferee) owns a majority of our Common Stock, it will then have sufficient

votes to elect all of our directors and to approve any other corporate action requiring the affirmative vote of holders of a majority

of the outstanding shares of our Common Stock.

After

careful consideration, the Board determined that the Purchase Agreement and the transactions contemplated thereby, including the including

the issuances of Series A Preferred Shares and the Warrants, are advisable and in the best interests of the Company and its stockholders,

and determined to recommend that our stockholders approve the Proposals which need to be approved in order to complete the Closing.

In

making its determinations, the Board considered various factors, including:

| |

● |

The immediate and long-term benefit to the Company’s

financial condition of receiving approximately $2.8 million in cash from the sale of the Preferred Stock and Warrants, in light of the

Company’s current cash position and longer-term liquidity needs. |

| |

|

|

| |

● |

The Company management’s analysis of the likelihood of

securing alternative sources of capital, of a potential public or private sales of common stock, warrants, or convertible or nonconvertible

debt securities and the likely price and other terms and conditions of such sales, which revealed a low likelihood of consummation of

any alternatives, as well as a significant cost of such financing, assuming it could be obtained, to the Company and the associated significant

dilution to its shareholders, which the Board determined was substantially less favorable to the Company than pursuing the transactions

contemplated by the Purchase Agreement. |

| |

● |

The significant likelihood that, without the consummation of

the transactions contemplated by the Purchase Agreement, the Company will need to seek bankruptcy protection in the near term, which

may result in the Company’s shareholders receiving no or very little value in respect of their shares of the Company’s stock. |

| |

|

|

| |

● |

The funding that David Lazar has provided and that David Lazar

(or a Lazar Transferee) would provide would allow us to explore strategic alternatives to maximize stockholder value. |

| |

|

|

| |

● |

The recent performance of the Company’s stock price on

Nasdaq and the capital markets as a whole, including the Company’s inability to secure any alternative offers to finance the Company

via an investment in the Company’s equity or to acquire the Company outright. |

| |

|

|

| |

● |

The investment by Lazar (or a Lazar Transferee) would serve

to increase stockholders’ equity and support the Company’s efforts to satisfy the minimum $2,500,000 stockholders’

equity requirement for continued listing on The Nasdaq Capital Market. |

| |

|

|

| |

● |

The Company’s extensive exploration, both by the Company’s

internal business development team as well as through its strategic advisors of opportunities for strategic partnership and/or investment,

based on which the Board believes that the Purchase Agreement offers the best opportunity with greatest financial benefit, including

after considering the risks that any such anticipated benefits could ultimately not materialize. |

| |

|

|

| |

● |

The fact that, in connection with the transactions contemplated

by the Purchase Agreement, the Company has covenanted to have the Proposals approved by our stockholders; |

| |

|

|

| |

● |

The terms and conditions of the Purchase Agreement, including,

among other things, the representations, warranties, covenants and agreements of the parties, the conditions to closing, the form and

governance of the Company post-closing and the termination rights of the parties, taken as a whole, which the Board determined were more

favorable to the Company and its shareholders than those terms and conditions which could have been negotiated with or offered by other

potential strategic partners and/or investors. |

| |

|

|

| |

● |

Potential risks associated with alternatives to the Purchase

Agreement, including the potential impact on the price of the Company’s common stock and ability to generate sufficient capital

to support our ongoing operation. |

| |

|

|

| |

● |

Potential risks associated with David Lazar’s (or a Lazar

Transferee’s) significant ownership percentage following the Closing, including their right to designate a majority of directors

to the Board, which will enable them to affect the outcome of, or exert significant influence over, all matters requiring Board or stockholder

approval, including the election and removal of directors and any change in control, and could have the effect of delaying or preventing

a change in control of the Company or otherwise discouraging or preventing a potential acquirer from attempting to obtain control of

the Company, which, in turn, could have a negative effect on the market price of the Company’s Common Stock and could impact the

low trading volume and volatility of the Company’s Common Stock. |

Reverse

Stock Split - General

Further

to the terms and conditions of the Purchase Agreement, our Board has unanimously approved, and recommends that our stockholders approve,

an amendment to our Amended and Restated Certificate of Incorporation (the “Charter”) (the “Certificate of Amendment”),

to effect a reverse stock split (the “Reverse Stock Split”) at a ratio of 1-for-3, with the final decision of whether to

proceed with the Reverse Stock Split, and the effective time of the Reverse Stock Split, to be determined by the Board, in its sole discretion

and without further action by the stockholders. This proxy statement refers to the proposal to approval the Reverse Stock Split on the

terms described in the proxy statement as the “Reverse Stock Split Proposal.”

If